Antibody Discovery Market By Method (Phage Display, Hybridoma, Others), By Antibody Type (Humanized Antibody, Human Antibody, Chimeric Antibody, Murine Antibody) By End-user (Pharmaceutical and Biotechnology Industry, Research Laboratory, Academic Laboratory), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124443

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

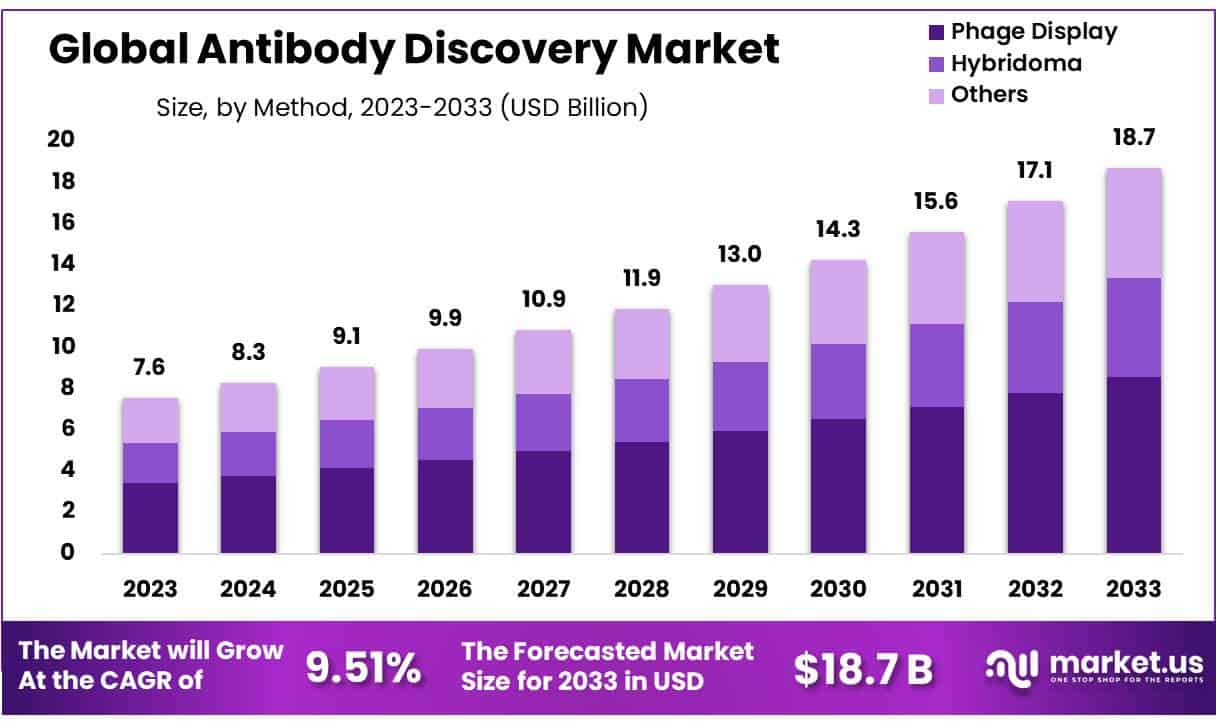

Global Antibody Discovery Market size is expected to be worth around USD 18.7 Billion by 2033 from USD 7.6 Billion in 2023, growing at a CAGR of 9.51% during the forecast period from 2024 to 2033.

The global antibody discovery market is witnessing opportunity-driven growth over the forecast period owing to factors such as increased investment in research and development due to the increasing prevalence of chronic diseases, technological advancements, and a shift towards personalized treatment alternatives. The rising prevalence of chronic diseases like cancer and autoimmune disorders drives demand for targeted therapies. Technological innovations in genomics, proteomics, and bioinformatics streamline antibody discovery, making it more efficient and cost-effective.

Personalized medicine trends further boost the market, as antibodies offer tailored treatment options with higher efficacy and lower toxicity. Collaborations between academic institutions, biotech firms, and pharmaceutical companies accelerate innovation and clinical application. Despite challenges such as high costs and regulatory hurdles, ongoing research and investment promise a dynamic and transformative future for the antibody discovery market.

