Global Aluminum Bag and packaging Market Size, Share, Growth Analysis By Product (Foil Bags, Stand Up Pouches, Flat Pouches, Gusseted Bags, Wicketed Bags, Others), By End User (Food, Pharmaceuticals, Cosmetics and Personal Care, Others), By Material (Paper, Aluminum, Plastics, Others), By Closure (Zippers, Adhesive, Tear Notch, Spout), By Printing (Printed, Unprinted), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152905

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

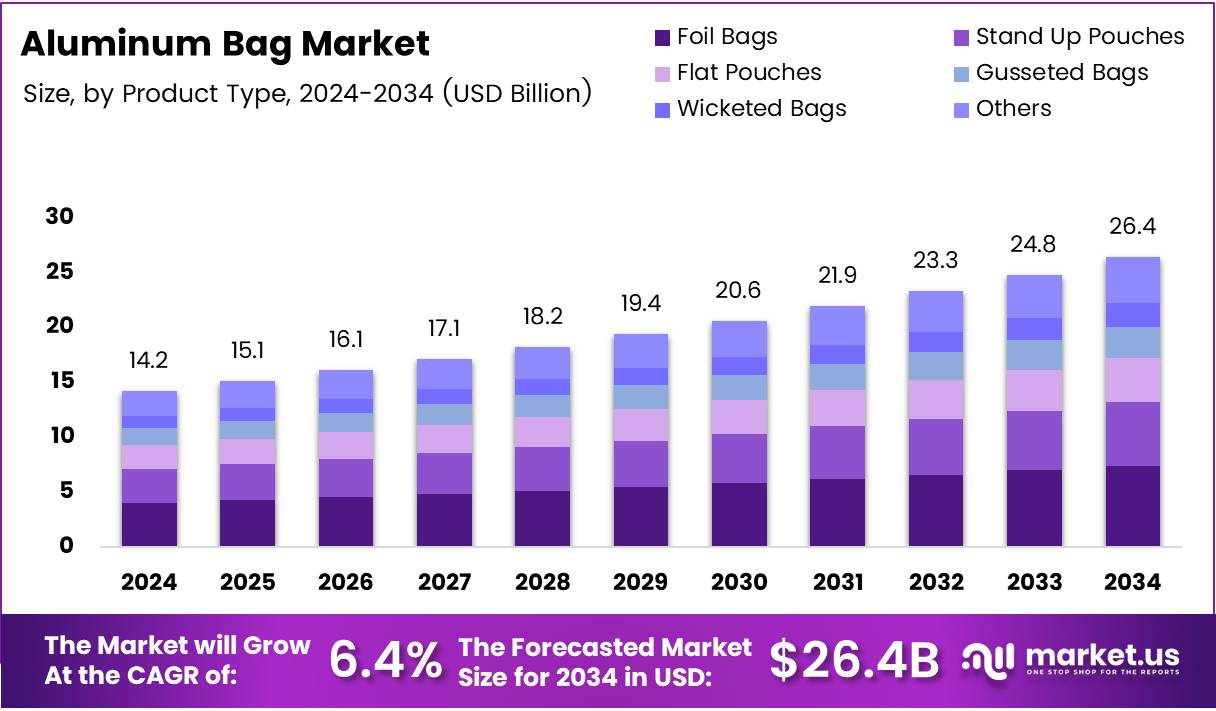

The Global Aluminum Bag and packaging Market size is expected to be worth around USD 26.4 Billion by 2034, from USD 14.2 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The aluminum bag and packaging market is witnessing steady growth, driven by rising demand for lightweight, durable, and recyclable materials across food, cosmetics, and healthcare sectors. Businesses increasingly prefer aluminum over plastic due to its superior barrier protection, resistance to moisture and light, and its role in extending product shelf life.

Moreover, the surge in e-commerce and global exports has encouraged manufacturers to invest in tamper-evident and eco-conscious aluminum packaging. The market’s expansion is also fueled by consumer preferences for premium and sustainable packaging options, which elevate both brand value and customer loyalty, especially in high-end product segments.

