Global Amla Extracts Market Size, Share, Growth Analysis By Form (Powder, Liquid, Capsules, Tablets), By Nature (Organic, Inorganic), By Application (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Nutraceutical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158178

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

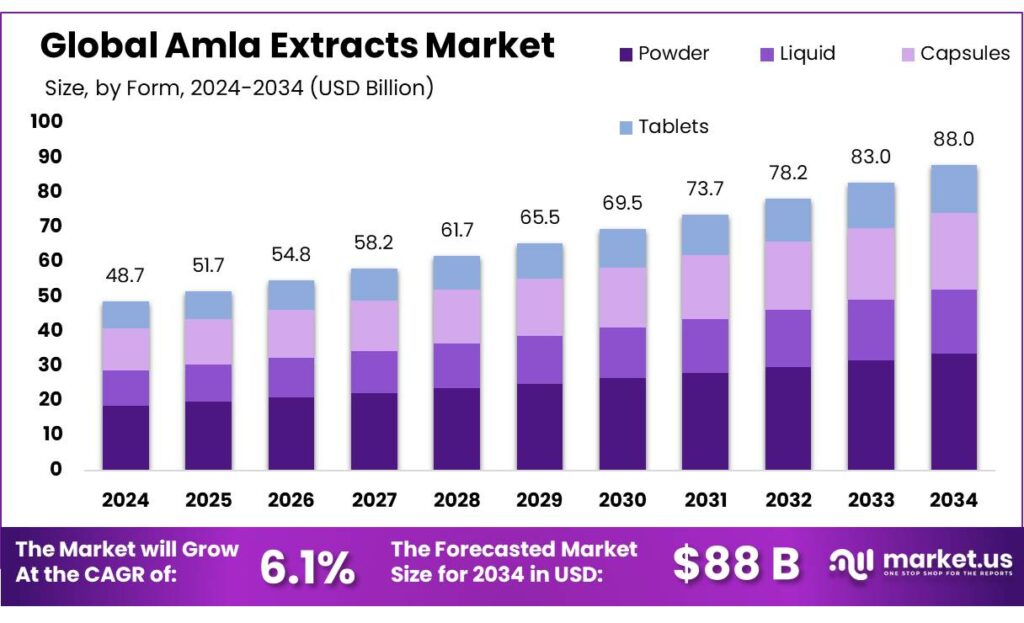

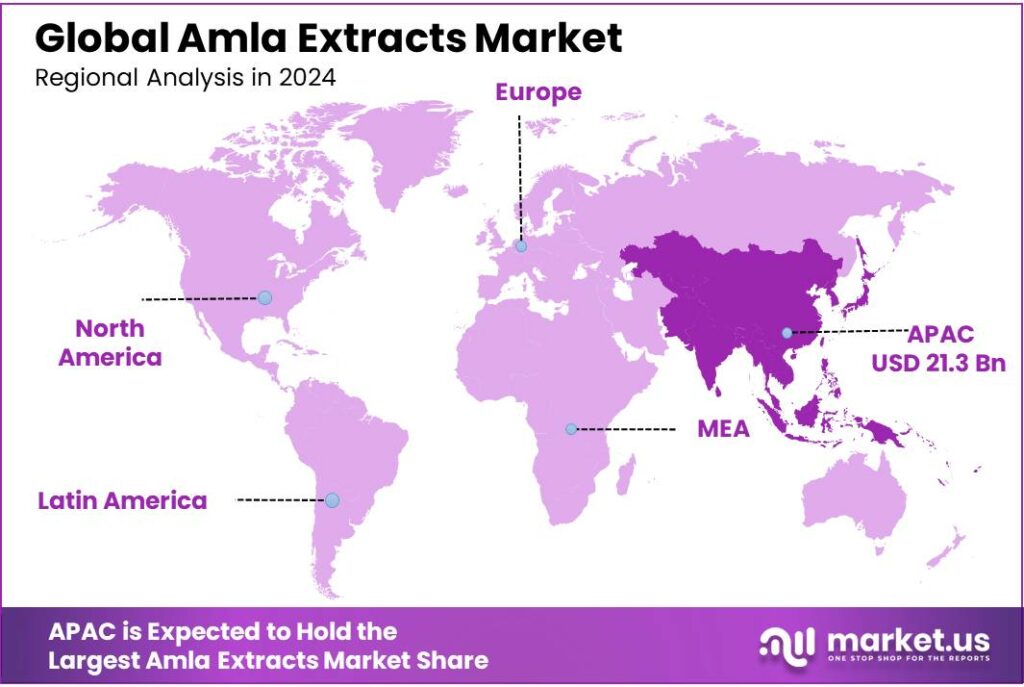

The Global Amla Extracts Market size is expected to be worth around USD 88.0 Billion by 2034, from USD 48.7 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 43.90% share, holding USD 21.3 Billion in revenue.

