Global Aerospace 3D Printing Market By Component(Hardware, Software, Services), By Technology(Selective Laser Melting (SLM), Electron Beam Melting (EBM), Direct Metal Laser Sintering (DMLS), Stereolithography (SLA), Other Technologies), By Application(Prototyping, Tooling, Functional Parts), By Material(Metal, Polymer (Plastic), Composite), By Platform(Aircraft, USVs, Spacecraft), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 17050

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

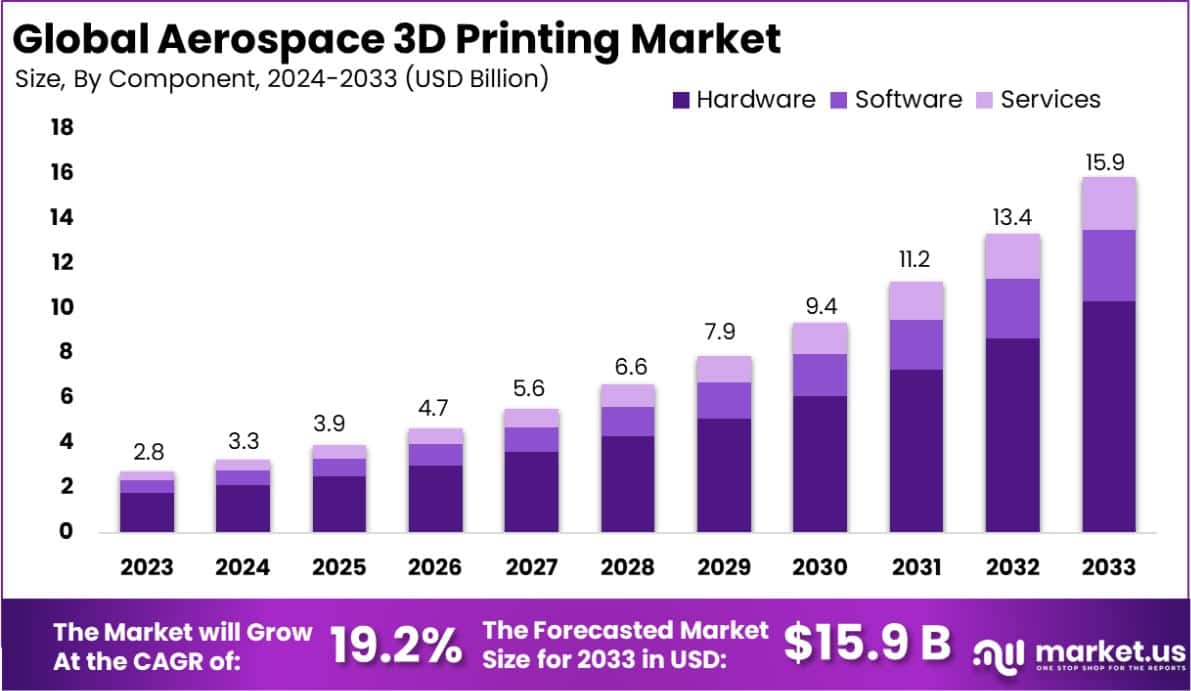

The Global Aerospace 3D Printing Market size is expected to be worth around USD 15.9 Billion By 2033, from USD 2.8 Billion in 2023, growing at a CAGR of 19.2% during the forecast period from 2024 to 2033. In 2023, North America led the Aerospace 3D Printing Market, capturing a 41% share and generating revenue of USD 1.12 Billion.

Aerospace 3D printing, also known as additive manufacturing, involves creating three-dimensional objects for aerospace applications by layering material according to digital blueprints. This technology is pivotal in manufacturing complex parts for aircraft and spacecraft at reduced costs and lead times.

The Aerospace 3D Printing Market is experiencing robust growth, driven by the increasing demand for lightweight and strong aircraft components. Airlines and space agencies are continuously seeking ways to reduce fuel consumption and increase efficiency, which significantly boosts the adoption of 3D printing technologies.

The market’s expansion is fueled by advancements in 3D printing technologies, supportive government initiatives for aerospace innovations, and the growing need for cost-effective small-batch production and prototyping.

Significant opportunities lie in developing high-performance materials suited for aerospace needs and in the expansion of 3D printing applications in the military and commercial aerospace sectors.

