Global Wheat Gluten Market Size, Share, Report Analysis By Form (Liquid, Powder), By Application (Bakery, Meat Alternatives, Confectionery, Nutritional Supplements, Convenience Foods, Others), By Distribution Channel (Retail Stores, Supermarkets and Hypermarkets, E-commerce, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156516

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

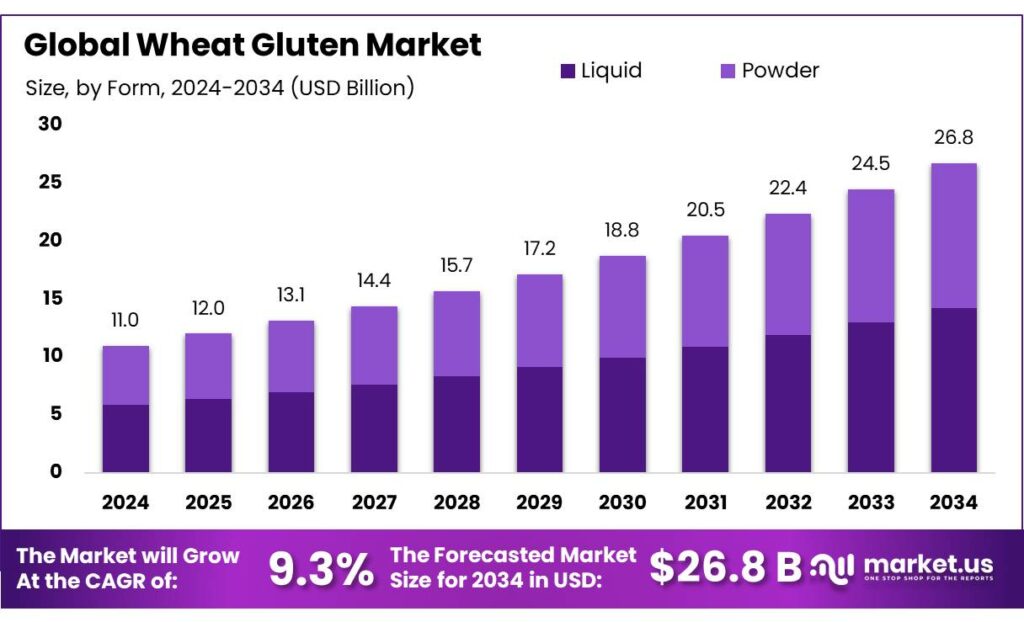

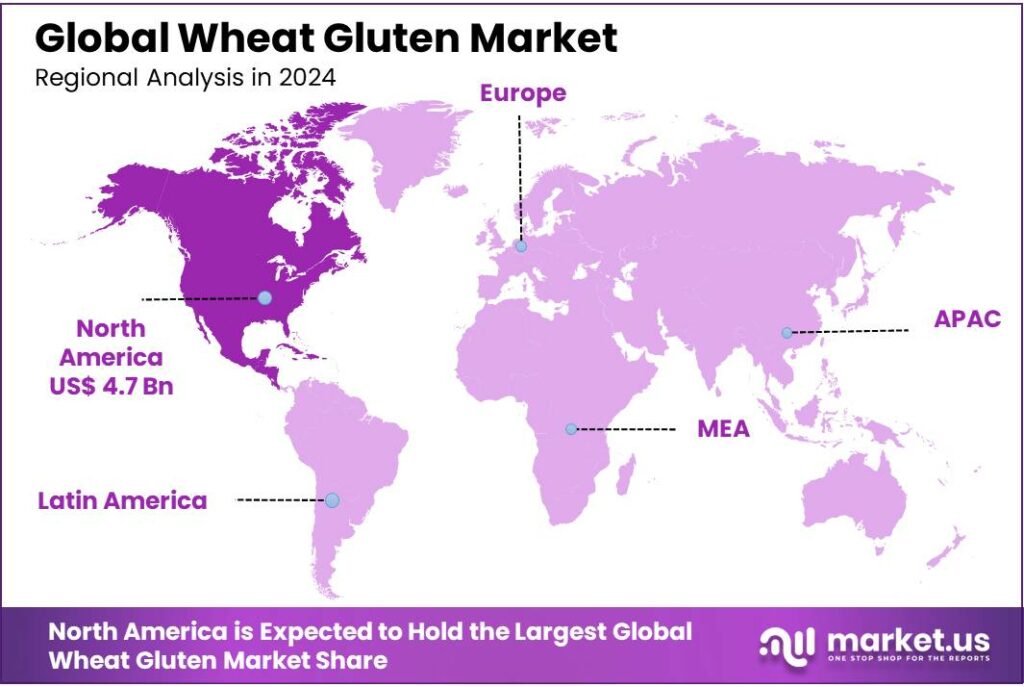

The Global Wheat Gluten Market size is expected to be worth around USD 26.8 Billion by 2034, from USD 11,0 Billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.80% share, holding USD 4.7 Billion revenue.

