Global AI In IoT Market By Component (Platform, Software, and Services), By Technology (Machine Learning and Deep Learning, Natural Language Processing, and Others), By End User (Manufacturing, Energy and Utilities, Transportation and Mobility, BFSI, Government and Defence, Retail, Healthcare and Life Sciences, Telecom, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 120305

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

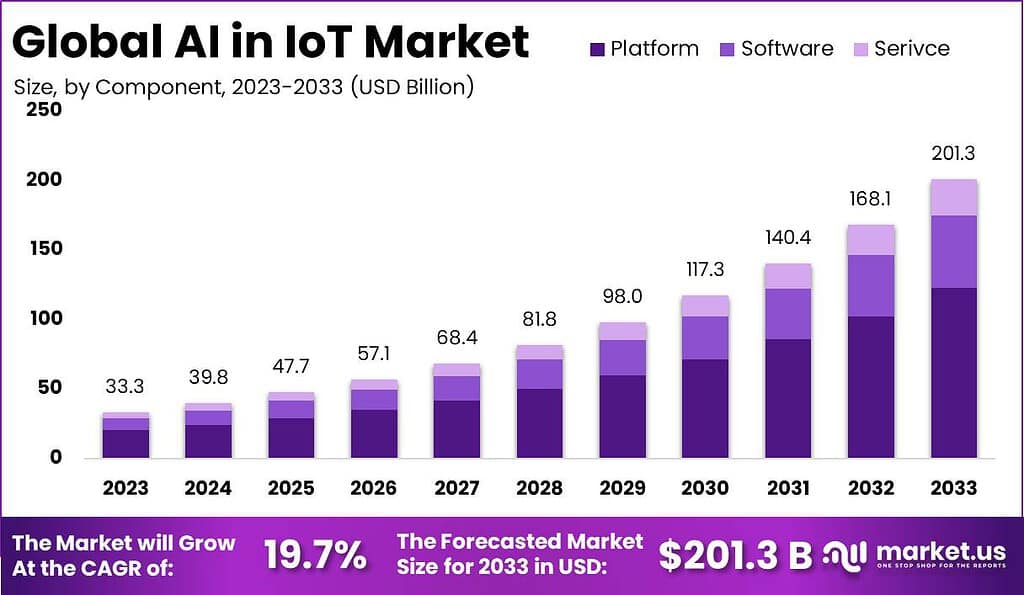

The Global AI in IoT Market size is expected to be worth around USD 201.3 Billion By 2033, from USD 33.3 Billion in 2023, growing at a CAGR of 19.7% during the forecast period from 2024 to 2033.

AI has evolved as a potential technology that is capable of simulating human intellectual functions. Similarly, IoT is an interconnected system of devices with unique IDs that are capable of communicating data across a particular network without human-to-human or human-to-computer interaction. Currently, the integration of AI in IoT systems has helped businesses build sophisticated machines that can iterate human behavior and help in decision-making with minimum human interventions.

The AI in IoT (Internet of Things) market is experiencing remarkable growth, driven by the increasing integration of AI technologies with IoT systems. The combination of AI and IoT enables smart devices and networks to gather, analyze, and act upon vast amounts of data in real-time, leading to enhanced automation, efficiency, and decision-making capabilities. This convergence has opened up new avenues of innovation and has the potential to revolutionize various industries.

However, the market faces several challenges. Security concerns, primarily related to data privacy and the vulnerability of IoT devices to cyber-attacks, pose significant risks. Furthermore, the complexity of integrating AI with existing IoT infrastructure requires substantial technical expertise, which can be a barrier for some organizations.

Despite these challenges, there are substantial opportunities for new entrants. The demand for customized AI solutions in IoT applications is growing, opening up markets for startups and smaller firms specializing in niche AI technologies. Additionally, as businesses increasingly recognize the value of AI-powered IoT, the need for innovative solutions that can ensure data security and seamless integration is expanding, providing fertile ground for new players to make their mark.

For instance, in March 2023, the Canadian government allocated about $1.81 million (C$2.4 million) to provide high-speed internet to nearly 300 homes in Campbellville, Ontario. This investment in upgrading the country’s digital infrastructure is expected to boost the demand for AI in IoT technologies. As more areas get better internet, the use of smart, AI-driven devices increases, which helps expand the market globally. Such initiatives show how government funding can directly support the growth of advanced technologies like AI in IoT.