Amla, or Indian gooseberry (Emblica officinalis), is a nutrient-dense fruit widely recognized for its exceptionally high vitamin C content, along with polyphenols, flavonoids, tannins, and other bioactive phytochemicals. Traditionally used in Ayurvedic and Siddha medical systems, Amla has gained traction in modern healthcare and wellness markets.

Its extract forms—including powder, pulp, oil, and liquid—are commonly incorporated into pharmaceuticals, nutraceuticals, functional foods, cosmetics, and dietary supplements. The industrial processing of Amla typically includes systematic harvesting, drying or pulping, extraction of key compounds, bioactive standardization, and finished formulation, followed by compliance-based packaging for domestic and export distribution.

The rising global consciousness around health and wellness has emerged as a major driver for Amla extracts. Consumers are increasingly shifting toward plant-based, natural ingredients for immunity enhancement, digestive support, anti-aging, and detoxification needs. Amla’s antioxidant potential has been a key selling point across wellness products, especially in developed markets. This trend aligns with the World Health Organization’s (WHO) observation that demand for medicinal plants is growing globally at an annual rate of 15–25%, reinforcing the relevance of Amla in both traditional and modern formulations.

The rising global consciousness around health and wellness has emerged as a major driver for Amla extracts. Consumers are increasingly shifting toward plant-based, natural ingredients for immunity enhancement, digestive support, anti-aging, and detoxification needs. Amla’s antioxidant potential has been a key selling point across wellness products, especially in developed markets. This trend aligns with the World Health Organization’s (WHO) observation that demand for medicinal plants is growing globally at an annual rate of 15–25%, reinforcing the relevance of Amla in both traditional and modern formulations.Government policy has played a crucial enabling role in this sector’s growth trajectory. The National Medicinal Plants Board (NMPB), operating under the Ministry of AYUSH, has promoted cultivation, conservation, and value addition of medicinal plants, with Amla being among the 140 prioritized species for commercial development.

Under the National AYUSH Mission (NAM) between FY 2015–16 and 2020–21, the Indian government supported the cultivation of medicinal plants over 56,305 hectares, while also funding 25 semi-processing or processing units to promote decentralised extraction capacity. Conservation efforts under the same framework led to the development of 105 Medicinal Plants Conservation and Development Areas (MPCDAs) across 20,589.45 hectares, ensuring biodiversity preservation alongside industrial expansion.

Export-oriented growth of Amla-based products has also received a push due to favorable trade conditions and rising demand for certified organic botanicals. As per data published by the Agricultural and Processed Food Products Export Development Authority (APEDA), India exported USD 665.96 million worth of organic products in FY 2024–25 (April to March), representing a 34.6% year-over-year growth, with Amla being a prominent high-value inclusion in these shipments. Such performance underscores the sector’s strategic importance not only in domestic herbal markets but also in global nutraceutical supply chains.

Key Takeaways

- Amla Extracts Market size is expected to be worth around USD 88.0 Billion by 2034, from USD 48.7 Billion in 2024, growing at a CAGR of 6.1%.

- Powder held a dominant market position, capturing more than a 38.2% share in the Amla Extracts Market.

- Organic held a dominant market position, capturing more than a 58.1% share in the Amla Extracts Market.

