Global Wheelchair Market Size, Share & Trends Analysis Report by Product Type (Manual and Electric), By Category (Adult and Pediatric), by Design & Function (Basic Wheelchair, Sports Wheelchair, Bariatric Wheelchair, Standing Wheelchair, and Others), By End Use (Homecare, Hospitals, Ambulatory Surgical Centers, and Rehabilitation Centers), By Region, And Segment Forecasts, 2024-2033

- Published date: July 2024

- Report ID: 15366

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

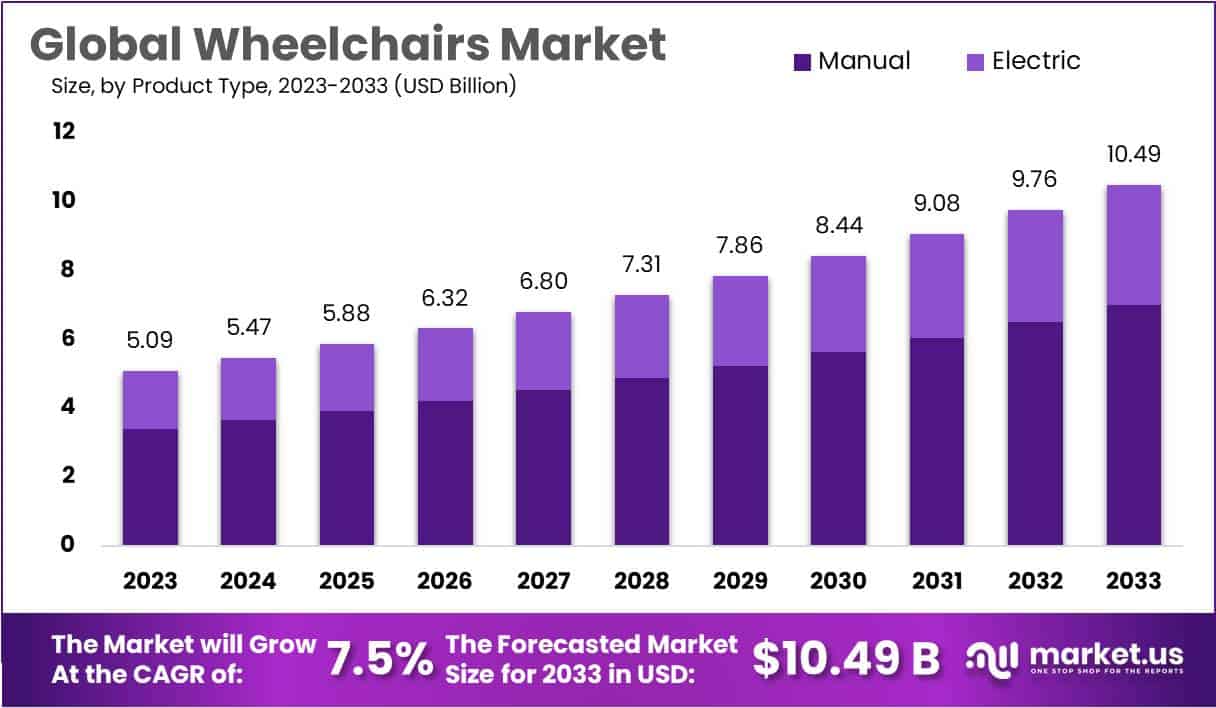

Global Wheelchair Market size is expected to be worth around USD 10.49 Billion by 2033 from USD 5.09 Billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

The growing geriatric population and the number of spinal string wounds that need portability help are some of the primary factors driving the market development.

Emerging nations, for instance, India, are supposed to be key income generators for wheelchair makers over the figure period. It likewise has one of the most significant incapacitated populations at a global level. Regarding accessibility and reception, the nation is currently at an early stage; in any case, with the strong government drives and developing mindfulness among buyers, the interest in wheelchairs is supposed to support in the coming years.

Key Takeaways

- Market Size: Expected to reach USD 10.49 Billion by 2033, growing at a 7.5% CAGR from USD 5.09 Billion in 2023.

- Growth Drivers: Rapidly expanding geriatric population and spinal cord injuries fuel market development, with 250 million experiencing mobility issues.

- Restraint: Cost of powered wheelchairs hinders growth due to higher expenses compared to manual counterparts.

- Opportunities: Continuous launch of new products, technological advancements, and government initiatives drive growth prospects in the wheelchair market.

