Global Aluminosilicate Market Size, Share, And Business Benefits By Product Type (Pure Aluminosilicate, Calcium Aluminosilicate, Sodium Aluminosilicate, Potassium Aluminosilicate), By Source (Natural, Synthetic), By End Use (Construction, Electronics, Petrochemical Refineries, Agriculture, Food and Beverages, Automotive and Aerospace), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161816

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

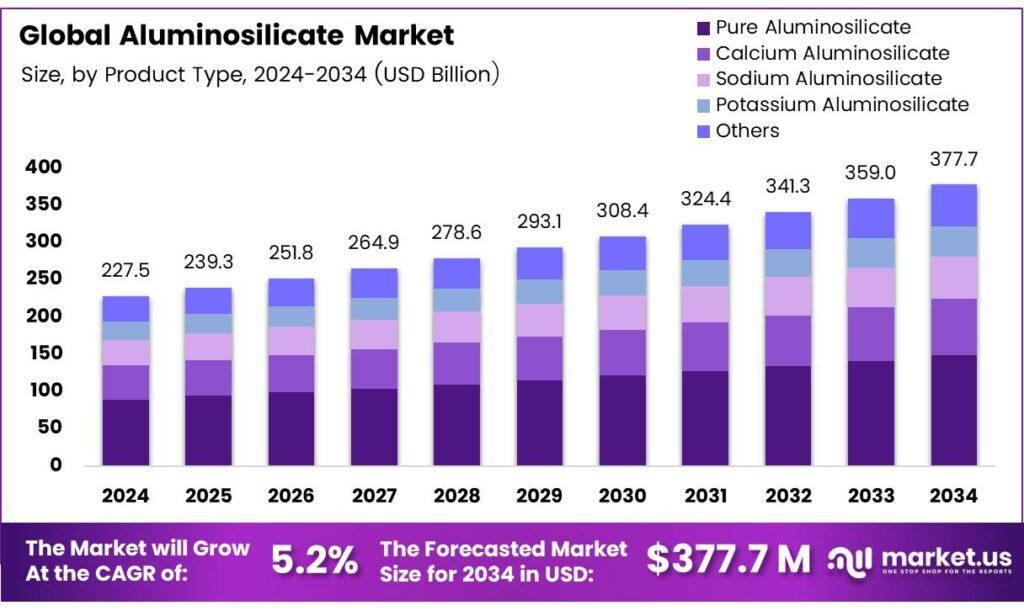

The Global Aluminosilicate Market size is expected to be worth around USD 377.7 Million by 2034, from USD 227.5 Million in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Aluminosilicates are a class of compounds composed of aluminum, silicon, and oxygen, forming solutions or gels that serve as precursors for the hydrothermal synthesis of zeolites. These materials are widely used in industrial applications as catalysts and ion exchangers due to their high surface area, shape selectivity, ion exchange capacity, and excellent thermal and hydrothermal stability. Traditionally, aluminosilicate polymers are derived from natural minerals, but recent advancements have enabled their production from waste materials such as fly ash, blast furnace slag, and other industrial byproducts.

Aluminosilicates provide a cost-effective alternative to traditional inorganic membrane materials like Al2O3, TiO2, and ZrO2, which require energy-intensive sintering above 1500°C. By using natural materials such as clay, kaolin, and binding agents, affordable ceramic membranes can be produced, reducing reliance on costly alumina powders and enhancing the sustainability and economic viability of membrane production.

Aluminosilicate wools (ASWs) are excellent high-temperature insulators due to their low thermal conductivity, minimal heat storage, thermal shock resistance, lightweight structure, corrosion resistance, and easy installation. With specific fiber compositions, ASWs can endure temperatures up to 1430°C (2600°F), making them suitable for demanding thermal environments. Amorphous aluminosilicate ceramics are vital in electrorheological (ER) fluids, both hydrous and anhydrous, delivering strong ER effects with yield stresses up to 10 kPa at 2.5 kV/mm and 45 wt% particle loading.

- Aluminosilicate aerogels surpass pure silica or alumina aerogels in thermal stability, with melting points above 1810°C, low density (0.05–0.63 g/cm³), low thermal conductivity (0.023–0.081 W/m·K), small pore sizes (0.5–50 nm), and high surface areas (150–905 m²/g), ideal for high-temperature insulation and advanced applications. The use of aluminosilicates in food additives raises health concerns, as the European Food Safety Authority (EFSA) sets a tolerable weekly intake (TWI) for aluminum at 1 mg/kg body weight.

