Global Woven Sacks Market By Design (Non-Printed, Printed, Textured), By Liner Type (Laminated, Unlaminated, Inner Liner, Outer Liner), By Closure Type (Open Mouth, Valve Mouth, Poly Twine Closure, Stitched Closure), by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 84646

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

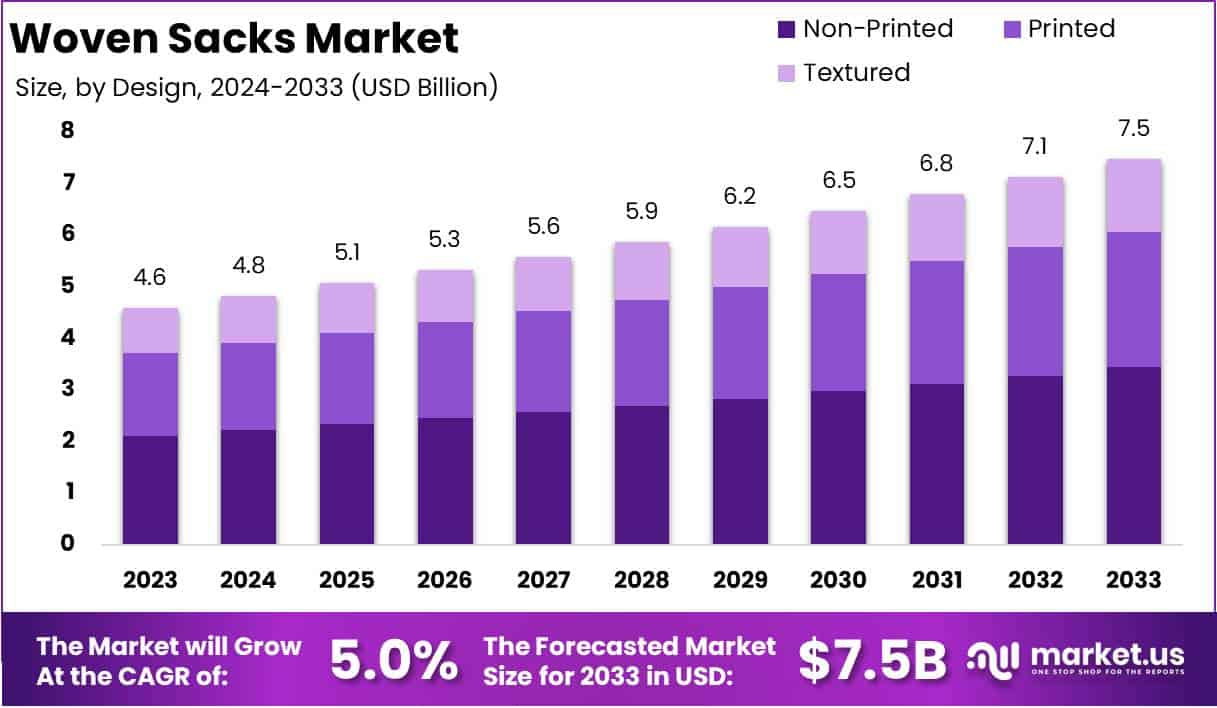

The Global Woven Sacks Market size is expected to be worth around USD 7.5 Billion by 2033, from USD 4.6 Billion in 2023, growing at a CAGR of 5.0% during the forecast period from 2024 to 2033.

Woven sacks are durable, lightweight, and cost-effective packaging solutions made from materials such as polypropylene (PP) or polyethylene (PE). These sacks are produced by weaving threads or tapes into a strong fabric, which is then stitched into bag shapes.

Woven sacks are widely used for packaging in various industries, including agriculture, construction, chemicals, and retail, due to their high tensile strength, reusability, and resistance to moisture and chemicals.

Key stakeholders in this market include manufacturers, raw material suppliers, and end-user industries. The market spans across regions, driven by industrial and agricultural demands, with significant production hubs in Asia-Pacific, particularly in India and China.

The woven sacks market is experiencing steady growth due to several factors. Firstly, the expansion of the agricultural sector, where woven sacks are extensively used for storing and transporting grains, seeds, and fertilizers, drives demand.

