Animal Health Market By Product Type (Pharmaceuticals (Parasiticides, Anti-inflammatory, Anti-infectives, Analgesics, and Others), Biologics (Vaccines (Modified/Live, Inactivated, and Other Vaccines), and Other Biologics), Medicinal Feed Additives, Diagnostics (Consumables, Reagents & Kits, and Instruments & Devices), Equipment & Disposables (Temperature Management Equipment, Research Equipment, Rescue & Resuscitation Equipment, Patient Monitoring Equipment, Fluid Management Equipment, Critical Care Consumables, and Anesthesia Equipment), and Others (Veterinary Telehealth, Veterinary Software, and Livestock Monitoring)), By Animal (Production Animals (Swine, Sheep & Goats, Poultry, Fish, and Cattle), and Companion Animals (Dogs, Cats, Horses, and Others)), By Distribution Channel (Hospital/Clinic Pharmacy, Retail, and E-Commerce), By End-user (Veterinary Hospitals & Clinics, Veterinary Reference Laboratories, Point-of-Care Testing/In-House Testing, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 96947

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

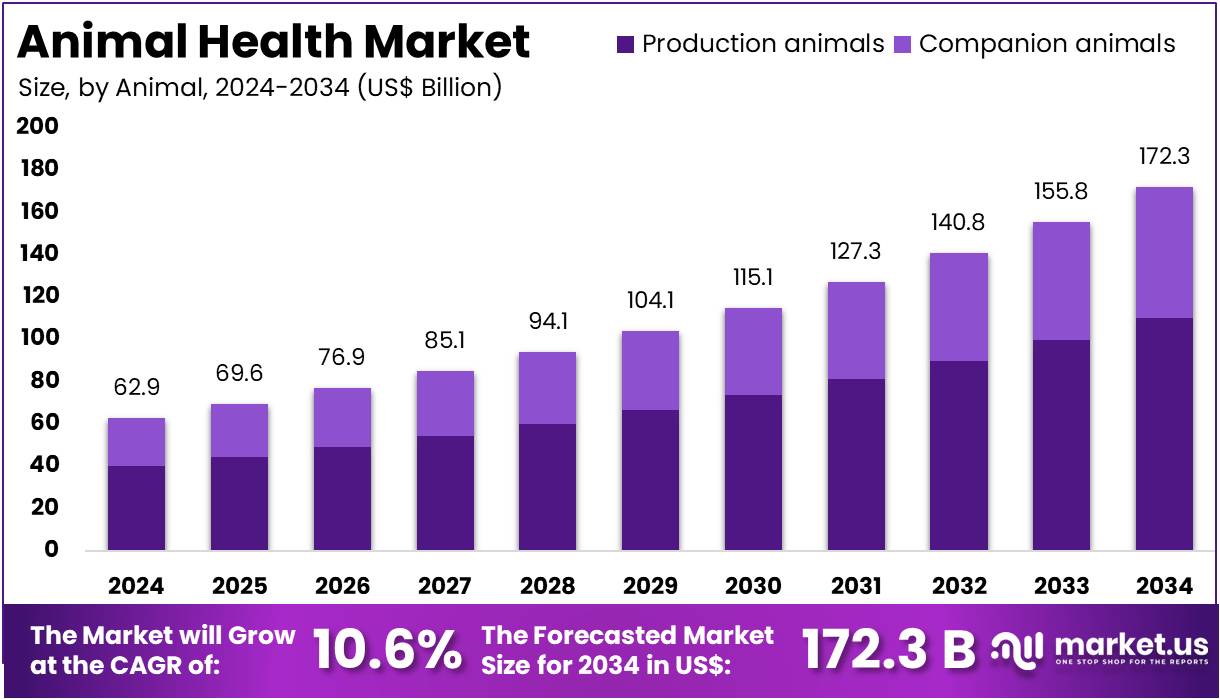

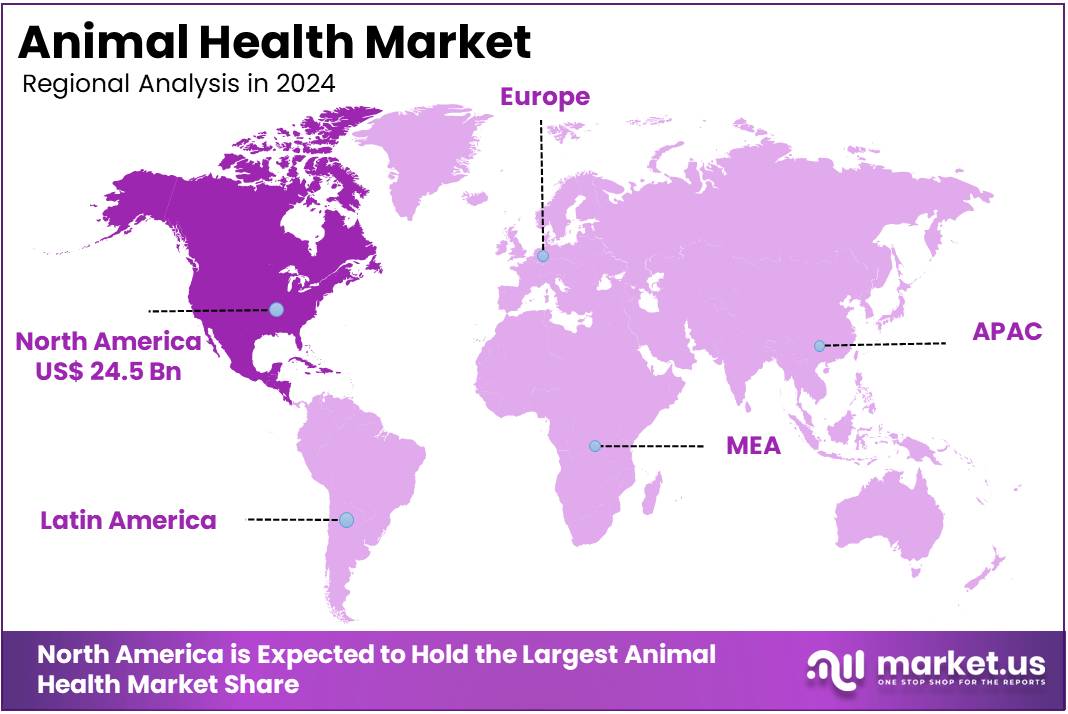

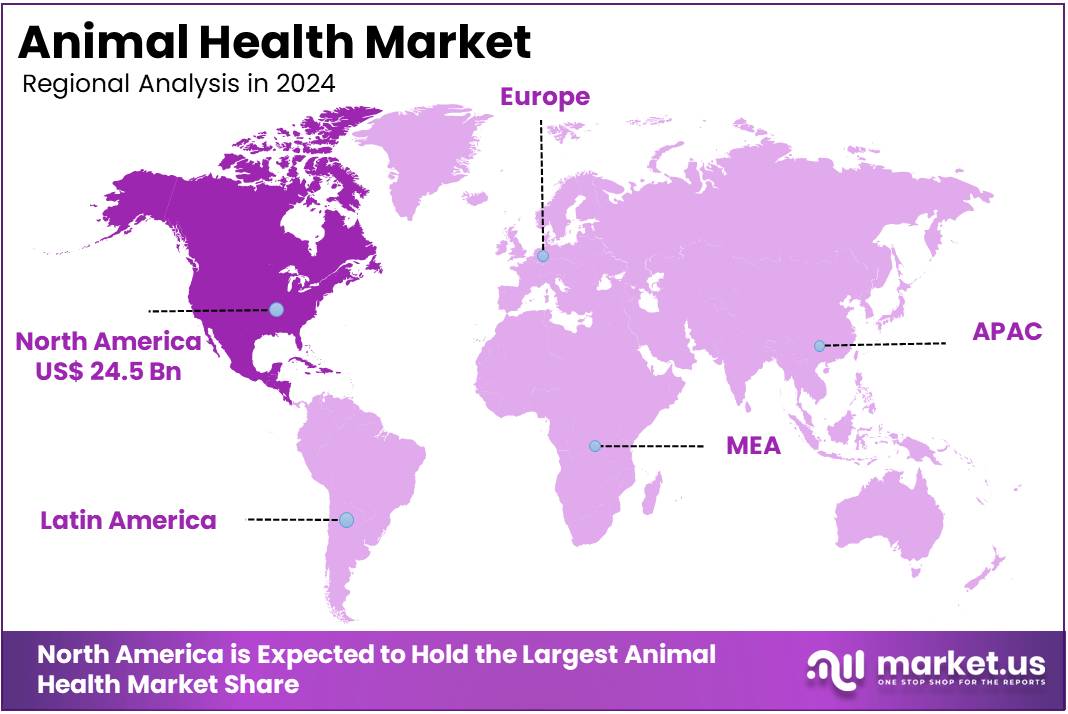

The Animal Health Market size is expected to be worth around US$ 172.3 billion by 2034 from US$ 62.9 billion in 2024, growing at a CAGR of 10.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 40.5% share and holds US$ 24.5 Billion market value for the year.

Rising awareness of animal health and welfare is a key factor propelling growth in the animal health market. Consumers and veterinary professionals are increasingly focused on the well-being of pets, livestock, and working animals, leading to greater demand for advanced healthcare solutions. The rise in pet ownership, especially in urban areas, has fueled the need for higher-quality care for companion animals.