Sodium aluminium silicate (E 554) contains up to 7.8% aluminum, with exposure levels in children reaching 1.58–2.13 mg/kg body weight per week, exceeding the TWI. Potassium aluminium silicate (E 555), used as a carrier for titanium dioxide (E 171) and iron oxides (E 172), contains 20.4% aluminum, potentially leading to exposures of 388 mg/kg and 297 mg/kg body weight per week, respectively, necessitating strict regulatory oversight.

Key Takeaways

- The Global aluminosilicate market is projected to reach USD 377.7 million by 2034 from USD 227.5 million in 2024, with a CAGR of 5.2%.

- Pure aluminosilicate led in 2024 with a 39.3% market share due to its high purity, thermal stability, and use in catalysts, ceramics, and glass.

- Natural aluminosilicates dominated in 2024, holding a 67.9% share, driven by the availability and cost-effectiveness of minerals like kaolinite and zeolite.

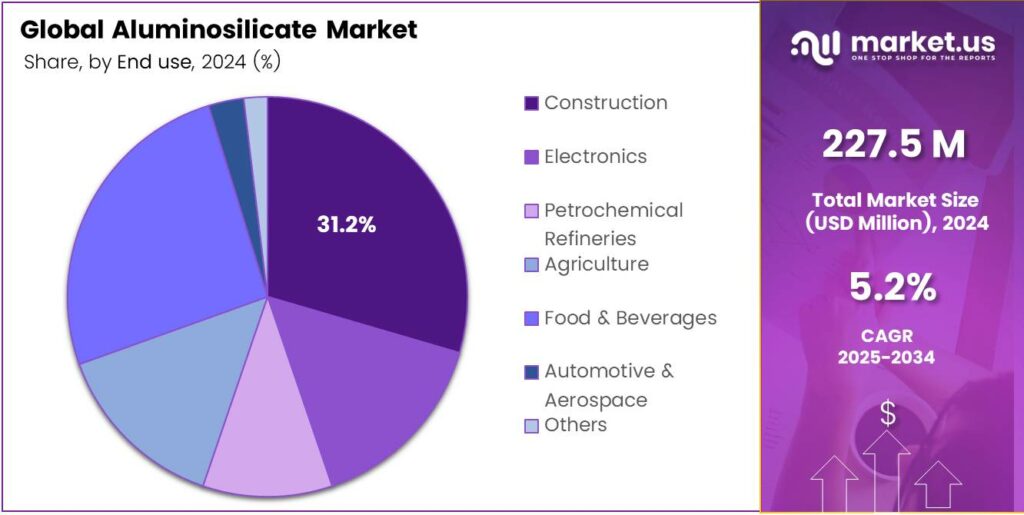

- The Construction sector held a 31.2% share in 2024, fueled by aluminosilicates’ extensive use in cement, ceramics, and insulation materials.

