Global Adaptive Steering Market Size, Share, Growth Analysis By Type (Electric Power Steering, Hydraulic Power Steering, Electric Hydraulic Power Steering), By Application (Lane Keeping Assist System, Park Assist, Adaptive Cruise Control, Vehicle Stability Control, Collision Avoidance Systems, Others), By Sales Channel (OEM, Aftermarket), By Vehicle (Passenger Vehicles, Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154771

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

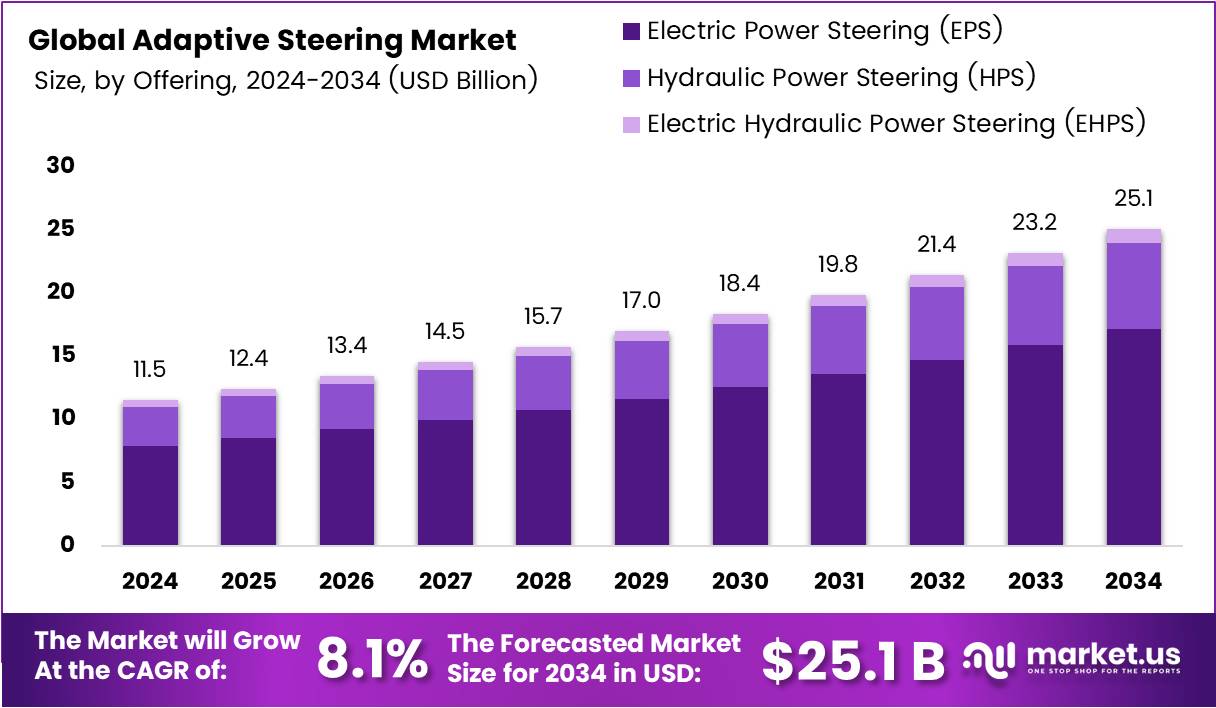

The Global Adaptive Steering Market size is expected to be worth around USD 25.1 Billion by 2034, from USD 11.5 Billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034.

The Adaptive Steering Market refers to a segment within the automotive steering systems industry where steering behavior is dynamically adjusted based on vehicle speed or driving conditions. Adaptive steering enhances driving comfort and control by changing the steering ratio. This technology is especially beneficial in passenger cars, premium vehicles, and electric vehicles.

Adaptive steering systems are gaining momentum due to the rise in advanced driver assistance systems (ADAS). As more automakers push toward semi-autonomous features, adaptive steering becomes a necessary enhancement. OEMs are integrating this feature to improve vehicle stability and reduce driver fatigue, especially in urban traffic and tight turns.

