Global ABL And PBL Tubes Market Size, Share, And Industry Analysis Report By Product Type (ABL Tubes, PBL Tubes), By Material (Plastic, Laminates, Aluminum, Others), By Application (Cosmetics, Food, Pharmaceuticals, Industrial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174279

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

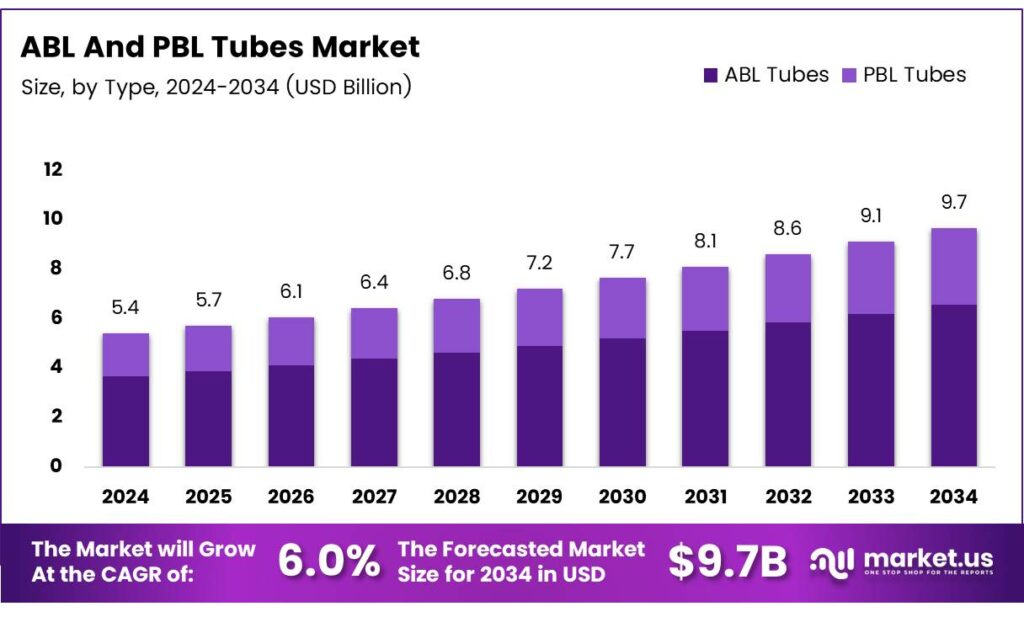

The Global ABL and PBL Tubes Market size is expected to be worth around USD 9.7 billion by 2034, from USD 5.4 billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

The ABL and PBL Tubes Market is a core segment within modern flexible and rigid packaging solutions. Fundamentally, this market covers laminated tube packaging used widely in personal care, pharmaceuticals, cosmetics, and food applications. These tubes balance protection, branding, and consumer convenience, supporting both mass-market and premium product positioning.

The ABL and PBL Tubes Market is closely tied to the rising demand for hygienic, lightweight, and shelf-stable packaging. Moreover, urbanization and higher consumption of personal care products continue to lift tube usage. Consequently, manufacturers increasingly prioritize barrier performance, recyclability, and design flexibility to meet evolving brand and regulatory expectations.

- ABL tubes offer strong aluminum-based barrier properties, while PBL tubes provide recyclable and design-friendly structures. According to packaging manufacturer technical disclosures, production capabilities typically cover diameters from 19 mm to 50 mm and filling volumes from 5 ml to 300 ml, enabling broad use across travel, retail, and professional product formats.

Closure innovation supports functional differentiation. As stated in industry packaging specification sheets, suppliers now offer multiple cap formats, including flip-top, conical, and cylindrical closures. These solutions enhance dispensing control and visual appeal, which directly support premiumization strategies and higher product margins across cosmetics and pharmaceutical packaging segments.

