Global Cancer Therapeutics and Biotherapeutics Market By Product Type (Chemotherapy, Hormone Therapy, Radiation Therapy, Biotherapy, and Others), By Application (Lung Cancer, Blood Cancer, Breast Cancer, Prostate Cancer, and Others), By End-use (Hospital, ASC, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138337

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

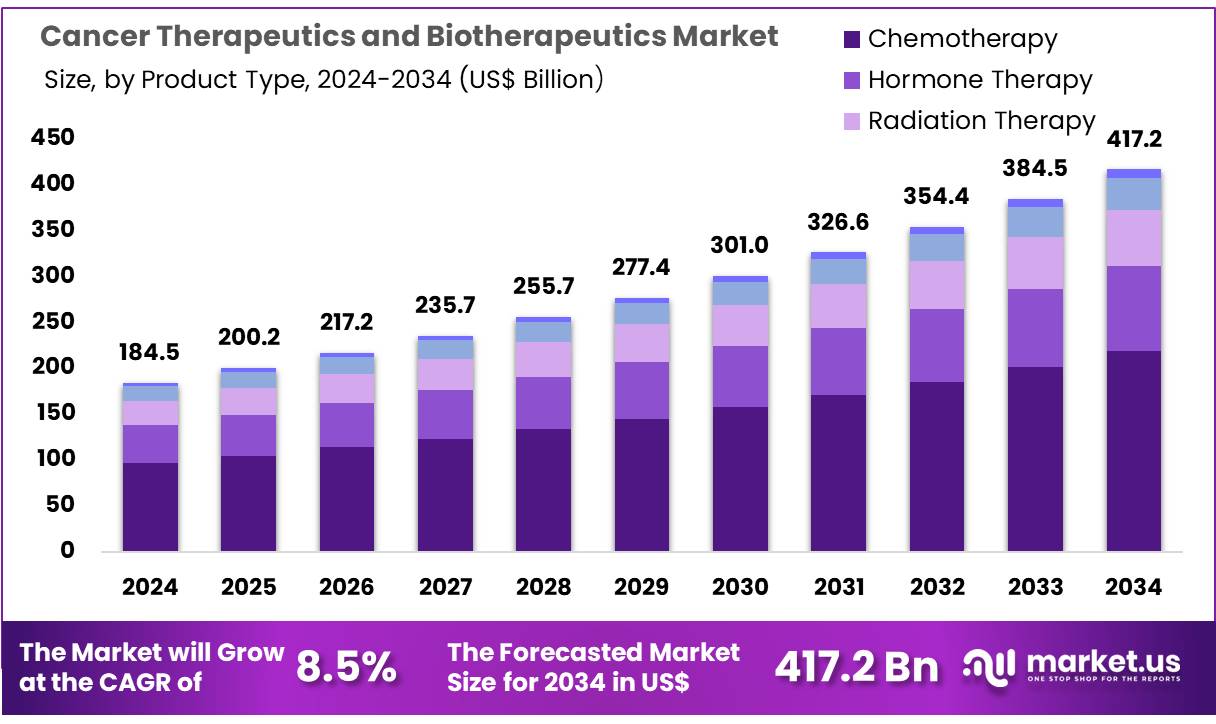

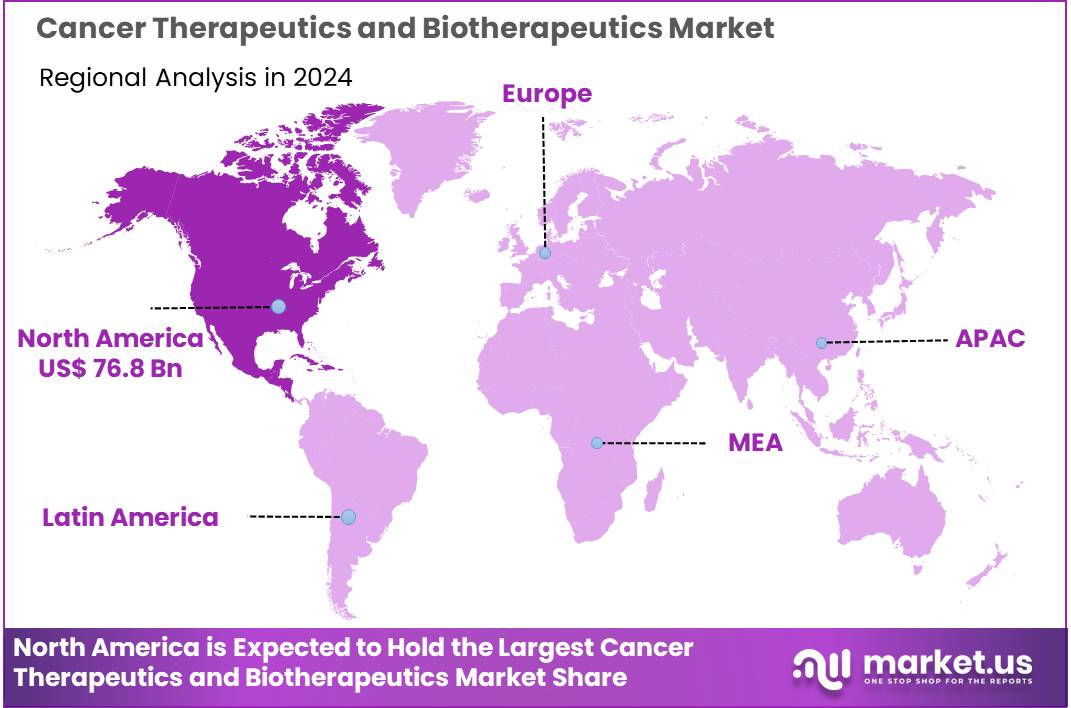

Global Cancer Therapeutics and Biotherapeutics Market size is expected to be worth around US$ 417.2 billion by 2034 from US$ 184.5 billion in 2024, growing at a CAGR of 8.5% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 41.6% share with a revenue of US$ 76.8 Billion.

Increasing advancements in cancer research and biotechnology are driving the rapid growth of the cancer therapeutics and biotherapeutics market. This market encompasses a wide range of innovative treatments, including immunotherapies, targeted therapies, and cell-based therapies, that aim to treat various cancer types more effectively and with fewer side effects. The rising prevalence of cancer worldwide, combined with the growing demand for personalized medicine, creates significant opportunities for novel cancer treatments.

