Global 2-Ethylhexyl Methacrylate (2-EHMA) Market Size, Share Analysis Report By Product Form (Liquid Form, Powder Form, Emulsion Form, Granules), By Grade (Industrial Grade, Laboratory Grade, Commercial Grade, Specialized Grade), By Application (Adhesives and Sealants, Coatings, Inks, Plastics and Polymer Production, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160122

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

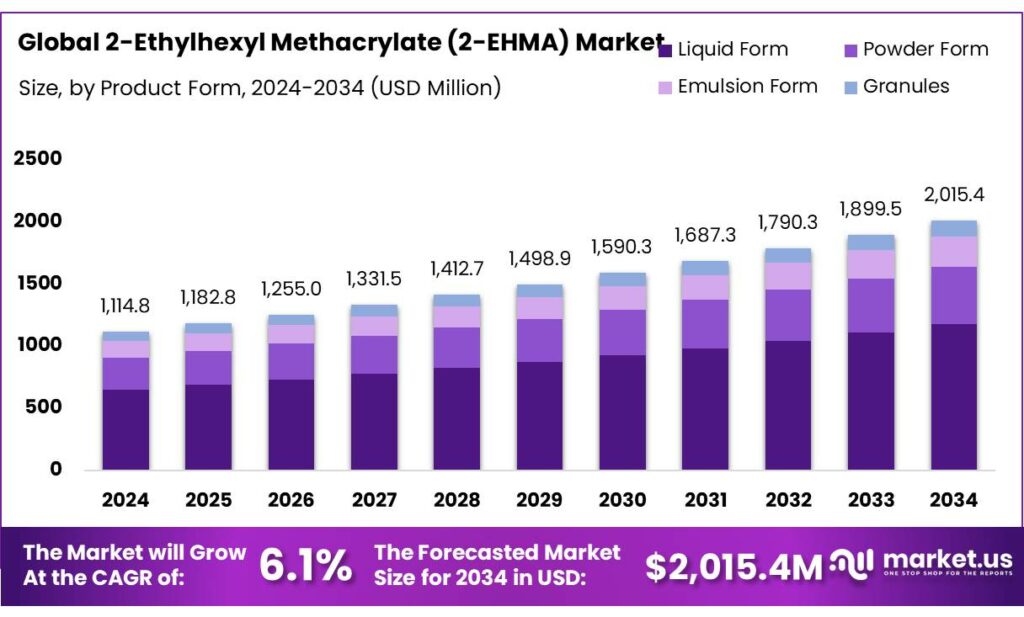

The Global 2-Ethylhexyl Methacrylate (2-EHMA) Market size is expected to be worth around USD 2015.4 Million by 2034, from USD 1114.8 Million in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

2-Ethylhexyl Methacrylate (2-EHMA), with the chemical formula C₁₂H₂₂O₂ and CAS number 688-84-6, is a transparent, colorless liquid primarily utilized as a monomer in the production of acrylic polymers. These polymers are integral to various applications, including paints, coatings, adhesives, sealants, and textiles, owing to their excellent flexibility, adhesion, and weather resistance properties.

Government initiatives, such as the Chemicals Management Plan in Canada, have been instrumental in assessing and regulating substances like 2-EHMA to ensure environmental and human health safety. Similarly, in the United States, the Food and Drug Administration (FDA) has established regulations under 21 CFR 177.1010, permitting the use of 2-EHMA in the production of acrylic and modified acrylic plastics intended for food contact, provided they meet specified safety standards.

The substance is manufactured and traded at industrial scale in the European Economic Area and is recorded in the REACH database in the 10,000 to <100,000 tonnes per year tonnage band, which indicates substantial industrial throughput within the EEA and relevant supply-chain exposure for downstream formulators. This tonnage classification is reported in ECHA dissemination records. The chemical is listed as “active” on the United States TSCA Inventory, confirming its commercial use and regulatory oversight in the U.S. market.

Regulatory surveillance and hazard characterisation have informed industrial handling and substitution strategies. Acute aquatic toxicity has been measured (e.g., 96-hour LC50 for Oryzias latipes ≈ 2.78 mg/L in a published safety data summary), which has led to standard risk-management measures for effluent and worker exposure controls in production and formulation sites.

