Global Border Security System Market Size, Share, Statistics Analysis Report By System Type (Camera Systems, Radar Systems, Laser Systems, Biometric Systems, Perimeter Intrusion Detection Systems, Command and Control (C2) Systems, Other System Types), By Environment (Ground, Aerial, Naval), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134127

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

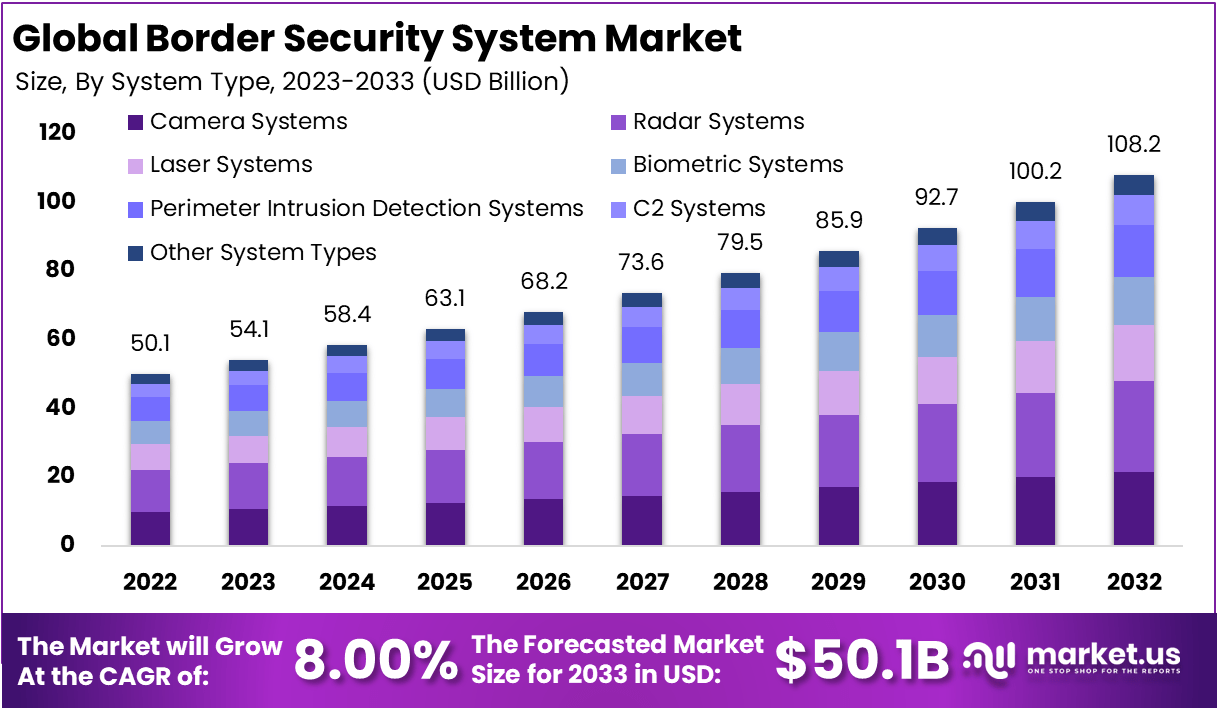

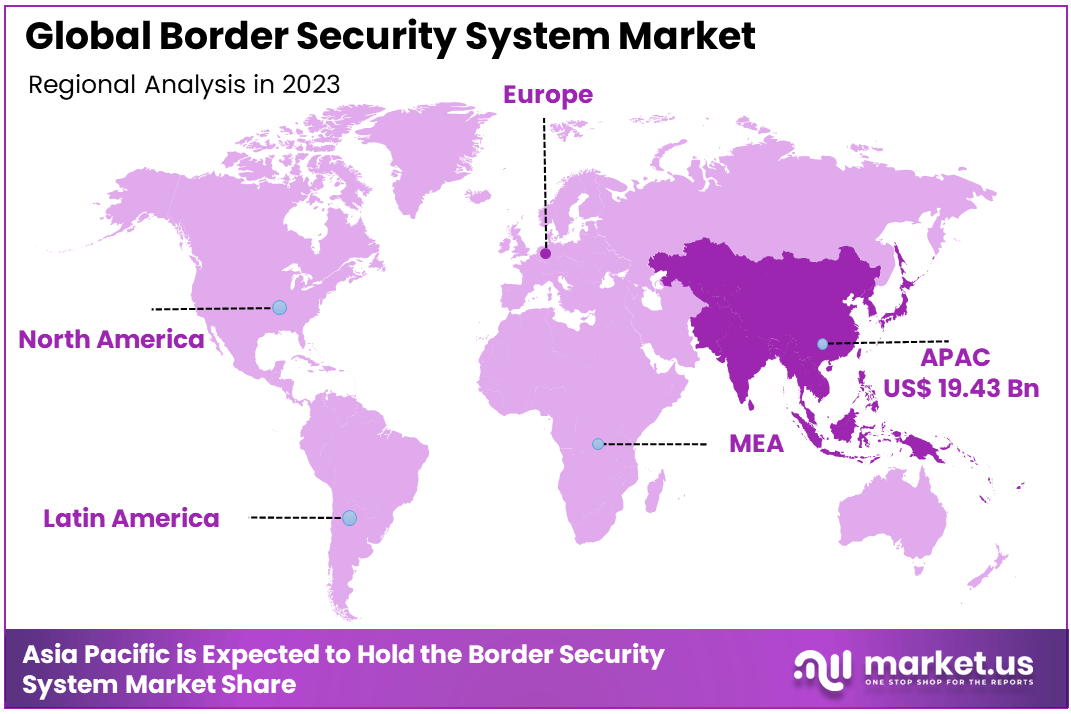

The Global Border Security System Market is expected to be worth around USD 108.2 Billion By 2033, up from USD 50.1 billion in 2023, growing at a CAGR of 8.00% during the forecast period from 2024 to 2033. In 2023, Asia-Pacific held a dominant market position, capturing more than a 38.8% share, holding USD 19.43 Billion in revenue.

A Border Security System refers to the comprehensive set of technologies and infrastructure deployed by governments and organizations to secure national borders from illegal crossings, smuggling, human trafficking, and other criminal activities. These systems encompass a range of physical and digital solutions, including surveillance cameras, drones, sensors, biometric verification systems, and automated border control solutions.

Their primary function is to enhance border surveillance, streamline security procedures, and monitor the movement of people, goods, and vehicles across borders. The integration of cybersecurity measures to protect the integrity of data in these systems is also essential, especially as more countries embrace digital technologies for border management. These systems are designed not only to protect borders but also to ensure the smooth flow of legitimate trade and travel.

The Border Security System Market refers to the global industry focused on the development, deployment, and maintenance of border security technologies and solutions. This market has been rapidly growing due to increased security threats such as terrorism, illegal immigration, drug trafficking, and the need for enhanced control over cross-border movements.

With the growing emphasis on national security, many governments are investing in state-of-the-art security solutions, including advanced surveillance technologies, biometric systems, and automated border management tools.

Additionally, as security concerns rise globally, the market is expected to see a boost in demand for advanced solutions that offer higher efficiency, scalability, and integration with other security systems. The growing complexity of international borders and the rise in cross-border trade further fuel the need for robust security systems.

The Border Security System Market is driven by several factors, including increasing geopolitical tensions, rising cross-border criminal activities, and the growing need for enhanced immigration control. Governments are investing heavily in advanced border security systems to combat terrorism, human trafficking, and illegal immigration, leading to a surge in demand for border security technologies.

Additionally, the threat of cyberattacks on border management systems has led to a push for better cybersecurity infrastructure at borders. Moreover, international trade and global travel are at an all-time high, making it more important than ever to maintain secure and efficient border control procedures. The rising use of biometric technologies and the need to combat fraud are also key contributors to the market’s growth.

The Border Security System Market is experiencing significant demand across the globe, particularly in regions that face higher security threats or have extensive borders. Countries in North America, Europe, and Asia-Pacific are seeing heightened investment in border security systems due to the increasing risks associated with terrorism and organized crime.

