Global 3D Printers Market By Type (Desktop Printers, and Industrial Printers), By Technology (Fused Deposition Modeling, Selective Laser Sintering, Stereolithography, Direct Metal Laser Sintering, PolyJet, MultiJet Fusion, Digital Light Processing, Binder Jetting, Electron-Beam Melting, Directed Energy Deposition, Laser Metal Fusion, Selective Absorption Fusion, and LCD 3D Printing), By Material Type (Plastics, Metals, Ceramics, Composites, Bio-based Materials, and Others), By Application (Prototyping, Tooling, Production of End-Use Parts, Personalization and Customization, Art and Design, and Manufacturing), and By End User (Automotive Industry, Aerospace and Defense, Healthcare and Medical, Consumer Goods, Construction and Architecture, Electronics, Education and Research, Fashion and Jewelry, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 11969

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

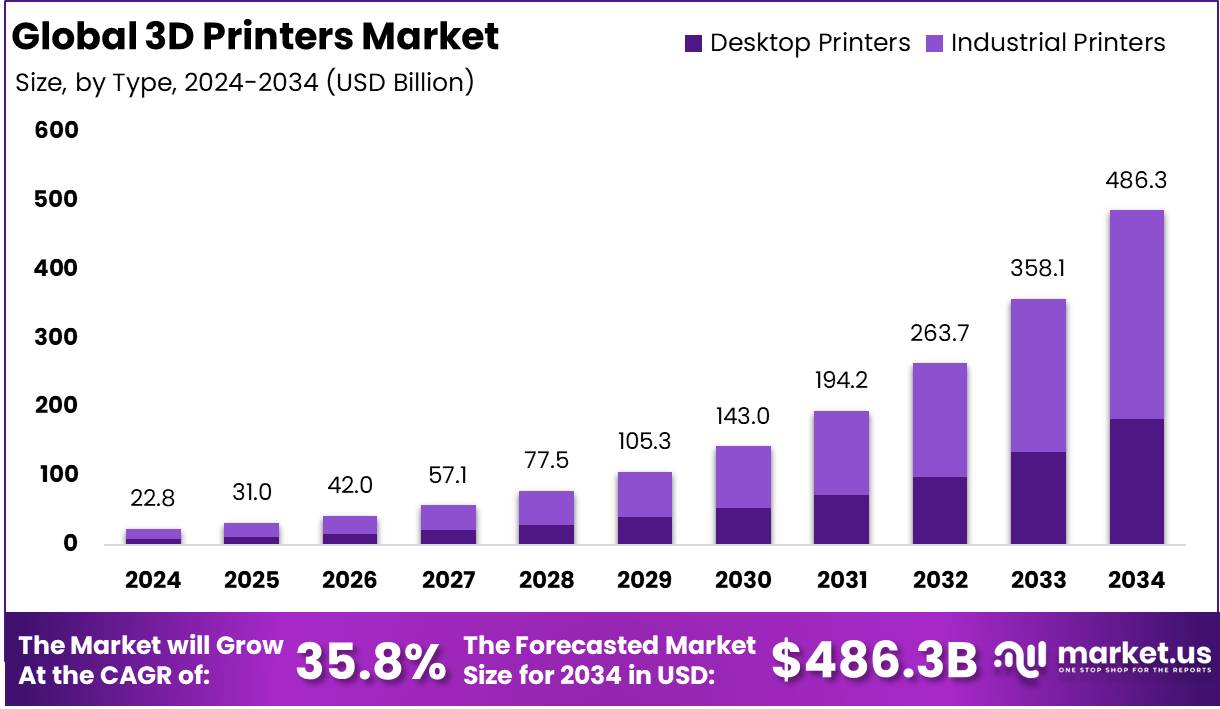

The Global 3D Printers Market size is expected to be worth around USD 486.3 Billion by 2034 from USD 22.8 Billion in 2024, growing at a CAGR of 35.8% during the forecast period from 2025 to 2034.

3D printing, also known as additive manufacturing, is a process that creates three-dimensional objects by layering material based on a digital design. This technology enables the production of complex and customized parts with high precision across various industries, including healthcare, automotive, aerospace, and consumer goods.

By eliminating traditional manufacturing constraints, 3D printing offers significant advantages such as reduced material waste, cost efficiency, and accelerated prototyping, making it a transformative force in modern production methodologies.

The 3D printing market encompasses the ecosystem of hardware, software, materials, and services that enable additive manufacturing across multiple industries. This market includes industrial-grade 3D printers, desktop models for small-scale applications, and advanced materials such as polymers, metals, and ceramics.

