Global Light Weapons Market Size, Share, Statistics Analysis Report By Type (Heavy Machine Guns (HMGs), Grenades and Grenade Launchers, Mortars, Man-portable Anti-tank Systems (MANPATS), Man-portable Air Defense Systems (MANPADS), Others), By Technology (Guided, Unguided), By Application (Defense, Homeland Security), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 134087

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Impact of AI on Light Weapon Industry

- Type Analysis

- Technology Analysis

- Application Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

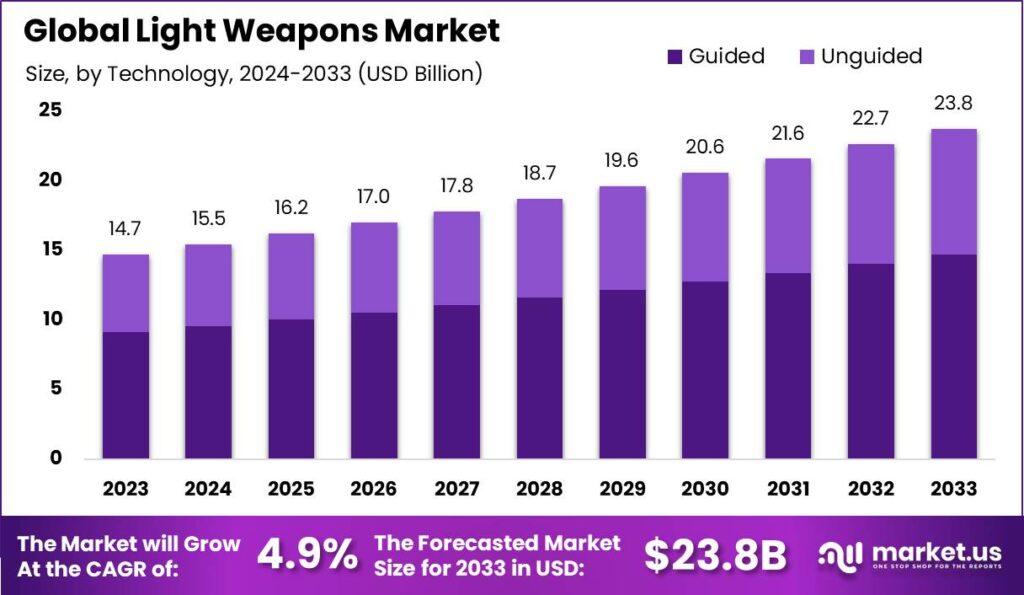

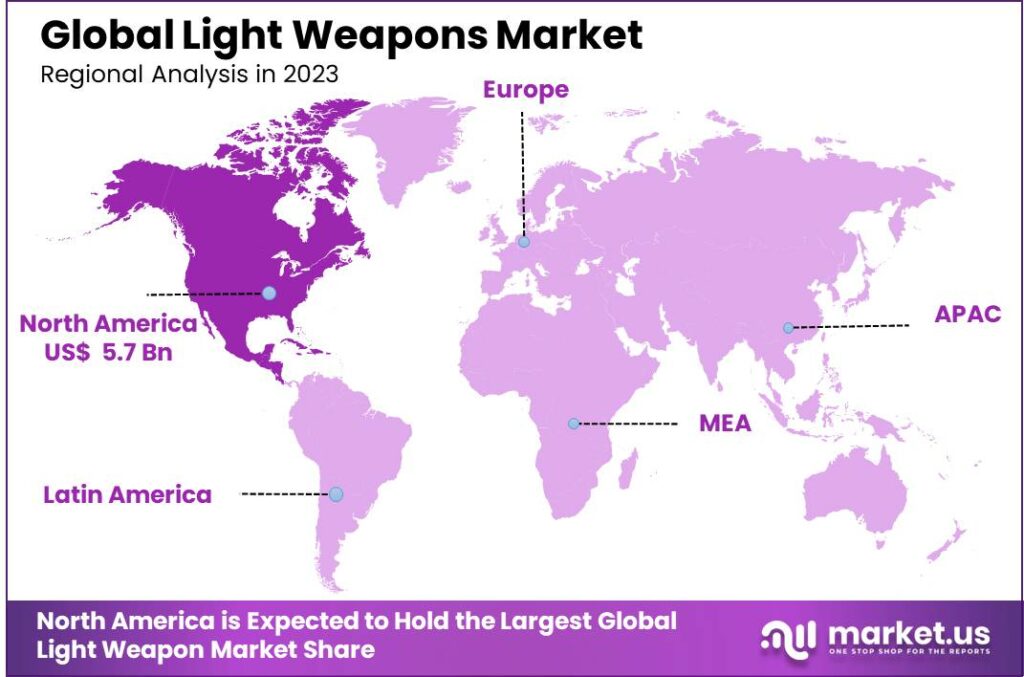

The Global Light Weapons Market size is expected to be worth around USD 23.8 Billion By 2033, from USD 14.73 Billion in 2023, growing at a CAGR of 4.90% during the forecast period from 2024 to 2033. In 2023, North America held a dominant position in the light weapons market, accounting for over 38.8% of the total market share and generating a revenue of approximately USD 5.7 billion.

The light weapons market refers to the sector dealing with small arms and handheld firearms, which are typically designed to be carried and operated by a single person. These weapons include items like rifles, pistols, submachine guns, machine guns, and grenade launchers, which are classified as “light” because they are portable, low-caliber, and generally used in close combat or by infantry forces.

The light weapons market encompasses the production, distribution, and sale of the aforementioned weapons to military entities, law enforcement agencies, and occasionally, civilian users. This market is closely regulated by international treaties and national laws due to the potential implications on security and stability. The market dynamics are influenced by the defense policies and military spending of countries, as well as by the geopolitical tensions that necessitate the upgrade and expansion of arsenals.

In recent years, the popularity of light weapons has surged, with firearms like pistols, rifles, and shotguns becoming integral not only for security purposes but also in recreational shooting and hunting activities. This growth is especially evident in countries with strong gun cultures, where firearms are seen as both a personal and societal tool.