In parallel, innovation in aluminum pouch formats—such as resealable, single-use, and spout designs—is reshaping retail packaging trends. These developments appeal to urban consumers who prioritize convenience and sustainability, further enhancing market opportunities for flexible aluminum-based solutions across household and personal care categories.

From an investment standpoint, the shift toward circular economy practices presents new avenues. Aluminum’s high recyclability rate ensures long-term cost efficiency and lower carbon footprints, allowing companies to align with ESG targets. As industries seek cleaner alternatives to plastic, aluminum packaging presents a compelling solution without compromising performance or branding potential.

On the regulatory front, governments globally are tightening rules on plastic waste and encouraging recyclable material usage in packaging. Subsidies and incentives for adopting aluminum packaging are growing, particularly in Europe and North America, helping manufacturers reduce transition costs and strengthen supply chain resilience in light of environmental mandates.

In addition, public-private partnerships are emerging to improve aluminum recycling infrastructure and waste collection. These initiatives aim to enhance recovery rates and promote closed-loop systems. As a result, companies operating in the aluminum bag market are now exploring ways to integrate post-consumer recycled content into their packaging lines.

According to WSJ, 37% of U.S. and Canadian consumers have avoided buying a product due to unsustainable packaging. This trend highlights the increasing pressure on brands to adopt recyclable solutions like aluminum. Meanwhile, Allure notes aluminum’s 35% recycling rate in the U.S.—significantly higher than plastic’s 9%—boosting its reputation in the beauty industry.

However, according to Reuters, the U.S. government’s decision to double tariffs on imported aluminum and steel to 50% has created headwinds. This move raised operational costs for U.S.-based aluminum packaging companies, prompting strategic sourcing shifts and supply chain diversification to mitigate risks and ensure business continuity.

Key Takeaways

- The global aluminum bag and packaging market is projected to reach USD 26.4 Billion by 2034, growing at a CAGR of 6.4% from 2025 to 2034.

- In 2024, foil bags dominated the product segment due to their superior protection against moisture, oxygen, and light.

