Global Women’s Health Rehabilitation Products Market By Product Type (Urinary Incontinence, Pelvic Pain, Orthopedic Care, Breast Cancer Care, and Others), By Application (Physical Therapy, Massage Therapy, Occupational Therapy, Chiropractic Therapy, and Others), By End-user (Hospitals, Physical Therapy Clinics, and Rehabilitation Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 106223

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

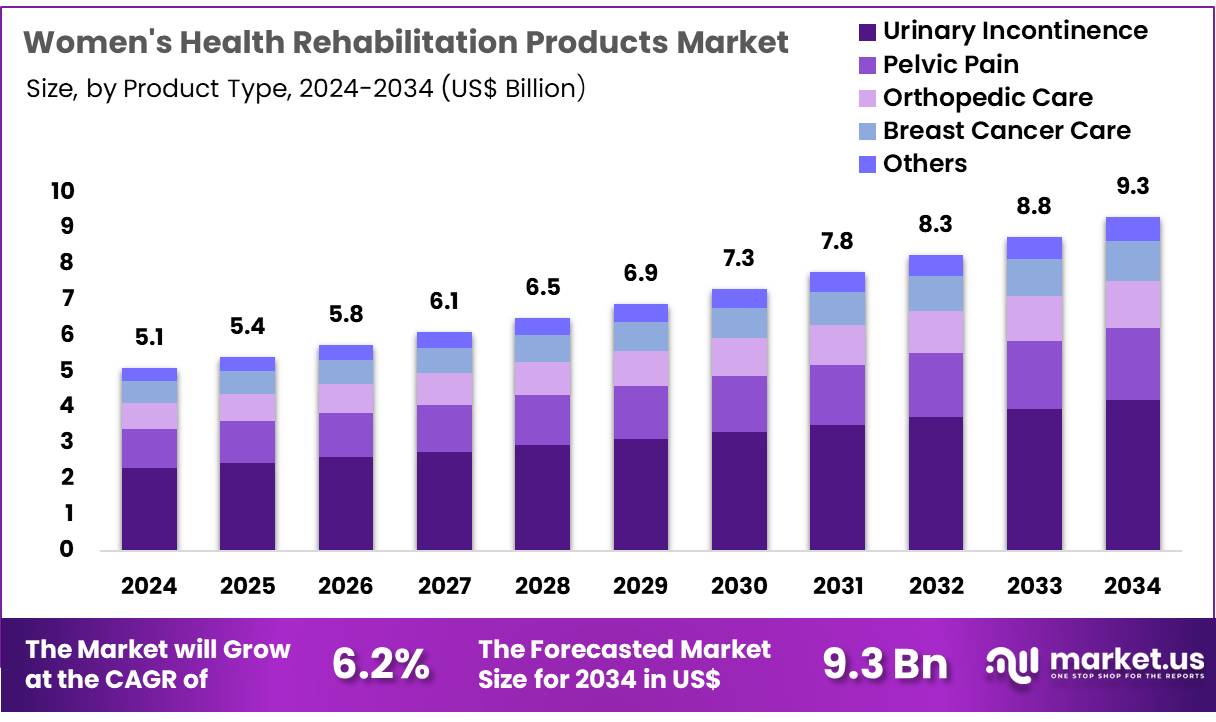

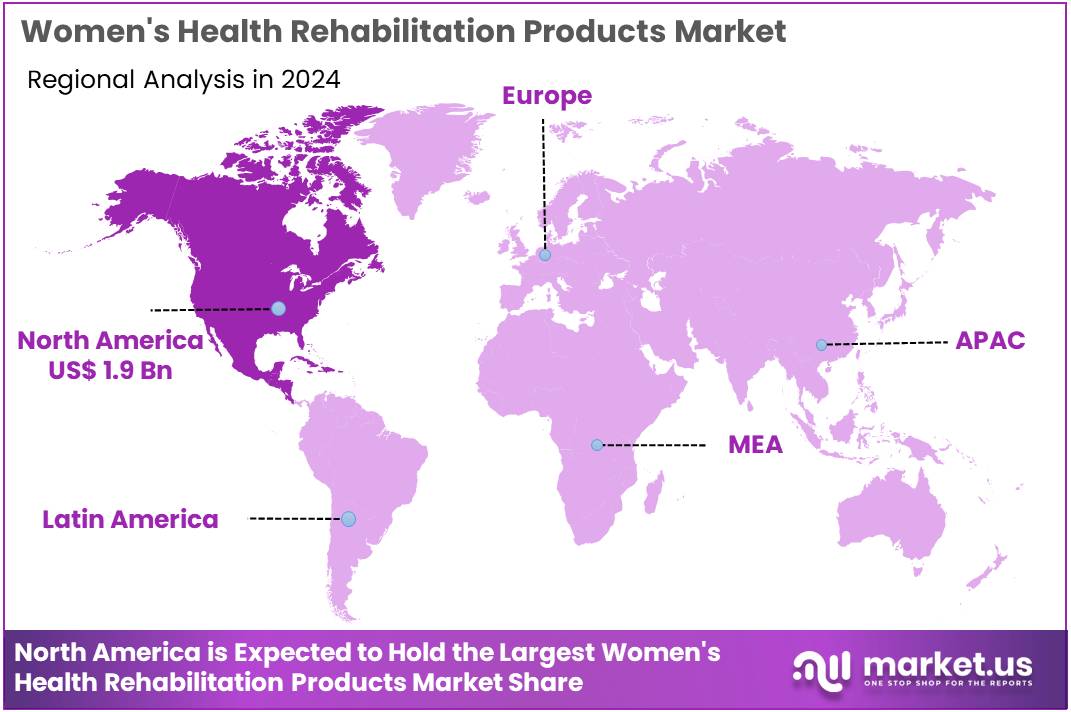

Global Women’s Health Rehabilitation Products Market size is expected to be worth around US$ 9.3 Billion by 2034 from US$ 5.1 Billion in 2024, growing at a CAGR of 6.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.5% share with a revenue of US$ 1.9 Billion.

Rising global focus on preventative health and women-specific wellness is a key driver for the women’s health rehabilitation products market. Products in this market address a range of issues, from pelvic floor dysfunction and postpartum recovery to post-surgical care.

The University of Iowa, in a study published in the journal Scientific Reports, found that at least 32% of adult women have at least one pelvic floor disorder diagnosis, underscoring the widespread need for effective solutions. This high prevalence, combined with a growing willingness among women to seek and discuss care for these conditions, fuels the demand for innovative and accessible rehabilitation products.

Growing technological advancements and a greater emphasis on data-driven health are key trends shaping the market. Manufacturers are developing smart devices, wearables, and digital therapeutics that provide personalized rehabilitation programs and real-time feedback. This trend is exemplified by collaborative efforts like the “Women’s Health Impact Tracking (WHIT) Platform,” launched in January 2025 by the World Economic Forum and the McKinsey Health Institute.

Supported by a global alliance of over 120 organizations, this platform is designed to provide data and metrics to address systemic inequities in women’s health, a major initiative expected to drive future investment and innovation in rehabilitation products and services.

Increasing recognition of the economic and social impact of women’s health is creating significant opportunities for market expansion. The World Economic Forum has estimated that for every dollar invested in women’s health, there is a three-dollar return to society, highlighting the strong business case for innovation in this sector.

The development of products that offer non-invasive, convenient, and effective at-home rehabilitation is critical for addressing conditions that have historically been underdiagnosed and undertreated. This shift is empowering women to take control of their own health and well-being, from managing post-pregnancy musculoskeletal issues to improving core strength and mobility, ensuring a robust and evolving market.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.1 Billion, with a CAGR of 6.2%, and is expected to reach US$ 9.3 Billion by the year 2034.