The primary driving factor for the light weapons market is the increasing geopolitical tensions and security concerns worldwide. Governments and defense sectors are focusing on enhancing their military capabilities in response to perceived threats and ongoing conflicts, which boosts the demand for advanced weaponry. Moreover, internal security issues, such as counter-terrorism and law enforcement operations, also drive the procurement of light weapons.

Opportunities in the light weapons market are linked closely with the global rise in defense budgets. Countries expanding their defense expenditure provide significant opportunities for manufacturers of light weapons. Additionally, collaborations and treaties among countries for defense technologies further open new avenues for the light weapons market to expand, particularly in developing regions looking to enhance their military strength.

For instance, The Canadian Ministry of Defence announced the purchase of 3,626 C6A1 FLEX General Purpose Machine Guns from Colt Canada, enhancing the capabilities of the Canadian Armed Forces with modern weaponry for training and operations. This acquisition underscores the ongoing trend of military upgrades across various nations

Global expansion is a key aspect of the light weapons market’s future. While established markets in North America and Europe continue to grow, emerging economies in Asia, the Middle East, and parts of Africa are showing increasing interest in light weaponry. These regions are experiencing rapid urbanization, and in some cases, a rising tide of political instability, both of which are contributing to growing demand for firearms.

The light weapons market is significantly shaped by technological advancements. Innovations in weapon design, accuracy, and material engineering have led to more effective and reliable weapons. The integration of advanced targeting systems and the development of lighter, more durable materials are examples of advancements that enhance the effectiveness of light weapons, making them more appealing to military and defense purchasers.

Key Takeaways

- The Global Light Weapons Market size is projected to reach USD 23.8 Billion by 2033, up from USD 14.73 Billion in 2023, reflecting a CAGR of 4.90% during the forecast period from 2024 to 2033.

- In 2023, the Man-portable Anti-tank Systems (MANPATS) segment held a dominant position, capturing more than 27% of the total light weapons market share.

- The guided segment of the light weapons market was the leading segment in 2023, accounting for more than 62% of the total market share.

