Global Robot Software Market By Software Type (Recognition Software, Data Management and Analysis Software, Communication Management Software, Simulation Software, Predictive Maintenance Software), By Robot Type (Industrial Robots (Articulated Robots, SCARA Robots, Cartesian Robots, Others), Service Robots), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Industry Vertical(Manufacturing, Healthcare, Aerospace & Defense, Retail, Logistics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 113382

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

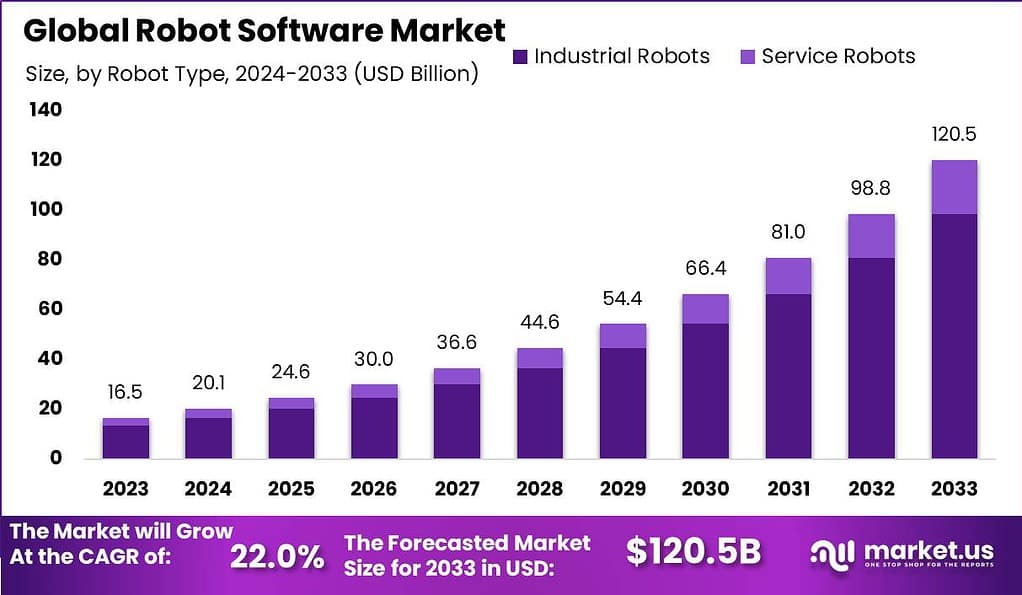

The Global Robot Software Market size is expected to be worth around USD 120.5 Billion by 2033, from USD 16.5 Billion in 2023, growing at a CAGR of 22.0% during the forecast period from 2024 to 2033.

Robot software refers to the collection of programs, algorithms, and tools that enable the operation, control, and programming of robots. It serves as the brain behind the physical robot, allowing it to perform various tasks and interact with its environment. Robot software encompasses a wide range of functionalities, including robot motion control, perception, planning, and communication. It provides the necessary instructions and algorithms for the robot to execute specific actions, adapt to changing conditions, and interact with humans or other machines.

The robot software market has witnessed substantial growth in recent years, driven by the increasing adoption of robotic solutions across various sectors. This market encompasses the sale and development of software solutions tailored for robots, including industrial robots, service robots, and autonomous vehicles. Factors contributing to the growth of the robot software market include the rising demand for automation, advancements in artificial intelligence and machine learning, and the expansion of applications in manufacturing, healthcare, logistics, and agriculture.

Key Takeaways

- The Robot Software Market is expected to reach a valuation of USD 120.5 Billion by 2033, with a remarkable Compound Annual Growth Rate (CAGR) of 22.0% from 2024 to 2033. This indicates significant growth opportunities within the industry.

- In 2023, Data Management and Analysis Software emerged as a dominant force in the robot software market, capturing over 36.0% market share. This software segment is crucial for efficient robot functioning, data-driven decision-making, and predictive maintenance.

- In 2023, the Industrial Robots segment dominated the robot software market, capturing over 82% market share. Industries like automotive, electronics, aerospace, and food and beverage heavily rely on industrial robots for automation, precision, and efficiency.