By 2025, the amount of data generated by IoT devices is estimated to reach an astonishing 80 zettabytes. This surge in data production corresponds to the rapid proliferation of IoT devices worldwide, expected to surpass 55 billion by the same year, a significant leap from the approximately 9 billion devices recorded in 2017. AI, pivotal in managing and analyzing this immense data deluge, emerges as a cornerstone technology in this ecosystem.

Recent surveys underscore the symbiotic relationship between AI and IoT, with 48% of organizations utilizing AI in conjunction with IoT to advance automation initiatives. Specifically, findings from a TCS survey reveal that among companies leveraging AI, 56% leverage machine learning for process automation, while 20% harness its power for IoT applications, showcasing a growing trend towards integration and synergy between these technologies.

Looking ahead, the manufacturing sector is poised to dominate the AI in IoT market by 2027, signaling a strategic shift towards enhanced operational efficiency and productivity in this industry. Moreover, forecasts predict that by 2030, AI is projected to contribute approximately $15.7 trillion to the global economy, highlighting its transformative potential across various sectors.

Amidst these developments, the adoption of IoT technology continues to soar, with an anticipated 90% of businesses embracing it by 2025. The total installed base of IoT connected devices globally is expected to skyrocket to 30.73 billion units by the same year, underlining the pervasive influence and ubiquity of IoT in the digital landscape.

Key Takeaways

- The AI in IoT market will reach a market value of USD 201.3 billion in the year 2033 with a CAGR of 19.72% in the forecast period of 2024 to 2033 and has accounted for the market value of USD 33.2 billion in the year 2023.

- On component based, the AI in IoT market is segmented into platform, software, and services segments, among which the platform segment has accounted for the largest market share of 61% in the year 2023.

- Based on technology type segmentation, the machine learning segment has attributed to the largest market share of 55% in the year 2023 due to factors such as accessibility, flexibility, and ease of use.

- By End User Industry, The manufacturing segment has the largest market share of 24% in the year 2023 in the AI in IoT market. This is due to the increased output and less labor cost incurred by the businesses in the industry.

- On dividing based on the regions, the North America region has registered the largest market share in the AI in IoT market with a market share of 41.5% in the year 2023 owing to the factors such as availability of adequate resources, funds, advanced technology, government support, presence of giant tech firms and others.

Component Analysis

In 2023, the Platform segment held a dominant market position in the AI in IoT market, capturing more than a 61% share. This leading status can be attributed to the essential role that platforms play in integrating artificial intelligence with the Internet of Things (IoT) devices.

Platforms serve as the critical infrastructure that enables the efficient management, processing, and analysis of data from numerous IoT sources. They provide the necessary tools and environments for developers to create, deploy, and maintain AI applications that are optimized for IoT ecosystems.

The dominance of the Platform segment is further reinforced by the increasing complexity and scale of IoT deployments. As enterprises continue to expand their IoT networks with a multitude of connected devices generating vast amounts of data, the demand for robust AI platforms that can handle large-scale data analytics and real-time decision making has surged.

These platforms not only facilitate data integration from diverse sources but also enable advanced analytics capabilities, machine learning models, and the automation of operational processes. Consequently, platforms that offer end-to-end solutions and support advanced AI functionalities have become integral to the growth and scalability of IoT systems. Moreover, the Platform segment’s leadership in the AI in IoT market is expected to persist as technological advancements continue to evolve.

The development of more sophisticated AI algorithms and the increased availability of edge computing options allow platforms to perform more complex tasks closer to the data source, thus reducing latency and enhancing the overall effectiveness of IoT solutions. This ongoing innovation within the platform segment ensures its vital position within the AI in IoT ecosystem, promising sustained growth and expansion in the forthcoming years.

Technology Analysis

In 2023, the Machine Learning segment held a dominant market position in the AI in IoT market, capturing more than a 55% share. This prominence is largely due to machine learning’s ability to enhance the decision-making capabilities of IoT systems by identifying patterns and insights from data without explicit programming.

