Global Cell Culture Media Market By Product (Serum-free Media, Classical Media, Chemically Defined media, Stem Cell Culture Media, Specialty Media, Others), By Application (Bio-pharmaceutical production, Diagnostics, Drug Screening and Development, Tissue Engineering and Regenerative medicine), By Type (Liquid Media, Semi-Solid Media, Solid Media), By End-User (Pharmaceutical and Biotechnology Companies, Hospitals and Diagnostics Laboratories, Research and Academic Institutes, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 116568

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

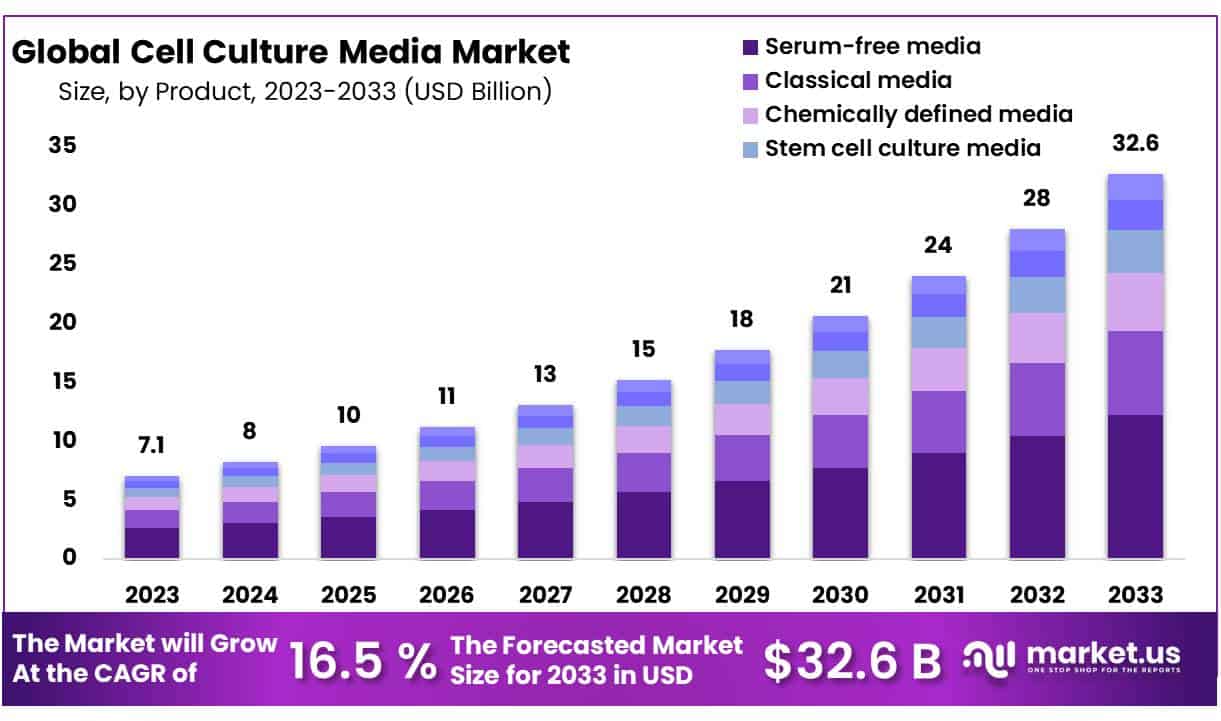

The Global Cell Culture Media Market size is expected to be worth around USD 32.6 Billion by 2033 from USD 7.1 Billion in 2023, growing at a CAGR of 16.5% during the forecast period from 2024 to 2033.

A gel or a liquid including compounds necessary to regulate and support the growth of cells or organisms used in manufacturing of biopharmaceuticals, is known as cell culture media. Cell culture is a broad term used to describe the removal of cells, tissues, or organs from an animal, or plant followed by transplantation of those tissues or organs into an environment created artificially to support the survival or proliferation.

An appropriate growth media for in vitro cultivation of cells or tissues is the fundamental and significant stage in cell culture process. A standard culture media majorly consists of inorganic salts, serum and glucose, vitamins, amino acids, growth hormones, and attachment factors. In addition with the provision of nutrients to the cells or tissues, the media aids in maintaining pH and osmolality.

