Company Overview

Stellantis Statistics: Stellantis N.V. is involved in the design, engineering, manufacturing, distribution, and sale of automobiles, light commercial vehicles, engines, transmission systems, mobility services, and metallurgical products. Additionally, the company engages in other activities such as software and data services, as well as financial services related to dealer and customer financing, vehicle leasing, and rentals.

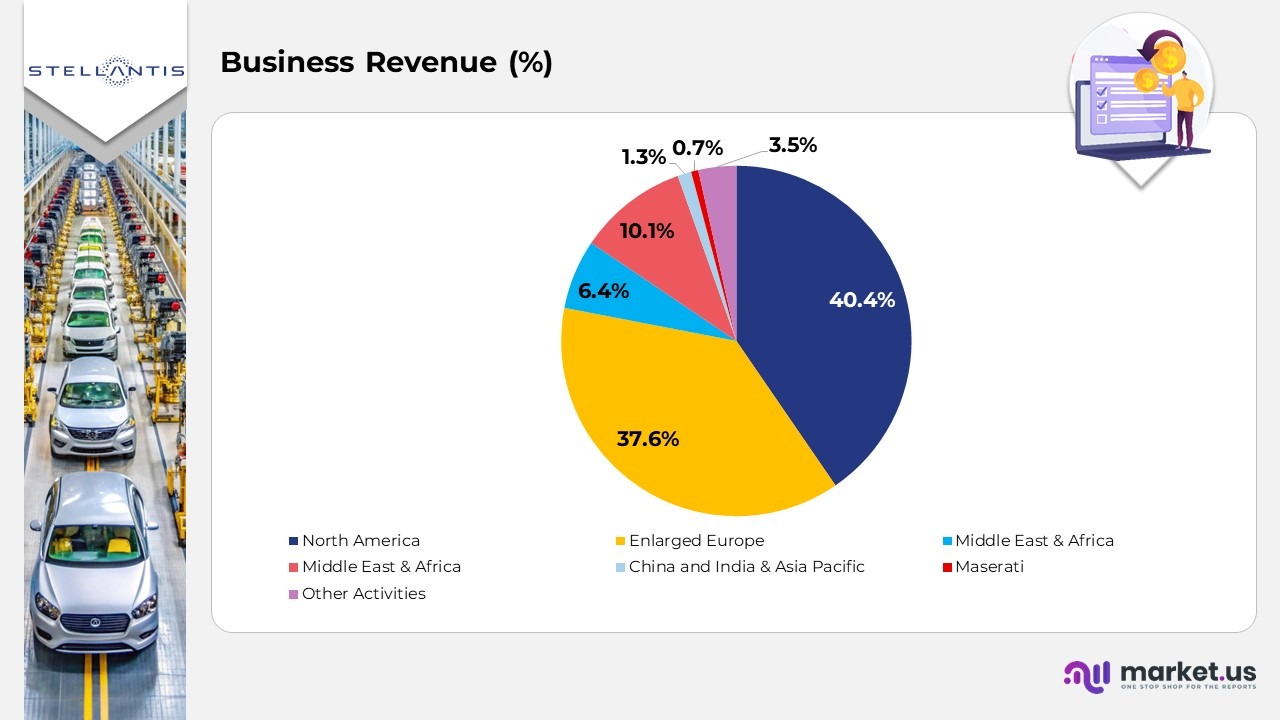

The company operates across 6 main segments: Enlarged Europe, North America, China and India & Asia Pacific, Middle East & Africa, South America, and Maserati.

With a diverse community of 165 nationalities, Stellantis has industrial operations in over 30 countries and serves customers across more than 130 markets globally. The company is publicly listed on the Euronext Milan (STLAM), New York Stock Exchange (NYSE), and Euronext Paris (STLAP). In 2020, the company submitted 1,239 patents.

Facts About Stellantis N.V.

- Formed on January 16, 2021, through the merger of Fiat Chrysler Automobiles (FCA) and Groupe PSA.

- Legally headquartered in Amsterdam, Netherlands, with regional operations across North America, Europe, and other global markets.

- Currently, one of the world’s largest automotive manufacturers by sales volume and revenue.

- Operates in over 130 markets with industrial facilities in more than 30 countries.

- Houses 14 major automotive brands, including Jeep, Peugeot, Fiat, Citroën, Chrysler, Dodge, Ram, Alfa Romeo, Maserati, Opel, and Vauxhall.

- Reported global revenue of approximately USD 169.7 billion in 2023.

- Employs over 270,000 people globally across manufacturing, design, and R&D operations.

- Actively engaged in developing electric and hybrid vehicles across its portfolio.

- Operates a comprehensive mobility services division offering car-sharing, leasing, and connected services.

- Major R&D centers are located in Italy, France, and the United States for advanced EV and software development.

- Focused on achieving carbon net-zero by 2038 under its “Dare Forward 2030” strategic plan.

- Listed on multiple stock exchanges, including Euronext Milan, Euronext Paris, and the New York Stock Exchange.

