Global Intelligent Parcel Delivery Lockers market Size, Share, Statistics Analysis Report By Type (Standard Smart Locker, Temperature Controlled Smart Locker), By Component (Harware, Software), By Application (Retail, Residential, Commercial, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143238

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

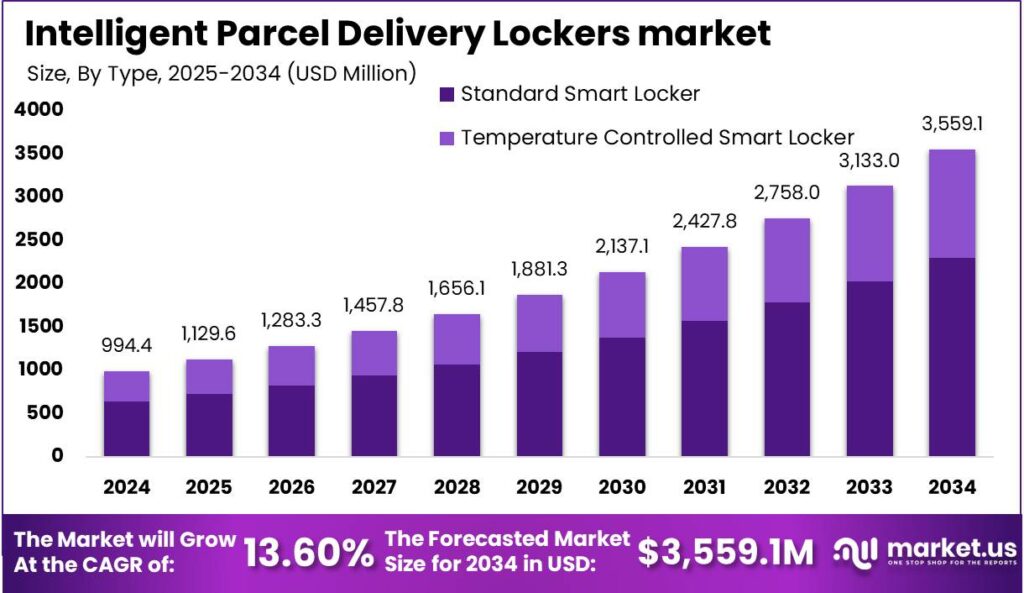

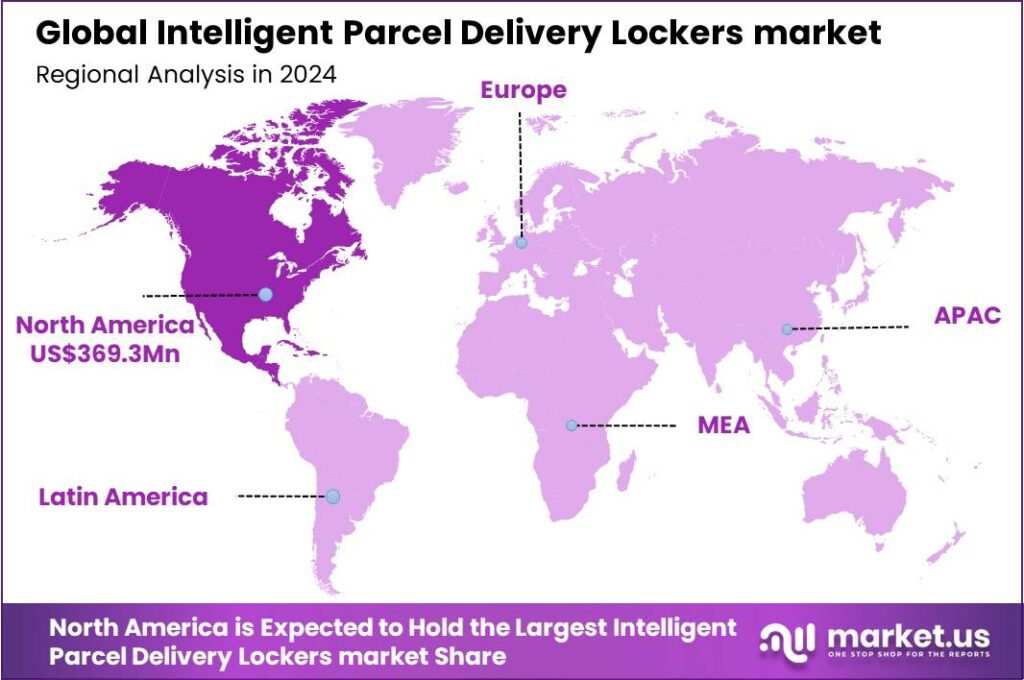

The Intelligent Parcel Delivery Lockers market size is expected to be worth around USD 3,559.1 Mn By 2034, from USD 994.4 Mn in 2024, growing at a CAGR of 13.60% during the forecast period from 2025 to 2034. North America captured the largest share in 2024, holding more than 37.4% of the Intelligent Parcel Delivery Lockers market, with revenue reaching approximately USD 369.3 Mn.

Intelligent Parcel Delivery Lockers are automated storage systems designed to securely store packages until they are retrieved by recipients. These lockers are commonly located in residential complexes, commercial buildings, and public spaces, offering a convenient, secure parcel delivery solution. Equipped with electronic systems, they send automated notifications and provide secure access through codes or QR codes for package retrieval.

The growth of the Intelligent Parcel Delivery Lockers market is driven by several key factors. The rise in online shopping has increased parcel volumes, requiring more efficient delivery solutions. The demand for contactless deliveries, spurred by health and safety concerns, also plays a major role. Additionally, reducing failed delivery attempts and the associated costs presents significant economic benefits for logistics providers.

The primary drivers of this market include the surge in online shopping, the expansion of urban areas, and the evolving consumer expectations for quick and secure parcel delivery services. These factors are compelling logistics and e-commerce businesses to invest in intelligent parcel delivery solutions to enhance customer satisfaction and streamline operations.

