Company Overview

Volkswagen Group Statistics: Volkswagen AG is one of the world’s leading manufacturers of automobiles and commercial vehicles and stands as Europe’s largest carmaker. The company operates through 3 key reportable segments: Passenger Cars and Light Commercial Vehicles, Commercial Vehicles, and Financial Services. Its extensive brand portfolio includes Audi, Bentley, Škoda, Scania, Volkswagen Commercial Vehicles, MAN, Lamborghini, Ducati, SEAT, Volkswagen Passenger Cars, MOIA, Porsche, Bugatti, and TRATON, ensuring a strong presence across all major global automotive markets.

Volkswagen AG functions as a subsidiary of Porsche Automobil Holding SE, which owns 53.1% of its ordinary shares. The company not only manufactures vehicles but also provides sub-assemblies, spare parts, and advanced technical components. Additionally, Porsche SE supports Volkswagen through technical and consulting assistance services, covering areas such as vehicle design, engine development, and industrial optimization.

In 2024, the Volkswagen Group achieved 9.0 million global vehicle deliveries, underscoring its scale and international reach. The company operates a vast network of 115 production facilities located across 17 European nations and 10 countries spanning North and South America, Asia, and Africa, reflecting its deeply integrated global manufacturing footprint.

Facts About Volkswagen

- Volkswagen AG was founded in 1937 in Germany, originally established by the German Labour Front to create an affordable “people’s car.”

- The company’s name translates to “People’s Car” in German, symbolizing its mission to make car ownership accessible to the public.

- Volkswagen’s headquarters are located in Wolfsburg, Germany, which is also home to one of the world’s largest car manufacturing plants.

- The first model, the Volkswagen Beetle, became one of the best-selling cars of all time, with over 21 million units produced.

- Volkswagen Group owns multiple major automotive brands, including Audi, Porsche, Lamborghini, Bentley, Bugatti, SEAT, Škoda, and Ducati.

- The company operates more than 100 production facilities in over 25 countries worldwide.

- Volkswagen is one of the world’s largest automakers by global sales volume, often competing closely with Toyota for the top spot.

- The brand’s modular platform strategy (MQB, MEB) allows flexibility and efficiency in producing multiple models using shared components.

- Volkswagen has made significant investments in electric vehicles, launching the ID. series to lead its electrification efforts.

- The company has committed to achieving carbon neutrality by 2050 as part of its “Way to Zero” sustainability program.

Global Deliveries of Passenger Cars and Light Commercial Vehicles

- In the first half of 2025, Volkswagen Group’s global sales of passenger cars and light commercial vehicles totaled 4,252,179 units, representing a modest 5% increase compared with the same period of the previous year.

- The brands Volkswagen Passenger Cars, SEAT/CUPRA, Škoda, and Lamborghini recorded growth in vehicle deliveries, supported by strong demand across key regions.

- Conversely, Audi, Volkswagen Commercial Vehicles, Bentley, and Porsche experienced a decline in sales volumes compared with the prior-year period.

- Overall, the company maintained stable global performance despite a challenging market environment, marked by supply constraints and uneven demand recovery across regions.

Deliveries in Europe/Other Markets

- In Western Europe, the Volkswagen Group delivered 1,644,340 vehicles in the first half of 2025, reflecting a 4% increase compared to the same period in the previous year.

- The region accounted for the strongest demand for electrified vehicles, with over 70% of all-electric model sales coming from Western Europe, totaling 338,221 units, including heavy commercial vehicles.

- Deliveries of all-electric vehicles in the region surged by nearly 90% year-on-year, raising their share of total Group deliveries to 9%, up from 10.7% in the prior year.

- Customer orders for all-electric Volkswagen Group models in Western Europe climbed by more than 60% year-on-year, signaling growing confidence in EV adoption.

- The top-selling models in the region were the Volkswagen T-Roc, Tiguan, and Golf hatchback, which continued to drive the Group’s market performance.

- In Germany, Volkswagen Group delivered 589,059 vehicles between January and June 2025, marking a 1% increase compared with the previous year, even as the overall market saw a slight decline.

- Deliveries of all-electric vehicles in Germany nearly doubled year-on-year to 116,774 units, including heavy commercial vehicles, underscoring accelerating domestic EV growth.

