Global Wind Turbine Maintenance Repair and Overhaul (MRO) Market Size, Share, And Industry Analysis Report By Service Type (Maintenance, Repair, Overhaul), By Turbine Type (Horizontal Axis, Vertical Axis), By Installation Type (Existing Installation, New Installation), By Location (Onshore, Offshore), By End User (Utilities, Independent Power Producers, Commercial Enterprises, Government), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173973

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

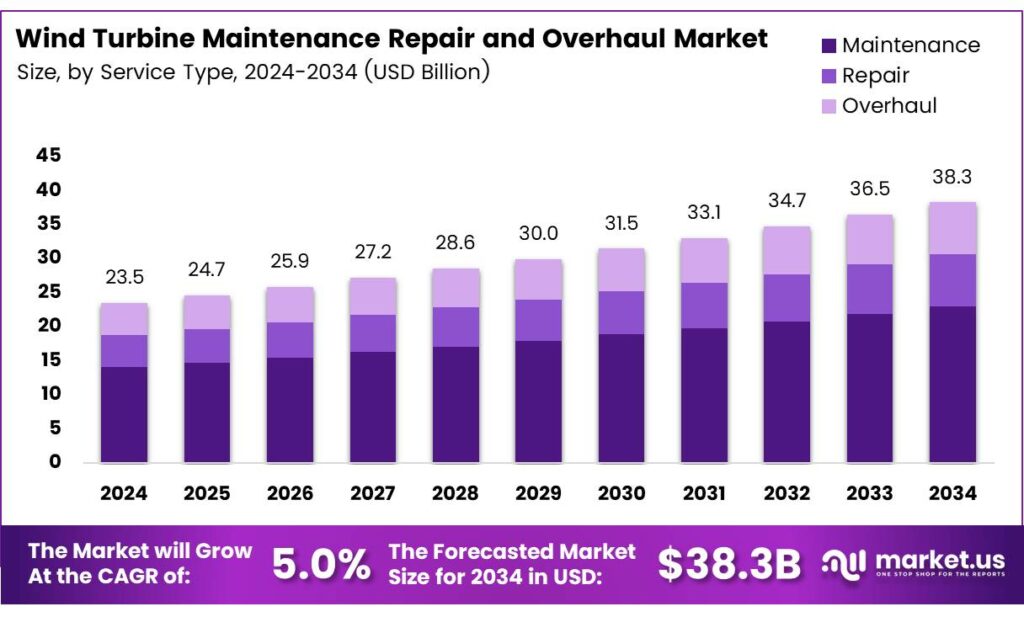

The Global Wind Turbine Maintenance, Repair and Overhaul (MRO) Market size is expected to be worth around USD 38.3 billion by 2034, from USD 23.5 billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034.

The Wind Turbine Maintenance, Repair, and Overhaul (MRO) market covers all technical activities required to keep wind turbines operating reliably throughout their service life. It includes scheduled servicing, corrective repairs, component replacement, and major overhauls. As global wind capacity expands, operators increasingly treat MRO as a strategic function rather than a routine cost center.

The Wind Turbine Maintenance, Repair, and Overhaul (MRO) market is shaped by long asset lifecycles and performance-based revenue models. Because wind projects depend on consistent availability, owners prioritize predictive maintenance, condition monitoring, and service optimization. MRO spending is increasingly planned over decades, aligning technical reliability with financial returns and long-term renewable energy targets.

- Failure patterns create sustained service demand across key components. Turbines experience 2–4 failures per unit annually, with gearbox issues causing the longest downtimes. Generators represent nearly 30% of maintenance costs and 5.5% of downtime, while turbines older than ten years show failure rates of 7–10%, driving higher overhaul and repair activity.

Market growth in wind turbine MRO closely follows installed capacity and aging profiles. As wind fleets pass their first decade of operation, maintenance intensity rises sharply. With proper servicing, turbine lifespans can be extended to 20–30 years, improving lifetime energy output and strengthening overall project economics.

Operational cost dynamics strongly favor MRO expansion. Operations and maintenance account for 20–35% of the total levelized cost per kilowatt-hour over a turbine’s lifetime. As a result, asset owners increasingly invest in predictive maintenance, advanced diagnostics, and digital tools to reduce risk and stabilize long-term operating costs.