In 2023, Merck & Co. gained FDA approval for its anti-PD-1 therapy, Keytruda, targeting microsatellite instability-high (MSI-H) or mismatch repair deficient (dMMR) solid tumors, demonstrating the continued progress in immuno-oncology. Additionally, in 2022, Bristol Myers Squibb secured FDA approval for Breyanzi, its CAR T-cell therapy, designed for patients with relapsed or refractory large B-cell lymphoma, highlighting the increasing role of cell-based therapies in cancer treatment.

Recent trends show an increasing focus on combination therapies, where different treatment modalities work together to enhance therapeutic efficacy. Moreover, advancements in biotherapeutics, including monoclonal antibodies and gene therapies, are unlocking new treatment possibilities.

The integration of artificial intelligence and machine learning in drug discovery and personalized cancer treatments presents further opportunities for market growth, improving the speed and precision of therapeutic development. As the cancer therapeutics market continues to evolve, biotherapeutic innovations will likely remain central to transforming cancer care.

Key Takeaways

- In 2024, the market for cancer therapeutics and biotherapeutics generated a revenue of US$ 184.5 billion, with a CAGR of 8.5%, and is expected to reach US$ 417.2 billion by the year 2024.

- The product type segment is divided into chemotherapy, hormone therapy, radiation therapy, biotherapy, and others, with chemotherapy taking the lead in 2024 with a market share of 52.4%.

