Global Wheat Protein Market, By Product Type (Wheat Gluten, Wheat Protein Isolate, Textured Wheat Protein, and Hydrolyzed Wheat Protein), By Form (Solid, and Liquid), By Protein Concentration (75% Protein Concentration, 80% Protein Concentration, and 95% Protein Concentration), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 100441

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

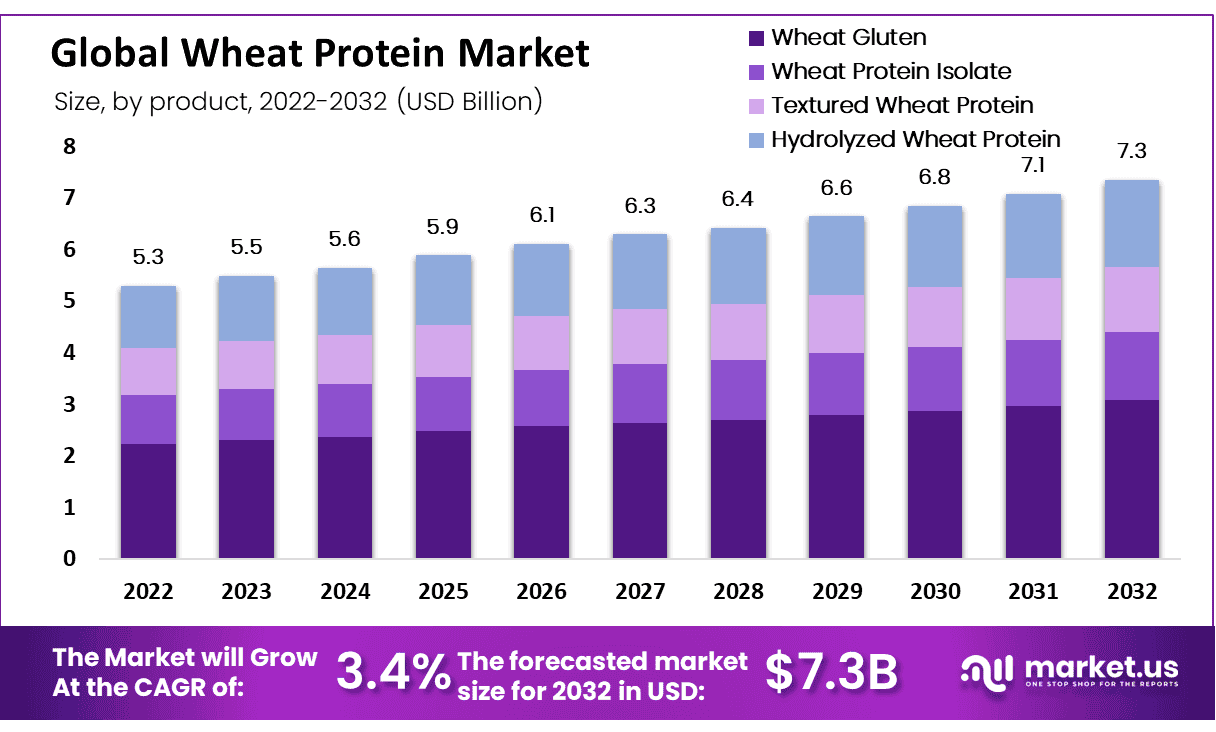

The Global Wheat Protein Market size is expected to be worth around USD 7.3 Billion by 2032 from USD 5.3 Billion in 2022, growing at a CAGR of 3.40% during the forecast period from 2023 to 2032.

The global wheat protein market refers to the industry that produces & sells different types of protein obtained from wheat. Wheat protein is increasingly being used as an ingredient in food and beverage products such as baked goods, vegetarian meat alternatives, and nutritional supplements. The demand for wheat protein is on the rise as more consumers look for plant-based and gluten-free options.

Furthermore, its nutritional profile stands out with high levels of protein, fiber, and essential amino acids. The market is being driven by factors like an increasing need for plant-based sources of protein sources, rising health awareness among consumers, and expanding applications of wheat protein within food manufacturing operations. With these drivers at play, wheat protein will continue growing steadily over the coming years due to rising demand from those seeking healthier food sources.

