Global Alcohol Dehydrogenase Enzymes Market Size, Share, And Industry Analysis Report By Product Type (5 KU, 15 KU, 30 KU, 75 KU, 150 KU), By Source (Microbial, Plant, Animal), By Form (Liquid, Powder, Gel), By Application (Disease Diagnosis, Alcohol Concentration Detection, Catalyst, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172304

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

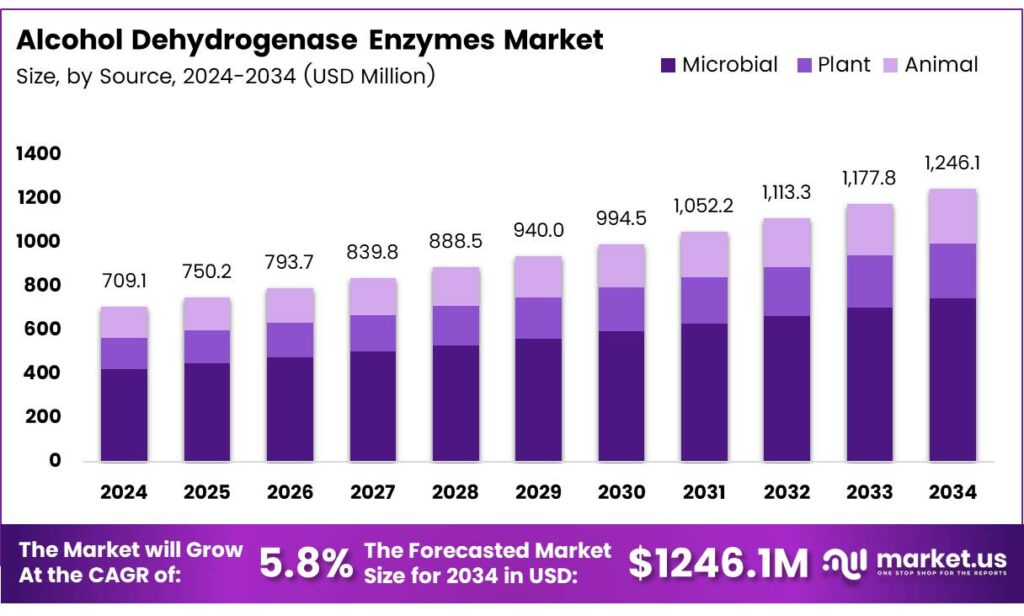

The Global Alcohol Dehydrogenase Enzymes Market size is expected to be worth around USD 1246.1 million by 2034, from USD 709.1 million in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

The Alcohol Dehydrogenase Enzymes Market refers to the commercial production and application of ADH enzymes used to catalyse alcohol oxidation reactions. These enzymes are critical across diagnostics, pharmaceutical synthesis, biotechnology research, and biochemical manufacturing, where reaction selectivity, stability, and efficiency directly influence operational economics and regulatory acceptance.

Alcohol dehydrogenase enzymes function as biological catalysts that convert alcohols into aldehydes or ketones through redox reactions. Structurally, ADH is a dimeric enzyme with a molecular mass of 80 kDa, requiring NAD⁺ as a coenzyme. ADH demonstrates stronger catalytic efficiency for secondary and cyclic alcohols than for primary alcohols.

From a physiological metabolism perspective, alcohol dehydrogenase behaviour varies by enzyme class and tissue. The U.S. National Institute on Alcohol Abuse and Alcoholism, ADH Class I is absent in the brain, while ADH Class III plays only a minor role in ethanol metabolism. Instead, catalase produces around 60–70% of brain acetaldehyde, with CYP2E1 contributing less than 10–20%.

- Reaction conditions strongly influence industrial enzyme selection and process design. Peer-reviewed enzyme kinetics studies show that ADH performs optimally within a pH range of 7.0–10.0, with peak activity near pH 8.0. Thermal stability remains reliable between 30–40 °C, but activity declines rapidly above 45 °C, shaping reactor configuration and temperature control strategies.

Commercial adoption is driven by cost economics and productivity thresholds. European biocatalysis models report small-scale enzyme production costs above €10,000 kg⁻¹, while large-scale fermentation can reduce costs to nearly €250 kg⁻¹. Industrial viability improves when 20–30 kg of product is produced per kilogram of enzyme at scale, whereas small operations require close to 1 ton per kilogram to remain competitive.