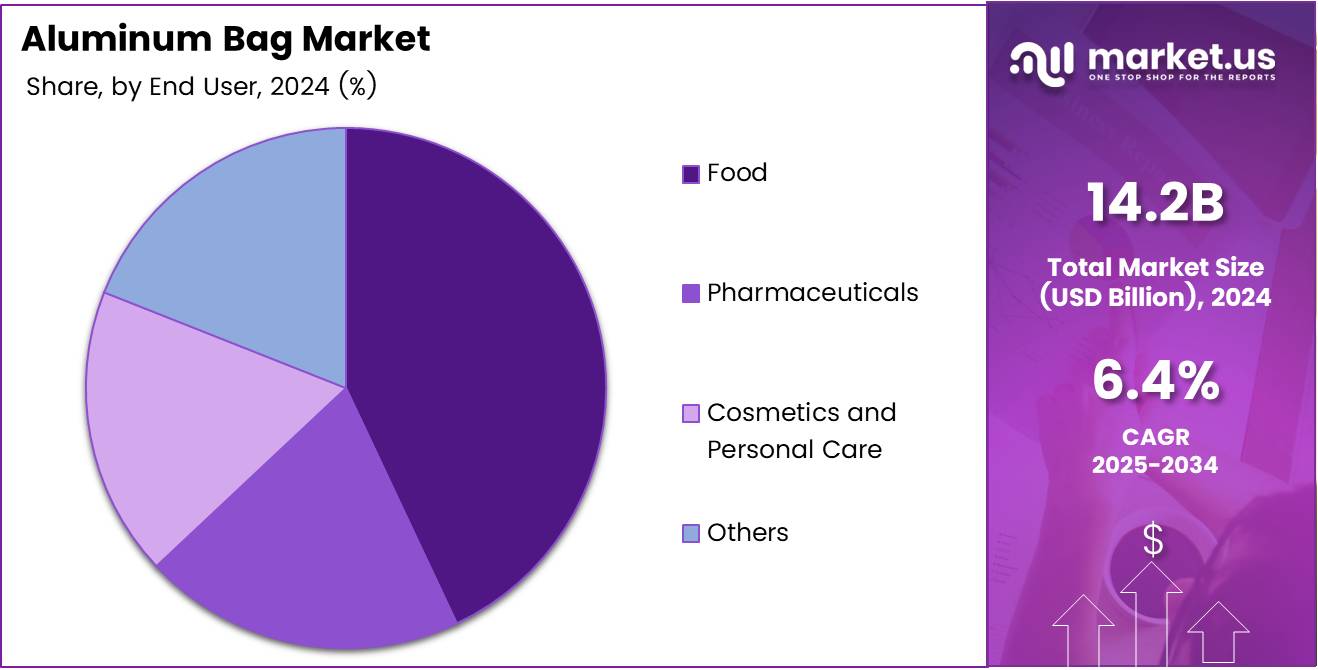

- The food sector held the leading position in the end-user segment in 2024, driven by aluminum bags’ ability to preserve flavor and extend shelf life.

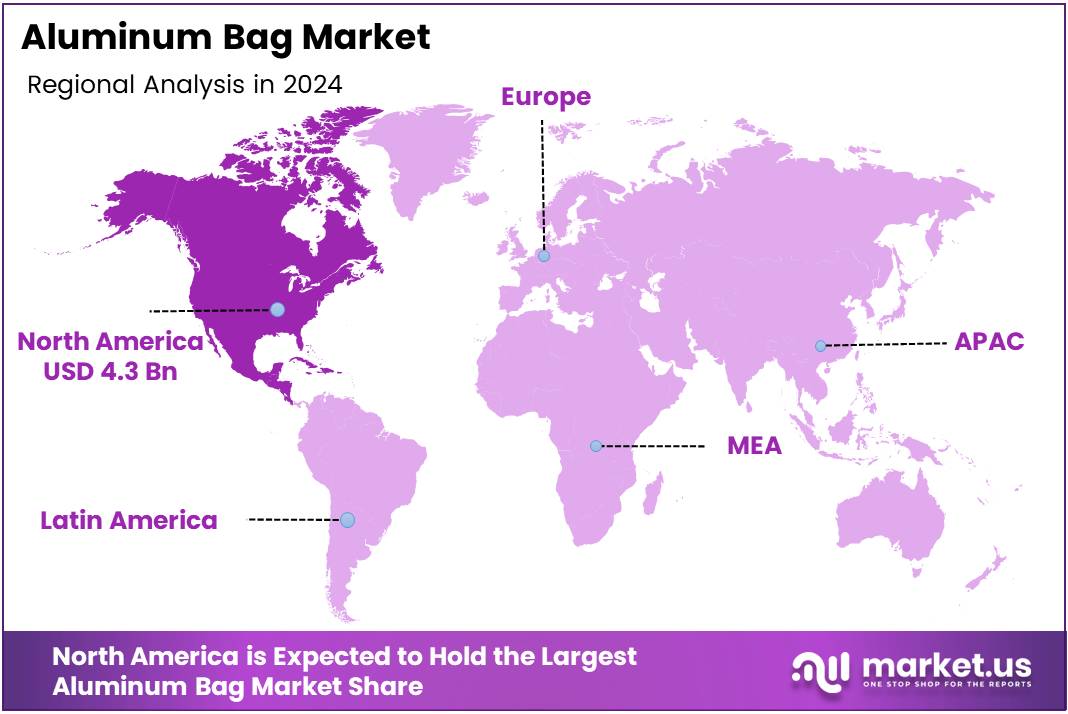

- North America emerged as the top regional market in 2024, holding a 30.4% market share worth USD 4.3 Billion.

Product Analysis

Foil Bags dominate with a strong market presence due to superior barrier protection and shelf appeal.

In 2024, Foil Bags held a dominant market position in the By Product Analysis segment of the Aluminum Bag and Packaging Market. These bags continue to gain traction across food, pharma, and cosmetics packaging because of their exceptional barrier properties, which protect products from moisture, oxygen, and light.

