Global Active Insulation Market By Product Type (Textile Insulation Products (Polyester, Cotton, Wool, Nylon, Others), Building & Construction Insulation Products (Glass Wool, Mineral Wool, EPS, Others)), By End-use (Textile (Activewear, Sportswear, Other), Building & Construction (Residential, Commercial)), by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 61440

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

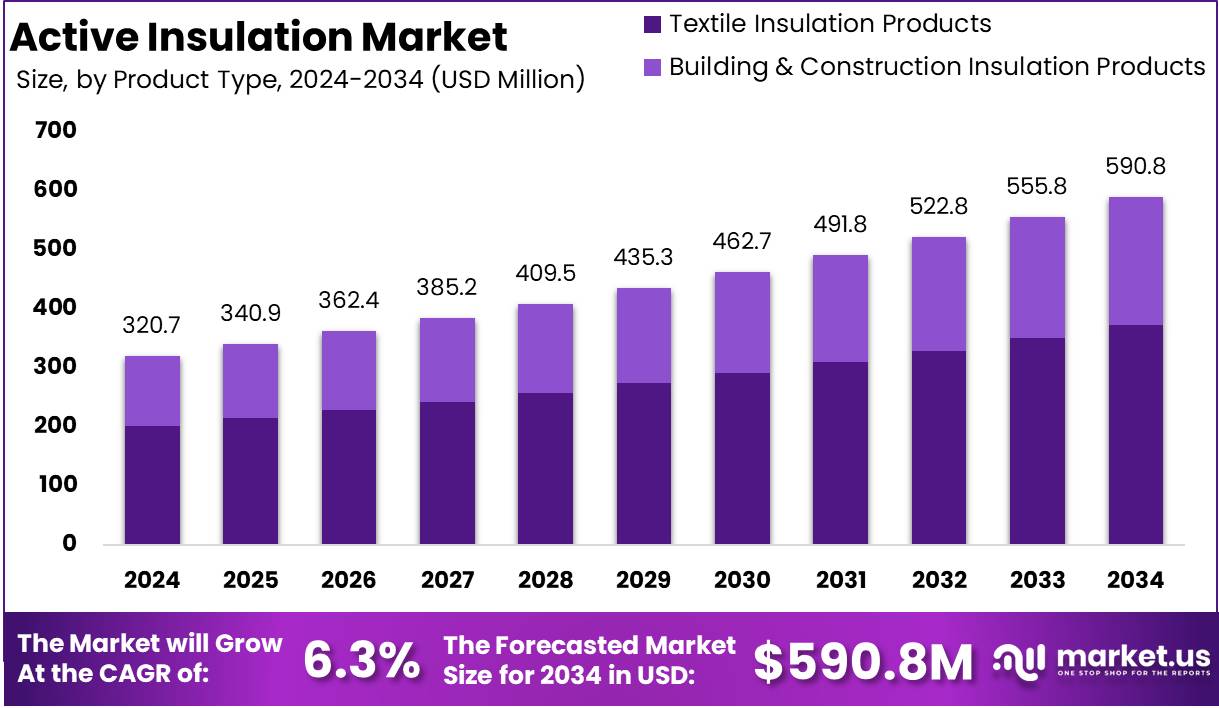

The Global Active Insulation Market size is expected to be worth around USD 590.8 Million by 2034 from USD 320.7 Million in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

Active insulation refers to advanced thermal management technology designed to regulate temperature dynamically by adapting to environmental conditions. Unlike traditional insulation, which provides passive thermal resistance, active insulation materials respond to temperature fluctuations, ensuring optimal heat retention or dissipation as needed.

These materials are widely used in apparel, construction, and industrial applications to enhance energy efficiency and thermal comfort. Innovations in smart textiles, phase-change materials (PCMs), and breathable membranes are driving advancements in active insulation solutions.

The active insulation market encompasses the development, production, and distribution of insulation materials designed to provide thermal adaptability across multiple industries. Key segments include the textile industry, particularly outdoor and performance wear, as well as the construction sector, where energy-efficient buildings demand high-performance insulation.

The market is characterized by increasing investments in sustainable insulation technologies, leveraging nanotechnology, smart fabrics, and eco-friendly materials. With heightened regulatory standards and a growing emphasis on energy efficiency, the market is evolving rapidly to cater to diverse end-use applications.