In 2023, the American Pet Products Association reported that pet ownership in the US reached 70% of households, driving the demand for improved pet care products. For example, Bimeda’s new manufacturing facility in China, launched in November 2023, produces sterile injections and parasite control products, meeting the growing global need for veterinary medicines. This investment emphasizes the importance of enhancing product accessibility and distribution to meet rising demands in the animal healthcare sector.

The increasing prevalence of animal diseases, including zoonotic diseases and antibiotic resistance, is spurring innovation and investment within the animal health sector. The rise in zoonotic diseases, which account for over 60% of emerging infectious diseases in humans according to the US Centers for Disease Control and Prevention, is driving the demand for preventive measures in animal healthcare. This shift toward disease prevention has spurred the development of new vaccines, diagnostics, and antimicrobial alternatives.

In October 2023, Zoetis launched Librela, an anti-NGF monoclonal antibody therapy for managing canine osteoarthritis, illustrating the rising demand for specialized treatments in companion animals. As veterinary professionals adopt new solutions to combat infectious diseases, the emphasis on preventative care and targeted treatments opens up significant growth opportunities for players in the animal health market.

Advancements in animal health research and biotechnology are influencing the latest trends, particularly in companion animal and livestock care. Biotechnology plays a pivotal role in developing personalized treatments, vaccines, and diagnostics for both pets and farm animals. The growing use of biologics, such as for treating cancer and arthritis in pets, reflects a broader trend toward specialized veterinary care.