Moreover, rising consumer expectations around smart driving technologies further support adoption. Vehicles equipped with adaptive steering offer improved lane control and driving precision. This growing preference is pushing Tier 1 suppliers to invest in R&D, driving the market forward. As a result, companies are developing compact and lightweight steering modules.

Globally, the market is expanding due to safety regulations and emission targets. Regions like North America, Europe, and Asia-Pacific are investing heavily in automotive innovation. Europe leads with strict Euro 6 standards, while Asia sees demand from growing vehicle production.

Transitioning to electric vehicles is another strong tailwind. Adaptive steering systems are well-suited for electric cars due to their precision and low energy consumption. EV manufacturers increasingly consider adaptive steering a key differentiator in driving dynamics and user experience. This creates new growth avenues across the electric mobility space.

In addition, rising demand for luxury and connected vehicles also strengthens the market. Premium carmakers offer adaptive steering as a standard or upgrade option, enhancing the vehicle’s handling capabilities. Customers are willing to pay more for intuitive steering feel and advanced safety integration, driving up per-unit revenues.

Furthermore, industry collaboration is shaping market trends. Automotive giants are partnering with software firms to integrate AI and machine learning in steering response systems. This enables predictive and self-adjusting steering based on real-time driving data, which enhances both safety and user satisfaction across segments.

Looking forward, the market is expected to grow at a CAGR of 8.2% between 2025 and 2030. As infrastructure for autonomous driving matures, adaptive steering will play a key role in enabling safe and responsive vehicle control. Market entrants must focus on cost efficiency and digital integration.

Key Takeaways

- The Global Adaptive Steering Market is projected to grow from USD 11.5 Billion in 2024 to USD 25.1 Billion by 2034, at a CAGR of 8.1%.

- Electric Power Steering (EPS) led the market in 2024 with a 65.4% share, due to its fuel efficiency, precision, and ADAS compatibility.