The demand for automated systems, such as biometric-based identification and facial recognition technology, is growing as these solutions offer enhanced speed, accuracy, and reduced human intervention at border checkpoints. Additionally, in developing countries, where security infrastructure is still evolving, the need for border security systems is expanding as these nations look to modernize their security frameworks. The rise in immigration and refugee movements also contributes to the increased demand for efficient and secure border management systems.

There are significant opportunities within the Border Security System Market driven by technological advancements, public-private partnerships, and the expanding need for integrated security solutions. Governments are increasingly seeking advanced, end-to-end security solutions that integrate surveillance, border control, and cybersecurity capabilities into one cohesive system. The integration of artificial intelligence (AI), machine learning (ML), and biometric technologies is creating opportunities for smarter and more responsive border security solutions.

Additionally, the growing need for cybersecurity in the face of digital threats to border management systems presents a major opportunity for tech companies to innovate and offer specialized security services. Emerging markets, particularly in Africa and the Middle East, present growth opportunities as these regions invest in modernizing their border security infrastructure.

In the Border Security System Market, technological advancements are transforming the way borders are secured. The adoption of AI and machine learning is enabling systems to analyze vast amounts of data from surveillance cameras, drones, and other monitoring equipment in real time, improving the detection of suspicious activities. The development of advanced biometric systems, including fingerprint recognition, iris scanning, and facial recognition, is helping to streamline border control processes and enhance security.

Additionally, automated border control systems are being deployed to speed up entry and exit procedures while minimizing human error. Drones and unmanned aerial vehicles (UAVs) are being increasingly used for surveillance and monitoring of hard-to-reach areas along borders, while satellite technologies provide crucial intelligence in remote locations. These technological innovations are significantly improving the effectiveness and efficiency of border security systems, while also reducing costs and improving user experience.

In terms of specific technologies, the surveillance systems segment is the largest, accounting for approximately 40% of the total market share in 2023. This segment includes advanced technologies such as unmanned aerial vehicles (UAVs), which are increasingly utilized for border monitoring. For instance, it is estimated that over 2,000 UAVs are currently in operation for border security purposes worldwide.

Biometric systems are also gaining traction, with an estimated 1.5 billion biometric identification transactions conducted globally in 2022 alone. These systems enhance security measures by providing accurate identification and verification of individuals crossing borders. Additionally, access control technologies, including automated border control gates, are becoming more prevalent; as of 2023, there were approximately 1,200 automated border control gates installed across various international airports.

Furthermore, investments in training and personnel are critical to effective border security operations. In many countries, border security agencies employ over 100,000 personnel dedicated to maintaining safety and managing immigration processes. Overall, the border security system market is driven by technological advancements and the increasing need for effective measures to address cross-border challenges.

Key Takeaways

- Market Growth: The global Border Security System market is projected to grow from USD 50.1 billion in 2023 to USD 108.2 billion by 2033, reflecting a steady CAGR of 8.00%.

- Dominant System Type: Radar systems hold a significant share of 24.5% in 2023, driven by their ability to provide real-time detection and monitoring over large areas, crucial for border security operations.