The expansion of the active insulation market is driven by technological advancements in smart insulation materials, the growing demand for energy-efficient solutions, and the rising preference for sustainable building practices. The apparel industry, particularly in outdoor and sportswear segments, continues to integrate active insulation for enhanced thermal regulation.

The demand for active insulation is witnessing steady growth, fueled by evolving consumer preferences and industry-wide sustainability initiatives. The apparel sector is adopting advanced insulation technologies to enhance user comfort in extreme climates, while the construction industry is incorporating these materials into energy-efficient buildings.

Rising disposable income and urbanization trends in emerging economies are contributing to the market’s expansion, with increased adoption across residential and commercial projects. Moreover, advancements in smart textiles and adaptive insulation materials are further bolstering demand in performance-driven applications.

Significant growth opportunities exist in the development of bio-based and recycled insulation materials, aligning with sustainability goals and regulatory compliance. The integration of IoT-enabled smart insulation systems presents new possibilities for real-time thermal adaptation, particularly in high-performance apparel and next-generation buildings. Emerging markets in Asia-Pacific and Latin America offer untapped potential, driven by urbanization, infrastructural development, and increasing consumer awareness.

The Active Insulation Market is growing with increasing energy efficiency regulations. According to Houseg Rail, 780M tons of CO₂ are reduced annually through insulation. 60% of energy is lost in uninsulated homes, and 50-70% of household energy consumption comes from heating and cooling. Insulation saves 600x more energy than fluorescent lights, Energy Star appliances, and windows combined.

While it slows heat transfer, it does not block airflow. Rising sustainability goals and stricter policies are driving market demand, making active insulation a crucial solution for energy conservation and emissions reduction.

According to So-Eco, the Active Insulation Market is growing as uninsulated homes lose over 60% of energy, increasing demand for energy-efficient solutions. Sustainability is a key driver, with cellulose insulation made of 85% recycled paper, mineral wool containing 75% post-industrial recycled content, and fiberglass using up to 60% recycled materials. Regulatory policies and environmental concerns are accelerating adoption, positioning active insulation as a vital solution for energy conservation and sustainability.

Key Takeaways

- The global active insulation market is projected to reach USD 590.8 million by 2034, up from USD 320.7 million in 2024, registering a CAGR of 6.3% during the forecast period (2025-2034).

- Textile Insulation Products held a dominant position in 2024, accounting for over 63% of the market share.