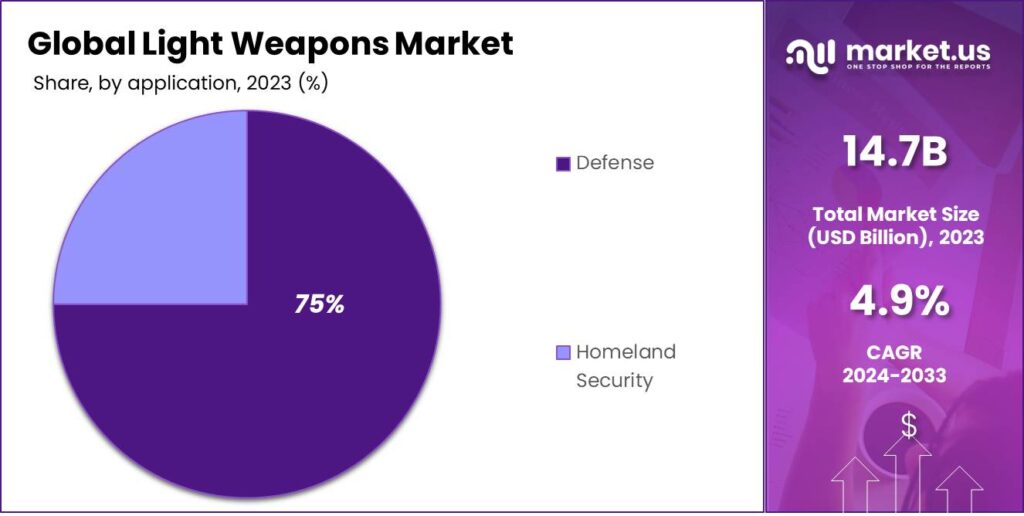

- The defense segment dominated the light weapons market in 2023, with a share of more than 75% of the total market share.

- In 2023, North America held the largest market share in the light weapons market, capturing more than 38.8%, with a revenue of approximately USD 5.7 billion.

Impact of AI on Light Weapon Industry

The integration of Artificial Intelligence (AI) into the light and automatic weapons sector is reshaping the landscape of military engagements and raising significant ethical, strategic, and geopolitical concerns. This transformative phase is influenced by the accelerated development and deployment of smart weapons systems which are increasingly autonomous, such as drones and AI-powered targeting systems.

These technologies promise precision and reduced collateral damage but also raise the specter of escalated arms races and geopolitical tensions as nations strive to outpace each other’s capabilities. The market for such technologies is expanding rapidly. In the realm of light weapons, various types like guided missiles and smart ammunitions are increasingly adopting AI to enhance effectiveness and accuracy.

These advancements are significantly visible in regions with high defense spending such as North America, which dominates the market, followed by Europe and the Asia-Pacific region, each pushing forward in the adoption of advanced military technologies. Economically, the global market for light weapons is poised to grow, driven by the increasing incorporation of high-tech guidance systems. The automatic weapons segment, especially, is expected to see substantial growth, fueled by ongoing conflicts and the escalating need for advanced defensive capabilities.

Beyond the market dynamics, there are profound implications for international peace and security. The shift towards AI-powered systems is altering the traditional paradigms of warfare, reducing the human cost of conflicts, and potentially making the initiation of conflict more palatable to states by minimizing direct human involvement in combat. This can lead to a decrease in the perceived consequences of aggression, potentially destabilizing international relations further.

Moreover, the adoption of AI in military applications is sparking a debate on the need for robust governance frameworks to ensure these technologies are developed and used responsibly. This involves international cooperation to establish norms and regulations that mitigate the risks associated with autonomous weapons systems, ensuring they do not exacerbate conflicts or lead to unintended escalations.

Type Analysis

In 2023, the Man-portable Anti-tank Systems (MANPATS) segment held a dominant market position, capturing more than 27% of the total light weapons market share.

This dominance can be attributed to the increasing demand for portable yet highly effective weapon systems capable of targeting and neutralizing armored vehicles, which is essential in modern warfare. MANPATS offer flexibility and high mobility, allowing infantry forces to disable tanks, armored personnel carriers, and other heavy military vehicles on the battlefield.