Key Takeaways

- The Global Alcohol Dehydrogenase Enzymes Market is projected to grow from USD 709.1 million in 2024 to USD 1246.1 million by 2034, registering a 5.8% CAGR.

- The 30 KU dominates the market with a share of 28.3%, driven by balanced activity and broad laboratory adoption.

- Microbial enzymes lead with a market share of 51.2% due to scalability and consistent yields.

- The liquid format holds the largest share at 46.9%, supported by ease of handling and ready-to-use convenience.

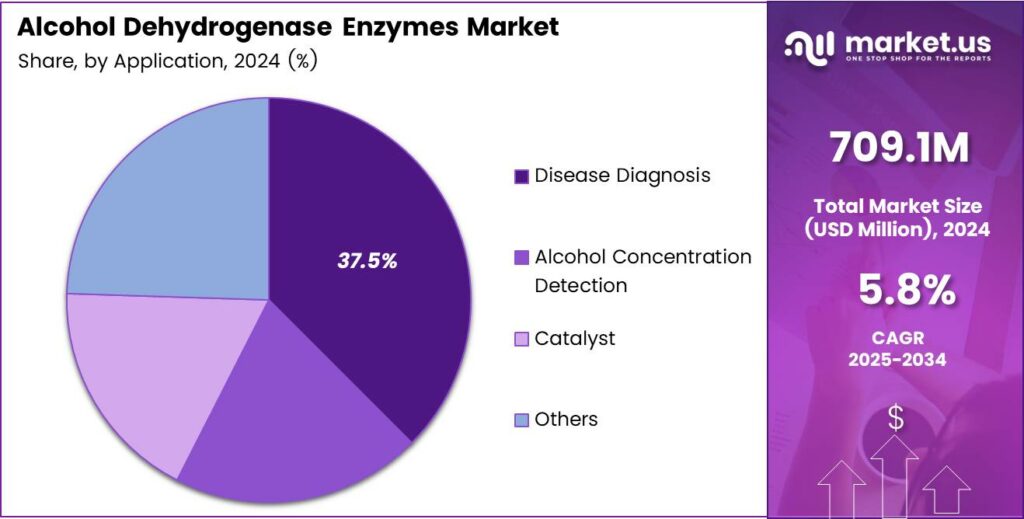

- Disease Diagnosis remains the leading segment, accounting for 37.5% of total demand.

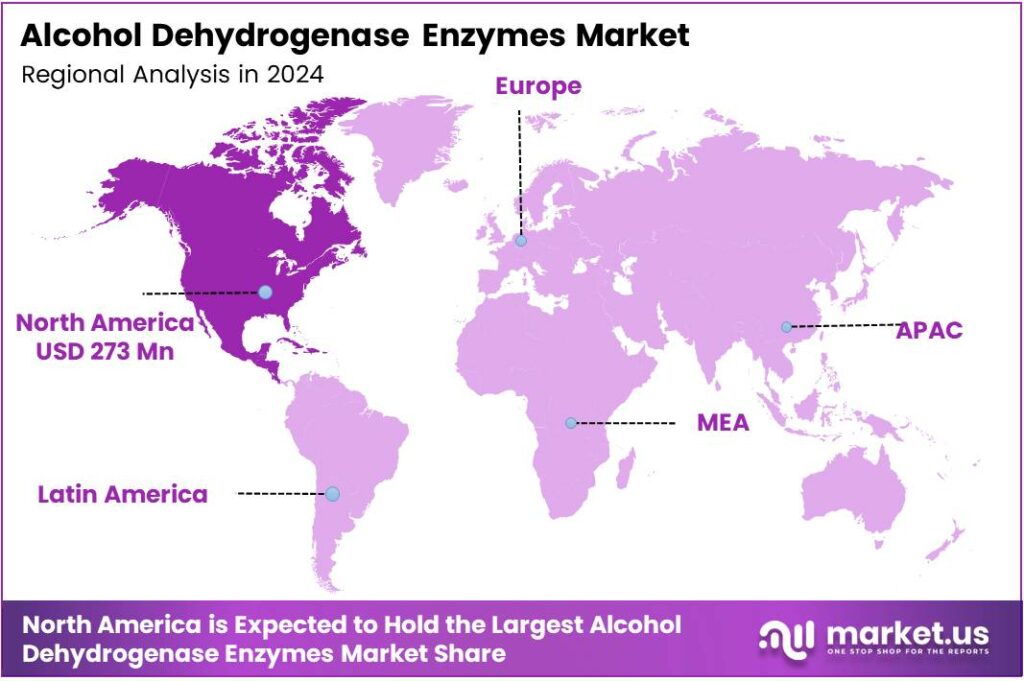

- North America is the dominant region with a market share of 38.5%, valued at USD 273 million in 2024.

