Global Zipper Market By Product Type (Close-end, Open-end), By Material (Metal, Coil, Plastic, Others), By Application (Garment, Luggage and Bags, Sporting Goods, Camping Gear, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 16117

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

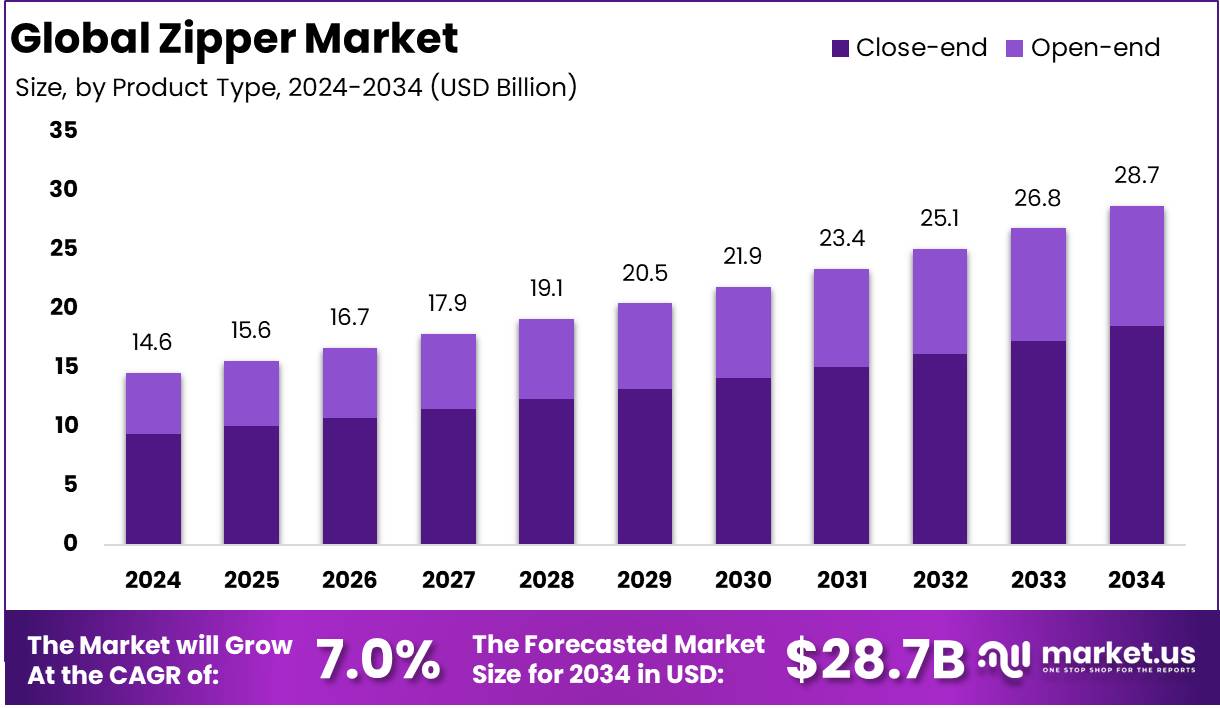

The Global Zipper Market size is expected to be worth around USD 28.7 Billion by 2034 from USD 14.6 Billion in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034.

A zipper is a fastening device used in various consumer and industrial applications to temporarily join two edges of fabric or other flexible materials. It typically consists of two strips of fabric tape with interlocking metal or plastic teeth and a slider mechanism that seamlessly opens or closes the fastening system.

Zippers are integral components in a wide range of products, including apparel, luggage, footwear, automotive interiors, outdoor gear, and industrial textiles, owing to their durability, ease of use, and secure fastening capabilities. Technological innovations have further enabled the production of waterproof, fire-resistant, and invisible zippers, expanding their functional scope across diverse end-use industries.

The zipper market refers to the global industry involved in the design, manufacturing, and distribution of zippers for use in consumer goods, industrial applications, and specialized sectors. It encompasses a broad spectrum of product types including coil zippers, metal zippers, plastic molded zippers, and specialty variants tailored for technical performance.