There is a robust demand for intelligent parcel delivery lockers across various applications including retail, universities, and residential complexes. In retail settings, these lockers help in managing the high volume of online order pickups and returns, providing a seamless customer experience while reducing in-store congestion.

According to Market.us, the Automated Parcel Delivery Terminals Market is projected to reach USD 2,624.9 million by 2033, growing from USD 796.2 million in 2023 at a CAGR of 12.67% during 2024-2033. This growth is driven by increasing e-commerce transactions, urbanization, and the demand for secure, contactless delivery solutions. Retailers and logistics providers are rapidly adopting automated terminals to enhance last-mile delivery efficiency and reduce operational costs.

Similarly, The Global Digital Parcel Locker Systems Market is set to reach USD 7.7 billion by 2034, up from USD 2.3 billion in 2024, with a CAGR of 12.90% between 2025 and 2034. In 2024, North America dominated the market with over 34% share, generating approximately USD 0.7 billion in revenue. The U.S. market alone is expected to reach USD 0.72 billion, growing at 12.4% CAGR.

Businesses benefit from deploying intelligent parcel lockers by reducing operational costs associated with delivery and returns, enhancing parcel security, and improving customer satisfaction through convenient, anytime parcel access. These lockers also help businesses in managing peak delivery times more efficiently.

Key Takeaways

- The Global Intelligent Parcel Delivery Lockers market is expected to reach USD 3,559.1 Million by 2034, up from USD 994.4 Million in 2024, growing at a CAGR of 13.60% during the forecast period from 2025 to 2034.

- In 2024, the Standard Smart Locker segment held a dominant market position, capturing more than 64.8% share of the Intelligent Parcel Delivery Lockers market. This leadership is mainly due to its broad applicability and cost-effectiveness.