Additionally, the construction industry’s growth, especially in emerging economies, fuels the need for woven sacks to package materials such as cement, sand, and aggregates. Moreover, increasing environmental awareness has prompted innovations in recyclable and biodegradable woven sacks, which align with global sustainability trends and further support market growth.

The demand for woven sacks is closely linked to the performance of key end-use industries. Agriculture remains the largest consumer, but other sectors, including retail and e-commerce, are contributing to growing demand due to the increased use of woven sacks for bulk and protective packaging.

As economies expand and urbanization accelerates, the demand for durable and efficient packaging solutions continues to rise. Additionally, the versatility and cost-effectiveness of woven sacks make them a preferred choice across a variety of applications, ensuring consistent demand even in volatile economic conditions.

Several opportunities exist within the woven sacks market, particularly in developing regions. As industrialization and infrastructure projects proliferate, the demand for construction materials and their associated packaging will increase, creating growth avenues for woven sacks manufacturers.

Additionally, the growing focus on sustainability presents opportunities for companies to innovate with eco-friendly and recyclable products. Expansion into untapped markets, such as rural areas and less industrialized regions, also offers significant potential, especially with the rise of government initiatives aimed at improving agricultural and industrial output.

According to Bigrentz, the U.S. construction industry, a significant consumer of woven sacks, is experiencing a robust demand for labor, evidenced by 336,000 job openings as of May 2023. This sector employs a diverse workforce, including 11,896 workers, with 54.6% aged between 42 and 61, and women making up 10.8% of the total.

The financial metrics further illustrate the industry’s scale, with an estimated $1.9 billion in construction work done in May 2023 alone. Additionally, the average hourly wage for construction employees stood at $35.21 as of January 2024, with full-time, nonunion workers earning a median weekly wage of $1,007 in 2023, underpinning the economic significance of this sector to related markets like woven sacks.

According to Mondi Group, the woven sacks market is experiencing notable advancements driven by increasing demand across industries such as agriculture, construction, and chemicals. Mondi’s collaboration with Scan Sverige to create a recyclable polypropylene (PP) mono-material packaging highlights the market’s shift toward sustainable practices, reflecting the growing emphasis on eco-friendly solutions.

Key Takeaways

- The global woven sacks market is projected to grow from USD 4.6 billion in 2023 to approximately USD 7.5 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.0% during the forecast period of 2024 to 2033.

- Polypropylene leads the material segment with a 35.1% market share in 2023, driven by its strength and cost-effectiveness.

- The 25-50 kgs capacity segment dominated with a 24% share in 2023, owing to its balance of durability and manageability.

- Building and Construction emerged as the top application segment, holding 34.7% of the market share in 2023.

- Non-Printed woven sacks dominated the design segment with a 45.8% market share in 2023, favored for cost-effective bulk packaging.

- Asia Pacific led the market with a 45.2% share in 2023, driven by robust agricultural and construction industries in China and India.

By Material Analysis

Polypropylene Dominating Material Segment with a Market Share of 35.1%

In 2023, Polypropylene held a dominant market position in the Woven Sacks market by material, capturing more than 35.1% of the total share. Known for its superior strength, lightweight nature, and cost-effectiveness, polypropylene is widely used across industries such as agriculture, food packaging, and construction.

Its high resistance to moisture and chemicals further enhances its appeal, driving significant demand in regions with expanding industrial sectors.

Polyethylene accounted for a notable share in the Woven Sacks market in 2023. Its flexibility, high durability, and recyclability make it a preferred choice for applications requiring enhanced environmental performance. With increasing environmental regulations and a shift towards sustainable materials, the polyethylene segment is poised for steady growth.

Although holding a smaller share, polyamide is gaining traction due to its high strength-to-weight ratio and excellent abrasion resistance. In 2023, its use in specialized applications such as industrial packaging and high-strength bags contributed to its growing relevance, particularly in sectors requiring advanced material performance.

Paper laminate accounted for a modest share of the Woven Sacks market in 2023, driven by the rising demand for sustainable and biodegradable packaging solutions. Its popularity is increasing in the food and retail sectors, where eco-conscious consumers are influencing purchasing decisions.

The material’s ability to combine the strength of woven fabrics with the printability of paper enhances its market potential.

Jute, although capturing a smaller market share, continues to be a vital segment in regions with established agricultural markets. Its biodegradable and renewable properties align with global sustainability trends, making it an attractive option for environmentally-conscious applications such as agricultural sacks and reusable bags.