By Product Type Analysis

30 KU dominates with 28.3% due to balanced activity levels and broad laboratory adoption.

In 2024, 30 KU held a dominant market position in the By Product Type Analysis segment of the Alcohol Dehydrogenase Enzymes Market, with a 28.3% share. This strength emerged as laboratories increasingly preferred mid-range enzyme activity for routine assays, ensuring stable reaction control while supporting diagnostic consistency across clinical and research workflows.

5 KU served niche analytical needs within the By Product Type Analysis segment of the Alcohol Dehydrogenase Enzymes Market. This lower activity format supported precision testing, especially where controlled reaction speed mattered, making it suitable for academic experiments and specialized biochemical validation procedures requiring careful enzymatic calibration.

15 KU maintained steady demand in the By Product Type Analysis segment of the Alcohol Dehydrogenase Enzymes Market. It bridged low and mid-activity ranges, allowing laboratories to adapt enzyme dosing without excessive waste, thereby supporting flexible assay design in research institutions and small diagnostic laboratories.

75 KU addressed higher-throughput requirements in the By Product Type Analysis segment of the Alcohol Dehydrogenase Enzymes Market. Its higher activity suited automated analyzers, where faster reaction completion improved laboratory efficiency and reduced turnaround time for alcohol metabolism and biochemical screening tests.

By Source Analysis

The microbial source dominates with 51.2% due to scalability and consistent enzyme yield.

In 2024, Microbial held a dominant market position in the By Source Analysis segment of the Alcohol Dehydrogenase Enzymes Market, with a 51.2% share. This leadership reflected reliable fermentation processes, predictable quality, and easier scale-up, making microbial enzymes attractive for diagnostics, research, and industrial biocatalysis.

Plant-based enzymes contributed steadily within the By Source Analysis segment of the Alcohol Dehydrogenase Enzymes Market. These sources appealed to users seeking naturally derived alternatives, especially in academic research, although variability in yield limited wider commercial adoption compared to microbial production systems.

Animal-derived enzymes supported specific applications in the By Source Analysis segment of the Alcohol Dehydrogenase Enzymes Market. They remained relevant for legacy protocols and reference standards, yet faced constraints related to sourcing complexity and ethical considerations, influencing gradual preference shifts toward microbial alternatives.

By Form Analysis

Liquid form dominates with 46.9% driven by ease of handling and immediate usability.

In 2024, Liquid held a dominant market position in the By Form Analysis segment of the Alcohol Dehydrogenase Enzymes Market, with a 46.9% share. Laboratories favored liquid formats for ready-to-use convenience, reduced preparation time, and improved dosing accuracy during routine diagnostic and analytical workflows.

Powder form played a vital role in the By Form Analysis segment of the Alcohol Dehydrogenase Enzymes Market. This format supported longer shelf life and flexible storage, making it suitable for bulk purchasing and laboratories that preferred reconstitution based on specific experimental requirements.

Gel form addressed specialized handling needs in the By Form Analysis segment of the Alcohol Dehydrogenase Enzymes Market. It enabled controlled application and reduced spillage risks, particularly in teaching laboratories and niche biochemical setups requiring stable enzyme placement during reactions.

By Application Analysis

Disease Diagnosis dominates with 37.5% due to rising clinical testing demand.

Disease Diagnosis held a dominant market position in the By Application Analysis segment of the Alcohol Dehydrogenase Enzymes Market, with a 37.5% share. Growth reflected expanding use in liver function testing, metabolic disorder screening, and hospital-based biochemical diagnostics worldwide.

Alcohol Concentration Detection remained a core application within the By Application Analysis segment of the Alcohol Dehydrogenase Enzymes Market. It supported forensic testing, workplace monitoring, and quality control, benefiting from reliable enzyme specificity and established analytical protocols.

