Global Amino Resins Market Size, Share, And Business Benefits By Type (Urea–formaldehyde, Melamine–formaldehyde, Others), By Form (Solid, Liquid), By Category (Solvent-based, Water-based), By Application (Adhesives, Paints and Coatings, Laminates, Others), By End-use (Building and Construction, Automotive, Electrical Appliances, Textile, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 122391

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

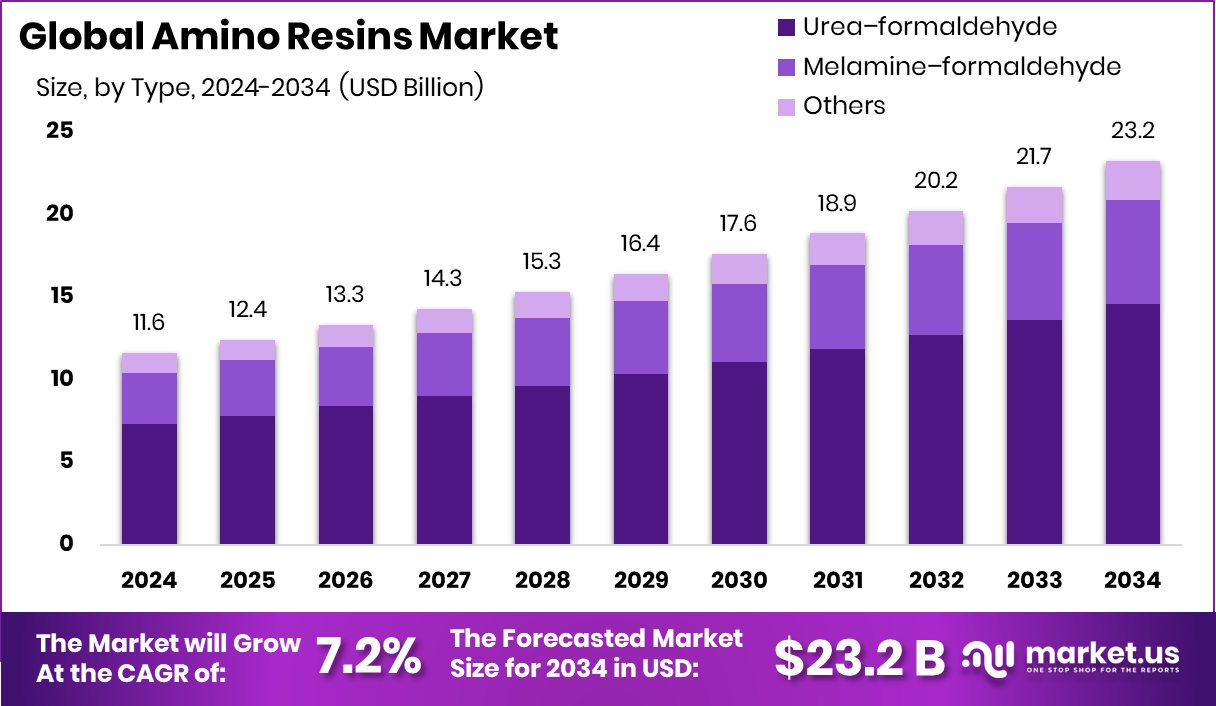

Global Amino Resins Market is expected to be worth around USD 23.2 billion by 2034, up from USD 11.6 billion in 2024, and grow at a CAGR of 7.2% from 2025 to 2034. Rapid industrialization and construction growth fueled Asia-Pacific’s 42.1% Amino Resins Market leadership.

Amino resins, also known as amino plastics, are thermosetting resins with outstanding tensile strength, hardness, and impact resistance, which makes them highly suitable for a variety of industrial applications. These resins are formed through the condensation of formaldehyde with amino compounds such as urea and melamine, leading to the production of urea-formaldehyde and melamine-formaldehyde, the two primary types of amino resins.

