Global Ultra-fine ATH Market Size, Share, And Business Benefits By Type (Upto 1um, 1-1.5um, 1.5-2.5um, Above 2.5 um), By Application (Filling Material, Catalyst Carrier, Others), By End-use (Construction, Electrical and Electronics, Automotive, Plastics and Polymers, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 30906

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

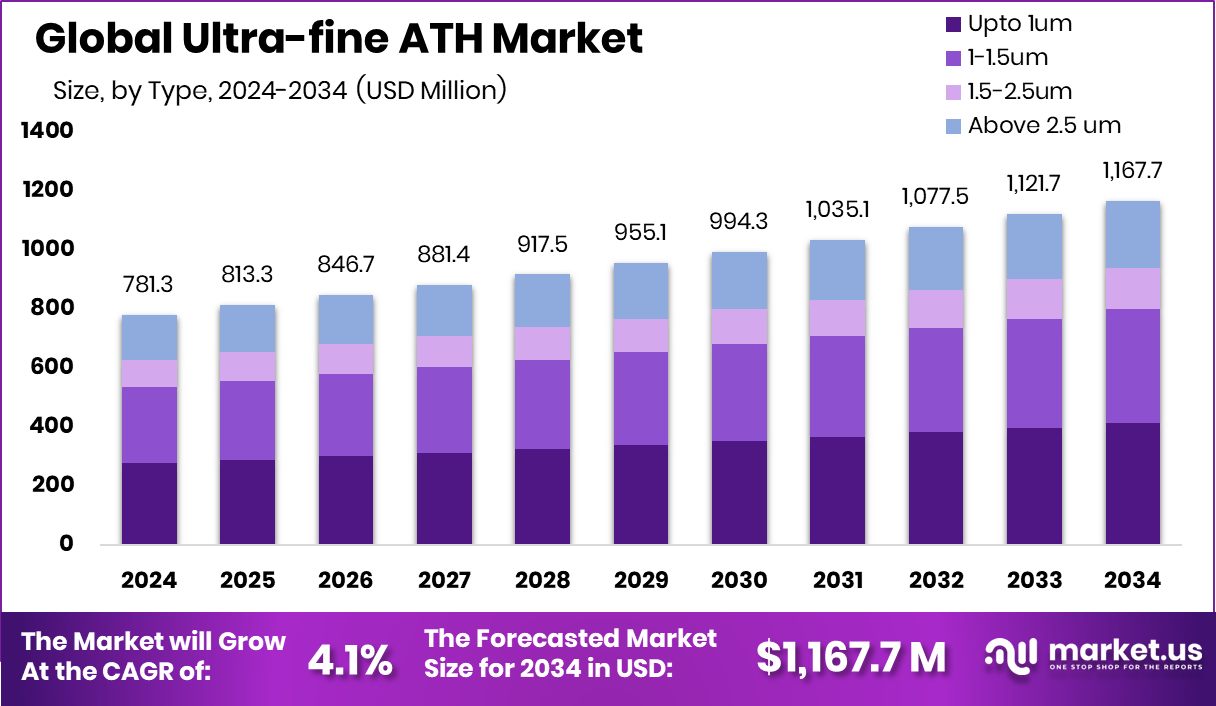

Global Ultra-fine ATH Market is expected to be worth around USD 1,167.7 million by 2034, up from USD 781.3 million in 2024, and grow at a CAGR of 4.1% from 2025 to 2034. Strong regulations and construction demand supported North America’s 41.30% Ultra-fine ATH market lead.

Ultra-fine Aluminum Trihydrate (ATH) is a highly refined form of aluminum hydroxide characterized by its extremely small particle size, typically below 1 micron. It is widely used as a flame retardant and smoke suppressant in polymers, coatings, wire and cable insulation, and adhesives. The ultra-fine grade provides better dispersion and improved mechanical properties, making it particularly useful in high-performance and thin-layer applications where uniformity and surface finish are critical.

The Ultra-fine ATH market is witnessing steady growth, driven largely by increasing demand for halogen-free flame retardant solutions. With stricter fire safety regulations across the construction, automotive, and electronics sectors, manufacturers are turning to eco-friendly alternatives like ultra-fine ATH that do not release toxic gases when exposed to fire. This shift in material preference is significantly contributing to market expansion.