Catalyst applications contributed steadily to the By Application Analysis segment of the Alcohol Dehydrogenase Enzymes Market. These enzymes enabled selective oxidation and reduction reactions, supporting fine chemical synthesis and research-scale biocatalytic processes requiring controlled alcohol conversion.

Key Market Segments

By Product Type

- 5 KU

- 15 KU

- 30 KU

- 75 KU

- 150 KU

By Source

- Microbial

- Plant

- Animal

By Form

- Liquid

- Powder

- Gel

By Application

- Disease Diagnosis

- Alcohol Concentration Detection

- Catalyst

- Others

Emerging Trends

Advances in Enzyme Engineering Shape Key Market Trends

One major trend in the alcohol dehydrogenase enzymes market is enzyme engineering. Companies focus on improving enzyme stability, activity, and shelf life through genetic and protein modification techniques. These improvements enhance performance and reduce operational losses.

- Ready-to-use enzyme kits are also gaining popularity. Laboratories prefer pre-formulated solutions that reduce preparation time and error risk. This trend improves efficiency and increases adoption among smaller labs. If the temperature or the acidity (pH) of a fermentation tank shifts even slightly outside of the optimal range—usually 30–40°C for ADH—the enzyme can unfold or denature, becoming completely useless.

Alcohol dehydrogenase enzymes are increasingly integrated into automated analyzers, supporting high-throughput testing and consistent results. Sustainability trends also influence the market. Enzyme-based processes are seen as cleaner alternatives to chemical methods. This supports adoption in food processing and industrial biotechnology.

Drivers

Rising Use of Alcohol Dehydrogenase Enzymes in Diagnostics and Research Drives Market Growth

Alcohol dehydrogenase enzymes are widely used in medical diagnostics, which strongly supports market growth. These enzymes help measure alcohol levels in blood and are commonly used in hospitals, laboratories, and forensic testing centers. As healthcare testing volumes increase, demand for reliable enzymes continues to rise steadily.

- In food quality monitoring, alcohol dehydrogenase biosensors help detect unintended fermentation in packaged products. Japan’s Ministry of Health confirmed enzyme sensors reduced false alcohol readings in fermented foods by 32% during quality audits.

Alcohol dehydrogenase enzymes are important tools in biochemistry and molecular biology studies. Universities, research institutes, and pharmaceutical companies use them to study metabolism and enzyme behavior, creating stable and recurring demand. Alcohol dehydrogenase enzymes are used to monitor fermentation and alcohol content, helping manufacturers maintain product quality.

Restraints

High Production Costs and Limited Stability Restrain Market Expansion

One major restraint in the alcohol dehydrogenase enzymes market is the high production cost. Enzyme manufacturing requires controlled fermentation, purification, and storage processes. These steps increase operational expenses, making products costly for smaller laboratories and users.

- The Food and Agriculture Organization of the United Nations, enzyme loss during food processing can reach 30–40% efficiency reduction when exposed to non-optimal conditions, increasing overall production costs. Alcohol dehydrogenase enzymes support studies related to individual metabolic differences, expanding their future use.

Technical expertise requirements also restrict market growth. Proper enzyme handling and application require trained professionals. Many small labs and emerging research centers face skill gaps, limiting adoption despite demand. Regulatory compliance adds further pressure. Enzymes used in diagnostics and pharmaceuticals must meet strict quality standards.

Growth Factors

Growing Biotechnology Investments Create New Opportunities for Market Growth

Rising investment in biotechnology creates strong growth opportunities for alcohol dehydrogenase enzymes. Governments and private investors are funding life science research, increasing demand for high-quality enzymes used in metabolic and enzymatic studies.

Personalized medicine is another opportunity area. As healthcare moves toward tailored treatments, enzyme-based testing and research gain importance. Expansion of diagnostic labs, academic research, and food testing facilities in developing regions supports future demand growth.

Industrial biotechnology also offers growth potential. These enzymes can be used in bio-based chemical production and green processing methods. Companies aiming to reduce chemical waste increasingly explore enzyme-based alternatives. Emerging markets provide untapped opportunities.