Key Takeaways

- Market Size and Growth: The Wheat Protein Market is projected to be worth around USD 7.3 billion by 2032, showing a growth from USD 5.3 billion in 2022. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 3.40% during the forecast period from 2023 to 2032.

- Product Types: The market segments include Wheat Gluten, Wheat Protein Isolate, Textured Wheat Protein, and Hydrolyzed Wheat Protein. Wheat Gluten is the most lucrative segment, with a projected CAGR of 3.4%.

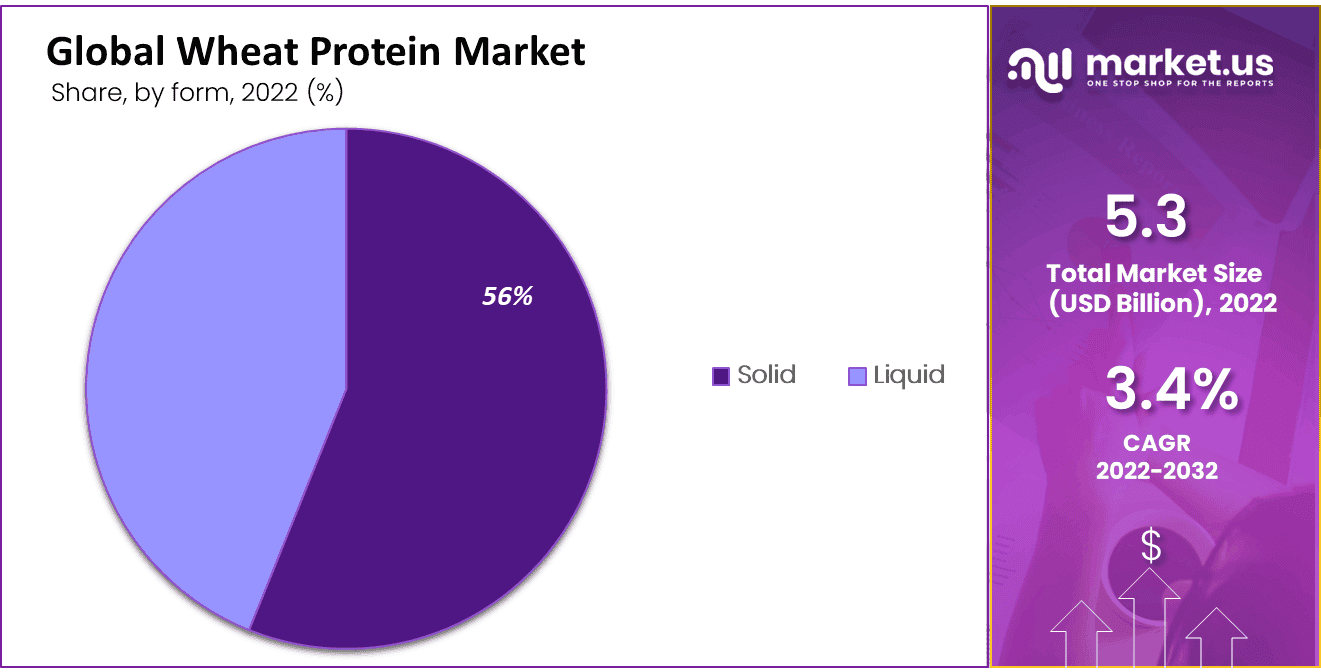

- Forms: Wheat protein comes in solid and liquid forms. Solid wheat protein, available as powders or granules, holds the largest revenue share (56.1%) in the market in 2022.

- Protein Concentration: Wheat protein varies in protein concentration, with 75%, 80%, and 95% concentration types. Wheat protein with 75% protein concentration is the most lucrative, with a 43% revenue share in 2022.

- Applications: Wheat protein finds use in various applications, including dairy, bakery & confectionery, nutritional supplements, animal feed, meat analogy, processed meat, and others. The bakery & confectionery segment held the largest revenue share (41%) in 2022.