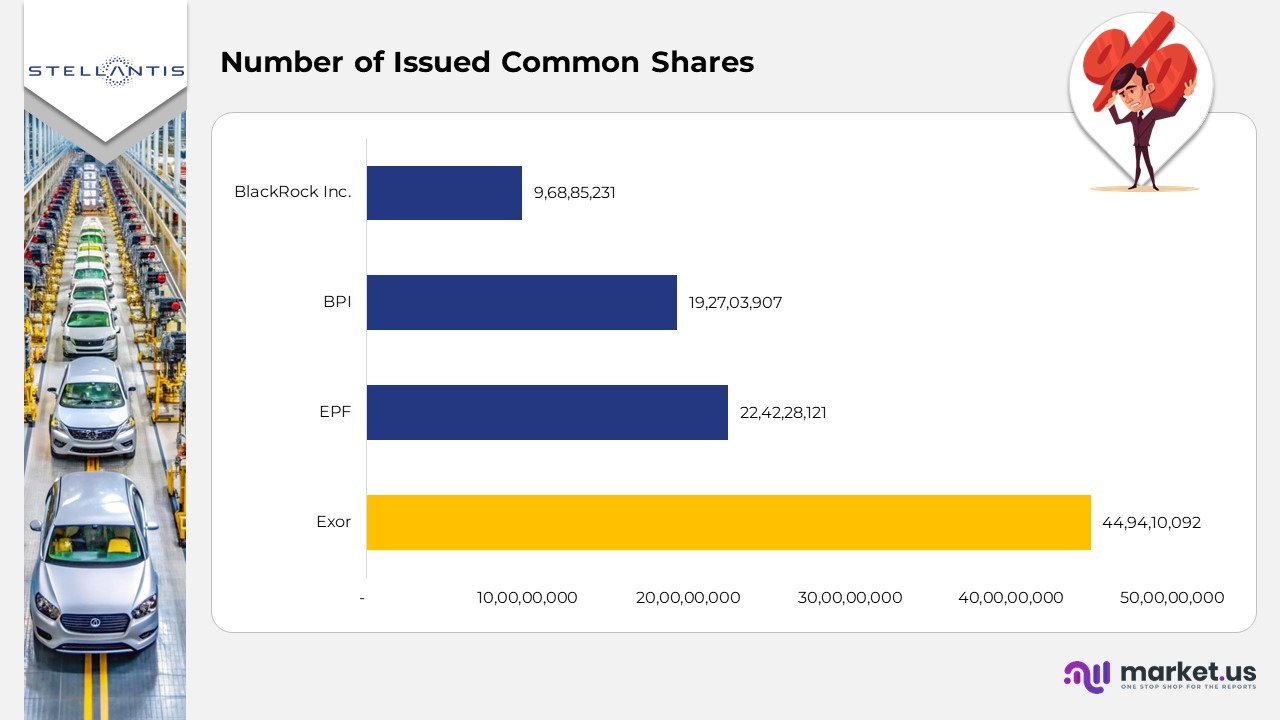

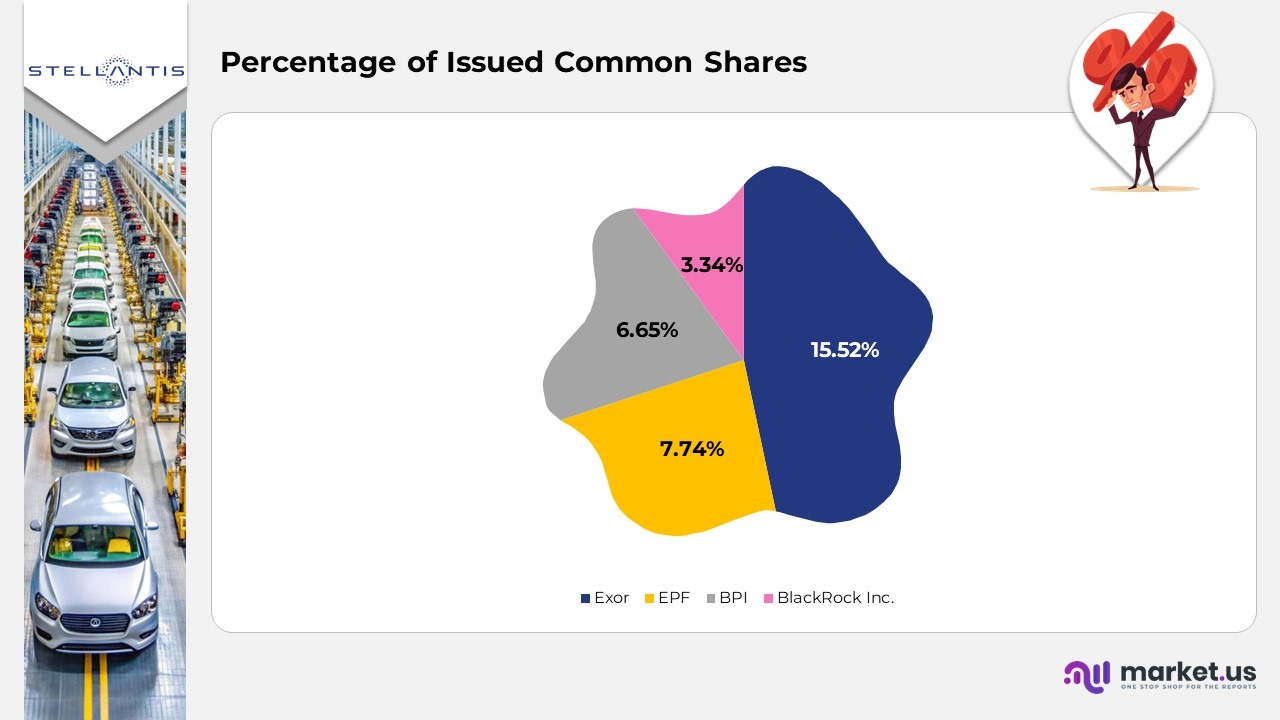

Shareholders Analysis

- Exor holds a total of 449,410,092 common shares, which accounts for 52% of the total issued shares.

- EPF possesses 224,228,121 common shares, representing 74% of the issued shares.

- BPI owns 192,703,907 common shares, making up 65% of the total shares issued.

- BlackRock Inc. holds 96,885,231 common shares, or 34% of the total issued shares.