The market is supported by an extensive value chain comprising raw material suppliers, component manufacturers, assembling units, and global distributors. The competitive landscape is characterized by a mix of large multinational manufacturers and small to mid-sized enterprises, with Asia Pacific emerging as a dominant manufacturing hub due to cost-effective production capabilities and proximity to textile industries.

The growth of the zipper market can be attributed to the consistent expansion of the global apparel and fashion industry, which continues to be a primary consumer of zippers. Increased urbanization, rising disposable incomes, and shifting consumer preferences toward premium and functional garments are driving higher demand for quality fastening solutions.

In parallel, the proliferation of travel and tourism, the growing popularity of outdoor sports, and advancements in automotive upholstery design are supporting the need for durable and specialized zippers. Furthermore, sustainability trends are leading manufacturers to adopt recycled materials and eco-friendly production processes, thereby broadening the market’s appeal across environmentally conscious brands.

Demand for zippers remains robust across both consumer and industrial segments, with apparel accounting for the largest share of consumption. The rising penetration of fast fashion brands and growing e-commerce channels has amplified the need for efficient and aesthetically versatile fastening solutions.

Additionally, sectors such as luggage and bags, sportswear, footwear, and furniture upholstery are generating stable demand volumes. Industrial demand is also gaining traction, particularly in automotive, medical textiles, military gear, and protective clothing, where performance specifications are critical. The diversification of applications and the integration of technical attributes continue to reinforce steady year-over-year growth in global zipper consumption.

Significant market opportunities are emerging from the integration of sustainability and innovation within zipper manufacturing. The adoption of bio-based polymers, recycled plastics, and low-impact dyeing techniques aligns with global initiatives to reduce the environmental footprint of the fashion and textile supply chain.

Moreover, customization and smart functionality such as zippers embedded with sensors or those designed for seamless wearables are creating value-added applications in both luxury and performance-driven markets. Emerging economies in Southeast Asia, Latin America, and Africa present untapped growth potential, supported by rising apparel manufacturing activity and growing middle-class consumption. Strategic investments in R&D, coupled with supply chain localization, are expected to unlock new avenues for differentiation and expansion within the zipper industry.

According to Fixnzip, the Zipper Market demonstrates robust consumption, with 4.5 billion zippers used annually in the U.S. alone, reflecting significant demand across apparel, luggage, and industrial applications. YKK, a global leader, manufactures over 1.5 billion zippers yearly, supported by operations in 71 countries and a workforce of 39,000.

This widespread adoption and production scale underline the market’s operational intensity and global reach. However, the presence of counterfeit YKK products signals a growing concern over product authenticity and brand protection. These dynamics emphasize the strategic importance of quality control and supply chain integrity in sustaining market leadership.

According Marketplace, the Zipper Market demonstrates significant volume and scale, with 4.5 billion zippers consumed annually in the U.S. alone equivalent to 14 zippers per American each year. Global production is led by YKK, whose output exceeds 1.2 million miles of zippers annually, enough to encircle the earth 50 times.

The YKK national manufacturing center in Macon, Georgia, contributes approximately 65,000 miles per year to this global output. Each zipper involves between 15 to 50 intricate production steps, starting from in-house copper melting to finished product, reflecting the industry’s vertically integrated manufacturing model and precision-driven supply chain.

Key Takeaways

- The global zipper market is projected to reach USD 28.7 billion by 2034, expanding from USD 14.6 billion in 2024, at a CAGR of 7.0% during the forecast period (2025–2034).

- In 2024, close-end zippers held a dominant share of over 64.5% in the product type segment. Their prevalence in garment and accessory applications, particularly in trousers, bags, and footwear, has contributed to their leadership in the market.

