Global Anti Infective Endotracheal Tube Market By Product Type (Coated Endotracheal Tubes, Antibiotic-Coated Endotracheal Tubes, Silver-Coated Endotracheal Tubes, and Uncoated Endotracheal Tubes), By Material (Polyvinyl Chloride, Polyurethane, Silicone, and Others), By End User (Hospitals, Ambulatory Surgical Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140357

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

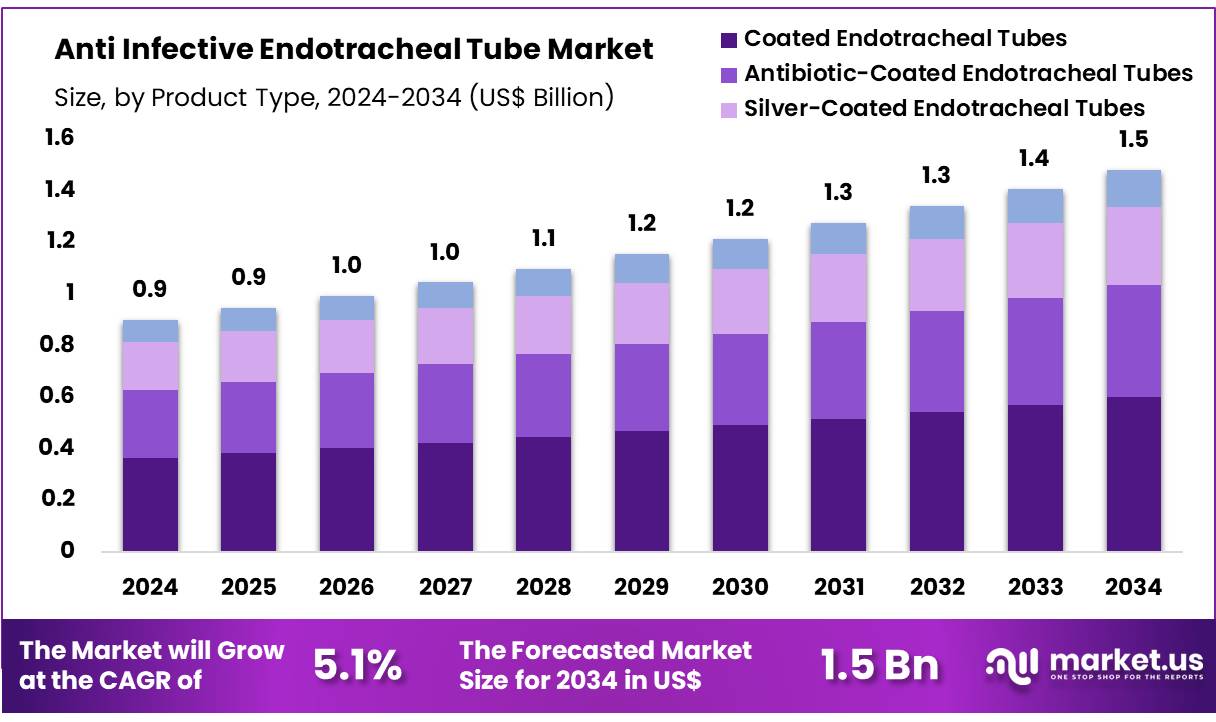

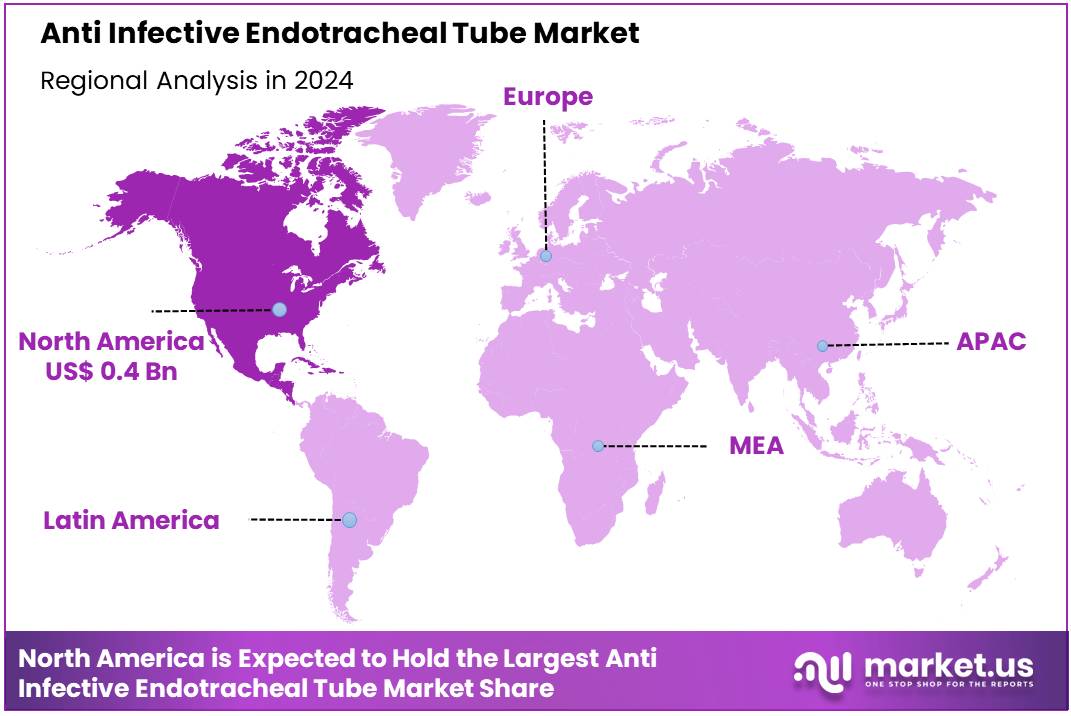

Global Anti Infective Endotracheal Tube Market size is expected to be worth around US$ 1.5 billion by 2034 from US$ 0.9 billion in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 39.6% share with a revenue of US$ 0.4 Billion.

Growing concern over hospital-acquired infections and the increasing prevalence of respiratory diseases are driving the expansion of the anti-infective endotracheal tube market. Anti-infective endotracheal tubes are designed to prevent infections, particularly in patients who require mechanical ventilation for respiratory support.

These tubes are essential in critical care settings, where patients are at high risk of infections due to prolonged intubation, such as in cases of lung diseases, surgeries, or intensive care unit (ICU) treatments. The rise in chronic respiratory conditions, including COPD and lung cancer, contributes significantly to the demand for these tubes.

According to the NCBI, lung cancer is the second-most common type of cancer in the US and the leading cause of cancer-related deaths, with an anticipated 235,760 new cases in 2021. Recent trends show a growing focus on improving the antimicrobial properties of endotracheal tubes, including coatings that reduce bacterial growth and biofilm formation.

Additionally, the increasing emphasis on patient safety and infection control in hospitals presents opportunities for innovations in anti-infective endotracheal tube technologies. Manufacturers are also exploring the integration of smart technology with these tubes, such as sensors for real-time monitoring of infections and other complications. The growing focus on reducing healthcare-associated infections, combined with advances in medical technology, positions the anti-infective endotracheal tube market for continued growth.

Key Takeaways

- In 2024, the market for Anti Infective Endotracheal Tube generated a revenue of US$ 9 billion, with a CAGR of 5.1%, and is expected to reach US$ 1.5 billion by the year 2033.

- The product type segment is divided into coated endotracheal tubes, antibiotic-coated endotracheal tubes, silver-coated endotracheal tubes, and uncoated endotracheal tubes, with coated endotracheal tubes taking the lead in 2023 with a market share of 40.5%.