The global demand for amino resins is driven by their critical role in the manufacturing of coatings, adhesives, molding compounds, and laminates. Their excellent adhesive properties make them indispensable in the woodworking industry for bonding plywood, particleboard, and other wood products. Furthermore, the automotive and electrical appliance industries extensively utilize these resins due to their thermal resistance and insulation properties.

Government initiatives have a profound impact on the amino resins industry. For instance, the U.S. government’s policies on reducing VOC emissions have led to innovations in low-emission amino resin products. Such regulatory frameworks are not only pushing for environmental compliance but are also spurring technological advancements within the industry.

Looking ahead, the future growth opportunities for amino resins lie in the development of more sustainable and eco-friendly resins. The push towards reducing formaldehyde emissions in resin manufacturing has led to research into alternative bio-based amino resins. These developments are supported by government-funded research initiatives, like those from the National Science Foundation, which allocated $5 million last year to projects developing sustainable polymeric materials.

Key Takeaways

- Global Amino Resins Market is expected to be worth around USD 23.2 billion by 2034, up from USD 11.6 billion in 2024, and grow at a CAGR of 7.2% from 2025 to 2034.

- Urea–formaldehyde dominates the Amino Resins Market with a substantial share of 62.9%.

- Solid form amino resins are prevalent, holding 57.1% of the market by form.

- Water-based amino resins are highly favored, making up 67.5% of the category segment.

- A significant 56.8% of amino resins are used as adhesives across various applications.

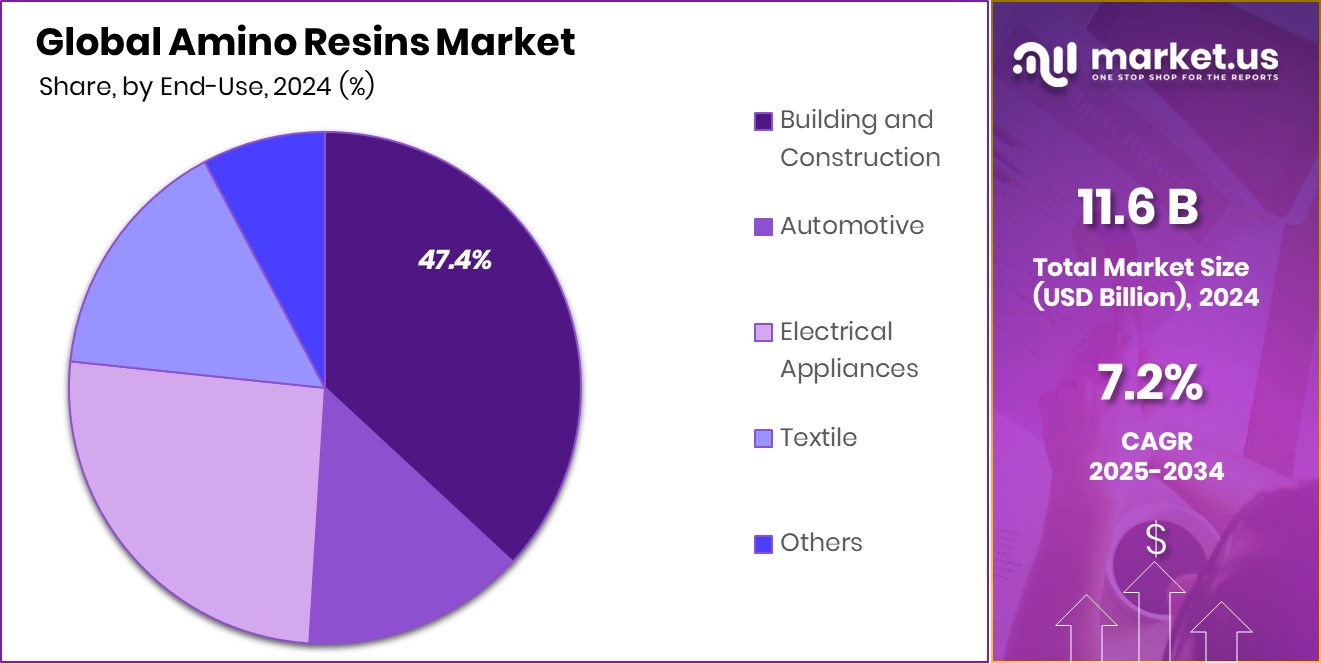

- Building and construction end-use leads, comprising 47.4% of the amino resins market.