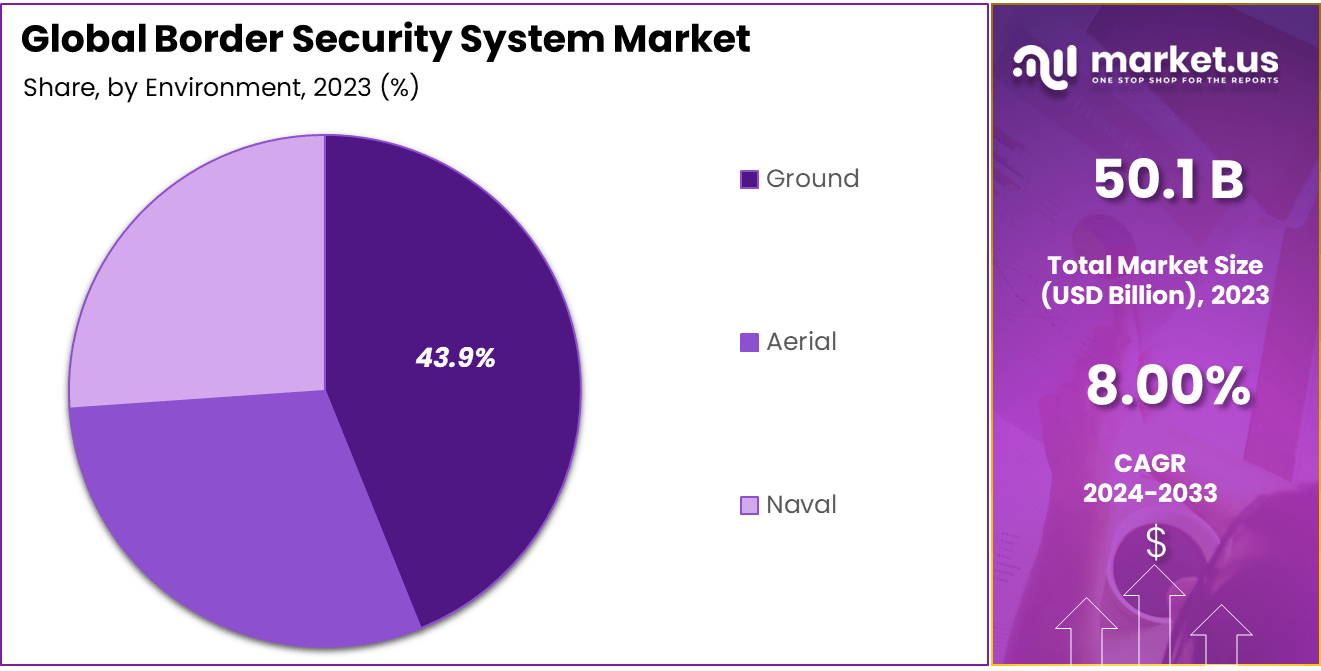

- Environmental Focus: The ground environment segment leads the market with a share of 43.9% in 2023, highlighting the extensive use of ground-based surveillance systems such as sensors, fences, and patrol vehicles for border protection.

- Regional Leadership: The Asia-Pacific region holds a dominant position with 38.8% of the market share in 2023, driven by increasing border security concerns in countries like China, India, and Southeast Asia.

- Technological Advancements: The adoption of advanced surveillance and radar technologies, along with the integration of AI and machine learning, is expected to continue driving growth in border security systems.

- Revenue Drivers: Heightened security threats, geopolitical tensions, and the need for enhanced surveillance at international borders are key factors propelling the growth of this market.

By System Type

In 2023, the Radar Systems segment held a dominant market position, capturing more than a 24.5% share in the Border Security System Market. This dominance can be attributed to the increasing reliance on radar technology for continuous surveillance and monitoring of vast border areas. Radar systems are highly effective in detecting and tracking moving objects, even under challenging environmental conditions such as fog, rain, and low visibility, which makes them a preferred choice for border security agencies.

The effectiveness of radar systems in long-range detection is another key factor driving their leadership. Unlike other security systems that may require closer proximity or visual contact, radar systems can cover larger distances and detect unauthorized movements at early stages.

This capability is particularly critical for border regions where security threats may originate from remote or hard-to-reach areas. Moreover, radar technology can be integrated with other security systems, such as cameras and drones, to provide a comprehensive border security solution.

Furthermore, the adoption of advanced radar systems, such as Synthetic Aperture Radar (SAR) and phased-array radar, has contributed to the segment’s growth. These technologies offer higher precision and better resolution, enabling real-time monitoring and rapid response to potential security breaches. With ongoing advancements in radar systems, the technology is becoming more cost-effective and capable, reinforcing its market dominance.

By Environment

In 2023, the Ground segment held a dominant market position, capturing more than a 43.9% share of the Border Security System Market. The primary driver of this dominance is the critical role that ground-based security systems play in providing continuous surveillance and protection along land borders. Ground systems, including perimeter intrusion detection systems, ground-based radar, and motion sensors, are essential for monitoring large stretches of land, which are often vulnerable to unauthorized crossings.

The extensive use of ground-based security systems is also influenced by the cost-effectiveness and flexibility of these solutions. Ground systems can be deployed in a variety of terrains, from mountainous regions to flat plains, making them highly adaptable to different geographical challenges. These systems are designed to detect and respond to physical threats, such as individuals crossing the border, and can be integrated with other technologies, such as drones and surveillance cameras, to offer real-time monitoring and response.

