AI in Cancer Diagnostics Market By Product Type (Software Solutions, Services, and Hardware), By Application (Breast Cancer, Brain Tumor, Colorectal Cancer, Lung Cancer, and Others), By End-user (Hospital, Surgical Centers & Medical Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153365

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

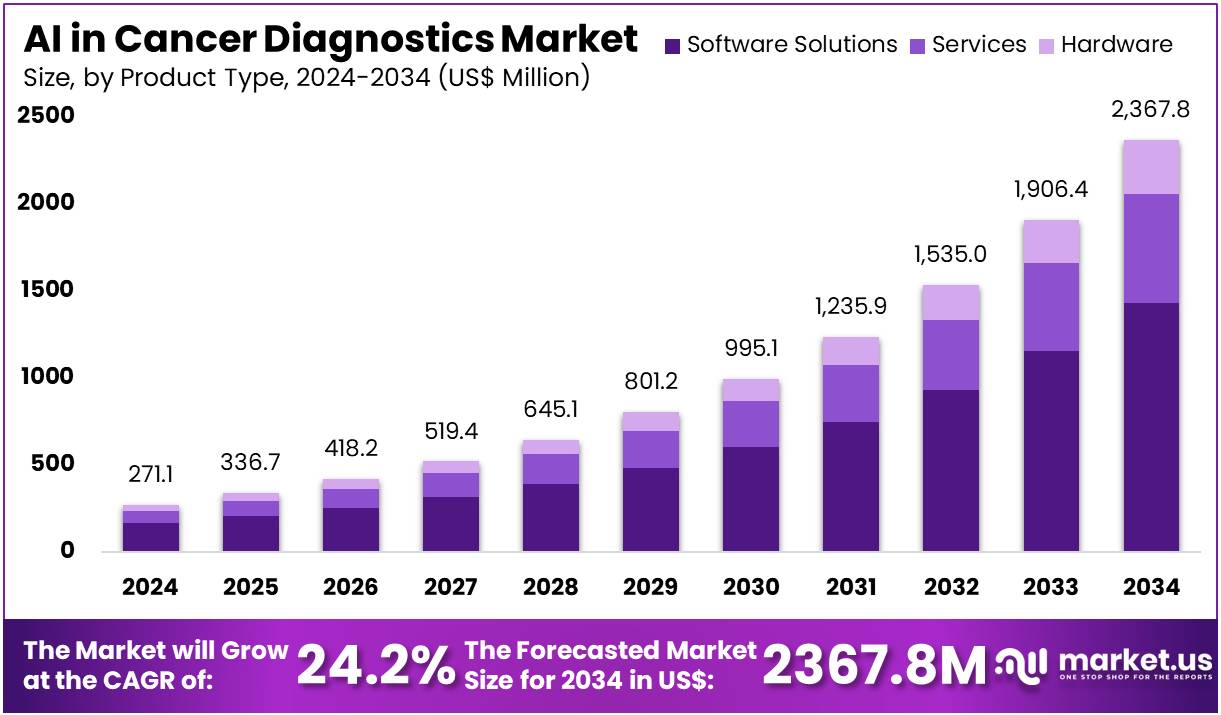

The AI in Cancer Diagnostics Market size is expected to be worth around US$ 2,367.8 million by 2034 from US$ 271.1 million in 2024, growing at a CAGR of 24.2% during the forecast period 2025 to 2034.

Increasing advancements in artificial intelligence (AI) and the growing need for more accurate, efficient cancer diagnostics are driving the expansion of the AI in cancer diagnostics market. AI technologies, such as machine learning, deep learning, and computer vision, are transforming cancer detection by analyzing medical imaging, genomic data, and patient history to provide faster and more accurate results. These tools help radiologists and oncologists identify tumors at earlier stages, significantly improving treatment outcomes and patient survival rates.

The growing prevalence of cancer worldwide and the increasing complexity of diagnosing various cancer types are key drivers, pushing the demand for AI-driven solutions to assist in clinical decision-making. In October 2022, Tempus AI, Inc. introduced Tempus AI, Inc.+, a platform designed to enhance collaborative precision oncology research by utilizing real-world data. This platform combines AI-powered analytics with data from leading healthcare and research institutions, further advancing the field of oncology by improving the accuracy of cancer diagnoses and enabling the development of more personalized treatment plans.