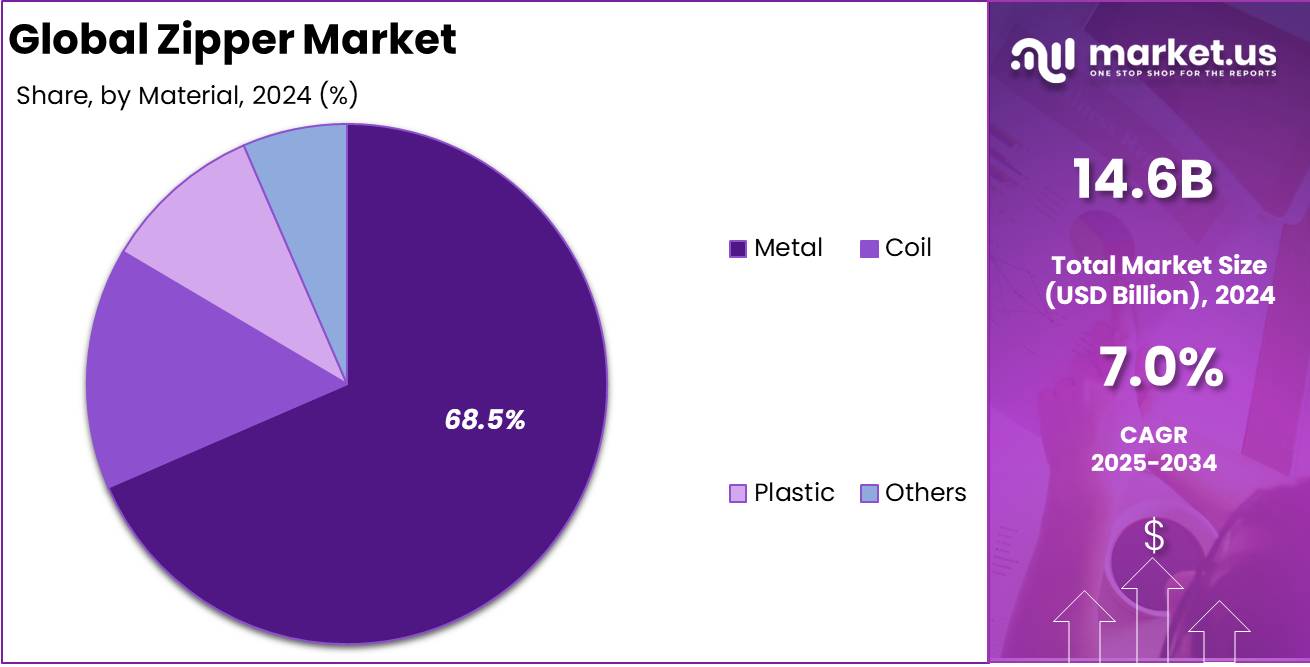

- Metal zippers accounted for the largest share of 68.5% in 2024. Their durability, aesthetic appeal, and preference in high-end apparel and luggage have supported their dominance in the material segment.

- The garment application segment captured a market share of over 35.6% in 2024. The consistent growth of the global apparel industry and fashion trends have reinforced the demand for zippers in clothing manufacturing.