(Source: Stellantis N.V. Annual Report)

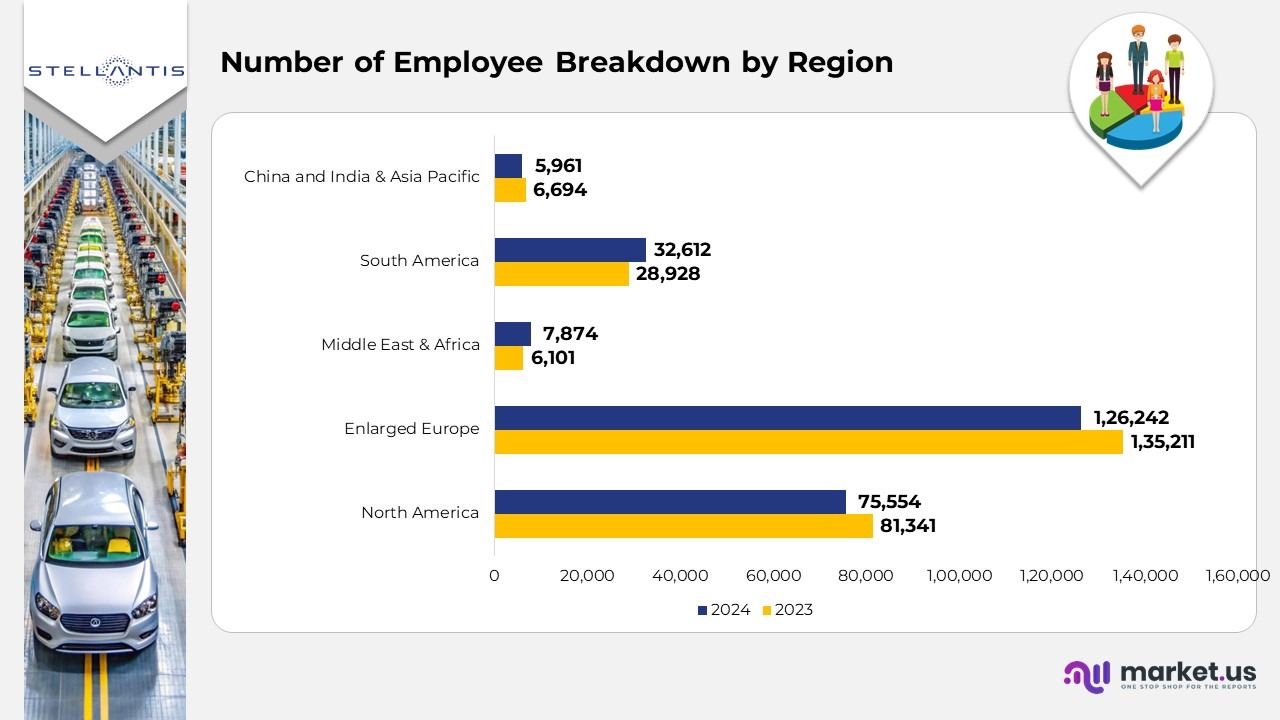

Employee Breakdown by Region

- As of December 31, 2024, Stellantis employed 248,243 people (excluding joint arrangements, associates, and unconsolidated subsidiaries), reflecting a 9% decrease compared to December 31, 2023, and an 8.9% decrease from December 31, 2022.

- North America employed 75,554 individuals in 2024, down from 81,341 in 2023 and 88,835 in 2022.

- Enlarged Europe had 126,242 employees in 2024, a decrease from 135,211 in 2023 and 142,681 in 2022.

- The Middle East & Africa experienced a rise to 7,874 employees in 2024, up from 6,101 in 2023 and 5,311 in 2022.

- South America saw an increase to 32,612 employees in 2024, compared to 28,928 in 2023 and 28,968 in 2022.

- China, India & Asia Pacific had 5,961 employees in 2024, down from 6,694 in 2023 and 6,572 in 2022.

(Source: Stellantis N.V. Annual Report)

Number of Vehicles Shipped by Stellantis

In 2024, total consolidated shipments amounted to 5,415 vehicles, a decrease from 6,168 in the previous period. Out of this total:

- North America shipped 1,432 vehicles, down from 1,903 in the previous period.

- Enlarged Europe delivered 2,576 vehicles, a decrease from 2,814 in the prior period.

- Middle East & Africa shipped 423 vehicles, slightly lower than 443 in the previous period.

- South America saw 912 vehicles shipped, showing an increase from 879 in the prior period.

- China, India & Asia Pacific shipped 61 vehicles, down from 102 in the previous period.

- Maserati delivered 11 vehicles, a reduction from 27 in the prior period.

(Source: Stellantis N.V. Annual Report)