Antibody discovery involves identifying and developing antibodies that target specific antigens found on pathogens, cancer cells, or other disease-causing agents. The process includes target identification, antibody generation through methods like immunization or phage display, and screening to find effective antibodies. Selected antibodies are then characterized for binding affinity and functional activity, followed by optimization for therapeutic properties.

Finally, they undergo preclinical and clinical testing to ensure safety and efficacy. This process is essential for creating targeted therapies for diseases such as cancer, autoimmune disorders, and infections, utilizing advanced biotechnology and molecular biology techniques.

- According to studies, as of 2023, a total of 162 antibodies have gained approval for therapeutic uses.

- In 2021, the World Health Organization (WHO) reported that 77% of deaths related to chronic diseases occurred in countries with low and middle incomes.

Key Takeaways

- Market Size: Antibody Discovery Market size is expected to be worth around USD 18.7 Billion by 2033 from USD 7.6 Billion in 2023.

- Market Growth: The market growing at a CAGR of 9.51% during the forecast period from 2024 to 2033.

- Method Analysis: Based on the method, the phage display segment generated the most revenue for the market with a market share of 45.7%.

- Antibody Type Analysis: By antibody type, the humanized antibody segment contributed the most to the market and secured a market share of 35.7%.

- End-Use Analysis: In terms of end-users, the pharmaceutical and biotechnology industry led the market in 2023, with a market share of 37.1%.

- Regional Analysis: Region-wise, North America remained the lead contributor to the market, by claiming the highest market share, amounting to 32.6%.

- Growth Drivers: Increasing demand for targeted therapies, advancements in biotechnology, and rising prevalence of chronic diseases are driving market growth.

- Key Technologies: Phage display, hybridoma technology, and transgenic animal platforms are key methods for antibody discovery.

By Method Analysis

The market shows three diverse sub-segments when classified based on method, namely phage display, hybridoma, and others. Among all the segments, the phage display segment held the largest market share in the year 2023. The segment attributed for 45.7% share in the global market owing to its versatility, robustness, and applicability over the other methods. Phage display technology dominates the global antibody discovery market due to its unparalleled ability to efficiently generate vast libraries of antibodies.

By displaying antibody fragments on bacteriophage surfaces, this method enables rapid screening of extensive libraries against diverse targets. Its capability to identify antibodies with precise binding properties and therapeutic potential enhances its appeal in pharmaceutical research and development. Moreover, continuous advancements in library design and screening methodologies bolster its effectiveness and scalability across various therapeutic areas.

As a result, phage display technology maintains a commanding presence in the antibody discovery sector, driven by its robust performance and strategic relevance in the pursuit of novel therapeutic candidates.

By Antibody Type Analysis

In the antibody discovery market, antibody type is segmented into humanized, human, chimeric, and murine antibodies. As of 2023, the humanized antibody segment led in revenue contribution and is projected to experience the fastest growth throughout the forecast period. This dominance can be attributed to the increasing acceptance and adoption of human antibody drugs in therapeutic applications.

Humanized antibodies are favored for their specificity, stability, and cost-effectiveness compared to murine, chimeric, and fully human antibodies. For instance, therapies utilizing humanized antibodies have demonstrated superior clinical outcomes in treating conditions such as cancer and autoimmune diseases. Their reduced immunogenicity and improved safety profiles also contribute to their rising preference among healthcare providers and patients alike.

The market’s shift towards humanized antibodies underscores a strategic pivot towards more effective and targeted therapies, aligning with the evolving demands of precision medicine and personalized healthcare. As research and development efforts continue to enhance the production and efficacy of humanized antibodies, their prominence in the global antibody discovery market is expected to further solidify in the coming years.

IMAGE

By End-User Analysis

Based on end-users the market is segmented into the pharmaceutical and biotechnology industry, research laboratories, and academic laboratories. In 2023, the pharmaceutical and biotechnology industry segment held the largest market share and is expected to continue leading throughout the forecast period. This dominance is attributed to the significant rise in R&D activities within these industries, along with substantial government expenditure aimed at advancing the pharmaceutical and biotechnology sectors.

The ongoing investment in developing advanced technologies and products within these industries further bolsters their market position. Additionally, the increasing focus on innovative solutions and the continuous expansion of the pharmaceutical and biotechnology sectors contribute to maintaining their leading role in the market. This trend is expected to persist, driven by the continuous efforts to enhance research capabilities and technological advancements in these fields.

