Global 3D Printing Materials Market By Type (Ceramics, Metals, and Plastics), By Form (Powder, Filament, Liquid), By Technology: (FDM, SLS, SLA, DMLS, Others), By Application:(Prototyping, Manufacturing, Others), By End-Use (Aerospace & Defense, Automotive, Medical, and Consumer Products & Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 38164

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

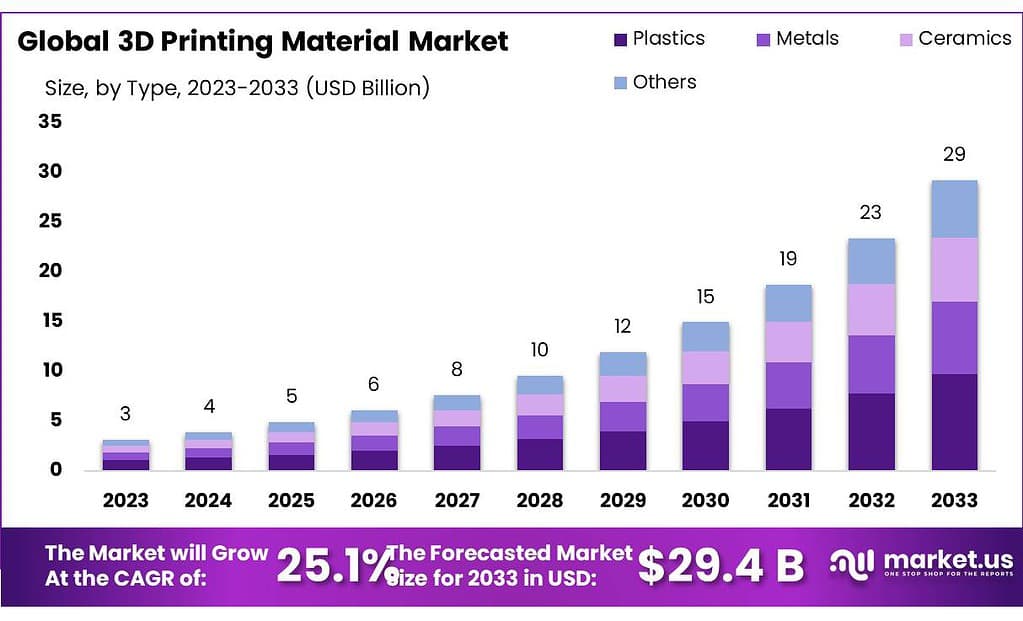

The global 3D Printing Materials Market size is projected to reach USD 29.4 billion by 2033 from USD 3.12 billion in 2023 – at a compound annual compound growth rate of 25.1% over its predicted lifespan between 2023-2033.

As more industries, such as aerospace & defense and automotive, seek high-performance materials such as 3D printers for production purposes, the market size is projected to experience exponential growth.

The 3D printing materials market is experiencing remarkable expansion and transformation due to technological innovations and increasing adoption across various industries. It encompasses various materials, technologies, and applications that drive innovation while revolutionizing traditional manufacturing processes.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The 3D Printing Materials Market is predicted to expand significantly, with an anticipated value of USD 29.4 billion by 2033 from USD 3.12 billion in 2023, showing a remarkable 25.1% Compound Annual Growth Rate (CAGR).

- Material Types: Plastic materials dominate the market, accounting for over 33.2% in 2023 due to their versatility and cost-effectiveness, widely used in automotive and healthcare industries.

- Demand Factors: High-performance materials, particularly thermoplastic materials, are expected to drive demand due to their lightweight yet resilient applications in aerospace, automotive, medical, and other sectors.

- Material Forms & Technologies: Powder-based and filament-based printing methods are prominent, each catering to specific materials like metals, plastics, and ceramics. Various technologies like FDM, SLS, SLA, and DMLS, among others, cater to different material types.

- Applications: The market serves diverse applications such as prototyping and manufacturing across industries like aerospace & defense, automotive, healthcare, consumer products, and industrial sectors.