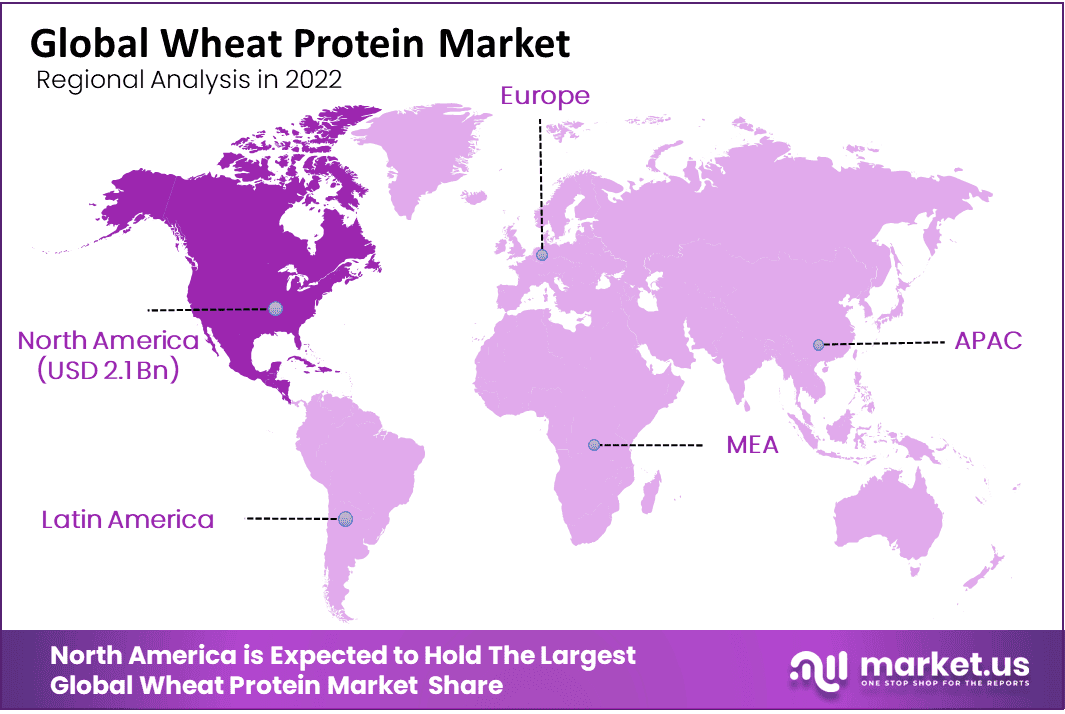

- Regional Analysis: North America, particularly the United States and Canada, accounted for the largest revenue share in the global wheat protein market in 2022, with a 36% market share. Meanwhile, the Asia Pacific region is projected to be the fastest-growing market with a CAGR of 3.4%, driven by rising consumer awareness and the demand for plant-based proteins.

- Key Players: The wheat protein market is highly competitive and fragmented. Archer Daniels Midland Company is a major player with a global market share of around 20%. Other key players include Agridient Inc, MGP Ingredients, Cargill Inc, Manildra Group, and more.

Driving Factors

Increasing demand for plant-based protein sources and research & development activities in wheat protein products.

As more consumers adopt plant-based diets, the requirement for plant-based protein sources like wheat protein is on the increase. Wheat protein is a versatile and sustainable protein source that is becoming increasingly popular among consumers who are looking for healthy and eco-friendly food options.

There is a significant amount of research & development activity focused on wheat protein, including the development of the latest products and the improvement of existing ones. This is driving innovation in the market and leading to the introduction of new and greater wheat protein products.

Growing applications and health consciousness among consumers for wheat protein products or importance.

Wheat protein is used in a variety of food and beverage products, such as baked goods, meat alternatives, and nutritional supplements. The versatility of wheat protein has driven its adoption within the food industry and contributed to its growth within this market.

As consumers become more health-conscious they seek foods high in protein, fiber, and other essential nutrients; wheat protein provides them in abundance! Wheat protein is a rich source of these nutrients and is therefore in the highest demand.

Restraining Factors

The production of wheat protein can be costly, which can lead to higher prices for consumers. This could limit the adoption of wheat protein products, particularly in price-sensitive markets. Wheat protein can be a common allergen, which could limit its uses in particular products or markets. This could impact the overall requirement for wheat protein products and slow the growth of the market.

While the requirement for plant-based proteins is rising, there are many other plant-based protein sources available like soy, pea, and rice protein. This could limit the adoption of wheat protein products if consumers choose to use other protein sources instead. There may be regulatory challenges related to the production and labeling of wheat protein products, particularly in markets with strict food safety and labeling regulations. This could limit the availability of wheat protein products in individual markets.