Additionally, the shift towards precision medicine in veterinary care allows for treatments tailored to an animal’s genetic and environmental factors. As regulations evolve, companies are focusing on the research and development of safe, effective, and affordable solutions. Furthermore, innovations in diagnostic tools are improving disease detection accuracy and speed, enabling more efficient interventions for both livestock and pets. These advancements underscore the dynamic nature of the animal health market and its capacity to respond to evolving challenges.

Key Takeaways

- In 2024, the market generated a revenue of US$ 62.9 billion, with a CAGR of 10.6%, and is expected to reach US$ 172.3 billion by the year 2034.

- The product type segment is divided into pharmaceuticals, biologics, medicinal feed additives, diagnostics, equipment & disposables, and others, with pharmaceuticals taking the lead in 2024 with a market share of 45.8%.

- Considering animal, the market is divided into production animals and companion animals. Among these, production animals held a significant share of 63.9%.

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital/clinic pharmacy, retail, and e-commerce. The hospital/clinic pharmacy sector stands out as the dominant player, holding the largest revenue share of 40.5% in the market.

- The end-user segment is segregated into veterinary hospitals & clinics, veterinary reference laboratories, point-of-care testing/in-house testing, and others, with the veterinary hospitals & clinics segment leading the market, holding a revenue share of 50.3%.

- North America led the market by securing a market share of 38.9% in 2024.