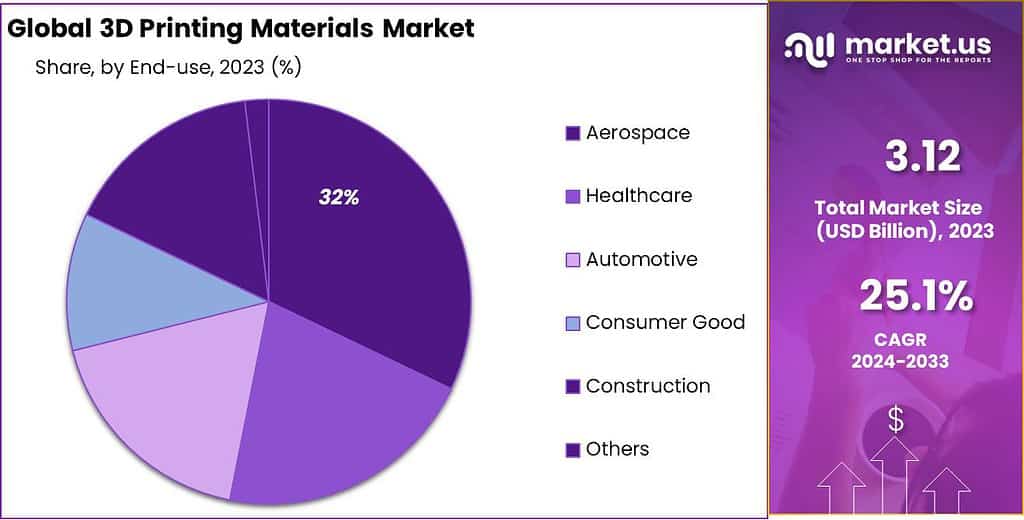

- End-Use Sectors: Aerospace & defense claimed a significant market share of over 33.4% in 2023, relying on 3D printing materials for lightweight yet robust components. Medical applications, including prosthetics and implants, also contribute to market growth.

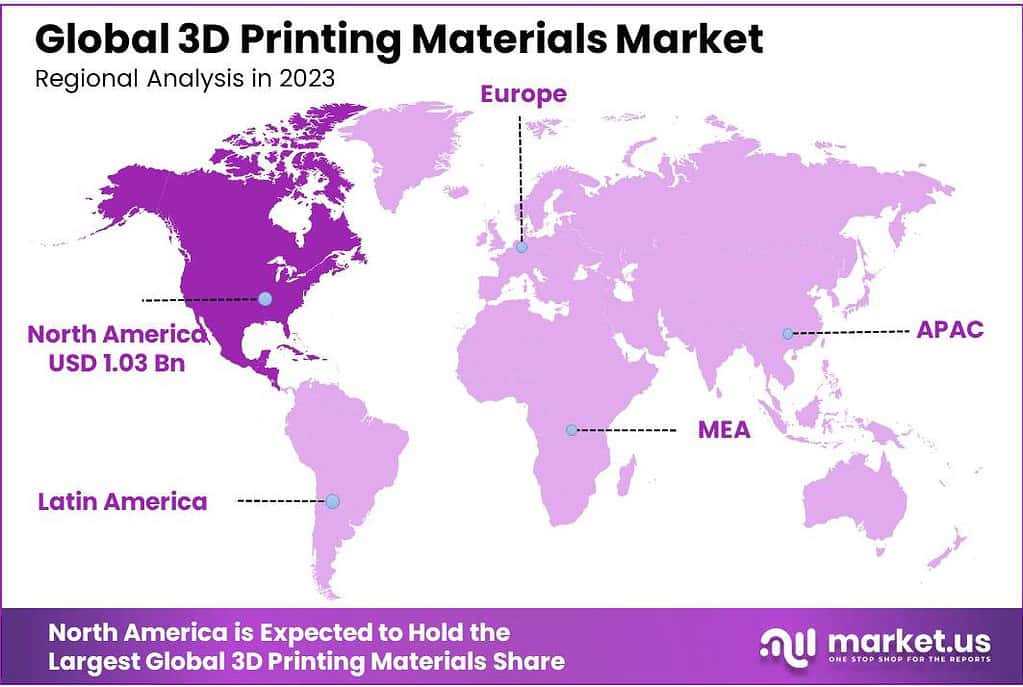

- Regional Analysis: North America held a substantial market share in 2023 (32.1%), likely to expand due to increased investments and demand within the region, particularly in metals from industries like consumer electronics, defense, aerospace, and automotive.