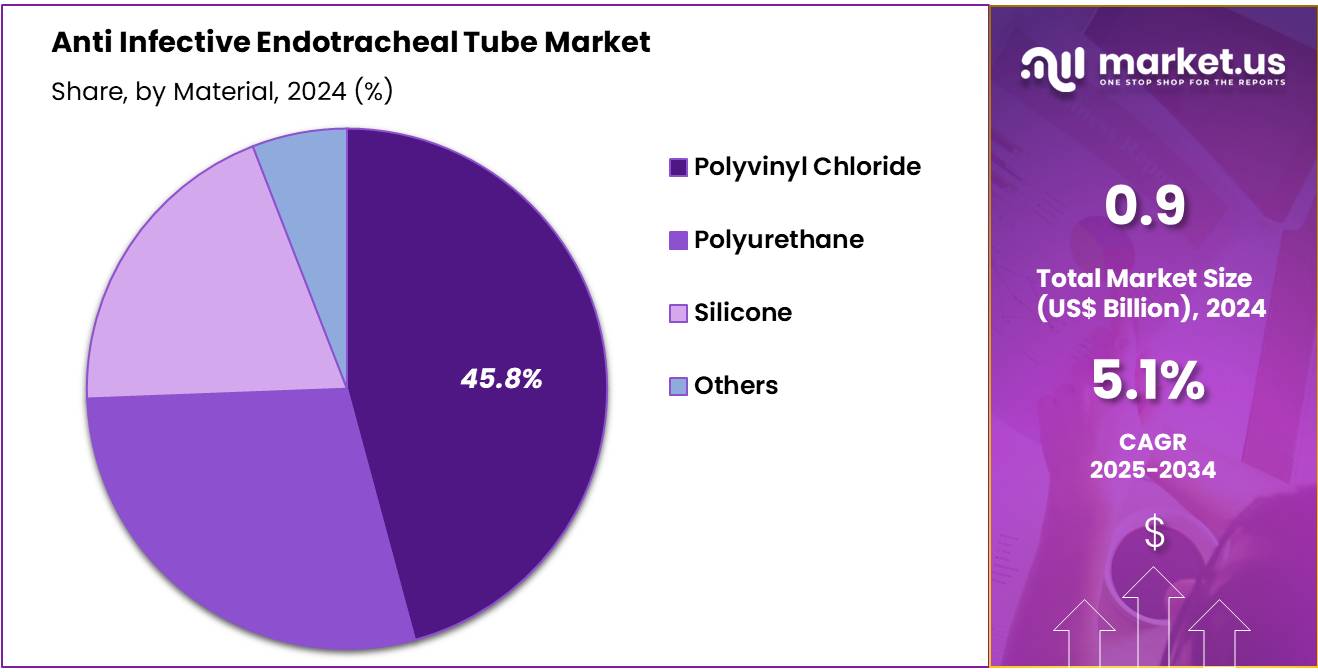

- Considering material, the market is divided into polyvinyl chloride, polyurethane, silicone, and others. Among these, polyvinyl chloride held a significant share of 45.8%.

- Furthermore, concerning the end user segment, the market is segregated into hospitals, ambulatory surgical centers, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 53.2% in the Anti Infective Endotracheal Tube market.

- North America led the market by securing a market share of 39.6% in 2023.

Product Type Analysis

The coated endotracheal tubes segment led in 2023, claiming a market share of 40.5% owing to their ability to reduce the risk of infections during mechanical ventilation. Coated endotracheal tubes are anticipated to gain popularity as they offer enhanced protection against microbial colonization, particularly in intensive care units where the risk of ventilator-associated pneumonia (VAP) is high.

The rising demand for infection prevention and the increasing number of surgeries and procedures requiring ventilation are projected to drive the growth of this segment. Additionally, advances in coating technologies, including the use of antimicrobial and anti-inflammatory coatings, are likely to increase the adoption of coated endotracheal tubes, further supporting market growth.

Material Analysis

The polyvinyl chloride held a significant share of 45.8% due to as PVC continues to be a preferred material for the production of endotracheal tubes due to its excellent combination of flexibility, strength, and cost-effectiveness. PVC endotracheal tubes are projected to remain popular because they offer ease of use, sufficient biocompatibility, and a high level of patient safety.

The growing focus on affordability in healthcare settings, coupled with the widespread use of PVC in various medical applications, is likely to drive the demand for PVC-based endotracheal tubes. As hospitals and medical centers increasingly prioritize cost-effective solutions without compromising patient care, the polyvinyl chloride segment is expected to witness continued growth in the market.

End-User Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 53.2% owing to the increasing demand for endotracheal tubes in hospital settings, particularly in intensive care units (ICUs) and emergency departments. Hospitals are projected to remain the largest end-users of anti-infective endotracheal tubes, as these institutions treat a high volume of critically ill patients who require mechanical ventilation.

The growing prevalence of chronic diseases such as respiratory infections, cardiovascular conditions, and pneumonia is likely to drive the demand for anti-infective endotracheal tubes. Additionally, hospitals are expected to continue prioritizing infection control measures, further contributing to the adoption of anti-infective endotracheal tubes to minimize the risk of ventilator-associated infections.

Key Market Segments

Product Type

- Coated Endotracheal Tubes

- Antibiotic-Coated Endotracheal Tubes

- Silver-Coated Endotracheal Tubes

- Uncoated Endotracheal Tubes

Material

- Polyvinyl Chloride

- Polyurethane

- Silicone

- Others

End User

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Growing Prevalence of Non-Communicable Diseases Driving the Anti-Infective Endotracheal Tube Market

Growing prevalence of non-communicable diseases (NCDs) is anticipated to drive the anti-infective endotracheal tube market significantly. In September 2022, the World Health Organization reported that NCDs accounted for approximately 40 million global deaths. Conditions such as obesity, diabetes, and cardiovascular diseases often result in complications requiring mechanical ventilation, increasing the demand for endotracheal tubes.