Key Takeaways

- The Global Wind Turbine MRO Market is projected to grow from USD 23.5 billion in 2024 to USD 38.3 billion by 2034, registering a 5.0% CAGR.

- Maintenance leads the service type segment with a dominant share of 52.8%, reflecting its critical role in turbine reliability.

- Horizontal-axis turbines dominate by turbine type, accounting for 92.1% of total MRO demand.

- Existing installations represent the largest installation segment with a share of 73.6%, driven by aging wind assets.

- Onshore wind turbines hold a leading market share of 81.4% due to easier access and higher installed capacity.

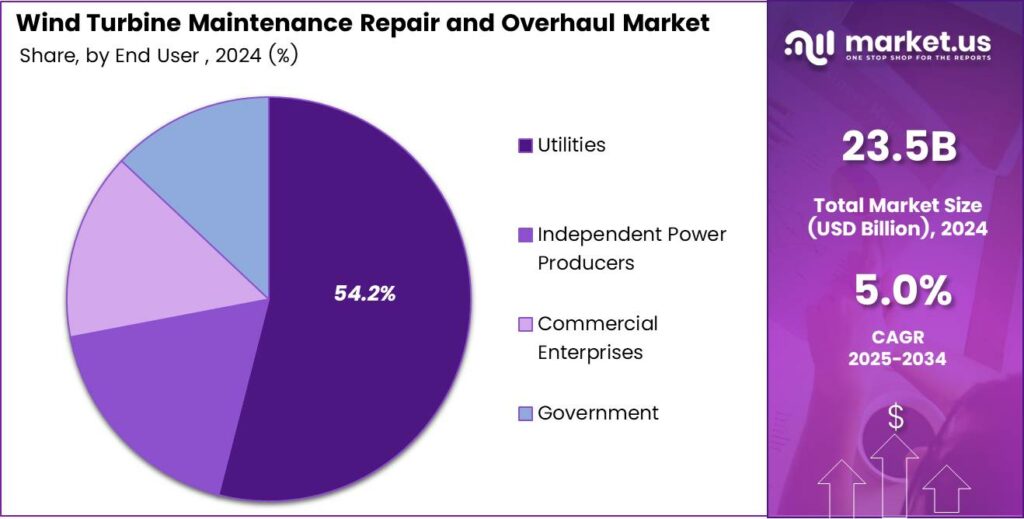

- Utilities are the largest end users, contributing 54.2% of total market demand.

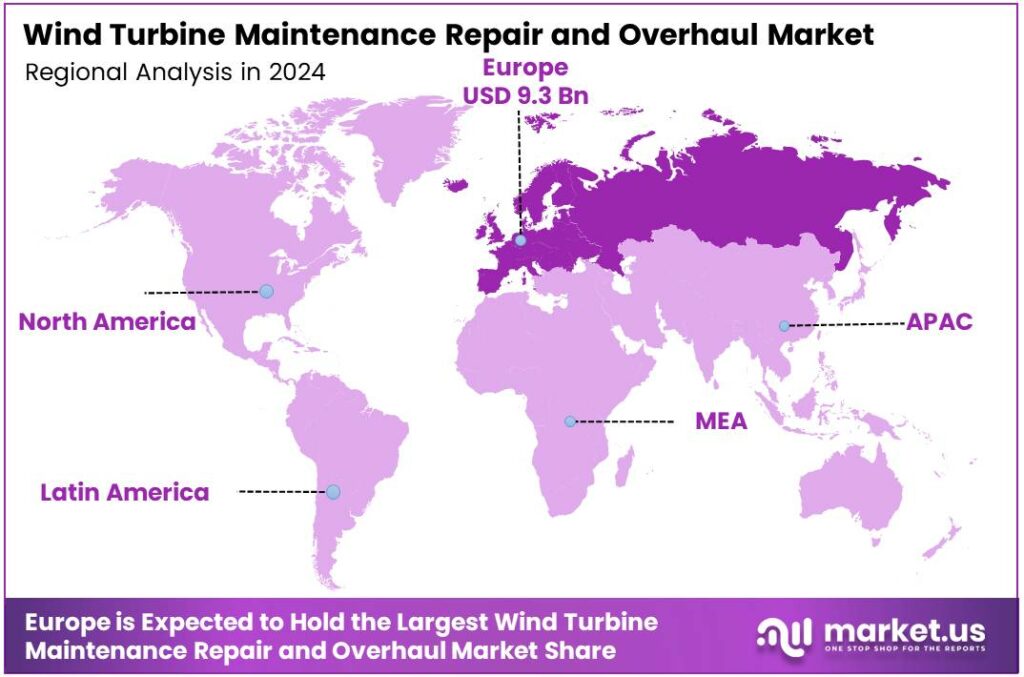

- Europe dominates the regional landscape with a market share of 39.9%, valued at USD 9.3 billion.