The industry has evolved from a niche prototyping tool to a mainstream manufacturing solution, driven by continuous innovation and increasing adoption across sectors seeking agility, cost savings, and sustainability.

The expansion of the 3D printing market is fueled by advancements in material science, increasing industrial automation, and the rising adoption of digital manufacturing techniques. Innovations in high-performance materials and multi-material printing have enhanced application possibilities, while the integration of AI and machine learning in 3D printing processes has improved efficiency and precision.

The demand for 3D printing is driven by its ability to streamline production processes, reduce lead times, and enable customization. Industries such as aerospace and defense leverage the technology for lightweight, durable components, while healthcare applications include patient-specific implants, prosthetics, and bioprinting. The automotive sector is also witnessing increased adoption for rapid prototyping and on-demand production of spare parts, further strengthening the market’s growth trajectory.

The 3D printing industry presents significant opportunities in mass customization, distributed manufacturing, and sustainability. The ability to produce components on-demand and closer to the point of use reduces logistics costs and carbon footprints.

Emerging applications in bioprinting and construction hold immense potential, with innovations in tissue engineering and 3D-printed housing paving the way for new revenue streams. As technology matures and costs decline, adoption is expected to surge across both industrial and consumer segments, unlocking further market expansion.

According to G2, 82% of users report significant cost savings through 3D printing, reinforcing its role in driving operational efficiency. The market’s expansion is evident, with China’s manufacturers exporting approximately 2.032 million units, accounting for 90% of their total sales. The United States remains the largest market, contributing $3.1 billion, or 22% of global revenue.

Europe dominates in business concentration, hosting 52% of all 3D printing firms. Despite budget constraints cited by 33% of businesses, 61% of users plan to increase investment, highlighting strong growth potential. The market’s trajectory reflects rising adoption and strategic advancements in additive manufacturing.

The 3D printers market is experiencing rapid growth, with analysts projecting an annual expansion of 18% to 27%. According to Toner Buzz, 69% of users adopt 3D printing for its ability to create complex geometries, while 52% value its rapid prototyping capabilities, and 41% highlight its mass customization potential.

Among companies utilizing 3D printing, 38% consider it their core business, 18% have dedicated in-house departments, and 16% apply it across multiple divisions. Additionally, 70% of firms investing in 3D printing use it for small series, 49% for large series, and 18% for mass production, reinforcing its industrial scalability.

Key Takeaways

- The global 3D printers market is projected to reach approximately USD 486.3 billion by 2034, up from USD 22.8 billion in 2024, exhibiting a CAGR of 35.8% from 2025 to 2034.

- Industrial 3D printers represented the largest market segment in 2024, accounting for over 62.4% of the total market share.

- Fused Deposition Modeling (FDM) was the leading technology segment, capturing more than 44.8% of the global market share in 2024.

