Global Air Conditioning Systems Market Size, Share, And Upcoming Investment By Type(Window-type, Split-type, PAC, VRF, By Technology, Inverter, Non-Inverter), By Capacity (Upto 12,000 BTU/Hr, 12,000 BTU/Hr to 24,000 BTU/Hr, 24,000 BTU/Hr to 48,000 BTU/Hr, Above 48,000 BTU/Hr), By End-use (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 24695

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

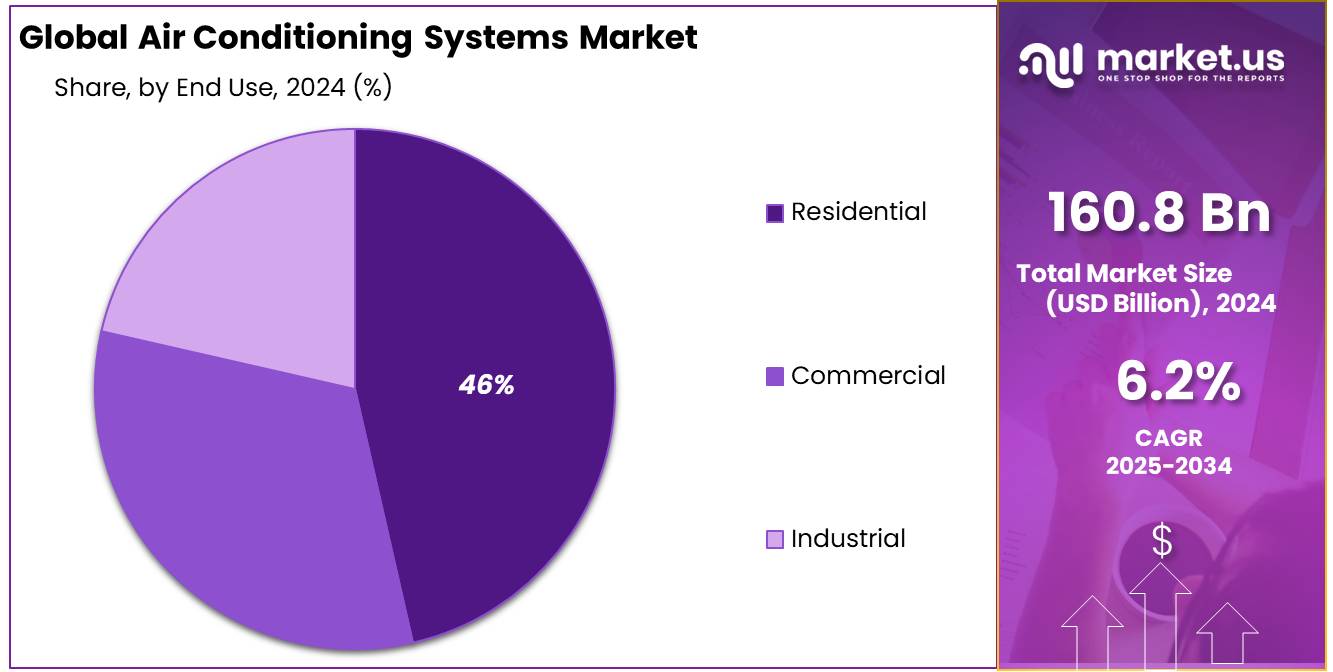

The Air Conditioning Systems Market size is expected to be worth around USD 293.4 billion by 2034, from USD 160.8 Bn in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The global air conditioning systems market is an essential part of the HVAC industry, providing solutions for temperature, humidity, and air circulation control in residential, commercial, and industrial settings. With rising global temperatures and unpredictable climate patterns, the demand for reliable cooling systems has increased significantly. This growth is further driven by rapid urbanization, increasing disposable incomes, and a heightened focus on energy-efficient technologies.