By Capacity Analysis

25-50 kgs Dominating Capacity Segment with a Market Share of 24%

In 2023, the 25-50 kgs capacity segment held a dominant position in the Woven Sacks market, capturing more than 24% of the total share. This segment’s versatility and suitability for transporting a wide range of goods, including grains, fertilizers, and cement, make it highly sought after in industries such as agriculture and construction.

Its balance between durability and manageable size contributes significantly to its widespread adoption.

The Less than 25 kgs segment accounted for a substantial share in 2023, primarily driven by its application in packaging smaller quantities of products such as seeds, chemicals, and retail goods. This segment benefits from increasing demand for convenient and easy-to-handle packaging in urban markets and e-commerce.

The 50-100 kgs segment represented a notable portion of the market in 2023, particularly in industries requiring heavy-duty packaging, such as mining and bulk commodity transport. Its ability to handle larger loads while maintaining structural integrity makes it a reliable choice for heavy industrial applications.

In 2023, the 100-200 kgs segment occupied a smaller but significant niche in the Woven Sacks market. This capacity range is primarily utilized for specific industrial uses, including bulk storage and transportation of raw materials like polymers and industrial chemicals.

The Over 200 kgs segment held a limited but important share of the market in 2023. It caters to specialized bulk logistics, particularly in sectors like agriculture and industrial goods, where high-volume transport is essential. This segment’s growth is supported by the increasing demand for cost-efficient, bulk handling solutions.

By Application Analysis

Building and Construction Dominating Application Segment with a Market Share of 34.7%

In 2023, Building and Construction emerged as the dominant application segment in the Woven Sacks market, capturing more than 34.7% of the total share. This segment’s growth is driven by the high demand for durable and cost-effective packaging solutions for materials such as cement, sand, gypsum, and lime.

The construction industry’s rapid expansion in developing regions has further bolstered the use of woven sacks for bulk material handling.

The Agriculture segment accounted for a significant portion of the Woven Sacks market in 2023. These sacks are extensively used for packaging cereals, seeds, and cattle feed, offering moisture resistance and enhanced storage capabilities. The increasing global focus on food security and efficient agricultural supply chains has driven demand in this segment.

The Chemical segment held a notable market share in 2023, driven by the packaging needs for fertilizers, resins, and other chemical products. Woven sacks are valued in this sector for their ability to withstand harsh chemical environments while providing secure transportation and storage.

In 2023, the Food application segment represented a growing share of the Woven Sacks market, driven by its use in packaging staples such as flour, sugar, and rice. The segment’s growth is fueled by increasing urbanization, rising demand for packaged food products, and the need for lightweight yet durable packaging solutions.

By Design Analysis

Non-Printed Dominating Design Segment with a Market Share of 45.8%

In 2023, Non-Printed woven sacks held a dominant position in the Woven Sacks market by design, capturing more than 45.8% of the total share. These sacks are widely preferred for their cost-effectiveness and functional simplicity, particularly in industries like agriculture, construction, and chemicals. Their high durability and suitability for bulk packaging applications further contribute to their widespread use.

The Printed segment accounted for a significant share in 2023, driven by the increasing need for branding and product differentiation. Printed woven sacks are extensively used in the food and retail sectors, where visual appeal and product information play a crucial role in consumer purchasing decisions.

Textured woven sacks held a smaller share of the market in 2023 but cater to specialized needs, particularly in premium packaging and industrial sectors. Their enhanced grip and aesthetic appeal make them ideal for specific applications, supporting steady growth within their niche.

By Liner Type Analysis

Laminated Dominating Liner Type Segment with a Market Share of 40%

In 2023, Laminated woven sacks held a dominant market position by liner type, capturing more than 40% of the total share. These sacks offer enhanced protection against moisture, dust, and external contaminants, making them highly suitable for packaging in industries such as agriculture, chemicals, and construction.

Their durability and superior barrier properties drive their widespread adoption, particularly in applications requiring long-term storage.

The Unlaminated segment accounted for a considerable share in 2023, favored for its cost-efficiency and suitability in non-critical packaging applications. These sacks are widely used for bulk transportation in industries such as mining and basic agricultural goods where exposure to external elements is minimal.