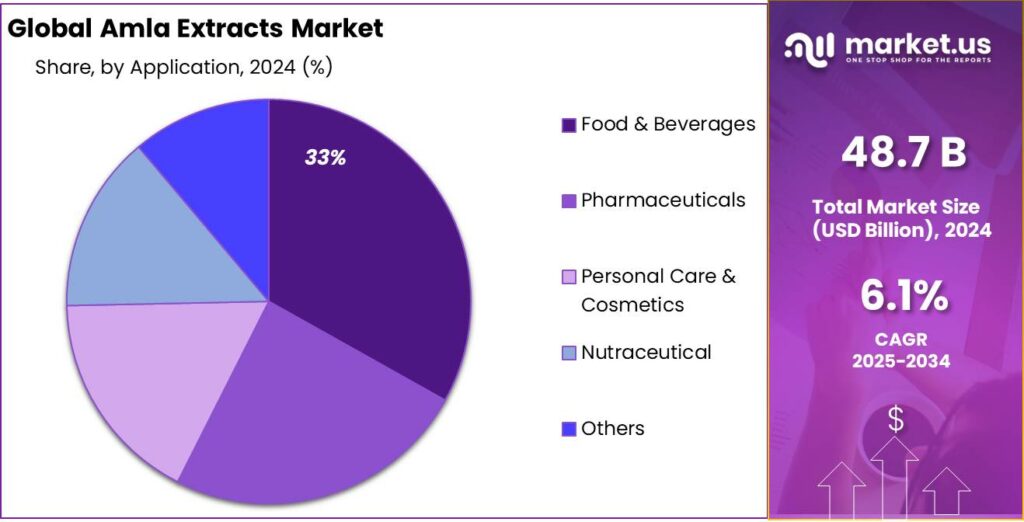

- Food & Beverages held a dominant market position, capturing more than a 33.7% share in the Amla Extracts Market.

- Asia Pacific emerged as the dominating region in the global Amla Extracts market, holding approximately 43.90% of total global revenue and accounting for a market size of about USD 21.3 billion.

By Form Analysis

Powder dominates with 38.2% due to its long shelf life and easy usage

In 2024, Powder held a dominant market position, capturing more than a 38.2% share in the Amla Extracts Market by Form segment. The growing preference for powder form is driven by its convenience, longer shelf life, and wide application across dietary supplements, Ayurvedic medicines, and cosmetic formulations. Powdered amla is easy to store, transport, and mix into health drinks or skincare products, making it highly popular among consumers and manufacturers alike. The format is also cost-effective, especially for bulk usage in nutraceuticals and personal care. With rising demand for clean-label, natural ingredients and increasing global awareness of amla’s health benefits, the powdered form continued to grow steadily into 2025, supported by strong production capacities and domestic processing infrastructure.

By Nature Analysis

Organic leads with 58.1% as health-conscious buyers choose chemical-free options

In 2024, Organic held a dominant market position, capturing more than a 58.1% share in the Amla Extracts Market by Nature segment. This strong preference for organic extracts reflects the growing demand for clean, chemical-free, and sustainably sourced health products. Consumers are becoming more conscious about what they consume, especially in supplements, personal care, and wellness products, where organic certification signals purity and safety. The rise of organic farming practices and increasing government support for organic agriculture in India have boosted supply. By 2025, this trend is expected to continue upward, with more manufacturers offering certified organic amla extracts to meet both domestic and global demand, especially from Europe and North America.

By Application Analysis

Food & Beverages leads with 33.7% as consumers embrace functional nutrition

In 2024, Food & Beverages held a dominant market position, capturing more than a 33.7% share in the Amla Extracts Market by Application segment. The surge in demand for healthy drinks, fortified snacks, and functional foods has driven the use of amla extracts across a wide range of food and beverage products. Known for its high vitamin C content and antioxidant benefits, amla is being added to juices, herbal teas, gummies, and health bars to appeal to wellness-focused consumers. Its natural sourness also enhances flavor profiles, especially in traditional and fusion recipes. By 2025, this application is expected to see continued growth as more brands innovate with natural superfood ingredients and clean-label formulations.

Key Market Segments

By Form

- Powder

- Liquid

- Capsules

- Tablets

By Nature

- Organic

- Inorganic

By Application

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Nutraceutical

- Others

Emerging Trends

Surge in AYUSH & Herbal Exports with Bigger Volumes

One of the newest and strongest trends in the Amla extract and related herbal medicines space is how exports under the AYUSH and herbal products banner in India are growing—not just in money, but much more sharply in physical quantity. What’s happening now is that stakeholders are noticing demand from overseas, and that is pushing the industry to scale up volumes, better quality, and more certified/standardized supplies.

Consumers at home are also changing. More people in India are looking for foods, cosmetics, and supplements that are not heavily synthetic, and that include traditional/herbal ingredients. In a survey cited by Mintel, over a quarter of Indian consumers said they plan to spend more on food and drink items that use Ayurvedic herbs.

- In particular, about 34% of consumers especially from “financially healthy” segments and those in Western India are keen on functional foods or beverages enriched with Ayurvedic ingredients. That trend matters because as demand rises domestically, producers have both a local and an export market. Amla extract manufacturers can innovate products (functional foods, drinks, beauty supplements) using amla ingredients to ride this consumer‐interest wave.

On the more practical side, many manufacturers are responding. For example, in states like Madhya Pradesh, clusters of herbal & Ayurvedic medicine makers are pushing to upgrade facilities, to set up testing labs, and improve infrastructure so they can meet export standards and supply more reliably. This translates to local jobs, better incomes for farmers of medicinal plants, better quality control, and eventually more consistent supply of ingredients like Amla.