Growth Opportunities

The sports nutrition market is growing speedily, and there is a rising requirement for high-quality protein sources that can help athletes build & maintain muscle mass. Wheat protein is a rich source of protein and crucial amino acids, making it an attractive option for the sports nutrition market. Wheat protein can be used as a gluten-free alternative to wheat flour in many food products like bread and pasta.

The increasing demand for gluten-free products presents a significant opportunity for the wheat protein market. There is significant potential for the development of the latest wheat protein products like textured wheat protein and wheat protein-based beverages. These latest products could help to expand the market and increase the adoption of wheat protein products.

Trending Factors

The adoption of plant-based diets is increasing speedily, driven by factors like health consciousness, animal welfare concerns, and environmental sustainability. This trend is driving the requirement for plant-based protein sources, including wheat protein. The meat alternative market is growing speedily, as consumers seek out plant-based alternatives to traditional meat products. Wheat protein is used as an ingredient in many meats’ alternative products like veggie burgers and sausages, and this trend is driving the requirement for wheat protein.

Consumers are increasingly looking for products that contain natural, minimally processed ingredients, and this trend is impacting the wheat protein market. Producers are using clean labels and natural ingredients in their products, and this is driving demand for wheat protein as a natural & minimally processed protein source.

Product Analysis

The Wheat Gluten Type Segment is The Most Lucrative Segment in the Product of Wheat Protein Market

Based on product, the market for wheat protein market is segmented into wheat gluten, wheat protein isolate, textured wheat protein, and hydrolyzed wheat protein. Among these types, the wheat gluten fragment is the most lucrative in the global wheat protein market, with a projected CAGR of 3.4%. The total revenue share of product type wheat protein is 42% in 2022. Wheat gluten is the most commonly used wheat protein product.

It is a highly elastic protein that is commonly used as a dough improver and binder in various food products such as bread, pasta, and baked goods. Hydrolyzed wheat protein is a protein derived from wheat that has been broken down into smaller peptides, and it is commonly used as a flavor enhancer and protein source in various food products like soups, sauces, and seasonings.

Form Analysis

The Solid Segment Accounted for the Largest Revenue Share in the Form of the Wheat Protein Market in 2022.

Based on form, the market is fragmented into solid, and liquid. Among these, the solid segment is estimated to be the most lucrative segment in the global wheat protein market, with the largest revenue share of 56.1% and a projected CAGR of 3.4% during the forecast period. Owing to Solid wheat protein is available in the form of powders or granules and is widely used in various food products such as baked goods, meat alternatives, and snacks.

Solid wheat protein is highly concentrated and can be easily incorporated into different formulations. Liquid wheat protein is available in the form of syrups or solutions and is commonly used as a binder, emulsifier, or flavor enhancer in various food and beverage products. Liquid wheat protein is easily soluble and can be added to different formulations without affecting their texture or consistency.

Protein Concentration Analysis

The 75% Protein Concentration Type Segment is The Most Lucrative Segment in the Protein Concentration Wheat Protein Market

Based on the product, the market for wheat protein market is divided into 75% protein concentration, 80% protein concentration, and also 95% protein concentration. Among these types, the 75% protein concentration fragment is the most lucrative in the global wheat protein market, with a projected CAGR of 3.4%. The total revenue share of protein concentration type wheat protein is 43% in 2022. Wheat protein products with 75% protein concentration are usually used in bakery products, which are dough strengtheners & improvers.

They are also used in meat alternatives, snacks, and breakfast cereals. Wheat protein products with an 80% protein concentration are widely used in meat alternatives, including vegetarian burgers, sausages, and nuggets. Wheat protein products with a 95% protein concentration are highly concentrated and used in applications that require the highest level of protein like sports nutrition, weight management, and medical nutrition products.

Application Analysis

The Bakery and Confectionery Segment Accounted for the Largest Revenue Share in the Application of the Wheat Protein Market in 2022.

Based on application, the market is fragmented into dairy, bakery & confectionery, nutritional supplements, animal feed, meat analogy, processed meat, and other applications. Among these, the bakery & confectionery segment is estimated to be the most lucrative segment in the global wheat protein market, with the largest revenue share of 41% during the forecast period.