- Major Players: The market is influenced by key players like Höganäs AB, 3D Systems Corporation, General Electric, and Arkema S.A., among others, with continuous research and development efforts contributing to customer-specific solutions and market dominance.

- Challenges & Opportunities: Challenges revolve around standard process control and the production of low-cost 3D printing materials. However, the opportunities lie in the adoption of 3D printing technology in home printing, driving market expansion.

By Type

In 2023, By Type, Plastic materials were in the lead, holding over 33.2% of the market. They’re popular due to their versatility and cost-effectiveness, used widely in industries like automotive and healthcare.”

The 3D printing materials market is a major factor use of materials such as photopolymers and thermoplastics. Other material types include ceramics and plywood filaments. Material selection is determined by their mechanical properties, manufacturing characteristics, and appearance as well as cost. Their durability and flexibility are expected to increase their demand in all application industries.

High-performance Materials Demand will likely benefit from the low costs associated with thermoplastic materials. Their increase will likely be driven by increasing demands for lightweight yet resilient applications in sectors like aerospace & defense, automotive sector, medical as well as other fields.

Metal Alloys are a preferred raw material cost for the dental industry. Implants are made using metal leading segments like titanium, aluminum, chrome, and even cobalt. The 3D Printing Materials market size is expected to grow because of the growing demand for aerospace & defense sectors.

Laywood filament is made from recycled wood and polymer binding. It can also be used for the 3D printing materials market. Laywood filament is used primarily to produce large architectural models, bowls, and sculptures. This segment is expected to grow with the increased adoption of technology in various industries.

By Form

Powder Form: Powder-based 3D printing technologies such as Selective Laser Sintering (SLS) and Electron Beam Melting (EBM), use powdered materials. Metals, plastics, ceramics and composite materials may all be utilized by this printing method – including metals like iron and copper as well as more exotic ones like bronze. Lasers or electron beams fuse layer by layer this powder until an object has been created with complex geometries such as aerospace components or functional parts for industries like automotive or healthcare industries.

Filament Form: Fused Deposition Modeling (FDM) is one of the most popular 3D printing methods that uses materials in filament form. Filaments are typically made of thermoplastics like PLA, ABS, PETG, and nylon. The filament is heated and extruded through a nozzle, layering it to form the object. FDM is widely used due to its ease of use, cost-effectiveness, and suitability for rapid prototyping.

Stereolithography (SLA) and Digital Light Processing (DLP) are 3D printing technologies that use liquid materials as 3D printer resins are photosensitive resins that solidify when exposed to certain wavelengths of light, including standard, flexible, tough, and high-temperature variants of resin. Both SLA and DLP have become well known for their high-resolution printing abilities and have found application across industries including jewelry making, dentistry, and prototyping where intricate details play an integral part of success.

By Technology

Fused Deposition Modeling/ Fused Filament Fabrication (FDM/ FFF): Fused Deposition Modeling/ Fused Filament Fabrication is an increasingly popular technology which involves extrusion of thermoplastic filaments through heated nozzles to form objects layer by layer. Due to its accessibility, ease of use, and cost effectiveness it has seen widespread adoption for prototyping purposes, product development projects, educational settings as well as prototyping projects.

Selective Laser Sintering (SLS): SLS employs high-powered lasers to sinter powdered materials (such as plastics, metals, and ceramics ) layer by layer until they fuse together into three-dimensional objects. It’s often utilized by aerospace, automotive, and medical industries due to its ability to create strong parts with intricate designs while being economically sustainable.

Stereolithography (SLA): SLA utilizes a vat of liquid photopolymer resin cured by ultraviolet (UV) lasers or other light sources. The laser selectively solidifies the resin layer by layer, creating highly detailed and accurate models. SLA is favored for its high resolution and surface finish, suitable for applications in jewelry, dental, and product design.

Direct Metal Laser Sintering (DMLS) / Selective Laser Melting (SLM): These technologies use high-powered lasers to selectively melt and fuse metal powders layer by layer, creating metal components. DMLS and SLM are widely used in aerospace, healthcare (for implants), automotive, and tooling due to their ability to produce strong, complex metal parts.