- Dominant Product: Manual wheelchairs hold a 62.4% market share in 2023, showing popularity due to their low cost and lightweight design.

- Key Category: Adults segment commands a significant 70.3% revenue share in 2023, driven by the global rise in the elderly population.

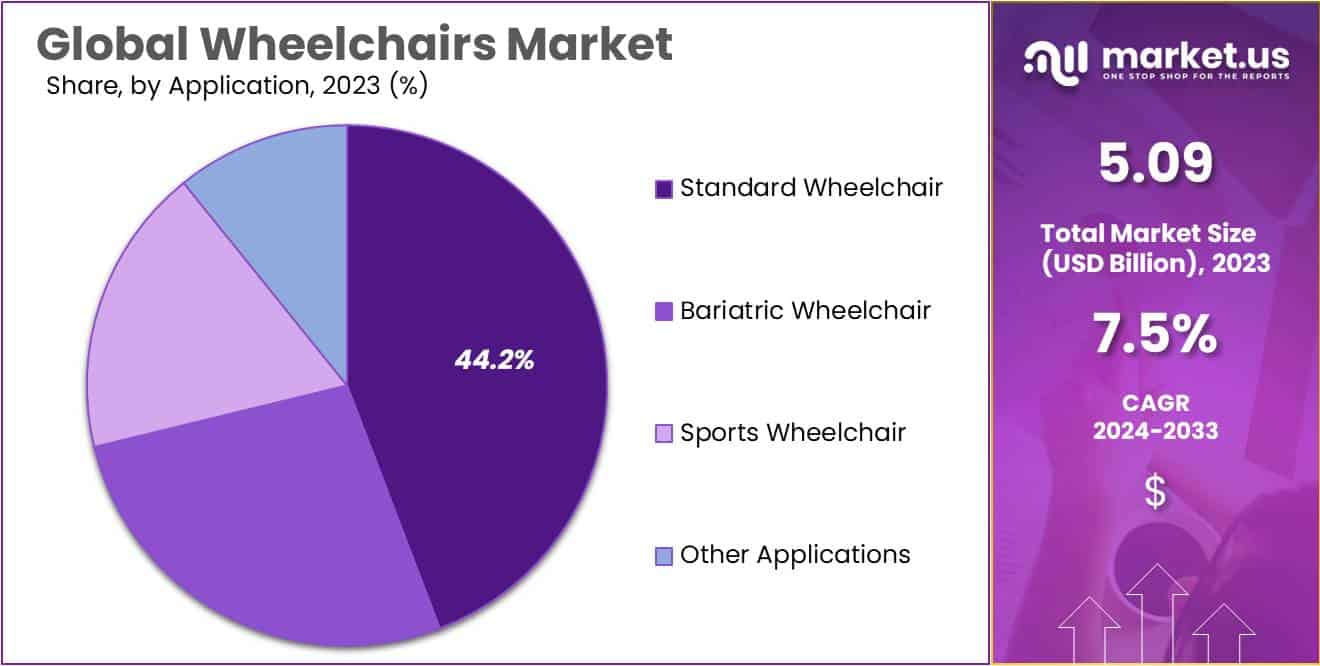

- Application Focus: Standard wheelchairs capture a 44.2% market share in 2023, driven by increasing use among the disabled population.

- End-User Impact: Hospitals dominate with over a 59.6% share in 2023, highlighting their significant role as bulk purchasers for patient use.

- Design & Function Dynamics: Basic wheelchairs dominate with a 49.3% market share in 2023, meeting essential mobility needs, while specialized designs gain prominence.