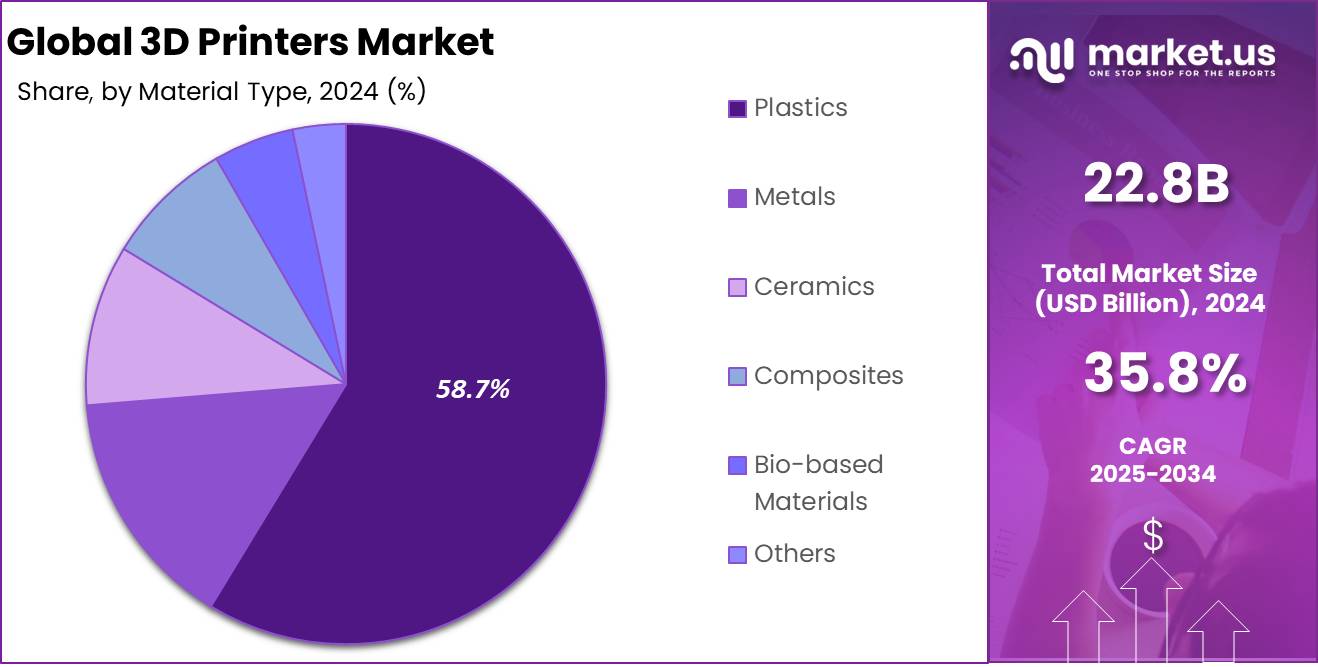

- Plastics were the most utilized material in 3D printing, holding a dominant market share of over 58.7% in 2024.

- Prototyping was identified as the primary application of 3D printing, accounting for over 36.8% of market share in 2024.

- The automotive industry emerged as the leading end-user sector, contributing more than 29.0% to the market share in 2024.

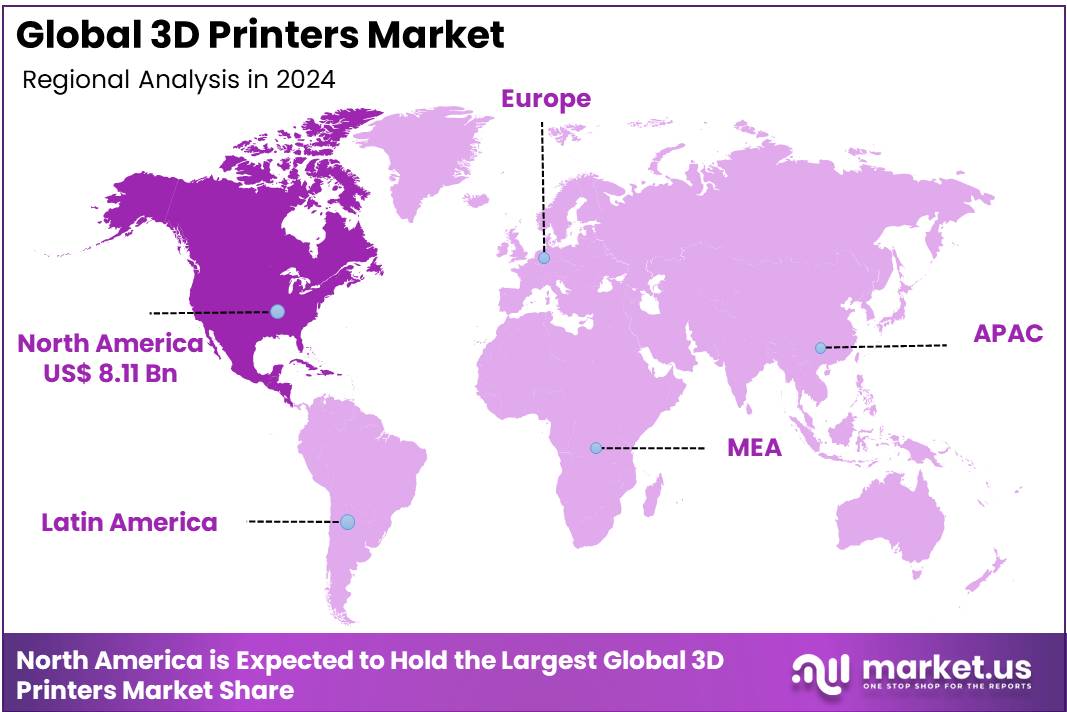

- North America dominated the global 3D printers market in 2024, holding a substantial 35.6% market share, valued at approximately USD 8.11 billion.

By Type Analysis

Industrial Printers Dominate the 3D Printing Market with a 62.4% Share in 2024

In 2024, industrial 3D printers emerged as the dominant segment in the global 3D printing market, capturing more than 62.4% of the market share. The increasing adoption of additive manufacturing across industries such as aerospace, automotive, healthcare, and manufacturing has driven this growth.