Inner Liner sacks represented a smaller but important market segment in 2023. Their ability to provide an additional layer of protection makes them ideal for packaging moisture-sensitive products such as fertilizers, grains, and chemicals.

The Outer Liner segment held a niche share in the Woven Sacks market in 2023. These sacks are primarily utilized in scenarios where external reinforcement and additional protection are required, supporting product integrity during transport and storage in challenging conditions.

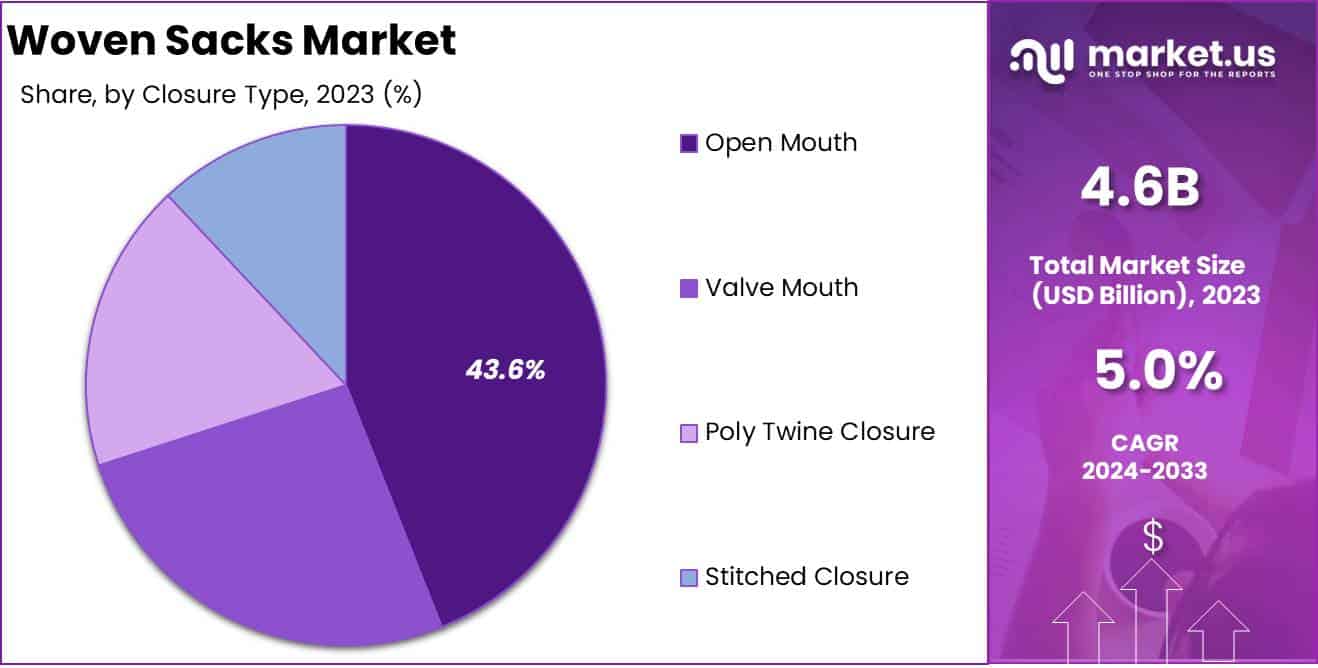

By Closure Type Analysis

Open Mouth Woven Sacks Dominating the Closure Type Segment with 43.6% Market Share in 2023

In 2023, Open Mouth Woven Sacks held a dominant position within the closure type segment, accounting for over 43.6% of the market share. These sacks are widely preferred across industries such as agriculture, construction, and chemicals due to their ease of use and cost efficiency.

The open-mouth design allows for quick filling and emptying, making them an ideal choice for packaging bulk commodities like grains, cement, and fertilizers.

Valve Mouth Woven Sacks captured a notable share of the woven sacks market in 2023. These sacks are particularly popular in the construction and chemical industries, where precise and automated filling processes are essential. Their self-closing valve design minimizes spillage and ensures efficient handling, enhancing their appeal in high-demand sectors.

The Poly Twine Closure Woven Sacks segment is steadily gaining traction, offering flexibility and reusability. Although this segment accounts for a smaller share compared to open and valve mouth closures, it is increasingly favored in applications requiring secure and adjustable closures, such as packaging agricultural products and industrial goods.