Recent trends in the market also highlight the integration of AI with next-generation sequencing (NGS) to analyze genetic mutations associated with specific cancers, offering greater insight into personalized treatment options. Moreover, AI technologies are improving workflow efficiencies by automating routine tasks, allowing clinicians to focus on more complex cases. As AI continues to evolve, it presents significant opportunities for early cancer detection, more effective monitoring, and better treatment planning, ultimately improving patient outcomes and driving the growth of the cancer diagnostics market.

Key Takeaways

- In 2024, the market for AI in cancer diagnostics generated a revenue of US$ 271.1 million, with a CAGR of 24.2%, and is expected to reach US$ 2,367.8 million by the year 2034.

- The product type segment is divided into software solutions, services, and hardware, with software solutions taking the lead in 2023 with a market share of 60.4%.

- Considering application, the market is divided into breast cancer, brain tumor, colorectal cancer, lung cancer, and others. Among these, breast cancer held a significant share of 35.0%.

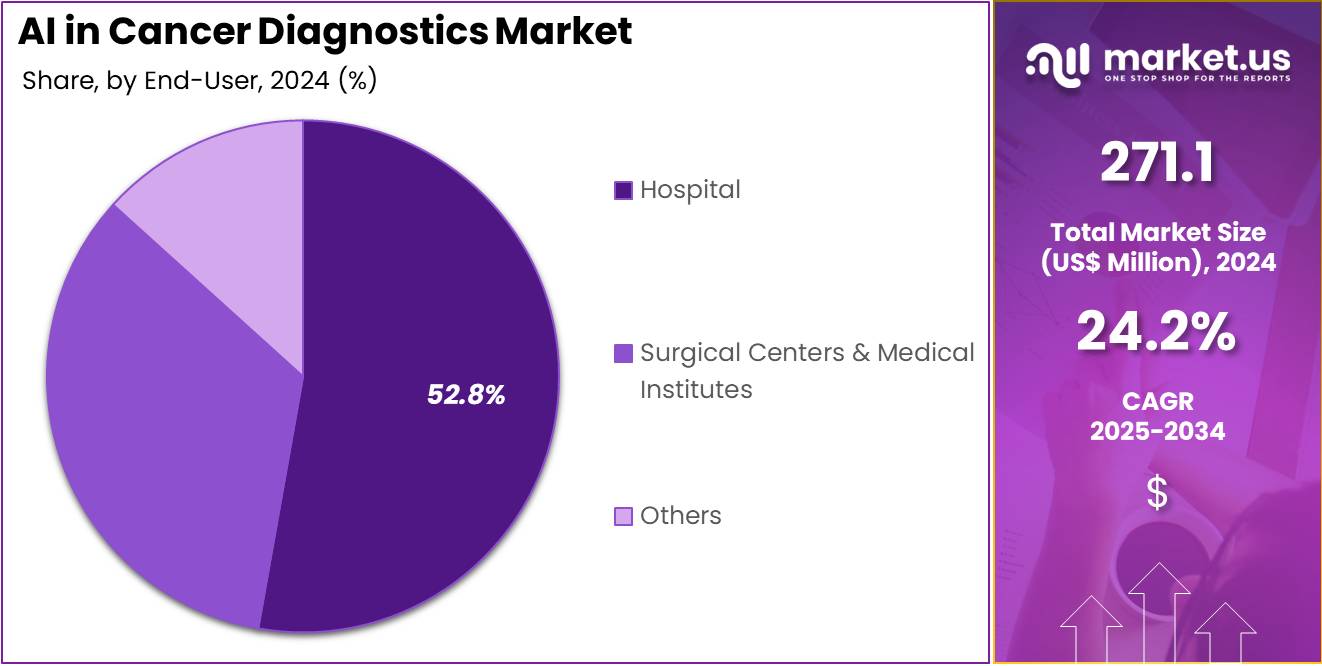

- Furthermore, concerning the end-user segment, the market is segregated into hospital, surgical centers & medical institutes, and others. The hospital sector stands out as the dominant player, holding the largest revenue share of 52.8% in the AI in cancer diagnostics market.