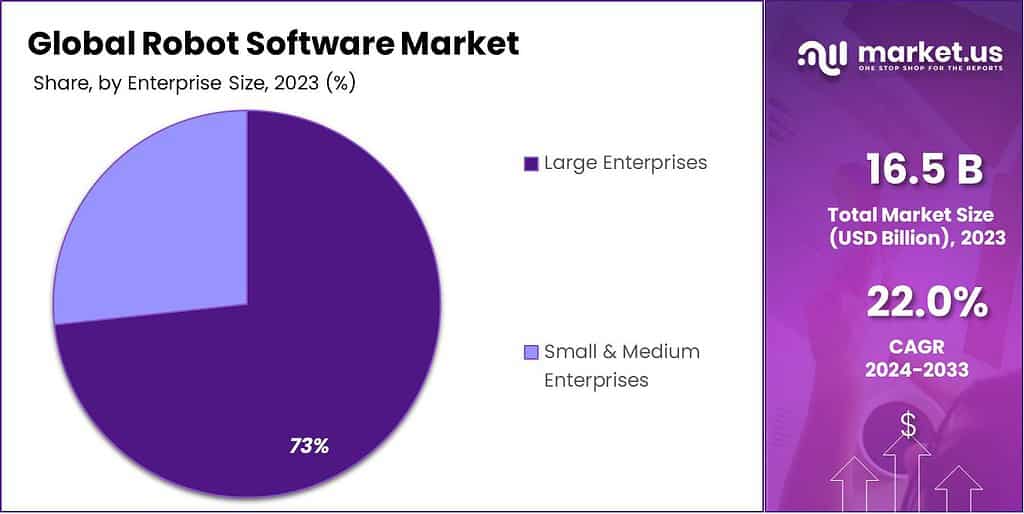

- Large Enterprises held a significant market share of over 75% in 2023. They are more inclined to invest in robot software due to their complex operations, higher production volumes, and financial capabilities.

- The Manufacturing segment emerged as the dominant force in the robot software market in 2023, capturing over 78% market share. This industry leverages robot software to optimize production processes and achieve higher levels of automation.

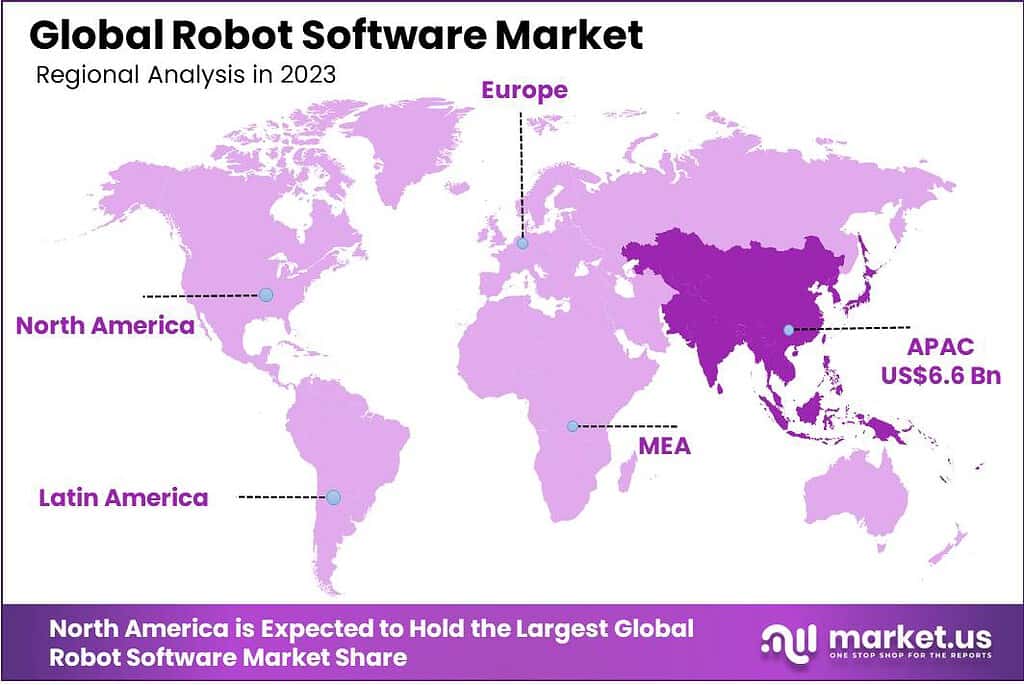

- In 2023, APAC (Asia-Pacific) held a dominant market position with more than 40% market share. Key factors contributing to APAC’s strong position include manufacturing hubs, investments in R&D, and rising demand for automation.

- Major players in the robot software market include ABB Ltd., Clearpath Robotics, NVIDIA Corporation, CloudMinds Technology Inc., and others. These players are at the forefront of innovation, competition, and market evolution.

Software Type

In 2023, the Data Management and Analysis Software segment emerged as a dominant force in the robot software market, capturing a significant market share of over 36.0%.