The market growth for cell culture media is mainly driven by rising ultimatum for biopharmaceuticals, scaling investments in research and development, and favorable governmental policies. In addition to this, the approval of cell based candidate vaccine viruses by Food and Drug Administration (FDA) for usage in cell-based influenza vaccines has advanced the efficiency of cell-based flu vaccines. Furthermore, for 2021-2022 influenza season, all 4 flu viruses used in cell based vaccines are cell-derived.

- The formulation of Seqirus, “FLUCELVAX QUADRIVALENT”, received US FDA approval, which is the first and only cell-based influenza vaccine in the United States.

Key Takeaways

- Market Size: Cell Culture Media Market size is expected to be worth around USD 32.6 Billion by 2033 from USD 7.1 Billion in 2023.

- Market Growth: growing at a CAGR of 16.5% during the forecast period from 2024 to 2033.

- Product Analysis: Serum-free media dominate the market by 37.4% in 2023.

- Application Analysis: Biopharmaceutical production was major market leader in 2023.

- Type Analysis: Liquid Media segment occupied a remarkable market share of 63.4% in the year 2023.

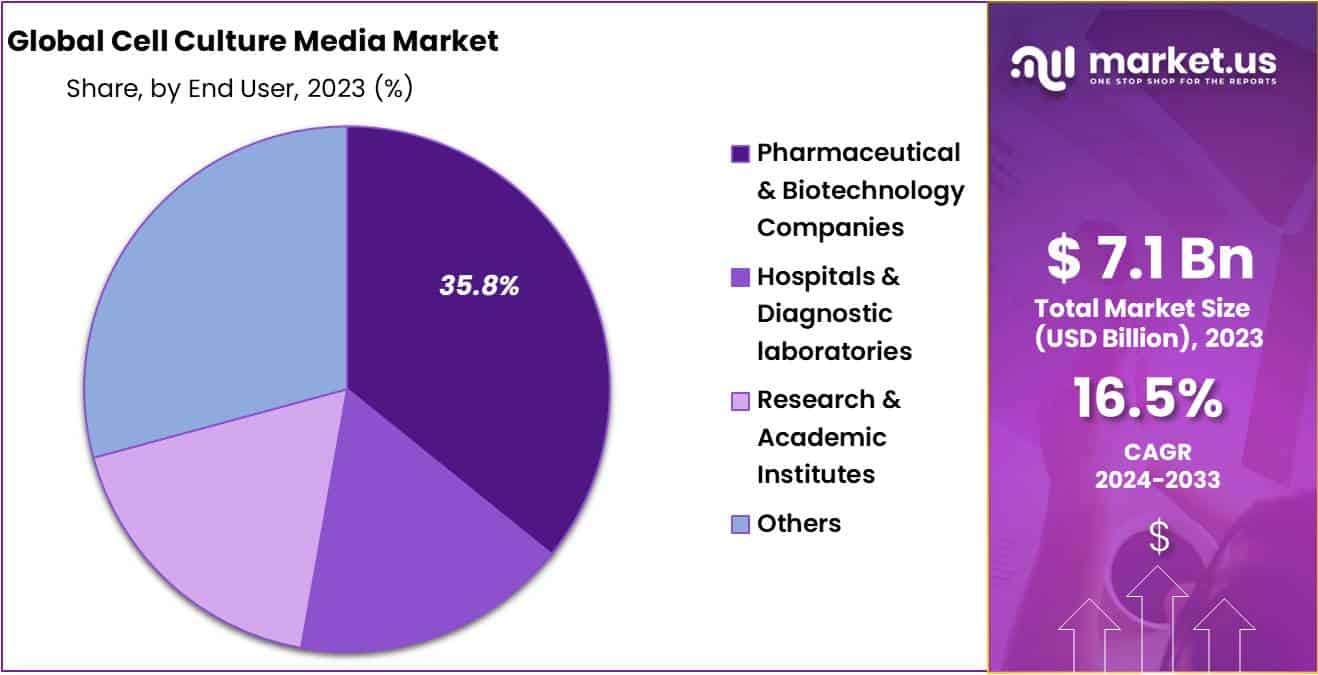

- End-Use Analysis: Pharmaceutical and biotechnology companies dominate 35.8% market share in 2023.