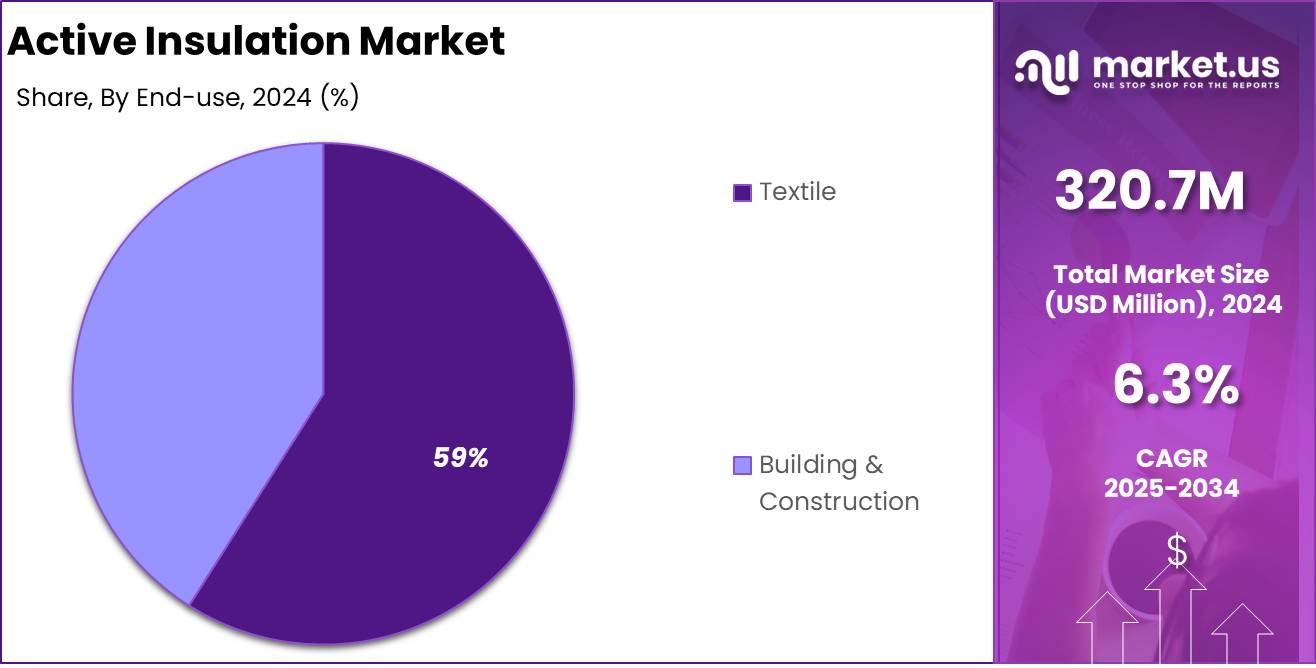

- The textile sector emerged as the leading end-use segment in 2024, contributing to more than 59% of the market share.

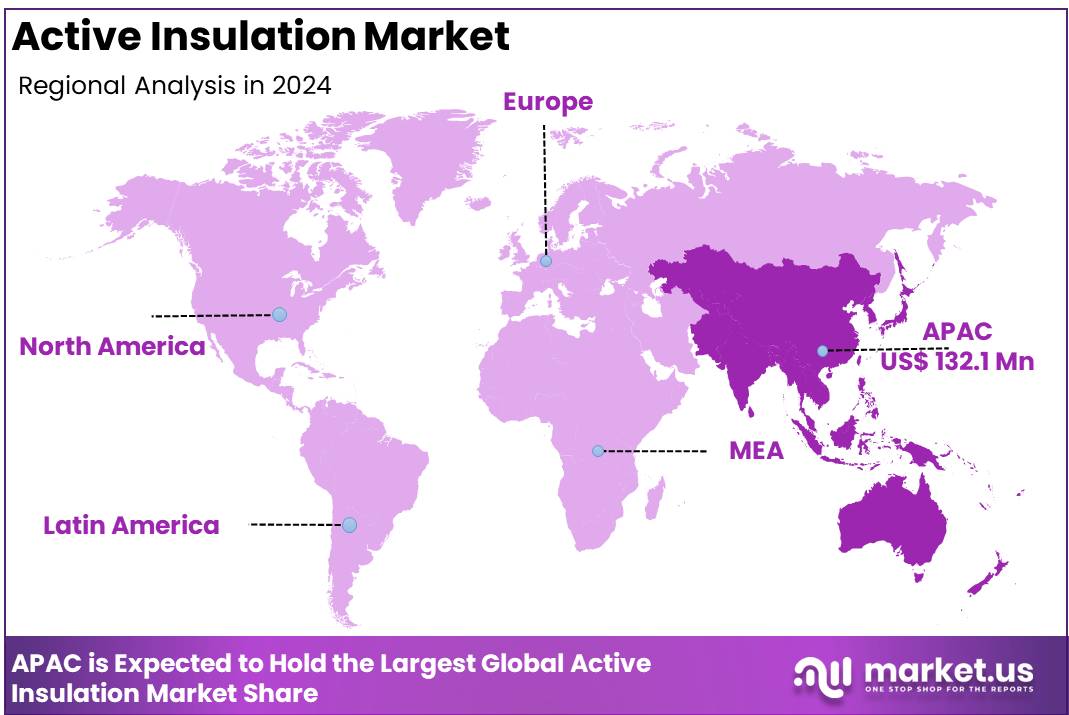

- Asia Pacific led the global active insulation market in 2024, securing the largest market share of 41%, with a market valuation of USD 132.1 million.

By Product Analysis

Textile Insulation Products Dominating Segment in Active Insulation Market with 63% Share

In 2024, Textile Insulation Products held a dominant market position in the Active Insulation Market, capturing more than 63% share. The segment’s growth is driven by increasing demand from the sportswear and outdoor apparel industries, where temperature-regulating fabrics enhance comfort and performance.

Advancements in breathable and moisture-wicking insulation materials have further strengthened adoption across consumer and industrial applications. Additionally, sustainability initiatives promoting recyclable and eco-friendly textiles are expected to contribute to long-term segment expansion.

The Building & Construction Insulation Products segment is experiencing significant growth within the Active Insulation Market, driven by stringent energy efficiency regulations and the rising adoption of sustainable construction materials.

Increasing demand for high-performance insulation solutions in residential and commercial buildings has propelled the market, particularly in regions emphasizing green building initiatives. The integration of intelligent insulation technologies that adapt to varying temperatures further supports the segment’s expansion, positioning it as a key area of growth within the industry.