Industrial printers are preferred for their high precision, scalability, and ability to produce complex prototypes and end-use parts, making them essential for large-scale production. Companies continue to invest in advanced metal and polymer-based 3D printing technologies, further strengthening the industrial segment’s market presence.

Desktop 3D printers have witnessed steady growth due to increasing adoption among small businesses, educational institutions, and hobbyists. Their affordability, ease of use, and enhanced material compatibility have contributed to their expansion.

Additionally, rising demand for rapid prototyping, personalized manufacturing, and educational applications has fueled the growth of this segment. With continuous material innovations and improved accessibility, desktop 3D printers are expected to gain further traction in the coming years.

By Technology Analysis

Fused Deposition Modeling (FDM) Leads the 3D Printing Market with a 44.8% Share in 2024

In 2024, Fused Deposition Modeling (FDM) emerged as the dominant technology in the 3D printing market, capturing more than 44.8% of the market share. The cost-effectiveness, ease of use, and wide material availability of FDM technology have contributed to its widespread adoption across industries such as automotive, consumer goods, healthcare, and education. Its ability to produce functional prototypes and end-use parts with minimal investment makes it a preferred choice for both businesses and individuals.

Selective Laser Sintering (SLS) continues to grow due to its ability to produce highly durable and complex parts without support structures. Industries such as aerospace, automotive, and medical are increasingly adopting SLS for low-volume production and functional prototyping, making it a key player in the 3D printing market.

Stereolithography (SLA) remains a preferred technology for applications requiring high precision and fine details. Widely used in dental, jewelry, and prototyping industries, SLA technology provides smooth surface finishes and excellent accuracy, driving its continued growth.

The Direct Metal Laser Sintering (DMLS) segment is expanding rapidly, fueled by increasing demand for metal 3D printing in aerospace, healthcare, and industrial manufacturing. Its capability to produce strong, lightweight, and intricate metal components has positioned it as a vital technology for high-performance applications.

PolyJet and MultiJet Fusion (MJF) technologies are gaining momentum due to their ability to print with multiple materials and colors in a single process. Industries such as medical, consumer goods, and prototyping benefit from their high speed and precision, supporting market expansion.

Digital Light Processing (DLP) technology is growing steadily, especially in the dental, jewelry, and medical sectors, where high-speed and accurate resin printing is essential. Its cost-effectiveness compared to SLA further enhances its adoption.

Binder Jetting is seeing increased adoption for its ability to produce complex metal and ceramic parts at lower costs. Its applications in automotive, aerospace, and tooling industries are driving its market presence.

Electron-Beam Melting (EBM) is emerging as a key technology in high-performance metal additive manufacturing, particularly in the aerospace and medical implant industries. Its capability to produce dense, strong metal components has contributed to its growth.

Directed Energy Deposition (DED) is growing in importance for repairing and fabricating large metal structures, particularly in industries like aerospace, defense, and energy. Its ability to work with multiple metal alloys and repair worn components is driving its demand.

Laser Metal Fusion (LMF) is gaining market presence due to its ability to produce complex, high-strength metal components used in automotive, medical, and aerospace applications.

Selective Absorption Fusion (SAF) is gaining attention for its high-speed powder bed fusion process, making it a competitive option for industrial manufacturing and large-scale production.

LCD 3D printing is expanding in the market, driven by affordable resin-based printers catering to hobbyists, small businesses, and educational sectors. Its high-detail output and accessibility make it a promising segment for future growth.

By Material Type Analysis

Plastics Lead the 3D Printing Market with a 58.7% Share in 2024

In 2024, plastics emerged as the dominant material in the 3D printing market, capturing more than 58.7% of the market share. The affordability, versatility, and ease of processing of plastic materials have contributed to their widespread use across industries such as automotive, healthcare, aerospace, and consumer goods. Popular plastic materials like PLA, ABS, PETG, and nylon continue to drive growth, supported by advancements in high-performance thermoplastics for industrial applications.

Metals remain a key segment in 3D printing, with increasing adoption in aerospace, automotive, and medical implants. Materials such as titanium, aluminum, stainless steel, and cobalt-chrome are widely used for producing high-performance, lightweight, and durable parts in critical applications.

Ceramic 3D printing is gaining traction, particularly in dental, aerospace, and industrial applications where high-temperature resistance, durability, and biocompatibility are essential. The demand for customized dental prosthetics, heat-resistant components, and artistic applications is driving growth in this segment.