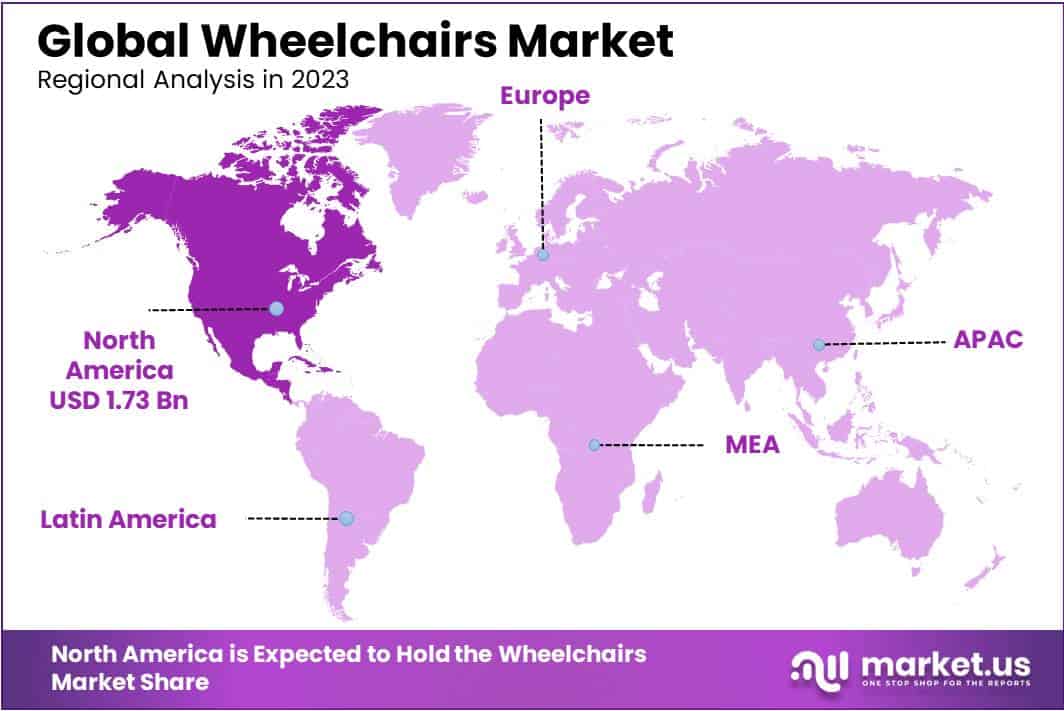

- Regional Leadership: North America leads with a 34.1% market share in 2023, driven by a high incidence of spinal cord injuries, while Asia Pacific shows the fastest CAGR.

Product Analysis

The manual product segment accounted for the largest market share of 62.4% globally in 2023. It is assessed to extend at the growing CAGR over the forecast period because of the popularity of manual wheelchairs owing to their minimal expense and lightweight structure. Likewise, they are accessible in different setups and loads, from standard to super lightweight, requiring little space as many of the item models are foldable.

The electric wheelchair segment is additionally assessed to have critical development over the conjecture years. These wheelchairs are great for clients having no chest area strength. Electric wheelchairs are more well known in created nations, such as the U.S., attributable to the accessibility of cutting-edge medical care offices.

Category Analysis

Among category segments, the adult segment dominated the market and accounted for the larger revenue share of 70.3% in 2023. The area is projected to continue with its strength over the estimation period. This is mainly because of the rising old populace internationally, which structures part of the definition for grown-ups. Handicap in more seasoned individuals because of joint inflammation torment or firmness in a knee, hip, lower leg, or foot builds interest in wheelchairs.

The pediatric segment is likewise expected to become fundamentally inferable from the developing number of experienced growing-up problems such as cerebral paralysis. Cerebral paralysis is one of the most well-known development problems that require wheelchairs. As per the Cerebral Paralysis Direction, more than 10,000 children in the U.S. are brought into the world with this issue every year. It is the most usually analyzed development handicap in youth in the U.S. In this way, the pediatric portion is supposed to be a key income generator for wheelchair producers before very long.

Application Analysis

The market is divided into standard wheelchairs, bariatric wheelchairs, sports wheelchairs, and others by application. The standard wheelchair segment will continue to possess the 44.2% market share in the year 2023. Because of their increasing use among the disabled population, the standard wheelchair segment captured the largest market share during the forecast period.

In addition, the demand for these wheelchairs will likely rise during the forecast period due to the availability of low-cost alternatives.

Because of the rising prevalence of sedentary lifestyles and the rising number of overweight individuals, the bariatric wheelchair market is anticipated to expand at the fastest rate. The latter is one of the most important market trends that would accelerate this segment’s expansion. The competition gap has narrowed due to growing technological advancements, which have provided disabled athletes with significant opportunities. During the forecast period, such improvements are likely to boost the growth of the sports wheelchair market.

End-User Analysis

End-users have segmented the market into homecare, hospitals, ambulatory surgical centers, rehabilitation centers & other end-users. Among these, healthcare facilities, such as Hospitals held a dominant market position, capturing more than a 59.6% share in 2023, and they purchase wheelchairs in bulk for use by their patients and residents. These facilities require high-quality, durable, and comfortable wheelchairs to ensure the safety and comfort of their patients.