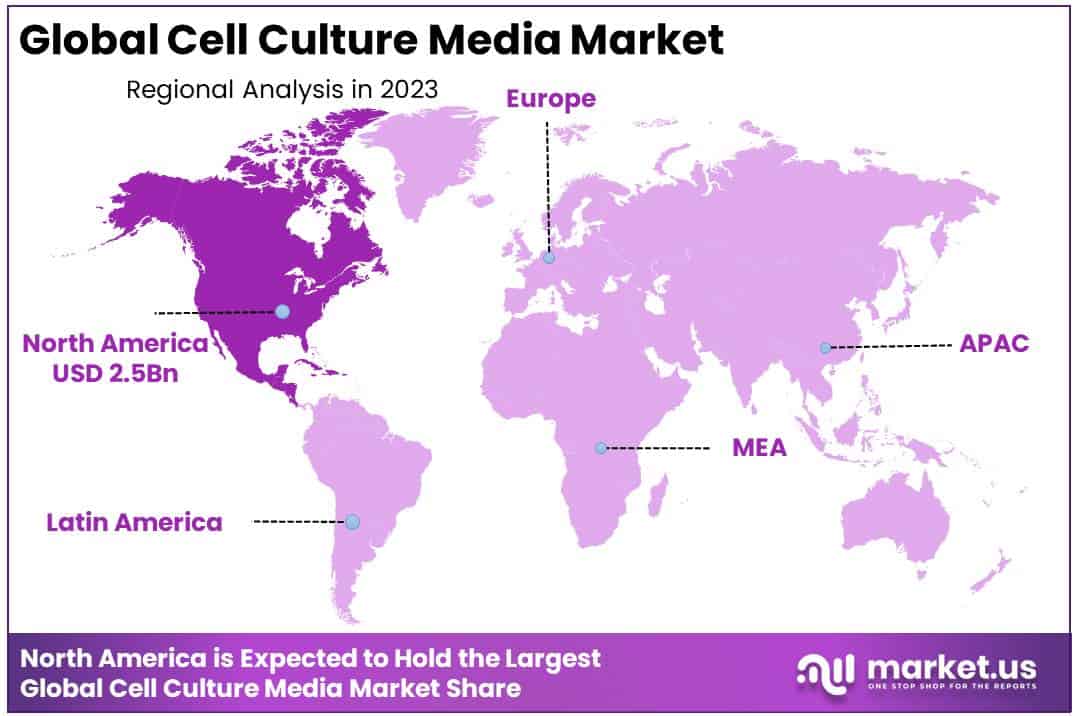

- Regional Analysis: North America comes up as a frontrunner in the global cell culture media market, grabbing a valuable market share of 36.4% in the year 2023.

- Technological Advancements: Innovations in cell culture media formulations, such as serum-free and chemically defined media, are enhancing cell viability and productivity, contributing to market growth.

- Challenges: The market faces challenges including high costs of media components, complexity in formulation, and the need for extensive quality control to ensure consistency and reproducibility.

By Product Analysis

Based on product, the cell culture media market is broadly classified into Serum-free Media, Classical Media, Chemically Defined media, Stem Cell Culture Media, Specialty Media, and other segments. A commendable market share of 37.4% is withheld by serum-free media, dominating the market in the year 2023. Being a significant tool, serum-free media enables researchers to perform specific applications or grow a specific cell type without using serum. The segment predominates the market by virtue of its consistent performance, increased growth, eradication of infection caused by serum borne adventitious agents in the culture and a better control over physiological sensitivity.

In addition to the aforementioned advantages, the segment serve animal welfare being a major driver for the adoption of serum-free media. Many primary cultures and cell lines including Chinese Hamster Ovary lines, hybridoma cell lines, are docile to serum-free media formulations such as 293, VERO, MDCK, and MDBK.