By Service Type Analysis

Maintenance dominates with 52.8% due to its critical role in ensuring turbine reliability and operational continuity.

In 2024, Maintenance held a dominant market position in the By Service Type analysis segment of the Wind Turbine Maintenance, Repair and Overhaul (MRO) Market, with a 52.8% share. This dominance reflects the need for routine inspections, lubrication, and monitoring to avoid unplanned downtime and sustain consistent power output.

Repair services play a vital supporting role by addressing unexpected component failures and wear-related issues. These services are increasingly important as turbine fleets age, requiring timely corrective actions. Repair activities help restore performance quickly, thereby reducing energy losses and preventing minor issues from escalating into costly system failures.

Overhaul services focus on the comprehensive refurbishment of major turbine components after extended operational periods. Although less frequent, overhauls are essential for extending turbine life and maintaining safety standards. This segment supports long-term asset value by improving efficiency and reliability through planned, large-scale maintenance interventions.

By Turbine Type Analysis

Horizontal-axis turbines dominate with 92.1% owing to their widespread deployment and higher energy efficiency.

In 2024, Horizontal Axis turbines held a dominant market position in the By Turbine Type analysis segment of the Wind Turbine Maintenance, Repair and Overhaul (MRO) Market, with a 92.1% share. Their dominance is driven by large installed bases, which directly increase demand for regular maintenance and specialized repair services.

Vertical-axis turbines represent a smaller yet relevant segment, often used in niche or urban applications. While maintenance needs are generally lower, these turbines still require periodic inspection and servicing. As adoption grows in specific settings, MRO services remain important for ensuring stable and safe turbine operation.

By Installation Type Analysis

Existing Installation dominates with 73.6% as aging wind assets require continuous service support.

In 2024, Existing Installation held a dominant market position in the By Installation Type analysis segment of the Wind Turbine Maintenance, Repair and Overhaul (MRO) Market, with a 73.6% share. This reflects the growing number of operational turbines that need regular maintenance, repairs, and upgrades to maintain performance.

New Installation services focus on early-stage inspections, warranty-related maintenance, and initial performance optimization. Although smaller in share, this segment supports smooth commissioning and long-term reliability. Preventive maintenance during early operation helps reduce future repair needs and improves lifecycle efficiency.

By Location Analysis

Onshore dominates with 81.4% due to easier access and a higher concentration of installed turbines.

In 2024, Onshore held a dominant market position in the By Location analysis segment of the Wind Turbine Maintenance, Repair and Overhaul (MRO) Market, with an 81.4% share. Onshore turbines benefit from simpler logistics, enabling frequent maintenance and faster repair responses.

Offshore MRO services address turbines operating in harsh marine environments. Although smaller in share, this segment demands specialized expertise and equipment. Offshore maintenance focuses on minimizing downtime and ensuring structural integrity, as access challenges increase the importance of planned and efficient service operations.

By End User Analysis

Utilities dominate with 54.2% as they manage large-scale wind power portfolios.

In 2024, Utilities held a dominant market position in the By End User analysis segment of the Wind Turbine Maintenance, Repair and Overhaul (MRO) Market, with a 54.2% share. Their large installed capacity drives continuous demand for structured maintenance and long-term service agreements.

Independent Power Producers rely on MRO services to maximize asset availability and stabilize revenue streams. These operators focus on cost-effective maintenance strategies that reduce downtime and enhance operational efficiency across diversified wind energy portfolios.

Commercial Enterprises utilize MRO services to support captive or supplemental wind power systems. Maintenance ensures a reliable energy supply for business operations, while timely repairs help manage operational risks and maintain predictable energy costs.

Government entities support MRO activities for publicly owned or supported wind projects. Their focus remains on operational safety, regulatory compliance, and long-term performance, ensuring that wind assets continue delivering clean energy reliably.