Anti-infective solutions reduce the risk of ventilator-associated infections, enhancing patient outcomes during prolonged intubation. Hospitals and intensive care units increasingly adopt these specialized tubes to mitigate risks associated with secondary infections. Technological advancements improve the efficacy of antimicrobial coatings, offering sustained protection against pathogens.

Rising awareness about infection control fosters the demand for advanced endotracheal tubes in critical care settings. Collaborations between medical device companies and healthcare providers accelerate the development and adoption of innovative solutions. Expanding healthcare infrastructure in emerging economies further supports market growth. These trends emphasize the importance of anti-infective technologies in addressing the healthcare challenges posed by the rising prevalence of NCDs.

Restraints

High Costs Are Restraining the Anti-Infective Endotracheal Tube Market

High costs associated with anti-infective endotracheal tubes are restraining the market. Advanced technologies, such as antimicrobial coatings and drug-eluting properties, require substantial R&D investments, increasing production costs. Healthcare providers in low-income regions face financial constraints, limiting access to these advanced products.

Limited insurance coverage for premium medical devices discourages widespread adoption in cost-sensitive markets. Manufacturing expenses for maintaining sterility and ensuring regulatory compliance further inflate prices. Training healthcare workers to use specialized devices adds additional operational costs for hospitals.

Developing economies struggle to afford these devices due to restricted healthcare budgets and lack of funding for infection control measures. Addressing these cost-related barriers requires innovative manufacturing techniques and supportive policies to make these devices more affordable and accessible.

Opportunities

Increasing Innovation as an Opportunity for the Anti-Infective Endotracheal Tube Market

Increasing innovation is projected to create significant opportunities for the anti-infective endotracheal tube market. In August 2021, researchers at the Children’s Hospital of Philadelphia (CHOP) developed an endotracheal tube coating that releases antimicrobial peptides to combat bacterial infections. This novel technology provides sustained peptide release for up to two weeks, reducing bacterial inflammation and preventing complications such as subglottic stenosis.

Advancements in material science enable the development of tubes with enhanced antimicrobial properties and biocompatibility. Manufacturers focus on integrating nanotechnology and drug-eluting systems to improve the efficacy of infection prevention. Expanding research funding accelerates the introduction of innovative solutions tailored to critical care needs.

Partnerships between academic institutions and medical device companies foster the commercialization of next-generation endotracheal tubes. Rising awareness about the benefits of advanced infection control measures drives adoption across healthcare facilities globally. These trends highlight the critical role of innovation in advancing the capabilities of anti-infective endotracheal tubes and improving patient outcomes.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a significant role in shaping the anti-infective endotracheal tube market. On the positive side, increasing investments in healthcare infrastructure, particularly in emerging economies, drive the demand for advanced medical devices like anti-infective endotracheal tubes. Growing awareness about the importance of infection control in respiratory treatments further fuels market growth.

However, economic slowdowns or reduced healthcare budgets can hinder the adoption of premium medical devices, especially in resource-constrained regions. Geopolitical factors such as political instability, trade restrictions, and regulatory barriers may disrupt the supply chain for essential materials and delay market expansion.

Variations in healthcare policies, particularly regarding reimbursement for advanced devices, can also impact market growth. Despite these challenges, the increasing focus on patient safety and the need for effective infection prevention in critical care environments continue to provide a positive outlook for the market’s growth.

Latest Trends

Integration of AI Driving the Anti Infective Endotracheal Tube Market:

Rising integration of artificial intelligence (AI) is playing a pivotal role in driving the anti-infective endotracheal tube market. High demand for enhanced precision in clinical procedures is expected to accelerate the adoption of AI-powered technologies that improve the effectiveness of intubation and reduce the risk of infections.

AI applications in medical devices are likely to enhance real-time decision-making and streamline the assessment process, offering healthcare providers advanced tools for patient safety. In November 2021, GE Healthcare announced it had received FDA 510(k) clearance for its AI-powered algorithm, designed to help doctors assess the proper placement of Endotracheal Tubes (ETT).

This technology aims to enhance clinical decision-making and improve patient outcomes during intubation procedures. As AI integration continues to evolve, it is projected to further optimize the use of anti-infective endotracheal tubes, driving market expansion and improving clinical efficacy.