Product Type Analysis

Pharmaceuticals hold 45.8% of the market share and are expected to maintain strong growth due to their essential role in the treatment and prevention of diseases in animals. Increasing awareness of animal health and the growing need for veterinary medicines, particularly in production animals, are driving this segment. The rising prevalence of infectious diseases in livestock, as well as the demand for improved veterinary care for companion animals, is anticipated to support the continuous need for pharmaceutical products.

Pharmaceutical advancements in antibiotic alternatives, such as vaccines and biologics, are expected to foster growth as regulatory agencies seek safer, more sustainable solutions. The expansion of veterinary clinics and hospitals worldwide, especially in emerging markets, is likely to boost demand for pharmaceuticals. Furthermore, the growing trend of pet humanization and increasing healthcare spending on companion animals are expected to drive the demand for pharmaceuticals in the companion animal segment.

Animal Analysis

Production animals account for 63.9% of the market and are projected to remain the dominant segment, primarily driven by the demand for efficient food production. The increasing global population and the rising demand for animal-based food products, including meat, dairy, and eggs, are anticipated to fuel growth in this segment. Livestock health management is critical for maintaining optimal productivity, which is expected to drive the demand for pharmaceuticals, diagnostics, and feed additives in production animals.

Governments’ focus on improving animal welfare standards and the rising adoption of advanced animal husbandry practices are likely to enhance the productivity of the sector. Additionally, increasing concerns regarding zoonotic diseases and food safety are expected to support the continued growth of health management solutions for production animals. The growing trend of sustainable farming and organic products will further accelerate demand for innovative veterinary solutions in the production animal segment.

Distribution Channel Analysis

Hospital/clinic pharmacies capture 40.5% of the market share and are expected to continue dominating due to their vital role in delivering veterinary healthcare services. These pharmacies are expected to benefit from the increasing number of veterinary hospitals and clinics, particularly in emerging markets where pet ownership is on the rise. The growth of companion animal health awareness, combined with the expansion of healthcare infrastructure, is likely to drive demand for pharmaceuticals, biologics, and diagnostic products in veterinary settings.

The rising preference for personalized and specialized veterinary care, particularly for chronic diseases in companion animals, is expected to contribute to the growth of hospital/clinic pharmacies. In addition, growing veterinary healthcare spending and the availability of advanced diagnostic tools in these settings are likely to improve treatment outcomes, further boosting the segment’s demand. The integration of e-prescription systems and telemedicine services into veterinary clinics is expected to enhance accessibility, driving further growth in hospital/clinic pharmacy sales.

End-User Analysis

Veterinary hospitals and clinics, with a 50.3% share, are projected to remain the leading end-users in the animal health market. This growth is attributed to the increasing number of veterinary establishments, driven by the rising adoption of pets globally. The humanization of pets and the growing focus on preventive healthcare are expected to boost the demand for diagnostic services, pharmaceuticals, and specialized treatments in these establishments. As pet owners increasingly seek advanced medical care for their animals, veterinary hospitals and clinics are expected to expand their service offerings, including surgical procedures, emergency care, and specialized treatments.

The growing awareness of animal welfare and the need for regular health check-ups are projected to sustain demand for veterinary services. Furthermore, the rising focus on the management of chronic conditions, such as diabetes, arthritis, and heart disease in companion animals, is likely to drive growth in this segment. Investment in state-of-the-art facilities, as well as improvements in veterinary care standards, will continue to reinforce the role of veterinary hospitals and clinics in the market.

Key Market Segments

By Product Type

- Pharmaceuticals

- Parasiticides

- Anti-inflammatory

- Anti-infectives

- Analgesics

- Others

- Biologics

- Vaccines

- Modified/ Live

- Inactivated

- Other Vaccines

- Other Biologics

- Vaccines

- Medicinal Feed Additives

- Diagnostics

- Consumables, reagents & kits

- Instruments & devices

- Equipment & Disposables

- Temperature Management Equipment

- Research Equipment

- Rescue & Resuscitation Equipment

- Patient Monitoring Equipment

- Fluid Management Equipment

- Critical Care Consumables

- Anesthesia Equipment

- Others

- Veterinary Telehealth

- Veterinary Software

- Livestock Monitoring

By Animal

- Production Animals

- Swine

- Sheep & Goats

- Poultry

- Fish

- Cattle

- Companion Animals

- Dogs

- Cats

- Horses

- Others

By Distribution Channel

- Hospital/ Clinic Pharmacy

- Retail

- E-Commerce

By End-user

- Veterinary Hospitals & Clinics

- Veterinary Reference Laboratories

- Point-of-care Testing/In-house Testing

- Others

Drivers

The Deepening Human-Animal Bond and Increased Pet Expenditure is driving the market