At the European level, ECHA’s regulatory activity (including recent updates to the REACH Candidate List and Member State Committee deliberations during 2025) has increased scrutiny of several functional monomers and additives; stakeholders in downstream industries have therefore been advised to monitor candidate-list developments and prepare substitute-evaluation dossiers where required.

Key Takeaways

- 2-Ethylhexyl Methacrylate (2-EHMA) Market size is expected to be worth around USD 2015.4 Million by 2034, from USD 1114.8 Million in 2024, growing at a CAGR of 6.1%.

- Liquid Form held a dominant market position, capturing more than a 58.3% share.

- Industrial Grade held a dominant market position, capturing more than a 44.8% share.

- Adhesives and Sealants held a dominant market position, capturing more than a 39.2% share.

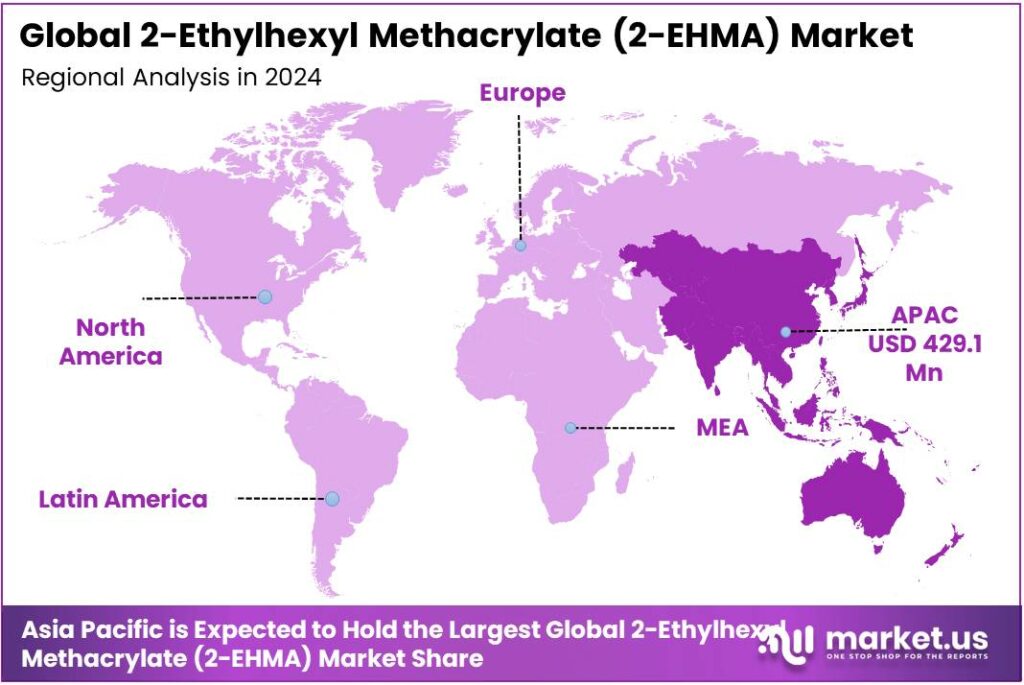

- Asia Pacific held a dominant position in the global 2-Ethylhexyl Methacrylate (2-EHMA) market, accounting for 38.50% of the total share and generating revenues of USD 429.1 million.

By Product Form Analysis

Liquid Form dominates with 58.3% due to its ready-to-use handling and wide downstream compatibility.

In 2024, Liquid Form held a dominant market position, capturing more than a 58.3% share. The prevalence of the liquid grade can be attributed to its ease of incorporation into formulations, reduced need for on-site dissolution equipment, and consistent rheological behaviour that benefits coatings, adhesives and sealant manufacturers. Production and supply chains have been structured to favour liquid deliveries because they lower processing steps for converters and shorten lead times for batch changes; as a result, formulation reliability and operational efficiency were improved for many end users.

Regulatory compliance and worker-safety measures have also been more straightforward to implement for liquid shipments, since standardized packaging and documented handling procedures are widely available. In 2025, demand patterns continued to reflect a strong preference for the liquid form as manufacturers prioritized faster throughput and fewer processing stages, while R&D efforts focused on optimizing co-monomer blends to retain performance without adding complexity to production. The liquid form’s dominance is therefore grounded in practical manufacturing advantages and downstream cost-efficiencies that supported its market share in 2024 and sustained its acceptance into 2025.