Key Market Segments

By Service Type

- Maintenance

- Repair

- Overhaul

By Turbine Type

- Horizontal Axis

- Vertical Axis

By Installation Type

- Existing Installation

- New Installation

By Location

- Onshore

- Offshore

By End User

- Utilities

- Independent Power Producers

- Commercial Enterprises

- Government

Emerging Trends

Digitalization and Predictive Maintenance Shape Current Market Trends

One of the most important trending factors in the Wind Turbine MRO market is the growing use of digital technologies. Operators increasingly rely on sensors and real-time data to track turbine health. This shift helps identify early signs of wear, reducing unexpected breakdowns.

- Predictive maintenance is becoming a standard approach. Instead of fixed service schedules, maintenance is now planned based on actual equipment condition. U.S. operating-cost benchmarking lifetime all-in wind OpEx expectations falling from about $80/kW-yr (around $35/MWh) for projects to levels approaching $40/kW-yr (around $11/MWh) for projects under construction.

Service consolidation is also shaping the market. Larger MRO providers are expanding their service portfolios to offer end-to-end solutions. This trend benefits operators by simplifying service management and improving accountability. Together, digital tools, predictive strategies, automation, and integrated services are reshaping how wind turbine MRO activities are delivered globally.

Drivers

Growing Installed Wind Capacity and Aging Turbine Fleets Drive MRO Demand

The Wind Turbine Maintenance, Repair, and Overhaul (MRO) market is strongly driven by the rapid growth in installed wind capacity worldwide. As more wind farms are commissioned, the total number of turbines requiring regular servicing increases steadily. Every operating turbine needs routine inspections, lubrication, and monitoring to ensure stable power output and grid reliability.

- The aging profile of existing wind turbines. Many onshore wind projects installed over the past decade are now entering higher-wear operational phases. IRENA reports total installed wind capacity rising from 7.5 GW in 1997 to 1,131 GW by 2024. Wind added 113 GW in that year alone, and wind power generation reached 2,304 TWh in 2023.

Operational cost control also fuels market growth. Wind asset owners focus heavily on reducing downtime because idle turbines lead to lost revenue. Preventive maintenance helps detect issues early, lowering the risk of major failures. As a result, operators invest more in professional MRO contracts.

Restraints

High Service Costs and Skilled Labor Shortages Restrain Market Expansion

One major restraint in the Wind Turbine MRO market is the high cost of maintenance and repair activities. Specialized equipment, heavy-lift cranes, and replacement components can significantly increase service expenses. For smaller wind farm operators, these costs may limit the frequency of preventive maintenance.

- Skilled labor shortages also slow market growth. Wind turbine maintenance requires trained technicians with expertise in mechanical, electrical, and digital systems. The European Commission notes the EU has around 16.3 GW of offshore wind installed, and that to meet countries’ commitments, offshore installations would need to rise to almost 12 GW per year on average, about 10 times the 1.2 GW installed.

Logistical difficulties further restrain the market. Transporting spare parts to offshore or distant onshore sites is complex and time-consuming. Weather-related access issues can delay repairs, increasing downtime and operational risk for asset owners.

Growth Factors

Rising Focus on Lifetime Extension Creates Strong Growth Opportunities

A major growth opportunity in the Wind Turbine MRO market comes from the increasing focus on extending turbine operational life. Instead of replacing aging turbines, many operators prefer refurbishment and component upgrades. This approach is often more cost-effective and supports higher returns on existing assets.

Repowering projects also create new demand for MRO services. These projects involve upgrading blades, gearboxes, or control systems while keeping existing foundations and towers. Such activities require specialized maintenance and overhaul expertise, opening long-term opportunities for service providers.

Offshore wind expansion presents another strong opportunity. Offshore turbines operate in harsh marine environments, leading to faster component wear. This increases the need for frequent inspections, corrosion control, and specialized repair solutions, boosting demand for advanced MRO services.

Regional Analysis

Europe Dominates the Wind Turbine Maintenance, Repair and Overhaul (MRO) Market with a Market Share of 39.9%, Valued at USD 9.3 Billion

Europe leads the Wind Turbine MRO market due to its large installed base of aging onshore and offshore wind turbines. In the region, Europe accounted for a dominant 39.9% share, with the market valued at USD 9.3 billion, driven by turbines entering mid-life and late-life operational phases. Strict performance standards and reliability expectations further support consistent demand for maintenance, repair, and overhaul services.