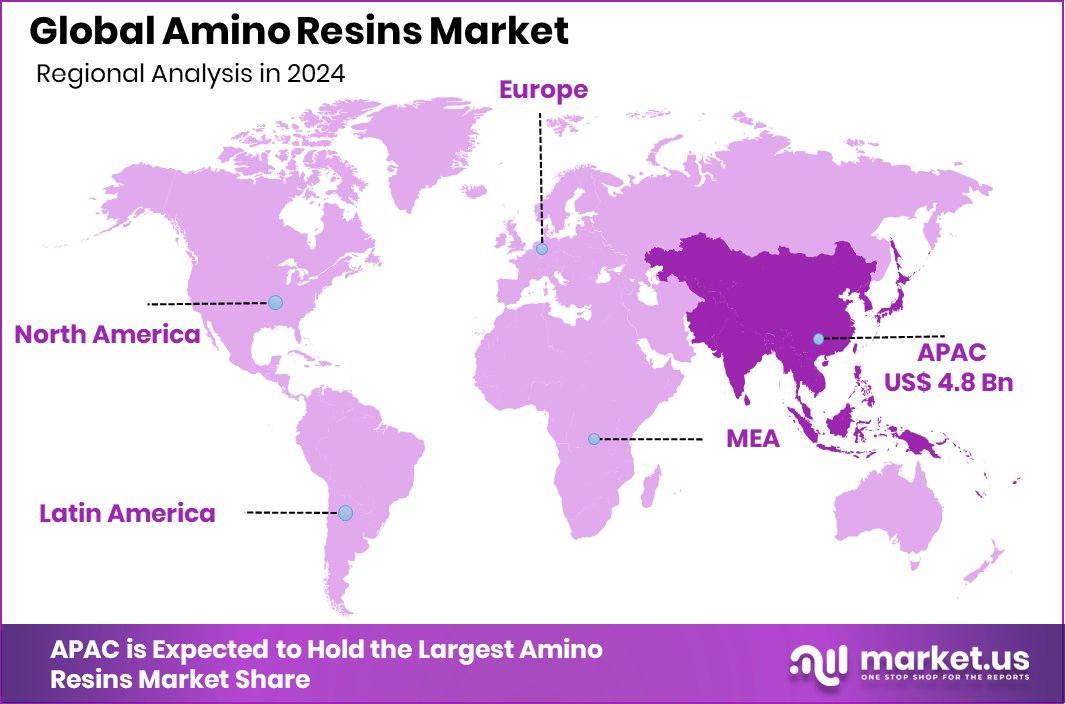

- Asia-Pacific Amino Resins Market reached a strong valuation of USD 4.8 billion.

By Type Analysis

Urea-formaldehyde dominates the market, holding a 62.9% share by type.

In 2024, Urea–formaldehyde held a dominant market position in By Type segment of the Amino Resins Market, with a 62.9% share. This dominance is primarily attributed to its extensive application in adhesives, laminates, and coatings due to its high strength and low cost. Industries favor urea-formaldehyde because it offers excellent moldability and surface hardness, making it a material of choice across wood-based applications.

Its rapid curing time and versatility further support its widespread usage in the furniture, construction, and automotive sectors. Additionally, Urea–urea-formaldehyde’s strong performance in moisture resistance and thermal stability enhances its appeal in building materials. The cost-efficiency of urea-formaldehyde compared to other thermosetting resins gives it a competitive advantage, especially in price-sensitive markets.