Drivers

Strong Government Support and Policy Backing

One of the most important reasons the Amla extracts industry is growing rapidly is the robust support and policy framework provided by governments, especially in India. When there’s clear institutional backing—financial, regulatory, or infrastructural—it gives farmers, processors, and entrepreneurs confidence, stability, and incentive to invest in cultivation, extraction, quality control, and exports.

- As per government records, during the years 2018‑19 to 2020‑21, the Ministry of AYUSH approved approximately Rs. 6,305.24 lakh (which is about INR 63.05 crore) for promoting cultivation of medicinal plants under NAM. This financial injection helps reduce the risk for farmers and companies, enabling them to adopt better practices, use quality planting material, and invest in higher technologies for extraction and standardization.

Another trusted data point: the export of medicinal plants under HS Code 1211 has been sizeable. For instance, in FY 2020‑21, exports of medicinal plants in that category were 107,961.09 metric tonnes, followed by 102,731.32 tonnes in 2021‑22, then 95,813.41 tonnes in 2022‑23. These numbers show that there’s actual demand in global trade, and the government’s policies are enabling supply to meet that demand.

In simple terms, when government provides subsidies, institutional support, quality control mechanisms, and infrastructure, the ecosystem around Amla extract becomes much more reliable. For farmers, it’s not just growing a crop, it’s growing one that can be processed, sold, and contributes to a larger wellness and herbal market. For the country, it means better healthcare options, export revenue, and sustaining traditions of herbal medicine. And for consumers, quality and safety improve when there’s regulation, traceability, and standardization.

Restraints

Post‑Harvest Losses, Quality Variation, and Weak Standardization

One of the biggest hurdles in scaling the Amla extracts industry is dealing with post‑harvest losses and inconsistent quality of raw material, combined with weak standardization of extraction and processing. These issues not only reduce profit margins for growers and processors but also make it harder to satisfy export and regulatory standards—hurting the entire chain from farm to finished product.

According to a study by the Ministry of Food Processing Industries (MoFPI), even though India produces over a million tonnes of Amla (1,164,000 metric tonnes in 2019‑20 from ~97,000 hectares), much of that fruit suffers from losses during harvesting, drying, storage, and transport. Poor drying or drying under uncontrolled conditions leads to degradation of vitamin C, formation of molds and fungal growth, and loss of other heat‑sensitive bioactive compounds. The MoFPI “Study on Infrastructure Gaps – Amla” identifies gaps like inadequate cold storage, insufficient mechanised dryers, lack of moisture‑controlled storage, and inefficient logistics between orchards and processing units.

Beyond loss of quantity, variation in quality from fruit to fruit, and batch to batch, is a big restraint. For Amla extracts, potency (e.g., vitamin C content), moisture content, degree of ripeness, presence of impurities (like pesticide residues, foreign matter or microbial contamination) all affect the extract output (yield and quality). If these are inconsistent, extractors cannot guarantee a stable product for downstream uses (nutraceuticals, cosmetics). Many small farmers use traditional sun‑drying and non‑standard drying methods which don’t control for temperature or humidity. As per MoFPI’s infrastructure gaps report, drying, storage, and transport remain weak links, with losses of both quantity and quality occurring at pre‑processing steps.

Opportunity

Rising Export Potential Amidst Organic and Ayush Sector Expansion

One of the most promising opportunities for the Amla extracts industry lies in its export potential, especially under India’s growing organic produce and AYUSH/herbal products sectors. With governments pushing for higher exports, better certifications, and more sustainable supply chains, Amla extract producers can ride this wave to gain both volume and value.

India’s exports of AYUSH and herbal products have shown meaningful expansion in recent years. The government‐of‐India data reveals that during the fiscal year 2024‑25, exports of AYUSH and herbal products stood at US$ 689.34 million, which is a rise of about 5.86% from US$ 651.17 million in FY 2023‑24. In terms of quantity, exports grew to 128,738 metric tonnes in FY 2024‑25, up from 105,984 metric tonnes in the prior year. This upward trend indicates that there is growing international demand for herbal/Ayush goods that adhere to relevant standards and that India is increasingly able to meet those standards.

Government initiatives also amplify this opportunity. For example, the National Programme for Organic Production (NPOP) ensures that land and produce under certified organic standards are eligible for exports. Schemes like Mission Organic Value Chain Development for North Eastern Region (MOVCD‑NER) offer subsidies and support for processing, grading, transport, cold storage, and certification for organic / medicinal plants in those states.