Residential demand remains a key growth driver, particularly in emerging markets where the expanding middle class is boosting air conditioning adoption. In commercial spaces, air conditioning systems are crucial for ensuring comfort and efficiency in offices, retail environments, and healthcare facilities. The industrial sector also relies on advanced cooling solutions, especially in temperature-sensitive industries like pharmaceuticals, food and beverage, and data centers. Notably, global data center investments are projected to reach USD 200 billion by 2025, accelerating the demand for high-performance cooling systems.

Several Driving factors are fueling market expansion, including the increasing frequency of heatwaves and climate change, making air conditioning a necessity in many regions. Urbanization trends indicate that by 2050, 68% of the global population will reside in cities, further driving demand for modern infrastructure equipped with efficient cooling solutions. In response to sustainability concerns, innovations such as variable refrigerant flow (VRF) systems, inverter-based units, and smart thermostats are improving energy efficiency, cutting consumption by 30–40%, and aligning with stringent government regulations on emissions.

The industry is also shifting towards eco-friendly refrigerants like R-32 and R-290, which have lower global warming potential (GWP). Regulations such as the Kigali Amendment are pushing manufacturers to phase out hydrofluorocarbons (HFCs) and adopt sustainable alternatives. Additionally, advancements in IoT and AI are revolutionizing the market by enabling predictive maintenance, remote monitoring, and an improved user experience, setting the stage for smarter and more energy-efficient air conditioning solutions.

Key Takeaways

- Air Conditioning Systems Market size is expected to be worth around USD 293.4 billion by 2034, from USD 160.8 Bn in 2024, growing at a CAGR of 6.2%.

- Split-type air conditioning systems maintained a commanding presence in the market, boasting a substantial 47.80% share.

- Inverter technology in air conditioning systems emerged as the clear market leader, securing a dominant 69.20% share.

- air conditioning systems segment ranging from 12,000 BTU/Hr to 24,000 BTU/Hr held a dominant market position, capturing more than a 37.90% share.

- residential segment of the air conditioning systems market held a dominant position, capturing more than a 46.30% share.