In 2024, demand was also supported by the material’s compliance with evolving formaldehyde emission regulations, ensuring it remained a preferred option for manufacturers. As companies continue to seek sustainable yet affordable solutions, the stronghold of Urea–urea-formaldehyde in the amino resins market is expected to persist in the near term.

By Form Analysis

Solid form prevails in usage, accounting for 57.1% of the market.

In 2024, Solid held a dominant market position in the By Form segment of the Amino Resins Market, with a 57.1% share. Solid-form amino resins are highly preferred due to their superior storage stability, ease of transportation, and convenience in handling compared to liquid counterparts. Industries favor the solid format for its ability to be easily stored for long periods without degradation, making it ideal for large-scale manufacturing operations.

The reduced risk of spillage and easier integration into automated production lines further contribute to the widespread adoption of solid amino resins across applications like adhesives, coatings, and molding compounds. In 2024, manufacturers increasingly chose solid amino resins to optimize logistics and minimize material wastage during production. Additionally, the consistent performance characteristics of the solid form, especially in high-temperature and high-humidity environments, boosted its market preference.

As demand continues to rise for durable and cost-efficient materials in the construction and automotive industries, solid amino resins are expected to retain their leading position in the By Form segment. Their practicality and adaptability to diverse industrial processes ensure their strong foothold as the market moves forward into 2025.

By Category Analysis

Water-based amino resins are preferred, with a 67.5% market category share.

In 2024, Water-based held a dominant market position in By Category segment of Amino Resins Market, with a 67.5% share. The rising shift towards eco-friendly and low-emission solutions drove the preference for water-based amino resins across multiple end-use sectors. Manufacturers favored this category due to its low volatile organic compound (VOC) emissions, which aligns with tightening environmental regulations and growing consumer awareness around sustainability.

Water-based resins also offered improved safety during handling and reduced fire hazards, making them more suitable for modern production environments. In 2024, industries such as construction, automotive, and wood processing steadily adopted water-based formulations to meet green building standards and environmental certifications. Additionally, water-based amino resins delivered adequate performance in terms of adhesion, curing speed, and surface finish without compromising on quality.

Their easy cleanup and compatibility with water-based systems further added to operational efficiency. This strong value proposition secured the water-based segment’s lead, as companies looked to balance performance with compliance and sustainability.

By Application Analysis

Adhesives are a major application, comprising 56.8% of the market use.

In 2024, Adhesives held a dominant market position in the By Application segment of the Amino Resins Market, with a 56.8% share. This strong lead is driven by the widespread use of amino resins, especially urea–urea-formaldehyde, in bonding wood-based panels, particleboards, and plywood. Their high bonding strength, quick curing ability, and cost-effectiveness make amino resin-based adhesives ideal for furniture, construction, and packaging sectors.

In 2024, manufacturers favored these adhesives for their reliability in both structural and non-structural applications, ensuring product durability and performance. The growing demand for lightweight, engineered wood products in interior décor and modular housing further boosted the consumption of amino resin adhesives.

Additionally, amino resin adhesives supported eco-friendly formulations, especially when combined with water-based systems, aligning with shifting regulatory norms. As industries seek efficient and economically viable bonding solutions, the adhesive application is expected to maintain its dominance.

By End-use Analysis

Building and construction lead end-uses with a 47.4% market share.

In 2024, Building and Construction held a dominant market position in the end-use segment of the Amino Resins Market, with a 47.4% share. This dominance was largely driven by the increasing use of amino resins in wood panels, laminates, and insulation materials used in modern construction. Urea–formaldehyde and melamine–formaldehyde resins are widely used in manufacturing particleboards, medium-density fiberboards, and plywood, all of which are essential in flooring, wall panels, and furniture.

In 2024, growing infrastructure projects and housing developments, particularly in developing regions, significantly boosted demand for cost-effective and durable building materials. Amino resins offered high thermal resistance, strength, and moisture protection—key features required in construction applications. Their compatibility with water-based systems also supported eco-friendly construction practices.