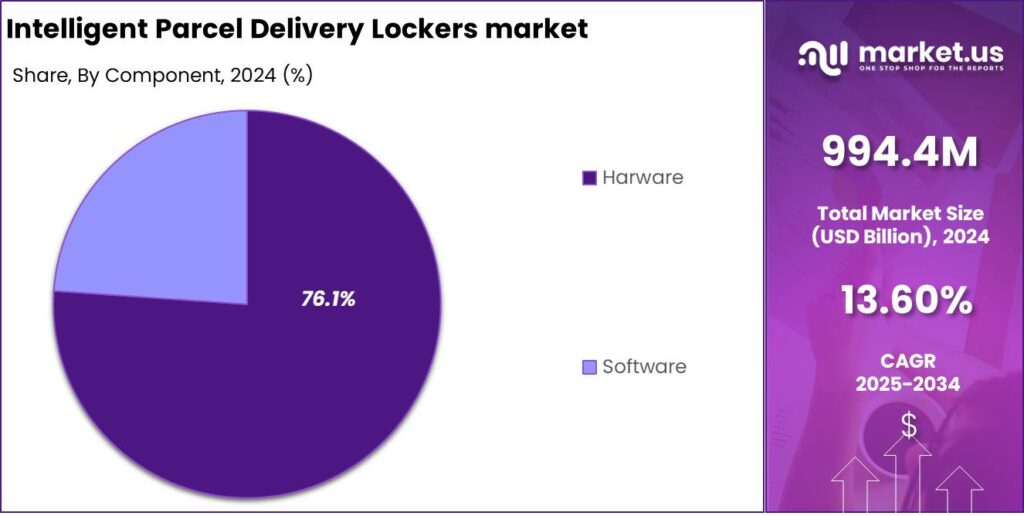

- The hardware segment dominated the market in 2024, holding a significant share of more than 76.1% of the Intelligent Parcel Delivery Lockers market.

- In 2024, the Commercial segment led the market, accounting for more than 38.4% of the share in the Intelligent Parcel Delivery Lockers market.

- North America captured the largest share in 2024, holding more than 37.4% of the Intelligent Parcel Delivery Lockers market, with revenue reaching approximately USD 369.3 million.

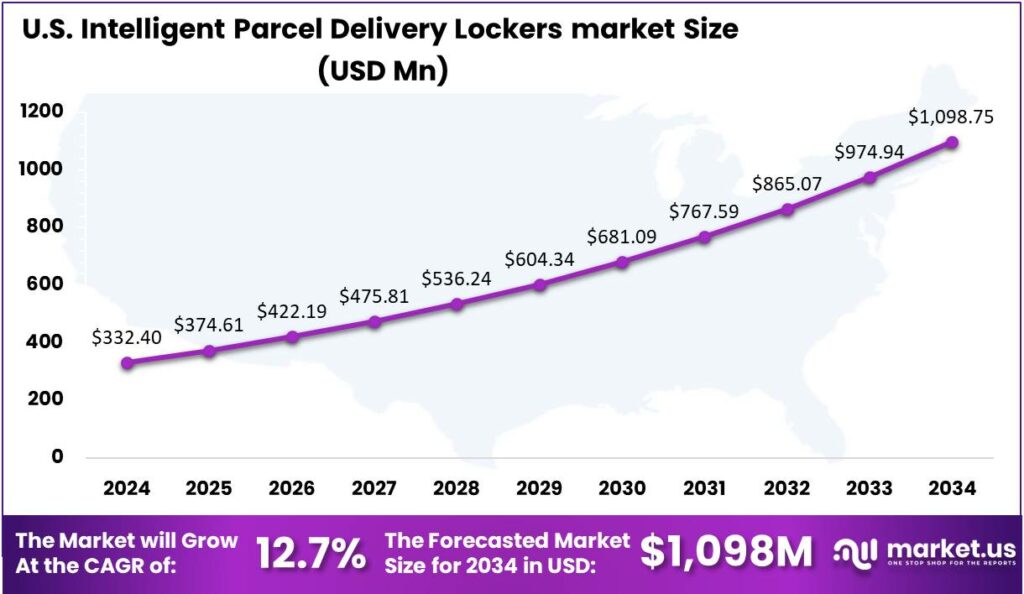

- In 2024, the United States market for Intelligent Parcel Delivery Lockers was valued at approximately USD 332.4 million, experiencing a robust CAGR of 12.7%.

Analysts’ Viewpoint

The market presents significant investment opportunities, particularly in technological advancements and infrastructure expansion to support the anticipated growth in parcel volumes. Innovations in locker technology, such as integration with smart technologies and improved security features, are key areas for potential investments.

Recent advancements include the integration of advanced security features like biometric sensors and real-time tracking capabilities, which enhance the safety and reliability of parcel deliveries. These technologies also enable more precise logistics management and a better end-user experience.

The regulatory landscape for intelligent parcel delivery lockers involves ensuring data protection and privacy, especially when biometric and personal data are involved. Compliance with local and international regulations governing the handling and storage of consumer data is critical as these solutions become more widespread.