On the manufacturing side, line technology plays a decisive role. According to technical guidance cited by Laue in laminated tube production literature, blown film and flat film extrusion lines each have thickness limitations. However, together they overlap efficiently, covering film thickness ranges from 200 µm to 350 µm, depending on end-product performance requirements.

Key Takeaways

- The Global ABL and PBL Tubes Market is projected to reach USD 9.7 billion by 2034, growing from USD 5.4 billion in 2024 at a 6.0% CAGR.

- ABL Tubes dominate the market with a share of 67.2%, supported by strong barrier protection.

- Plastic holds the leading position with a market share of 51.8% due to flexibility and cost efficiency.

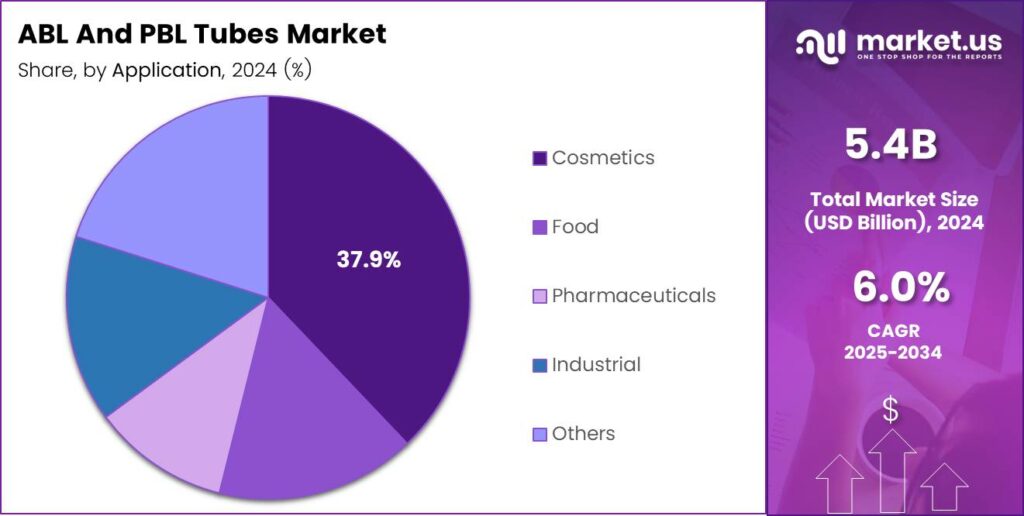

- Cosmetics account for the largest share at 37.9%, driven by daily-use and premium personal care demand.