Composite materials are witnessing increased adoption due to their high strength-to-weight ratio, durability, and resistance to extreme conditions. Industries such as automotive, aerospace, and defense are leveraging carbon-fiber, glass-fiber, and Kevlar-reinforced composites to create lightweight yet strong components for structural applications.

Bio-based materials are emerging as a sustainable alternative in the 3D printing market, with increasing use in medical, packaging, and eco-friendly product manufacturing. Materials such as biodegradable PLA, algae-based resins, and bioinks are driving advancements in bioprinting and environmentally conscious production.

The others category includes specialized materials such as food-based filaments, flexible elastomers, and conductive polymers, catering to unique applications in industries like electronics, food processing, and wearable technology. These materials continue to evolve, expanding the possibilities of 3D printing in diverse sectors.

By Application Analysis

Prototyping Leads the 3D Printing Market with a 36.8% Share in 2024

In 2024, prototyping emerged as the dominant application in the 3D printing market, capturing more than 36.8% of the market share. The ability of 3D printing technology to create rapid, cost-effective, and high-precision prototypes has fueled its adoption across industries such as automotive, aerospace, healthcare, and consumer goods.

Companies continue to invest in additive manufacturing for design validation, functional testing, and product development, making prototyping a crucial segment in the market.

Tooling and end-use part production are gaining traction as industries increasingly use 3D printing for functional components and customized tools. The ability to produce on-demand, lightweight, and durable parts for aerospace, automotive, and healthcare applications has driven growth in this segment.

Personalized and customized 3D printing applications continue to grow, particularly in sectors like healthcare, fashion, and consumer electronics. The demand for custom prosthetics, dental implants, and unique product designs is driving the expansion of this segment.

3D printing in art and design is experiencing increased adoption as artists, architects, and designers explore new creative possibilities. The ability to produce intricate, complex, and highly detailed structures has made 3D printing a valuable tool in sculpture, architecture, and product design.

Manufacturing applications for 3D printing are expanding, with industries leveraging additive manufacturing for low-volume production and supply chain optimization. The ability to reduce material waste, accelerate production cycles, and create lightweight components is driving increased adoption in automotive, aerospace, and medical device manufacturing.

By End User Analysis

Automotive Industry Leads the 3D Printing Market with a 29.0% Share in 2024

In 2024, the automotive industry emerged as the dominant end-user in the 3D printing market, capturing more than 29.0% of the market share. The industry’s adoption of additive manufacturing for prototyping, tooling, and production of lightweight components has driven this growth. Automakers are leveraging 3D printing for rapid design iteration, cost reduction, and supply chain efficiency, making it a key technology in modern vehicle manufacturing.

The aerospace and defense sector is witnessing increased adoption of 3D printing for lightweight, high-strength, and complex components. The ability to produce customized, fuel-efficient, and durable parts has made additive manufacturing essential in aircraft and defense equipment production.

The healthcare and medical segment is expanding as 3D printing technology revolutionizes personalized healthcare. The demand for custom prosthetics, dental implants, and bioprinting applications continues to grow, driving innovation in medical manufacturing.

The consumer goods industry is embracing 3D printing for product customization, rapid prototyping, and small-batch production. The ability to create unique, cost-effective, and sustainable designs has fueled the segment’s growth.

The construction and architecture sector is increasingly utilizing 3D printing for building prototypes, structural components, and sustainable housing solutions. The technology’s ability to reduce material waste and speed up construction is driving adoption in this market.

The electronics industry is adopting 3D printing for customized enclosures, prototypes, and printed circuit boards (PCBs). The technology’s role in miniaturization and rapid design iteration is fueling its growth in this sector.

The education and research industry continues to embrace 3D printing for academic learning, innovation labs, and engineering projects. The affordability and accessibility of desktop and industrial 3D printers have contributed to widespread use in universities and research institutions.

The fashion and jewelry segment is seeing increased adoption of 3D printing for customized, high-detail designs. The ability to produce intricate, lightweight, and personalized accessories has driven demand for additive manufacturing in this space.

The others category includes energy, marine, food, and sports industries, where 3D printing is being explored for unique, high-performance applications. The segment is expected to grow as industries continue experimenting with innovative uses of additive manufacturing.