The Aerospace 3D Printing Market is poised for significant growth, driven by advancements in additive manufacturing technologies and substantial investments from key global players. The market’s expansion is further fueled by the increasing demand for lightweight and complex aerospace components that leverage 3D printing for cost efficiency and reduced time-to-market.

Recent strategic initiatives underscore the market’s robust trajectory. According to hdr.undp.org, the Chinese government has earmarked $100 million in 2023 to establish a national center dedicated to aerospace 3D printing research and development. This initiative aims to catalyze innovation and fortify China’s position in the global aerospace sector. Additionally, as reported by additive manufacturing.media, there is a provision of nearly $12 million in research grants aimed at enhancing additive manufacturing.

This funding is targeted at developing new materials and technologies specific to aerospace applications, indicating a strong commitment to advancing the core capabilities of the industry. These investments not only signify a bullish outlook for the market but also pave the way for groundbreaking developments in aerospace manufacturing processes.

Key Takeaways

- The Global Aerospace 3D Printing Market size is expected to be worth around USD 15.9 Billion By 2033, from USD 2.8 Billion in 2023, growing at a CAGR of 19.2% during the forecast period from 2024 to 2033.

- In 2023, Hardware held a dominant market position in the By Component segment of Aerospace 3D Printing Market, capturing more than a 64.8% share.

- In 2023, Selective Laser Melting (SLM) held a dominant market position in the By Technology segment of Aerospace 3D Printing Market, capturing more than a 47.5% share.

- In 2023, Prototyping held a dominant market position in the By Application segment of Aerospace 3D Printing Market, capturing more than a 54.2% share.

- In 2023, Metal held a dominant market position in the By Material segment of Aerospace 3D Printing Market, capturing more than a 58.7% share.

- In 2023, Aircraft held a dominant market position in the By Platform segment of Aerospace 3D Printing Market, capturing more than a 59.4% share.

- North America dominated a 41% market share in 2023 and held USD 1.12 Billion in revenue from the Aerospace 3D Printing Market.

By Component Analysis

In 2023, Hardware held a dominant market position in the By Component segment of the Aerospace 3D Printing Market, capturing more than a 64.8% share. This substantial market share is attributed to the increasing adoption of 3D-printed components for critical aerospace applications, including engine parts and structural components. The need for lightweight and high-strength materials that reduce aircraft weight and enhance fuel efficiency has driven significant investment into developing specialized 3D printing hardware.

Software, the second largest segment, accounted for around 22.3% of the market. The growth in this segment is fueled by advancements in software solutions that enable more precise and efficient design capabilities, simulation, and testing of aerospace components before printing, reducing material waste and improving product performance.

Lastly, Services contributed 12.9% to the market share. This segment includes on-demand printing services, after-sales support, and maintenance. The growth in services is linked to the increasing outsourcing of 3D printing requirements by aerospace companies focusing on core competencies, paired with the expansion of service offerings by 3D printing companies to include full lifecycle support.

By Technology Analysis

In 2023, Selective Laser Melting (SLM) held a dominant market position in the By Technology segment of the Aerospace 3D Printing Market, capturing more than a 47.5% share. SLM’s prominence is primarily due to its ability to produce high-density, complex structures essential for aerospace components, which demand precision and strength. This technology is highly favored for manufacturing critical parts such as turbine blades and structural components for aircraft and spacecraft.

Electron Beam Melting (EBM) followed, with a market share of 20.8%. EBM’s use in aerospace is growing due to its superior material properties, such as high fatigue resistance, making it ideal for high-stress components.

Direct Metal Laser Sintering (DMLS) accounted for 16.4% of the market. Its versatility in using various metal alloys makes it attractive for aerospace applications where material properties can be finely tuned for specific needs.

Stereolithography (SLA) garnered 9.3% of the market, appreciated for its high accuracy and smooth surface finish, suitable for creating detailed models and prototypes.

Other Technologies made up the remaining 6.0%, encompassing methods like Fused Deposition Modeling (FDM) and Laminated Object Manufacturing (LOM), which are selected based on specific application requirements.

By Application Analysis

In 2023, Prototyping held a dominant market position in the By Application segment of the Aerospace 3D Printing Market, capturing more than a 54.2% share. This segment’s dominance is attributed to the critical role of rapid prototyping in shortening design cycles and enhancing innovation in aerospace development. Prototyping allows for quick feedback and iterative design adjustments, crucial for high-stakes aerospace applications where performance and compliance with stringent standards are paramount.