By Grade Analysis

Industrial Grade leads with 44.8% share driven by its extensive use in coatings and adhesives.

In 2024, Industrial Grade held a dominant market position, capturing more than a 44.8% share. This grade is widely preferred for large-scale applications such as paints, coatings, sealants, and adhesives, where high consistency and cost-effectiveness are essential. The industrial segment benefits from stable demand across construction, automotive, and packaging industries, where 2-EHMA is used to enhance flexibility, weather resistance, and adhesion properties of end products.

Supply chains have been streamlined to support bulk distribution, ensuring steady availability for manufacturers operating at scale. In 2025, Industrial Grade continued to retain its strong market presence as downstream sectors emphasized performance reliability and value over specialty formulations. The durability of demand in infrastructure development and industrial manufacturing further reinforced its role, making Industrial Grade a key driver of overall consumption during the period.

By Application Analysis

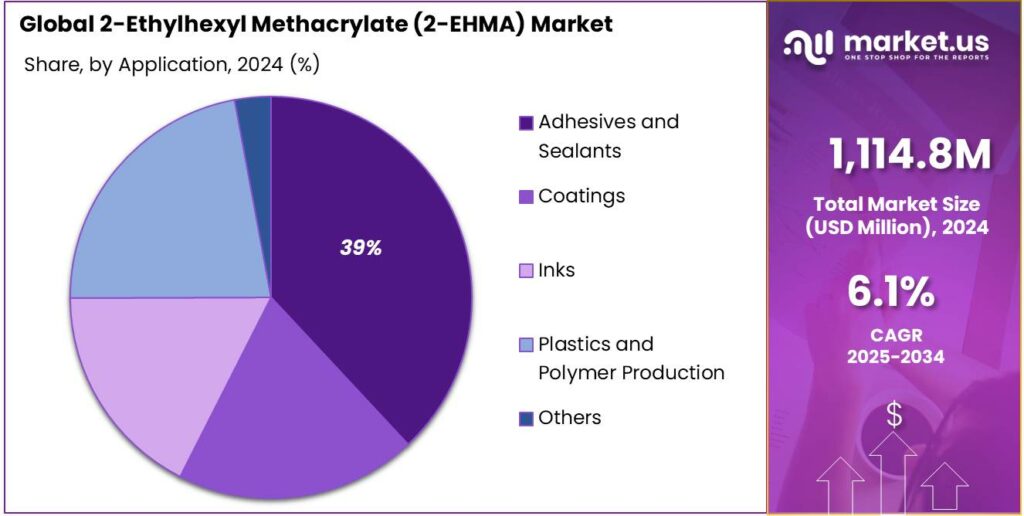

Adhesives and Sealants dominate with 39.2% share owing to their strong demand across construction and packaging.

In 2024, Adhesives and Sealants held a dominant market position, capturing more than a 39.2% share. The segment’s growth was supported by the increasing use of 2-EHMA in pressure-sensitive adhesives, construction sealants, and packaging applications where flexibility, durability, and strong bonding performance are required. Its ability to improve adhesion on diverse surfaces and provide long-lasting resistance to moisture and chemicals made it the preferred choice for industrial and commercial applications.

In 2025, demand from construction activities and the rising need for reliable packaging materials continued to drive the adhesives and sealants segment. With industries focusing on cost efficiency and performance stability, the use of 2-EHMA in adhesive formulations remained significant, reinforcing its strong market position through both 2024 and 2025.

Key Market Segments

By Product Form

- Liquid Form

- Powder Form

- Emulsion Form

- Granules

By Grade

- Industrial Grade

- Laboratory Grade

- Commercial Grade

- Specialized Grade

By Application

- Adhesives and Sealants

- Coatings

- Inks

- Plastics and Polymer Production

- Others

Emerging Trends

Sustainable Packaging Materials: A Growing Focus in the Food Industry

The food packaging industry is undergoing a significant transformation, with sustainability at the forefront. A notable trend is the increasing use of 2-Ethylhexyl Methacrylate (2-EHMA) in food packaging materials. 2-EHMA is a monomer that, when polymerized, enhances the flexibility and durability of packaging films, making them more resistant to tearing and punctures. This improvement extends the shelf life of food products, reduces waste, and aligns with the industry’s shift towards more sustainable practices.