Growth factors include rising awareness around environmental safety, along with regulatory mandates encouraging non-halogenated flame retardants. Additionally, the improved compatibility of ultra-fine ATH with various polymer systems enhances product performance, prompting increased industrial adoption. The trend toward lightweight and sustainable materials in automotive and consumer electronics is further accelerating usage.

Demand is growing due to the need for superior flame resistance in compact and high-density electronic components. As these devices require thinner coatings and fillers without compromising fire performance, ultra-fine ATH’s small particle size makes it a preferred solution, especially in developing economies focusing on electrical safety standards.

Key Takeaways

- Global Ultra-fine ATH Market is expected to be worth around USD 1,167.7 million by 2034, up from USD 781.3 million in 2024, and grow at a CAGR of 4.1% from 2025 to 2034.

- Ultra-fine ATH up to 1μm holds a 35.4% share, offering superior dispersion in polymer formulations.

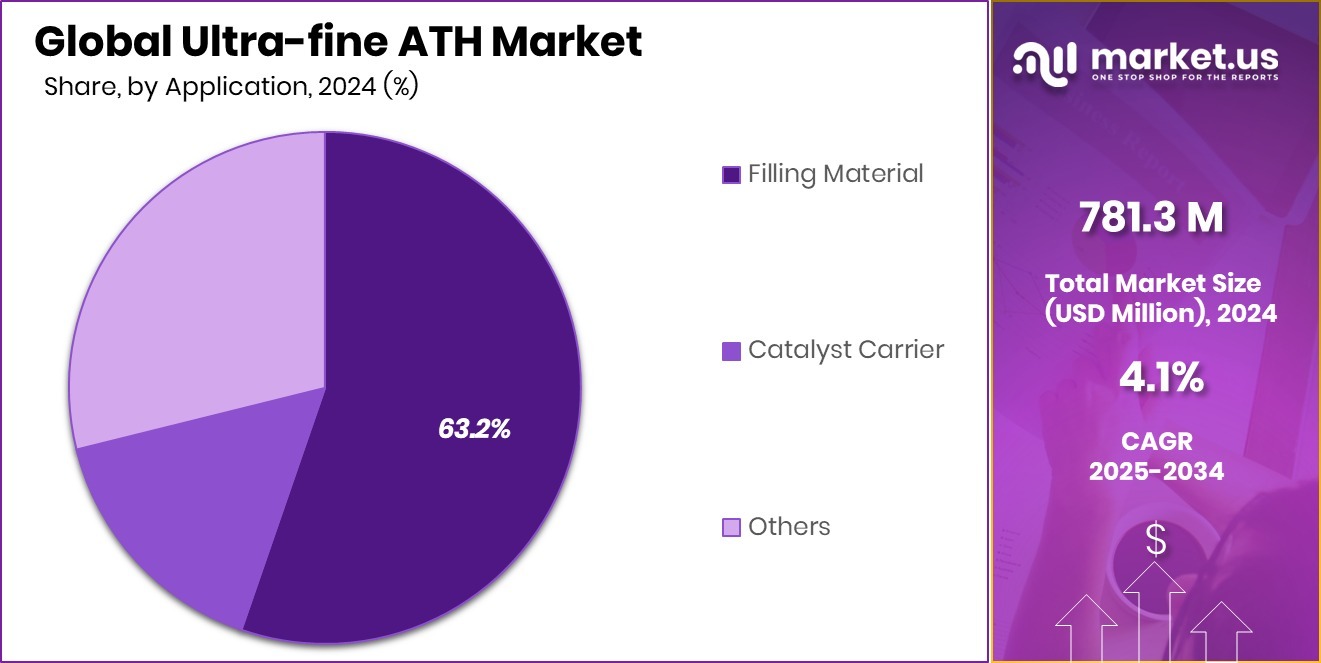

- Filling material dominates with a 63.2% market share, enhancing fire resistance and structural integrity in compounds.

- The construction sector leads with a 32.1% share, driven by strict fire safety norms and sustainable building materials.