The growing use of MANPATS in various geopolitical conflicts has also contributed to their market leadership. As military forces modernize their arsenals, the demand for more effective anti-tank capabilities has risen, particularly in light of the changing nature of warfare, where lighter, portable weaponry is becoming increasingly critical.

Additionally, MANPATS have gained traction due to the advancements in technology and increased focus on countering armored threats in high-intensity combat environments. These systems have evolved with more sophisticated guidance and targeting capabilities, ensuring higher accuracy and range.

Technology Analysis

In 2023, the guided segment of the light weapons market held a dominant position, capturing more than 62% of the total market share. This segment’s growth can be attributed to the increasing demand for precision in both military and law enforcement applications.

Guided light weapons, such as smart missiles and laser-guided projectiles, provide a high degree of accuracy, which is essential in modern warfare and tactical operations. Their ability to hit specific targets with minimal collateral damage is a critical factor driving adoption among defense agencies.

The superiority of guided light weapons in terms of operational efficiency and reduced risk to civilian areas has made them a preferred choice in various conflict zones. As geopolitical tensions rise and security threats evolve, military and defense agencies are prioritizing technology that offers higher precision.

Application Analysis

In 2023, the defense segment held a dominant market position in the light weapons market, capturing more than 75% of the total market share. This dominance can largely be attributed to the ongoing global demand for advanced weaponry by military forces around the world.

Defense agencies continue to invest heavily in modernizing their arsenals to address emerging threats and challenges. Light weapons are essential for a wide range of military operations, including combat, peacekeeping, counterterrorism, and special forces missions, where precision and mobility are key.

The growing complexity of security threats, including insurgencies, terrorism, and border conflicts, has led to an increased reliance on light weapons that are not only effective but also portable and versatile. Military forces prioritize these systems for their ability to provide flexibility in both urban and rural combat environments.

Additionally, innovations in guided light weapons, which offer improved accuracy and reduced collateral damage, have further cemented the defense segment’s dominance. The ability to equip personnel with compact, highly efficient weapons ensures that military units are well-prepared for a variety of operational scenarios, making defense applications the primary driver of the light weapons market.

Key Market Segments

By Type

- Heavy Machine Guns (HMGs)

- Grenades and Grenade Launchers

- Mortars

- Man-portable Anti-tank Systems (MANPATS)

- Man-portable Air Defense Systems (MANPADS)

- Others

By Technology

- Guided

- Unguided

By Application

- Defense

- Homeland Security

Driver

Rising Global Security Concerns

The increasing global security concerns, especially amidst geopolitical tensions and internal conflicts, continue to drive the demand for light weapons. These weapons are often seen as more manageable for both military forces and non-state actors due to their portability, ease of use, and relatively low cost.

As nations, organizations, and individuals look for ways to enhance their security capabilities, light weapons provide an attractive solution. The demand for lightweight, compact firearms, rifles, and handguns has surged in regions with unstable political climates or high crime rates. In addition, modern conflicts increasingly rely on asymmetrical warfare tactics, where smaller, easily deployable weapons are often preferred.

Restraint

Stringent International Regulations

While demand for light weapons is on the rise, the market faces significant restraints due to increasingly stringent international arms control regulations. International treaties like the Arms Trade Treaty (ATT) and regional agreements aim to regulate the global flow of weapons, ensuring they do not fall into the hands of unauthorized actors.

These regulations restrict the ability to export and import light weapons freely, especially in conflict zones where oversight is minimal. Additionally, various nations are strengthening their national regulations on arms sales and manufacturing, creating barriers for global suppliers. Compliance with these rules often requires expensive certifications and extensive documentation, slowing the speed at which manufacturers can deliver products to customers.

Opportunity

Growth of Law Enforcement and Private Security

An emerging opportunity in the light weapons market comes from the growing demand for law enforcement and private security services globally. As urbanization increases and public safety concerns rise, law enforcement agencies and private security firms are investing heavily in advanced weaponry, including light weapons.

These professionals need reliable, easily accessible firearms to maintain order and protect both citizens and property. In countries where police forces are being modernized or where crime rates are escalating, light weapons offer an effective means of maintaining security. In regions like North America, Latin America, and parts of the Middle East, the rise of private security firms presents a growing market for personal protection tools, including handguns and tactical weapons.