Machine learning technologies are pivotal in transforming raw data collected from IoT devices into actionable intelligence, thus optimizing processes and improving outcomes across various industries such as manufacturing, healthcare, and smart cities. The leadership of the Machine Learning segment is also supported by the continuous advancements in algorithmic techniques and the increasing computational power available to process large datasets.

These advancements have significantly improved the accuracy and efficiency of machine learning models in real-time environments, making them more applicable and beneficial for IoT applications. For instance, predictive maintenance in industrial settings utilizes machine learning to foresee equipment failures before they occur, thereby reducing downtime and maintenance costs.

Furthermore, the integration of machine learning with IoT not only drives operational efficiency but also opens up new avenues for innovation and service enhancements. As IoT devices become more prevalent and capable of collecting diverse types of data, machine learning algorithms can provide more sophisticated and contextually relevant insights. This ongoing development promises to keep the Machine Learning segment at the forefront of the AI in IoT market, continuing its growth trajectory and expanding its influence in emerging IoT applications.

End-user Analysis

In 2023, the Manufacturing segment held a dominant market position in the AI in IoT market, capturing more than a 24% share. This sector has increasingly leveraged AI-powered IoT solutions to enhance operational efficiency, improve product quality, and reduce downtime. Manufacturing companies are integrating AI with IoT to create ‘smart factories’ where machinery and equipment can communicate, predict failures, and self-optimize their operations using real-time data. This has not only streamlined production processes but also significantly reduced operational costs, contributing to the segment’s strong market share.

The leadership of the Manufacturing segment is further emphasized by the adoption of Industry 4.0 technologies, where IoT and AI play crucial roles. In February 2022, The National Association of Software and Services Companies (NASSCOM) teamed up with Capgemini to conduct a research study on how Indian manufacturing companies are adopting Industry 4.0 technologies. This study aimed to understand the extent and ways in which these advanced technologies are being integrated into manufacturing processes across India.

The ability of AI to analyze vast amounts of data generated by IoT devices allows for advanced predictive maintenance, quality control, and supply chain management. These applications are critical in today’s fast-paced, demand-driven production environments where efficiency and uptime are paramount. Additionally, AI-enabled IoT applications help in ensuring worker safety through continuous monitoring and predictive alerts, which is a significant concern in manufacturing environments.

Moreover, the push towards digital transformation initiatives across the globe has prompted manufacturers to adopt smart technologies at an increasing rate. The integration of AI and IoT not only aids in operational efficiency but also helps in adapting to changing market conditions and consumer demands more swiftly. This ongoing trend towards automation and data-driven manufacturing is expected to sustain the growth and dominance of the Manufacturing segment in the AI in IoT market in the upcoming years.

Key Market Segments

By Component Type

- Platform

- Software

- Services

By Technology type

- Machine Learning (ML)

- Natural Language Processing (NLP)

By End User

- Manufacturing

- Energy and Utilities

- Transportation and Mobility

- BFSI

- Government and Defense

- Retail

- Healthcare and Life Sciences

- Telecom

- Others

Driver

Increased Efficiency and Cost Savings

The integration of Artificial Intelligence (AI) with the Internet of Things (IoT) significantly drives market growth through enhanced efficiency and cost savings. AI algorithms are adept at analyzing the vast amounts of data generated by IoT devices, leading to improved decision-making and automation. This efficiency is crucial in industries such as manufacturing, where predictive maintenance of machinery can prevent costly downtimes.

Additionally, in energy management, AI can optimize the power usage of IoT devices, significantly reducing energy costs. These benefits are compelling companies across various sectors to adopt AI in IoT solutions, thereby propelling the market forward.

Restraint

Privacy and Security Concerns

One of the primary restraints in the AI in IoT market is the concern surrounding privacy and security. IoT devices collect and transmit massive amounts of data, some of which is highly sensitive. Integrating AI enhances the capabilities of these devices but also raises significant risks if the data is mishandled or exposed to cyber threats.

The complexity of securing IoT ecosystems becomes even more challenging with the addition of AI, as these systems often require new types of protections that can analyze and respond to threats in real-time. This complexity can deter organizations from adopting AI in IoT solutions, fearing potential data breaches and their repercussions.