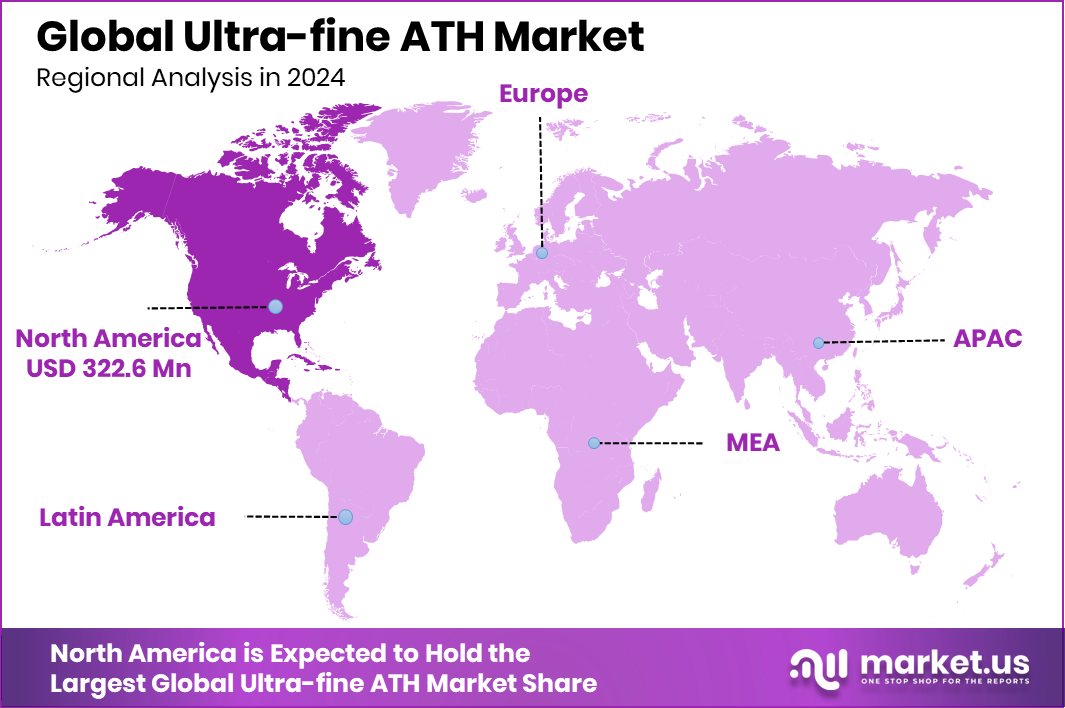

- The market value in North America reached approximately USD 322.6 million in 2024.

By Type Analysis

Ultra-fine ATH up to 1μm dominates with a 35.4% market share.

In 2024, Upto 1µm held a dominant market position in the By Type segment of the Ultra-fine ATH Market, with a 35.4% share. This dominance can be attributed to the rising demand for high-performance flame retardant materials in industries such as electronics, construction, and automotive, where fine particle dispersion and superior surface finish are critical. The sub-micron particle size of this segment allows for enhanced compatibility with polymer matrices, resulting in improved mechanical properties and better processing characteristics.

Moreover, the Upto 1µm grade is increasingly preferred in applications that demand minimal impact on the mechanical strength and transparency of end products, such as cable insulation, thin films, and engineered plastics. Its efficiency in maintaining fire safety standards without compromising physical properties gives it a competitive edge over coarser grades. The segment has also benefited from stricter global regulations promoting non-toxic, halogen-free flame retardants, which further support its adoption.

This market share reflects both the technical advantages and growing environmental considerations influencing material selection across several high-growth sectors. As regulatory pressure mounts and industries continue to prioritize sustainability and safety, the Upto 1µm segment is expected to maintain its leadership due to its proven performance and functional benefits in advanced manufacturing environments.

By Application Analysis

Filling material application holds 63.2% of the Ultra-fine ATH market.

In 2024, Filling Material held a dominant market position in the By Application segment of the Ultra-fine ATH Market, with a 63.2% share. This substantial market share highlights the critical role of ultra-fine ATH as a multifunctional additive used extensively as a filler in various industrial applications. Its fine particle size allows it to blend smoothly into composite materials, enhancing its thermal stability, mechanical strength, and flame-retardant properties without affecting surface finish or workability.

The dominance of the Filling Material segment is closely linked to its widespread use in producing non-halogenated flame retardant formulations across industries such as construction materials, electrical insulation, and polymer-based products. Its ability to act as both a flame retardant and smoke suppressant, while simultaneously improving product integrity and durability, has driven strong demand for this application.

Additionally, ultra-fine ATH as a filler offers cost-effectiveness and ease of processing, which makes it an attractive option for manufacturers aiming to meet regulatory standards without compromising on performance.

This high share also reflects the growing focus on safety and environmental sustainability, as industries increasingly opt for fillers that support halogen-free and low-emission formulations. The Filling Material segment’s leading position is expected to remain stable, driven by continuous demand for reliable and efficient fire-resistant materials.