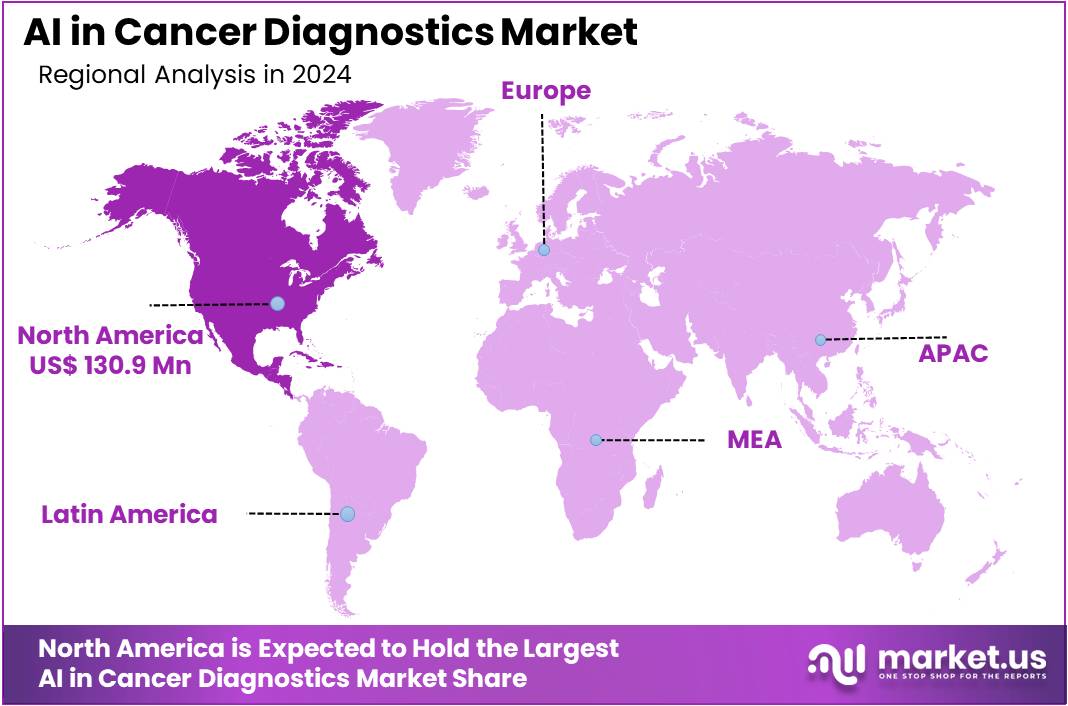

- North America led the market by securing a market share of 48.3% in 2023.

Product Type Analysis

Software solutions dominate the AI in cancer diagnostics market, holding 60.4% of the market share. This growth is expected to continue as artificial intelligence increasingly plays a critical role in diagnosing cancer. Software solutions, powered by AI algorithms, assist in the analysis of medical images, genetic data, and patient history to detect cancerous cells and assist with accurate diagnoses.

The rapid development of AI technologies in software, such as deep learning and neural networks, is anticipated to enhance diagnostic accuracy and reduce human error in cancer detection. These solutions can process vast amounts of data quickly, which is expected to streamline workflow in busy clinical environments and improve diagnostic turnaround times.

As hospitals, diagnostic labs, and clinics increasingly rely on AI to manage complex and high-volume cases, the demand for AI-powered diagnostic software is projected to grow significantly. Furthermore, the integration of these software solutions with other healthcare IT systems, such as Electronic Health Records (EHRs) and laboratory information systems (LIS), is expected to further fuel the adoption of AI in cancer diagnostics.

Application Analysis

Breast cancer holds the largest share of 35.0% in the application segment of the AI in cancer diagnostics market. This growth is expected to continue as breast cancer remains one of the most common types of cancer worldwide, prompting the need for enhanced diagnostic tools. AI technologies, including machine learning and image recognition, are increasingly being used to analyze mammograms, ultrasound, and MRI scans for early detection of breast cancer, enabling faster and more accurate diagnoses.

The ability of AI algorithms to detect subtle signs of cancer in imaging data that may be overlooked by human eyes is expected to significantly improve the accuracy of screenings. Additionally, as awareness and screenings for breast cancer increase globally, particularly in high-risk populations, the demand for AI-driven diagnostics is projected to rise.

The integration of AI into breast cancer diagnostic workflows is anticipated to be a key factor in reducing the time to diagnosis and improving survival rates. Furthermore, the growing trend of personalized medicine in breast cancer treatment is likely to contribute to the continued demand for AI-based diagnostic solutions.

End-User Analysis

Hospitals represent the largest end-user segment in the AI in cancer diagnostics market, with a share of 52.8%. This segment’s growth is driven by the increasing adoption of AI technologies to support clinical decision-making, improve diagnostic accuracy, and streamline workflows within hospital settings.