Stitched Closure Woven Sacks have been a traditional choice, maintaining a stable presence in the market. Known for their robust sealing and high load capacity, these sacks are preferred for transporting heavy and bulky goods. This segment continues to cater to industries prioritizing durability and long-distance logistics.

Key Market Segments

By Material

- Polypropylene

- Polyethylene

- Polyamide

- Paper Laminate

- Jute

By Capacity

- Less than 25 kgs

- 25-50 kgs

- 50-100 kgs

- 100-200 kgs

- Over 200 kgs

By Application

- Building and Construction

- Cement

- Sand

- Gypsum

- Lime

- Others

- Agriculture

- Cereal

- Seeds

- Cattle Feed

- Chemical

- Fertilizers

- Resins

- Others

- Food

- Flour

- Sugar

- Rice

- Others

By Design

- Non-Printed

- Printed

- Textured

By Liner Type

- Laminated

- Unlaminated

- Inner Liner

- Outer Liner

By Closure Type

- Open Mouth

- Valve Mouth

- Poly Twine Closure

- Stitched Closure

Driver

Escalating Demand in the Construction Sector

The global woven sacks market is experiencing significant growth, primarily driven by the escalating demand within the construction sector. As urbanization accelerates and infrastructure projects proliferate worldwide, the need for durable and reliable packaging solutions has intensified.

Woven sacks, known for their high tensile strength and resistance to wear and tear, have become indispensable for transporting and storing construction materials such as cement, sand, and aggregates. Their ability to withstand harsh environmental conditions without compromising the integrity of the contents makes them a preferred choice in construction logistics.

Moreover, the versatility of woven sacks allows for customization in size and strength, catering to specific requirements of various construction materials. This adaptability not only enhances operational efficiency but also contributes to cost savings by reducing material wastage and minimizing the risk of damage during transit.

As construction activities continue to expand, particularly in emerging economies, the reliance on woven sacks is expected to grow correspondingly, reinforcing their position as a critical component in the supply chain of the construction industry.

Restraint

Environmental Concerns and Regulatory Challenges

Despite their widespread utility, the woven sacks market faces significant challenges due to growing environmental concerns and stringent regulatory frameworks. Traditional woven sacks are predominantly manufactured from polypropylene and polyethylene, both of which are derived from non-renewable petroleum resources and are not biodegradable.

This has led to increased scrutiny from environmental agencies and a push for more sustainable packaging solutions. Regulatory bodies in various regions are implementing policies aimed at reducing plastic waste, including bans on single-use plastics and mandates for recyclable or biodegradable materials.

These regulatory pressures compel manufacturers to invest in research and development to create eco-friendly alternatives, which can be both time-consuming and costly. Additionally, the transition to sustainable materials may face technical challenges, such as maintaining the strength and durability that woven sacks are known for.

The need to comply with diverse regional regulations further complicates the production process, potentially leading to increased operational costs and affecting profit margins. Therefore, while environmental regulations aim to promote sustainability, they also present a formidable restraint to the growth of the traditional woven sacks market.

Opportunity

Innovation in Sustainable Materials

The increasing environmental concerns and regulatory pressures present a significant opportunity for innovation in the woven sacks market, particularly in the development of sustainable materials. Manufacturers are exploring alternatives such as biodegradable polymers and natural fibers to produce eco-friendly woven sacks.

Biodegradable polymers, derived from renewable resources like corn starch or sugarcane, offer the advantage of decomposing naturally, thereby reducing environmental impact. Similarly, natural fibers such as jute and hemp are being considered for their biodegradability and strength, making them suitable substitutes for traditional plastic-based sacks.

Investing in these sustainable materials not only aligns with global environmental goals but also opens new market segments. Consumers and businesses are increasingly prioritizing sustainability in their purchasing decisions, creating a demand for eco-friendly packaging solutions.

By adopting sustainable materials, manufacturers can differentiate their products, meet regulatory requirements, and appeal to environmentally conscious customers.

This strategic shift towards sustainability can enhance brand reputation, foster customer loyalty, and potentially lead to premium pricing, thereby driving growth and profitability in the woven sacks market.

Trends

Technological Advancements in Manufacturing Processes

Technological advancements are reshaping the woven sacks market, leading to enhanced product quality and production efficiency. The integration of automation and advanced machinery in manufacturing processes has enabled higher precision and consistency in woven sack production.