As governments promoted green building codes and energy-efficient housing, the preference for formaldehyde-reduced resin systems further increased. Additionally, their quick curing time helped accelerate construction timelines, making them suitable for both residential and commercial projects.

Key Market Segments

By Type

- Urea–formaldehyde

- Melamine–formaldehyde

- Others

By Form

- Solid

- Liquid

By Category

- Solvent-based

- Water-based

By Application

- Adhesives

- Paints and Coatings

- Laminates

- Others

By End-use

- Building and Construction

- Automotive

- Electrical Appliances

- Textile

- Others

Driving Factors

Eco-Friendly Building Trends Boost Amino Resins Demand

One of the top driving factors for the amino resins market is the increasing demand for eco-friendly construction materials. As more countries enforce stricter environmental regulations, builders and manufacturers are shifting toward sustainable and low-emission products.

Amino resins, especially water-based variants, release fewer volatile organic compounds (VOCs), making them safer for both users and the environment. In building and furniture applications, urea–formaldehyde and melamine–formaldehyde resins are popular for their strength and cost-effectiveness.

Green building certifications like LEED and BREEAM also promote the use of materials that meet emission standards. This push for greener infrastructure globally, particularly in Asia-Pacific and Europe, is encouraging more industries to adopt amino resins in wood panels, insulation, and interior applications.

Restraining Factors

Health Concerns Over Formaldehyde Limit Market Growth

A major restraining factor in the amino resins market is the health concerns linked to formaldehyde emissions. Urea–formaldehyde and melamine–formaldehyde resins, while widely used, can release formaldehyde gas over time, especially in indoor environments.

Formaldehyde is classified as a human carcinogen by health agencies like the U.S. Environmental Protection Agency (EPA) and the International Agency for Research on Cancer (IARC). This has raised consumer and regulatory concerns worldwide.

Several countries have introduced strict emission limits on formaldehyde-based products, especially in building materials and furniture. These regulations increase compliance costs for manufacturers and push them to develop low-emission or formaldehyde-free alternatives.

Growth Opportunity

Rising Demand For Low-Emission Resins Drives Growth

One major growth opportunity for the amino resins market lies in the rising global demand for low-emission and environmentally safe resins. As governments enforce stricter indoor air quality standards and consumers become more eco-conscious, manufacturers are innovating to offer amino resins with lower formaldehyde emissions. These upgraded products are gaining attention in sectors like furniture, housing, and interior construction, where health and safety are top priorities.

Companies investing in low-VOC (volatile organic compound) technologies are likely to benefit from this shift in demand. Additionally, industries looking to meet certifications such as LEED for green buildings are opting for cleaner resin systems. This push toward safer, greener alternatives is creating new business opportunities and expanding market potential.

Latest Trends

Innovative Low-Emission Resins Gain Popularity

A significant trend in the amino resins market is the growing adoption of low-emission resins. Manufacturers are increasingly focusing on developing amino resins with reduced formaldehyde emissions to meet stringent environmental regulations and cater to the rising consumer demand for eco-friendly products. These advancements are particularly impactful in industries such as construction and furniture manufacturing, where indoor air quality is a critical concern.

The shift towards sustainable building materials has led to a higher preference for water-based and low-VOC (volatile organic compound) amino resins, which offer comparable performance to traditional resins while minimizing health risks. This trend is expected to continue as regulatory bodies worldwide implement stricter emission standards, encouraging further innovation and adoption of environmentally friendly amino resin products.

Regional Analysis

In 2024, Asia-Pacific dominated the Amino Resins Market with a 42.1% share.

In 2024, Asia-Pacific held the dominant position in the Amino Resins Market, accounting for 42.1% of the total share and reaching a valuation of USD 4.8 billion. The region’s strong lead is supported by rapid industrialization, growing construction activities, and the expansion of furniture manufacturing across countries like China, India, and Southeast Asia.

Demand for urea–formaldehyde and melamine–formaldehyde resins remained high due to their cost-effectiveness and versatility in wood-based products. North America showed steady growth, driven by rising investments in eco-friendly and low-emission construction materials. Europe maintained a significant presence, focusing on regulatory compliance with low-VOC products to meet strict environmental standards.