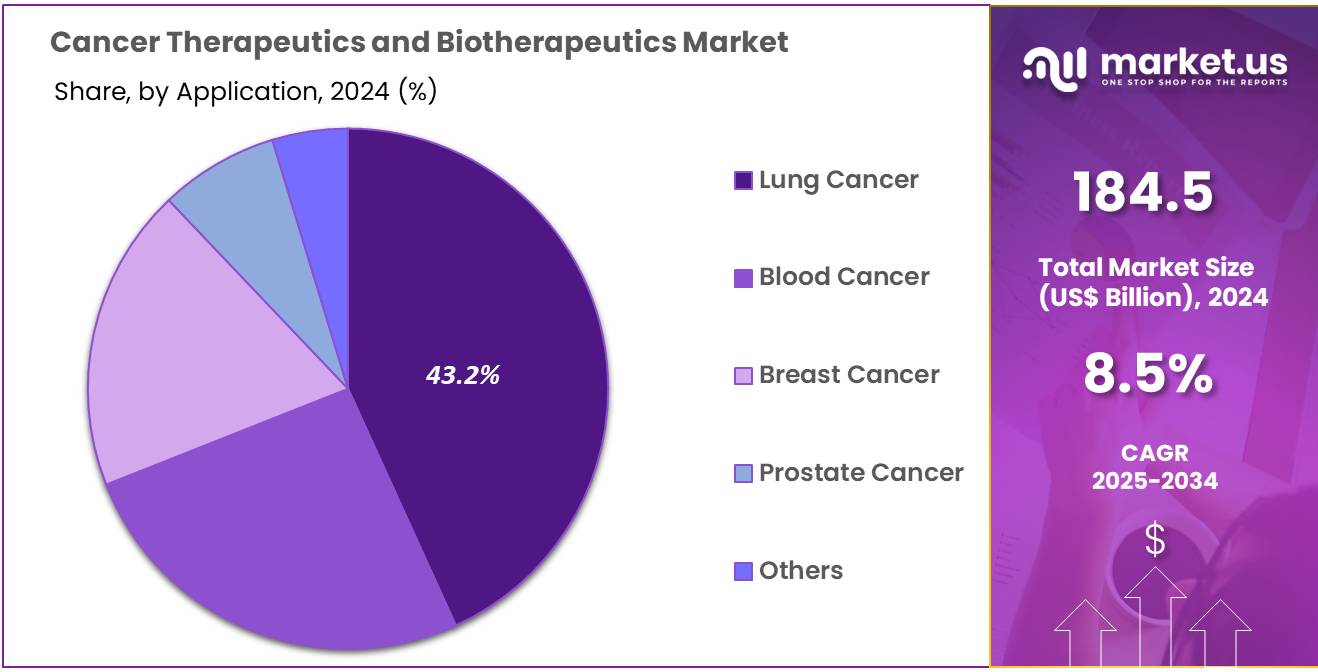

- Considering application, the market is divided into lung cancer, blood cancer, breast cancer, prostate cancer, and others. Among these, lung cancer held a significant share of 43.2%.

- Furthermore, concerning the end-use segment, the market is segregated into hospital, ASC, and others. The hospital sector stands out as the dominant player, holding the largest revenue share of 61.3% in the cancer therapeutics and biotherapeutics market.

- North America led the market by securing a market share of 41.6% in 2024.

Product Type Analysis

The chemotherapy segment led in 2023, claiming a market share of 52.4% owing to its long-standing role in the treatment of various cancer types. Chemotherapy remains a cornerstone of cancer treatment, particularly for solid tumors and hematologic malignancies. The increasing prevalence of cancer worldwide, combined with advancements in chemotherapy regimens and supportive care, is likely to drive demand for this therapeutic approach.

Chemotherapy is anticipated to be used in combination with other therapies, such as immunotherapy and targeted therapy, to enhance efficacy and reduce resistance. The development of novel chemotherapeutic agents with improved efficacy and reduced side effects is projected to further propel this segment’s growth. Additionally, the growing focus on personalized treatment plans for cancer patients is expected to increase the use of chemotherapy in specific patient populations.

Application Analysis

The lung cancer held a significant share of 43.2% due to the increasing incidence of lung cancer globally. Lung cancer remains one of the leading causes of cancer-related deaths, and the rising prevalence of smoking, as well as environmental factors such as pollution, are likely to contribute to the demand for more effective therapies.

The advancements in targeted therapies and immunotherapies for non-small cell lung cancer (NSCLC) are expected to drive the market growth for lung cancer treatments. As the focus on precision medicine increases, personalized therapies targeting specific genetic mutations in lung cancer are anticipated to improve treatment outcomes, further fueling the growth of this segment. Additionally, the increasing approval of new drugs and therapies for lung cancer is projected to accelerate the market’s expansion.

End-Use Analysis

The hospital segment had a tremendous growth rate, with a revenue share of 61.3% owing to the increasing number of cancer patients requiring advanced treatment options. Hospitals are likely to remain the primary setting for the administration of cancer therapies, including chemotherapy, immunotherapy, and radiation therapy. The growing complexity of cancer treatments and the need for specialized care in administering these therapies are anticipated to drive demand for hospital-based treatment.

Additionally, as the healthcare infrastructure expands and more hospitals integrate cutting-edge cancer therapies, the number of patients seeking treatment in hospitals is expected to rise. The rising trend of comprehensive cancer care centers within hospitals, where multidisciplinary teams provide personalized treatment plans, is projected to further contribute to the growth of this segment. The increasing adoption of advanced diagnostic and therapeutic technologies in hospitals is also expected to drive the segment’s expansion.