By Application Analysis

With respect to applications, the market is fragmented into Bio-pharmaceutical production, Diagnostics, Drug Screening and Development, Tissue Engineering and Regenerative medicine segment. Amongst these, biopharmaceutical production acts as a major market leader, dominating the market in the year 2023. The segment further promises to excel its reach during the projection period due to escalating demand for cell culture media in the market place.

Owing to the necessity for enhanced consistency and better-defined media to match increasing production levels by declining the risk of contamination in downstream procedures, the demand for cell culture media is elevating in biopharmaceutical industries. The segments’ growth has also hiked due to strategic activities by major biopharmaceutical companies in the respective work.

- An investment of the USD 1.5 billion was made by Cytiva and Pall Corporation over two years in July 2021 with the aim to meet the rising demand for biotechnology solutions. The two companies further planned to invest the USD 400+ million for culture media in powder or liquid coupled with burgeoning their operations in the U.S., Austria, and UK.

By Type Analysis

Based on type, the market is broadly categorized into Liquid Media, Semi-Solid Media and Solid Media segments. Liquid Media segment occupied a remarkable market share of 63.4% in the year 2023. A switch from premixed powders to liquid medias by rising number of biologics and biosimilar manufacturers, both upstream and downstream, liquid media adoption is on a large scale. This high adoption rate owes to the factors such as high rate of isolation and rapid mycobacterial growth.

In addition to these, usage of liquid media enables the researchers to eliminate a few process steps, thereby reducing the chances of hazardous exposure, making manufacturing and development more flexible and easy as compared to the powdered media. Furthermore, the need for mixing containers, balances, and installation of of water for injection loop is also eliminated with the use of ready to use liquid medias. Manufacturers are involved in strategic activities to scale the production and marketing of liquid medias.

- Sartorius in June 2021, screwed its new suite in Israel, aimed with formulations of customized and specialty cell culture especially for advanced therapies market, serving as an important production site for liquid culture medias and buffers.

By End-User Analysis

Based on end use of cell culture medias, the market is fractionated into Pharmaceutical and Biotechnology Companies, Hospitals and Diagnostics Laboratories, Research and Academic Institutes and other segments. An impressive market share of 35.8% is captured by pharmaceutical and biotechnology companies, dominating the cell culture media market in the year 2023. The segment being a frontrunner in the market owing to the expansion of current manufacturing capacities for biopharmaceuticals ultimating cell culture products.

- With the aim to support the growth of biotechnology industry, Cytiva in September 2020, announced its expansion for manufacturing capacity and hiring personnel in significant areas. With an investment plan of the USD 500 million for 5 years the company comes with the idea to escalate the manufacturing capacity.

Key Market Segments

By Product

- Serum-free Media

- Classical Media

- Chemically Defined media

- Stem Cell Culture Media

- Specialty Media

- Others

By Application

- Bio-pharmaceutical production

- Diagnostics

- Drug Screening and Development

- Tissue Engineering

- Regenerative medicine

By Type

- Liquid Media

- Semi-Solid Media

- Solid Media

By End User

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostics Laboratories

- Research and Academic Institutes

- Other

Market Drivers

Rising demand for serum free cell culture processes

Though fetal bovine serum is widely used and preferred media supplement for cell cultures, still it associates vital disadvantages including limited availability, potential pathogen transmission, impact on performance and safety of a cell product and batch to batch variability in serum composition. This has shifted the demand towards high adoption of serum free cell culture processes.

The market growth is further supported by the hiking advantages of serum-free cell culture medias including appropriate evaluations of cellular function, eradication of potential viral contaminants, simplified purification and downstream processing and consistency in performance.

This accelerates the demand for serum and animal component free media for the development for regenerative medicines and recombinant proteins. Major industry players, for instance, HiMedia Laboratories, STEMCELL Technologies, and Thermo Fisher Scientific have already dared into the development of serum-free media. Thus, the market for cell culture media thrives with the ongoing shift towards the development and adoption of serum and animal component-free media.

Rising ultimatum for biosimilars

Biosimilar manufacturers are enabled to enter major markets globally by virtue of the availability of an approval pathway in the U.S. regulations for biosimilar approvals have been established by the emerging countries like Venezuela, Colombia, Mexico and India. in addition, discussions on development of a biosimilar approval procedure has also begun by China FDA.