Meanwhile, the Middle East & Africa witnessed moderate expansion, fueled by urbanization projects and infrastructure development in key countries such as Saudi Arabia and the UAE. Latin America recorded gradual growth, supported by the recovery of the residential construction sector in nations like Brazil and Mexico.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Hexion Inc. continued to strengthen its leadership in the global amino resins market through innovation and sustainability-driven product development. The company focused heavily on producing low-emission and high-performance amino resins, particularly targeting the wood and construction industries. Hexion’s strong production footprint in North America and Asia-Pacific enabled it to meet rising regional demands efficiently, while its investments in formaldehyde-reduced technologies aligned with stricter environmental regulations globally.

DIC Corporation maintained a competitive position in the amino resins market by leveraging its diversified product portfolio and strong presence across Asia. The company emphasized research into water-based and eco-friendly resin systems, responding to the increasing need for sustainable construction and industrial materials. In 2024, DIC Corporation’s strategy focused on expanding into high-growth markets like India and Southeast Asia, capitalizing on the region’s robust infrastructure boom and growing furniture sector.

Acron Group operated steadily within the amino resins space, benefiting from its integrated production and raw material sourcing strengths. The company emphasized competitive pricing and consistent product quality, securing its foothold in both domestic and selected international markets. In 2024, Acron Group concentrated on strengthening its supply chains across Europe and enhancing operational efficiency to better serve industries requiring cost-effective resin solutions.

Top Key Players in the Market

- BASF SE

- Hexion Inc.

- DIC Corporation

- Acron Group

- Arclin Inc.

- BI-QEM SA

- Dynea AS

- Ercros SA

- Chimica Pomponesco Spa

- LRBG Chemicals Inc.

- Synpol Products Private Limited

- Hexza Corporation Bhd

- Prefere Resins Holding GmbH

- Uniform Synthetics

- Korfez Kimya

- Other Key Players

Recent Developments

- In December 2024, Hexion Inc. acquired Smartech, a company specializing in AI-driven autonomous manufacturing solutions. This acquisition aims to integrate advanced artificial intelligence and machine learning technologies into Hexion’s manufacturing processes, particularly in the wood processing industry. The goal is to enhance production efficiency, reduce costs, and improve sustainability and product quality.

- In August 2023, Bakelite Synthetics, a U.S.-based specialty resin producer, announced a definitive agreement to acquire LRBG Chemicals Inc. This acquisition aimed to expand Bakelite’s footprint into Canada and enhance service to the northeastern regions of Canada and the U.S. LRBG’s expertise in high-quality resins, including urea-formaldehyde and melamine-formaldehyde, complements Bakelite’s product portfolio.

Report Scope

Report Features Description Market Value (2024) USD 11.6 Billion Forecast Revenue (2034) USD 23.2 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Urea–formaldehyde, Melamine–formaldehyde, Others), By Form (Solid, Liquid), By Category (Solvent-based, Water-based), By Application (Adhesives, Paints and Coatings, Laminates, Others), By End-use (Building and Construction, Automotive, Electrical Appliances, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Hexion Inc., DIC Corporation, Acron Group, Arclin Inc., BI-QEM SA, Dynea AS, Ercros SA, Chimica Pomponesco Spa, LRBG Chemicals Inc., Synpol Products Private Limited, Hexza Corporation Bhd, Prefere Resins Holding GmbH, Uniform Synthetics, Korfez Kimya, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Hexion Inc.

- DIC Corporation

- Acron Group

- Arclin Inc.

- BI-QEM SA

- Dynea AS

- Ercros SA

- Chimica Pomponesco Spa

- LRBG Chemicals Inc.

- Synpol Products Private Limited

- Hexza Corporation Bhd

- Prefere Resins Holding GmbH

- Uniform Synthetics

- Korfez Kimya

- Other Key Players