Key Market Segments

By Product Type

- Chemotherapy

- Hormone Therapy

- Radiation Therapy

- Biotherapy

- Others

By Application

- Lung Cancer

- Blood Cancer

- Breast Cancer

- Prostate Cancer

- Others

By End-use

- Hospital

- ASC

- Others

Drivers

Increase in the Number of Clinical Trials Driving the Cancer Therapeutics and Biotherapeutics Market

Increasing numbers of clinical trials are anticipated to drive the cancer therapeutics and biotherapeutics market significantly. The American Society of Clinical Oncology reported in 2021 that over 2,500 biologics and immunotherapies are under clinical trials globally. These trials facilitate innovation, enhance therapeutic options, and accelerate the development of advanced treatments. Successful regulatory approvals stemming from these trials are projected to expand the availability of life-saving products in the market.

Pharmaceutical companies continue to prioritize investment in trials focusing on immunotherapies and targeted therapies. The rising global burden of cancer fuels demand for innovative solutions, pushing the market toward more diverse therapeutic options. These trials also provide data essential for optimizing patient outcomes, advancing precision medicine. Collaboration between research organizations, healthcare providers, and pharmaceutical firms strengthens trial success rates.

Expanding patient participation in trials further supports robust clinical data generation, essential for regulatory approvals. Emerging markets show growing involvement in oncology trials, enhancing accessibility to groundbreaking therapies. Increased government funding and public-private partnerships are fostering trial proliferation, improving overall industry growth. This trend underscores the critical role of clinical trials in shaping the future of cancer therapeutics and biotherapeutics.

Restraints

High Costs Are Restraining the Cancer Therapeutics and Biotherapeutics Market

High costs of development and commercialization of cancer therapeutics and biotherapeutics are restraining the market. Developing innovative treatments requires significant investment in research, clinical trials, and regulatory compliance. These expenses increase the price of therapies, limiting accessibility for patients in low- and middle-income regions. High manufacturing costs, especially for biologics and immunotherapies, contribute to elevated treatment expenses.

Insurance coverage gaps and limited reimbursement policies further burden patients and healthcare providers. Small and medium-sized enterprises face challenges in competing due to the high financial requirements for developing new products. Regulatory hurdles, including stringent approvals and long timelines, exacerbate cost challenges. Addressing these barriers requires innovative approaches to cost reduction and streamlining the commercialization process to ensure broader adoption.

Opportunities

High Rate of Approval of Novel Therapies as an Opportunity for the Cancer Therapeutics and Biotherapeutics Market

High rates of approval for novel therapies present a significant opportunity for the cancer therapeutics and biotherapeutics market. In 2023, the US Food and Drug Administration approved 13 new cancer therapies, accounting for 24% of total drug approvals that year. This surge in approvals highlights growing innovation in oncology, particularly in immunotherapies and targeted treatments.

Pharmaceutical companies leverage these approvals to expand their product portfolios and cater to unmet clinical needs. Accelerated regulatory pathways for breakthrough therapies enhance market entry, promoting quicker adoption by healthcare providers. These advancements improve patient outcomes by offering more effective and personalized treatment options. Rising approval rates encourage increased investment in research and development, fueling further innovation in the sector.

Partnerships between biopharma companies and academic institutions expedite the translation of laboratory discoveries into approved treatments. Robust pipelines of promising candidates are likely to sustain the upward trend in approvals. Expanding access to newly approved therapies fosters competition, driving affordability and adoption. This dynamic reinforces the critical role of innovation in advancing the cancer therapeutics and biotherapeutics market, creating substantial growth opportunities.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the cancer therapeutics and biotherapeutics market. On the positive side, increasing healthcare investments and the growing global burden of cancer drive the demand for advanced treatments and therapies. Rising awareness of cancer and the push for personalized medicine further fuel the market’s growth.

However, economic downturns can result in reduced healthcare spending, affecting the affordability and accessibility of cutting-edge cancer treatments. Geopolitical tensions, such as trade disputes or regulatory changes, may disrupt the supply chain for essential components used in biotherapeutics production.

Moreover, stringent healthcare regulations and varying reimbursement policies across countries can create barriers to market entry. Despite these challenges, ongoing advancements in biotechnology, coupled with a global push for improved healthcare infrastructure, ensure long-term growth in the cancer therapeutics and biotherapeutics market.

Latest Trends

Growing Popularity of Cell Therapy Driving the Cancer Therapeutics and Biotherapeutics Market:

Rising popularity of cell therapy is significantly driving the cancer therapeutics and biotherapeutics market. High demand for more personalized and effective cancer treatments is expected to accelerate the adoption of cell-based therapies. Innovations in cell biology and genome engineering are likely to enhance the efficacy of these treatments, offering new hope for patients with various types of cancer.