Stand Up Pouches are steadily growing in popularity due to their resealability and flexible display options. These pouches are particularly favored in the snack, beverage, and baby food segments.

Flat Pouches remain a preferred format for single-serve and lightweight packaging solutions. Their low-cost structure and ease of storage support their adoption in various consumer goods.

Gusseted Bags offer enhanced capacity and structure, making them ideal for bulky items like pet food and grains. Their expanded sides provide greater volume without compromising packaging strength.

Wicketed Bags are mainly used in high-speed automation settings, such as bakeries and industrial packaging. Their convenience in machine-fed environments continues to support their niche growth.

The Others segment includes specialty formats like spouted and zipper bags, which are used in premium and functional packaging. These bags serve evolving consumer needs for convenience and product longevity.

End User Analysis

Food segment leads the market owing to growing demand for fresh and long-lasting packaged goods.

In 2024, Food held a dominant market position in the By End User Analysis segment of the Aluminum Bag and Packaging Market. Aluminum bags are widely adopted in the food sector for their ability to extend shelf life, prevent contamination, and preserve flavor.

Pharmaceuticals represent the second-largest segment, driven by the need for tamper-proof and sterile packaging. The aluminum layer ensures effective protection for sensitive drugs and medical formulations.

Cosmetics and Personal Care products are increasingly packaged in aluminum-based formats for their sleek appearance and resistance to UV rays and oxidation. This trend is further fueled by premium brands shifting towards sustainable packaging.

The Others category includes electronics, chemicals, and industrial products. These sectors utilize aluminum bags for moisture control and anti-static purposes, particularly in temperature-sensitive or reactive goods.

Key Market Segments

By Product

- Foil Bags

- Stand Up Pouches

- Flat Pouches

- Gusseted Bags

- Wicketed Bags

- Others

By End User

- Food

- Pharmaceuticals

- Cosmetics and Personal Care

- Others

By Material

- Paper

- Aluminum

- Plastics

- Others

By Closure

- Zippers

- Adhesive

- Tear Notch

- Spout

By Printing

- Printed

- Unprinted

Drivers

Increasing Demand for Sustainable and Eco-Friendly Packaging Solutions Drives Market Growth

The aluminum bag and packaging market is seeing strong growth as more brands and consumers prefer eco-friendly solutions. Aluminum is recyclable, making it a greener option compared to plastic. This shift is pushing companies to adopt aluminum bags to meet sustainability goals and consumer expectations.

With the rise in online shopping, the demand for reliable packaging has surged. E-commerce businesses need sturdy, protective, and visually appealing packaging that can withstand transport. Aluminum bags provide a secure and premium feel, making them a preferred choice for shipping sensitive and valuable products.

Consumers are becoming more selective about packaging. They often associate aluminum bags with high-quality and secure products. This shift in behavior is prompting industries like cosmetics and specialty foods to use aluminum packaging to enhance brand perception and customer trust.

Innovation in aluminum bag technology is making the packaging lighter, more flexible, and cost-effective. Modern manufacturing methods allow for better sealing, printing, and design customization. These advancements are improving product shelf life while keeping environmental impact low, attracting companies looking for sustainable innovation.

Restraints

Environmental Impact Concerns of Aluminum Extraction and Production Limit Market Expansion

Despite its recyclability, aluminum production involves mining and high energy use, which contributes to pollution and emissions. These environmental impacts create resistance from eco-conscious consumers and regulators, especially in regions pushing for low-carbon alternatives.

Recyclability is another concern. Not all regions have the infrastructure to recycle aluminum efficiently. In many parts of the world, aluminum waste still ends up in landfills due to lack of sorting systems and collection practices, limiting the material’s environmental benefits.

Price instability in the raw aluminum market also adds uncertainty. Fluctuating costs affect production planning and profit margins. Manufacturers often struggle to maintain consistent pricing for aluminum bags, which impacts competitiveness compared to plastic or paper packaging alternatives.