Moreover, the development of advanced technologies like ground-based radar systems, sensors, and automated monitoring solutions has enhanced the effectiveness of ground security. These systems are capable of detecting not only human intrusions but also vehicle movements, making them vital for securing high-risk border areas prone to smuggling or trafficking activities. Additionally, the integration of artificial intelligence and machine learning into ground systems allows for more accurate threat detection and faster response times.

Key Market Segments

By System Type

- Camera Systems

- Radar Systems

- Laser Systems

- Biometric Systems

- Perimeter Intrusion Detection Systems

- Command and Control (C2) Systems

- Other System Types

By Environment

- Ground

- Aerial

- Naval

Driving Factors

Increasing Threats of Cross-Border Crime and Terrorism

One of the key drivers of growth in the Border Security System market is the rising threats of cross-border crime, terrorism, and illegal immigration. In recent years, countries around the world have been facing an increasing number of security challenges at their borders, which has prompted greater investments in border security infrastructure. The global surge in terrorism-related activities, drug trafficking, human smuggling, and other illicit activities has made it crucial for nations to enhance border security measures.

For instance, the rise of transnational criminal organizations that exploit border regions for illegal activities has highlighted vulnerabilities in traditional border controls. To address these concerns, countries are investing in advanced border security systems, such as radar systems, biometric identification, and surveillance drones, to strengthen surveillance and detection capabilities. As border threats evolve, there is a growing demand for high-tech, multi-layered security systems that can monitor, detect, and respond to these threats in real-time.

The use of radar systems, integrated camera networks, and biometric systems has become more common to enhance the detection of unauthorized border crossings. These technologies can track movement across large and remote areas, even in harsh weather conditions, thus improving the overall efficiency of border security. Additionally, governments are increasingly adopting automated systems that use artificial intelligence to analyze data and predict potential threats based on patterns and behaviors, making border security more proactive.

Restraining Factors

High Cost of Implementation and Maintenance

Despite the growing demand for advanced border security systems, one of the key restraints holding back market growth is the high cost of implementation and maintenance. Developing and deploying cutting-edge border security systems, which may include a combination of radar, camera networks, biometric systems, and other advanced technologies, requires significant financial investment. The cost of purchasing and installing these systems, along with their ongoing maintenance and upgrades, can be prohibitive for some governments, particularly in developing countries with limited defense budgets.

The complexity of these systems also adds to their cost. Many of these technologies require skilled personnel for installation, configuration, and maintenance, which further drives up expenses. Moreover, the systems must be regularly updated to ensure they can effectively counter evolving security threats. For example, radar systems and surveillance cameras must be kept in good working order, and software solutions for biometric verification and data analytics must be updated to stay ahead of potential cybersecurity threats.

Additionally, for many countries, particularly those with large, remote borders, the infrastructure needed to support these systems, such as power supplies and network connectivity, can be costly and logistically challenging. In regions with unstable or underdeveloped infrastructure, setting up effective border security can be a significant hurdle. While countries with strong economies and robust security budgets can invest in these technologies, others may struggle to allocate the necessary resources.

Growth Opportunities

Advancements in AI and Machine Learning for Border Security

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into border security systems presents a significant opportunity for market growth. AI and ML technologies can help enhance the intelligence and automation capabilities of border security solutions, allowing for faster, more accurate decision-making. By analyzing large volumes of data from various sources—such as radar, surveillance cameras, and sensors—AI systems can identify potential threats or irregular activities in real-time.

One of the most promising applications of AI and ML in border security is in the detection and prediction of illegal border crossings. For instance, AI algorithms can analyze patterns of movement and behavior to identify suspicious activity, reducing the reliance on manual monitoring. Machine learning models can also improve the accuracy of biometric identification systems, helping to verify identities more efficiently and with fewer errors. Furthermore, AI-powered systems can automate the process of alerting security personnel about potential breaches, ensuring faster responses.