Government agencies and non-profit organizations also play a significant role in the global wheelchair market. They may purchase wheelchairs to distribute to needy individuals, support disability-related programs and initiatives, or provide relief aid in disaster-stricken areas.

Design & Function Analysis

In 2023, the global wheelchair market was marked by the dominance of the Basic Wheelchair segment, commanding over 49.3% market share. This prevalence underscores the widespread acceptance of conventional wheelchair designs, addressing the essential mobility needs of a diverse user base. Basic Wheelchairs, known for their simplicity and cost-effectiveness, remain pivotal in catering to individuals with various mobility impairments. Despite this stronghold, the market exhibits a shifting landscape, with specialized segments gaining prominence.

Sports Wheelchairs, tailored for athletic pursuits, witness growing demand, reflecting the rise in adaptive sports participation. Simultaneously, the Bariatric Wheelchair segment gains traction, addressing the needs of users with higher body weights. The innovative Standing Wheelchair segment offers a dynamic solution, allowing users to transition between sitting and standing positions for enhanced health benefits.

Beyond these, the market includes Other Designs & Functions, embracing customizable features and technological integrations. As the industry evolves, understanding diverse user needs and staying abreast of technological advancements will be vital for sustained competitiveness in the dynamic wheelchair market.

Key Market Segments

By Product types

- Manual

- Electric

By Application

- Standard Wheelchair

- Bariatric Wheelchair

- Sports Wheelchair

- Other Applications

By Category types

- Adults

- Pediatric

- Other Types

By End-User

- Homecare

- Hospitals

- Ambulatory Surgical Centers

- Rehabilitation Centers

- Other End-Users

By Design & Function

- Basic Wheelchair

- Sports Wheelchair

- Bariatric Wheelchair

- Standing Wheelchair

- Other Designs & Functions

Driving Factors

Developing Maturing Populace and Innovative Headways to Drive the Market

One of the significant drivers for the global market is the rapidly developing geriatric population. The more seasoned ages will probably experience the ill effects of portability problems with the developing period, which is expected to build the interest in wheelchairs, further bolstering the wheelchair market development during the forecasted period as indicated by a report published by the United Countries, around 250 million populations are currently encountering moderate to serious portability.

Alongside this, the fast expansion in spinal rope wounds among individuals is expected to fuel the market deals tremendously during the estimated time period. The ascent in the commonness of strolling handicaps among each age gathering and the rising rate of lower limit injury is supposed to build interest in wheelchairs during the coming years.

Restraining Factors

Increasing Geriatric Population

Manual wheelchairs are not battery-impelled and should be worked physically. Most of the clients are mature and debilitated and, in this way, are reliant upon others to perform their wheelchairs. An option in contrast to manual seats is controlled wheelchairs, which run on a power source and can be achieved by patients. Be that as it may, the expense of these controlled wheelchairs is high contrasted with manual partners. This is expected to hold the global wheelchair market development during the upcoming years.

Growth Opportunities

Central members are continually associated with the send-off of new wheelchairs and related items on the lookout. For example, in March 2019, Yamaha Engine Corp., The US, declared the send-off of its NAVIGO joystick power framework for wheelchair riders. NAVGIO is a movable and compelling joystick power system that can be coordinated with manual wheelchair outlines.

Moreover, rapidly developing mechanical advancements in wheelchairs and the presentation of numerous items, for example, fueled wheelchairs by a few organizations, will probably grow the deals of wheelchairs during the upcoming years. Besides, the rising drives attempted by the public authority to improve the availability of cutting-edge wheelchairs in low-asset nations are supposed to help the market development.

Regional Analysis

North America dominated the global market in 2023, representing the most significant market share of 34.1% and holds USD 1.73 Billion market value for the year. This development is attributable to the highly objective populace and expanded reception of cutting-edge wheelchairs. As per the Public Spinal Line Injury Factual Center, around 17,730 new spinal rope wounds happen in the U.S. consistently, with vehicular accidents being the primary source of injury.

Accordingly, the U.S. remains an important market for wheelchairs. The Coronavirus pandemic has fundamentally impacted the vehicle and versatility area. It had upset the inventory channel of the wheelchair by and large.

Besides, the presence of an enormous number of market players in the district will; further lift the market development during the conjecture time frame. As indicated by our examination, many little ventures are considering special wheelchairs to take special care of specialty crowds.