By End-use Analysis

Textile Dominating Segment in Active Insulation Market with 59% Share

In 2024, Textile held a dominant market position in the Active Insulation Market by End-Use, capturing more than 59% share. The growth of this segment is driven by rising demand for thermally efficient and breathable fabrics in outdoor apparel, sportswear, and fashion industries.

Increasing consumer preference for performance-enhancing and moisture-regulating textiles has further boosted market expansion. Additionally, advancements in sustainable and recycled insulation materials are supporting the segment’s long-term growth, reinforcing its leading position in the industry.

The Building & Construction segment is witnessing strong growth in the Active Insulation Market, fueled by the increasing adoption of energy-efficient building materials and stringent sustainability regulations. The demand for high-performance insulation solutions in residential, commercial, and industrial structures is driving market expansion.

Additionally, the integration of smart insulation technologies that enhance thermal regulation is further contributing to the segment’s rising share, positioning it as a key area of development in the industry.

Key Market Segments

By Product Type

- Textile Insulation Products

- Polyester

- Cotton

- Wool

- Nylon

- Others

- Building & Construction Insulation Products

- Glass Wool

- Mineral Wool

- EPS

- Others

By End-use

- Textile

- Activewear

- Sportswear

- Other

- Building & Construction

- Residential

- Commercial

Driver

Rising Demand for Energy-Efficient Buildings

The global active insulation market is experiencing substantial growth due to the increasing emphasis on energy-efficient buildings. Governments and regulatory bodies worldwide are introducing stringent building codes and energy efficiency standards to reduce overall energy consumption and greenhouse gas emissions.

These regulations are pushing builders and developers toward sustainable construction materials that enhance thermal performance while minimizing the need for extensive heating and cooling systems. Active insulation, known for its ability to dynamically regulate indoor temperatures, is becoming an integral component of modern construction projects.

The growing awareness among consumers and businesses regarding long-term energy cost savings further fuels demand, as energy-efficient buildings offer financial and environmental benefits.

The adoption of active insulation solutions in construction significantly contributes to market expansion. By providing effective thermal regulation, these materials support the development of buildings that maintain optimal indoor temperatures with minimal energy input.

As sustainability continues to dominate architectural and urban planning discussions, the role of active insulation is becoming increasingly critical. Additionally, developers are recognizing the added value of energy-efficient buildings in real estate markets, which enhances their appeal to both buyers and tenants. This shift towards greener construction methods and materials ensures that active insulation remains a key factor in shaping the future of the industry.

Restraint

High Initial Costs of Active Insulation Materials

Despite its benefits, the high upfront costs of active insulation materials present a significant challenge to market growth. Advanced insulation technologies require specialized manufacturing processes and high-quality raw materials, resulting in higher production costs compared to traditional insulation options.

This cost disparity makes it difficult for some builders and homeowners, particularly in cost-sensitive regions, to justify the investment in active insulation. The affordability factor becomes a primary concern, especially in residential construction projects where budget constraints influence material selection.

Additionally, fluctuations in raw material prices, including those derived from petrochemicals, contribute to the unpredictable pricing of insulation products, adding further uncertainty for buyers. The financial barrier associated with active insulation adoption limits its widespread use, particularly in developing regions. While the long-term benefits of energy savings and improved building efficiency are evident, the initial cost burden can be discouraging for consumers and businesses.

Moreover, the need for skilled professionals to install these advanced insulation materials correctly adds another layer of cost and complexity. Without proper installation, insulation effectiveness is reduced, leading to suboptimal performance and diminished energy efficiency gains. Addressing these cost-related challenges through incentives, subsidies, and technological advancements will be crucial to ensuring broader market adoption and sustained growth.

Opportunity

Technological Advancements in Insulation Materials

The active insulation market is poised for significant growth due to continuous advancements in insulation technologies. Manufacturers are developing innovative materials with superior thermal properties that offer enhanced efficiency, durability, and environmental sustainability.

The introduction of next-generation insulation solutions, including bio-based materials, aerogels, and phase-change materials, is revolutionizing the industry. These innovations not only improve energy performance but also align with sustainability goals by reducing reliance on synthetic or non-renewable resources.

As new insulation solutions become more commercially viable, they offer an opportunity to replace conventional insulation products with smarter, more adaptive alternatives.