Together, these restraints could hinder the widespread adoption of aluminum bags in regions where regulations, cost, and recycling infrastructure remain underdeveloped.

Growth Factors

Expansion of the Food and Beverage Sector Requires Improved Packaging Solutions

The rapid growth of the food and beverage industry is creating more demand for safe and long-lasting packaging. Aluminum bags offer excellent protection from moisture, light, and air—qualities that help preserve flavor and freshness, especially in snacks, coffee, and ready-to-eat foods.

Healthcare and pharmaceutical sectors are turning to aluminum bags for their sterility and barrier properties. These industries demand packaging that maintains drug stability and prevents contamination. The rising focus on patient safety and regulation compliance is further driving the demand for aluminum-based formats.

In cosmetics and personal care, aluminum packaging is gaining attention for its premium look and strong product protection. It’s also valued for being non-reactive and lightweight, making it easier to transport while maintaining brand appeal in a competitive space.

Emerging markets, particularly in Asia and Latin America, are witnessing a shift toward durable and affordable packaging. Aluminum bags fit this need by offering long shelf life and flexible design options. As income levels rise, demand for modern, premium packaging is expected to increase significantly.

Emerging Trends

Increasing Use of Holographic and Customizable Designs Enhances Product Visibility

Brands are embracing holographic and personalized designs to stand out on shelves. Aluminum bags offer excellent printability and shine, making them perfect for eye-catching packaging. These design upgrades are driving consumer engagement, especially in lifestyle and luxury segments.

The trend of resealable and tamper-evident packaging is growing across food, pharma, and personal care. Aluminum bags with zippers or tear notches are enhancing usability and safety, aligning with evolving consumer demands for convenience and product integrity.

Smart packaging is becoming a valuable tool for traceability and brand interaction. Aluminum bags are now being embedded with QR codes, temperature indicators, and freshness sensors, making them a part of digital packaging innovation, especially in the premium and healthcare sectors.

Lightweight packaging continues to trend, and aluminum bags meet this need without compromising strength. Brands are choosing these solutions to reduce shipping costs and environmental impact. This is especially important as industries look to align packaging design with global sustainability goals.

Regional Analysis

North America Dominates the Aluminum Bag and Packaging Market with a Market Share of 30.4%, Valued at USD 4.3 Billion

In 2024, North America led the global aluminum bag and packaging market, capturing a substantial market share of 30.4%, equivalent to a valuation of USD 4.3 billion. This dominance is attributed to strong consumer awareness about eco-friendly packaging, strict sustainability regulations, and the widespread use of aluminum bags in industries like food, pharmaceuticals, and cosmetics. The United States, in particular, drives regional demand through a mature retail sector and increasing use of secure, tamper-proof packaging.

Europe Aluminum Bag and Packaging Market Trends

Europe follows closely behind in market performance, supported by its well-established recycling systems and strict environmental legislation. The growing shift toward reusable and lightweight materials is enhancing the adoption of aluminum-based solutions across countries such as Germany, France, and the UK. The region continues to promote closed-loop packaging systems and extended producer responsibility, positioning itself as a long-term growth hub for aluminum packaging.

Asia Pacific Aluminum Bag and Packaging Market Trends

Asia Pacific represents a rapidly expanding region for aluminum bag and packaging, fueled by rising urbanization and a booming e-commerce landscape. Nations like China and India are witnessing heightened demand for packaged food and personal care products, contributing to market growth. Additionally, the increasing use of cost-effective and durable aluminum packaging in regional manufacturing and exports adds to its growth momentum.

Middle East and Africa Aluminum Bag and Packaging Market Trends

The Middle East and Africa are witnessing gradual development in aluminum packaging adoption. Expanding pharmaceutical and FMCG sectors, particularly in Gulf countries and South Africa, are opening up new opportunities. Government support for sustainability and infrastructure improvement is encouraging businesses to shift toward recyclable and barrier-resistant packaging formats like aluminum bags.