Additionally, AI technologies can enhance the ability to monitor and secure remote or hard-to-reach areas of borders, reducing the need for extensive human presence. Drones, integrated with AI, can be deployed to patrol large sections of borders, providing real-time footage and even using AI algorithms to identify potential threats such as unauthorized vehicles or people crossing the border.

Challenging Factors

Evolving Nature of Security Threats

A major challenge facing the border security system market is the rapidly evolving nature of security threats. As border security technologies become more advanced, so too do the methods used by criminals, terrorists, and other malicious actors. The rise of new technologies such as drones, encrypted communication networks, and cyber-attacks poses new challenges for border security. Criminals are increasingly using sophisticated tools and techniques to bypass traditional security measures, making it difficult for security systems to keep up with emerging threats.

For example, the use of drones to transport illicit goods across borders has become a growing concern, as these unmanned aerial vehicles can bypass ground-based security systems and avoid detection by traditional radar. Additionally, cyber-attacks targeting border security systems can disable or manipulate surveillance networks, rendering them ineffective. As technology advances, criminals are becoming more creative in their methods of circumventing border controls, forcing governments to constantly update their systems to stay one step ahead.

Moreover, the increasing sophistication of border security technologies creates a dual challenge: on one hand, governments must invest in the latest technologies to maintain a competitive edge, and on the other hand, they must ensure that their systems are adaptable enough to counter the changing tactics of adversaries. This dynamic nature of security threats means that border security systems must be highly flexible and capable of evolving rapidly, requiring constant upgrades, patches, and innovation.

Growth Factors

The Border Security System market is experiencing significant growth driven by several factors. Increasing threats from terrorism, human trafficking, and drug smuggling are among the primary contributors to the rising demand for advanced border security solutions.

Governments worldwide are investing heavily in cutting-edge technologies such as biometric systems, radar surveillance, and drones to safeguard their borders. The need for more efficient, automated systems is pushing the demand for integrated, multi-layered security solutions that can operate in challenging environments, from remote border areas to densely populated urban zones.

Additionally, the geopolitical instability in various regions, particularly in areas with high-security risks, has further fueled investments in border protection. Nations are focusing on strengthening their borders not only to prevent illegal immigration but also to protect national sovereignty and infrastructure. The increasing use of artificial intelligence (AI) and machine learning (ML) in border security systems is helping authorities to analyze large datasets more effectively, improving threat detection and response times.

Emerging Trends

One of the key emerging trends is the integration of AI and machine learning (ML) in border security systems. These technologies enable real-time threat detection and predictive analytics, making border security more proactive and efficient.

The growing use of autonomous drones for surveillance is also gaining momentum, providing flexibility and reducing the need for human personnel in hazardous areas. Furthermore, the adoption of biometric technologies, including facial recognition and fingerprint scanning, is improving the accuracy of identification processes and ensuring secure access control at borders.

Another trend is the increased focus on cybersecurity, as border security systems become more connected to digital networks. Cyber threats targeting border surveillance and control systems are a significant concern, leading to innovations in cybersecurity solutions to protect these critical infrastructures.

Business Benefits

For businesses involved in the border security sector, there are several notable benefits. The increasing demand for advanced security technologies provides a lucrative opportunity for vendors to develop innovative solutions, driving revenue growth. Additionally, governments’ investments in modernizing border security systems offer long-term, recurring revenue streams for companies specializing in border protection technologies.

For governments, these advanced systems provide improved security, operational efficiency, and better control over illegal activities at borders. With the integration of AI and machine learning, border authorities can make quicker, data-driven decisions, enhancing their response time to potential threats. Furthermore, the use of automated systems reduces the dependence on human personnel, which lowers operational costs and increases the overall effectiveness of border protection measures.

Regional Analysis

In 2023, Asia-Pacific held a dominant market position in the Border Security System market, capturing more than a 38.8% share, equivalent to USD 19.43 billion in revenue. The region’s dominance can be attributed to the growing geopolitical tensions, rapid technological advancements, and increasing government investments in securing borders.

Countries such as China, India, and several Southeast Asian nations are significantly enhancing their border security systems to address rising security threats, including terrorism, illegal immigration, and cross-border criminal activities. The large geographical expanse and diverse terrain in the region further emphasize the need for advanced border security solutions, driving demand for radar systems, biometric identification, and surveillance technologies.