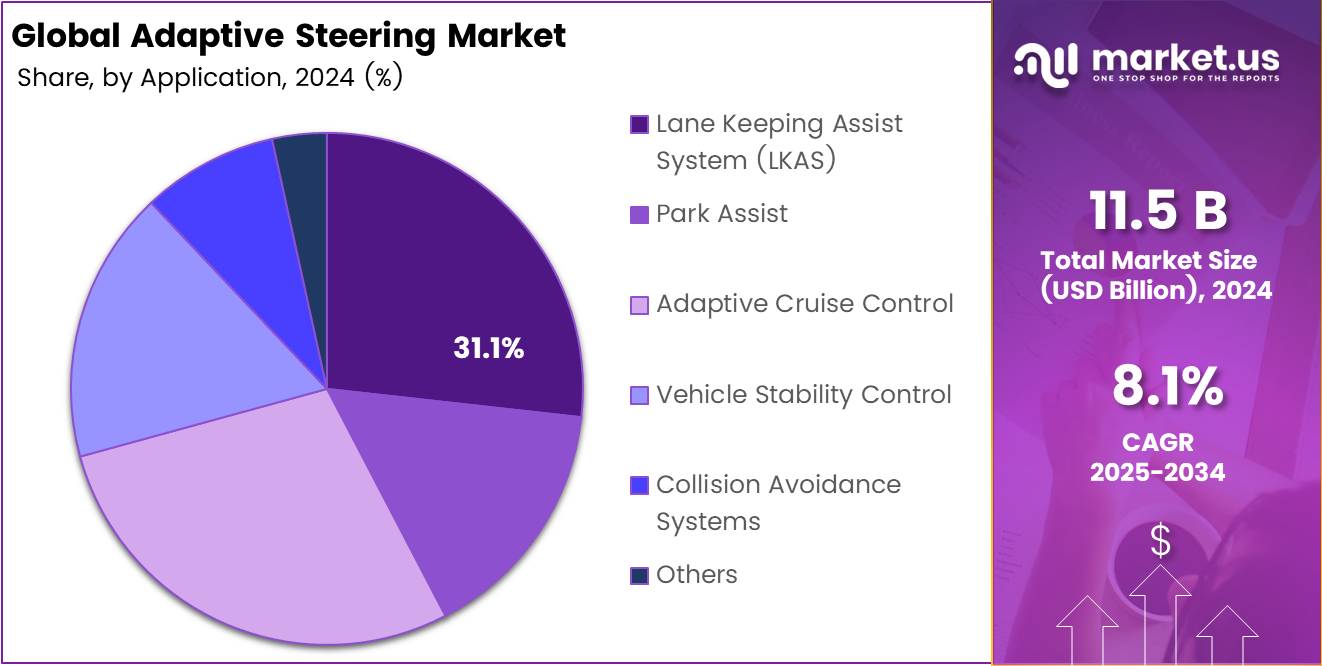

- Lane Keeping Assist System (LKAS) dominated the application segment in 2024 with a 31.1% share, driven by safety regulations and demand for semi-autonomous features.

- OEMs held an 81.2% share in the sales channel segment in 2024, favored for their seamless integration and alignment with vehicle specs.

- Passenger Vehicles accounted for a 72.1% market share in 2024, reflecting consumer preference for safer and more advanced cars.

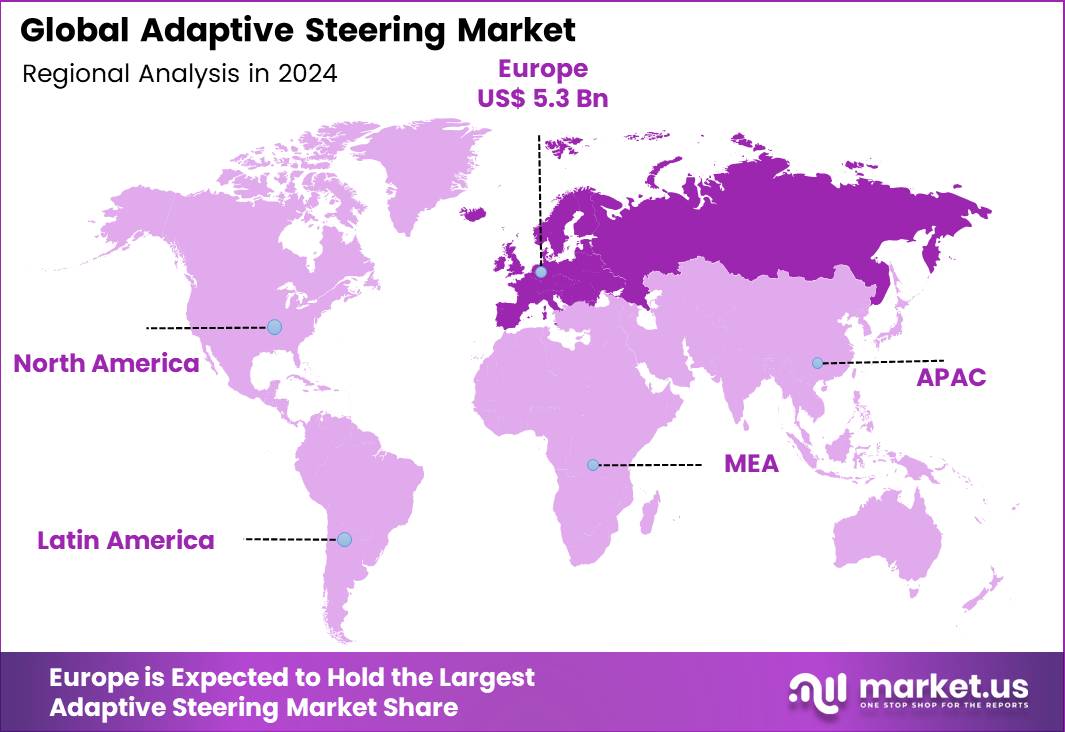

- Europe led the market with a 42.1% share valued at USD 5.3 Billion, supported by strong manufacturing, regulations, and demand for EV-integrated steering tech.

Offering Analysis

Electric Power Steering (EPS) leads with 65.4% market share due to its efficiency and integration in modern vehicles.