Key Market Segments

By Type

- Desktop Printers

- Industrial Printers

By Technology

- Fused Deposition Modeling (FDM)

- Selective Laser Sintering (SLS)

- Stereolithography (SLA)

- Direct Metal Laser Sintering (DMLS)

- PolyJet, MultiJet Fusion (MJF)

- Digital Light Processing (DLP)

- Binder Jetting

- Electron-Beam Melting (EBM)

- Directed Energy Deposition (DED)

- Laser Metal Fusion (LMF)

- Selective Absorption Fusion (SAF)

- LCD 3D Printing

By Material Type

- Plastics

- Metals

- Ceramics

- Composites

- Bio-based Materials

- Others

By Application

- Prototyping

- Tooling Production of End-Use Parts

- Personalization and Customization

- Art and Design

- Manufacturing

By End User

- Automotive Industry

- Aerospace and Defense

- Healthcare and Medical

- Consumer Goods

- Construction and Architecture

- Electronics

- Education and Research

- Fashion and Jewelry

- Others

Driver

Advancements in Material Science Fueling 3D Printing Expansion

The global 3D printing market is experiencing significant growth, propelled by continuous advancements in material science. The development of diverse and high-performance materials has broadened the applications of 3D printing across various industries. Innovations in polymers, metals, ceramics, and composites have enhanced the mechanical properties, durability, and functionality of 3D-printed components.

This evolution has enabled the production of complex geometries and customized products, meeting the specific demands of sectors such as aerospace, automotive, healthcare, and consumer goods. For instance, the aerospace industry benefits from lightweight yet robust materials, leading to improved fuel efficiency and performance.

Similarly, in healthcare, biocompatible materials have facilitated the creation of patient-specific implants and prosthetics, revolutionizing personalized medicine. These material advancements have not only expanded the capabilities of 3D printing but have also made it a viable alternative to traditional manufacturing methods, thereby driving market growth.

Moreover, the development of sustainable and recyclable materials has addressed environmental concerns associated with manufacturing. The ability to use eco-friendly materials in 3D printing aligns with the global shift towards sustainable practices, attracting industries aiming to reduce their carbon footprint. Additionally, the reduction in material waste due to the additive nature of 3D printing contributes to cost savings and resource efficiency.

These factors collectively enhance the appeal of 3D printing, leading to increased adoption across various sectors. As material science continues to evolve, it is expected that the range of applications for 3D printing will further expand, solidifying its role as a transformative manufacturing technology.

Restraint

High Initial Capital Investment Impeding Widespread Adoption

Despite its numerous advantages, the widespread adoption of 3D printing technology is hindered by the high initial capital investment required. The cost of acquiring industrial-grade 3D printers, which offer the precision and capabilities necessary for large-scale manufacturing, remains substantial. This financial barrier is particularly pronounced for small and medium-sized enterprises (SMEs), which may lack the resources to invest in such advanced equipment.

Consequently, these organizations may be reluctant to integrate 3D printing into their production processes, limiting the technology’s penetration in certain markets. Additionally, the expenses associated with training personnel to operate and maintain 3D printing systems add to the overall cost, further deterring potential adopters. This economic constraint slows the pace at which 3D printing can be embraced across various industries, thereby restraining market growth.

Furthermore, the high cost of materials compatible with 3D printers contributes to the overall expense. Specialized materials, such as certain metals and high-performance polymers, are often more expensive than those used in traditional manufacturing methods. This cost disparity can make 3D printing less attractive for applications where material expenses significantly impact the overall production budget.

Additionally, the rapid pace of technological advancements in 3D printing can render equipment obsolete relatively quickly, posing a risk to companies considering such investments. These financial considerations collectively act as a restraint on the widespread adoption of 3D printing technology, particularly among cost-sensitive businesses.

Opportunity

Rising Demand for Personalized Medical Solutions Driving 3D Printing Growth

The growing emphasis on personalized healthcare is significantly driving the adoption of 3D printing in the medical sector. The increasing need for customized medical devices, such as implants, prosthetics, and surgical instruments, has positioned 3D printing as a transformative technology.

Unlike traditional manufacturing methods, 3D printing allows for the production of patient-specific solutions with high precision, improving both treatment effectiveness and patient outcomes. This capability is particularly beneficial in areas such as orthopedics and dentistry, where tailored implants and prosthetic devices enhance comfort, functionality, and compatibility.

The ability to create intricate and biocompatible structures further strengthens the role of 3D printing in regenerative medicine, where researchers are exploring the potential of bio-printing tissues and organs.

Additionally, the integration of 3D printing with advanced imaging technologies has expanded its applications in surgical planning and medical training. High-precision anatomical models created through 3D printing enable surgeons to visualize complex procedures in detail, leading to improved accuracy and reduced operation times.