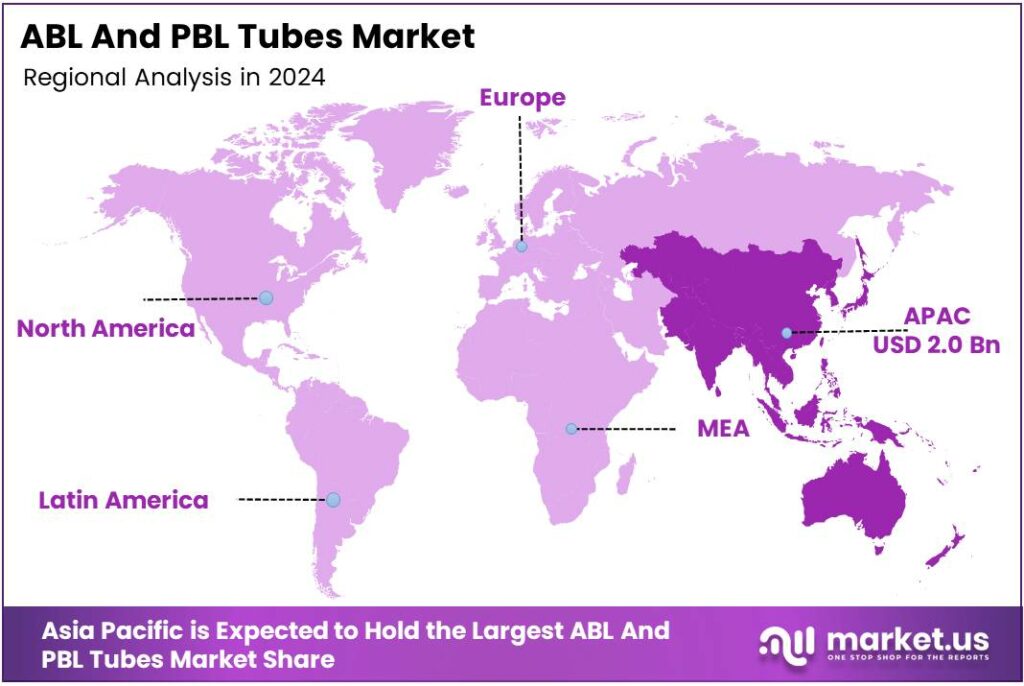

- Asia Pacific leads the market with a 37.8% share, valued at USD 2.0 billion.

By Product Type Analysis

ABL Tubes dominate with 67.2% due to strong barrier protection and longer product shelf life.

In 2025, ABL Tubes held a dominant market position in the By Product Type analysis segment of the ABL and PBL Tubes Market, with a 67.2% share. Moreover, brands increasingly preferred ABL tubes for sensitive formulations, as aluminum layers effectively blocked oxygen, light, and moisture while supporting premium product positioning.

PBL Tubes, meanwhile, gained steady traction as sustainability expectations grew. Although holding a smaller share, PBL tubes offered design flexibility, lighter weight, and recycling advantages. As a result, manufacturers gradually adopted PBL tubes for mass-market personal care and food products seeking an attractive appearance and cost efficiency.

By Material Analysis

Plastic dominates with 51.8% due to flexibility, lightweight properties, and cost efficiency.

In 2025, Plastic held a dominant market position in the By Material analysis segment of the ABL and PBL Tubes Market, with a 51.8% share. Notably, plastic materials supported high-speed production, offered impact resistance, and enabled innovative tube shapes that improved consumer convenience.

Laminates followed as a crucial material choice, combining multiple layers for enhanced protection. Transitioning further, laminate structures balanced barrier performance and visual quality, making them suitable for cosmetics and pharmaceuticals where both product safety and shelf appeal mattered.

Aluminum remained important for applications requiring maximum protection. Although used selectively, aluminum-based structures provided superior resistance against contamination. Consequently, they were preferred in medicated creams and specialty formulations where stability outweighed material cost considerations.

Others, including emerging blends and alternative materials, addressed niche requirements. Gradually, these materials supported innovation in texture, recyclability, and performance. As material science evolved, such options helped manufacturers experiment while aligning with regulatory and sustainability expectations.

By Application Analysis

Cosmetics dominate with 37.9% driven by rising demand for premium and daily-use personal care products.

In 2025, Cosmetics held a dominant market position in the By Application analysis segment of the ABL and PBL Tubes Market, with a 37.9% share. Increasing consumption of skincare, haircare, and beauty products supported consistent demand for visually appealing, protective tube packaging.

Food applications expanded steadily as tubes offered hygiene, portion control, and convenience. Gradually, sauces, spreads, and specialty food products adopted tube formats, benefiting from easy dispensing and extended freshness across retail and online distribution channels.

Pharmaceuticals relied on tube packaging for topical medicines and therapeutic creams. Consequently, ABL and PBL tubes ensured dosage accuracy, contamination prevention, and regulatory compliance, making them essential for healthcare-focused packaging requirements.

Industrial and other applications served adhesives, lubricants, and specialty products. Although smaller in scale, these segments valued durability and controlled dispensing. Together, they contributed incremental demand and diversified the overall application landscape.