Automation reduces human error, increases production speed, and allows for the efficient handling of complex designs and customizations. Additionally, innovations in weaving technology have improved the tensile strength and durability of woven sacks, making them more competitive against alternative packaging solutions.

Furthermore, advancements in digital printing technology have expanded the possibilities for branding and customization. High-quality, multicolor prints can now be applied directly onto woven sacks, providing businesses with an effective medium for marketing and information dissemination.

This capability enhances the aesthetic appeal of the sacks and adds value for end-users. The adoption of these technological innovations not only improves product quality but also optimizes production processes, reduces waste, and lowers operational costs.

As a result, manufacturers can offer superior products at competitive prices, thereby strengthening their position in the global woven sacks market.

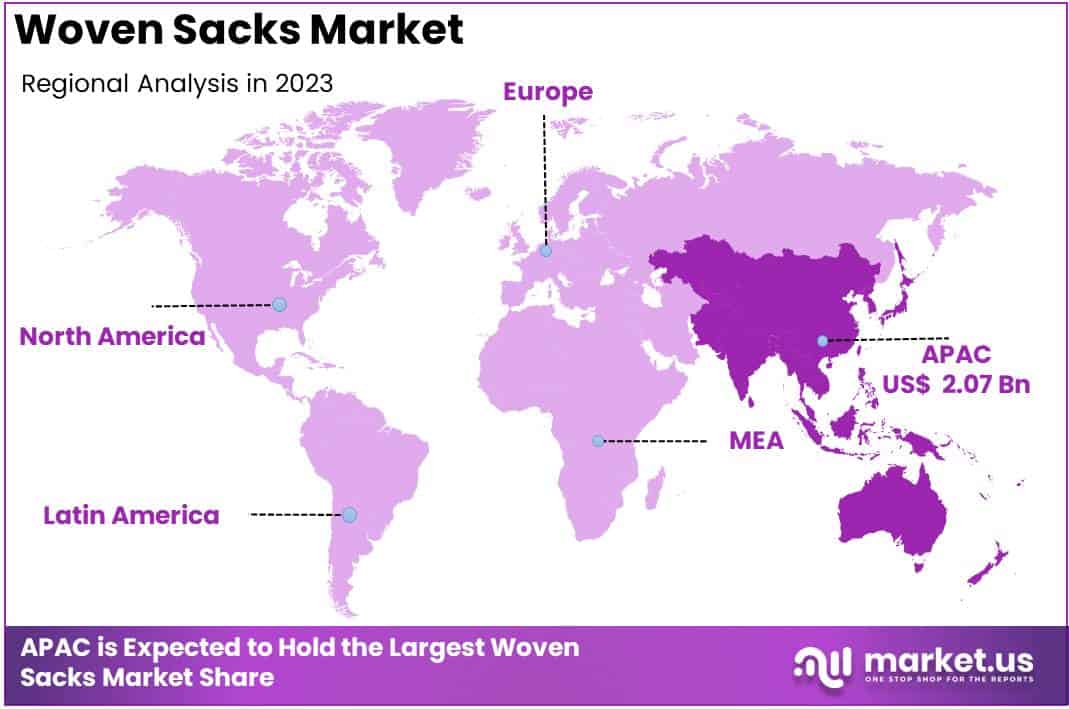

Regional Analysis

Asia Pacific Leads Woven Sacks Market with 45.2% Share in 2023

The global woven sacks market exhibits distinct regional dynamics, with Asia Pacific leading the sector. In 2023, Asia Pacific accounted for 45.2% of the market share, translating to approximately USD 2.07 billion.

This dominance is attributed to the region’s robust agricultural and construction industries, particularly in countries like China and India, which drive substantial demand for woven sacks.

North America and Europe also represent significant portions of the market. In North America, the market is bolstered by the packaging needs of the food and chemical sectors, with the United States being a major contributor.

Europe’s market is propelled by stringent packaging regulations and a growing emphasis on sustainable materials, leading to increased adoption of woven sacks across various industries.

The Middle East & Africa region is experiencing steady growth, primarily due to the expanding construction sector and agricultural activities, which necessitate durable packaging solutions.