Challenge

Illicit Arms Trade and Smuggling

The illicit arms trade remains a major challenge for the light weapons market. Despite efforts by governments and international organizations to curb the illegal flow of weapons, smugglers and black-market dealers continue to circumvent regulations and supply weapons to conflict zones and unauthorized groups.

The proliferation of light weapons in such areas increases the risks of armed conflict, civil unrest, and terrorism, posing serious threats to both national security and global peace. Moreover, the ease with which these weapons can be concealed and transported makes it difficult for authorities to control their movement. While legitimate arms sales are heavily regulated, the illicit trade flourishes, often fueled by demand in areas with weak enforcement mechanisms.

Emerging Trends

The light weapons market is witnessing rapid transformation, driven by advancements in technology, evolving geopolitical landscapes, and increasing security threats. One prominent trend is the integration of smart technologies into light weapon systems. These include features such as automated targeting, enhanced accuracy, and connectivity with other military equipment.

Another significant trend is the rise of modularity in design. Many modern light weapons are now built with interchangeable components, allowing users to customize the weapon for specific missions. This modularity provides greater flexibility, reducing the need for multiple specialized firearms.

Additionally, there is a growing focus on lightweight, compact designs that provide better maneuverability without sacrificing firepower. Weapons are being engineered with advanced materials like polymers and lightweight alloys, ensuring that they remain effective while being easier to carry and deploy.

Business Benefits

One of the most significant benefits for businesses is the increasing demand for defense and security products globally. With rising concerns over terrorism, civil unrest, and geopolitical tensions, governments around the world are prioritizing the modernization of their defense forces.

Moreover, the trend toward modular and customizable weapons systems allows manufacturers to offer products that meet a broad range of needs, from military personnel to law enforcement agencies. This versatility opens up new revenue streams and broadens the customer base.

Another key advantage is the long lifecycle of military-grade light weapons. Once sold to a government or military unit, these products can require regular servicing, upgrades, and spare parts, generating recurring revenue streams.

Regional Analysis

In 2023, North America held a dominant market position in the light weapons market, capturing more than 38.8% of the total market share, with a revenue of approximately USD 5.7 billion. This leadership can largely be attributed to the strong defense infrastructure and extensive military procurement budgets in the region.

The U.S. military’s ongoing modernization programs and its strategic need to maintain superior combat capabilities have driven demand for a wide range of light weapons, including small arms, anti-tank systems, and man-portable air defense systems (MANPADS).

The region’s dominance is also supported by robust defense contracts with major defense contractors such as Lockheed Martin, General Dynamics, and Raytheon, which provide advanced light weapon systems to the U.S. military and allied forces. The steady flow of defense spending, which surpassed USD 800 billion in 2023, has allowed North American nations to continuously upgrade and innovate their weaponry.

Another significant factor contributing to North America’s market dominance is its leading role in the global arms trade. The U.S. is a major exporter of light weapons to countries around the world, particularly in regions with high conflict risks such as the Middle East and parts of Asia.

North America also sees significant demand for light weapons in law enforcement and private security sectors, where weapons such as semi-automatic rifles and handguns are commonly used. The rising concerns around security, including terrorism, civil unrest, and organized crime, have further increased the demand for light weapons in these sectors, creating additional growth avenues for the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The light weapons market is highly competitive, with several key players shaping its direction through innovation, strategic partnerships, and a strong global presence.

FN Herstal SA, based in Belgium, is a leading manufacturer of firearms and weapon systems, with a legacy of supplying both military and law enforcement agencies worldwide. FN Herstal is known for its high-performance firearms like assault rifles, machine guns and sniper rifles, that are widely used by armed forces across the globe.

Saab AB, a Swedish defense and aerospace company, is another major player in the light weapons market, particularly in the field of guided weapons. Saab is renowned for its advanced technologies in providing cutting-edge solutions for land, air, and naval defense.

MBDA Inc., a leading European missile systems manufacturer, has established itself as a major player in the global defense industry. Known for its precision-guided missiles and air-defense systems, MBDA plays a crucial role in the light weapons market, particularly in the production of advanced, lightweight missiles for tactical military operations.