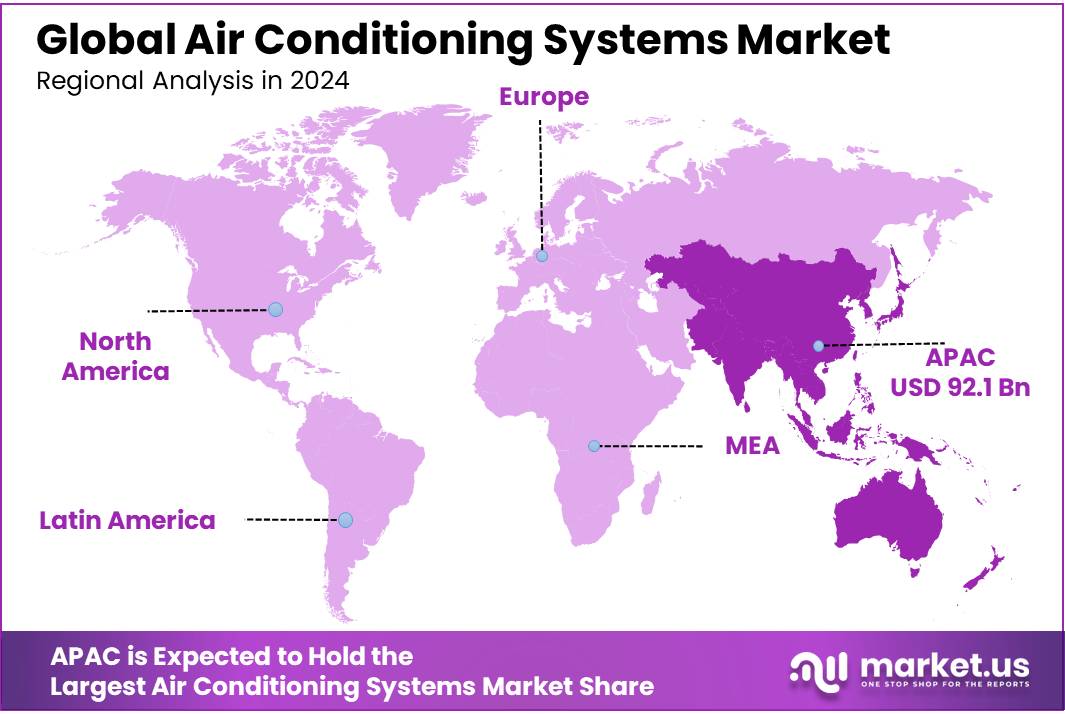

- APAC holds a significant 57.30% share, valued at approximately USD 92.1 billion.

Type Analysis

In 2024, Split-type air conditioning systems maintained a commanding presence in the market, boasting a substantial 47.80% share. This type of system is favored for its efficiency and the ability to cool multiple rooms without the need for extensive ductwork, making it an ideal choice for both residential and commercial settings. Particularly, the flexibility offered by both single-split and multi-split configurations allows consumers to tailor their cooling solutions to specific needs, driving their popularity.Technology Analysis

In 2024, Inverter technology in air conditioning systems emerged as the clear market leader, securing a dominant 69.20% share. This technology has been increasingly preferred for its energy efficiency and ability to maintain consistent room temperatures without the constant on-off cycling of compressors found in non-inverter units. By adjusting the speed of the compressor to control the refrigerant flow, inverter ACs significantly reduce energy consumption and provide quieter operation, making them an attractive choice for both residential and commercial use.

non-inverter air conditioners, while being more straightforward and initially less expensive, operate at full power and stop completely once the set temperature is reached, which can lead to greater energy use and more noticeable temperature fluctuations. Despite these drawbacks, non-inverter units continue to hold a place in the market, particularly in settings where initial cost is a major factor and precise temperature control is less of a concern.

By Capacity Analysis

In 2024, the air conditioning systems segment ranging from 12,000 BTU/Hr to 24,000 BTU/Hr held a dominant market position, capturing more than a 37.90% share. This capacity range is particularly popular among residential users due to its ideal balance between cooling efficiency and energy consumption. It suits small to medium-sized rooms, making it a versatile choice for households.

Air conditioners with a capacity of up to 12,000 BTU/Hr are generally used in smaller spaces such as individual rooms or small apartments. These units are appreciated for their affordability and are often seen as a budget-friendly cooling solution.

The next category, 24,000 BTU/Hr to 48,000 BTU/Hr, caters mainly to larger residential spaces and commercial environments that require more robust cooling power. This range is capable of efficiently cooling larger areas without the need for multiple units, thus optimizing space and energy usage.

Finally, systems with a capacity of above 48,000 BTU/Hr are typically reserved for industrial applications or very large commercial spaces where extensive cooling is necessary. These high-capacity units are essential in environments that deal with high heat loads or where many people gather.

End-Use Analysis

In 2024, the residential segment of the air conditioning systems market held a dominant position, capturing more than a 46.30% share. This segment’s strength is largely due to the increasing demand for comfort in homes across varied climates, coupled with rising global temperatures. The residential market benefits from the widespread adoption of energy-efficient and smart air conditioning units that offer enhanced user control and integration with home automation systems.

The commercial segment also plays a crucial role in the overall market. Air conditioning systems in commercial settings, such as offices, retail spaces, and hospitality venues, are essential for creating a comfortable environment that can enhance productivity and customer satisfaction. As businesses continue to invest in healthier and more sustainable building solutions, the adoption of advanced HVAC systems is expected to grow.

Meanwhile, the industrial segment, although smaller in comparison, is critical for maintaining the necessary conditions in facilities that require precise temperature control such as manufacturing plants, data centers, and processing units. Industrial air conditioners are designed to handle large spaces and harsh environments, making them more robust and significantly different from their residential and commercial counterparts.