Binder Jetting: This technique involves selectively depositing a binding agent onto a powdered material (metal, sand, ceramics) layer by layer. It’s used for rapid prototyping, sand casting molds, and creating complex parts in various industries.

Digital Light Processing (DLP): Similar to SLA, DLP uses light to cure liquid photopolymer resin layer by layer. However, instead of a laser, it uses a digital light projector to solidify the entire layer simultaneously. DLP can achieve faster print times and is utilized in industries requiring high-resolution prints.

By Application

Prototyping: One of the earliest and still prevalent applications of 3D printing is rapid prototyping. This practice provides quick, cost-effective creation of prototypes which enables designers and engineers to test concepts, iterate designs, and visualize products before mass production begins – something found across industries including automotive, aerospace, consumer goods and electronics production.

Manufacturing: 3D printing has evolved from prototyping to actual manufacturing of end-use parts. Industries such as aerospace, automotive, healthcare, and electronics utilize additive manufacturing for producing final components. The technology’s ability to create complex geometries, customized designs, and lightweight structures has made it an integral part of manufacturing processes.

End-Use

In 2023, the Aerospace and defense industry stood out, securing a significant market share of over 33.4%. This sector heavily relies on 3D printing materials for producing lightweight yet robust components, driving innovation and efficiency in manufacturing.

Market growth prospects are expected to be boosted by the increasing use of the 3D printing market for 3D Printing medical purposes, such as prosthetics and implants for hip and knee replacements, and surgical tools. The industry is expected to grow due to the increasing use of 3D-printed models by surgeons and doctors to perform complex operations forecast periods.

Due to China’s growing manufacturing sector, Japan,’s and other economies, the consumer product and industrial segment will grow in the forecast period. Market growth will also be supported by the increased use of ceramics in house decor, art, and sculpture.

The market for 3D printing materials market demand also includes divisions for architecture, the education sector, and construction. The market is anticipated to expand as a result of rising exploration activities and manufacturing methods, as well as rising 3D printing use in the architectural sector.

*Actual Numbers Might Vary In The Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Type

- Photopolymers

- Metals

- Plastics

- Other Materials

By Form

- Powder

- Filament

- Liquid

By Technology

- FDM

- SLS

- SLA

- DMLS

- Others

By Application

- Prototyping

- Manufacturing

- Others

End-Use

- Aerospace & Defense Industry

- Automotive Sector

- Medical

- Consumer Products & Industrial Sectors

- Other Applications

Driver

Development of new industrial-grade 3D printing materials

Making new materials available for 3D printing is of utmost importance. While plastic was once our sole resource for 3D printing, now ceramics, metals and even materials that benefit human bodies can all play an essential part in expanding 3D printing’s potential in areas like electronics and energy production.

There’s this cool filament from The Virtual Foundry that mixes PLA with lots of metal. With this, any FDM printer can make things like bronze or copper. Also, composites are getting popular, especially in aerospace.

These new materials will make 3D printing better. They’ll help make things with specific properties, especially in important jobs. For normal FDM printers, it’s mostly ABS, PLA, and mixes of these that are used.

Restraint

Lack of standard process control

Due to uncontrollable process variables and material differences based on machine and manufacturer, the consistency of each 3D printing process varies. Currently, very few monitoring techniques meet specific criteria by reflecting 3D printing process inconsistencies.

Because of the limited data available for process control, it is difficult to develop detailed and accurate mathematical models using 3D printing, especially in complex and sophisticated applications outputs may result from limitations in the planning phase, process control, and pre-and postproduction procedures.

Opportunity

Adoption of 3D printing technology in home printing

3D printing has been around for 30 years, yet its recent surge can be traced to home 3D printers’ recent availability on the market due to their lower prices – spurring rapid expansion in both demand for home 3D printers as well as 3D materials market growth.

These printers can now be found everywhere from homes and offices, to computer stores and shopping malls; providing users with quick and cost-effective means of producing low-cost goods in a short period.