Key Market Segments

By Product Type

- ABL Tubes

- PBL Tubes

By Material

- Plastic

- Laminates

- Aluminum

- Others

By Application

- Cosmetics

- Food

- Pharmaceuticals

- Industrial

- Others

Emerging Trends

Innovation in Tube Design and Digital Printing Shapes Market Trends

One of the key trending factors in the ABL and PBL tubes market is innovation in design and decoration. Brands increasingly use matte finishes, metallic effects, and tactile surfaces to enhance product appeal and differentiation. Digital printing adoption is another important trend.

- It allows shorter production runs, faster turnaround, and cost-effective customization. This trend supports seasonal launches, limited editions, and personalized packaging strategies. The European Union Packaging and Packaging Waste Directive sets a target that 50% of plastic packaging must be recycled, rising to 55% by 2030, forcing laminate tube producers to rethink multi-layer designs.

Lightweighting is also gaining momentum. Manufacturers are reducing material usage while maintaining strength and barrier performance. This helps lower transportation costs and supports sustainability goals. Demand for flip-top, dispensing, and child-resistant caps continues to rise.

Drivers

Rising Demand for Flexible and High-Barrier Packaging Drives Market Growth

The ABL and PBL tubes market is mainly driven by growing demand from cosmetics, personal care, and pharmaceutical brands. These industries prefer tube packaging because it is lightweight, easy to use, and hygienic. ABL tubes offer strong barrier protection, which helps extend product shelf life.

- The rise in urban lifestyles and travel-friendly packaging needs. Consumers increasingly choose compact tubes for toothpaste, creams, gels, and ointments. Its recyclable laminate tube structures can reduce non-recyclable content by up to 60% compared to traditional aluminum-heavy formats, while maintaining barrier performance for toothpaste and pharma creams.

Brand owners are also focusing on premium appearance and better shelf visibility. PBL tubes allow high-quality printing, modern designs, and shape flexibility, helping brands stand out. This branding advantage continues to push adoption across mass and premium product categories.

Restraints

Fluctuating Raw Material Prices Restrain Market Expansion

One of the major restraints in the ABL and PBL tubes market is volatility in raw material prices. Aluminum, plastics, and laminated materials are closely linked to global oil and metal markets. Sudden price changes increase production costs for tube manufacturers.

- Environmental regulations also pose challenges, especially for multi-layer packaging. Recycling ABL structures remains complex due to aluminum-plastic combinations. Traditional ABL structures combine plastic with aluminum, making separation expensive and infrastructure-dependent. The OECD reports that only 9% of plastic waste globally is recycled, with multi-layer packaging among the hardest formats to process.

Regulatory pressure on packaging waste forces companies to invest in redesign and compliance, increasing operational costs. Another restraint is competition from alternative packaging formats. Bottles, pumps, sachets, and pouches are gaining popularity for certain product categories. These alternatives sometimes offer lower costs or easier recyclability.

Growth Factors

Shift Toward Sustainable and Recyclable Packaging Creates Growth Opportunities

Sustainability trends create strong growth opportunities for the ABL and PBL tubes market. Brand owners are actively shifting toward recyclable and mono-material PBL tubes to meet environmental goals. This transition opens new demand for innovative tube structures.

Growth in emerging markets also supports future expansion. Rising income levels, expanding middle-class populations, and increasing consumption of personal care products drive packaging demand. Tubes remain a preferred option due to affordability and practicality.

Pharmaceutical and dermatology product launches offer another opportunity. Increasing focus on topical treatments, medicated creams, and OTC products boosts demand for high-barrier tube packaging. Customization and smart packaging solutions further enhance opportunities.

Regional Analysis

Asia Pacific Dominates the ABL and PBL Tubes Market with a Market Share of 37.8%, Valued at USD 2.0 billion

Asia Pacific leads the ABL and PBL tubes market due to strong growth in the personal care, pharmaceutical, and food packaging industries. Rapid urbanization, rising disposable incomes, and expanding manufacturing bases support higher tube consumption. The region accounted for a 37.8% share, reaching USD 2.0 billion, driven by demand for cost-efficient and high-barrier packaging formats.