Key Market Segments

By Type

- Window-type

- Split-type

- Single-split

- Multi-split

- PAC

- VRF

By Technology

- Inverter

- Non-Inverter

By Capacity

- Upto 12,000 BTU/Hr

- 12,000 BTU/Hr to 24,000 BTU/Hr

- 24,000 BTU/Hr to 48,000 BTU/Hr

Above 48,000 BTU/Hr

By End-use

- Residential

- Commercial

- Industrial

Drivers

Growing Demand in the Commercial Sector

According to the National Restaurant Association, the projected sales for the U.S. restaurant industry in 2024 are expected to exceed $899 billion, a notable increase from previous years. This growth isn’t just a signal of economic recovery but also highlights the expanding infrastructure that requires efficient cooling solutions to accommodate increased foot traffic and enhance customer experiences. Restaurants, cafes, and diners are investing in high-quality air conditioning systems to create a pleasant dining environment, which is crucial for attracting and retaining customers.

In the retail sector, similar trends are observed. The U.S. Census Bureau reported that retail sales in July 2024 spiked by 5.7% compared to the same period in the previous year. Retailers are continuously looking for ways to improve the shopping experience, and maintaining a comfortable in-store temperature is a key component. Effective air conditioning not only ensures customer comfort but also helps preserve the quality of perishable products, making it a critical investment for grocery stores and supermarkets.

Furthermore, the rise of eco-friendly and sustainable building practices is significantly shaping the air conditioning market. Government initiatives aimed at reducing energy consumption and greenhouse gas emissions are compelling businesses to adopt more efficient HVAC systems. For example, the U.S. Environmental Protection Agency (EPA) has been actively promoting the Energy Star program, which encourages the adoption of energy-efficient products including air conditioners. Buildings that comply with Energy Star standards have reported nearly 35% less energy usage than regular buildings.

Internationally, similar initiatives are supporting market growth. The European Union’s Energy Performance of Buildings Directive (EPBD) mandates that all new buildings constructed within EU member states must be nearly zero-energy buildings (NZEB) by the end of 2025. This directive is a powerful motivator for the incorporation of advanced air conditioning systems that contribute to energy efficiency in commercial constructions.

Restraints

High Installation and Maintenance Costs

For many food service establishments, such as small cafes and family-owned restaurants, the upfront cost of installing an efficient and modern air conditioning system can be a major barrier. These systems not only require significant initial investment but also ongoing expenses in terms of maintenance and repairs. According to a report from the U.S. Department of Energy, commercial buildings, including those in the food service sector, spend approximately 15% of their total energy costs on air conditioning alone. This is a substantial financial burden, considering the tight profit margins in the hospitality industry.

Moreover, the complexity and specificity of HVAC systems for food-related environments, where temperature and humidity control are crucial for product quality, add additional layers of expense. Systems capable of these controls are more sophisticated and thus more costly to install and maintain. This is particularly evident in industries like food processing and high-end gastronomy, where precise climate control is essential to product quality and compliance with food safety regulations.

Government regulations, while aimed at increasing energy efficiency and reducing environmental impact, can also add to the cost burden. For instance, regulations that require the use of specific, environmentally friendly refrigerants can make older systems obsolete, forcing businesses to invest in new equipment. The EPA’s regulations on the phasing out of certain hydrofluorocarbons (HFCs) under the American Innovation and Manufacturing (AIM) Act is an example where compliance costs could deter businesses from upgrading their systems due to the high expense of newer, compliant models.

The financial impact of these regulations is felt most acutely by small businesses. A study by the Small Business Administration found that small enterprises bear a disproportionate share of federal regulatory costs, spending about 45% more per employee than larger firms to comply with federal regulations. This disparity can restrain smaller food service businesses from investing in advanced air conditioning systems, thus hindering their ability to provide a comfortable environment for customers and employees.

Opportunities

Expansion into Emerging Markets

Countries in Asia, Africa, and Latin America are witnessing rapid urbanization, which is directly correlated with increased air conditioning sales. The United Nations projects that by 2050, urban areas are expected to house 68% of the world’s population, up from 55% in 2018. This urban growth is particularly notable in countries like India, China, and Nigeria, where new commercial buildings, hotels, and residential complexes are continually being developed.