U.S. Market Growth

In 2024, the market for Intelligent Parcel Delivery Lockers in the United States was valued at approximately $332.4 million. This sector is experiencing a robust compound annual growth rate (CAGR) of 12.7%, indicating a strong trajectory of growth within the parcel management solutions landscape.

Intelligent Parcel Delivery Lockers, as an automated solution for securing and handling deliveries, address the increasing demand for efficient last-mile delivery services. The growth of the market can be attributed to several factors including the surge in online shopping, the need for secure package delivery solutions, and the optimization of logistics operations.

Furthermore, the integration of advanced technologies such as IoT connectivity and smart access control systems in these lockers enhances user experience by offering real-time tracking and notifications for both senders and recipients. The continued innovation and integration of technology in this field are likely to propel the market forward, sustaining its growth over the upcoming years.

In 2024, North America held a dominant market position in the Intelligent Parcel Delivery Lockers market, capturing more than a 37.4% share with revenue amounting to approximately USD 369.3 million. This leading position is due to the region’s rapid adoption of advanced technologies in logistics and retail, coupled with a significant rise in e-commerce activities.

The proliferation of e-commerce in North America has been a critical driver for the expansion of intelligent parcel delivery solutions. With online shopping reaching unprecedented levels, particularly in the United States and Canada, there has been a corresponding increase in the demand for efficient and secure parcel delivery options.

Additionally, the region’s robust infrastructure for technological innovation supports the widespread implementation of these smart systems. North American companies are at the forefront of integrating IoT and smart technologies in parcel delivery solutions, which has enhanced the functionality and user experience of these lockers.

The growing urban population and high density of metropolitan areas in North America drive the need for innovative delivery solutions to tackle space and security challenges. Intelligent Parcel Delivery Lockers are being integrated into residential and commercial buildings as a standard amenity, showcasing the region’s progressive approach to modern delivery complexities.

Type Analysis

In 2024, the Standard Smart Locker segment held a dominant market position, capturing more than a 64.8% share of the Intelligent Parcel Delivery Lockers market. This segment’s leadership can primarily be attributed to its broad applicability and cost-effectiveness.

The proliferation of e-commerce has significantly contributed to the dominance of the Standard Smart Locker segment. As online shopping continues to grow, the demand for reliable and secure delivery systems has escalated. Standard Smart Lockers meet this demand effectively by providing a secure location for parcel drop-off and pick-up, which minimizes the risk of theft and damage.

The integration of IoT and AI in Standard Smart Lockers boosts their appeal by enabling real-time tracking, notifications, and enhanced security. Remote management and usage monitoring also help logistics companies optimize operations, reducing costs linked to missed deliveries and redelivery attempts.

Despite the growing interest in more specialized locker solutions, such as Temperature Controlled Smart Lockers, the Standard Smart Locker segment continues to lead due to its scalability. Businesses can deploy large networks of these lockers without substantial increments in investment, making them a viable solution for expanding logistics networks.

Component Analysis

In 2024, the hardware segment held a dominant position in the intelligent parcel delivery lockers market, capturing more than a 76.1% share. This significant market share is largely due to the essential role that physical components play in the functionality and deployment of these lockers.

The dominance of the hardware segment is driven by the capital-intensive nature of physical components. Significant investments in quality materials and advanced locking systems are essential for durability and security, making hardware the primary focus of investment in intelligent parcel delivery systems.

Moreover, the continuous need for robust and vandal-resistant materials to withstand various environmental conditions contributes to the segment’s dominance. The hardware must be equipped to handle diverse climates and physical settings, from cold and damp to hot and dry, ensuring reliability regardless of external conditions.

While software is vital for intelligent parcel delivery lockers, hardware receives the most investment, especially when expanding into new markets or upgrading existing systems. This ongoing hardware investment highlights its dominance over software, which requires lower capital expenditure and undergoes faster innovation cycles.

Application Analysis

In 2024, the Commercial segment held a dominant market position in the Intelligent Parcel Delivery Lockers market, capturing more than a 38.4% share. This segment’s leadership is largely driven by the growing need for efficient parcel management systems within corporate environments and business settings, where the volume of parcel deliveries is high and security is paramount.