The most significant driver of the Animal Health market is the cultural shift that elevates pets to the status of family members, leading to a substantial increase in discretionary spending on their well-being, commonly referred to as the ‘pet humanization‘ trend. This transformation means pet owners are increasingly willing to pay for premium food, advanced veterinary procedures, and specialized pharmaceuticals, viewing health expenditures as a non-negotiable part of responsible pet ownership. This commitment is evident in the rapidly rising veterinary care spending.

In the United States, total pet industry expenditures reached US$147 billion in 2023, and further grew to an estimated US$152 billion in 2024, according to the American Pet Products Association (APPA). A critical component of this total is the amount spent on veterinary care and product sales, which reached US$35.9 billion in 2022, representing a considerable outlay by pet owners to maintain their animals’ health.

The sheer scale of pet ownership reinforces this driver, with the American Pet Products Association (APPA) reporting that approximately 71% of US households, or about 94 million families, owned a pet as of the 2024-2025 National Pet Owners Survey. This high percentage of households willing to invest significant capital in their companion animals creates a consistently high-demand environment for veterinary medicines, diagnostics, and services, forming a robust foundation for market growth.

Restraints

The Chronic Shortage of Veterinary Professionals is restraining the market

A major structural restraint on the Animal Health market is the pervasive and worsening shortage of qualified veterinary professionals, particularly in companion animal and food animal sectors. This workforce deficit limits the capacity of veterinary clinics and hospitals to accommodate the growing demand for services driven by increased pet ownership and longer pet lifespans.

The result is often longer wait times for routine and specialized care, which can deter pet owners from seeking timely intervention, and ultimately constrains the market’s ability to capitalize on the underlying demand. This critical shortage is quantified by the available data on the profession’s demographics and demand. For example, the American Veterinary Medical Association (AVMA) estimated that it would require nearly 55,000 additional veterinarians to meet the companion animal healthcare needs by 2030, and even with new graduates, a shortage of over 24,000 veterinarians is still projected for that year.

Furthermore, the limited supply of professionals is especially acute outside of companion animal practice; in 2023, there were approximately 68,400 veterinarians in companion animal medicine, yet only slightly more than 8,100 veterinarians worked in food animal or mixed animal practices, according to AVMA data. This scarcity, particularly among production animals, creates a significant bottleneck for disease management, vaccination programs, and the adoption of advanced health products for livestock.

Opportunities

The Rising Global Prevalence of Zoonotic and Production Animal Diseases is creating growth opportunities

The increasing incidence of high-impact infectious diseases in both companion and food production animals offers a powerful opportunity for the Animal Health market, driving the need for sophisticated diagnostics, advanced vaccines, and therapeutic treatments. The threat of zoonotic diseases, which can transmit from animals to humans, has heightened public and governmental awareness, leading to greater investment in animal health surveillance and control measures.

A prime example of this is the detection and spread of Highly Pathogenic Avian Influenza (HPAI), which poses a massive economic and public health risk. The US Department of Agriculture’s Animal and Plant Health Inspection Service (USDA APHIS) confirmed HPAI in over 1,300 poultry premises across the nation since the outbreak began in February 2022.

Furthermore, a novel development in 2024 saw USDA APHIS confirm the first detection of HPAI H5N1 in a dairy herd in March 2024, with subsequent identification across over 900 herds in 17 states. These continuous outbreaks, and the potential for new cross-species transmission, create an urgent and non-discretionary demand for innovative vaccines, biosecurity products, and rapid, reliable diagnostic tests, compelling both private and public sectors to fund and purchase high-value animal health solutions to mitigate these widespread threats.