The food industry in these emerging markets presents a unique opportunity for growth in the air conditioning sector. With rising incomes, there is an increased demand for dining out and high-quality food services, which necessitates the installation of effective air conditioning systems to ensure customer comfort and food safety. The Asian Development Bank reports that consumer spending in Asia is expected to reach $32 trillion by 2030, accounting for 43% of worldwide consumption. This surge in spending power is a strong driver for the hospitality sector, where air conditioning is crucial for maintaining a pleasant environment.

Government initiatives across these regions further support this growth by promoting infrastructure development and energy-efficient technologies. For instance, India’s National Cooling Action Plan aims to reduce cooling demand across sectors by 20% to 25% by 2037-38. Such policies encourage the adoption of advanced, efficient air conditioning systems, aligning with global sustainability goals.

Moreover, these markets are also seeing an increase in environmental awareness, which drives the demand for energy-efficient and sustainable HVAC solutions. Programs like China’s Green Building Evaluation Standard and Brazil’s Procel Seal are designed to promote energy conservation in buildings, influencing the types of air conditioning systems installed.

Latest Trends

The Rise of Smart and Eco-Friendly Air Conditioning Systems

One of the most significant trends shaping the air conditioning systems market is the increasing demand for smart, eco-friendly technologies. As global awareness of environmental sustainability grows, both consumers and businesses are seeking out air conditioning solutions that not only provide effective cooling but also minimize energy consumption and reduce environmental impact.

Smart air conditioning systems that integrate with IoT (Internet of Things) technology are at the forefront of this trend. These systems offer users unprecedented control over their indoor environments, with features that allow for remote operation, real-time energy monitoring, and automatic adjustments based on ambient conditions or occupancy levels. According to the Energy Saving Trust, smart air conditioning can reduce energy use by up to 20%, highlighting its appeal to cost-conscious consumers and environmentally minded businesses alike.

The push towards eco-friendly air conditioning is particularly pronounced in the food industry, where maintaining optimal storage temperatures is crucial for ensuring product quality and safety. Restaurants, grocery stores, and food processing plants are increasingly adopting advanced HVAC systems that feature energy recovery, environmentally friendly refrigerants, and high-efficiency particulate air (HEPA) filters. These features not only help businesses comply with stringent food safety standards but also contribute to broader corporate sustainability goals.

Government initiatives are further amplifying this trend by setting stricter energy standards and offering incentives for the adoption of green technologies. In the United States, for example, the Department of Energy (DOE) has implemented new efficiency standards for HVAC systems that will take effect in 2025, requiring new air conditioners to use about 7% less energy than current models. This regulatory push is mirrored in the European Union’s eco-design directives, which aim to significantly reduce the energy consumption of air conditioners by enforcing minimum energy performance standards.

The convergence of these factors is creating a robust market for advanced air conditioning systems that offer enhanced performance, lower environmental impact, and better alignment with modern technological ecosystems. As more organizations recognize the business benefits and societal value of sustainable practices, the demand for green and smart HVAC technologies is expected to continue growing.

Regional Analysis

The air conditioning systems market is witnessing varied trends across different regions, with Asia Pacific (APAC) leading the charge. Dominating the global market, APAC holds a significant 57.30% share, valued at approximately USD 92.1 billion. This dominance is driven by rapid urbanization, increasing middle-class incomes, and the expanding real estate sector, particularly in countries like China, India, and Japan. These nations are experiencing a surge in both residential and commercial construction activities, necessitating advanced air conditioning solutions to meet growing demand.

In contrast, North America and Europe are focused more on replacing older systems with energy-efficient models in response to stringent environmental regulations. These regions are adopting smart and sustainable technologies to minimize energy use and carbon footprint. For instance, the European Union’s directives on eco-design and energy labeling have spurred the adoption of high-efficiency air conditioning systems.