- The product type segment is divided into urinary incontinence, pelvic pain, orthopedic care, breast cancer care, and others, with urinary incontinence taking the lead in 2023 with a market share of 45.3%.

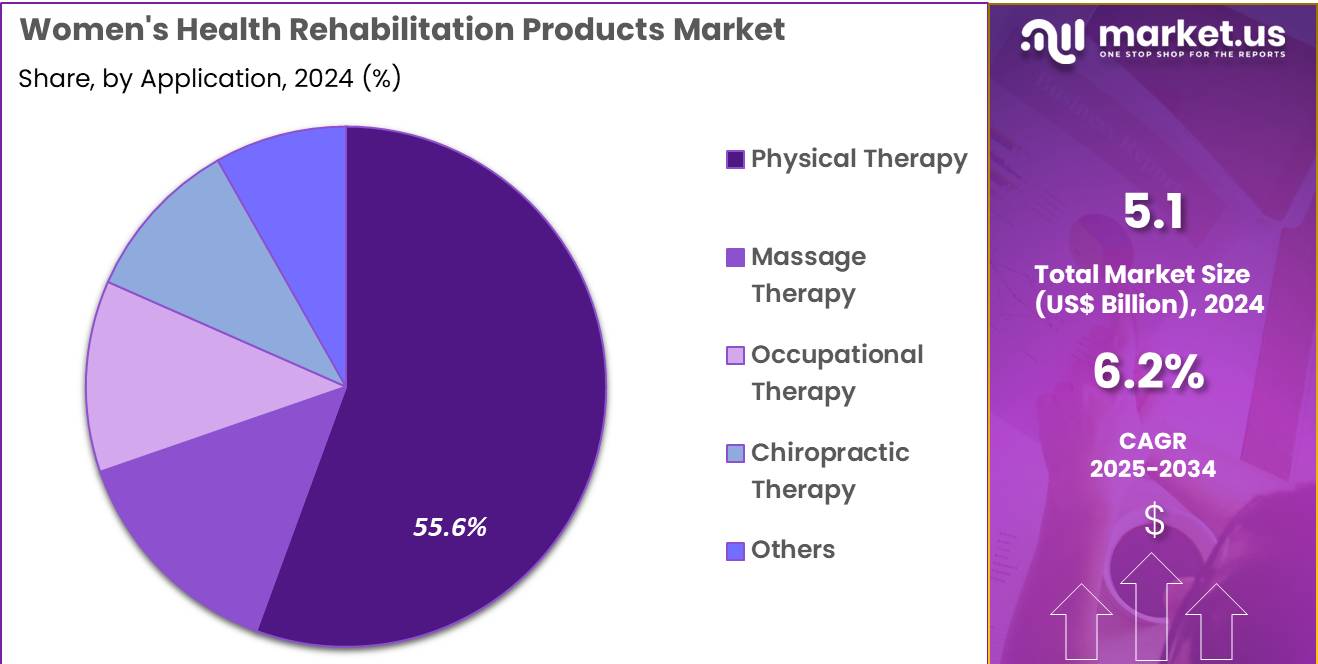

- Considering application, the market is divided into physical therapy, massage therapy, occupational therapy, chiropractic therapy, and others. Among these, physical therapy held a significant share of 55.6%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, physical therapy clinics, and rehabilitation centers. The hospitals sector stands out as the dominant player, holding the largest revenue share of 48.9% in the market.

- North America led the market by securing a market share of 37.5% in 2023.

Product Type Analysis

Urinary incontinence products hold the largest share of 45.3% in the women’s health rehabilitation products market. This segment is expected to continue its growth due to the rising prevalence of urinary incontinence among women, particularly in older age groups and following childbirth. As women increasingly seek non-invasive solutions for urinary incontinence, the demand for products like absorbent pads, pelvic floor exercises devices, and electrical stimulation units is projected to rise.