Segmental Analysis

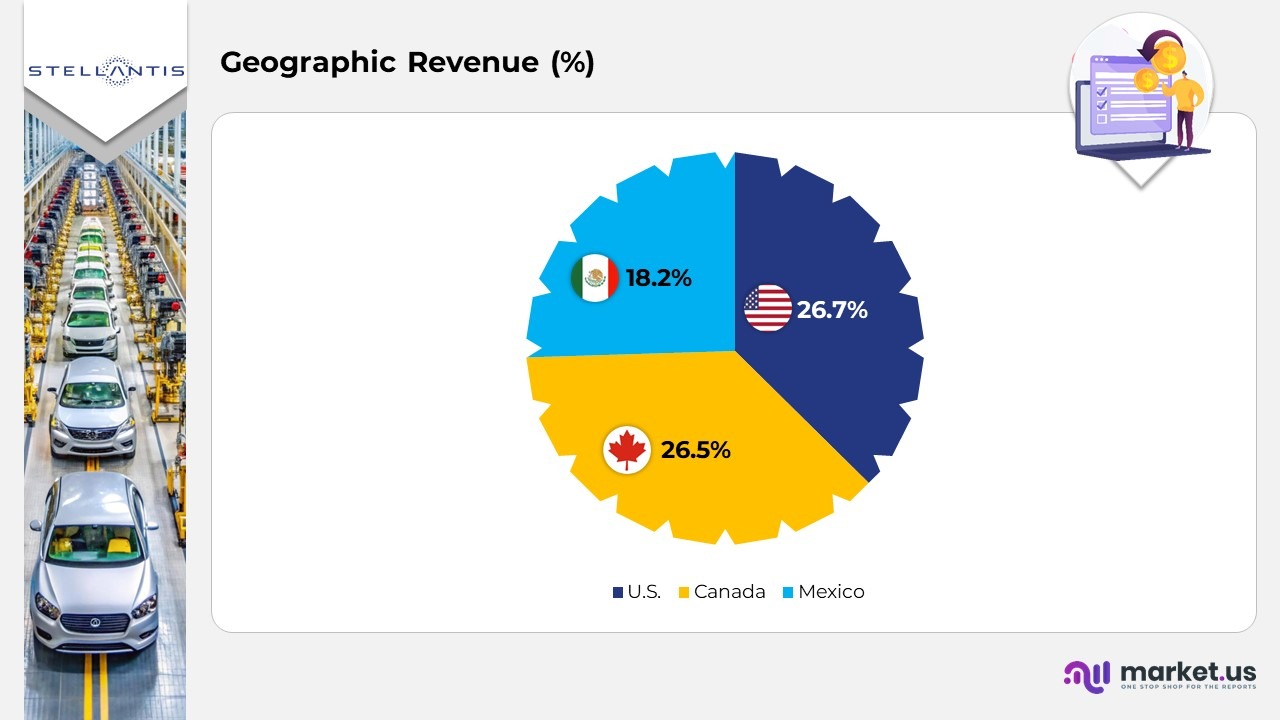

North America

- Stellantis operates in Canada, the United States, and Mexico to produce, distribute, and sell vehicles, mainly under the Jeep, Dodge, FIAT, Ram, Chrysler, and Alfa Romeo

- Its manufacturing facilities are strategically located across the U.S., Canada, and Mexico.

- Net Revenues €63,450 million in 2024, down from €86,500 million in 2023.

- Adjusted Operating Income €2,660 million in 2024, compared to €13,298 million in 2023.

- Consolidated Shipments 1,432 thousand units in 2024, a decrease from 1,903 thousand units in 2023.

Vehicle Sales and Projected Market Share in North America

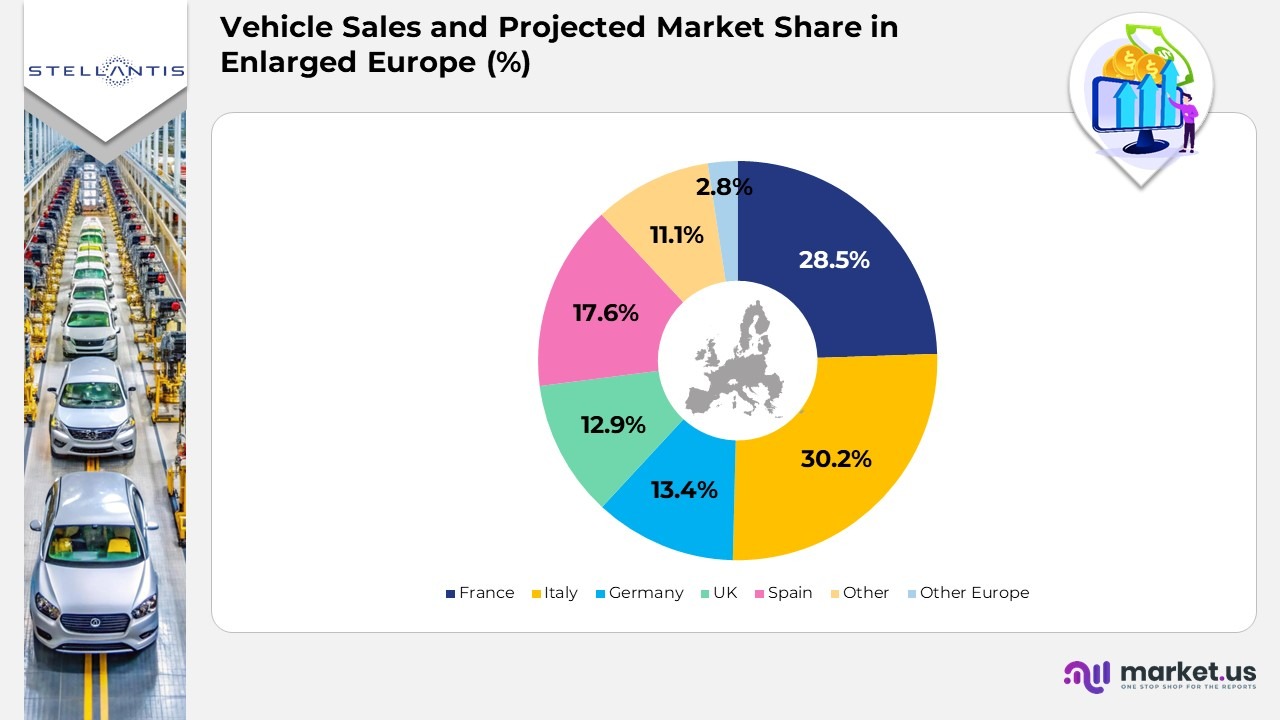

Enlarged Europe

- Stellantis operates in Europe, including the 27 EU countries, the United Kingdom (UK), and the European Free Trade Association (EFTA)

- The company manufactures, distributes, and sells vehicles under its mainstream brands: FIAT, Opel, Citroën, Peugeot, and Vauxhall.

- Stellantis also offers premium brands: Alfa Romeo, Lancia, and DS.

- Manufacturing plants are located in France, Spain, the UK, Serbia, Germany, Italy, Poland, Portugal, and Slovakia.

- In 2024, Stellantis started distributing Leapmotor-branded vehicles in Europe.

- Net Revenues €59,010 million in 2024, down from €66,598 million in 2023.

- Adjusted Operating Income €2,419 million in 2024, compared to €6,519 million in 2023.