Hospitals are increasingly integrating AI-based diagnostic tools into their radiology departments, enabling more precise image analysis and faster identification of cancerous lesions in various organs. The high volume of patients and the growing complexity of cancer cases in hospitals are expected to accelerate the demand for AI-based solutions.

Additionally, the ability of AI to assist pathologists and oncologists in interpreting complex data, such as biopsy results and imaging scans, is likely to improve treatment planning and patient outcomes. Hospitals are also anticipated to adopt AI technologies to enhance their research capabilities, optimize resource management, and improve operational efficiency.

As hospitals strive to provide cutting-edge care and reduce healthcare costs, the demand for AI in cancer diagnostics is projected to continue to grow, maintaining the dominance of hospitals as the primary end-user segment.

Key Market Segments

By Product Type

- Software Solutions

- Services

- Hardware

By Application

- Breast Cancer

- Brain Tumor

- Colorectal Cancer

- Lung Cancer

- Others

By End-user

- Hospital

- Surgical Centers & Medical Institutes

- Others

Drivers

Rising Global Cancer Incidence and Diagnostic Challenges are Driving the Market

The rising global incidence of cancer, along with the ongoing challenges in achieving timely and accurate diagnoses, serves as a major driver for the growth of the AI in cancer diagnostics market. Traditional diagnostic approaches can be time-consuming, demand specialized expertise, and may overlook subtle signs, particularly in the early stages of the disease.

AI brings transformative potential by improving the speed, precision, and objectivity of cancer detection across various modalities such as pathology, radiology, and genomics. It can process large volumes of complex data from medical images and genetic sequences, identifying patterns that may not be visible to the human eye, thereby enhancing diagnostic accuracy and efficiency. According to the World Health Organization (WHO), there were nearly 20 million new cancer cases and 9.7 million cancer-related deaths globally in 2022.

Moreover, the number of new cancer cases is expected to reach approximately 30 million annually by 2040, highlighting the growing need for advanced diagnostic tools. AI’s capability to assist pathologists and radiologists in detecting cancers earlier, more effectively stratifying risk, and reducing observer variability addresses the pressing need for scalable, highly accurate diagnostic solutions in the face of the increasing global cancer burden.

Restraints

Data Privacy Concerns and High Implementation Costs are Restraining the Market

Significant concerns regarding data privacy and the substantial initial implementation costs pose considerable restraints on the AI in cancer diagnostics market. AI systems in diagnostics rely on access to large, diverse datasets of patient medical images, pathology slides, and clinical records for training and validation. Handling this highly sensitive information raises critical privacy issues and requires strict adherence to regulations like HIPAA and GDPR. Any breach or misuse of data could lead to severe penalties and erode public trust.

In 2023, according to figures reported by The HIPAA Journal, a total of 725 healthcare data breaches were logged with the Office for Civil Rights (OCR), exposing or improperly disclosing over 133 million patient records. This marks a dramatic surge compared to the 51.9 million records compromised in 2022, underscoring the growing and persistent threat of cyberattacks targeting the healthcare sector.

Furthermore, integrating AI solutions into existing diagnostic workflows often requires substantial investments in high-performance computing infrastructure, specialized software, and extensive training for healthcare professionals. For instance, implementing a complex deep learning model for cancer diagnosis can cost upwards of US$ 100,000 in development alone, not including ongoing cloud or on-premise infrastructure expenses. These financial and regulatory hurdles make adoption challenging for many healthcare providers, thereby restraining market growth.

Opportunities

Addressing Pathologist Shortages and Enhancing Diagnostic Throughput is Creating Growth Opportunities

The persistent and growing global shortage of pathologists, coupled with the increasing volume of diagnostic workloads, is creating significant growth opportunities for the AI in cancer diagnostics market. Pathologists are critical for accurate cancer diagnosis, yet many regions face a severe scarcity of these highly specialized professionals, leading to diagnostic backlogs and delays in patient care.

AI solutions can augment the capabilities of existing pathology departments by automating preliminary screenings, quantifying specific biomarkers, and flagging suspicious areas on slides, thereby significantly increasing throughput and reducing the diagnostic burden. A report in the American Journal of Clinical Pathology in November 2023 noted that only 2% of any US medical school class enters Pathology, indicating a constrained pipeline for future pathologists. This shortage is further exacerbated by an aging pathology workforce and a rising cancer incidence.