Top Opportunities Awaiting for Players

The light weapons market presents numerous growth opportunities for companies looking to innovate, expand their product range, or explore emerging markets.

- Rise in Global Security Concerns Ongoing geopolitical tensions, local conflicts, and the increasing threat of terrorism are driving demand for advanced light weapons. For light weapon manufacturers, this creates a robust demand for products that can be easily deployed in both military and law enforcement applications.

- Technological Advancements in Weaponry: Advances in materials, electronics, and ammunition technology are enabling manufacturers to develop more effective and efficient light weapons. Companies that embrace innovation in areas such as lightweight, durable materials, smart ammunition, and modular designs stand to gain a competitive edge.

- Defense Modernization Programs: Many countries are actively modernizing their defense forces to remain competitive. This includes upgrading their weaponry with next-generation firearms and light weapons. With the global defense spending on the rise in countries like Asia-Pacific, the Middle East, and Eastern Europe, light weapon manufacturers have significant opportunities to secure contracts for modernization projects.

- Increased Adoption of Non-Lethal Weapons: Non-lethal weapons such as stun guns, rubber bullets, and less-lethal grenade launchers provide a means to control crowds or subdue individuals without causing permanent harm. As more governments and security agencies prioritize safety and human rights, non-lethal solutions are becoming an integral part of their arsenals.

- Growth in Civilian and Commercial Markets: While military and law enforcement sectors remain the dominant buyers of light weapons, the civilian market is also showing growth. The demand for personal defense weapons, hunting rifles, and sporting firearms continues to rise, especially in regions like North America, Europe, and parts of Asia. Companies looking to tap into this market need to focus on quality, customization, and user-friendly designs.

Top Key Players in the Market

- FN Herstal SA

- Saab AB

- Raytheon Technologies Corporation

- MBDA Inc.

- Thales Group

- BAE Systems PLC

- Rheinmetall AG

- Rostec

- Lockheed Martin Corporation

- Rafael Advanced Defense Systems Ltd

- Denel SOC Ltd

- General Dynamics Corporation

- Heckler & Koch GmbH

- Israel Aerospace Industries Ltd

- Other Key Players

Recent Developments

- In October 2024, Lockheed Martin announced the successful test of their new lightweight anti-tank guided missile system, which is expected to enhance operational effectiveness for ground forces.

- In September 2024, Rheinmetall secured a contract to supply advanced light weapons systems to an unnamed European nation, emphasizing their commitment to modernizing military capabilities.

- In August 2023, General Dynamics launched a new line of modular light weapons designed for rapid deployment in urban warfare scenarios, showcasing advancements in weapon technology.

- In July 2023, Thales Group unveiled an upgraded version of their lightweight assault rifle, featuring enhanced accuracy and reduced weight, aimed at improving soldier mobility.

Report Scope

Report Features Description Market Value (2023) USD 14.73 Bn Forecast Revenue (2033) USD 23.8 Bn CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Heavy Machine Guns (HMGs), Grenades and Grenade Launchers, Mortars, Man-portable Anti-tank Systems (MANPATS), Man-portable Air Defense Systems (MANPADS), Others), By Technology (Guided, Unguided), By Application (Defense, Homeland Security) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape FN Herstal SA, Saab AB, Raytheon Technologies Corporation, MBDA Inc., Thales Group, BAE Systems PLC, Rheinmetall AG, Rostec, Lockheed Martin Corporation, Rafael Advanced Defense Systems Ltd, Denel SOC Ltd, General Dynamics Corporation, Heckler & Koch GmbH, Israel Aerospace Industries Ltd, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- FN Herstal SA

- Saab AB

- Raytheon Technologies Corporation

- MBDA Inc.

- Thales Group

- BAE Systems PLC

- Rheinmetall AG

- Rostec

- Lockheed Martin Corporation

- Rafael Advanced Defense Systems Ltd

- Denel SOC Ltd

- General Dynamics Corporation

- Heckler & Koch GmbH

- Israel Aerospace Industries Ltd

- Other Key Players