- Consolidated Shipments 2,576 thousand units in 2024, down from 2,814 thousand units in 2023.

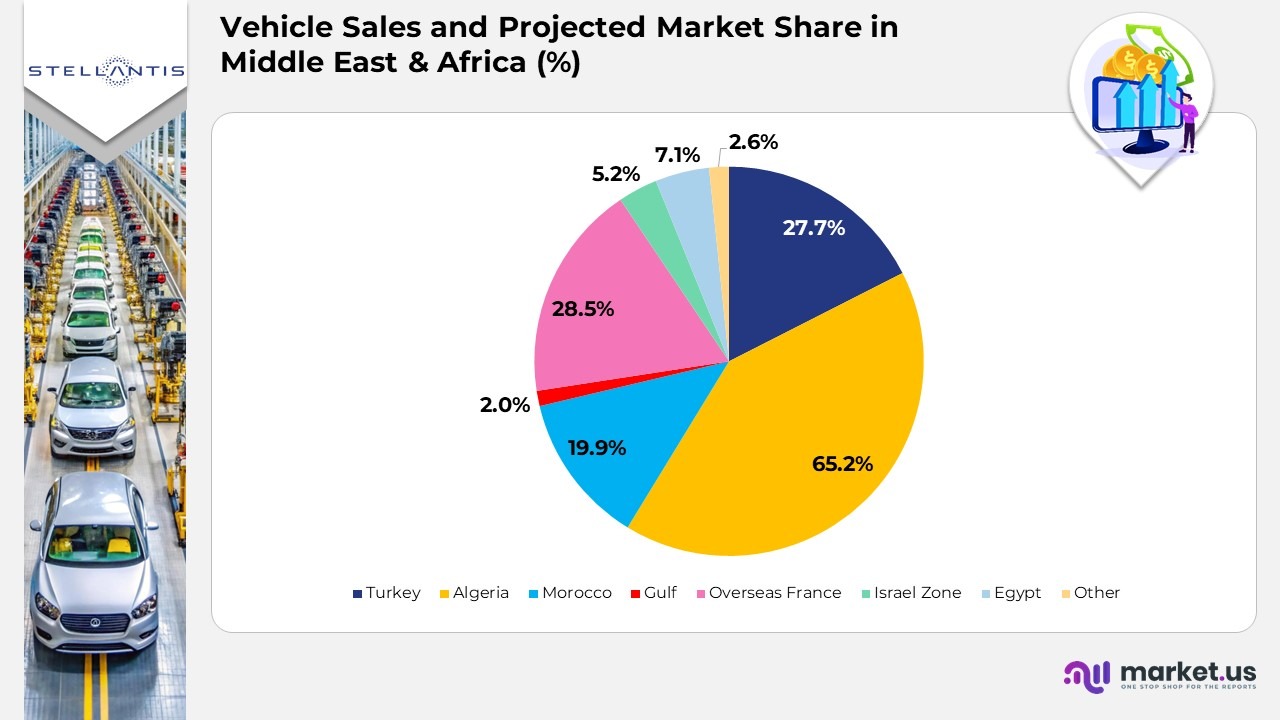

Middle East & Africa

- Stellantis operates to manufacture, distribute, and sell vehicles primarily in Turkey, Morocco, and Algeria.

- The company offers vehicles under the Peugeot, Opel, FIAT, Citroën, and Jeep.

- Manufacturing plants are mainly located in Morocco, Algeria, and Turkey.

- Net Revenues €10,097 million in 2024, a slight decrease from €10,560 million in 2023.

- Adjusted Operating Income €1,901 million in 2024, compared to €2,503 million in 2023.

- Consolidated Shipments: 423 thousand units in 2024, down from 443 thousand units in 2023.