- In Central and Eastern Europe, the Volkswagen Group achieved an 8% year-on-year increase in customer deliveries during the reporting period, highlighting sustained momentum in emerging European markets.

North America Deliveries

- Between January and June 2025, Volkswagen Group deliveries in North America declined by 9% year-on-year, mainly due to a challenging market environment, even though the overall regional market showed slight growth.

- Deliveries of all-electric vehicles (including heavy commercial vehicles) increased by 0%, totaling 37,122 units, which raised the BEV share to 8.0%, up from 6.7% in the previous year.

- The Taos, Jetta, and Atlas models were among the most in-demand vehicles. In contrast, new and successor models such as the Taos, Tayron, Audi A5, Audi Q5, and Porsche 911 were introduced during the period.

- Volkswagen Group’s overall market share in North America slipped to 3% from 4.8%, while its BEV market share grew to 5.5% from 4.8%, indicating steady electric mobility progress despite soft total sales.

- South America: In the first half of 2025, Volkswagen Group deliveries in South America rose sharply by 1% year-on-year, supported by a strong rebound in the regional passenger and light commercial vehicle markets.

- The Polo and T-Cross emerged as top-selling models, helping increase the Group’s market share to 13.5%, up from 5% in the previous year.

- The market for all-electric vehicles in South America remained very limited, reflecting the region’s early-stage EV adoption.

- In Brazil, vehicle deliveries climbed by 9%, with strong demand for the T-Cross and Saveiro models. In Argentina, where the overall market expanded significantly, Volkswagen Group more than doubled its sales, driven by models like the Amarok and Polo.

Deliveries in Asia-Pacific

- During the first six months of 2025, Volkswagen Group’s sales volume in the Asia-Pacific region fell by 2%, even as the regional market grew noticeably.

- Deliveries of all-electric vehicles (including heavy commercial vehicles) dropped by 1% to 72,719 units, reducing their share of total Group deliveries to 4.9%, compared with 6.5% a year earlier.

- The Sagitar and Passat were the region’s highest-selling models, while the Group’s passenger car market share slipped to 1% from 8.7%, and the BEV market share fell to 1.9% from 3.5%.

- In China, the largest market in the region, deliveries declined by 3%, mainly due to intense competition, though the overall Chinese market expanded.

- Volkswagen delivered 59,351 all-electric vehicles in China, marking a 5% decrease year-on-year, and its share of total Group deliveries fell to 4.5% from 6.7%.

- The Sagitar, Passat, and Magotan were the top-selling models, while the T-Cross and Tiguan Allspace saw rising demand.

- Newly introduced or updated models included the Tayron, Teramont, Jetta VA7, Audi A5L Sportback, and Porsche 911, reflecting Volkswagen’s effort to refresh its lineup.

- In India, the Group recorded a strong 0% increase in vehicle sales, with standout demand for the newly launched Škoda Kylaq and high-performing Volkswagen Virtus.

- In Japan, Volkswagen’s deliveries rose by 5% year-on-year amid a growing automotive market, led by strong sales of the T-Cross and Golf hatchback models.

(Source: Volkswagen Annual Report)

Global Deliveries Commercial Vehicles

- From January to June 2025, the Volkswagen Group delivered a total of 153,137 commercial vehicles worldwide, representing a 4% decline compared with the same period in the previous year.

- Within this total, truck deliveries amounted to 121,359 units, a decrease of 7%, while bus deliveries rose sharply by 33.4% to 16,718 units, reflecting a strong rebound in the segment.

- Deliveries of the MAN TGE van series increased by 3%, reaching 15,060 vehicles, supported by higher customer demand and improved production availability.

- In the EU27+3 region (27 EU countries excluding Malta but including the United Kingdom, Norway, and Switzerland), sales declined by 7% year-on-year, totaling 67,305 units.

- Of these, 49,203 were trucks, 3,323 were buses, and 14,779 were MAN TGE vans, indicating stable performance in the light commercial segment despite regional market softness.

- In North America, commercial vehicle sales dropped by 3% to 36,061 units, including 29,024 trucks and 7,037 buses.

- The decline in truck sales was largely due to buyer caution amid economic uncertainty and concerns over tariff developments and reciprocal trade effects.

- Conversely, bus deliveries surged significantly, as the delayed production ramp-up of the new International school bus model had impacted the prior-year period.