This advancement enhances both preoperative preparation and patient safety, making surgical procedures more efficient. Furthermore, the cost-effectiveness of 3D printing in producing limited-batch, customized medical products appeals to healthcare providers seeking innovative yet budget-conscious solutions.

As regulatory frameworks evolve to accommodate the growing presence of 3D-printed medical devices, the industry is expected to witness accelerated growth, reinforcing 3D printing’s role as a vital technology in modern healthcare.

Trends

Integration of Artificial Intelligence Enhancing 3D Printing Capabilities

The integration of artificial intelligence (AI) into 3D printing processes represents a significant trend that is enhancing the technology’s capabilities and efficiency. AI algorithms can optimize design models for 3D printing, improving structural integrity while minimizing material usage. This optimization leads to cost savings and supports sustainability efforts by reducing waste.

Additionally, AI-driven predictive maintenance can monitor the condition of 3D printers in real-time, anticipating potential failures and scheduling maintenance proactively. This approach minimizes downtime and extends the lifespan of equipment, contributing to more efficient manufacturing operations.

The synergy between AI and 3D printing also facilitates the development of more complex and precise components, expanding the range of applications across industries such as aerospace, automotive, and healthcare. As AI technology continues to evolve, its integration with 3D printing is expected to drive further innovations, solidifying 3D printing’s role as a cornerstone of modern manufacturing.

Furthermore, AI enhances the adaptability of 3D printing by enabling real-time process monitoring and quality control. Machine learning algorithms can analyze data from the printing process to detect anomalies and adjust parameters on-the-fly, ensuring consistent quality in the final product.

This capability is particularly valuable in industries where precision is critical, such as medical device manufacturing and aerospace engineering. The combination of AI and 3D printing also accelerates the prototyping

Regional Analysis

North America Leads the 3D Printers Market with the Largest Market Share of 35.6%

North America dominates the global 3D printers market, holding a significant market share of 35.6% in 2024, with a valuation of approximately USD 8.11 billion. The growth in this region is driven by strong technological advancements, high adoption rates across industries, and significant investments in additive manufacturing.

The presence of well-established research and development facilities, along with widespread usage in aerospace, automotive, healthcare, and consumer goods sectors, contributes to market expansion. The demand for high-performance 3D printing materials and the integration of artificial intelligence in printing technologies further accelerate market penetration.

Europe remains a prominent market for 3D printers, benefiting from a robust manufacturing sector and supportive regulatory policies promoting industrial digitization. The increasing adoption of 3D printing in healthcare, automotive, and industrial applications has strengthened market demand.

Countries in Western Europe, particularly Germany, France, and the United Kingdom, have positioned themselves as key players due to their strong research and development focus. Government initiatives supporting additive manufacturing and sustainability drive further market expansion.

The Asia Pacific region is experiencing rapid growth in the 3D printers market, driven by expanding industrialization, rising investments in advanced manufacturing, and increasing government support for innovation. Countries such as China, Japan, and South Korea are at the forefront of technological adoption, leveraging 3D printing in various applications, including healthcare, automotive, and consumer electronics.

The cost advantages associated with mass production and advancements in materials science contribute to the growing market demand. The region’s competitive manufacturing landscape further enhances the market’s expansion.

The Middle East & Africa region is gradually embracing 3D printing technologies, with increasing adoption in sectors such as construction, healthcare, and aerospace. The market growth is supported by government-led initiatives aimed at promoting digital transformation and industrial diversification.

The UAE and Saudi Arabia lead regional advancements in additive manufacturing, focusing on sustainability and cost-efficient production methods. The adoption of 3D printing in infrastructure projects and medical applications further supports regional growth.

Latin America’s 3D printers market is expanding as industries such as healthcare, automotive, and consumer goods incorporate additive manufacturing into their operations. Brazil, Mexico, and Argentina are key contributors to market development, benefiting from increasing industrial investments and a growing focus on customized manufacturing. Government initiatives promoting technology adoption and cost-effective production methods enhance market expansion in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global 3D Printers Market in 2024 is characterized by intense competition among key players, each contributing to innovation, technological advancements, and market expansion. Stratasys and 3D Systems continue to lead the market, leveraging their extensive portfolio of industrial-grade 3D printers and strong customer base in aerospace, automotive, and healthcare.

EOS GmbH remains a dominant force in metal additive manufacturing, catering to high-precision industries with its laser sintering technology. HP Inc. is strengthening its position through Multi Jet Fusion (MJF) technology, offering scalable and cost-effective solutions for mass production.