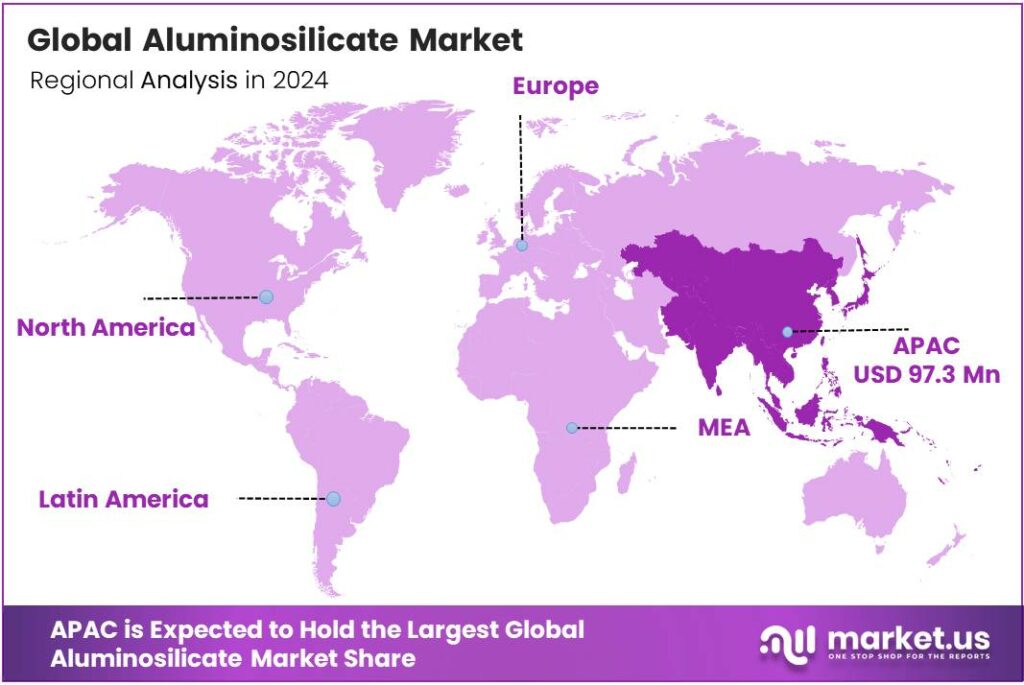

- Asia-Pacific accounted for 42.8% of market revenue in 2024 (USD 97.3 million), driven by strong industrial and construction demand.

By Product Type

Pure Aluminosilicate Leads Market with 39.3% Share

In 2024, Pure Aluminosilicate held a dominant market position, capturing more than a 39.3% share in the global Aluminosilicate Market. The segment’s leadership stems from its high purity, excellent thermal stability, and chemical resistance, making it a preferred choice in catalysts, ceramics, and glass manufacturing.

Industries such as petrochemicals and automotive rely heavily on pure aluminosilicate catalysts for hydrocracking and fluid catalytic cracking, enhancing fuel efficiency and emission control. Demand for pure aluminosilicate is expected to strengthen further as industries shift toward cleaner processing materials and high-temperature applications.

Its use in zeolite synthesis and environmental filtration systems continues to expand, particularly in Asia-Pacific and Europe, where industrial and construction growth remains robust. Furthermore, ongoing technological advances in synthetic aluminosilicate production are expected to reduce impurities and improve yield efficiency, sustaining the product’s market leadership in the near term.

By Source

Natural Segment Leads with 67.9% Market Share

In 2024, Natural held a dominant market position, capturing more than a 67.9% share of the global aluminosilicate market. This strong position was mainly due to the wide availability and cost-effectiveness of naturally occurring aluminosilicate minerals such as kaolinite, zeolite, and feldspar.

These minerals are preferred in industries like construction, ceramics, glass, and water treatment because they require minimal processing and offer consistent quality. The demand further increased with the global trend toward sustainable and environmentally friendly raw materials.

Natural aluminosilicate is expected to continue leading the market as industries increasingly adopt mineral-based inputs to reduce synthetic dependency and carbon footprint, reinforcing its importance in large-scale industrial and construction applications worldwide.

By End Use

Construction Segment Dominates with 31.2% Share

In 2024, Construction held a dominant market position, capturing more than a 31.2% share of the global aluminosilicate market. The dominance of this segment was largely driven by the widespread use of aluminosilicates in building materials such as cement, ceramics, and insulation products.

These compounds are valued for their high thermal stability, mechanical strength, and ability to enhance durability in structural applications. The growing shift toward energy-efficient and sustainable building solutions further supported their adoption in modern infrastructure projects.

The construction industry is expected to maintain strong demand for aluminosilicate materials, supported by rising urbanization, government housing programs, and infrastructure investments across developing economies. This steady expansion underscores the essential role of aluminosilicates in advancing long-lasting and eco-friendly construction materials.

Key Market Segments

By Product Type

- Pure Aluminosilicate

- Calcium Aluminosilicate

- Sodium Aluminosilicate

- Potassium Aluminosilicate

- Others

By Source

- Natural

- Synthetic

By End Use

- Construction

- Electronics

- Petrochemical Refineries

- Agriculture

- Food and Beverages

- Automotive and Aerospace

- Others

Emerging Trends

Shift toward clean-label and low-aluminium alternatives in food applications

One major emerging trend in the realm of aluminosilicate use (especially as anti-caking or flow agents in powdered foods) is pressure from consumers, regulators, and food bodies to reduce or eliminate aluminium-based additives in favor of cleaner, low-aluminium or non-metallic alternatives. In recent years, many people have become more aware of aluminium exposure from food additives.