- In South America, deliveries edged up 5%, reaching 34,750 units, comprising 29,843 trucks and 4,906 buses.

- In Brazil, however, sales dropped noticeably by 3% to 27,779 units, including 23,817 trucks and 3,962 buses, reflecting a temporary slowdown in demand.

- In the Asia-Pacific region, Volkswagen Group sold 4,189 commercial vehicles, down 6% from the previous year, consisting of 3,424 trucks and 765 buses, indicating weaker regional demand and competitive market conditions.

(Source: Volkswagen Annual Report)

Volkswagen Group Financial Services

- During the first half of 2025, Volkswagen Group’s Financial Services Division recorded strong demand for its financing, leasing, service, and insurance offerings.

- A total of 5 million new contracts were signed globally, maintaining the same level as the prior year despite a competitive market environment.

- The penetration rate representing leased and financed vehicles as a share of total Group deliveries rose to 35.9%, up from 8% in the previous year, indicating increased customer engagement with financial solutions.

- As of June 30, 2025, the total number of active contracts reached 1 million, compared with 28.5 million at the end of June 2024, highlighting steady portfolio expansion.

- In Europe and Other Markets, Volkswagen Financial Services signed 0 million new contracts, maintaining its prior-year volume.

- The total number of contracts in this region increased to 8 million, up from 20.4 million at the end of 2024, with 7.4 million contracts attributed to customer financing and leasing activities.

Moreover

- In North America, 644,000 new contracts were signed from January to June 2025, down from 733,000 in the same period last year.

- The contract portfolio remained steady at 3 million, with 1.7 million contracts under customer financing and leasing, reflecting stable retention rates amid slower new signings.

- In South America, Volkswagen Financial Services achieved 593,000 new contracts, a substantial increase from 381,000 in the previous year.

- The total number of contracts rose to 0 million, compared with 1.7 million at the end of 2024, including 0.8 million in the customer financing/leasing segment, signifying expanding market penetration.

- In the Asia-Pacific region, 337,000 new contracts were signed in the reporting period, compared with 389,000 in the prior year.

- By the end of June 2025, the region’s contract base stood at 0 million, slightly lower than 2.2 million a year earlier, with 1.1 million linked to customer financing and leasing operations.

(Source: Volkswagen Annual Report)