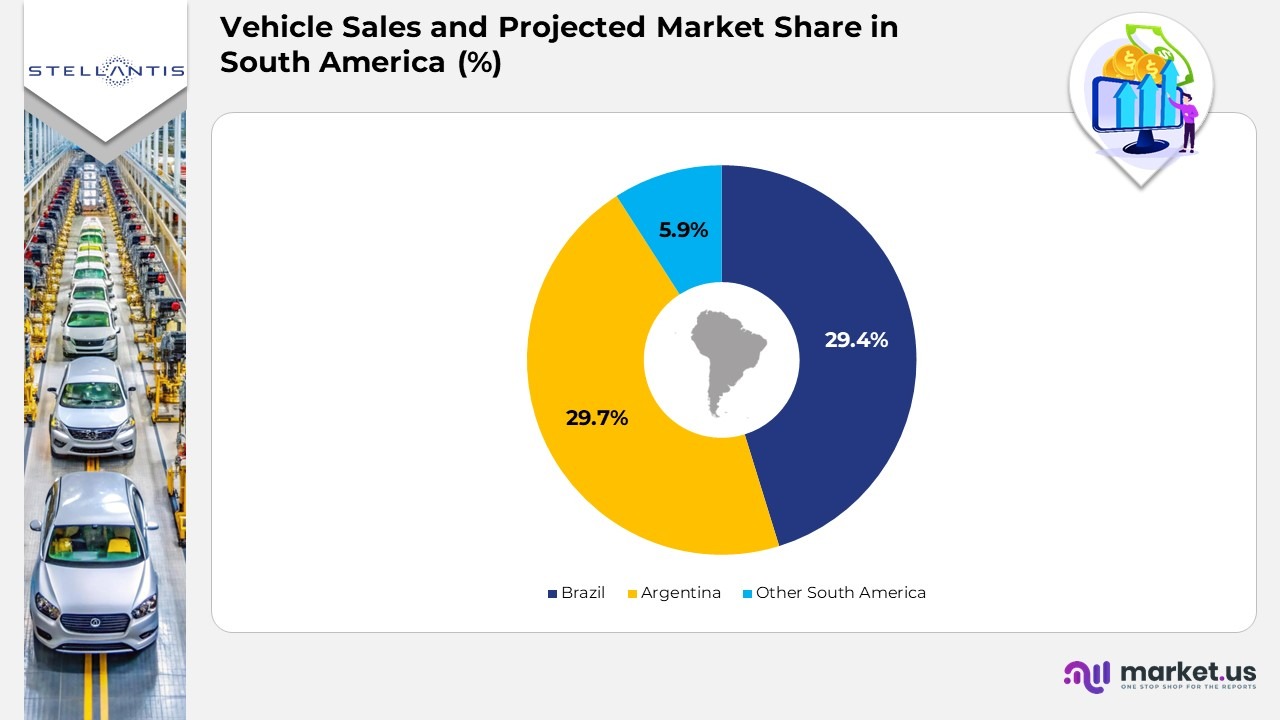

South America

- Stellantis operates to manufacture, distribute, and sell vehicles in South and Central America.

- The company primarily offers vehicles under the FIAT, Ram, Jeep, Peugeot, and Citroën

- The largest focus of its operations is in Argentina and Brazil.

- Manufacturing plants are located in Brazil and Argentina, the main markets in the region.

- In 2025, Stellantis will begin distributing Leapmotor-branded vehicles in South and Central America.

- Net Revenues €15,863 million in 2024, slightly down from €16,058 million in 2023.

- Adjusted Operating Income €2,272 million in 2024, compared to €2,369 million in 2023.

- Consolidated Shipments 912 thousand units in 2024, an increase from 879 thousand units in 2023.

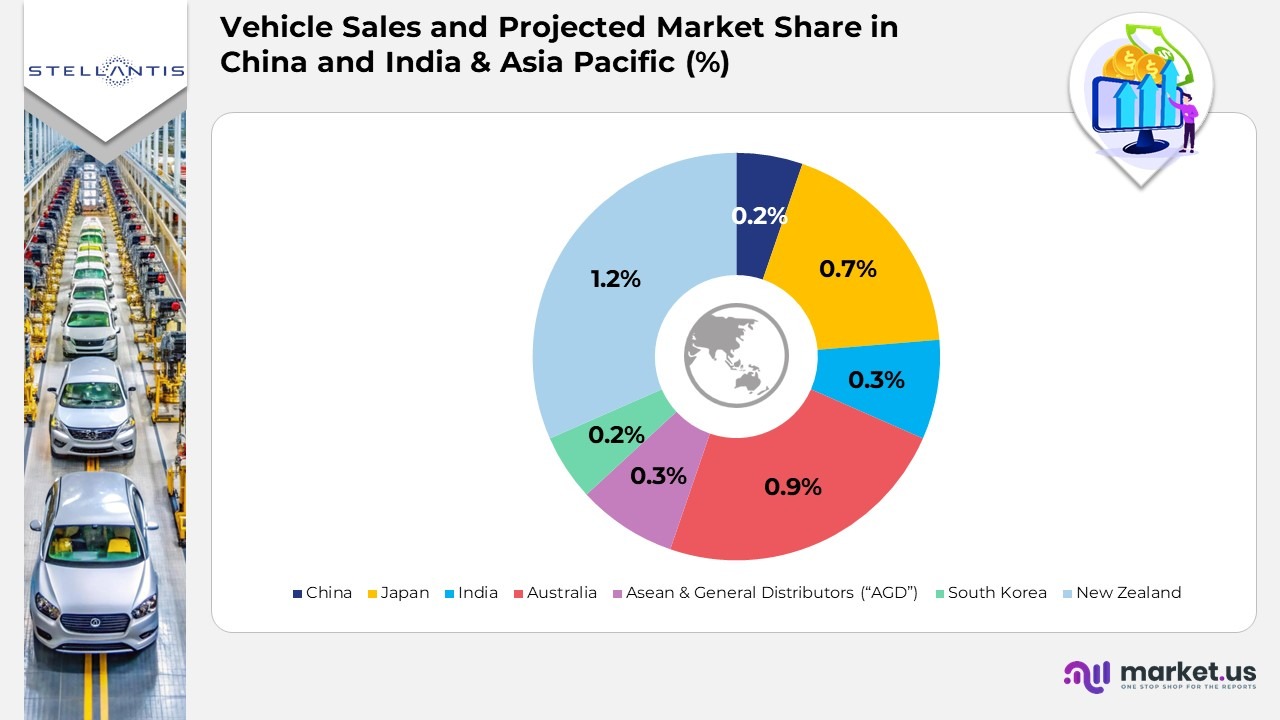

China and India & Asia Pacific

- Stellantis operates to manufacture, distribute, and sell vehicles in the Asia Pacific region, with a focus on China, India, Japan, Australia, and South Korea.

- Operations are conducted through both subsidiaries and joint ventures, primarily under the Jeep, DS, Citroën, Peugeot, FIAT, and Alfa Romeo

- Manufacturing plants are situated in Malaysia and India through the India Fiat India Automobiles Private Limited and Stellantis Gurun (Malaysia), a wholly owned subsidiary.

- Peugeot and Citroën vehicles are produced in China by Dongfeng Peugeot Citroën Automobiles (DPCA) under various license agreements.

- In 2024, Stellantis began distributing Leapmotor-branded vehicles in the Asia Pacific region (excluding China).

- Net Revenues €1,993 million in 2024, down from €3,528 million in 2023.

- Adjusted Operating Income was a loss of (€58) million in 2024, compared to €502 million in 2023.

- Consolidated Shipments: 61 thousand units in 2024, down from 102 thousand units in 2023.

Maserati

- Stellantis is responsible for designing, engineering, developing, manufacturing, and distributing luxury vehicles globally under the Maserati.

- The company’s engineering, design, and manufacturing facilities are based in Italy.

- Net Revenues €1,040 million in 2024, a decrease from €2,335 million in 2023.