Key Market Segments

By Method

- Phage Display

- Hybridoma

- Others

By Antibody Type

- Humanized Antibody

- Human Antibody

- Chimeric Antibody

- Murine Antibody

By End-user

- Pharmaceutical and Biotechnology Industry

- Research Laboratory

- Academic Laboratory

Drivers

Growing Demand for Antibodies in Therapeutic Applications is Driving the Market Growth

The therapeutic demand for antibodies is rising, notably in treating chronic ailments like cancer and autoimmune disorders. This trend reflects a growing preference for antibody-based therapies due to their specificity and efficacy in targeting disease mechanisms. Antibodies are increasingly utilized to develop advanced treatments that can precisely modulate immune responses or inhibit disease pathways. This expanding application underscores antibodies’ pivotal role in modern medicine, driving continuous innovation and development in therapeutic antibody discovery and production technologies.

- As per the CDC, approximately 129 million individuals in the United States are affected by at least one major chronic disease. Furthermore, five out of the top 10 leading causes of death in the United States are either preventable or strongly linked to treatable chronic diseases.

- Besides, approximately 90% of the $4.1 trillion annual healthcare expenditure is allocated towards the management and treatment of chronic diseases and mental health conditions.

Restrains

High Cost of Antibody Discovery Restrains the Market Growth

The high costs involved in antibody discovery and development pose a substantial barrier for smaller companies and academic institutions aiming to enter the market. These expenses primarily stem from the intricate and resource-intensive nature of antibody research, which includes screening large libraries of antibodies, optimizing candidates for efficacy and safety, conducting preclinical and clinical trials, and navigating regulatory approvals.

For smaller entities with limited financial resources, these upfront costs can be prohibitive, often necessitating partnerships with larger pharmaceutical companies or seeking external funding sources such as government grants or venture capital. Additionally, the expertise required in antibody engineering, production, and validation further adds to the financial burden, making it challenging for newcomers to compete effectively.

To address these challenges, efforts to reduce development costs through technological advancements, automation of screening processes, and collaborative research initiatives are essential. Moreover, regulatory incentives that support innovation and reduce entry barriers for smaller players can foster a more inclusive and competitive antibody discovery market.

Opportunities

Advancements in Technology are Staging Growth Opportunities for the Market

Advancements in antibody discovery technologies like phage display, transgenic animal platforms, and computational modeling are revolutionizing therapeutic development. Phage display allows for rapid screening of vast antibody libraries, identifying high-affinity candidates. Transgenic animals produce human antibodies, mimicking human immune responses for more relevant therapeutic candidates.

Computational modeling predicts antibody-antigen interactions, guiding design and optimization. These technologies collectively enhance efficiency by streamlining discovery processes, reducing time and costs. They also expand the scope of antibody therapeutics, enabling the targeting of complex diseases with greater precision and efficacy, thereby driving innovation in biopharmaceutical research and development.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the global antibody discovery market. Economic stability or instability can influence healthcare spending and investment in biopharmaceutical research. For instance, during economic downturns, funding for research and development may decrease, affecting innovation and pipeline development in antibody therapies.

Conversely, economic growth can spur healthcare investments and increase demand for novel biological treatments, including antibodies. Geopolitical factors such as trade policies, regulatory changes, and international collaborations also play crucial roles. Trade disputes or regulatory barriers can hinder market access and disrupt supply chains for critical resources in antibody discovery and production.

Conversely, international partnerships and agreements can facilitate knowledge exchange, resource sharing, and market expansion opportunities. Navigating these factors requires companies to adapt strategies that mitigate risks, leverage opportunities in diverse markets, and maintain agility in responding to regulatory and economic shifts globally.

Latest Trends

Recent advancements in the global antibody discovery market are leveraging cutting-edge technologies to revolutionize therapeutic development. Artificial Intelligence (AI) and machine learning are transforming the landscape by analyzing extensive datasets to predict antibody-antigen interactions swiftly. This accelerates both the discovery of novel antibodies and their optimization for therapeutic use.

Concurrently, the expansion of single-cell analysis techniques is enabling the detailed characterization of individual immune cells. This capability enhances the discovery of rare antibodies and provides deeper insights into immune responses, thereby broadening the scope for developing targeted and effective therapies.