Increasing awareness about treatment options and the benefits of early intervention is also likely to drive the market for urinary incontinence products. Furthermore, the integration of innovative technologies such as wearable devices and mobile apps for tracking and improving treatment outcomes is expected to support continued growth in this segment. The growing emphasis on improving quality of life for women suffering from incontinence is projected to fuel market demand further.

Application Analysis

Physical therapy accounts for 55.6% of the application segment in the women’s health rehabilitation products market. This segment’s significant share can be attributed to the increasing recognition of physical therapy as an essential treatment for a range of women’s health issues, from musculoskeletal problems to post-surgical recovery. Physical therapy products, such as therapeutic equipment and rehabilitation tools, are projected to continue growing in demand due to their effectiveness in restoring mobility and function.

Additionally, the expansion of physical therapy services, especially in women’s health-focused rehabilitation, is expected to boost this segment. With a growing aging population and more women opting for physical therapy over surgical interventions, this segment is anticipated to experience strong growth. The rise in personalized healthcare, focusing on women’s specific needs, is also likely to accelerate growth in physical therapy applications.

End-User Analysis

Hospitals hold 48.9% of the end-user segment in the women’s health rehabilitation products market. This dominance is expected to persist as hospitals remain the primary setting for women’s health rehabilitation services, including post-operative care and chronic illness management. With increasing hospital investments in rehabilitation units and specialized women’s health services, the demand for rehabilitation products is anticipated to rise.

Hospitals are expected to expand their offerings to provide comprehensive care, addressing a wide range of conditions from pelvic pain to orthopedic care, ensuring better recovery outcomes for women. Moreover, advancements in hospital infrastructure and the integration of advanced rehabilitation technologies are projected to further drive this segment’s growth. The growing focus on reducing hospital readmission rates through effective rehabilitation also highlights the rising demand for women’s health rehabilitation products in hospital settings.

Key Market Segments

By Product Type

- Urinary Incontinence

- Pelvic Pain

- Orthopedic Care

- Breast Cancer Care

- Others

By Application

- Physical Therapy

- Massage Therapy

- Occupational Therapy

- Chiropractic Therapy

- Others

By End-user

- Hospitals

- Physical Therapy Clinics

- Rehabilitation Centers

Drivers

The rising prevalence of pelvic floor disorders is driving the market.

The market for women’s health rehabilitation products is experiencing significant growth, primarily driven by the high prevalence of pelvic floor disorders (PFDs), particularly in an aging population and among women who have given birth. These conditions, which include urinary incontinence, fecal incontinence, and pelvic organ prolapse, can severely impact a woman’s quality of life. As awareness of these issues grows, more women are seeking effective solutions for management and treatment.

Products such as pelvic floor exercisers, biofeedback devices, and pessaries are becoming increasingly accepted as viable, non-surgical options. A study published in Otolaryngology–Head and Neck Surgery in March 2024 reported that the weighted prevalence of at least one PFD was 23.7% among women in the United States. The same study also found that the proportion of women reporting at least one disorder increased with age, reaching 49.7% for those 80 years or older. This substantial and growing patient population represents a strong and consistent demand for products that offer a path to recovery and improved health.

Restraints

A lack of awareness and social stigma is restraining the market.

A significant restraint on the market is the enduring social stigma and lack of awareness surrounding women’s pelvic health issues. Despite their high prevalence, conditions like urinary incontinence are often not openly discussed, leading many women to suffer in silence and avoid seeking professional help or purchasing products. This deep-seated discomfort and embarrassment prevent a large portion of the potential customer base from entering the market, thereby limiting its overall size.

While progress is being made through public health campaigns, a substantial gap remains. A 2024 study, funded in part by the Centers for Disease Control and Prevention (CDC), found that only one in four women with urinary incontinence ever seek professional care. The average time between the onset of symptoms and first contact with a healthcare professional is 6.5 years. This vast undertreated population represents a major headwind for market growth, as a lack of demand due to silence and shame directly impacts sales.