- Adjusted Operating Income was a loss of (€260) million in 2024, compared to €141 million in 2023.

- Consolidated Shipments: 11 thousand units in 2024, down from 27 thousand units in 2023.

- Other Activities €6,151 million in 2024.

(Source: Stellantis N.V. Annual Report)

Financial Analysis

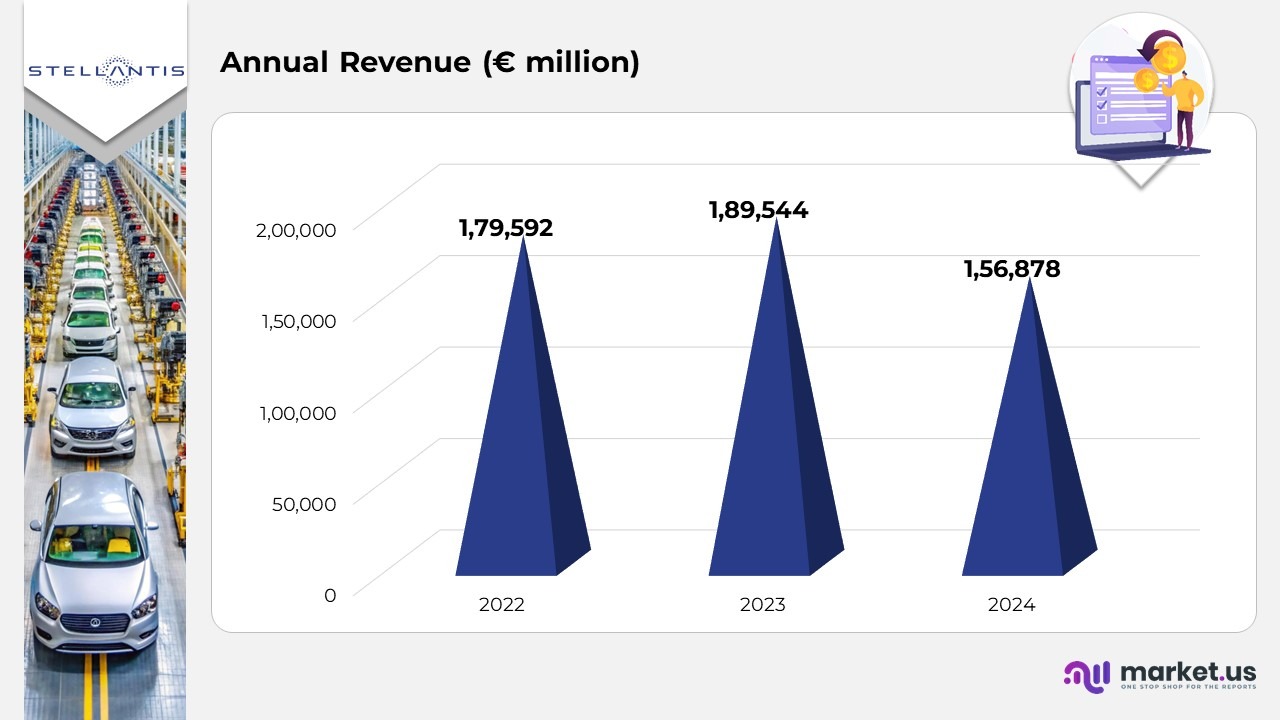

Group Revenues:

- Net revenues amounted to €156.9 billion, showing a 17% decline compared to 2023.

- Net profit fell by 70%, totaling €5.5 billion, mainly driven by operational challenges and disruptions during the shift to the next generation of products.

(Source: Stellantis N.V. Annual Report)

Business Revenue

- In FY 2024, Kia’s retail sales were primarily driven by the RV segment, which made up 5% of total sales, translating to 2,077 thousand units. This dominance highlights Kia’s strong foothold in the global SUV and crossover market.

- The Passenger vehicle segment accounted for 1%, with 750 thousand units sold, reflecting consistent consumer preference for Kia’s range of compact and mid-sized sedans in key regions.

- The Commercial vehicle segment contributed 4%, amounting to 162 thousand units, demonstrating steady demand within corporate and logistics fleet operations.

(Source: Stellantis N.V. Annual Report)

U.S. Automotive Market Share Trends

- In 2024, General Motors (GM) retained its leadership in the U.S. automotive market with a 6% share, rising from 16.3% in 2023 and 16.1% in 2022, reaffirming its dominant position.

- Toyota followed closely with a 3% market share in 2024, slightly up from 14.2% in 2023 but below 14.9% in 2022, showing consistent yet moderate performance.

- Ford accounted for 8% of the market in 2024, a small rise from 12.5% in 2023, though still under 13.2% in 2022, reflecting steady recovery amid strong competition.

- The combined Hyundai/Kia group maintained a solid presence with 5% in 2024, marginally improving from 10.4% in both 2023 and 2022, indicating stable consumer demand.

- Honda achieved notable gains, increasing its share to 7% in 2024, compared with 8.2% in 2023 and 7.0% in 2022, driven by strong sales across popular models.

- Stellantis continued to decline, posting 0% in 2024, down from 9.6% in 2023 and 10.9% in 2022, pointing to weakening market traction.

- Nissan sustained its position with 7% in both 2024 and 2023, up from 5.2% in 2022, showing steady performance in its core vehicle categories.

- The Other automakers category collectively expanded to 4% of the U.S. market in 2024, an increase from 23.1% in 2023 and 22.4% in 2022, highlighting the growing influence of smaller and emerging brands.

(Source: Stellantis N.V. Annual Report)

Europe Automotive Market Share Trends

- Volkswagen reinforced its leadership in the European automotive sector with a 3% market share in 2024, up from 24.0% in 2023 and 23.0% in 2022, supported by sustained demand across its passenger and electric vehicle portfolios.