Latin America, while currently holding a smaller market share, is anticipated to witness growth driven by developments in the agricultural sector and rising industrialization.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In the evolving landscape of the global woven sacks market, key players are strategically positioning themselves to capitalize on emerging opportunities and address industry challenges.

Berry Global, Inc. continues to leverage its extensive manufacturing capabilities and global distribution network to meet the increasing demand for sustainable packaging solutions. The company’s focus on innovation and sustainability aligns with market trends favoring eco-friendly materials.

Mondi Plc. maintains a strong presence through its integrated packaging and paper solutions. By emphasizing product innovation and sustainability, Mondi addresses the growing consumer preference for environmentally responsible packaging options.

Uflex Ltd, as a leading flexible packaging company, is expanding its product portfolio to include advanced woven sacks that cater to diverse industrial needs. Uflex’s commitment to technological advancements positions it favorably in the competitive market.

Muscat Polymers Pvt. Ltd. focuses on producing high-quality polypropylene woven sacks, serving sectors such as agriculture and construction. The company’s emphasis on quality control and customer satisfaction enhances its market reputation.

Mansarovar Agro Sacks Pvt. Ltd. specializes in manufacturing woven sacks for agricultural applications. By aligning its products with the specific requirements of the agricultural sector, the company strengthens its market position.

Bang Polypacks offers a range of woven sacks and packaging solutions, catering to various industries. The company’s adaptability and customer-centric approach contribute to its sustained growth.

Commercial Syn Bags Limited provides a diverse array of packaging solutions, including woven sacks. Its focus on innovation and adherence to international quality standards bolster its competitive edge.

Al-Tawfiq Company serves the Middle Eastern market with a variety of woven sacks, emphasizing quality and reliability. The company’s strategic location and market understanding facilitate its regional dominance.

Anduro Manufacturing produces woven sacks tailored for industrial applications, prioritizing durability and functionality. Its commitment to meeting industry-specific needs enhances its market relevance.

Palmetto Industries offers a comprehensive range of woven sacks and bulk bags, focusing on customization and quality assurance. The company’s global reach and customer-focused solutions drive its market success.

Wirapetro Plastindo operates in the Southeast Asian market, providing woven sacks for various industries. Its regional expertise and commitment to quality position it as a key player in the local market.

Top Key Players in the Market

- Berry Global, Inc.

- Mondi Plc.

- Uflex Ltd

- Muscat Polymers Pvt. Ltd.

- Mansarovar Agro Sacks Pvt. Ltd.

- Bang Polypacks

- Commercial Syn Bags Limited

- Al-Tawfiq Company

- Anduro Manufacturing

- Palmetto Industries

- Wirapetro Plastindo

Recent Developments

- In 2023, UFlex Limited demonstrated its commitment to innovation, achieving several awards and patents in Q1 FY24. By focusing on progressive advancements across its business verticals, the company solidified its position as a leader in flexible packaging and sustainability solutions.

- In 2024, Mondi partnered with Scan Sverige to develop WalletPack, a recyclable mono-material polypropylene (PP) packaging. This innovation supports circular economy goals by replacing non-recyclable PET-PE and PA-PE laminates. WalletPack can be efficiently processed at Site Zero, Europe’s leading plastic recycling facility in Sweden, further enhancing sustainable packaging solutions

Report Scope

Report Features Description Market Value (2023) USD 4.6 Billion Forecast Revenue (2033) USD 7.5 Billion CAGR (2024-2033) 5.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Design (Non-Printed, Printed, Textured), By Liner Type (Laminated, Unlaminated, Inner Liner, Outer Liner), By Closure Type (Open Mouth, Valve Mouth, Poly Twine Closure, Stitched Closure) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Berry Global, Inc., Mondi Plc., Uflex Ltd, Muscat Polymers Pvt. Ltd. , Mansarovar Agro Sacks Pvt. Ltd., Bang Polypacks, Commercial Syn Bags Limited, Al-Tawfiq Company, Anduro Manufacturing, Palmetto Industries, Wirapetro Plastindo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Berry Global, Inc.

- Mondi Plc.

- Uflex Ltd

- Muscat Polymers Pvt. Ltd.

- Mansarovar Agro Sacks Pvt. Ltd.

- Bang Polypacks

- Commercial Syn Bags Limited

- Al-Tawfiq Company

- Anduro Manufacturing

- Palmetto Industries

- Wirapetro Plastindo