This segment’s strong position can be attributed to several key factors driving its growth and adoption. Data Management and Analysis Software plays a crucial role in the efficient functioning of robots by handling and processing vast amounts of data collected during their operations. Robots generate a substantial volume of data through various sensors and actuators, and this software enables the effective management, organization, and analysis of this data.

One of the primary reasons for the dominance of the Data Management and Analysis Software segment is the increasing emphasis on data-driven decision-making in robotics. The software enables users to extract valuable insights from the collected data, facilitating better understanding and optimization of robot performance. This data-driven approach empowers businesses to enhance operational efficiency, identify areas for improvement, and make informed strategic decisions.

Moreover, data management and analysis software also facilitates predictive maintenance, which is a critical aspect of ensuring the longevity and reliability of robotic systems. By analyzing data patterns and trends, this software can anticipate potential issues or failures, allowing proactive maintenance and minimizing downtime. This capability translates into cost savings for businesses and improves overall productivity.

Furthermore, the growing adoption of artificial intelligence (AI) and machine learning (ML) technologies in robotics has further propelled the demand for Data Management and Analysis Software. These advanced analytics techniques enable robots to learn from data, adapt to changing environments, and make intelligent decisions. As AI and ML continue to advance, the need for sophisticated data management and analysis software will only increase.

Robot Type Analysis

In 2023, the Industrial Robots segment emerged as the dominant market force in the robot software market, capturing a significant market share of over 82%. This segment’s strong position can be attributed to several key factors driving its growth and widespread adoption.

Industrial robots, including articulated robots, SCARA robots, Cartesian robots, and others, are extensively used in manufacturing and industrial processes to automate repetitive and complex tasks. These robots offer high precision, speed, and efficiency, enabling businesses to enhance productivity, improve product quality, and reduce labor costs.

The dominance of the Industrial Robots segment can be primarily attributed to the substantial demand for automation in industries such as automotive, electronics, aerospace, and food and beverage. These sectors rely heavily on industrial robots to streamline production processes, achieve consistent output, and meet the growing consumer demand for high-quality products.

Moreover, the increasing focus on operational efficiency and competitiveness has led to the wider adoption of industrial robots. These robots are capable of performing tasks with high accuracy and repeatability, leading to improved production throughput and reduced errors. The integration of robot software with industrial robots enhances their functionality, enabling tasks such as motion control, trajectory planning, and sensor integration.

Furthermore, advancements in robot software, including sophisticated programming interfaces, intuitive user interfaces, and simulation capabilities, have contributed to the dominance of the Industrial Robots segment. These software solutions simplify the programming and operation of industrial robots, making them more accessible to a broader range of users, including non-experts. The ease of use and flexibility offered by robot software have accelerated the deployment of industrial robots in various applications.

Additionally, the ongoing research and development activities in the field of robotics, particularly in industrial automation, continue to drive the growth of the Industrial Robots segment. Manufacturers are constantly striving to develop more advanced and intelligent industrial robots that can adapt to dynamic environments, collaborate with humans, and perform complex tasks. These advancements rely heavily on robust and sophisticated software solutions.

Enterprise Size Analysis

In 2023, the Large Enterprises segment emerged as the dominant market force in the robot software market, capturing a significant market share of over 75%.

This segment’s strong position can be attributed to several key factors driving its growth and prominence. Large enterprises, with their extensive resources and capabilities, have been at the forefront of adopting advanced technologies such as robotics and automation. These enterprises often have complex operations and higher production volumes, making them more inclined to invest in robotic systems to improve productivity, efficiency, and cost-effectiveness.

The dominance of the Large Enterprises segment can be primarily attributed to the scale of operations and the need for process optimization. Large enterprises typically have multiple production lines, warehouses, and facilities, which require sophisticated robot software to coordinate and manage various tasks. The integration of software solutions allows them to control and monitor robot operations, ensure smooth coordination between multiple robots, and optimize overall production processes.

Moreover, large enterprises have the financial capability to invest in advanced robot software solutions, which often come with higher costs due to their complexity and customization requirements. These enterprises can allocate significant budgets for research and development, enabling them to leverage cutting-edge technologies and stay ahead of the competition. The availability of resources ensures that large enterprises can acquire and implement the most suitable and robust robot software solutions for their specific needs.

Additionally, large enterprises often have dedicated teams or departments focusing on robotics and automation. These teams have the expertise and knowledge to identify and implement the right robot software solutions for their operations. The ability to leverage in-house expertise and collaborate with software developers and integrators further strengthens the dominance of large enterprises in the robot software market.

Furthermore, large enterprises have established supply chains and extensive networks, allowing them to integrate robot software seamlessly into their existing infrastructure. They can leverage their strong relationships with suppliers, system integrators, and technology partners to deploy and integrate robot software at scale. This integration provides them with a competitive advantage, enabling streamlined operations, improved quality control, and enhanced customer satisfaction.