Ultimaker, Formlabs, and MakerBot are driving desktop and professional 3D printing adoption, focusing on user-friendly designs and material versatility. Markforged is gaining traction with its composite 3D printing solutions, appealing to industries requiring lightweight yet strong materials.

Prusa Research has established a strong presence in the consumer and prosumer segments, emphasizing affordability and open-source development. Sinterit specializes in compact SLS printers, targeting small businesses and research institutions.

Renishaw and Voxelfab are advancing the metal 3D printing space, integrating precision engineering for industrial applications. Carbon, with its proprietary Digital Light Synthesis (DLS) technology, is enabling rapid production for dental, medical, and consumer goods sectors.

XYZprinting remains a key player in the affordable desktop 3D printer market, while Raise3D is expanding its industrial-grade offerings with high-performance materials and software solutions. Collectively, these players are shaping the competitive landscape, with continuous R&D and strategic collaborations driving market growth.

Top Key Players in the Market

- Stratasys

- 3D Systems

- EOS GmbH

- HP Inc.

- Ultimaker

- Formlabs

- MakerBot

- Markforged

- Prusa Research

- Sinterit

- Renishaw

- Voxelfab

- Carbon

- XYZ printing

- Raise3D

- Others

Recent Developments

- In 2023, Stratasys ended its proposed $1.8 billion merger with Desktop Metal after shareholders voted against it during an extraordinary meeting. Following this decision, Stratasys began exploring other strategic business options.

- In 2024, Nano Dimension agreed to buy Desktop Metal in an all-cash deal valued between $135 million and $183 million. The acquisition price ranged from $4.07 to $5.50 per share, offering Desktop Metal investors a significant premium over recent market prices.

- In 2025, Bambu Lab requested dismissal of Stratasys’ patent infringement case in Texas’ Eastern District. The company, however, agreed to continue litigation in Austin, where Stratasys previously filed a related suit. The lawsuit focused on features commonly found in desktop FDM printers, such as heated build platforms and networking.

- In 2024, Hexagon acquired the Geomagic 3D software tools from 3D Systems. These tools help users convert scanned physical objects into precise digital models suitable for manufacturing and quality inspection. The acquisition expands Hexagon’s capabilities in manufacturing software solutions.

- In September 2024, ICON, in collaboration with hotel innovator Liz Lambert, started building the world’s first large-scale 3D-printed hotel in Marfa, Texas. Designed by architectural firm BIG, the project includes uniquely shaped structures such as domes and arches, creating a distinctive hospitality experience within the desert landscape.

- In 2024, GKN Aerospace invested £50 million in advanced 3D printing at its Swedish site. Supported partly by the Swedish Energy Agency, this initiative aims to significantly reduce material waste by up to 80%, contributing to more sustainable aerospace manufacturing.

- In January 2024, Align Technology completed the purchase of Cubicure GmbH, a company specializing in polymer-based 3D printing technologies. Cubicure’s innovative materials and equipment will enhance Align’s offerings in digital orthodontics and dentistry solutions.

Report Scope

Report Features Description Market Value (2024) USD 22.8 Billion Forecast Revenue (2034) USD 486.3 Billion CAGR (2025-2034) 35.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Desktop Printers, and Industrial Printers), By Technology (Fused Deposition Modeling (FDM), Selective Laser Sintering (SLS), Stereolithography (SLA), Direct Metal Laser Sintering (DMLS), PolyJet, MultiJet Fusion (MJF), Digital Light Processing (DLP), Binder Jetting, Electron-Beam Melting (EBM), Directed Energy Deposition (DED), Laser Metal Fusion (LMF), Selective Absorption Fusion (SAF), and LCD 3D Printing), By Material Type (Plastics, Metals, Ceramics, Composites, Bio-based Materials, and Others), By Application (Prototyping, Tooling, Production of End-Use Parts, Personalization and Customization, Art and Design, and Manufacturing), and By End User (Automotive Industry, Aerospace and Defense, Healthcare and Medical, Consumer Goods, Construction and Architecture, Electronics, Education and Research, Fashion and Jewelry, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stratasys, 3D Systems, EOS GmbH, HP Inc., Ultimaker, Formlabs, MakerBot, Markforged, Prusa Research, Sinterit, Renishaw, Voxelfab, Carbon, XYZprinting, Raise3D, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Stratasys

- 3D Systems

- EOS GmbH

- HP Inc.

- Ultimaker

- Formlabs

- MakerBot

- Markforged

- Prusa Research

- Sinterit

- Renishaw

- Voxelfab

- Carbon

- XYZ printing

- Raise3D

- Others