According to a 2024 report by the Sustainable Packaging Coalition, sustainable materials have become a focal point in the packaging industry, and this trend is set to intensify. With consumers becoming increasingly aware of packaging’s impact on the environment, demand continues to rise for eco-friendly packaging solutions that are biodegradable, compostable, and made from recycled materials

Governments and regulatory bodies are also contributing to this shift. For instance, the European Union has implemented regulations that encourage the use of recyclable and compostable materials in food packaging. These regulations not only aim to reduce environmental impact but also promote innovation in packaging materials, encouraging companies to explore alternatives like 2-EHMA-based polymers.

In India, the Food Safety and Standards Authority (FSSAI) has been actively involved in setting standards for food contact materials, ensuring that packaging materials used in the food industry are safe and do not pose health risks. This regulatory framework supports the adoption of materials like 2-EHMA, which can be engineered to meet stringent safety and performance criteria.

Drivers

Regulatory Approvals for Food Contact Applications

One significant factor propelling the growth of the 2-Ethylhexyl Methacrylate (2-EHMA) market is its approval for use in food contact applications by regulatory bodies such as the U.S. Food and Drug Administration (FDA). This approval expands the potential applications of 2-EHMA-based polymers in the food packaging industry, thereby increasing market demand.

The FDA has listed certain 2-EHMA-based polymers in its Inventory of Food Contact Substances, indicating that these materials are authorized for use in food contact applications under specified conditions. For instance, the FDA has approved the use of copolymers containing 2-EHMA for food contact applications, subject to compliance with specific regulations.

This regulatory endorsement is crucial as it ensures the safety and suitability of 2-EHMA-based materials for food contact, addressing consumer health concerns and meeting industry standards. The approval also facilitates the adoption of these materials by manufacturers in the food packaging sector, leading to increased production and consumption of 2-EHMA.

Restraints

Environmental Impact and Regulatory Challenges

One of the primary challenges facing the 2-Ethylhexyl Methacrylate (2-EHMA) industry is its environmental impact, particularly concerning aquatic toxicity and regulatory scrutiny. Despite its widespread use in various applications, 2-EHMA has been identified as having potential adverse effects on aquatic ecosystems.

Research indicates that 2-EHMA is harmful to aquatic organisms and may cause long-term adverse effects in the aquatic environment. For instance, a safety data sheet from Fisher Scientific notes that the substance is toxic to aquatic life. Additionally, the European Chemical Agency (ECHA) provides hazard classifications that highlight the environmental risks associated with 2-EHMA.

In response to these concerns, regulatory bodies have implemented measures to mitigate the environmental impact of 2-EHMA. For example, the Japan Ministry of the Environment reported that in fiscal 2020, approximately 0.18 tons of 2-EHMA were released into the environment, with the majority being emitted into the atmosphere and public water bodies. These releases were closely monitored and reported under the Pollutant Release and Transfer Register (PRTR) Law.

Opportunity

Expansion into Food Contact Applications

A significant growth opportunity for 2-Ethylhexyl Methacrylate (2-EHMA) lies in its expanding use in food contact applications, driven by regulatory approvals and the increasing demand for versatile, high-performance materials in the food packaging industry.

The U.S. Food and Drug Administration (FDA) has authorized certain 2-EHMA-based copolymers for use in food contact materials. For instance, the FDA has issued a Finding of No Significant Impact (FONSI) for Food Contact Notification (FCN) 2034, which pertains to copolymers containing 2-ethylhexyl acrylate, among other monomers, used as dispersants for rosin sizing agents in the manufacture of paper and paperboard. These materials are intended for use at a maximum level of 0.1% relative to dry paper or paperboard and are not to be used in contact with infant formula or human milk

This regulatory approval opens avenues for the incorporation of 2-EHMA-based polymers into various food packaging applications, enhancing their flexibility, clarity, and resistance to environmental factors. The versatility of these materials makes them suitable for packaging a wide range of food products, thereby expanding their market potential.

Regional Insights

Asia Pacific leads the global 2-EHMA market with 38.5% share valued at USD 429.1 million.