A major driver of the commercial segment is the growing integration of intelligent parcel delivery lockers in business complexes and institutions. These lockers offer secure and efficient parcel management, helping organizations streamline operations, enhance security, and reduce administrative burdens, ultimately improving operational efficiency.

The rise in remote working has increased the demand for intelligent systems in commercial spaces. Flexible work policies require employees to receive personal and professional deliveries at work, and these lockers offer secure, 24/7 parcel collection, enhancing convenience for employees and reducing front desk staff workload.

The growth of the commercial segment is fueled by technological advancements enabling better integration with existing security and communication systems. This seamless integration allows for remote monitoring and management, supporting businesses’ digital transformation. As efficiency and security in parcel delivery remain priorities, demand for intelligent delivery solutions in this sector is expected to grow.

Key Market Segments

By Type

- Standard Smart Locker

- Temperature Controlled Smart Locker

By Component

- Harware

- Software

By Application

- Retail

- Residential

- Commercial

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Surge in E-Commerce and Online Shopping

The rapid expansion of e-commerce has significantly increased the demand for efficient last-mile delivery solutions. Consumers’ growing preference for online shopping necessitates innovative approaches to parcel delivery.

Intelligent parcel delivery lockers have emerged as a pivotal solution, offering secure and convenient options for package retrieval. These lockers address common delivery challenges, such as missed deliveries and package theft, by providing 24/7 access for consumers to collect their parcels at their convenience.

This not only enhances customer satisfaction but also streamlines the logistics process for retailers and delivery companies. The integration of intelligent lockers into the delivery ecosystem exemplifies a strategic response to the evolving dynamics of consumer behavior and technological advancement.

Restraint

High Initial Investment Costs

The implementation of intelligent parcel delivery lockers requires substantial upfront investments, encompassing hardware acquisition, software development, infrastructure setup, and ongoing maintenance. These financial commitments can be particularly burdensome for small to medium-sized enterprises (SMEs) and organizations operating with limited budgets.

The high initial costs may deter potential adopters from integrating these systems, despite the long-term operational efficiencies and customer satisfaction benefits they offer. This financial barrier underscores the need for scalable and cost-effective solutions to facilitate broader adoption across diverse market segments.

Opportunity

Integration of Sustainable and Eco-Friendly Solutions

The increasing global emphasis on sustainability presents a significant opportunity for intelligent parcel delivery lockers. By reducing the number of individual delivery attempts and consolidating deliveries to centralized locker locations, these systems contribute to lower carbon emissions associated with transportation.

Additionally, the adoption of energy-efficient technologies and the use of recyclable materials in locker manufacturing align with the growing consumer demand for environmentally responsible practices. Embracing these sustainable approaches not only enhances corporate social responsibility but also appeals to eco-conscious consumers, potentially driving market growth.

Challenge

Space and Installation Constraints

Deploying intelligent parcel delivery lockers in densely populated urban areas poses significant challenges due to limited available space. Securing appropriate locations for locker installations is often complicated by high real estate costs and stringent zoning regulations.

These constraints can hinder the widespread adoption of locker systems, particularly in metropolitan regions where the demand for efficient delivery solutions is highest. Addressing these challenges requires innovative approaches to locker design and placement, as well as collaboration with local authorities to navigate regulatory landscapes effectively.

Emerging Trends

One prominent trend is the customization and modular design of these lockers. Businesses can tailor locker configurations to meet specific needs, allowing for scalability and adaptability in various environments. This flexibility ensures that the locker systems can evolve in tandem with changing business requirements.

The integration of smart technologies is also shaping the future of parcel lockers. Features such as touchscreens, barcode scanners, and cameras are becoming standard, enhancing user interaction and streamlining the package retrieval process. These technological advancements contribute to a more seamless and efficient user experience.

Sustainability is another driving force behind the evolution of intelligent parcel lockers. By reducing the number of delivery attempts and optimizing delivery routes, these lockers contribute to lower carbon emissions, aligning with the growing emphasis on environmental responsibility within the logistics industry.

Business Benefits

One significant benefit is the enhancement of security. Smart lockers provide a secure solution for managing package deliveries, deterring theft and unauthorized access. This assurance is particularly valuable for businesses handling sensitive or high-value items, ensuring that packages are stored safely until collected by the intended recipient.