These technological advancements contribute to market expansion by making active insulation solutions more efficient and accessible. The development of lightweight, high-performance insulation materials enhances installation ease and reduces overall construction time, making them attractive to builders and developers. Furthermore, the growing interest in eco-friendly insulation options supports the market’s shift towards more sustainable building practices.

As research and development efforts continue to focus on improving insulation performance while lowering costs, the market is expected to see increased adoption across various applications, from residential and commercial buildings to industrial and automotive sectors. The evolution of insulation technology represents a major driver for long-term market growth.

Trends

Integration of Active Insulation in Smart Building Systems

The integration of active insulation materials with smart building technologies is emerging as a transformative trend in the construction industry. Smart buildings rely on intelligent systems that monitor and adjust indoor environments for optimal comfort and energy efficiency.

Active insulation materials complement these systems by dynamically regulating temperature based on external and internal conditions, reducing reliance on heating, ventilation, and air conditioning (HVAC) systems.

The combination of smart sensors, automation, and adaptive insulation enhances energy efficiency while ensuring consistent indoor climate control. This trend is particularly relevant in commercial and high-performance residential buildings, where energy optimization is a priority.

The growing emphasis on sustainable and technology-driven construction practices is driving the adoption of active insulation within smart building frameworks. As the demand for intelligent energy management solutions increases, architects and developers are incorporating insulation systems that contribute to automated building performance.

This shift not only improves operational efficiency but also aligns with the broader industry push toward environmentally responsible design. The seamless integration of insulation materials with smart building infrastructure enhances overall energy conservation efforts, positioning active insulation as a crucial component in the next generation of sustainable construction. The increasing adoption of these systems will further accelerate market expansion.

Regional Analysis

Asia Pacific Leads Active Insulation Market with Largest Market Share of 41% in 2024

The Asia Pacific region dominates the active insulation market, holding the largest market share of 41% in 2024, with a market valuation of USD 132.1 million. This growth is attributed to the expanding construction and textile industries, particularly in countries such as China, India, and Japan, where rapid urbanization and rising disposable income have driven demand for high-performance insulation materials.

Additionally, government initiatives promoting energy-efficient buildings and increasing awareness of sustainable insulation solutions contribute to the region’s strong market position. The growing sports and outdoor apparel industry further fuels demand for active insulation in the region.

North America follows as a significant market for active insulation, driven by stringent energy efficiency regulations and the rising adoption of smart insulation technologies in residential and commercial buildings.

The increasing focus on green buildings and sustainable insulation materials has propelled market demand in the United States and Canada. Moreover, the presence of a well-established textile industry that integrates advanced insulation materials into performance wear and outdoor clothing contributes to market expansion.

Europe maintains a substantial share in the active insulation market, supported by stringent energy efficiency directives and the adoption of high-performance insulation in construction and industrial applications.

The European Union’s regulations aimed at reducing carbon emissions have accelerated the adoption of advanced insulation materials, particularly in Germany, France, and the United Kingdom. The region’s strong presence in the textile sector, with a high demand for breathable and moisture-regulating insulation materials, further supports market growth.

The Middle East & Africa region witnesses a steady demand for active insulation, driven by increasing investments in infrastructure and commercial construction projects. The extreme climatic conditions necessitate effective thermal insulation solutions, particularly in countries such as Saudi Arabia and the UAE. Additionally, the rising preference for premium sportswear and protective clothing supports market demand.

Latin America is an emerging market for active insulation, with growing demand from the residential and industrial sectors. Countries like Brazil and Mexico are experiencing increased adoption of energy-efficient insulation materials due to the expansion of the construction sector and favorable government policies promoting sustainable infrastructure development.The increasing awareness of insulation benefits in temperature regulation and energy conservation drives market growth in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Active Insulation Market in 2024 is witnessing robust competition, driven by advancements in material science, sustainability trends, and regulatory compliance. Major players are strategically focusing on innovation, mergers, and sustainability-driven initiatives to strengthen their market presence.

3M remains a leading force with its advanced insulation materials, leveraging its R&D capabilities to develop high-performance solutions. Armacell continues to dominate the flexible foam insulation segment, catering to industrial and commercial applications.

H. Dawson Wool is capitalizing on the rising demand for natural and biodegradable insulation, positioning wool as a sustainable alternative. Imerys, with its expertise in mineral-based solutions, is enhancing thermal efficiency and fire resistance in insulation materials. Knauf Digital GmbH and Saint-Gobain Group are investing heavily in digitalization and energy-efficient insulation systems to meet evolving consumer needs.