- By the end of 2019, China’s Biosimilar drug industry had maximum number of biosimilar drugs in research, with 393 biosmimilar drugs in research and development pipeline.

Market Restraints

High cost of products related to research

Expensive cell biology research products is likely to impede the market for cell culture media in the upcoming years. The media, reagents and other products associated with the research on development of new therapies such as stem cell and gene therapies needs to be of high quality in order to ontain precise results. This escalates the cost of cell biology related research by virtue of the need to maintain high quality standards and compliance with frameworks set up by regulatory authorities.

This limits many small scale companies and institutes to afford such expensive products needed for research in cell biology. In addition to this, the use of advanced media and kits is more expensive in comparison to the conventional ones. Thus, high cost of media cause impediments towards the market growth.

Opportunities

The need for cell culture processes up scaled due to its widespread applications in providing diagnostic information combined with research related to HIV/AIDS, cancer, and various infectious diseases. The threat of new virus outbreaks increased with climate change, close contact between animals and humans and growing population across the globe.

Accounting 9.75 million deaths in 2020, cancer has become a leading cause of death worldwide. This boosted the need to conduct extensive research for diagnosis and treatment, offering growth opportunities for cell culture technologies and cell culture media products. On the other hand, the recurring influenza pandemics poses a significant economic and social burden.

Thus, the demand for diagnostics is accelerates with the rising incidencs of such communicable diseases coupled with increasing risk of pandemics, offering potential opportunities for players working in cell culture media market during the foreseeable days.

- According to GLOBOCAN, the number of cancer cases will be around 30 million by 2040.

- According to Centre for Disease Control, there have been 27-54 million flu illnesses, 12-26 million flu medical visits, 300,000 to 650,000 flu hospitalization and 19,000 to 58,000 flu deaths.

Impact of Macoeconomic Factors

Inflation Likely to Influence Market Growth

With the persisting inflation, the maket for cell culture media will be affected to a considerable extent. With the increase in cost, the production costs for cell culture media preparation will also soar. This will greatly influence customer behavior. In addition, with the increase in production costs, businesses will likely lower their investments in the research and development efforts. This will impact innovation in the market, which in turn will influence competition and by extension maket growth.

Latest Trends

Cell culture media market is expanding with several advancements incorporated into the procedures. Some of them include:

Customized Media Solutions: Tailoring to the specific needs of bioproduction processes or individual research projects, there arises a growing trend towards the development of customized media solutions, enabling researchers better flexibility and control over their cell culture experiements.

Incorporation of advanced technologies: Cell media development processes are highly integrated with advances in technology including automation, high-throughput screening, and microfluidics. This helps in quick screening of media formulations, culture conditions optimization and thereby expediting overall workflow of research and development.

Regional Analysis

North America comes up as a frontrunner in the global cell culture media market, grabbing a valuable market share of 36.4% in the year 2023. The dominance of the region is highly attributed to the robust presence of major industry players including Thermo Fisher Scientific, Inc., Cytiva and others. The ongoing efforts of these market players to constantly launch innovative products and draw strategies to remain competitive in the field of lifescience bolsters the position of North America in the market place.

- Cytiva, a pioneer in life science industry acquired CVEC Pharmaceuticals, a viral vector manufacturing technology and leading provider of high-performance cell line development in Germany. This bolsters Cytiva’s position as the industry leader in biomanufacturing solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Developing key players are concentrated on various strategies to develop their particular companies in foreign markets. Several nanopharmaceuticals market companies are concentrating on growing their R&D facilities and existing operations. Furthermore, businesses in the nanopharmaceuticals market are developing a portfolio and new product expansion strategies through mergers, investments, and acquisitions.

- In July 2023, an investment of the USD 24.38 million was made by Merck KGaA to boost cell culture media production in United States, expanding the production capacity of the Lenexa facility to manufacture cell culture media.

Listed below are some of the most prominent cell culture media market players:

- STEMCELL Technologies

- Lonza Group

- PromoCell GmbH

- Thermo Fisher Scientific, Inc.