In 2024, Electric Power Steering (EPS) held a dominant market position in the By Offering Analysis segment of the Adaptive Steering Market, with a 65.4% share. This dominance is attributed to EPS’s fuel efficiency, precise handling, and compatibility with advanced driver assistance systems (ADAS).

Hydraulic Power Steering (HPS) continues to serve traditional vehicle systems but has seen a decline in preference due to its mechanical complexity and lower energy efficiency. However, it remains relevant in applications requiring higher torque handling, particularly in commercial and heavy-duty vehicles.

Electric Hydraulic Power Steering (EHPS) acts as a hybrid solution, balancing the benefits of electric and hydraulic systems. While not as dominant as EPS, EHPS is finding use in vehicles transitioning toward full electrification.

Application Analysis

Lane Keeping Assist System (LKAS) dominates with 31.1% due to growing driver safety and automation needs.

In 2024, Lane Keeping Assist System (LKAS) held a dominant market position in the By Application Analysis segment of the Adaptive Steering Market, with a 31.1% share. The surge in adoption of LKAS is driven by increasing regulatory focus on vehicle safety and growing demand for semi-autonomous features.

Park Assist continues to gain momentum, especially in urban settings where precision maneuvering is vital. Adaptive Cruise Control is also growing, driven by long-distance driving comfort and reduced driver fatigue.

Vehicle Stability Control contributes to accident reduction, particularly in challenging terrain or weather conditions. Collision Avoidance Systems are rapidly being integrated across models to meet evolving crash avoidance standards. The Others category includes emerging tech still gaining traction.

Sales Channel Analysis

OEM dominates with 81.2% due to embedded integration with new vehicle manufacturing.

In 2024, OEM held a dominant market position in the By Sales Channel Analysis segment of the Adaptive Steering Market, with a 81.2% share. OEMs are the preferred channel for adaptive steering systems as they ensure seamless integration during vehicle production and align with manufacturer specifications.

OEM solutions also benefit from early-stage R\&D collaboration and guarantee high-quality control, making them more attractive to automotive brands focused on safety and innovation.

On the other hand, the Aftermarket segment, while growing, still holds a secondary role. It primarily caters to vehicle upgrades and replacements, and often faces limitations in compatibility and technical integration.

Vehicle Analysis

Passenger Vehicles dominate with 72.1% share as adaptive steering aligns with comfort and safety expectations.

In 2024, Passenger Vehicles held a dominant market position in the By Vehicle Analysis segment of the Adaptive Steering Market, with a 72.1% share. The high share is a result of increased consumer demand for safer, more comfortable, and technologically advanced personal transportation.

Adaptive steering systems enhance handling at both high and low speeds, providing improved control and responsiveness—key selling points in passenger vehicles.

Commercial Vehicles, while still critical to the market, lag in adaptive steering adoption. Factors include higher upfront costs and a more conservative approach to implementing new technologies. However, as safety regulations tighten, this segment is expected to gradually integrate adaptive systems.

Key Market Segments

By Type

- Electric Power Steering (EPS)

- Hydraulic Power Steering (HPS)

- Electric Hydraulic Power Steering (EHPS)

By Application

- Lane Keeping Assist System (LKAS)

- Park Assist

- Adaptive Cruise Control

- Vehicle Stability Control

- Collision Avoidance Systems

- Others

By Sales Channel

- OEM

- Aftermarket

By Vehicle

- Passenger Vehicles

- Commercial Vehicles

Drivers

Rising Integration of Advanced Driver Assistance Systems (ADAS) in Modern Vehicles

The growing presence of Advanced Driver Assistance Systems (ADAS) in today’s vehicles is a major driver of the adaptive steering market. These systems require precise and responsive steering for features like lane-keeping and automated parking. Adaptive steering aligns well with these needs, making it an essential part of modern safety systems.

Electric and hybrid vehicles are becoming more common, and they often include smart steering technologies as standard. Adaptive steering supports efficient handling, especially in models focused on sustainability and innovation. This trend helps push adaptive steering systems into the mainstream automotive market.