Under MOVCD‑NER, a target is to create 100 Farmer Producer Organisations (FPOs) / FPCs in the eight North Eastern states, covering 50,000 hectares of area, with support in organic inputs, certification, aggregation, processing, and marketing. These frameworks reduce risk, lower costs, and help small and medium scale growers and processors comply with export requirements.

For Amla extract producers, this means that if they invest in organic farming, traceability, certification, better extraction and processing practices, they can access higher‐premium export markets: Europe, the US, Japan etc., which pay more for certified products with strong quality, safety and sustainability credentials. Also, as AYUSH products gain broader acceptance globally (both regulatory acceptance and consumer demand), there’s likely to be more demand for plant extracts with documented bioactives, safety, and good manufacturing practices.

Regional Insights

Asia Pacific dominates at 43.90% with ~USD 21.3 Billion market size

In 2024, Asia Pacific emerged as the dominating region in the global Amla Extracts market, holding approximately 43.90% of total global revenue and accounting for a market size of about USD 21.3 billion. This strong regional leadership is rooted in both supply and demand fundamentals. On the supply side, countries like India are major producers of amla fruit and hosts of traditional extraction industries, giving them not only raw material advantages but also established processing capacities.

Within the region, India plays a pivotal role both as the largest consumer and exporter of processed amla extracts. Its domestic consumption bolstered by government schemes to promote medicinal plants and natural wellness complements exports to markets like East Asia and the West. Meanwhile, countries such as China, South Korea, and Japan are adopting amla in high‑value cosmetic, dietary supplement, and nutraceutical applications, increasingly preferring standardized extracts and organic certified forms.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Biomax Life Sciences is an Indian producer/exporter of botanical extracts including Emblica extract (Phyllanthus emblica, amla). They supply food‑grade amla extract with around 40% Emblica content, targeted at nutraceuticals, supplements, and functional foods. They export in multiple shipments (e.g. 134 export shipments logged) to markets like USA, Taiwan, France, Germany. Biomax positions itself in the export‑led botanical extract space with emphasis on quality (food‑grade, standardized extract levels).

Arjuna Natural is an Indian botanical extraction and innovation firm founded in 1989 with global reach (serving customers in 70+ countries). They produce branded amla extracts such as Tri‑Low® (a full‑spectrum extract standardized with ALA bound diacyl glycerol, preserving natural vitamin C) for cardiovascular health, and Amlamax for heart health, immunity, and rejuvenation. Their extraction is in‑house, with strict safety, purity, and clinical validation standards.

Patanjali Ayurveda is a major Indian Ayurvedic FMCG & herbal wellness company which also offers amla‑based products such as amla juice and health drinks etc. Their amla juice is made from pure Indian gooseberry (amla) and is rich in vitamin C, minerals (carotene, calcium, iron) and vitamin B complex. Being a large player in Ayurveda and herbal wellness, Patanjali leverages strong domestic distribution, brand trust, and cost‑competitive sourcing.

Top Key Players Outlook

- Biomax Life Sciences Limited

- Taiyo International

- Arjuna Natural

- Patanjali Ayurveda Limited

- Archerchem

- SYDLER

- RiSun Bio-Tech Inc

- Ambe Phytoextracts Pvt. Ltd.

- Herbeno Herbals

- Bhumi Amla

Recent Industry Developments

Taiyo reports that for the fiscal year ending March 31, 2025, their consolidated net sales were 119,010 million yen, up 13.6% from previous year.

In FY 2024, Patanjali Ayurved’s total income rose by 23.15% to ₹9,335.32 crore, helped largely by “other income” items. Its net sales‑revenue for the same period dropped about 14.25% to ₹6,460.03 crore, partly because the group moved its food business to a separate company Patanjali Foods.

Report Scope

Report Features Description Market Value (2024) USD 48.7 Bn Forecast Revenue (2034) USD 88.0 Bn CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid, Capsules, Tablets), By Nature (Organic, Inorganic), By Application (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Nutraceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Biomax Life Sciences Limited, Taiyo International, Arjuna Natural, Patanjali Ayurveda Limited, Archerchem, SYDLER, RiSun Bio-Tech Inc, Ambe Phytoextracts Pvt. Ltd., Herbeno Herbals, Bhumi Amla Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Biomax Life Sciences Limited

- Taiyo International

- Arjuna Natural

- Patanjali Ayurveda Limited

- Archerchem

- SYDLER

- RiSun Bio-Tech Inc

- Ambe Phytoextracts Pvt. Ltd.

- Herbeno Herbals

- Bhumi Amla