The Codex Committee on Food Additives (CCFA) has formally recommended that food additives containing aluminium be reduced as far as possible. Meanwhile, the FAO/WHO’s Global Standard for Food Additives notes that aluminium silicate (INS 559 / kaolin or kaolin variants) currently has no specific Codex limit provisions despite being used as an anti-caking agent.

In India, the Food Safety and Standards Authority of India (FSSAI) has been aligning its additive regulations with international norms. In its finalized list of food additives, FSSAI revised and restricted certain additives, reflecting evolving safety concerns. Although not specific to aluminosilicates, this signals a regulatory climate more open to stricter limits.

Drivers

Health and Safety Pressure on Aluminium Exposure

One of the strongest forces pushing innovation and restraint in aluminosilicate use in food is the mounting concern over aluminium exposure and its possible health effects. Consumers, regulators, and health bodies are increasingly vigilant about how much aluminium we absorb through food — and this scrutiny is influencing decisions in formulation, ingredient choice, and regulation.

- Scientific and regulatory bodies have set intake limits for aluminium to protect health. The European Food Safety Authority (EFSA) has set a Tolerable Weekly Intake (TWI) of 1 mg aluminium per kilogram of body weight per week. For a 70-kg adult, that means no more than 70 mg of aluminium per week from all sources.

The Joint FAO/WHO Expert Committee on Food Additives (JECFA) had recommended a provisional TWI of 2 mg/kg bw for all aluminium compounds in food. These figures highlight how tight the margins are: many foods already contribute significantly to this limit.

Restraints

Tightening limits on aluminium-based additives in foods

Across food categories, regulators are steadily narrowing the room for aluminium-bearing additives such as sodium aluminosilicate (INS 554). The core constraint is numeric and simple: how much aluminium people can safely consume each week. Europe’s food watchdog set a Tolerable Weekly Intake (TWI) of 1 mg/kg body weight/week for aluminium from all dietary sources, a level that leaves little margin in highly processed or bakery-heavy diets.

- Global bodies also frame the ceiling: the JECFA provisional TWI is 2 mg/kg bw/week, based on a NOAEL of 30 mg/kg bw/day, still a tight boundary once intake from multiple foods is added up. Hong Kong’s Centre for Food Safety found 100–320 mg/kg aluminium in steamed breads, buns, and cakes, and up to 1,200 mg/kg in ready-to-eat jellyfish; these numbers make it easy for frequent consumers to creep toward weekly limits.

In response, the same authority issued practical guidelines urging the reduction or replacement of aluminium-containing additives and listing maximum use levels for sodium aluminosilicate across specific categories (e.g., crackers at 100 mg/kg, batters at 1,000 mg/kg). International standards are also explicit. The Codex GSFA caps sodium aluminosilicate in some foods—for instance, beverage whiteners at 570 mg/kg (as aluminium)—and otherwise pushes “good manufacturing practice” to avoid excess.

Opportunity

Versatility as Anti-Caking Agent in Powdered Foods

One major growth driver for aluminosilicates (like sodium aluminosilicate, INS 554) is their versatile functionality as anti-caking and flow agents in powdered and granulated food systems. Because many food products rely on powders (spices, dry mixes, baking mixes, powdered milk, salt blends, seasonings), the consistent handling and stability of those powders is critical.

Aluminosilicates help by absorbing moisture and preventing clumping, thereby improving shelf life, flowability, packaging, and consumer usability. In the Food and Agriculture Organization’s Codex General Standard for Food Additives (GSFA), INS 554 (sodium aluminosilicate) is permitted for use as an anti-caking agent in multiple food categories (such as seasonings, baking mixes, powdered drink mixes) under good manufacturing practice.

Moreover, many manufacturers favor aluminosilicates because they can deliver a reliable anti-caking effect at relatively low inclusion levels compared to some alternatives. This means less additive burden on flavor, cost, or sensory impact. As more food products move toward powdered or dry systems (drinks, meal replacements, spice blends, health mixes), demand for effective anti-caking agents is rising.