Urban areas are getting more crowded, making smooth maneuvering critical for drivers. Adaptive steering allows for better control at low speeds, helping vehicles turn more easily in tight spaces. This feature is especially valuable in cities with dense traffic and limited parking.

Automakers (OEMs) are also focusing on making cars lighter and more modular. Adaptive steering systems support this goal by reducing the need for heavy mechanical parts. This approach also allows manufacturers to design flexible platforms that can be shared across multiple vehicle models.

Restraints

High Initial Cost of Adaptive Steering Systems in Entry-Level Vehicles

One of the biggest restraints is the high cost of adaptive steering systems, especially in budget or entry-level cars. Manufacturers often hesitate to include them due to added costs, making it harder for this technology to reach a wider market.

In emerging markets, consumer awareness about adaptive steering is still low. Many buyers prioritize basic features over advanced technology, limiting the growth potential in these regions. Education and outreach are needed to close this gap.

Retrofitting adaptive steering into older vehicles is complicated and expensive. These systems are often designed for new platforms, making integration into existing models technically challenging and economically unviable for many vehicle owners.

There are also concerns about how adaptive steering systems perform in extreme weather or rough terrain. In harsh environments, electronic components can fail, reducing reliability and raising safety issues. This creates hesitation among buyers in regions with tough driving conditions.

Growth Factors

Expansion of Adaptive Steering in Commercial and Off-Highway Vehicle Segments

The adaptive steering market is seeing promising opportunities in commercial and off-highway vehicles. These vehicles operate in complex environments where precision steering can improve safety and productivity. This sector is expected to grow as fleet operators invest in smart technologies.

As autonomous vehicle development continues, fail-safe and redundant steering systems are becoming crucial. Adaptive steering can serve as a foundation for these advanced technologies, providing a reliable backup if other systems fail. This expands its use beyond conventional driving.

Tech companies and automakers are increasingly collaborating to develop smarter steering solutions. These partnerships combine hardware innovation with software intelligence, leading to faster development and market adoption of adaptive steering technologies.

Steer-by-wire systems, which eliminate the mechanical link between the steering wheel and wheels, are gaining traction in next-gen vehicles. Adaptive steering fits naturally into this transition by offering customizable and responsive steering control, aligned with the future of automotive design.

Emerging Trends

Integration of AI and Machine Learning Algorithms for Real-Time Steering Adjustments

Artificial Intelligence (AI) and machine learning are revolutionizing adaptive steering. These technologies allow real-time analysis of driving conditions, enabling the system to adjust steering sensitivity based on terrain, speed, or traffic. This smart response enhances both safety and comfort.

Smart sensors and IoT technologies are being used to monitor steering performance and predict maintenance needs. This helps prevent unexpected failures and lowers the cost of ownership by improving system reliability and service planning.

Premium vehicles are increasingly equipped with personalized steering modes. Drivers can choose settings based on their preference—comfort, sport, or eco-driving. Adaptive steering makes these custom modes possible, adding value for high-end car buyers.

The shift toward Software-Defined Vehicles (SDVs) is also shaping the adaptive steering market. With more vehicle functions being controlled by software, steering systems are becoming more configurable and updatable, paving the way for over-the-air upgrades and continuous improvements.

Regional Analysis

Europe Dominates the Adaptive Steering Market with a Market Share of 42.1%, Valued at USD 5.3 Billion

Europe leads the global adaptive steering market, driven by advanced automotive manufacturing, supportive regulatory frameworks, and strong demand for vehicle safety and comfort technologies. The region holds a 42.1% market share, valued at USD 5.3 Billion, indicating significant adoption across luxury and passenger vehicle segments. Continuous innovation and increasing integration of steering technologies in EVs further bolster the region’s dominance.

North America Adaptive Steering Market Overview

North America continues to be a key region for adaptive steering, supported by robust technological advancements and a high preference for premium vehicles. Increasing adoption of electric vehicles and government support for autonomous driving capabilities contribute to the market growth. The presence of a well-established automotive infrastructure further supports innovation and commercialization.