Tooling accounted for 27.1% of the market. The growth in this segment is driven by the use of 3D printing to create complex tools that are otherwise difficult and expensive to manufacture using traditional methods. This not only reduces the cost and time involved in tool production but also allows for more customized and optimized tool designs.

Functional Parts made up 18.7% of the market share, demonstrating growing confidence in 3D printing technologies to meet the operational requirements of finished aerospace components. This segment is expanding as the materials and processes continue to advance, allowing for the production of parts that meet the rigorous safety and performance criteria of the aerospace industry.

By Material Analysis

In 2023, Metal held a dominant market position in the By Material segment of the Aerospace 3D Printing Market, capturing more than a 58.7% share. This leadership is largely due to the essential role of metals in aerospace manufacturing, particularly in producing high-strength, durable components such as engine parts and structural elements. Metals like titanium and aluminum are preferred for their lightweight and high-performance characteristics, which are critical in achieving fuel efficiency and safety standards in aerospace applications.

Polymer (Plastic) materials accounted for 24.6% of the market. Polymers are increasingly used in non-structural aerospace components like cabin interiors due to their versatility and ability to reduce overall aircraft weight. Advances in polymer technology, including high-temperature and high-strength plastics, continue to expand their applicability in more demanding aerospace roles.

Composite materials comprised 16.7% of the market share. Composites are valued for their exceptional strength-to-weight ratios and are used in both structural and non-structural aerospace parts. The ability to blend materials to achieve desired properties has made composites a growing choice for specialized applications where traditional materials may not suffice.

By Platform Analysis

In 2023, Aircraft held a dominant market position in the By Platform segment of the Aerospace 3D Printing Market, capturing more than a 59.4% share. This substantial market share underscores the integral role of 3D printing in modern aircraft manufacturing, where it is increasingly used to produce both structural and non-structural components. The technology’s ability to reduce weight, decrease material waste, and shorten production times has made it especially valuable in crafting complex, lightweight designs that are essential for enhancing aircraft performance and fuel efficiency.

Unmanned Surface Vehicles (USVs) accounted for 22.1% of the market. The use of 3D printing in USVs is growing due to its application in creating custom, lightweight parts that improve the endurance and functionality of these vehicles, which are used in military, research, and commercial applications.

Spacecraft represented 18.5% of the market share. The adoption of 3D printing in this segment is driven by the need for highly specialized components that can withstand the harsh conditions of space. The ability to print parts on-demand also offers potential for future long-duration space missions, where carrying numerous spare parts is impractical.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- Selective Laser Melting (SLM)

- Electron Beam Melting (EBM)

- Direct Metal Laser Sintering (DMLS)

- Stereolithography (SLA)

- Other Technologies

By Application

- Prototyping

- Tooling

- Functional Parts

By Material

- Metal

- Polymer (Plastic)

- Composite

By Platform

- Aircraft

- USVs

- Spacecraft

Drivers

Key Drivers in Aerospace 3D Printing

The Aerospace 3D Printing market is experiencing significant growth driven by a few key factors. Firstly, aerospace companies are continually seeking ways to reduce the weight of their aircraft to enhance fuel efficiency and performance.

3D printing, or additive manufacturing, allows for the creation of complex, lightweight structures that are otherwise impossible to produce using traditional methods. This capability not only helps in achieving weight reduction but also significantly cuts down on waste material, offering a more sustainable manufacturing option.

Additionally, the flexibility of 3D printing technologies accelerates the production process, enabling faster development and testing of new aerospace components. This rapid production capability is crucial for keeping pace with evolving aerospace design and manufacturing demands, thus pushing the market forward.

Restraint

Challenges in Aerospace 3D Printing

A major restraint in the aerospace 3D printing market is the high cost associated with implementing these technologies. Setting up 3D printing systems for aerospace applications involves substantial initial investments in high-quality printers and specialized materials, which can be a barrier for many companies, especially smaller ones or those in emerging markets.

Additionally, the aerospace industry requires parts that meet very stringent standards for reliability and performance. Ensuring that 3D printed components consistently meet these rigorous quality standards involves extensive testing and certification processes, which can be both time-consuming and expensive.

This challenge is compounded by the limited availability of materials suitable for high-performance aerospace applications, further slowing adoption and innovation within the sector.

Opportunities

Expanding Opportunities in Aerospace 3D Printing

The aerospace 3D printing market is ripe with opportunities, particularly in the development of new materials and the expansion into emerging markets. Innovations in printable materials that can withstand extreme temperatures and pressures are opening new applications within aerospace, from high-performance engine components to intricate cabin features.