Wheat protein is used in bakery and confectionery products such as bread, cakes, cookies, and pastries as a dough improver and binder. Dairy products such as cheese, yogurt, and ice cream a stabilizers, thickeners, and emulsifiers. The demand for wheat protein varies across different applications based on its functional properties and cost-effectiveness.

Key Market Segments

Based on Product Type

- Wheat Gluten

- Wheat Protein Isolate

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

Based on Form

- Solid

- Liquid

Based on Protein Concentration

- 75% Protein Concentration

- 80% Protein Concentration

- 95% Protein Concentration

Based on Application

- Dairy

- Bakery & Confectionery

- Nutritional Supplements

- Animal Feed

- Meat Analogy

- Processed Meat

- Other Applications

Regional Analysis

North America Accounted for the Largest Revenue Share in the Global Wheat Protein Market in 2022.

The region has a well-established food & beverage industry, which supports the growth of the wheat protein market. The United States & Canada are the major markets in the region, raising consumer awareness of the health benefits of plant-based proteins and gluten-free products.

North America is estimated to be the maximum lucrative market in the global wheat protein market with the greatest market equity of 36% and is expected to register a CAGR of 3.3% in the time of the forecasting period.

Asia Pacific is expected as the Fastest Growing Region in the Projected Period in the Global Wheat Protein Market.

Asia Pacific is expected as the fastest-growing region in the global wheat protein market with a CAGR of 3.4%. Asia-Pacific is the fastest-growing market for wheat protein, with increasing consumer awareness of health and wellness and the demand for plant-based proteins.

The region has the largest population and growing middle class, which presents significant opportunities for the rise of the wheat protein market. China, Japan, and India are huge markets in the Asia Pacific.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global wheat protein market is highly competitive and fragmented, with few key players operating in the market. These companies are focusing on innovation, product development, and strategic partnerships to expand their market share and meet the growing requirement for wheat protein products.

Archer Daniels Midland Company is a main player in the wheat protein market, with a global market share of around 20%. The company offers a vast range of wheat protein products, including vital wheat gluten, hydrolyzed wheat protein, and wheat protein isolates.

Market Key Players

- Archer Daniels Midland Company

- Agridient Inc

- MGP Ingredients

- AB Amilina

- Cargill Inc

- Manildra Group

- Crespel & Deiters GmbH and Co. KG

- Kroener Staerke

- Crop Energies AG

- Roquette Freres

- Other Key Players

Recent Developments

December 2021: ADM published the expansion of its plant-based protein production facility in Missouri, USA, to meet the growing demand for plant-based proteins, including wheat protein products.

January 2022: Cargill published the introduction of its new line of wheat protein products, which are specifically designed for meat alternative applications.

Report Scope

Report Features Description Market Value (2022) USD 5.3 Bn Forecast Revenue (2032) USD 7.3 Bn CAGR (2023-2032) 3.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type-Wheat Gluten, Wheat Protein Isolate, Textured Wheat Protein, and Hydrolyzed Wheat Protein; By Form-Solid, and Liquid; By Protein Concentration-75% Protein Concentration, 80% Protein Concentration, and 95% Protein Concentration; By Application- dairy, bakery & confectionery, nutritional supplements, animal feed, meat analogy, processed meat, and other applications; Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Archer Daniels Midland Company, Agridient Inc, MGP Ingredients, AB Amilina, Cargill Inc, Manildra Group, Crespel & Deiters GmbH and Co. KG, Kroener Staerke, Crop Energies AG, Roquette Freres, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Wheat Protein Market Size During the Forecast Period 2023-2032?The Global Wheat Protein Market size is expected to be worth around USD 7.3 Billion by 2032 growing at a CAGR of 3.40% during the forecast period from 2023 to 2032.

What is the Wheat Protein Market CAGR During the Forecast Period?The Global Wheat Protein Market size is expected to be worth around USD 7.3 Billion by 2032 growing at a CAGR of 3.40% during the forecast period from 2023 to 2032.

What was the Wheat Protein Market Size Around the Year 2022?The Global Wheat Protein Market size is expected to be worth around USD 5.3 Billion in 2022, growing at a CAGR of 3.40%.

-

-

- Archer Daniels Midland Company

- Agridient Inc

- MGP Ingredients

- AB Amilina

- Cargill Inc

- Manildra Group

- Crespel & Deiters GmbH and Co. KG

- Kroener Staerke

- Crop Energies AG

- Roquette Freres

- Other Key Players