Regional Analysis

Asia-Pacific leads with a 42.8% share and a USD 97.3 Million market value.

In 2024, Asia-Pacific held a dominant position in the global aluminosilicate market, accounting for 42.8% of total market revenue, valued at approximately USD 97.3 million. The region’s leadership is driven by its robust industrial base, expanding construction sector, and strong demand from ceramics, glass, and petrochemical industries.

Countries such as China, India, Japan, and South Korea contribute significantly due to large-scale infrastructure projects, the growing automotive industry, and rising consumer goods manufacturing. China remains the largest producer and exporter of aluminosilicate-based materials, benefiting from abundant raw materials such as kaolin and bauxite, along with extensive industrial manufacturing capacity.

Rapid urbanization and housing development across emerging Asian economies are also propelling demand for aluminosilicate in cement additives, insulation materials, and high-performance ceramics. In India, for instance, government initiatives like the Smart Cities Mission and Pradhan Mantri Awas Yojana (PMAY) have intensified construction activities, indirectly boosting aluminosilicate consumption in building composites and heat-resistant materials.

Asia-Pacific’s food and beverage industries are increasingly utilizing sodium aluminosilicate (INS 554) as an anti-caking agent, further widening its application base. Rising investments in chemical innovation and energy-efficient materials by regional players are expected to enhance market growth over the coming decade. The combination of industrial expansion, infrastructural investment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Huber Engineered Materials is recognized for its high-performance specialty chemicals. The company provides a range of aluminosilicate products, primarily used as functional fillers and extenders. Their materials are critical in enhancing performance in sectors like paints, coatings, adhesives, and plastics by improving durability and matting efficiency.

Evonik Industries is a leading global specialty chemicals company and a major player in the aluminosilicate market. Its advanced materials portfolio includes synthetic aluminosilicates, primarily used as highly efficient adsorbents and matting agents. These products are essential in applications ranging from industrial coatings and construction to personal care. Leveraging its extensive R&D capabilities.

Wacker Chemie AG is a prominent supplier of high-quality aluminosilicates, often under its SILCRON brand. These products are engineered to act as free-flow aids, matting agents, and flattening agents, primarily for the coatings, inks, and plastics industries. Wacker’s expertise in silicone chemistry and silicates allows it to offer products that provide consistent matting, excellent transparency, and easy dispersion.

Top Key Players in the Market

- Huber Engineered Materials

- Evonik Industries

- Wacker Chemie

- Shin-Etsu Chemical Co Ltd.

- Grace Catalysts Technologies

- SCHOTT AG

- Kepa Minerals

- DK Industries

- VV Mineral

- Kyanite Mining Corporation

Recent Developments

- In 2024, Evonik Industries is a major producer of specialty chemicals, including silica (SiO2) and alumina (Al2O3)-based materials that form aluminosilicates for applications in tires, batteries, coatings, and catalysts. Emphasize production expansions, strategic realignments, and sustainability targets, directly impacting aluminosilicate precursors like precipitated silica and fumed aluminum oxide.

- In 2024, Wacker Chemie produces silicon-based chemicals and polymers, with aluminosilicates relevant in silane-silica hybrids for tires and coatings. Recent updates center on financial resilience amid market weakness, with expansions in silicones and biotech indirectly supporting aluminosilicate applications in sustainable materials.

Report Scope

Report Features Description Market Value (2024) USD 227.5 Million Forecast Revenue (2034) USD 377.7 Million CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pure Aluminosilicate, Calcium Aluminosilicate, Sodium Aluminosilicate, Potassium Aluminosilicate, Others), By Source (Natural, Synthetic), By End Use (Construction, Electronics, Petrochemical Refineries, Agriculture, Food and Beverages, Automotive and Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Huber Engineered Materials, Evonik Industries, Wacker Chemie, Shin-Etsu Chemical Co Ltd., Grace Catalysts Technologies, SCHOTT AG, Kepa Minerals, DK Industries, VV Mineral, Kyanite Mining Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Huber Engineered Materials

- Evonik Industries

- Wacker Chemie

- Shin-Etsu Chemical Co Ltd.

- Grace Catalysts Technologies

- SCHOTT AG

- Kepa Minerals

- DK Industries

- VV Mineral

- Kyanite Mining Corporation