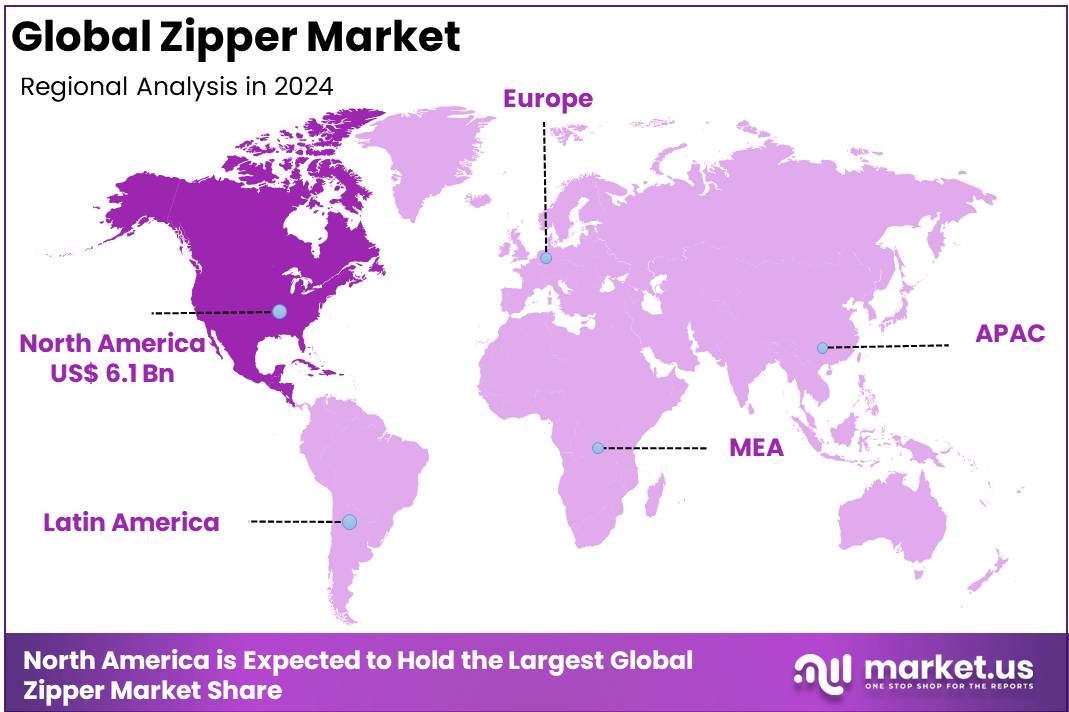

- North America emerged as the leading regional market, holding a substantial 42.3% share in 2024. The regional market was valued at approximately USD 6.1 billion.

By Product Analysis

Close-End dominated the Zipper Market by securing more than 64.5% of the market share.

In 2024, Close-End held a dominant market position in the By Product Type segment of the Zipper Market, capturing more than 64.5% share. This significant market share can be attributed to the widespread adoption of close-end zippers in a variety of end-use applications, particularly in garments such as trousers, skirts, and bags, where the closure does not require full separation.

The compact and durable design of close-end zippers makes them a preferred choice for enhancing product functionality and longevity, especially in casual and formal apparel. Additionally, their cost-effectiveness and ease of integration into manufacturing processes have further contributed to their leading position in the market.

Furthermore, growth in the global fashion and apparel industry, especially in emerging markets, has reinforced the demand for close-end zippers. Rising urbanization, increased disposable incomes, and consumer preference for durable yet affordable clothing have significantly increased production volumes that rely on such zipper types. The segment is also witnessing innovation in materials and finishes, including rust-resistant metals and sustainable alternatives, which is expected to support steady demand over the forecast period.

In 2024, the Open-End segment held a significant position in the Zipper Market under the By Product Type category. Open-end zippers are widely utilized in applications where complete separation between the two sides is required, such as in jackets, coats, and other outerwear.

Their design provides ease of use and functional flexibility, making them especially suitable for fashion-conscious consumers and utility-driven apparel. Additionally, open-end zippers are extensively employed in sectors like luggage, sportswear, and outdoor equipment, where full detachment enhances product functionality.

Despite having a smaller share compared to close-end zippers, the open-end segment continues to play an essential role in the market. Its relevance is particularly strong in premium and performance-oriented product categories. The segment is expected to benefit from rising trends in activewear and technical clothing.

By Material Analysis

Metal dominated the Zipper Market by securing more than 68.5% of the market share.

In 2024, Metal held a dominant market position in the By Material segment of the Zipper Market, capturing more than a 68.5% share. The widespread use of metal zippers in heavy-duty applications such as denim garments, leather products, bags, and footwear has significantly contributed to this leadership.

Their superior strength, durability, and premium finish have made them the preferred choice among manufacturers targeting high-end and long-lasting consumer products. Additionally, the aesthetic appeal of metal zippers aligns with the growing consumer preference for sturdy and luxury-grade fastening systems, especially in developed markets across North America and Europe.

The increased demand for high-performance zippers in industrial and fashion applications has further fueled the adoption of metal zippers. Moreover, ongoing innovations in corrosion-resistant coatings and smoother slider mechanisms have enhanced product functionality, reinforcing their popularity across both fashion and functional uses. As a result, metal zippers continue to outperform other materials in terms of reliability and longevity, supporting their substantial market share in 2024.