In addition to these security concerns, the Asia-Pacific region benefits from rapid technological development. The widespread adoption of AI, drones, and IoT-based border security solutions has been instrumental in improving efficiency and reducing response times.

Furthermore, several countries in the region are focusing on the integration of smart security systems that provide real-time data and automation, allowing authorities to quickly identify potential threats and enhance border protection. This shift toward more modern and high-tech solutions is contributing significantly to the market’s growth in the region.

The increasing government expenditure on infrastructure and security, particularly in India and China, is another major factor propelling the region’s market share. The growing need to manage the vast and often remote border areas in these countries is also a key driver. With increasing investments in defense and border security technologies, the region is poised to continue its leadership in the global Border Security System market.

Moreover, the rise of cross-border trade, regional conflicts, and the increasing number of illegal activities are encouraging countries in the Asia-Pacific region to enhance their border security measures, further cementing the region’s dominance in the market. With ongoing advancements in surveillance technologies and strategic collaborations, Asia-Pacific is expected to maintain a strong growth trajectory in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Thales Group has been a key player in the Border Security System market, with a focus on enhancing its technological capabilities through strategic acquisitions and innovations. In 2023, the company made significant strides by expanding its offerings in biometric systems and radar surveillance solutions, which are crucial for border security.

Thales has a strong presence in providing high-end integrated security systems, including command and control (C2) systems, which are widely adopted by government agencies globally. The company has been focused on leveraging advanced artificial intelligence (AI) and data analytics to improve border protection. In terms of acquisitions, Thales strengthened its position in the market by acquiring companies that specialize in cybersecurity and advanced radar technologies.

RTX Corporation (formerly Raytheon Technologies) has continued to solidify its leadership in the border security space by introducing cutting-edge technologies and expanding its global reach. The company has been particularly active in the radar and sensor systems segment, providing critical infrastructure for border protection.

RTX’s radar systems, known for their accuracy and reliability, have been a key factor driving their growth in the market. Additionally, RTX made a strategic acquisition of a leading cybersecurity company, strengthening its ability to provide integrated security solutions that combine both physical and cyber defense for borders.

Northrop Grumman Corporation continues to be a formidable player in the border security market, with a focus on advanced surveillance and detection systems. The company’s growth strategy involves continuous product innovation and strategic partnerships with government agencies worldwide.

In 2023, Northrop Grumman launched a new line of perimeter intrusion detection systems, integrating AI and machine learning to enhance real-time threat detection. These systems are gaining traction in critical border areas, where rapid detection and response are vital. The company has also been heavily involved in providing air and ground-based solutions for comprehensive border security.

Top Key Players in the Market

- Thales Group

- RTX Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Elbit Systems Ltd.

- Teledyne FLIR LLC

- Leonardo S.p.A.

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Smiths Detection

- Israel Aerospace Industries Ltd.

- Other Key Players

Recent Developments

- In October 2023, Thales Group unveiled its next-generation biometric border security system, integrating facial recognition and fingerprint scanning technologies.

- In September 2023, Northrop Grumman Corporation announced the successful deployment of its advanced perimeter intrusion detection system at several high-security border points.

Report Scope

Report Features Description Market Value (2023) USD 50.1 Bn Forecast Revenue (2033) USD 108.2 Bn CAGR (2024-2033) 8.00% Largest Market Asia Pacific Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By System Type (Camera Systems, Radar Systems, Laser Systems, Biometric Systems, Perimeter Intrusion Detection Systems, Command and Control (C2) Systems, Other System Types), By Environment (Ground, Aerial, Naval) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Thales Group, RTX Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, Elbit Systems Ltd., Teledyne FLIR LLC, Leonardo S.p.A., Honeywell International Inc., L3Harris Technologies, Inc., Smiths Detection, Israel Aerospace Industries Ltd., Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Border Security System MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Border Security System MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thales Group

- RTX Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Elbit Systems Ltd.

- Teledyne FLIR LLC

- Leonardo S.p.A.

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Smiths Detection

- Israel Aerospace Industries Ltd.

- Other Key Players