Impact of Macroeconomic / Geopolitical Factors

Rising US inflation at 2.9% for the 12 months ending August 2025, as reported by the Bureau of Labor Statistics, increases costs for veterinary drug developers, tightening R&D budgets and slowing animal vaccine innovation. US-China trade tensions and the Russia-Ukraine conflict disrupt raw material supplies, delaying production and raising compliance costs for global manufacturers. Still, companies build US innovation hubs and partner with European suppliers to stabilize supply chains.

Growing zoonotic disease risks boost veterinary care investments, driving demand for advanced diagnostics. Meanwhile, US Section 301 tariffs, rising to 50% on Chinese medical gloves in 2025 per the USTR, hike costs for veterinary drugs and equipment, pressuring clinic budgets and risking shortages. Proactive firms tap federal incentives to expand US manufacturing, creating specialized jobs. These steps enhance AI-driven diagnostics and streamline regulations, strengthening the sector. Such moves ensure steady growth and innovation leadership.

Latest Trends

Accelerated Adoption of Pet Health Insurance is a recent trend (2024)

The rapid and sustained adoption of pet health insurance represents a significant, defining trend in the Animal Health market in the 2023-2024 period. Insurance coverage fundamentally changes the purchasing behavior of pet owners, making them less price-sensitive and more likely to approve and pursue comprehensive, high-cost medical treatments, including diagnostics and specialty pharmaceuticals. This financial mechanism helps bridge the gap between the high costs of advanced veterinary care and a pet owner’s budget, thus increasing the utilization of animal health products and services.

The North American Pet Health Insurance Association (NAPHIA) reported substantial, double-digit growth in this area. Specifically, the overall number of pets insured in the US reached approximately 6.4 million by the end of 2024, a notable increase from 5.7 million pets insured at the end of 2023. This represents a robust year-over-year growth rate of 12.7% in the total insured pets in the US in 2024.

Moreover, the total gross written premiums for pet insurance policies in the US surpassed US$4.7 billion in 2024, up from US$3.9 billion in 2023, highlighting a significant inflow of revenue that supports higher utilization of advanced veterinary services and consequently, the greater consumption of animal health products.

Regional Analysis

North America is leading the Animal Health Market

In 2024, North America maintained a 38.9% share of the global animal health market, bolstered by sustained demand for vaccines and therapeutics amid expanding companion animal populations and intensified biosecurity measures in livestock operations. Veterinary practices increasingly integrated advanced diagnostics and preventive protocols to combat emerging zoonotic threats, enhancing herd immunity and reducing economic losses from outbreaks like avian influenza. Regulatory frameworks from the USDA facilitated expedited approvals for novel biologics, enabling rapid deployment in response to regional disease surges and supporting sustainable farming practices.

Collaborative initiatives between industry leaders and federal agencies refined supply chain resilience, ensuring consistent availability of antibiotics and antiparasitics for mixed-use facilities. The post-pandemic surge in pet adoptions amplified retail channels for over-the-counter supplements, aligning with consumer trends toward holistic wellness for aging animals.

Economic pressures on feed costs further drove adoption of nutritional additives, optimizing productivity in dairy and beef sectors. These developments underscored the region’s strategic focus on integrated health management. According to data presented at the 2024 AVMA Veterinary Economic and Business Forum, overall revenue at veterinary practices increased by 3.9% year-over-year from August 2023 to August 2024, despite a 2.3% decline in patient visits.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific animal health sector to advance significantly during the forecast period, as governments enhance veterinary infrastructure to sustain burgeoning livestock outputs in densely populated agrarian economies. National administrations in India and China invest in surveillance networks, prompting producers to adopt robust vaccination schedules for poultry and swine to mitigate endemic infections.

Pharmaceutical entities collaborate with state institutes to develop localized formulations, anticipating broader uptake of growth promoters in intensive farming systems. Regional authorities prioritize biosecurity training for smallholders, equipping them with affordable diagnostics to curb antimicrobial resistance in tropical climates.