By assisting pathologists in managing larger case volumes and focusing on the most complex cases, AI tools can alleviate staffing pressures and ensure more timely diagnoses. The ability of AI to enhance efficiency, reduce turnaround times, and potentially extend the reach of expert pathology services is driving strong demand and creating substantial growth avenues within the market.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and sustained healthcare sector investment, significantly influence the AI in cancer diagnostics market by affecting R&D funding and the affordability of advanced technology. While inflation can increase the cost of developing sophisticated AI algorithms, including high-performance computing resources and specialized talent, the critical and growing need for improved cancer detection often compels continued investment.

Hospitals and diagnostic centers increasingly view AI as a strategic asset for efficiency and accuracy. According to the American Hospital Association (AHA) “Costs of Caring” report from April 2025, US hospitals experienced a 5.1% increase in total expenses in 2024, outpacing the overall inflation rate of 2.9%, indicating persistent cost pressures but also substantial operational expenditures.

Despite these financial challenges, the imperative to enhance diagnostic capabilities and address the rising cancer burden ensures continued allocation of resources towards innovative solutions. Geopolitical stability also plays a crucial role in maintaining stable supply chains for the high-tech components required for AI infrastructure. The long-term value proposition of AI in reducing healthcare costs through earlier diagnosis and more effective treatment pathways sustains market resilience and growth, even amidst broader economic fluctuations.

Evolving US trade policies, including the imposition of tariffs on imported IT hardware and specialized AI components, are shaping the AI in cancer diagnostics market by influencing the cost of essential infrastructure. AI in cancer diagnostics relies heavily on advanced computing hardware, such as Graphics Processing Units (GPUs) and high-capacity storage, many of which contain components manufactured internationally.

Tariffs on these imports can increase the capital expenditure for healthcare providers and technology companies developing and deploying AI solutions in the US A report by the Association of American Medical Colleges (AAMC) in May 2025 indicated that the US imported over US$75 billion in medical devices and supplies in 2024, highlighting the medical sector’s reliance on global supply chains, where tariffs can directly impact costs.

For instance, components for high-resolution scanners and AI servers could see price increases. These policies may also encourage domestic manufacturing and diversification of supply chains to reduce reliance on specific countries. While tariffs might present an initial cost hurdle, the strategic importance of AI in improving cancer diagnosis drives continued investment in compliant and high-performance technologies, fostering a more secure and resilient, albeit potentially more expensive, domestic ecosystem for advanced diagnostics.

Latest Trends

Advancements in Early Detection and Screening Algorithms are a Recent Trend

A prominent recent trend shaping the AI in cancer diagnostics market in 2024 and continuing into 2025 is the rapid advancement and integration of AI algorithms specifically designed for early cancer detection and mass screening programs. AI is increasingly being deployed to analyze medical images from mammograms, lung CT scans, and dermatological images to identify subtle signs of cancer at its earliest, most treatable stages. These algorithms often outperform human interpretation in speed and consistency, particularly when processing large volumes of screening data.

The US Food and Drug Administration (FDA) has actively cleared numerous AI-enabled medical devices, with a significant number focused on radiology. As of July 10, 2025, the FDA’s database of AI-Enabled Medical Devices lists a substantial number of such clearances. For example, in May 2025, new AI-powered diagnostic ultrasound systems received clearance, expanding the application of AI in imaging.

The SITC (Society for Immunotherapy of Cancer) and the National Cancer Institute (NCI) also hosted a webinar in May 2024 focusing on “Real-Time AI-based Monitoring & Early Detection of Adverse Immune-Related Events: AI in Immuno-oncology,” highlighting research into AI for early detection. This growing regulatory confidence and ongoing research validate the clinical utility of AI in improving the effectiveness of population-level cancer screening, driving its adoption as a critical tool for preventative oncology.

Regional Analysis

North America is leading the AI in Cancer Diagnostics Market

North America dominated the AI in Cancer Diagnostics market with the highest revenue share of 48.3% owing to increasing investment in precision medicine, the rising adoption of digital imaging technologies, and the critical need for early and accurate cancer detection. AI-powered solutions are revolutionizing the interpretation of complex medical images, such as mammograms, CT scans, and pathology slides, augmenting the capabilities of radiologists and pathologists.

The US Food and Drug Administration (FDA) has actively cleared AI-enabled devices for oncology applications, reflecting a supportive regulatory environment. For instance, the FDA granted 30 AI/ML-enabled device authorizations in oncology in 2022, increasing to 52 in 2023, and reaching 30 by May 2024, as per the FDA’s Artificial Intelligence and Machine Learning (AI/ML)-Enabled Medical Devices database. These authorizations span various diagnostic modalities, enhancing capabilities in areas like breast cancer screening and prostate cancer detection.