Challenge

Production of low-cost 3D printing materials

Cost concerns over 3D printing materials have long hampered market expansion. Multiple applications exist that use these materials but may face various restrictions due to their higher costs; creating low-cost technologies for producing these printing materials remains a top challenge facing key manufacturers and researchers.

Due to their high cost, 3D printing materials are used only in high-end and luxury cars. There are significant opportunities in other economic automotive sectors for 3D printing materials. The consumer & industrial sector leads the 3D printing materials market and is expected to dominate the market due to the decreased production cost.

Regional Analysis

North America held 32.1% market share as of 2023 and it’s predicted to keep expanding thanks to increased investments from producers and demand from major players within the region, who remain focused on technological innovations and investment in 3D Printing materials.

The favorable government policies, large manufacturing base, high-performance material research and development investment, and wide range spread availability of 3D printing products are expected to drive the industry’s growth. High product demand is expected to be a result of rising disposable income and an improved standard of life.

Over the forecast period, North America’s market size will see a rise in product demand for metals from consumer electronics, defense, aerospace, and automotive Segment industries. Industry growth will also be supported by the increased use of metals, ceramics, and photopolymers in product intricate design and manufacturing.

Demand for 3D Printing Materials Market growth will likely be driven by rapid industrialization and infrastructure development throughout Asia Pacific, while North American demand will also benefit from an upsurge in R&D investments made in countries like China, India, Japan and Indonesia to upgrade aerospace and defense industry equipment.

Key Players Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Manufacturers are likely to increase their use of 3D printing technology, which will drive demand for metals, thermoplastics, and photopolymers. The key major company players also invest more in R&D to create customer-specific solutions and strengthen their market player position.

Кеу Market Рlауеrѕ

- Höganäs AB

- 3D Systems Corporation

- General Electric

- Arkema S.A.

- Royal DSM N.V.

- Stratasys Ltd.

- Evonik Industries AG.

- EOS GmbH

- Sandvik AB

- Other Key Major players

Recent Developments

June 2023: BASF announced the launch of its new bio-based 3D printing material, EcoPaXX. EcoPaXX is a high-performance, recyclable material that is made from renewable resources. It is suitable for a wide range of applications, including automotive, medical, and consumer goods.

August 2022: An agreement was reached and concluded by Sandvik to purchase 10% of the stock holdings in Sphinx Tools Ltd., situated in Swartzland, and its fully owned subsidiary Sphinx Tools. Most of the tools offered by Sphinx are surgical cutting tools and precision solid round tools. The aerospace, automotive, and healthcare industries account for most customers. Sandvik Coromant, a section of Sandvik Manufacturing and Machining Solutions, is anticipated to cover the business.

Report Scope

Report Features Description Market Value (2023) USD 3.12 Bn Forecast Revenue (2033) USD 29.4 Bn CAGR (2024-2033) 25.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Metals, Ceramics, Plastics, Others), By form:(Powder, Filament, Liquid), By technology: (FDM, SLS, SLA, DMLS, Others), By application:(Prototyping, Manufacturing, Others), By end-use(Aerospace, Healthcare, Automotive, Consumer Go, Construction, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Höganäs AB, 3D Systems Corporation, General Electric, Arkema S.A., Royal DSM N.V., Stratasys Ltd., Evonik Industries AG., EOS GmbH, Sandvik AB, Other Key Major players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of 3D Printing Materials Market?The global 3D Printing Materials Market size is expected to be worth around USD 29.4 billion by 2033, from USD 3.12 billion in 2023.

What is the CAGR of 3D Printing Materials Market?The global 3D Printing Materials Market is growing at a CAGR of 5.3% during the forecast period 2022 to 2033.Who are the major players operating in the 3D Printing Materials Market?Höganäs AB, 3D Systems Corporation, General Electric, Arkema S.A., Royal DSM N.V., Stratasys Ltd., Evonik Industries AG., EOS GmbH, Sandvik AB, Other Key Major players.

3D Printing Materials MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

3D Printing Materials MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Höganäs AB

- 3D Systems Corporation

- General Electric

- Arkema S.A.

- Royal DSM N.V.

- Stratasys, Ltd.

- Evonik Industries AG.

- EOS GmbH

- Sandvik AB

- Other Key Players