Regional Analysis

North America is leading the Anti Infective Endotracheal Tube Market

North America dominated the market with the highest revenue share of 39.6% owing to advancements in medical technologies, the increasing prevalence of respiratory infections, and a rising focus on patient safety. Anti-infective ETTs, designed to reduce the risk of infections associated with intubation, have become an essential tool in critical care settings, especially for patients undergoing mechanical ventilation.

The growth of the market can be attributed to the increasing number of surgeries and intensive care treatments, as well as the heightened awareness of preventing ventilator-associated pneumonia (VAP) and other respiratory infections. In May 2021, Medtronic unveiled its SonarMed airway monitoring system in the US, which marked a breakthrough in using acoustic technology to detect blockages in endotracheal tubes and confirm their placement.

This real-time monitoring tool provides critical insights, empowering clinicians to make immediate, life-saving decisions, especially in vulnerable pediatric patients. As the demand for more efficient and effective ETTs grows, the market is expected to continue expanding, fueled by ongoing innovations in infection prevention and monitoring technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare infrastructure investments, rising awareness of infection prevention, and the growing burden of respiratory diseases. Countries like China, India, and Japan are expected to see a surge in demand for anti-infective ETTs as healthcare systems improve and more patients require mechanical ventilation in critical care units.

The rise in surgeries, the prevalence of chronic respiratory diseases, and the increasing number of ICU admissions will likely drive the need for advanced airway management solutions. Additionally, the expanding healthcare facilities and the adoption of advanced medical technologies in the region will support market growth.

Governments’ focus on improving healthcare quality and safety, along with the increasing availability of anti-infective technologies, is expected to further boost demand for these devices. With a growing emphasis on reducing hospital-acquired infections and enhancing patient outcomes, the anti-infective endotracheal tube market in Asia Pacific is estimated to experience significant growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the anti-infective endotracheal tube market focus on developing innovative products with antimicrobial coatings and advanced materials to reduce the risk of ventilator-associated infections. Companies invest in R&D to create tubes with enhanced durability, comfort, and ease of insertion.

Collaborations with hospitals and healthcare providers promote product adoption and support customized solutions for specific clinical needs. Geographic expansion into regions with increasing healthcare investments and awareness of infection control drives market growth. Many players also prioritize regulatory compliance and affordability to ensure accessibility and trust among healthcare professionals.

Teleflex Incorporated is a leading company in this market, offering advanced endotracheal tubes like the HI-LO EVAC product line designed to minimize infection risks. The company integrates cutting-edge technology with ergonomic designs to deliver effective and reliable airway management solutions. Teleflex’s global presence and commitment to patient safety position it as a key player in the healthcare industry.

Top Key Players

- Well Lead Medical Co., Ltd

- Viggo Medical Devices

- Mercury Medical

- Medline

- Hollister Incorporated

- BRIO DEVICE, LLC

- BD

- ARMSTRONG MEDICAL

Recent Developments

- In November 2022, AlphaLab Health, a joint program by Innovation Works and Allegheny Health Network, revealed its third group of participating companies. The initiative is focused on nurturing the growth of entrepreneurs in the healthcare and life sciences sectors, offering them resources to accelerate their innovation and business impact.

- In June 2023, Teleflex Incorporated, a leading global medical technology company specializing in critical care and surgical solutions, announced the recall of specific batches of Rüsch Endotracheal Tube products. These tubes, used for oral or nasal intubation, are critical for managing a patient’s airway by inserting the tube into the trachea, often with the assistance of a stylet to aid proper placement.

- In January 2022, ICU Medical, Inc. acquired Smith’s Medical, a prominent medical device manufacturer. This acquisition significantly bolstered ICU Medical’s position in the global medical technology market, expanding its product offerings and reinforcing its competitive edge.

Report Scope

Report Features Description Market Value (2024) US$ 0.9 billion Forecast Revenue (2034) US$ 1.5 billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Coated Endotracheal Tubes, Antibiotic-Coated Endotracheal Tubes, Silver-Coated Endotracheal Tubes, and Uncoated Endotracheal Tubes), By Material (Polyvinyl Chloride, Polyurethane, Silicone, and Others), By End User (Hospitals, Ambulatory Surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Well Lead Medical Co., Ltd, Viggo Medical Devices, Mercury Medical, Medline, Hollister Incorporated, BRIO DEVICE, LLC, BD, and ARMSTRONG MEDICAL. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Anti Infective Endotracheal Tube MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Anti Infective Endotracheal Tube MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Well Lead Medical Co., Ltd

- Viggo Medical Devices

- Mercury Medical

- Medline

- Hollister Incorporated

- BRIO DEVICE, LLC

- BD

- ARMSTRONG MEDICAL