- Stellantis ranked second with 0% in 2024, marking a decline from 18.3% in 2023 and 19.7% in 2022, reflecting competitive pressures and slower performance in certain regional markets.

- Renault achieved moderate growth, reaching 7% in 2024, compared to 10.5% in 2023 and 10.1% in 2022, benefiting from rising sales in its small car and hybrid segments.

- Toyota continued its upward momentum with a 4% share in 2024, higher than 6.7% in 2023 and 6.8% in 2022, driven by strong hybrid adoption and reliable brand positioning.

- The Hyundai/Kia alliance recorded a 1% market share in 2024, slightly lower than 7.5% in 2023 and 8.2% in 2022, as competition intensified in the crossover and mid-size categories.

- Mercedes-Benz maintained stability at 2% in both 2024 and 2023, marginally below 6.5% in 2022, sustaining solid performance in the premium and electric segments.

- BMW also sustained a consistent market presence with 2% in 2024 and 2023, compared to 6.3% in 2022, supported by steady luxury vehicle demand and EV growth.

- Ford experienced a dip to 5% in 2024, down from 5.9% in 2023 and 6.5% in 2022, reflecting softer sales amid ongoing restructuring in the region.

- The Other automakers category grew notably, accounting for 6% in 2024, up from 14.7% in 2023 and 12.8% in 2022, signifying the increasing footprint of newer and regional manufacturers.

(Source: Stellantis N.V. Annual Report)

Middle East & Africa Automotive Market Share Trends

- Toyota continued to lead the Middle East & Africa automotive market with a 5% share in 2024, slightly down from 18.0% in 2023 and 20.3% in 2022, reflecting a gradual normalization in demand following earlier market highs.

- Stellantis ranked second with 5% in 2024, compared to 16.8% in 2023 and 14.8% in 2022, indicating uneven performance due to varying brand strengths across regional markets.

- Hyundai/Kia maintained a steady position with 1% in 2024, nearly aligned with 13.3% in 2023 and 13.9% in 2022, supported by strong traction in passenger cars and SUVs.

- Volkswagen increased its market share to 2% in 2024, up from 7.7% in 2023 and 6.8% in 2022. Driven by the rising popularity of its newer SUV and crossover models.

- Renault recorded 2% in 2024, a marginal decline from 8.6% in 2023 and 9.3% in 2022, as intensified competition impacted sales performance in select markets.

- Ford gained ground with a 5% market share in 2024, improving from 5.2% in 2023 and 4.7% in 2022, supported by growing demand for its commercial and utility vehicle lineup.

- Nissan achieved 2% in 2024, up from 4.9% in 2023 and 5.0% in 2022, showcasing steady sales momentum in the Gulf and North African regions.

- Mercedes-Benz saw a slight improvement, reaching 6% in 2024, compared with 1.4% in both 2023 and 2022, indicating stable demand in the luxury vehicle segment.

- BMW remained consistent with a 2% share in 2024, marginally up from 1.1% in 2023 and 1.1% in 2022, supported by a loyal customer base in key metropolitan markets.

(Source: Stellantis N.V. Annual Report)

Recent Developments

- In October 2025, Stellantis expanded its partnership with Mistral AI to accelerate the adoption of artificial intelligence across its global operations. Enhancing innovation and efficiency throughout the company’s automotive ecosystem.

- In June 2025, the company collaborated with the Venture Awards initiative to celebrate and support startups aimed at improving customer engagement and overall experience.

- In January 2025, Stellantis agreed with dSPACE, a leader in simulation and validation technologies, to integrate the VEOS platform for Software-in-the-Loop (SIL) testing within the Stellantis Virtual Engineering Workbench (VEW), enabling faster and scalable development of next-generation vehicle features.

- In December 2024, Stellantis signed a strategic agreement with Zeta Energy Corp. to jointly develop lithium-sulfur EV batteries featuring exceptional gravimetric energy density and volumetric performance comparable to advanced lithium-ion batteries.

- In September 2024, the company invested in the development of lithium-sulfur electric vehicle batteries. Focusing on breakthrough advancements in energy density to enhance EV performance and sustainability.

Further

- In March 2024, Stellantis partnered with the California Air Resources Board (CARB) to advance its Dare Forward 2030 strategic goal of achieving carbon net zero by 2038, reinforcing its leadership in electrification and environmental education for U.S. consumers and dealers.

- In the same month, March 2024, the company announced a €5.6 billion (R$30 billion) investment in South America to support over 40 new products. Expand decarbonization technologies and foster new business opportunities across the region.

- In January 2024, Stellantis enhanced its hydrogen vehicle capabilities by starting in-house production of fuel cell vehicles in Hordain, France, and Gliwice, Poland, broadening its zero-emission mobility portfolio.

- Also in January 2024, Stellantis entered a multi-billion-euro agreement with SIXT. Allowing the rental company to purchase up to 250,000 vehicles over the next three years for its fleet across Europe and North America, strengthening Stellantis’ market presence in the mobility sector.

(Source: Stellantis N.V. Press Releases)

Fun Facts About Stellantis N.V.

- The name “Stellantis” comes from the Latin word stello, meaning “to brighten with stars.”

- The merger between FCA and PSA created one of the largest auto alliances in history.

- Stellantis manages both premium brands like Maserati and everyday brands like Fiat and Peugeot under the same parent company.

- Jeep remains one of the most profitable brands in the Stellantis portfolio.

- Peugeot was originally a coffee mill company before becoming an automobile brand.

- Stellantis reported a 41% rise in global battery-electric vehicle sales in 2022.

- Its global platform strategy allows shared vehicle components across different brands, reducing costs and increasing efficiency.

- The company is investing heavily in solid-state batteries and EV charging networks across Europe and North America.

- Stellantis is also developing connected vehicle software and autonomous driving systems through its STLA SmartCockpit and STLA Brain platforms.

- Its long-term strategy includes transforming from a traditional car manufacturer into a “sustainable mobility technology company.”