Financial Analysis

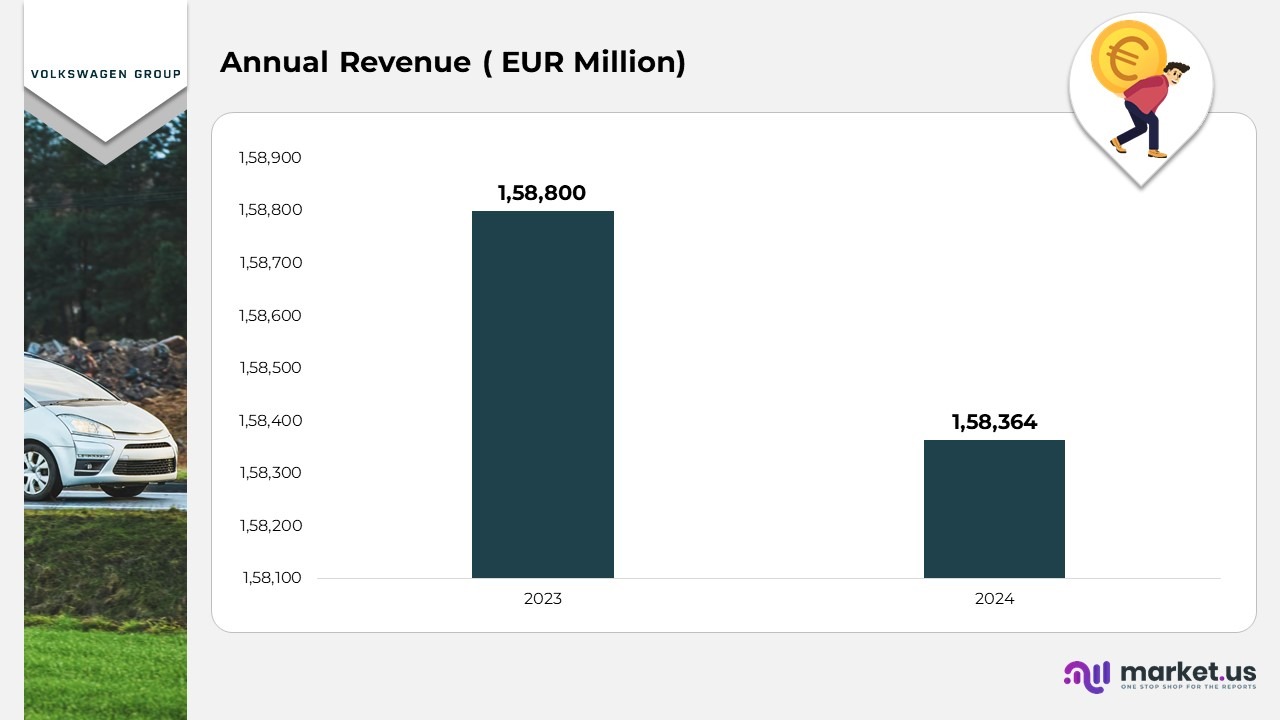

Annual Revenue

- During January to June 2025, the Volkswagen Group reported sales revenue of €158.4 billion, nearly matching the previous year’s figure of €158.8 billion, indicating stable overall performance despite a challenging market environment.

- The Financial Services Division made a notable positive contribution, helping offset weaker trends in other segments and supporting overall revenue stability.

- A substantial 7% of total sales revenue was generated outside Germany, underscoring Volkswagen’s strong international presence and diversified regional portfolio.

- The Group’s gross profit declined by €2.9 billion to €26.4 billion, primarily because the cost of sales increased faster than revenue, which placed pressure on profit margins.

- Consequently, the gross margin decreased to 7%, compared with 18.4% in the same period last year, reflecting cost inflation and supply chain constraints.

- The operating result for the first half of 2025 stood at €6.7 billion, down from €10.0 billion in the prior-year period.

- The operating return on sales fell to 2%, compared with 6.3% a year earlier, marking a noticeable profitability decline.

- The lower earnings performance was mainly attributed to higher import tariffs in the United States effective from April 2025, increased provisions related to CO₂ fleet compliance in Europe and the U.S., and ongoing litigation costs linked to the diesel issue.

(Source: Volkswagen Annual Report)