- Danaher

- Sartorius AG

- Merck KGaA

- InVivoGen

- Biologos LLC

- HiMedia Laboratories Pvt, Ltd

Recent Developments

- STEMCELL Technologies (May 2024): STEMCELL Technologies launched a new serum-free cell culture medium designed for hematopoietic stem cell expansion. This innovative product aims to enhance cell growth and viability, offering researchers a reliable and efficient solution for stem cell research and therapy development.

- Lonza Group (April 2024): Lonza Group acquired a biotechnology firm specializing in cell culture media formulations. This acquisition aims to expand Lonza’s product portfolio and enhance its capabilities in providing advanced media solutions for biopharmaceutical production and research applications.

- PromoCell GmbH (June 2024): PromoCell GmbH introduced a new chemically defined cell culture medium for primary cells, designed to improve cell viability and reproducibility in research applications. This launch reflects PromoCell’s commitment to providing high-quality media solutions for the scientific community.

- Thermo Fisher Scientific, Inc. (February 2024): Thermo Fisher Scientific, Inc. launched the Gibco™ High-Performance Serum Replacement, a new product aimed at replacing fetal bovine serum in cell culture. This product offers consistent performance and supports various cell types, addressing the demand for more reliable and ethical culture media.

- Danaher (March 2024): Danaher merged with a leading cell culture media company to strengthen its position in the biopharmaceutical market. This merger aims to combine expertise and resources to provide innovative and high-quality media solutions for research and manufacturing purposes.

Report Scope

Report Features Description Market Value (2023) USD 7.1 Billion Forecast Revenue (2033) USD 32.6 Billion CAGR (2024-2033) 16.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Serum-free Media, Classical Media, Chemically Defined media, Stem Cell Culture Media, Specialty Media, Others), By Application (Bio-pharmaceutical production, Diagnostics, Drug Screening and Development, Tissue Engineering and Regenerative medicine), By Type (Liquid Media, Semi-Solid Media, Solid Media), By End-User (Pharmaceutical and Biotechnology Companies, Hospitals and Diagnostics Laboratories, Research and Academic Institutes, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape STEMCELL Technologies, Lonza Group, PromoCell GmbH, Thermo Fisher Scientific, Inc., Danaher, Sartorius AG, Merck KGaA, InVivoGen, Biologos LLC, HiMedia Laboratories Pvt, Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is cell culture media?Cell culture media is a solution or gel designed to support the growth, proliferation, maintenance, and storage of cells in laboratory environments. It provides essential nutrients, growth factors, hormones, and gases, and maintains the pH and osmotic pressure of the culture.

How big is the Cell Culture Media Market?The global Cell Culture Media Market size was estimated at USD 7.1 Billion in 2023 and is expected to reach USD 32.6 Billion in 2033.

What is the Cell Culture Media Market growth?The global Cell Culture Media Market is expected to grow at a compound annual growth rate of 16.5%. From 2024 To 2033

Who are the key companies/players in the Cell Culture Media Market?Some of the key players in the Cell Culture Media Markets are STEMCELL Technologies, Lonza Group, PromoCell GmbH, Thermo Fisher Scientific, Inc., Danaher, Sartorius AG, Merck KGaA, InVivoGen, Biologos LLC, HiMedia Laboratories Pvt, Ltd.

What are the key components of cell culture media?Key components typically include amino acids, vitamins, inorganic salts, glucose as an energy source, serum or serum alternatives, and often specific growth factors or supplements depending on the cell type being cultured.

Which industries use cell culture media?The primary users are the biotechnology and pharmaceutical industries, research laboratories, and academic institutions. They use it for drug development, vaccine production, regenerative medicine, cancer research, and various other biomedical applications.

How does the market for cell culture media impact healthcare?The market impacts healthcare by enabling the advancement of medical research, development of new vaccines and drugs, personalized medicine, and regenerative therapies. It plays a crucial role in the production of biopharmaceuticals and for in vitro testing of new medical treatments.

-

-

- STEMCELL Technologies

- Lonza Group

- PromoCell GmbH

- Thermo Fisher Scientific, Inc.

- Danaher

- Sartorius AG

- Merck KGaA

- InVivoGen

- Biologos LLC

- HiMedia Laboratories Pvt, Ltd