In 2024, the Coil segment became the second most utilized zipper type in the Zipper Market. Made from materials like nylon or polyester, coil zippers are lightweight, flexible, and cost-effective, making them ideal for jackets, sportswear, backpacks, and tents. Their ability to bend and maintain functionality under stress has increased their popularity.

The segment also benefits from demand in children’s apparel and lightweight luggage due to their strength-to-weight ratio. Innovations in materials and sealing techniques have further expanded their use in outdoor and performance products, ensuring continued growth despite competition from plastic alternatives.

In 2024, the Plastic segment continued to play a significant role in the Zipper Market. Known for their lightweight construction, corrosion resistance, and customizability, plastic zippers are widely used in casual clothing, handbags, and children’s apparel. Their affordability and ease of production make them attractive for mass-market applications.

Despite being less durable than metal or coil zippers, plastic zippers remain popular in design-conscious markets. Additionally, the rise of biodegradable and recycled plastic options aligns with sustainability trends, ensuring their ongoing relevance in specific niches.

In 2024, the Others segment, which includes bio-based, invisible, and magnetic zippers, represented a smaller but innovative part of the Zipper Market. These zippers are often used in high-fashion garments, adaptive clothing, and smart textiles. With a growing focus on customization and sustainability, manufacturers are increasingly incorporating eco-friendly and biodegradable options. Although small in market share, this segment is expected to grow steadily as advancements in technology and material development enhance the functionality and appeal of these specialized zippers.

By Application Analysis

Garment dominated the Zipper Market by securing more than 35.6% of the market share.

In 2024, Garment held a dominant market position in the By Application segment of the Zipper Market, capturing more than 35.6% share. This dominance can be attributed to the consistent demand for zippers in apparel manufacturing across both developed and emerging economies. Zippers remain a core component in casual wear, jeans, jackets, uniforms, and formal clothing due to their reliability and user-friendly nature.

Additionally, rapid urbanization and rising disposable incomes have accelerated fashion consumption, directly boosting zipper demand in garment applications. The integration of zippers in athleisure and performance wear, coupled with innovations in zipper aesthetics and materials, has further reinforced their indispensable role in the garment sector.

Moreover, the growth of fast fashion and mass clothing production has increased the volume of zipper usage globally. Manufacturers are focusing on producing durable and lightweight zippers to align with consumer preferences for comfort and style. The increasing preference for customized and eco-friendly zippers, especially in premium and sustainable fashion collections, is expected to provide a further uplift to this segment. With continued expansion in online and offline apparel retail, the garment segment is projected to maintain its leading position in the global zipper market over the forecast period.

In 2024, Luggage and Bags emerged as a significant segment within the By Application category of the Zipper Market. This growth has been supported by increasing international and domestic travel, evolving consumer lifestyles, and the expansion of e-commerce logistics. Zippers are integral to the design and functionality of luggage products such as suitcases, backpacks, handbags, and travel pouches, offering secure and user-friendly closure systems. The demand for lightweight, durable, and stylish bags has prompted zipper manufacturers to innovate and adapt to market expectations.

In 2024, the Sporting Goods segment continued to hold a notable presence in the Zipper Market by Application, driven by expanding interest in fitness, sports, and outdoor recreational activities. Zippers are used in various sporting items such as track jackets, gym bags, running accessories, and equipment pouches. Their lightweight and flexible design makes them suitable for performance wear, where ease of movement and functionality are crucial.

In 2024, Camping Gear was identified as an emerging growth segment within the By Application classification of the Zipper Market. The rising popularity of camping, trekking, and nature tourism has spurred demand for reliable outdoor gear. Zippers serve a crucial function in products such as tents, sleeping bags, and rugged backpacks, where strong and weather-resistant closures are necessary. Their ability to perform under harsh conditions makes them indispensable in camping applications.

Key Market Segments

By Product Type

- Close-end

- Open-end

By Material

- Metal

- Coil

- Plastic

- Others

By Application

- Garment

- Luggage and Bags

- Sporting Goods

- Camping Gear

- Others

Driver

Expansion of the Global Apparel Industry

The primary driver accelerating the growth of the global zipper market in 2024 is the continued expansion of the global apparel and textile industry. The growing demand for casualwear, sportswear, outdoor clothing, and functional garments across developing and developed economies is directly contributing to the increased consumption of zippers. As zippers remain essential fastening components in garments, the surge in apparel production inherently amplifies zipper demand.