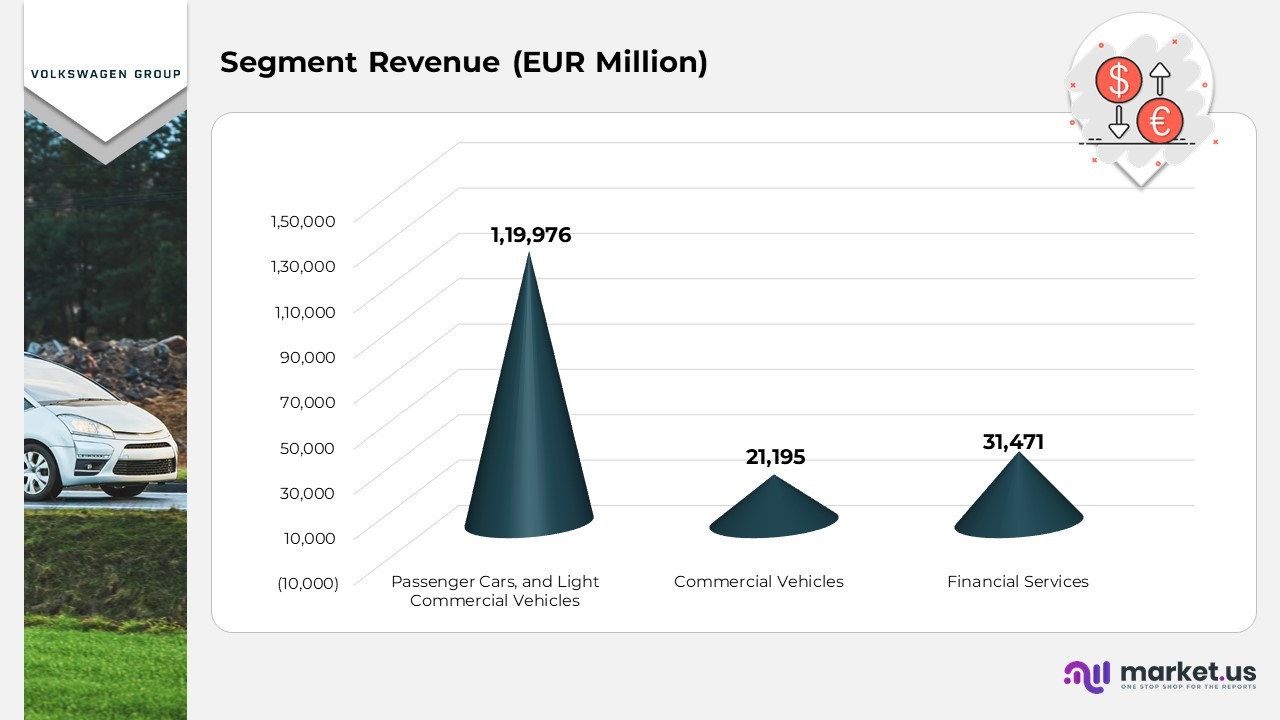

Segment Revenue

- In 2024, the Passenger Cars and Light Commercial Vehicles segment recorded revenue of €119,976 million, maintaining its leadership within the Volkswagen Group’s portfolio. The performance was driven by strong demand for models such as the Golf, Tiguan, and the expanding all-electric ID lineup.

- The Commercial Vehicles segment generated €21,195 million in revenue during 2024, reflecting steady fleet demand and improved performance across key markets in Europe and South America.

- The Financial Services segment achieved €31,471 million in revenue for 2024, supported by increased leasing, financing, and insurance contracts, reinforcing Volkswagen’s global financial stability and customer-focused mobility solutions.

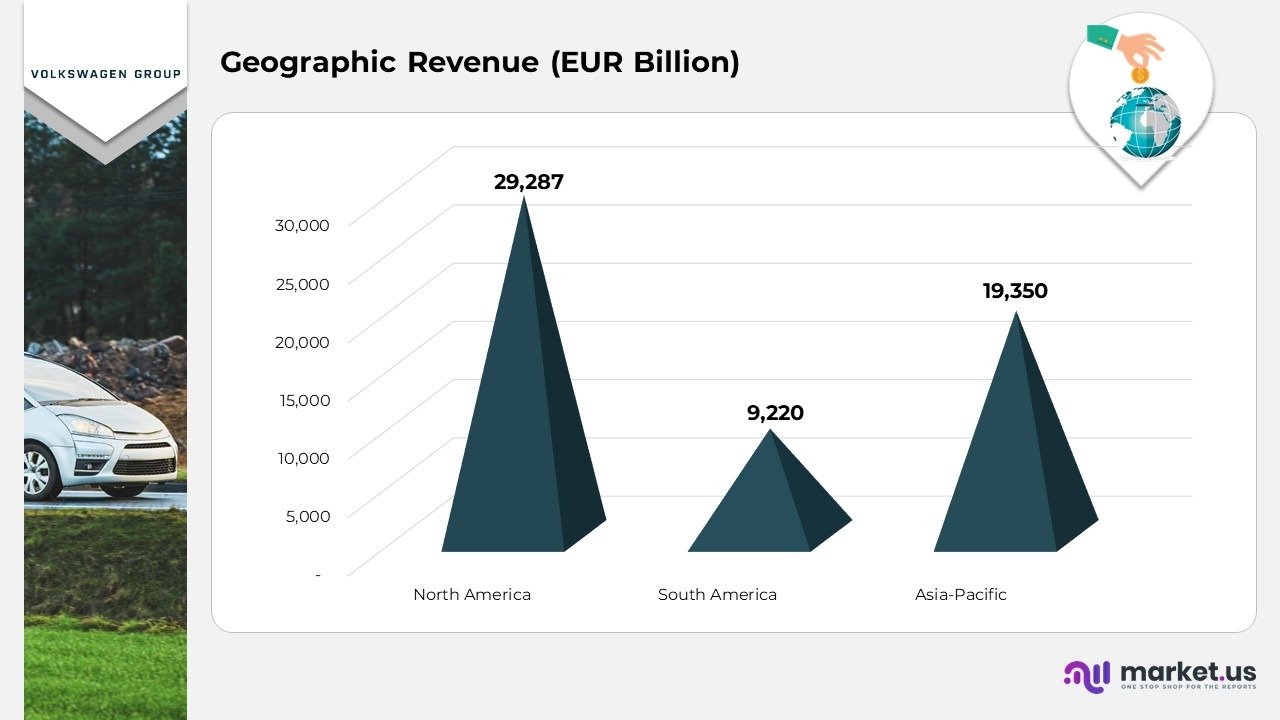

Geographical Revenue

- In 2024, the Europe and Other Markets region generated €100,735 million in revenue, continuing to be Volkswagen’s largest and most profitable market. Growth was primarily driven by increasing sales of electric and premium vehicles in key markets such as Germany, the United Kingdom, and France.