In June 2023, Cambrian Bio introduced Telos Biotech, a subsidiary focused on advancing cell therapy innovations. Leveraging its expertise in cell biology and genome engineering, Telos Biotech aims to create more effective and versatile cell therapies to address a wide range of diseases and medical conditions. As the field of cell therapy continues to evolve, it is anticipated to play a pivotal role in transforming cancer treatment, further expanding the market’s potential.

Regional Analysis

North America is leading the Cancer Therapeutics and Biotherapeutics Market

North America dominated the market with the highest revenue share of 41.6% owing to advancements in immunotherapy, targeted therapies, and increasing investments in oncology research. The region’s healthcare system, coupled with growing awareness of cancer treatments, has spurred demand for novel therapies that offer more personalized and effective treatment options.

A key milestone in this growth was the FDA’s approval of 11 oncology drugs and biologics in 2023, specifically targeting pediatric cancer patients. This approval demonstrates a strong commitment to enhancing treatment options for younger populations, further supporting the expansion of the cancer therapeutics market.

Additionally, the rise in cancer incidences, along with the demand for cutting-edge biologic therapies, such as monoclonal antibodies and gene therapies, has contributed to the rapid market growth. The increasing focus on personalized medicine and precision oncology, along with the growing collaboration between pharmaceutical companies and research institutions, is expected to continue driving market expansion in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to a rising cancer burden, improving healthcare infrastructure, and increasing adoption of advanced treatment options. Countries such as China, India, and Japan are projected to experience significant growth in the market due to a growing focus on cancer treatment and research initiatives. The increasing prevalence of cancer in these countries, coupled with the need for innovative therapies, is likely to fuel demand for biotherapeutics.

As healthcare systems in the region continue to modernize, the adoption of advanced treatments such as immunotherapies, gene therapies, and targeted therapies is expected to rise. The development of novel biologic drugs by regional and global pharmaceutical companies, combined with government support for cancer research, is anticipated to propel market growth.

With the focus shifting towards more personalized and effective treatment regimens, the market for cancer therapeutics and biotherapeutics in Asia Pacific is likely to experience robust growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the cancer therapeutics and biotherapeutics market focus on strategies such as advancing immunotherapy and targeted therapy to improve treatment efficacy and patient outcomes. Companies prioritize R&D to develop innovative biologics and precision medicines for various cancer types. Strategic partnerships with pharmaceutical firms and research institutions accelerate drug development and clinical trials. Expansion into emerging markets with rising healthcare investments supports broader access to therapies. Many players also emphasize regulatory compliance and patient affordability to drive adoption and trust.

Roche Holding AG is a leading company in this market, known for its pioneering cancer treatments like Avastin and Tecentriq. The company integrates cutting-edge research with a strong focus on precision medicine to deliver effective therapies. Roche’s global presence and continuous investment in oncology innovations solidify its leadership in the field of cancer treatment.

Top Key Players

- Novartis

- Merck & Co Inc

- Genmab A/S

- EnGeneIC Ltd

- Celgene Corporation

- Bristol-Myers Squibb

- BridgeBio Oncology Therapeutics

- Amgen Inc

Recent Developments

- In May 2024, biotechnology investors provided US$ 200 million to support the spin-out of BridgeBio Pharma, now rebranded as BridgeBio Oncology Therapeutics. Formerly known as TheRas under BridgeBio, this new entity is dedicated to developing therapies targeting mutations in the KRAS gene, which are commonly found in colon, lung, and pancreatic cancers.

- In June 2021, Genmab A/S and Bolt Biotherapeutics, Inc. launched a collaboration focused on oncology research and development. The partnership combines Genmab’s expertise in antibodies and bispecific antibody engineering with Bolt’s Boltbody immune-stimulating antibody conjugate (ISAC) platform.

Report Scope

Report Features Description Market Value (2024) US$ 184.5 billion Forecast Revenue (2034) US$ 417.2 billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Chemotherapy, Hormone Therapy, Radiation Therapy, Biotherapy, and Others), By Application (Lung Cancer, Blood Cancer, Breast Cancer, Prostate Cancer, and Others), By End-use (Hospital, ASC, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novartis, Merck & Co Inc, Genmab A/S, EnGeneIC Ltd, Celgene Corporation, Bristol-Myers Squibb, BridgeBio Oncology Therapeutics, and Amgen Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cancer Therapeutics and Biotherapeutics MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Cancer Therapeutics and Biotherapeutics MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Novartis

- Merck & Co Inc

- Genmab A/S

- EnGeneIC Ltd

- Celgene Corporation

- Bristol-Myers Squibb

- BridgeBio Oncology Therapeutics

- Amgen Inc