Emerging economies in Asia-Pacific, particularly China, India, Bangladesh, and Vietnam, are witnessing a robust increase in garment manufacturing activities due to rising consumer spending, urbanization, and growth in export-oriented textile industries.

Moreover, the diversification of garment styles, introduction of specialized functional clothing, and seasonal fashion trends are leading to the use of various types of zippers such as invisible, two-way, and waterproof zippers across a wide range of designs. This variety boosts the demand for differentiated zipper products, pushing manufacturers to enhance production capacity and innovate zipper functionality.

With an increasing number of fashion brands launching new clothing lines seasonally, the market is witnessing elevated order volumes for high-performance and aesthetic zippers. The direct correlation between fashion trends and zipper utilization strengthens the market’s upward momentum.

Additionally, rising consumer interest in athleisure and activewear, segments that rely heavily on durable and smooth-operating zippers, is further reinforcing demand. In summary, the consistent and growing requirements of the global apparel sector remain a significant driver in expanding the zipper market landscape, both in volume and variety. As the fashion and textile sector continues to flourish, particularly in export-driven Asian markets, the zipper market is positioned to achieve sustained growth over the forecast period.

Restraint

Volatility in Raw Material Prices Disrupting Cost Structures

A significant restraint impacting the global zipper market in 2024 is the volatility in raw material prices, particularly those related to metals and synthetic polymers. Zippers are predominantly manufactured using materials such as aluminum, brass, nickel, and polyester. These materials are subject to frequent price fluctuations due to geopolitical factors, energy costs, supply chain disruptions, and global demand-supply imbalances.

For instance, the price of nickel widely used in metallic zippers witnessed substantial volatility in the last year due to export restrictions and increased demand from the battery and automotive sectors. These unpredictable pricing trends are creating significant challenges for zipper manufacturers in maintaining cost stability, especially in mass production for price-sensitive industries such as apparel and luggage.

This volatility not only elevates production costs but also compresses profit margins, particularly for small and medium-sized zipper producers. As a result, manufacturers are forced to either absorb the increased costs or pass them on to consumers, which can impact demand negatively. Furthermore, inconsistent material availability can lead to production delays and supply chain bottlenecks, disrupting delivery schedules and long-term contracts with apparel or accessory brands.

In some cases, buyers may switch to alternative fastening solutions, such as hook-and-loop systems or buttons, when zipper prices become unfavorable, thereby reducing overall market share. Additionally, sustainability pressures are prompting manufacturers to shift towards eco-friendly materials, which often come at a premium, adding another layer of cost complexity. While large players may navigate these fluctuations through hedging strategies and diversified sourcing, the majority of the market continues to be impacted by raw material instability. Therefore, the irregularity in input costs remains a crucial challenge to the consistent and profitable growth of the global zipper market.

Opportunity

Rising Demand for Sustainable and Recyclable Zipper Solutions

One of the most promising opportunities shaping the global zipper market in 2024 is the rising consumer and industry demand for sustainable, recyclable, and eco-friendly fastening solutions. As environmental consciousness deepens and regulatory frameworks tighten around plastic use and carbon footprints, manufacturers across fashion, luggage, automotive, and sportswear industries are increasingly integrating sustainability into product design.

This has led to a growing preference for zippers made from recycled PET, biodegradable plastics, and low-impact metals. The zipper market is responding by innovating with green materials, reducing production emissions, and incorporating closed-loop recycling systems into their manufacturing processes. Such sustainable initiatives are gaining traction with environmentally responsible brands, creating new business avenues for zipper suppliers focused on ecological innovation.

This transition to eco-conscious zipper solutions is not only meeting consumer expectations but also enabling companies to align with global compliance standards and sustainability reporting mandates. The push for circular economy models is creating partnerships between zipper producers and textile recyclers, ensuring that post-consumer garments and accessories can be fully disassembled and reused, with zippers as an integral recoverable component.