Opportunities

The shift to at-home and over-the-counter solutions is creating growth opportunities.

A key growth opportunity in the women’s health rehabilitation products market lies in the shift toward at-home and over-the-counter (OTC) solutions. Women are increasingly empowered to take control of their own health and are seeking convenient, discreet, and cost-effective alternatives to clinical visits. Products such as personal pelvic floor trainers, massage tools, and dilators are becoming more accessible through e-commerce and retail channels, eliminating the need for a prescription or a physician’s visit. This trend is a direct result of broader consumer spending habits on personal health.

According to data from the US Bureau of Labor Statistics (BLS), consumer expenditures on personal care products and services saw a significant increase of 9.7% in 2023. This figure highlights a strong and growing consumer willingness to invest in self-care items that improve quality of life and provide convenience, a trend that the at-home women’s health market is well-positioned to capitalize on.

Impact of Macroeconomic / Geopolitical Factors

The women’s health rehabilitation products market is significantly influenced by macroeconomic and geopolitical factors. Rising healthcare expenditure, which has been a consistent global trend, supports the adoption of advanced medical devices and therapies for women’s health. However, high inflation and the threat of recession can lead to budget tightening in healthcare systems and cause a shift in consumer spending toward more economical solutions.

Geopolitically, the industry is vulnerable due to a concentration of manufacturing in a few key countries, making the supply chain susceptible to disruptions from trade conflicts and other geopolitical tensions. For instance, the US has recently implemented new trade policies that impose tariffs on certain imports from various countries, including India.

These duties, which can be as high as 50% on certain Indian medical devices, have led to concerns within the industry about increased costs, trade instability, and a loss of competitiveness. This compels companies to either raise product prices for consumers or explore alternative sourcing strategies, which can create delays and disrupt the availability of essential products, impacting patient care.

Latest Trends

The development of smart, biofeedback-enabled devices is a recent trend.

A defining trend in 2024 is the accelerated development and adoption of smart, biofeedback-enabled devices that offer personalized and data-driven rehabilitation. These innovative products connect with smartphone apps, providing real-time feedback and guided exercise programs to help women perform pelvic floor exercises correctly and effectively. This technology removes the guesswork from traditional Kegel exercises, allowing users to track their progress and see tangible improvements over time.

The personalized guidance and motivational tools offered by these apps are proving to be a powerful driver of long-term adherence and successful outcomes. A review of the US Patent and Trademark Office (USPTO)’s database reveals a clear focus on this technology. In 2024, multiple utility patents were granted for systems and methods for pelvic floor muscle training, with a specific emphasis on biofeedback mechanisms and guided therapeutic sessions, a sign of strong industry commitment to this product innovation.

Regional Analysis

North America is leading the Women’s Health Rehabilitation Products Market

The North American market for women’s health rehabilitation products held a significant 37.5% share of the global market in 2024. This leadership is directly attributable to the region’s advanced healthcare infrastructure, rising awareness of pelvic floor disorders, and a large population of women seeking solutions for postpartum and age-related conditions. The rising prevalence of pelvic health issues is a significant market driver.

According to a 2024 study by the Pelvic Floor Disorders Network, approximately 25% of adult women in the United States experience at least one pelvic floor disorder, such as urinary incontinence and pelvic organ prolapse. This statistic underscores the immense patient pool requiring therapeutic products for management and recovery.

Furthermore, the market is propelled by a cultural shift toward open discussions about women’s health, which encourages patients to seek out both clinical and at-home solutions. The high number of annual births in the US and Canada, with over 3.6 million births in the US in 2023 alone, also creates a consistent and expanding demographic for postpartum rehabilitation products.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific women’s health rehabilitation products market is anticipated to experience robust growth during the forecast period. This is largely a result of rapidly increasing health consciousness, a vast and rising middle-class population, and significant government initiatives to improve maternal and women’s health. The region’s dense populations and urbanization contribute to a high incidence of health issues that require care.