- The North America region contributed €29,287 million in 2024, supported by strong consumer demand for SUVs and the expanding electric vehicle (EV) lineup, especially in the United States and Canada.

- In South America, Volkswagen recorded €9,220 million in revenue during 2024, reflecting a steady recovery in countries like Brazil and Argentina, where models such as the Polo and T-Cross continued to perform well.

- The Asia-Pacific region achieved €19,350 million in 2024, backed by robust operations in China and India. The company emphasized localized production and further investment in hybrid and electrified mobility solutions to strengthen its market position.

(Source: Volkswagen Annual Report)

Employee Analysis

- As of June 2025, the Volkswagen Group employed 635,855 active workers, marking a 6% decrease compared with December 31, 2024.

- Additionally, 16,483 employees were in the passive phase of partial retirement, while 14,852 young people were enrolled in vocational training programs, reflecting the company’s continued investment in skill development.

- Including its Chinese joint ventures, Volkswagen’s total global workforce stood at 667,190 employees, representing a 8% decline from the end of 2024.

- Of this total, 286,248 employees were based in Germany (a 4% decline), and 380,942 employees were located outside Germany (down 1.3%).

- When excluding the Chinese joint ventures, the Group’s workforce totaled 604,561 employees, showing a 6% reduction compared to the previous year-end.

- The slight workforce contraction reflects Volkswagen’s ongoing efficiency and restructuring measures, balanced with efforts to maintain employment stability amid global market transitions.

(Source: Volkswagen Annual Report)

Fun Facts

- The original Volkswagen Beetle design was influenced by Ferdinand Porsche, who developed it at Adolf Hitler’s request for a “people’s car.”

- The Wolfsburg plant was initially built to manufacture the Beetle but was later converted to military production during World War II.

- The iconic Beetle became a cultural symbol in the 1960s and starred as “Herbie” in Disney’s The Love Bug film series.

- Volkswagen’s logo—consisting of a “V” over a “W” within a circle—has changed little since its introduction in 1938.

- The company’s electric ID. Buzz is a modern revival of the classic VW Microbus from the 1950s and 1960s.

- The Golf, introduced in 1974, replaced the Beetle as Volkswagen’s best-seller and remains one of Europe’s most popular cars.

- Volkswagen is one of the few carmakers that operates its own city—Wolfsburg—built around its factory and employee community.

- The brand’s “Das Auto” slogan, meaning “The Car,” reflected its confidence in defining the standard of automobile quality.

- Volkswagen owns one of the world’s largest automotive museums, the Autostadt, showcasing its vehicles and history.

- In recent years, Volkswagen has shifted its focus toward sustainability and digital transformation, positioning itself as a leader in next-generation mobility.

Recent Developments

- In September 2025, Volkswagen announced a €1 billion investment in advancing AI-driven vehicle development, industrial automation, and high-performance IT infrastructure, reinforcing its digital transformation strategy across production and mobility services.

- In August 2025, the company merged with LOGPAY Transport Services GmbH, consolidating its charging and fueling card business within the Volkswagen Group. The integration streamlines operations, eliminates redundancies, and enables the company to provide customers with comprehensive mobility solutions from a single source.

- In February 2025, Volkswagen partnered with Dassault Systèmes to implement the 3DEXPERIENCE Platform, designed to optimize vehicle development, enhance collaboration across engineering teams, and accelerate innovation cycles.

- In August 2024, the company collaborated with Amazon Web Services (AWS) to modernize and digitize its production network, harnessing AI and cloud-based technologies to improve efficiency and sustainability across manufacturing plants.

- In December 2024, Volkswagen partnered with Patriot Battery Metals Inc. as part of its vertical integration strategy from raw material extraction to battery production, strengthening its position in the global electric vehicle supply chain.

(Source: Volkswagen Press Releases)