North America shows stable demand for ABL and PBL tubes, supported by premium cosmetics, oral care, and regulated pharmaceutical packaging. Sustainability-focused packaging design and recyclability requirements influence material selection. Innovation in laminate structures and consumer preference for convenient dispensing formats continue to support moderate regional growth.

Europe’s market growth is shaped by strict packaging regulations and strong adoption of recyclable and mono-material tube solutions. Demand remains consistent across cosmetics, healthcare, and specialty food segments. The region emphasizes lightweight packaging, reduced aluminum usage, and compliance with circular-economy policies.

The U.S. market is driven by innovation-led demand in personal care and pharmaceutical packaging. High focus on product safety, branding aesthetics, and sustainable materials shapes tube design preferences. Growth remains consistent due to strong consumer spending and advanced packaging infrastructure.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Albea SA is viewed as a packaging specialist that benefits from long-standing relationships with beauty, personal care, and pharma brands. Its strength typically sits in design execution and high-volume manufacturing discipline, which matters in ABL formats where barrier performance and consistent decoration are key. The company’s competitiveness is also linked to its ability to align tube structures with evolving recyclability expectations.

Amcor Limited stands out as a scale-driven packaging player with broad material and barrier know-how that can translate well into PBL tube demand. Its advantage is the ability to bring global brand requirements, compliance needs, and supply assurance into tube programs that run across multiple regions. The focus is often on lightweighting, downgauging, and improving circular-ready packaging outcomes without sacrificing shelf appeal.

Essel Propack Limited is often associated with large tube volumes and a strong emerging-market reach. It is positioned to capture steady demand from oral care and everyday FMCG categories. The market view is that its operational footprint and cost competitiveness support high-throughput PBL production, while continued improvements in laminate structures help brands balance price, performance, and sustainability messaging.

CCL Industries Inc. brings a diversified packaging and label ecosystem that supports premiumization and differentiated branding in tube formats. Its capability to pair tube packaging with decoration, security, and product-identification features that help brand owners on crowded retail shelves. This plays well for cosmetics and pharma segments where trust, traceability, and visual impact influence repeat purchases.

Top Key Players in the Market

- Albea S A

- Amcor Limited

- Essel Propack Limited

- CCL Industries Inc

- Sonoco Products Company

- Montebello Packaging

- Unette Corporation

- Hoffmann Neopac AG

- Tubapack A S

- CTL Packaging

Recent Developments

- In 2025, Amcor will be active in the packaging sector, with several developments focused on sustainable and innovative tube packaging solutions, which align with ABL (Aluminum Barrier Laminate) and PBL (Plastic Barrier Laminate) technologies used in personal care, healthcare, and other applications.

- In 2025, EPL Limited, formerly Essel Propack, continues to focus on laminate tube packaging in the ABL and PBL sectors, with recent financial and operational updates from BSE filings. EPL released its Q1 FY26 Earnings Presentation, highlighting performance in tube manufacturing across certified facilities in six countries.

Report Scope

Report Features Description Market Value (2024) USD 5.4 Billion Forecast Revenue (2034) USD 9.7 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (ABL Tubes, PBL Tubes), By Material (Plastic, Laminates, Aluminum, Others), By Application (Cosmetics, Food, Pharmaceuticals, Industrial, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Albea S A, Amcor Limited, Essel Propack Limited, CCL Industries Inc, Sonoco Products Company, Montebello Packaging, Unette Corporation, Hoffmann Neopac AG, Tubapack A S, CTL Packaging Customization Scope Customization for segments and region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  ABL And PBL Tubes MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

ABL And PBL Tubes MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Albea S A

- Amcor Limited

- Essel Propack Limited

- CCL Industries Inc

- Sonoco Products Company

- Montebello Packaging

- Unette Corporation

- Hoffmann Neopac AG

- Tubapack A S

- CTL Packaging