In 2024, Asia Pacific held a dominant position in the global 2-Ethylhexyl Methacrylate (2-EHMA) market, accounting for 38.50% of the total share and generating revenues of USD 429.1 million. The region’s strong industrial base, rapid urbanization, and large-scale manufacturing activities have created robust demand for 2-EHMA, particularly in coatings, adhesives, and sealants. China, India, Japan, and South Korea are the leading contributors, supported by expanding construction and automotive industries.

- For example, China’s construction output reached USD 4.3 trillion in 2024, according to the National Bureau of Statistics of China, reflecting a consistent pipeline of demand for coating and adhesive materials. Similarly, India’s packaging sector recorded double-digit annual growth, exceeding USD 70 billion in value, as per Invest India 2024 data, which further boosted the consumption of high-performance adhesives where 2-EHMA is a critical raw material.

The coatings industry also contributed to regional growth. According to the Japan Paint Manufacturers Association, Asia Pacific accounted for more than 55% of global paint and coatings demand in 2024, underlining the importance of methacrylate monomers in industrial and architectural coatings. Favorable government initiatives, such as “Make in India” and China’s “14th Five-Year Plan” for new materials development, further reinforced domestic production and investment in specialty chemicals, thereby strengthening the 2-EHMA market outlook.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE, headquartered in Ludwigshafen, Germany, is a leading global chemical company. The company produces 2-Ethylhexyl Methacrylate F (2-EHMA F), a versatile monomer used in manufacturing polymers. BASF’s 2-EHMA F is utilized in various applications, including coatings, adhesives, and sealants, due to its excellent flexibility and weather resistance. The company emphasizes sustainability and innovation in its product offerings.

Evonik Industries AG, headquartered in Essen, Germany, is a global leader in specialty chemicals. The company produces VISIOMER® eCO EHMA, a hydrophobic monomer with low glass transition temperature and low shrinkage. Evonik’s 2-EHMA is widely used in acrylic resin applications, providing flexibility and excellent dilution power. The company emphasizes sustainability and innovation in its product offerings.

Nippon Shokubai Co., Ltd., based in Tokyo, Japan, is a leading chemical company. The company offers a range of methacrylate products, including 2-Ethylhexyl Acrylate. Nippon Shokubai’s product is used in various applications such as adhesives, paints, and coatings. The company focuses on providing high-quality materials to meet diverse industrial needs.

Top Key Players Outlook

- BASF SE

- Mitsubishi Chemical Corporation

- Evonik Industries AG

- Arkema Group

- Dow Chemical Company

- Nippon Shokubai Co., Ltd.

- Fushun Anxin Chemical Co., Ltd.

- Shanghai Hechuang Chemical Co., Ltd.

- Shandong Hongxu Chemical Co., Ltd.

- Eastman Chemical Company

Recent Industry Developments

In 2024, Arkema’s net sales amounted to €9.5 billion, with a Group EBITDA margin of 16.1%, reflecting the company’s robust performance in a challenging global macroeconomic environment.

In fiscal 2024, Nippon Shokubai reported sales revenue of ¥409,346 million, up 4.4% from the previous year, with operating profit ¥19,062 million, up 15.1% year-on-year.

Report Scope

Report Features Description Market Value (2024) USD 1114.8 Mn Forecast Revenue (2034) USD 2015.4 Mn CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Form (Liquid Form, Powder Form, Emulsion Form, Granules), By Grade (Industrial Grade, Laboratory Grade, Commercial Grade, Specialized Grade), By Application (Adhesives and Sealants, Coatings, Inks, Plastics and Polymer Production, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Mitsubishi Chemical Corporation, Evonik Industries AG, Arkema Group, Dow Chemical Company, Nippon Shokubai Co., Ltd., Fushun Anxin Chemical Co., Ltd., Shanghai Hechuang Chemical Co., Ltd., Shandong Hongxu Chemical Co., Ltd., Eastman Chemical Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2-Ethylhexyl Methacrylate (2-EHMA) MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

2-Ethylhexyl Methacrylate (2-EHMA) MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Mitsubishi Chemical Corporation

- Evonik Industries AG

- Arkema Group

- Dow Chemical Company

- Nippon Shokubai Co., Ltd.

- Fushun Anxin Chemical Co., Ltd.

- Shanghai Hechuang Chemical Co., Ltd.

- Shandong Hongxu Chemical Co., Ltd.

- Eastman Chemical Company