This has enhanced the appeal of recyclable zippers in luxury fashion, outdoor gear, and even automotive interiors where environmental branding is becoming a competitive advantage. Additionally, sustainable zippers are commanding a price premium, thereby creating higher-margin opportunities for manufacturers with green product lines. With growing investments in R&D to improve the durability, strength, and visual appeal of eco-friendly zippers, this segment is poised for rapid expansion.

The market’s shift towards sustainable solutions reflects a structural evolution that aligns with global sustainability goals, positioning green zippers as a high-growth segment within the overall zipper industry.

Trends

Integration of Smart and Functional Zippers in Technical Applications

A prominent trend influencing the global zipper market in 2024 is the increasing integration of smart and functional zippers in technical and performance-oriented applications. Driven by advancements in wearable technology and multifunctional clothing, zippers are being embedded with features that go beyond conventional fastening.

For instance, smart zippers with embedded sensors can monitor physical activity, temperature, or stress points in garments, offering real-time data collection for use in medical, sports, or defense sectors. This trend is pushing zipper manufacturers to collaborate with electronics and textile companies to design modular fastening systems that serve both mechanical and technological functions.

In addition to smart capabilities, functional enhancements in zippers such as self-repairing mechanisms, waterproof seals, anti-theft locks, and fire-retardant properties are becoming increasingly relevant in outdoor gear, military wear, and industrial clothing. These advanced features cater to consumer segments prioritizing safety, performance, and convenience. The rising popularity of outdoor adventure gear and wearable tech further reinforces this trend, with product designers actively seeking innovative zipper solutions to enhance end-user experience.

While the adoption of such technologies is still niche, the growing interest among high-end fashion brands, sportswear producers, and tactical equipment manufacturers is likely to boost demand. As the zipper evolves into a smart accessory and not just a closure device, this trend is expected to open new frontiers for product differentiation and value creation in the zipper market.

Regional Analysis

North America Leads the Zipper Market with Largest Market Share of 42.3% in 2024

The global zipper market demonstrates significant regional variation, with North America emerging as the dominant region, accounting for the largest market share of 42.3% in 2024. The regional market value in North America is estimated at USD 6.1 billion, driven by high consumer demand for apparel, luggage, footwear, and sporting goods.

The presence of a well-established textile industry, along with consistent demand for premium and functional fashion products, has significantly contributed to the market’s growth. Furthermore, the widespread adoption of advanced manufacturing technologies in zipper production and a strong inclination toward product innovation and customization have supported the region’s leading position in the global landscape.

In Europe, the zipper market continues to grow steadily, supported by the region’s strong focus on sustainable fashion and high-end consumer goods. Demand for recyclable and durable fasteners in the fashion and automotive industries has strengthened the adoption of quality zippers. Countries such as Germany, France, and Italy have shown growing integration of zippers in both luxury and utility segments, driven by trends in functional design and eco-conscious consumer behavior. The market also benefits from the presence of well-established fashion and textile hubs, which consistently push demand for aesthetically enhanced and reliable fasteners.

The Asia Pacific region remains a significant and fast-expanding market, propelled by rapid industrialization, urbanization, and the expanding middle-class population. Although not the leading region in terms of market share, countries like China, India, Bangladesh, and Vietnam are key production centers for zippers due to cost-effective manufacturing and high-volume exports of garments and bags.

The region’s market is influenced by the increasing consumption of fast fashion and growing demand for low-cost yet durable consumer goods. This makes Asia Pacific a strategic hub for supply-side growth in the global zipper industry.

The Middle East & Africa region displays a growing demand for zippers, driven by rising consumer interest in westernized fashion and lifestyle changes. While the market share remains relatively modest compared to other regions, gradual developments in retail infrastructure and increasing textile imports are encouraging the demand for zippers. Latin America, on the other hand, is witnessing moderate growth, influenced by rising domestic manufacturing activities and growing demand for locally produced apparel and accessories.