Moreover, smart lockers significantly improve the customer experience by offering a convenient and secure method for package pickup. Customers can retrieve their packages at their convenience, eliminating the need to wait in line or be present for a delivery.

Integration with existing systems further amplifies the benefits for businesses. Smart lockers can seamlessly integrate with inventory management and point-of-sale systems, allowing for more effective management of deliveries and tracking of inventory. This integration streamlines operations and reduces the potential for errors, contributing to overall business efficiency.

Key Player

The Intelligent Parcel Delivery Lockers market is characterized by dynamic growth and innovation, driven by key industry players who are shaping market trends through technological advancements and strategic expansions.

Smartbox is a leading player in the intelligent parcel locker market, known for its innovative approach to parcel delivery. Smartbox’s systems prioritize convenience and security, offering features like contactless delivery and advanced tracking, making them a popular choice for businesses and customers.

Cleveron stands out for its focus on automation and efficiency in the parcel delivery space. Cleveron’s intelligent lockers, featuring robotic parcel machines and self-service kiosks, streamline parcel collection and are highly scalable for various settings, from small stores to large distribution centers.

DeBourgh is a well-established player that has been making strides in the intelligent parcel delivery locker market. The company offers a range of customizable locker solutions, catering to different types of businesses, from residential complexes to large-scale commercial enterprises.

Top Key Players in the Market

- Smartbox

- Cleveron

- DeBourgh

- KEBA

- Kern Ltd

- Package Nexus

- Patterson Pope

- RENOME SMART

- Snaile Inc.

- TZ Limited

- Other Major Players

Top Opportunities Awaiting for Players

- Expansion in E-commerce: The continued expansion of e-commerce is a significant driver, creating a surge in parcel volumes that require efficient last-mile delivery solutions. Intelligent parcel lockers provide a secure and convenient way to manage these deliveries, thereby enhancing customer satisfaction by reducing missed deliveries and allowing for flexible pickup times.

- Urbanization and Space Efficiency: Increasing urbanization and the associated space constraints in metropolitan areas offer a considerable opportunity for the deployment of intelligent parcel lockers. These lockers serve as space-efficient solutions that facilitate secure and organized parcel delivery, which is particularly valuable in densely populated urban settings.

- Technological Integration: There is an opportunity for market players to integrate advanced technologies such as the Internet of Things (IoT), artificial intelligence and data analytics. These technologies can enhance the functionality of parcel lockers, providing features like real-time tracking, optimized locker utilization, and personalized user interactions, which can improve operational efficiency and user experience.

- Diversification into New Segments: The market offers opportunities for diversification into various sectors including residential complexes, educational institutions, and office buildings. Each of these segments presents unique needs and usage scenarios for intelligent lockers, from reducing mailroom burdens in universities to enhancing parcel handling in corporate environments.

- Global Market Penetration: While North America and Europe are currently the largest markets for intelligent parcel lockers, there is significant growth potential in the Asia-Pacific region, driven by rapid urbanization, e-commerce expansion, and smart city initiatives. Emerging markets in the Middle East, Africa, and Latin America offer new opportunities for expansion as online shopping and urban development grow.

Recent Developments

- In October 2024, InPost, a prominent European parcel locker operator, acquired the remaining 70% stake in Britain’s Menzies Distribution for £60.4 million. This strategic move aimed to enhance InPost’s logistics capabilities in the UK, particularly in urban centers like London, Manchester, and Birmingham.

- In November 2024, KEBA partnered with GLS Group to expand parcel locker networks across Europe, enhancing last-mile delivery infrastructure.

Report Scope

Report Features Description Market Value (2024) USD 994.4 Mn

Forecast Revenue (2034) USD 3,559.1 Mn CAGR (2025-2034) 13.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Standard Smart Locker, Temperature Controlled Smart Locker), By Component (Harware, Software), By Application (Retail, Residential, Commercial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Smartbox, Cleveron, DeBourgh, KEBA, Kern Ltd, Package Nexus, Patterson Pope, RENOME SMART, Snaile Inc., TZ Limited, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intelligent Parcel Delivery Lockers marketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Intelligent Parcel Delivery Lockers marketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Smartbox

- Cleveron

- DeBourgh

- KEBA

- Kern Ltd

- Package Nexus

- Patterson Pope

- RENOME SMART

- Snaile Inc.

- TZ Limited

- Other Major Players