Opportunity

Advancements in Edge Computing

A major opportunity within the AI in IoT market is the advancement of edge computing technologies. Edge computing allows data processing to be done closer to the source of data generation, i.e., IoT devices themselves. This minimizes latency, reduces transmission costs, and decreases dependency on centralized cloud services.

With AI capabilities embedded directly into edge devices, real-time data processing and decision-making become faster and more reliable, enabling more autonomous IoT operations. This is particularly advantageous in scenarios where immediate response is critical, such as in autonomous vehicles and real-time remote monitoring systems.

Challenge

Integration Complexity

A significant challenge in the AI in IoT market is the complexity of integrating AI with existing IoT infrastructures. Many IoT systems were not originally designed to support the high computational demands of AI applications. Retrofitting AI into these systems often requires substantial changes in both hardware and software, including updates to data processing capabilities and security measures.

Additionally, the lack of standardization across different IoT platforms can complicate the integration process further, leading to increased costs and extended deployment times, which can hinder the adoption of AI in IoT solutions.

Microeconomic Factors

- Investment Levels: The amount of investment in technology infrastructure varies significantly across regions, influencing the adoption and implementation of AI in IoT. Regions with higher investment in R&D, startups, and technology hubs often see faster growth and innovation in this field.

- Supply Chain Dynamics: The AI in IoT market is susceptible to the microeconomic conditions affecting the supply of essential components like semiconductors and sensors. Disruptions in supply chains can lead to increased costs or delays in production and deployment of AI IoT systems.

- Labor Market Conditions: The availability and cost of skilled labor, particularly experts in AI, machine learning, and IoT technologies, can directly affect market growth. Regions with a concentration of tech talent can more effectively develop and implement AI in IoT solutions.

Geopolitical Factors

- Trade Policies and Regulations: Trade policies, including tariffs and import/export regulations, can impact the cost and availability of IoT devices and related technologies. Stricter regulations or higher tariffs can increase costs and slow down the pace of technology transfer between countries.

- Data Privacy and Security Laws: Geopolitical dynamics influence the regulatory landscape, especially concerning data protection. Laws like the GDPR in Europe enforce strict data privacy standards, affecting how data collected through AI in IoT applications is handled, stored, and transferred.

- International Relations: Relationships between countries can affect cooperation in technological advancements and standard-setting for IoT and AI. For example, tensions between countries may hinder collaboration or lead to fragmented technology markets with incompatible standards.

Emerging Trends

- Edge AI Expansion: The trend towards processing data locally on IoT devices, known as edge computing, is growing. This minimizes latency, reduces bandwidth use, and enhances the responsiveness of AI applications in real-time environments such as autonomous vehicles and smart factories.

- Predictive Analytics for Maintenance: AI-driven predictive maintenance is becoming more prevalent, particularly in manufacturing and industrial sectors. By predicting equipment failures before they occur, companies can save on repair costs and minimize downtime, enhancing operational efficiency.

- AIoT in Healthcare: The integration of AI with IoT in healthcare—often termed AIoT—is revolutionizing patient care. This includes remote monitoring of patients, personalized medicine, and more efficient management of healthcare resources.

- Increased Focus on Security: As the deployment of IoT devices increases, so does the focus on securing them. AI is being leveraged to develop more sophisticated cybersecurity measures for IoT networks to prevent data breaches and ensure privacy.

- Smart Cities: AI in IoT is playing a pivotal role in developing smart cities, improving everything from traffic management and waste control to energy usage and public safety. This trend is accelerating as urban areas seek more sustainable and efficient infrastructure solutions.

- Interoperability and Standardization: There is a growing trend towards developing standards and protocols to ensure interoperability among different IoT devices and platforms. This is crucial for the scalability of IoT solutions and their integration across various industries and sectors.

Regional Analysis

In 2023, North America held a dominant market position in the AI in IoT market, capturing more than a 41.5% share. This substantial market share can be attributed to several key factors including advanced technological infrastructure and the presence of major technology firms that are pioneering AI and IoT integrations.

The region has seen significant investments in IoT technologies, particularly in industrial and healthcare applications, which are increasingly incorporating AI for enhanced data analytics and decision-making processes. Additionally, supportive government policies promoting IoT adoption across various sectors have further bolstered the growth in this market.