North America represents a mature wind market with steady growth in MRO demand, supported by large onshore wind fleets installed over the past decade. As turbines age, operators increasingly focus on preventive maintenance and component refurbishment to control operational costs. The region benefits from structured service planning and long-term asset management strategies.

Asia Pacific shows strong growth potential in the Wind Turbine MRO market due to rapid capacity additions across emerging and developed economies. A growing number of turbines are moving beyond warranty periods, increasing reliance on independent and advanced maintenance solutions. The region also experiences higher wear rates due to diverse climatic conditions, boosting repair and inspection needs.

The Middle East and Africa region is gradually expanding its wind energy footprint, creating early-stage demand for maintenance and repair services. Most turbines are relatively new, so routine maintenance dominates current MRO activity. However, harsh operating environments increase the importance of regular inspections and condition monitoring. As installed capacity grows, long-term overhaul demand is expected to strengthen.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Siemens Gamesa Renewable Energy SA sits close to the core of OEM-led service, where long-term maintenance agreements and performance guarantees shape how owners manage risk. Large-fleet reliability programs, lifecycle upgrades, and parts planning that reduce unplanned downtime. The company’s MRO footprint also benefits from standardization—repeatable processes, structured inspections, and data-led condition monitoring that help operators keep availability high.

General Electric Company brings scale and an industrial service mindset that fits owners looking for predictable uptime and faster fault resolution. The key differentiator in 2024 is how well service models tie diagnostics to action—remote monitoring, predictive alerts, and rapid field response supported by structured spares. This creates a clear commercial advantage for owners who want fewer major events and smoother O&M budgeting over the turbine life.

ZF Friedrichshafen AG matters to MRO because drivetrains and power transmission remain high-impact cost items when failures occur. Refurbishment pathways and component-level engineering support can materially shorten turnaround times versus full replacement. Its role is especially relevant where gearbox and drivetrain availability directly determines revenue protection for wind asset owners.

Vestas Wind Systems A/S remains a benchmark for service intensity and operational discipline, particularly where multi-year service contracts and digital tools are integrated into routine maintenance. In 2024, the advantage is the ability to convert turbine data into practical interventions—targeted inspections, proactive part swaps, and upgrade strategies that extend useful life.

Top Key Players in the Market

- Siemens Gamesa Renewable Energy SA

- General Electric Company

- ZF Friedrichshafen AG

- Vestas Wind Systems A/S

- Suzlon Energy Ltd

- ABB Ltd

- Dana SAC UK Ltd

- Mistras Group

- Integrated Power Services LLC

Recent Developments

- In 2025, Siemens Gamesa participated in Husum Wind, showcasing updates to its onshore product portfolio, including the SG 7.0-170 turbine, along with comprehensive service capabilities and aftermarket solutions tailored for Senvion and Siemens fleets. This includes tailored onshore aftermarket solutions such as maintenance, repairs, and upgrades for existing fleets.

- In 2025, GE Vernova secured its first onshore wind repower upgrade contract outside the United States with Taiwan Power Company, supplying repower upgrade kits for 25 of its 1.5 MW-70.5m turbines, along with a five-year operations and maintenance (O&M) services agreement. Aiming to extend turbine life and support decarbonization.

Report Scope

Report Features Description Market Value (2024) USD 23.5 Billion Forecast Revenue (2034) USD 38.3 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Maintenance, Repair, Overhaul), By Turbine Type (Horizontal Axis, Vertical Axis), By Installation Type (Existing Installation, New Installation), By Location (Onshore, Offshore), By End User (Utilities, Independent Power Producers, Commercial Enterprises, Government) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Siemens Gamesa Renewable Energy SA, General Electric Company, ZF Friedrichshafen AG, Vestas Wind Systems A/S, Suzlon Energy Ltd, ABB Ltd, Dana SAC UK Ltd, Mistras Group, Integrated Power Services LLC Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Wind Turbine Maintenance Repair and Overhaul (MRO) MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Wind Turbine Maintenance Repair and Overhaul (MRO) MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Gamesa Renewable Energy SA

- General Electric Company

- ZF Friedrichshafen AG

- Vestas Wind Systems A/S

- Suzlon Energy Ltd

- ABB Ltd

- Dana SAC UK Ltd

- Mistras Group

- Integrated Power Services LLC