A 2023 study published in the journal Frontiers in Public Health documented that between 35-45% of women in Asia experience at least one form of pelvic floor dysfunction, highlighting a substantial patient base. The market’s expansion is further supported by a growing consumer base that increasingly views personal health and wellness as a priority, fueling demand for a variety of at-home and clinical products.

The increasing availability of these products through online channels, combined with targeted marketing campaigns and improving healthcare infrastructure, is likely to make these products more accessible to a broader consumer base and fuel the market’s significant growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the women’s health rehabilitation products market are driving growth through several key strategies. They are heavily investing in product innovation, particularly by integrating advanced technologies like biofeedback, electrical stimulation, and AI-driven apps into pelvic floor exercisers and other devices.

Companies are also pursuing strategic acquisitions and partnerships to expand their product portfolios and gain access to new therapeutic areas, such as postpartum recovery and breast cancer rehabilitation. Furthermore, they are broadening their market reach by leveraging digital marketing to increase consumer awareness and promote at-home solutions, thereby meeting the growing demand for convenient and discreet care.

Zynex, Inc., a medical technology company, has established a significant presence in the sector by specializing in the manufacturing and selling of non-invasive devices for pain management, patient monitoring, and rehabilitation. The company’s business model is centered on a deep commitment to providing high-quality, clinically-validated products that empower patients to manage their conditions at home.

Zynex’s strategy involves continuously innovating its product line, securing new product approvals, and expanding its sales force to drive market penetration. The company’s focus on non-invasive solutions and its robust direct-to-patient model makes it a key partner for many healthcare providers and patients.

Top Key Players

- Zynex, Inc

- Win Health Medical Ltd

- Solis Mammography

- Meyer Physical Therapy

- Hyivy Health

- GPC Medical Ltd

- GE HealthCare

- DeRoyal Industries, Inc.

- AliMed

- Access Health

Recent Developments

- In March 2025, Boston Scientific announced the launch of its Endura Weight Loss Solutions, a significant development in addressing health conditions that disproportionately affect women. While weight loss is a broad category, the press release highlighted data from a national survey of US women, which underscores the company’s focus on this specific demographic. This new solution provides a non-surgical option for women seeking to manage their weight, a factor often linked to conditions requiring rehabilitation. This development aligns with the trend of key players creating products that address a broad range of women’s health concerns.

- In April 2024, Solis Mammography joined forces with Northwest Healthcare to expand breast imaging services in Tucson. The partnership seeks to increase availability of advanced mammography, supporting early detection efforts and enhancing overall women’s health care in the local community.

- In September 2024, Hyivy Health obtained USD 1.5 million to advance its pelvic rehabilitation platform. The system focuses on treating a wide range of female pelvic health conditions, aiming to improve both therapy and diagnosis while setting new benchmarks in women’s healthcare solutions.

Report Scope

Report Features Description Market Value (2024) US$ 5.1 Billion Forecast Revenue (2034) US$ 9.3 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Urinary Incontinence, Pelvic Pain, Orthopedic Care, Breast Cancer Care, and Others), By Application (Physical Therapy, Massage Therapy, Occupational Therapy, Chiropractic Therapy, and Others), By End-user (Hospitals, Physical Therapy Clinics, and Rehabilitation Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zynex, Inc, Win Health Medical Ltd, Solis Mammography , Meyer Physical Therapy, Hyivy Health, GPC Medical Ltd, GE HealthCare, DeRoyal Industries, Inc., AliMed, Access Health Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Women’s Health Rehabilitation Products MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Women’s Health Rehabilitation Products MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zynex, Inc

- Win Health Medical Ltd

- Solis Mammography

- Meyer Physical Therapy

- Hyivy Health

- GPC Medical Ltd

- GE HealthCare

- DeRoyal Industries, Inc.

- AliMed

- Access Health