This innovation attracts not only established aerospace giants but also startups and mid-sized companies eager to carve out niches. Furthermore, as countries around the world invest more in their aerospace capabilities, the demand for cost-effective, efficient manufacturing solutions like 3D printing grows.

This trend is particularly noticeable in regions with burgeoning aerospace sectors, offering a significant growth avenue for 3D printing technology providers. These dynamics suggest a thriving future for 3D printing in aerospace, driven by material innovations and geographic expansion.

Challenges

Key Hurdles in Aerospace 3D Printing

One of the primary challenges facing the aerospace 3D printing market is the stringent regulatory environment. Aerospace components are critical to safety and require rigorous testing and certification by various international authorities before they can be used.

This process can be lengthy and costly, slowing down the adoption of 3D printing technologies. Additionally, there’s a skills gap in the workforce. The high level of technical expertise required to design, operate, and maintain 3D printing equipment is not widely available, which can hinder the integration of these technologies into traditional aerospace manufacturing processes.

Moreover, the current speed of 3D printing processes may not meet the high-volume production demands of larger aerospace projects, posing further challenges to widespread adoption in the industry. These factors collectively underscore the complex hurdles that need navigating within this innovative field.

Growth Factors

Growth Drivers for Aerospace 3D Printing

The aerospace 3D printing market is set for robust growth, driven by several compelling factors. First, the technology’s ability to manufacture complex parts quickly and at a lower cost is a major draw for aerospace companies aiming to reduce production times and improve efficiency.

This efficiency is particularly valuable in producing lightweight components that significantly decrease aircraft weight and enhance fuel efficiency. Moreover, the ongoing advancements in 3D printing technologies and materials are broadening the range of applications, from small customized components to critical engine parts.

The increasing investment by major aerospace firms in 3D printing research and development also signals a strong industry commitment to integrate this technology more deeply into manufacturing processes. This growing adoption, fueled by technological advancements and industry investment, positions aerospace 3D printing as a key player in the future of aerospace manufacturing.

Emerging Trends

Trends Shaping Aerospace 3D Printing

Emerging trends in the aerospace 3D printing market are set to transform how aircraft and their components are manufactured. One of the most notable trends is the increasing use of metal 3D printing, which allows for stronger, lighter, and more durable components.

This shift is particularly beneficial for producing complex parts that traditional manufacturing struggles with, such as those with intricate internal structures. Additionally, there is a growing emphasis on sustainability, with the aerospace industry looking to 3D printing to reduce waste and improve energy efficiency during production.

Another trend is the integration of artificial intelligence with 3D printing processes, enhancing precision and reducing errors. These technological advancements are making 3D printing more accessible and practical, leading to its expanded use across a wider range of aerospace applications, signaling a significant shift towards more innovative manufacturing methods in the industry.

Regional Analysis

The Aerospace 3D Printing market is segmented into five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each exhibiting distinct growth dynamics and opportunities. North America leads the market with a dominant share of 41%, valued at USD 1.12 billion, driven by the presence of major aerospace manufacturers and high-tech innovation hubs, emphasizing advanced manufacturing technologies.

Europe follows, with robust growth propelled by increasing investments in aerospace R&D and supportive government policies aimed at enhancing the aerospace infrastructure.

Asia Pacific is witnessing rapid growth due to the expanding aerospace capabilities of countries like China and India, coupled with increasing investments in new aerospace projects and technology adoption. The Middle East & Africa, though smaller in comparison, are experiencing growth due to rising demand for new aircraft and modernization of existing fleets, particularly in Gulf countries.

Latin America, while still in nascent stages, shows potential for growth through regional carriers updating their fleets to more fuel-efficient models. This regional segmentation underlines the widespread adoption and integration of 3D printing technologies across the global aerospace sector, with North America remaining the market leader due to its advanced technological base and substantial investments in aerospace innovations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Aerospace 3D Printing market has been significantly shaped by the contributions and advancements from key players such as Ultimaker BV, ENVISIONTEC US LLC, and GE Additive, a subsidiary of General Electric Company.

Ultimaker BV has carved a niche for itself by providing user-friendly, cost-effective 3D printers that appeal to both small aerospace firms and educational institutions looking to train the next generation of aerospace engineers. Their focus on accessibility and community-driven innovation continues to support the widespread adoption of 3D printing technologies across various levels of the aerospace industry.