By End-use Analysis

The construction sector leads with 32.1% of ultra-fine ATH demand.

In 2024, Construction held a dominant market position in the By End-use segment of the Ultra-fine ATH Market, with a 32.1% share. This leading position reflects the growing emphasis on fire safety standards and the increasing use of flame-retardant materials in building components such as panels, insulation, coatings, sealants, and cable sheathing. Ultra-fine ATH’s ability to provide both flame retardancy and smoke suppression without releasing toxic halogenated gases has made it an essential additive in modern construction practices.

The construction industry’s preference for ultra-fine ATH is largely driven by regulatory compliance requirements, particularly in commercial and residential infrastructure projects that demand low-smoke and non-toxic fire safety solutions. The fine particle size enhances material dispersion in construction compounds, ensuring better performance and surface quality in applications like decorative coatings and composite boards.

Moreover, with global construction activities rising—especially in urban development and public infrastructure—there has been a consistent demand for cost-effective, environmentally friendly additives that meet evolving safety norms. The 32.1% share achieved by the Construction segment in 2024 highlights the material’s crucial role in addressing these sectoral needs.

Key Market Segments

By Type

- Upto 1um

- 1-1.5um

- 1.5-2.5um

- Above 2.5 um

By Application

- Filling Material

- Catalyst Carrier

- Others

By End-use

- Construction

- Electrical and Electronics

- Automotive

- Plastics and Polymers

- Pharmaceuticals

- Others

Driving Factors

Growing Demand for Halogen-Free Flame Retardants Globally

One of the top driving factors for the growth of the Ultra-fine ATH market is the increasing global demand for halogen-free flame retardants. Governments and regulatory bodies across the world are introducing stricter fire safety and environmental regulations, especially in sectors like construction, electricals, automotive, and electronics. Traditional halogen-based flame retardants are being phased out due to the harmful gases they release during combustion.

In contrast, ultra-fine aluminum trihydrate provides a safer, non-toxic alternative that suppresses flames and reduces smoke without releasing toxic fumes. Its fine particle size allows better mixing with materials, making it more efficient and compatible with various applications. This rising demand for safer, greener fire-resistant materials is steadily boosting the market for ultra-fine ATH.

Restraining Factors

High Processing Costs Limit Broader Market Adoption

A key restraining factor in the growth of the Ultra-fine ATH market is the high processing and production cost associated with achieving extremely fine particle sizes. Producing ultra-fine aluminum trihydrate requires advanced grinding and purification technologies, which add to the overall manufacturing cost. These higher costs make ultra-fine ATH more expensive than standard grades or alternative flame retardants, limiting its use in price-sensitive markets and applications.

Additionally, industries with tight budget constraints—especially in developing regions—may hesitate to adopt ultra-fine ATH, despite its superior performance. This cost barrier can slow down market penetration and restrict adoption, especially where end-users prioritize affordability over enhanced flame retardant properties. As a result, pricing remains a major concern for wider acceptance.

Growth Opportunity

Rising Use of Green Construction Materials Worldwide

A major growth opportunity for the Ultra-fine ATH market lies in its increasing use of green and sustainable construction materials. As global focus shifts toward eco-friendly buildings, demand is rising for fire-retardant fillers that are both non-toxic and compliant with green building standards. Ultra-fine ATH fits well into this trend due to its halogen-free nature, low smoke emission, and environmental safety.

It is being used in wall panels, coatings, sealants, and insulation materials that meet new energy codes and fire safety norms. Governments promoting energy-efficient and safe infrastructure are also encouraging the adoption of such materials. This shift opens significant opportunities for ultra-fine ATH to expand its role in modern, sustainable construction applications around the world.

Latest Trends

Shift Toward Electrically Conductive Ultra‑fine ATH Composites

A notable recent trend in the Ultra‑fine ATH market is the development of electrically conductive composite materials. Traditionally, ATH has been used for flame resistance and smoke suppression, but recent innovations involve modifying ultra‑fine ATH powder to enhance electrical conductivity when mixed into polymer matrices. This advancement is particularly useful in applications such as antistatic coatings, electromagnetic interference (EMI) shielding, and electronic housing materials.

Manufacturers are blending small amounts of conductive additives with ultra‑fine ATH to create multifunctional fillers that not only improve fire safety but also provide electrical functionality. This dual performance opens doors to advanced applications in electronics and communication devices, where space-saving, integrated material solutions are in demand.