Latin America Aluminum Bag and Packaging Market Trends

Latin America is exhibiting moderate market activity, supported by rising awareness of sustainable packaging options and the growth of the packaged food sector. Brazil and Mexico are key contributors due to their evolving retail industries and growing export activity. The demand for flexible, heat-resistant, and visually appealing aluminum bags is expected to gain further traction in the region over the next few years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Aluminum Bag and packaging Company Insights

In 2024, Huhtamaki maintained its leadership in the aluminum bag and packaging market by prioritizing sustainable solutions for food and healthcare applications. The company expanded its flexible packaging range with recyclable aluminum formats to meet the growing demand for eco-conscious products.

Technovin strengthened its presence by integrating smart printing technologies and improving foil barrier properties, which appealed to pharmaceutical and high-end cosmetic sectors. Its focus on innovation and customization helped secure long-term partnerships with global distributors.

Berry Global demonstrated aggressive investment in lightweight, durable aluminum packaging solutions tailored for e-commerce and food delivery. Its vertically integrated supply chain strategy and material science capabilities provided a competitive advantage in both cost and speed.

UltraSource focused on enhancing the durability and hygiene standards of its aluminum bag offerings, making significant gains in the meat and poultry processing sector. Its precise manufacturing and food-grade certifications improved its brand credibility in North America.

While the above players drove momentum through innovation and specialization, others such as Sonoco, Coveris, Bryce, and Bemis continued to optimize manufacturing efficiency and target emerging markets. Companies like Flexopack, Amcor, and Novolex are also leveraging automation and recyclability to increase market penetration, while Printpack, Mondi, Pactiv, ProAmpac, and Celplast focused on multi-layer barrier bags and resealable pouches to diversify their portfolios.

Overall, key players in 2024 aligned their strategies with global trends such as sustainability, convenience, and smart packaging integration, positioning themselves competitively in a fast-evolving aluminum bag and packaging landscape.

Top Key Players in the Market

- Huhtamaki

- Technovin

- Berry Global

- UltraSource

- Sonoco

- Coveris

- Bryce

- Bemis

- Flexopack

- Amcor

- Novolex

- Printpack

- Mondi

- Pactiv

- ProAmpac

- Celplast

Recent Developments

- In May 2025, a multibagger aluminium stock surged in value after securing a significant order worth Rs 121 crore from Minda Corporation Ltd, boosting investor sentiment and future revenue outlook.

- In December 2024, Db, a premium travel gear brand, attracted a strategic investment from the LVMH Luxury Ventures Fund, strengthening its position in the luxury and lifestyle segment.

- In October 2024, pharmaceutical packaging startup Sorich successfully raised $1 million, aiming to scale its sustainable solutions and expand its product offerings in the healthcare packaging sector.

- In November 2024, global packaging leader Ball Corporation acquired Alucan, an extruded aluminium packaging company, enhancing its European production capabilities and lightweight packaging portfolio.

- In September 2024, the IMA Group expanded its packaging technology operations by acquiring Sarong’s Packaging Machinery and Packaging Materials divisions, reinforcing its footprint in the pharmaceutical and food sectors.

Report Scope

Report Features Description Market Value (2024) USD 14.2 Billion Forecast Revenue (2034) USD 26.4 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Foil Bags, Stand Up Pouches, Flat Pouches, Gusseted Bags, Wicketed Bags, Others), By End User (Food, Pharmaceuticals, Cosmetics and Personal Care, Others), By Material (Paper, Aluminum, Plastics, Others), By Closure (Zippers, Adhesive, Tear Notch, Spout), By Printing (Printed, Unprinted) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Huhtamaki, Technovin, Berry Global, UltraSource, Sonoco, Coveris, Bryce, Bemis, Flexopack, Amcor, Novolex, Printpack, Mondi, Pactiv, ProAmpac, Celplast Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aluminum Bag and packaging MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

Aluminum Bag and packaging MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Huhtamaki

- Technovin

- Berry Global

- UltraSource

- Sonoco

- Coveris

- Bryce

- Bemis

- Flexopack

- Amcor

- Novolex

- Printpack

- Mondi

- Pactiv

- ProAmpac

- Celplast