For example, in January 2020, a U.S.-based startup, Segway, Inc., sent off an egg-molded case that permits individuals to sit while they easily voyage around grounds, amusement parks, air terminals, and even urban communities. This case can likewise involve wheelchair-bound people, especially cooks for transportation with a fast of 24 mph.

In the Asia Pacific, the market is projected to enlist the quickest CAGR during the gauge time frame. An enormous populace base in nations such as India and China upholds the locale. This is attributable to the upgrades in medical services offices and developing government drives for offering quality portability gadgets. Additionally, the high geriatric populace in nations like Japan likewise upholds market development.

Key Regions & Countries

North America

- The US

- Canada

- Mexico

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market players are acquiring inventive advances to extend their item portfolio. For example, in July 2021, Dawn Clinical sent off the Fast in and out Nitrum super light wheelchair, offering a unique unbending nature and strength. Wheelchair producers needed to stop their activities during the Coronavirus pandemic.

A few different organizations confronted comparative difficulties. In 2020, the organization began its tasks and offered e-administrations, for example, e-arrangements using video calls, home conveyance, and tips on its virtual entertainment pages for its clients.

Market Key Players

Listed below are some of the most prominent global wheelchair market players.

- Carex Health Brands, Inc.

- Drive Medical Design & Manufacturing

- Graham-Field Health Products Inc.

- Invacare

- Medline

- Sunrise Medical LLC

- Karman Healthcare

- Quantum Rehab

- Numotion

- Pride Mobility Products Corp.

- Seating Matters

- Other Key Players

Recent Developments

- Drive Medical Design & Manufacturing (June 2024): Drive Medical launched a new lightweight, foldable electric wheelchair, the Drive Lite. This product features advanced battery technology and ergonomic design, targeting increased mobility and convenience for users. It is designed to be easily transported and stored, addressing common user pain points in wheelchair mobility.

- Graham-Field Health Products Inc. (May 2024): Graham-Field acquired Everest & Jennings, a well-known wheelchair manufacturer. This acquisition expands Graham-Field’s product portfolio and enhances its market presence in the mobility aids sector, allowing the company to offer a more comprehensive range of solutions to its customers.

- Invacare (April 2024): Invacare introduced the Invacare Platinum, a high-end wheelchair designed for extreme durability and comfort. This model incorporates advanced materials and customizability options, aiming to provide users with enhanced support and long-term reliability.

- Medline (March 2024): Medline merged with HealthFlex, a provider of home healthcare solutions. This merger is set to broaden Medline’s product offerings and strengthen its distribution network, particularly in the home healthcare market, enhancing its service capabilities across the United States.

- Sunrise Medical LLC (February 2024): Sunrise Medical launched the Quickie Pulse, an innovative power wheelchair featuring intuitive controls and a compact design. The Quickie Pulse is aimed at providing superior maneuverability and ease of use, especially in tight indoor spaces.

- Karman Healthcare (January 2024): Karman Healthcare acquired the mobility division of Mobility X, a company specializing in high-performance wheelchairs. This acquisition aims to integrate Mobility X’s advanced technology into Karman’s product line, enhancing their offerings in the high-performance wheelchair segment.

Report Scope

Report Features Description Market Value (2023) USD 5.09 Billion Forecast Revenue (2033) USD 10.49 Billion CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Types (Manual, Electric), Category Types (Adults, Paediatric, Other Types), Application (Standard Wheelchair, Bariatric Wheelchair, Sports, Wheelchair, Other Applications), End-Use – Homecare, Hospitals, Ambulatory Surgical Centres, Rehabilitation Centres, Other End Uses), Design & Function (Basic Wheelchair, Sports Wheelchair, Bariatric Wheelchair, Standing Wheelchair, And Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Carex Health Brands Inc., Drive Medical Design & Manufacturing, Graham-Field Health Products Inc., Invacare, Medline, Sunrise Medical LLC, Karman Healthcare, Quantum Rehab, Numotion, Pride Mobility Products Corp., Seating Matters, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Carex Health Brands, Inc.

- Drive Medical Design & Manufacturing

- Graham-Field Health Products Inc.

- Invacare

- Medline

- Sunrise Medical LLC

- Karman Healthcare

- Quantum Rehab

- Numotion

- Pride Mobility Products Corp.

- Seating Matters

- Other Key Players