The North American market benefits from a robust ecosystem for research and development, facilitated by collaborations between universities, tech giants, and startups. This environment fosters innovation and rapid deployment of AI in IoT solutions across verticals. The United States, in particular, has been at the forefront, with Silicon Valley acting as a hub for both technological advancements and venture capital funding, driving the regional market’s growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The AI in IoT market is led by a diverse group of global technology firms, each contributing unique innovations and solutions. Google LLC stands out with its advanced AI capabilities, integrating them with IoT devices to enhance smart home and business solutions. Amazon Web Services Inc. offers robust cloud platforms that support IoT infrastructure, enabling efficient data processing and analytics.

IBM Corporation is another major player, providing AI-powered IoT solutions that improve operational efficiency in industries like manufacturing and healthcare. SAP SE specializes in integrating AI with IoT to optimize business processes and supply chain management, delivering valuable insights to enterprises.

Top Key Players in the Market

- Google LLC

- SAP SE

- PTC Inc.

- Salesforce, Inc.

- Hitachi Ltd.

- Softweb Solutions Inc.

- Amazon Web Services Inc.

- IBM Corporation

- SAS Institute Inc.

- Oracle Corporation

- Other Key Players

Recent Developments

- In March 2024, Accenture launched the Accenture LearnVantage service to assist clients with a comprehensive technology learning and training service and achieve greater business value with the help of AI-based IoT systems.

- In January 2024, Vodafone and Microsoft signed a ten-year strategic partnership to develop AI-based IoT and other digital services as Vodafone has tried to scale its new standalone IoT business with Microsoft.

- In March 2023, Accenture announced its acquisition of Flutura, a provider of data science and IoT services. This strategic move aims to bolster Accenture’s industrial AI services under its Applied Intelligence brand. By integrating Flutura’s expertise in data analytics and IoT with Accenture’s global reach and industry insights, the company aims to offer enhanced AI-driven solutions to its clients, driving innovation and value creation across various sectors.

Report Scope

Report Features Description Market Value (2023) USD 33.3 Bn Forecast Revenue (2033) USD 201.3 Bn CAGR (2024-2033) 19.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Platform, Software, and Services), By Technology (Machine Learning and Deep Learning, Natural Language Processing, and Others), By End User (Manufacturing, Energy and Utilities, Transportation and Mobility, BFSI, Government and Defence, Retail, Healthcare and Life Sciences, Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google LLC, SAP SE, PTC Inc., Salesforce Inc., Hitachi Ltd., Softweb Solutions Inc., Amazon Web Services Inc., IBM Corporation, SAS Institute Inc., Oracle Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is AI in IoT?AI in IoT refers to the integration of artificial intelligence technologies with IoT devices and systems. This combination allows IoT devices to not only collect and share data but also to analyze and act on the data intelligently, often in real-time.

How big is AI in IoT Market?The Global AI in IoT Market size is expected to be worth around USD 201.3 Billion By 2033, from USD 33.3 Billion in 2023, growing at a CAGR of 19.7% during the forecast period from 2024 to 2033.

What are the current trends in the AI in IoT market?Key trends include the increasing adoption of edge computing, the rise of smart cities, advancements in machine learning algorithms, the growth of 5G networks, and the proliferation of connected devices in industries such as healthcare, manufacturing, and automotive.

What are the key factors driving the growth of the AI in IoT Market?The integration of advanced analytics, the proliferation of connected devices, and the need for efficient data management and predictive maintenance are primary drivers for the AI in IoT market's expansion.

What are the major challenges and opportunities in the AI in IoT Market?Major challenges include data privacy concerns, integration complexities, and high initial investment costs. Opportunities lie in the enhancement of operational efficiencies, development of smart city solutions, and innovations in industrial IoT applications.

Who are the leading players in the AI in IoT Market?Prominent companies include Google LLC, SAP SE, PTC Inc., Salesforce Inc., Hitachi Ltd., Softweb Solutions Inc., Amazon Web Services Inc., IBM Corporation, SAS Institute Inc., Oracle Corporation, Other Key Players

-

-

- Google LLC

- SAP SE

- PTC Inc.

- Salesforce, Inc.

- Hitachi Ltd.

- Softweb Solutions Inc.

- Amazon Web Services Inc.

- IBM Corporation

- SAS Institute Inc.

- Oracle Corporation

- Other Key Players