ENVISIONTEC US LLC stands out for its specialization in high-precision 3D printers, which are capable of producing very detailed and complex aerospace components that require meticulous accuracy. Their continuous innovation in photopolymerization technologies positions them as a valuable player in aerospace applications where material properties and surface finish are critical.

GE Additive, under the umbrella of General Electric, leverages its deep industry knowledge and financial resources to push the boundaries of metal 3D printing technologies. GE Additive’s focus on developing new aerospace-grade materials and high-throughput printers aims to meet the demanding standards of the aerospace industry, thereby driving the adoption of 3D printing in manufacturing critical, high-performance aerospace components. Collectively, these companies are pivotal in advancing aerospace applications of 3D printing, reflecting a strong trajectory for growth and innovation in the sector.

Top Key Players in the Market

- Stratasys Ltd

- 3D Systems Corporation

- Norsk Titanium AS

- Ultimaker BV

- ENVISIONTEC US LLC

- GE Additive (General Electric Company)

- EOS GmbH

- MATERIALSE NV

- Renishaw PLC

- TRUMPF SE + Co. KG

- OC Oerlikon Management AG

- Hoganas AB

- Other Key Players

Recent Developments

- In June 2023, Stratasys launched a new 3D printer designed specifically for aerospace needs, enhancing part precision and production speed.

- In May 2023, 3D Systems acquired a smaller 3D printing firm, expanding their material offerings for aerospace applications to improve component durability.

- In April 2023, Norsk Titanium secured an additional $30 million in funding to expand its production of aerospace-grade titanium parts, aiming to double its output capacity.

Report Scope

Report Features Description Market Value (2023) USD 2.8 Billion Forecast Revenue (2033) USD 15.9 Billion CAGR (2024-2033) 19.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component(Hardware, Software, Services), By Technology(Selective Laser Melting (SLM), Electron Beam Melting (EBM), Direct Metal Laser Sintering (DMLS), Stereolithography (SLA), Other Technologies), By Application(Prototyping, Tooling, Functional Parts), By Material(Metal, Polymer (Plastic), Composite), By Platform(Aircraft, USVs, Spacecraft) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stratasys Ltd, 3D Systems Corporation, Norsk Titanium AS, Ultimaker BV, ENVISIONTEC US LLC, GE Additive (General Electric Company), EOS GmbH, MATERIALSE NV, Renishaw PLC, TRUMPF SE + Co. KG, OC Oerlikon Management AG, Hoganas AB, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Aerospace 3D Printing?Aerospace 3D printing, also known as additive manufacturing, involves creating three-dimensional objects for aerospace applications by layering material according to digital blueprints. This technology is pivotal in manufacturing complex parts for aircraft and spacecraft at reduced costs and lead times.

How big is Aerospace 3D Printing Market?The Global Aerospace 3D Printing Market size is expected to be worth around USD 15.9 Billion By 2033, from USD 2.8 Billion in 2023, growing at a CAGR of 19.2% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Aerospace 3D Printing Market?The Aerospace 3D Printing market is growing due to its ability to create lightweight, complex structures, reduce waste, and speed up component development and testing.

What are the emerging trends and advancements in the Aerospace 3D Printing Market?The aerospace 3D printing market is evolving with metal printing, enhanced sustainability, and AI integration, driving more precise and efficient manufacturing across diverse applications.

What are the major challenges and opportunities in the Aerospace 3D Printing Market?The aerospace 3D printing market offers growth through new materials and market expansion but faces regulatory, skills, and speed challenges hindering its broader adoption.

Who are the leading players in the Aerospace 3D Printing Market?Stratasys Ltd, 3D Systems Corporation, Norsk Titanium AS, Ultimaker BV, ENVISIONTEC US LLC, GE Additive (General Electric Company), EOS GmbH, MATERIALSE NV, Renishaw PLC, TRUMPF SE + Co. KG, OC Oerlikon Management AG, Hoganas AB, Other Key Players

Aerospace 3D Printing MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample

Aerospace 3D Printing MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Stratasys Ltd

- 3D Systems Corporation

- Norsk Titanium AS

- Ultimaker BV

- ENVISIONTEC US LLC

- GE Additive (General Electric Company)

- EOS GmbH

- MATERIALSE NV

- Renishaw PLC

- TRUMPF SE + Co. KG

- OC Oerlikon Management AG

- Hoganas AB

- Other Key Players