Industry Vertical

In 2023, the Manufacturing segment emerged as the dominant force in the robot software market, capturing a significant market share of over 78%.

This segment’s strong position can be attributed to several key factors driving its growth and prominence. The manufacturing industry has been at the forefront of adopting robotic systems and automation to improve productivity, operational efficiency, and product quality. With the increasing demand for high-volume production, consistency, and precision, manufacturers are leveraging robot software to optimize their production processes.

The dominance of the Manufacturing segment can be primarily attributed to the widespread use of industrial robots in manufacturing operations. Industrial robots offer capabilities such as assembly, material handling, welding, painting, and quality inspection, which are vital in streamlining manufacturing processes. The integration of robust and advanced software solutions enhances the functionality of these robots, enabling seamless coordination, precise control, and efficient utilization across production lines.

Moreover, the manufacturing industry has witnessed significant advancements in robot software, including machine learning, computer vision, and AI-based algorithms. These technologies enable robots to adapt to changing production environments, learn from data, and perform complex tasks with minimal human intervention. The integration of such intelligent software solutions has revolutionized manufacturing processes, allowing manufacturers to achieve higher levels of automation and optimize their operations.

Furthermore, the manufacturing sector’s focus on lean manufacturing, just-in-time production, and continuous process improvement has further fueled the demand for robot software. Manufacturers are constantly seeking ways to eliminate waste, optimize resource utilization, and enhance product quality. Robot software plays a crucial role in achieving these goals by enabling data-driven decision-making, predictive maintenance, and real-time monitoring of production processes.

Key Market Segments

Software Type

- Recognition Software

- Data Management and Analysis Software

- Communication Management Software

- Simulation Software

- Predictive Maintenance Software

By Robot Type

- Industrial Robots

- Articulated Robots

- SCARA Robots

- Cartesian Robots

- Others

- Service Robots

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Industry Vertical

- Manufacturing

- Healthcare

- Aerospace & Defense

- Retail

- Logistics

- Others

Driver

Increasing demand for automation and robotics across various industries

The primary driver for the Robot Software market is the escalating demand for automation and robotics solutions across a wide spectrum of industries. Businesses are increasingly recognizing the benefits of incorporating robots into their operations to enhance efficiency and productivity. This demand is particularly prominent in manufacturing, logistics, healthcare, and agriculture, where robots can perform repetitive tasks with precision and consistency.

The desire to reduce labor costs, minimize errors, and improve operational speed is propelling the adoption of robot software. As industries strive to remain competitive and responsive to evolving consumer expectations, the need for advanced software to control and optimize robotic systems continues to grow.

Restraint

Complexity and customization requirements

A significant restraint in the Robot Software market is the complexity and customization requirements associated with implementing robot software. Each industry and even individual businesses within those industries may have unique needs and workflows. Tailoring robot software to suit these specific requirements can be intricate and time-consuming. This complexity can lead to higher initial implementation costs and longer deployment times.

Moreover, businesses often need specialized expertise to configure and maintain these customized solutions. Balancing the need for customization with cost-effectiveness presents a considerable challenge in the adoption of robot software.

Opportunity

Advancements in artificial intelligence (AI) and machine learning (ML)

An exciting opportunity in the Robot Software market lies in the continuous advancements in artificial intelligence (AI) and machine learning (ML) technologies. These innovations enable robot software to evolve beyond traditional programming and become more adaptable and intelligent.

AI and ML algorithms empower robots to learn from their environment, make real-time decisions, and handle complex, unstructured tasks. This opens up new possibilities for robots in industries such as healthcare, where they can assist with diagnostics and surgery, and in logistics, where they can optimize supply chain operations. The integration of AI and ML into robot software creates opportunities for companies to develop more capable and versatile robotic solutions, driving market growth.

Challenge

Security and safety of robot systems

One of the key challenges in the Robot Software market is ensuring the security and safety of robot systems. As robots become more interconnected and data-driven, they become potential targets for cyberattacks.

Ensuring the integrity of robot operations and the confidentiality of sensitive data is crucial. Additionally, safety concerns arise when robots work alongside humans in collaborative environments. Ensuring that robots are programmed to operate safely and effectively without endangering human workers is a critical challenge. Striking the right balance between functionality, security, and safety remains a complex task in the development and deployment of robot software. Addressing these challenges will be essential to building trust in the technology and fostering its widespread adoption.