Regional Analysis

In 2024, North America led the Ultra-fine ATH market with a 41.30% share.

In 2024, North America held the dominant position in the global Ultra-fine ATH Market, accounting for 41.30% of the total market share, with a recorded market value of USD 322.6 million. This leadership is attributed to the region’s strong emphasis on fire safety regulations, growing use of halogen-free flame retardants, and rising construction and infrastructure investments.

The adoption of advanced building materials in commercial and residential projects further supports the demand for ultra-fine aluminum trihydrate as a key additive in coatings, sealants, and insulation products.

Europe followed with a steady market performance, driven by stringent environmental policies and its focus on sustainable construction practices. In Asia Pacific, the market reflected growing interest due to rapid urbanization and the expansion of manufacturing hubs in countries like China and India. However, no percentage or monetary value was provided for this region.

The Middle East & Africa and Latin America showed emerging potential, particularly in infrastructure and industrial applications, although their contribution remains comparatively modest. Overall, North America remained the leading region in 2024, both in terms of market share and revenue generation, supported by a combination of regulatory drivers and material innovation within fire-safe building and industrial applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Ultra-fine ATH market featured several leading players—Almatis, Huber, KC Corporation, and R.J. Marshall—each contributing distinct strengths and demonstrating a competitive distribution of technical capability, geographic reach, and product quality.

Almatis has maintained a reputation for delivering highly consistent ultra-fine aluminum trihydrate with fine particle distributions. Its investments in process innovation and quality control have supported reliable supply to key industrial sectors, including electronics and construction. Almatis is positioned favorably for ongoing regulatory compliance trends and remains an industry stalwart.

Huber continues to leverage its strong R&D infrastructure in specialty mineral solutions to refine surface treatments and improve ATH performance in composite applications. Its product integration focus within polymers and coatings indicates a strategic orientation toward end-use differentiation. Huber’s infrastructure gives it an advantage in customized solutions across regional markets.

KC Corporation has emphasized production flexibility and global distribution, enabling it to meet varied regional specifications. Its presence in key manufacturing bases allows for responsive customer service and inventory agility. KC’s flexible manufacturing posture has supported timely product scaling, particularly in emerging markets.

R.J. Marshall has focused on precision grinding technologies, targeting ultra-fine particle size distributions under 1 µm. This technical specialization enables the company to serve high-performance applications requiring minimal filler impact and robust flame retardancy. Its technological focus aligns with demand from advanced electronics and cable insulation sectors.

Top Key Players in the Market

- Almatis

- Huber

- KC Corporation

- R.J. Marshall

- Sumitomo

- CHALCO Shandong Co.,Ltd

- Hindalco Industries Ltd.

- Ataman Chemicals

- Zibo Pengfeng New Material Technology Co., Ltd.

- KINGWAY

Recent Developments

- In May 2025, J.M. Huber Corporation (HAM business unit) completed the acquisition of R.J. Marshall’s Alumina Trihydrate, antimony-free flame-retardant, and molybdate-based smoke suppressant product lines. This transfer of ultra-fine ATH assets—well-known for consistent quality and performance—into Huber’s portfolio strengthens Huber’s position in North America and ensures continued support for existing customers.

- In September 2023, Sumitomo Chemical began mass production of its new NXA Series ultra‑fine α‑alumina at its Ehime Works in Niihama, Japan. The powders feature uniform sub‑150 nm particles with high purity (~99.99%), and are used for advanced industrial applications including lithium‑ion battery separators, LED substrates, and semiconductor thermal materials.

Report Scope

Report Features Description Market Value (2024) USD 781.3 Million Forecast Revenue (2034) USD 1,167.7 Million CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Upto 1um, 1-1.5um, 1.5-2.5um, Above 2.5 um), By Application (Filling Material, Catalyst Carrier, Others), By End-use (Construction, Electrical and Electronics, Automotive, Plastics and Polymers, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Almatis, Huber, KC Corporation, R.J. Marshall, Sumitomo, CHALCO Shandong Co.,Ltd, Hindalco Industries Ltd., Ataman Chemicals, Zibo Pengfeng New Material Technology Co., Ltd., KINGWAY Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Almatis

- Huber

- KC Corporation

- R.J. Marshall

- Sumitomo

- CHALCO Shandong Co.,Ltd

- Hindalco Industries Ltd.

- Ataman Chemicals

- Zibo Pengfeng New Material Technology Co., Ltd.

- KINGWAY