Asia Pacific Adaptive Steering Market Trends

Asia Pacific is emerging as a fast-growing region in the adaptive steering market, fueled by expanding automotive production in countries like China, Japan, and South Korea. Rising consumer awareness of advanced driver-assistance systems (ADAS) and increasing disposable incomes are propelling demand. Government initiatives promoting smart mobility and electric vehicles also play a vital role.

Middle East and Africa Adaptive Steering Market Insights

The Middle East and Africa are gradually adopting adaptive steering technologies, mainly in high-end vehicles. Growth is supported by rising urbanization and infrastructure development in select Gulf nations. Although still in a nascent stage, the market is expected to benefit from growing investments in smart transportation systems.

Latin America Adaptive Steering Market Outlook

Latin America shows moderate growth in the adaptive steering market, with rising vehicle ownership and increasing interest in advanced automotive safety features. Countries like Brazil and Mexico are gradually integrating adaptive steering into new vehicle models, driven by changing consumer preferences and improved affordability.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Adaptive Steering Company Insights

In 2024, the global Adaptive Steering Market continues to evolve with major contributions from key players driving innovation and integration of advanced systems. ThyssenKrupp remains a vital force in the market, leveraging its extensive engineering capabilities to enhance adaptive steering technology for both commercial and passenger vehicles. The company’s focus on modular and scalable systems adds value to OEMs looking for flexible solutions.

Aisin Seiki plays a pivotal role with its strategic emphasis on integrating steering systems with advanced driver assistance technologies. Its reputation for quality and precision makes it a preferred choice among top-tier automakers, especially in the Asia-Pacific region.

Bosch continues to lead through its robust R&D investments and strong presence in the electronics and mobility sector. The company’s adaptive steering solutions are increasingly being integrated into EV platforms, showcasing its adaptability to future vehicle architectures.

Delphi contributes through its smart vehicle technologies, particularly in the areas of software and system integration. With its deep roots in automotive electronics, Delphi offers solutions that align well with autonomous and semi-autonomous vehicle trends.

These players collectively contribute to the competitive dynamics of the adaptive steering market by prioritizing safety, vehicle responsiveness, and system efficiency. As automotive trends continue toward electrification and autonomy, adaptive steering will play a critical role in enhancing driver comfort and safety. The ongoing collaboration between system integrators and component manufacturers will likely define the trajectory of innovation and adoption across global markets.

Top Key Players in the Market

- ThyssenKrupp

- Aisin Seiki

- Bosch

- Delphi

- Infineon

- Hitachi

- JTEKT

- Mando

- Nexteer

- ZF Friedrichshafen

Recent Developments

- In 13 Dec 2023, Nexteer Automotive announced a global production milestone of 100 million electric power steering (EPS) systems. This achievement highlights EPS as a key technology that contributes significantly to fuel efficiency in modern vehicles.

- In Jan 2025, ZF Rane Automotive India operated three manufacturing plants in Tiruchirapally, Chennai, and Rudrapur for hydraulic power steering systems. In March 2025, the joint venture completed the full acquisition of TRW Sun Steering Wheels, expanding its footprint in the steering components market.

Report Scope

Report Features Description Market Value (2024) USD 11.5 Billion Forecast Revenue (2034) USD 25.1 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Electric Power Steering (EPS), Hydraulic Power Steering (HPS), Electric Hydraulic Power Steering (EHPS)), By Application (Lane Keeping Assist System (LKAS), Park Assist, Adaptive Cruise Control, Vehicle Stability Control, Collision Avoidance Systems, Others), By Sales Channel (OEM, Aftermarket), By Vehicle (Passenger Vehicles, Commercial Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ThyssenKrupp, Aisin Seiki, Bosch, Delphi, Infineon, Hitachi, JTEKT, Mando, Nexteer, ZF Friedrichshafen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ThyssenKrupp

- Aisin Seiki

- Bosch

- Delphi

- Infineon

- Hitachi

- JTEKT

- Mando

- Nexteer

- ZF Friedrichshafen