The Middle East and Africa (MEA) show potential for growth, particularly due to the climatic conditions that necessitate the use of air conditioning systems year-round. The development of large-scale commercial projects, such as malls and hotels, particularly in the Gulf Cooperation Council (GCC) countries, is propelling the demand for sophisticated HVAC systems.

Latin America, although smaller in market size compared to APAC or North America, is experiencing gradual growth fueled by economic recovery and urban development, particularly in Brazil and Mexico. Here, the focus is on cost-effective solutions that cater to a price-sensitive consumer base.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The air conditioning systems market features a dynamic competitive landscape with numerous key players that contribute to its global reach and technological advancements. Leading the pack is Daikin Industries, Ltd., renowned for its innovation in energy-efficient air conditioning technologies. Daikin’s strategic focus on eco-friendly products aligns with global environmental standards, which helps maintain its strong market presence.

Carrier Global, which alongside Trane Technologies and LG Electronics, dominates in both residential and commercial air conditioning markets. These companies have broadened their market reach through diverse product portfolios that include advanced features like IoT connectivity and AI-driven performance optimization. In the realm of consumer electronics and household appliances, companies like Whirlpool, Haier Inc., and Panasonic Holdings Corporation have successfully integrated their air conditioning solutions with other home automation systems, enhancing user convenience and energy management.

Voltas and ALFA LAVAL are also making significant inroads by focusing on market-specific needs and expanding into new geographic regions. These companies leverage local market insights to develop tailored solutions that address unique climate conditions and regulatory frameworks, particularly in high-growth markets like Asia Pacific and the Middle East. The continued expansion and innovation by these key players underscore the air conditioning systems market’s competitive nature and its rapid adaptation to changing environmental and technological landscapes.

Market Key Players

- Daikin Industries, Ltd.

- Murata Manufacturing Co., Ltd

- Mitsubishi Electric

- Johnson Controls International

- Carrier Global

- Whirlpool

- Haier Inc

- BSH Hausgeräte GmbH

- ALFA LAVAL

- Lennox International Inc.

- FUJITSU GENERAL.

- Voltas

- SAMSUNG

- Trane Technologies

- Panasonic Holdings Corporation

- LG Electronics

- Other Key Players

Recent Developments

In 2024, Murata Manufacturing Co., Ltd. continued to innovate within the air conditioning systems sector, focusing on components that enhance the efficiency and environmental sustainability of HVAC systems.

In 2024, Daikin Industries, Ltd. continued to enhance its position in the global air conditioning market, focusing particularly on the commercial sector where it captured growing renewal demand due to the push for carbon-neutral policies.

Report Scope

Report Features Description Market Value (2024) USD 126.5 Bn Forecast Revenue (2034) USD 237.5 Bn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Window-type, Split-type, PAC, VRF, By Technology, Inverter, Non-Inverter), By Capacity (Upto 12,000 BTU/Hr, 12,000 BTU/Hr to 24,000 BTU/Hr, 24,000 BTU/Hr to 48,000 BTU/Hr, Above 48,000 BTU/Hr), By End-use (Residential, Commercial, Industrial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Daikin Industries, Ltd., Murata Manufacturing Co., Ltd, Mitsubishi Electric, Johnson Controls International, Carrier Global, Whirlpool , Haier Inc, BSH Hausgeräte GmbH, ALFA LAVAL, Lennox International Inc., FUJITSU GENERAL., Voltas , SAMSUNG, Trane Technologies, Panasonic Holdings Corporation, LG Electronics, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Air Conditioning Systems MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Air Conditioning Systems MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Daikin Industries, Ltd.

- Murata Manufacturing Co., Ltd

- Mitsubishi Electric

- Johnson Controls International

- Carrier Global

- Whirlpool

- Haier Inc

- BSH Hausgeräte GmbH

- ALFA LAVAL

- Lennox International Inc.

- FUJITSU GENERAL.

- Voltas

- SAMSUNG

- Trane Technologies

- Panasonic Holdings Corporation

- LG Electronics

- Other Key Players