Regional Analysis

In 2023, APAC (Asia-Pacific) held a dominant market position in the Robot Software market, capturing more than a 40% share. The region’s strong market position can be attributed to several factors. Firstly, APAC is home to some of the world’s largest manufacturing hubs, such as China, Japan, and South Korea, which have been early adopters of robotics and automation technologies.

The demand for Robot Software in APAC was valued at US$ 6.6 billion in 2023 and is anticipated to grow significantly in the forecast period. The increasing demand for automation in industries such as automotive, electronics, and logistics has been a key driver for the Robot Software market in APAC.

Furthermore, the region has witnessed significant investments in research and development, particularly in countries like China and Japan, which have propelled technological advancements in robotics and AI. This has created a favorable environment for the growth of the Robot Software market in APAC.

In addition, the rising population and urbanization in APAC have led to increased labor costs, driving the need for automation and robotics to improve productivity and efficiency. The governments in the region have also been supportive of initiatives promoting the adoption of robotics and automation, providing incentives and creating favorable policies that further boost the Robot Software market.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Robot Software market, a critical aspect of our analysis revolves around the examination of key players who wield substantial influence and drive the industry’s growth. These major players are the linchpins of innovation, competition, and market evolution.

One of the foremost entities in this arena is the ABB Group, renowned for its cutting-edge robotics and automation solutions. ABB’s expansive product portfolio and global reach establish it as a dominant force in the market.

Top Key Players

- ABB Ltd.

- Clearpath Robotics

- NVIDIA Corporation

- CloudMinds Technology, Inc.

- Liquid Robotics, Inc.

- Brain Corporation

- International Business Machines Corporation

- Energid Technologies Corporation

- IBrain Inc.

- Furhat Corporation

- Other key players

Recent Developments

In 2023, Clearpath Robotics:

- Released Baxter 8 SE: An update to their Baxter cobot with improved safety features and performance.

- Focused on educational and research applications: Partnered with universities and research institutions to develop cobot-based learning experiences.

In 2023, NVIDIA Corporation:

- Introduced Isaac Sim robotics platform: Provides a simulated environment for developing and testing cobot applications.

- Focused on AI and edge computing for cobots: Enabling advanced capabilities like vision-based object recognition and autonomous navigation.

In 2023, CloudMinds Technology, Inc.:

- Released CloudCobot Pro 6M: A cobot with a 6 kg payload and advanced vision capabilities.

- Focused on cloud-based cobot solutions: Offering remote monitoring, management, and data analytics for cobots.

Report Scope

Report Features Description Market Value (2023) US$ 16.5 Bn Forecast Revenue (2033) US$ 120.5 Bn CAGR (2024-2033) 22% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Software Type (Recognition Software, Data Management and Analysis Software, Communication Management Software, Simulation Software, Predictive Maintenance Software), By Robot Type (Industrial Robots (Articulated Robots, SCARA Robots, Cartesian Robots, Others), Service Robots), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Industry Vertical(Manufacturing, Healthcare, Aerospace & Defense, Retail, Logistics, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ABB Ltd., Clearpath Robotics, NVIDIA Corporation, CloudMinds Technology Inc., Liquid Robotics Inc., Brain Corporation, International Business Machines Corporation, Energid Technologies Corporation, IBrain Inc., Furhat Corporation, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Robot Software?Robot Software refers to the set of programs, algorithms, and applications that control and enable the functioning of robots. It encompasses the software systems responsible for robot programming, operation, and communication.

How big is Robot Software Industry?The Global Robot Software Market size is expected to be worth around USD 120.5 Billion by 2033, from USD 16.5 Billion in 2023, growing at a CAGR of 22.0% during the forecast period from 2024 to 2033.

Who are the key players in Robot Software Market?ABB Ltd., Clearpath Robotics, NVIDIA Corporation, CloudMinds Technology Inc., Liquid Robotics Inc., Brain Corporation, International Business Machines Corporation, Energid Technologies Corporation, IBrain Inc., Furhat Corporation, Other key players are the major companies operating in the Robot Software Market.

Which is the fastest growing region in Robot Software Market?In 2023, APAC (Asia-Pacific) held a dominant market position in the Robot Software market, capturing more than a 40% share.

What are the challenges facing the Robot Software Market?Challenges include the need for standardization in programming interfaces, addressing security concerns related to connected robots, and ensuring compatibility between software and diverse robotic hardware.

-

-

- ABB Ltd.

- Clearpath Robotics

- NVIDIA Corporation

- CloudMinds Technology, Inc.

- Liquid Robotics, Inc.

- Brain Corporation

- International Business Machines Corporation

- Energid Technologies Corporation

- IBrain Inc.

- Furhat Corporation

- Other key players