Koch Industries (Invista) and Milliken & Company are leveraging polymer technology to develop high-performance insulation materials, focusing on applications in construction and technical textiles. Neo Thermal Insulation (India) Private Limited and Polybond are expanding their presence in emerging markets by offering cost-effective solutions.

PrimaLoft Inc. continues to lead in synthetic insulation technology, particularly in the outdoor and sportswear segments. Remmers GmbH, Unger-Diffutherm GmbH, and Rockwool A/S are strengthening their product portfolios with advanced fire-resistant and soundproofing insulation solutions.

Additionally, Owens Corning and W. L. Gore & Associates, Inc. are driving innovation in lightweight and breathable insulation, targeting high-performance applications.

MacCann & Byrne (Ecological Building Systems) and Ultralight Outdoor Gear Ltd are benefiting from growing eco-conscious consumer preferences, emphasizing sustainable insulation materials. Overall, the competitive landscape remains dynamic, with key players continuously evolving to meet market demands.

Top Key Players in the Market

- 3M

- Armacell

- H. Dawson Wool

- Imerys

- Knauf Digital GmbH

- Koch Industries (Invista)

- MacCann & Byrne (Ecological Building Systems)

- Milliken & Company

- Neo Thermal Insulation (India) Private Limited

- Owens Corning

- Polybond

- PrimaLoft Inc.

- Remmers GmbH

- Rockwool A/S

- Saint-Gobain Group

- Ultralight Outdoor Gear Ltd

- Unger-Diffutherm GmbH

- W. L. Gore & Associates, Inc.

Recent Developments

- In 2023, Kingspan Group plc, a leading provider of high-performance insulation and building envelope solutions, announced an agreement to acquire approximately 51% of Steico SE from Schramek GmbH, with an option to purchase an additional 10% in the future. This strategic move enhances Kingspan’s portfolio by incorporating Steico’s wood-based insulation solutions, aligning with sustainability and energy efficiency goals. The integration of Steico’s bio-based technology with Kingspan’s global reach and innovation focus aims to expand sustainable building solutions for customers worldwide.

- In 2023, HD® Wool Apparel Insulation, in collaboration with Rudholm, gained recognition in the Sourcing Journal for its advancements in natural, traceable insulation. The article highlighted its effectiveness in outerwear insulation, emphasizing its renewable and moisture-regulating properties. HD Wool Apparel Insulation also plays a vital role in promoting regenerative agriculture by supporting farmers in ecological land management, aligning with the Savory Institute’s Land to Market standards for environmental improvement.

- In 2023, Polartec®, a Milliken™ & Company brand known for innovative textile solutions, announced the winners of the Polartec Apex Awards. These awards honor designers and brands that push the boundaries of performance and sustainability in apparel. The selected garments demonstrate excellence in durability, function, and technical innovation, catering to sport, lifestyle, and outdoor performance.

Report Scope

Report Features Description Market Value (2024) USD 320.7 Million Forecast Revenue (2034) USD 590.8 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Textile Insulation Products (Polyester, Cotton, Wool, Nylon, Others), Building & Construction Insulation Products (Glass Wool, Mineral Wool, EPS, Others)), By End-use (Textile (Activewear, Sportswear, Other), Building & Construction (Residential, Commercial)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M, Armacell, H. Dawson Wool, Imerys, Knauf Digital GmbH, Koch Industries (Invista), MacCann & Byrne (Ecological Building Systems), Milliken & Company, Neo Thermal Insulation (India) Private Limited, Owens Corning, Polybond, PrimaLoft Inc., Remmers GmbH, Rockwool A/S, Saint-Gobain Group, Ultralight Outdoor Gear Ltd, Unger-Diffutherm GmbH, W. L. Gore & Associates, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M

- Armacell

- H. Dawson Wool

- Imerys

- Knauf Digital GmbH

- Koch Industries (Invista)

- MacCann & Byrne (Ecological Building Systems)

- Milliken & Company

- Neo Thermal Insulation (India) Private Limited

- Owens Corning

- Polybond

- PrimaLoft Inc.

- Remmers GmbH

- Rockwool A/S

- Saint-Gobain Group

- Ultralight Outdoor Gear Ltd

- Unger-Diffutherm GmbH

- W. L. Gore & Associates, Inc.