Innovation ecosystems in Southeast Asia pioneer digital tracking tools, positioning cooperatives to monitor herd vitality and preempt nutritional deficiencies. Local regulators streamline import protocols for biologics, facilitating timely interventions during seasonal epizootics. These measures fortify the region’s capacity for resilient production chains. India’s Department of Animal Husbandry and Dairying reported milk production reaching 239.30 million tonnes in 2023-24, marking a 3.78% increase from 2022-23, alongside egg output at 142.77 billion units, up 3.18%.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major firms in the veterinary pharmaceuticals sector drive growth by launching AI-driven diagnostics and vaccines to combat zoonotic diseases and enhance livestock health, ensuring rapid response and prevention. They acquire biotech innovators to expand biologics portfolios and optimize global supply chains. Partnerships with feed producers and regulators yield sustainable antibiotic alternatives, aligning with stringent standards.

Leaders invest in digital tools for precision farming and pet telehealth to meet rising demand. They target Asia-Pacific and Latin America, adapting solutions to local disease patterns and regulations. Subscription-based diagnostics and training services strengthen distributor ties and ensure steady revenue.

Zoetis Inc., a 2013 Pfizer spin-off headquartered in Parsippany, New Jersey, leads globally with medicines, vaccines, and diagnostics for animals, advancing welfare in over 100 countries. CEO Juan Ramón Alaix drives innovation in biologics and digital platforms, collaborating with agricultural bodies to integrate solutions, maintaining dominance through regulatory alignment and customer-focused advancements.

Top Key Players in the Animal Health Market

- Zoetis

- Virbac

- Vetoquinol S.A

- Merck & Co., Inc

- Mars Inc

- Idexx Laboratories, Inc

- Elanco

- Dechra Pharmaceuticals Plc

- Ceva Santé Animale

- Boehringer Ingelheim Gmbh

Recent Developments

- In October 2024: VMD Sciences introduced Expanded Access Programs (EAPs) for pets and livestock, giving veterinarians access to advanced, potentially life-saving treatments not commonly available through conventional channels. This initiative drives the Animal Health Market by expanding the availability of innovative therapeutics, addressing unmet medical needs, and enabling veterinarians to provide higher-quality care across companion and farm animals.

- In May 2024: the USDA’s Animal and Plant Health Inspection Service (APHIS) announced funding exceeding US$22.2 million to strengthen early detection, preparedness, prevention, and rapid response to major livestock diseases in the US This investment boosts the Animal Health Market by supporting disease control measures, fostering adoption of vaccines and therapeutics, and encouraging innovations in animal disease management.

Report Scope

Report Features Description Market Value (2024) US$ 62.9 billion Forecast Revenue (2034) US$ 172.3 billion CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pharmaceuticals (Parasiticides, Anti-inflammatory, Anti-infectives, Analgesics, and Others), Biologics (Vaccines (Modified/Live, Inactivated, and Other Vaccines), and Other Biologics), Medicinal Feed Additives, Diagnostics (Consumables, Reagents & Kits, and Instruments & Devices), Equipment & Disposables (Temperature Management Equipment, Research Equipment, Rescue & Resuscitation Equipment, Patient Monitoring Equipment, Fluid Management Equipment, Critical Care Consumables, and Anesthesia Equipment), and Others (Veterinary Telehealth, Veterinary Software, and Livestock Monitoring)), By Animal (Production Animals (Swine, Sheep & Goats, Poultry, Fish, and Cattle), and Companion Animals (Dogs, Cats, Horses, and Others)), By Distribution Channel (Hospital/Clinic Pharmacy, Retail, and E-Commerce), By End-user (Veterinary Hospitals & Clinics, Veterinary Reference Laboratories, Point-of-Care Testing/In-House Testing, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zoetis, Virbac, Vetoquinol S.A, Merck & Co., Inc, Mars Inc, Idexx Laboratories, Inc, Elanco, Dechra Pharmaceuticals Plc, Ceva Santé Animale, Boehringer Ingelheim Gmbh. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zoetis

- Virbac

- Vetoquinol S.A

- Merck & Co., Inc

- Mars Inc

- Idexx Laboratories, Inc

- Elanco

- Dechra Pharmaceuticals Plc

- Ceva Santé Animale

- Boehringer Ingelheim Gmbh