Together, these innovations underscore a shift towards more precise and personalized approaches in antibody discovery, promising significant advancements in treating complex diseases and addressing unmet medical needs globally.

Regional Analysis

North America Dominates the Global Antibody Discovery Market

In 2023, North America led the global antibody discovery market, with the US emerging as the primary global leader, with a market share of 32.6%. The region’s dominance is due to its robust biopharmaceutical industry, advanced healthcare infrastructure, and substantial investments in research and development.

The region’s strong academic and research institutions and favorable regulatory frameworks foster innovation in antibody discovery technologies. Moreover, a high prevalence of chronic diseases and increasing demand for biological therapies contribute to North America’s dominance.

Key pharmaceutical companies and biotechnology firms in the United States drive significant advancements, making North America a pivotal hub for antibody discovery, development, and commercialization on a global scale.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is poised for the highest compound annual growth rate (CAGR) in the antibody discovery market during the forecast period. This growth is driven by expanding healthcare infrastructure, rising investments in biopharmaceutical research, and increasing adoption of advanced technologies in countries like China, Japan, and India.

Moreover, a growing focus on personalized medicine and the presence of a large patient population with unmet medical needs further stimulate demand for innovative antibody therapies. Strategic collaborations between local biotech companies, academic institutions, and multinational corporations also contribute to accelerating antibody discovery and development activities in the Asia Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global antibody discovery market is characterized by a competitive landscape with key players holding significant market shares. Major companies such as GenScript Biotech Corporation, Abcam plc, Thermo Fisher Scientific Inc., and Merck KGaA dominate the market. These players leverage advanced technologies and robust R&D capabilities to innovate in antibody discovery platforms.

Strategic initiatives such as mergers, acquisitions, and collaborations are common, enhancing market presence and expanding product portfolios. The market’s growth is driven by increasing investments in biopharmaceuticals, rising demand for targeted therapies, and expanding applications in diverse therapeutic areas, reinforcing the competitive dynamics among key industry players.

Top Key Players in Antibody Discovery Market

- Danaher Corporation

- Eurofins Scientific

- Evotec

- Twist Bioscience

- Charles River Laboratories

- Genscript Technology Corporation

- Biocytogen

- Sartorius AG

- Fairjourney Biologics S.A

- Creative Biolabs

- Other Key Players

Recent Developments

- In February 2024, SCIEX launched the Echo MS+ system at SLAS 2024, targeting challenges in high throughput screening for drug discovery.

- In March 2023, Biocytogen Pharmaceuticals signed a non-exclusive license agreement with Janssen Biotech. This agreement allows Janssen to use Biocytogen’s RenLite platform for developing fully human antibody therapeutics globally.

- In June 2023, AbTherx entered into an agreement with Gilead Sciences to in-license the Atlas Mice transgenic mouse technology from Gilead.

- In August 2023, Danaher Corporation acquired Abcam plc, bolstering its innovation and expertise in life sciences research.

- In September 2022, Abzena, a prominent provider in biologics and antibody drug conjugates discovery, development, and manufacturing, announced plans to enhance its R&D capabilities in Cambridge. This initiative aims to bolster rapid antibody discovery efforts and support advancements in their development processes.

- In July 2022, Bio-Techne completed a notable acquisition, integrating Namocell into its portfolio. This strategic move enhances Bio-Techne’s product range and broadens its capabilities in gene therapy, cell engineering, cell line development, single cell genomics, and antibody discovery.

Report Scope

Report Features Description Market Value (2023) USD 7.6 billion Forecast Revenue (2033) USD 18.7 billion CAGR (2024-2033) 9.51% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Method-Phage Display, Hybridoma, Others, By Antibody Type-Humanized Antibody, Human Antibody, Chimeric Antibody, Murine Antibody, By End-user- Pharmaceutical and Biotechnology Industry, Research Laboratory, Academic Laboratory. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Danaher Corporation, Eurofins Scientific. Evotec, Twist Bioscience, Charles River Laboratories, Genscript Technology Corporation, Biocytogen, Sartorius AG, Fairjourney Biologics S.A, Creative Biolabs and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Danaher Corporation

- Eurofins Scientific

- Evotec

- Twist Bioscience

- Charles River Laboratories

- Genscript Technology Corporation

- Biocytogen

- Sartorius AG

- Fairjourney Biologics S.A

- Creative Biolabs

- Other Key Players