Leading medical technology companies are significantly investing in and deploying these advanced tools. Siemens Healthineers, a key player in diagnostic imaging, reported a 5.6% comparable revenue growth for its Diagnostics segment in fiscal year 2024, driven partly by demand for advanced diagnostic solutions that increasingly integrate AI for improved accuracy and efficiency in cancer diagnosis across North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the region’s rapidly increasing cancer burden, significant government investments in digital health infrastructure, and a growing emphasis on early diagnosis to improve patient outcomes. Countries across Asia Pacific are rapidly adopting digital medical imaging technologies, creating a vast dataset suitable for AI analysis.

For example, China’s total health expenditure reached CNY 8.5 trillion (approximately US$1.2 trillion) in 2022, with a strong focus on advanced medical technologies, as reported by the National Health Commission of China. This substantial investment is anticipated to support the integration of AI tools for cancer screening and diagnosis. Japan’s Ministry of Health, Labour and Welfare also outlines strategies for integrating AI into healthcare to address challenges posed by an aging population and rising chronic diseases, including cancer.

Leading global companies with a strong presence in Asia Pacific are projected to drive this growth. Philips’ Diagnosis & Treatment businesses, which include diagnostic imaging and pathology solutions, generated €7.1 billion (approximately US$7.6 billion) in sales for the full year 2024, with significant contributions from the Asia Pacific region, indicating the rising demand for advanced diagnostic equipment that frequently incorporates AI features for enhanced cancer detection capabilities across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the AI-powered cancer diagnostics market implement a range of strategies to foster growth and improve patient outcomes. They focus on incorporating cutting-edge technologies like machine learning, deep learning, and natural language processing to enhance diagnostic precision, treatment planning, and drug discovery.

Companies also emphasize the creation of scalable, cloud-based solutions that provide real-time data access and seamless integration with existing electronic health records (EHR). Forming strategic partnerships with healthcare providers, research institutions, and tech firms allows these companies to broaden their market presence and expand service offerings. In addition, they prioritize the development of intuitive interfaces and mobile applications to improve user accessibility and experience. Expanding into emerging markets further drives their growth.

One significant player, Tempus AI, founded in 2015, is a health technology company leveraging data and AI to offer precision medicine services across oncology, radiology, cardiology, and depression. The company went public on June 14, 2024, under the ticker “TEM.” Tempus has created one of the largest global libraries of clinical and molecular data, along with a platform designed to make this information accessible and actionable, particularly in oncology. The company’s AI-driven platform supports precision medicine, enabling healthcare providers to take the next steps in managing cancer patient care.

Top Key Players in the AI in Cancer Diagnostics Market

- Tempus AI, Inc

- SkinVision

- PathAI, Inc

- Paige AI Inc

- Microsoft

- FLATIRON HEALTH

- EarlySign

- Cancer Center.ai

Recent Developments

- In October 2024, Microsoft introduced new features within Microsoft Cloud for Healthcare to enhance care experiences, boost collaboration among healthcare teams, and empower medical professionals. Collaborating with Paige.ai and Providence, the AI models developed aim to assist healthcare organizations in integrating and analyzing various data types, such as genomics, medical images, and clinical records, to gain deeper clinical and operational insights.

- In September 2024, PathAI, Inc. launched MET Predict, an AI-driven algorithm integrated into the AISight Image Management System (IMS). This innovative tool helps pathologists identify non-small cell lung cancer (NSCLC) tumors exhibiting MET exon 14 skipping (METex14) or MET amplification directly from H&E whole slide images.

Report Scope

Report Features Description Market Value (2024) US$ 271.1 million Forecast Revenue (2034) US$ 2,367.8 million CAGR (2025-2034) 24.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software Solutions, Services, and Hardware), By Application (Breast Cancer, Brain Tumor, Colorectal Cancer, Lung Cancer, and Others), By End-user (Hospital, Surgical Centers & Medical Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tempus AI, Inc, SkinVision, PathAI, Inc, Paige AI Inc, Microsoft, FLATIRON HEALTH, EarlySign, Cancer Center.ai. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI in Cancer Diagnostics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Cancer Diagnostics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tempus AI, Inc

- SkinVision

- PathAI, Inc

- Paige AI Inc

- Microsoft

- FLATIRON HEALTH

- EarlySign

- Cancer Center.ai