Brazil, in particular, contributes significantly due to its expanding fashion sector. Overall, while North America holds the dominant share, other regions are expected to register notable growth trajectories, enhancing the global zipper market’s competitive landscape.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global zipper market landscape of 2024, YKK Group continues to dominate as the foremost market leader, underpinned by its unmatched manufacturing scale, global distribution networks, and continuous innovation in high-performance zippers. The company maintains a premium reputation by integrating sustainability into its operations, notably with the introduction of eco-friendly products and automation in production. SBS Zipper holds a strong position, especially in the Asia-Pacific region, leveraging cost-competitive manufacturing and expansive product portfolios that cater to mass-market and industrial applications.

Ideal Fastener Corporation and Coats Group plc remain key players through their strategic presence in both developed and emerging markets. Ideal Fastener benefits from a robust footprint in the North American apparel industry, while Coats Group leverages its longstanding expertise and diversified textile solutions, enabling cross-market synergies in zippers and sewing threads. The Riri Group continues to attract luxury and fashion segments with its emphasis on design aesthetics and product customization, which supports its premium positioning in Europe.

Kao Shing Zipper Co., Ltd. and YBS Zipper Co., Ltd. have shown consistent growth by strengthening their export capabilities and targeting value-conscious customers in global markets. UCAN Zippers USA and Talon International, Inc. cater primarily to niche and fashion-centric markets in the United States, emphasizing fast turnaround times and design-oriented offerings.

Fujian SBS Zipper Science & Technology Co., Ltd. and KCC Zipper Co., Ltd. contribute significantly to the mid-tier and OEM segments. Meanwhile, Excella GmbH & Co. KG sustains its market relevance through precision engineering and a strong focus on European manufacturing excellence. Collectively, these players shape a competitive and diversified zipper market, marked by innovation, cost-efficiency, and regional specialization.

Top Key Players in the Market

- YKK Group

- SBS Zipper

- Ideal Fastener Corporation

- Coats Group plc

- Riri Group

- Kao Shing Zipper Co., Ltd.

- UCAN Zippers USA

- Talon International, Inc.

- YBS Zipper Co., Ltd.

- Fujian SBS Zipper Science & Technology Co., Ltd.

- KCC Zipper Co., Ltd.

- Excella GmbH & Co. KG

Recent Developments

- In 2024, Zip secured $190 million in a Series D funding round, bringing its total valuation to $2.2 billion. This fresh round was led by BOND, with participation from DST Global, Adams Street, and Alkeon. Existing investors like Y Combinator and CRV also joined the funding effort.

- In 2024, YKK Corporation received the top honor at the Orange Innovation Award hosted by Japan’s Ministry of Economy, Trade and Industry. The award recognized YKK’s innovation in designing zippers that support people living with dementia, using input directly from users. The company’s magnetic zipper, which aligns itself, was highlighted as a key solution developed through this co-creation model.

- In 2023, Sony Interactive Entertainment confirmed an agreement to acquire Firewalk Studios, known for its work on a new AAA multiplayer title for PS5 and PC. The studio will join forces with other Sony-owned teams like Bungie and Haven Interactive to shape the next wave of live service gaming for the PlayStation platform.

Report Scope

Report Features Description Market Value (2024) USD 14.6 Billion Forecast Revenue (2034) USD 28.7 Billion CAGR (2025-2034) 7.00% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Close-end, Open-end), By Material (Metal, Coil, Plastic, Others), By Application (Garment, Luggage and Bags, Sporting Goods, Camping Gear, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape YKK Group, SBS Zipper, Ideal Fastener Corporation, Coats Group plc, Riri Group, Kao Shing Zipper Co., Ltd., UCAN Zippers USA, Talon International, Inc., YBS Zipper Co., Ltd., Fujian SBS Zipper Science & Technology Co., Ltd., KCC Zipper Co., Ltd., Excella GmbH & Co. KG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- YKK Corporation

- Coats Group plc

- SBS

- Fuxing Group

- Talon International Inc.

- KEE Zippers Corporation Limited

- Tex Corp Limited

- Toni Zippers

- NEO Zipper Co.Ltd

- WeiXing Co.Ltd.(SAB)