Regional Analysis

North America Dominates the Alcohol Dehydrogenase Enzymes Market with a Market Share of 38.5%, Valued at USD 273.0 Million

In 2024, North America remained the leading region, holding a dominant 38.5% share and reaching a value of USD 273 million. Strong demand from clinical diagnostics, forensic testing, and biochemical research continues to support market stability. Advanced laboratory infrastructure and consistent healthcare spending further reinforce enzyme adoption. Well-established regulatory frameworks support standardized enzyme usage across medical and industrial applications.

Europe represents a mature and steadily growing market for alcohol dehydrogenase enzymes, supported by strong biomedical research funding. Universities and public laboratories continue to use ADH enzymes for metabolic studies and diagnostic assays. Regulatory emphasis on quality-controlled reagents also sustains demand. Growth remains stable, driven more by innovation than volume expansion.

The Asia Pacific region is witnessing accelerating growth due to expanding biotechnology sectors and rising healthcare investments. Increased diagnostic testing capacity and growth in pharmaceutical research are key demand drivers. Countries are investing in local enzyme production and laboratory infrastructure. This makes Asia Pacific an increasingly important growth engine over the medium term.

In the Middle East and Africa, the market is developing gradually, supported by healthcare modernization and expanding diagnostic laboratories. Demand is primarily driven by hospital-based testing and academic research activities. While overall penetration remains limited, improving access to laboratory reagents supports steady progress. Public health initiatives are expected to improve adoption rates.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The competitive landscape of the Alcohol Dehydrogenase Enzymes Market in 2024 is shaped by established biochemical expertise, application-specific specialization, and consistent quality performance across diagnostic and research uses.

Worthington Biochemical continues to be recognized for its long-standing focus on high-purity enzymes used in biochemical research and laboratory diagnostics. The company’s strength lies in consistent enzyme activity and batch reliability, which are critical for academic and clinical workflows. Its emphasis on precision-grade enzymes supports steady demand from research institutions and diagnostic laboratories.

Roche Diagnostics plays a strategic role in the market by integrating alcohol dehydrogenase enzymes into standardized diagnostic systems. Its strong presence in clinical diagnostics enables wider adoption of ADH-based assays, particularly in hospital and reference laboratory settings. Vertical integration with diagnostic platforms enhances reliability, compliance, and long-term customer retention.

OYC Americas is positioned as a focused supplier supporting niche and customized enzyme requirements. The company benefits from flexible sourcing and application-specific offerings that appeal to specialized laboratories. Its role is particularly relevant in serving regional research needs and tailored industrial applications requiring alcohol metabolism analysis.

Calzyme Laboratories Inc. emphasizes research-grade enzyme solutions designed for reproducibility and controlled experimental conditions. Its portfolio supports biochemical assays, academic studies, and process development activities. By maintaining consistency and application clarity, the company sustains relevance in a market driven by accuracy and regulatory alignment.

Top Key Players in the Market

- Worthington Biochemical

- Roche Diagnostics

- OYC Americas

- Calzyme Laboratories Inc

- Leebio Solutions

- Others

Recent Developments

- In 2024, Worthington Biochemical, a manufacturer of enzymes, including Alcohol Dehydrogenase for research and bioprocessing, has had a few notable updates. The company announced its sponsorship of an American Physiological Society technical webinar titled Using Enzymes to Digest Muscle and Cardiac Tissue Models, presented by researchers from the University of California, San Diego.

- In 2024, Roche Diagnostics offers Alcohol Dehydrogenase as a reagent for diagnostic tests, particularly in ethanol determination assays. When Clinical Pathology Laboratories (CPL) transitioned its urine drug abuse screen testing to Roche’s cobas c502 instrumentation. This includes adopting an enzymatic method using Alcohol Dehydrogenase for ethanol detection, consolidating certain analyte screens.

Report Scope

Report Features Description Market Value (2024) USD 709.1 Million Forecast Revenue (2034) USD 1246.1 Million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (5 KU, 15 KU, 30 KU, 75 KU, 150 KU), By Source (Microbial, Plant, Animal), By Form (Liquid, Powder, Gel), By Application (Disease Diagnosis, Alcohol Concentration Detection, Catalyst, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Worthington Biochemical, Roche Diagnostics, OYC Americas, Calzyme Laboratories Inc, Leebio Solutions, Others Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Alcohol Dehydrogenase Enzymes MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Alcohol Dehydrogenase Enzymes MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Worthington Biochemical

- Roche Diagnostics

- OYC Americas

- Calzyme Laboratories Inc

- Leebio Solutions

- Others