The wheat gluten industry represents a significant segment within the broader wheat processing sector, serving as a critical protein-rich ingredient across multiple food and industrial applications. Wheat gluten, comprising approximately 8-15% of wheat flour composition, is extracted through an industrial washing process that separates the protein fraction from starch and other components.

- According to the United States Department of Agriculture Economic Research Service, wheat ranks third (behind corn and soybeans) among U.S. field crops in planted acreage, production, and gross farm receipts, with U.S. farmers estimated to have produced a total of 1.97 billion bushels of winter, spring, and Durum wheat from a harvested area of 38.5 million acres in 2024/25.

The industrial scenario for wheat gluten production is intrinsically linked to the overall wheat milling industry, which has undergone substantial modernization since the 1970s. The USDA data indicates that Hard Red Winter wheat accounts for about 40 percent of total U.S. wheat production and is grown primarily in the Great Plains, while Hard Red Spring wheat accounts for about 25% of wheat production and is valued for its high protein levels, making these varieties particularly suitable for gluten extraction. The industrial processing capacity has evolved significantly, with modern wet milling facilities capable of producing high-quality vital wheat gluten through sophisticated separation technologies that achieve protein concentrations exceeding 75%.

Government initiatives have played a central role in strengthening the wheat gluten value chain. In October 2024, the Indian government raised the minimum support price for wheat by 6.6 %, increasing it to ₹2,425 per 100 kg, to incentivize farmers and secure production. At the same time, the 40 % import duty on wheat remains in place—underscoring efforts to shield domestic agriculture from external volatility. On a broader agricultural front, the Government of India launched the Prime Minister Dhan‑Dhaanya Krishi Yojana in mid‑2025—a six‑year initiative with an annual outlay of ₹24,000 crore—to boost yields and farmers’ incomes in 100 underperforming districts, by converging 36 existing schemes and enabling better infrastructure, credit access, and production diversification.

Key Takeaways

- Wheat Gluten Market size is expected to be worth around USD 26.8 Billion by 2034, from USD 11,0 Billion in 2024, growing at a CAGR of 9.3%.

- 0–3 years held a dominant market position, capturing more than a 68.3% share in the Infant Formula DHA Algae Oil market.

- Liquid held a dominant market position, capturing more than a 53.2% share in the wheat gluten market.

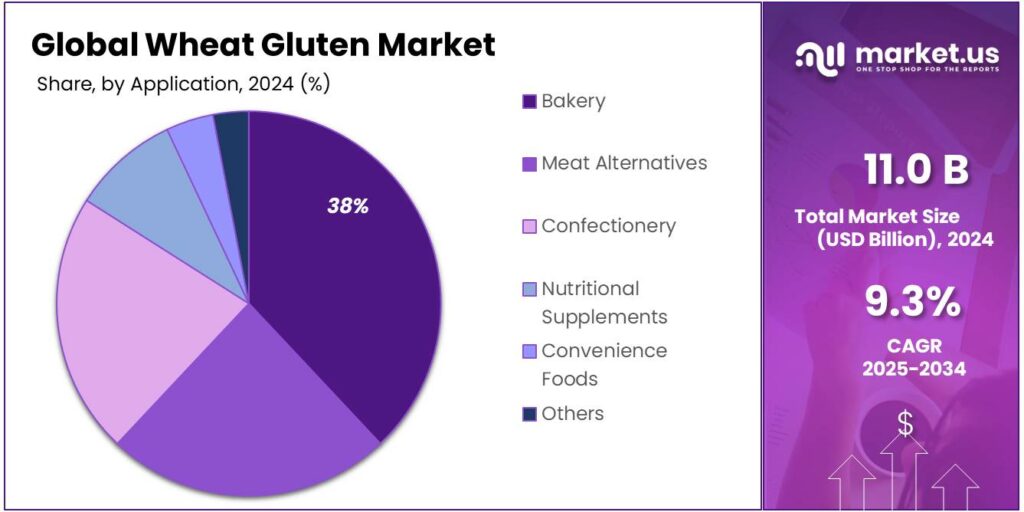

- Bakery held a dominant market position, capturing more than a 38.5% share in the global wheat gluten market.

- North America held a dominant position in the wheat gluten market, capturing more than a 42.80% share, valued at approximately USD 4.7 billion.

By Form Analysis

0–3 Years Segment Leads with 68.3% Share in 2024

In 2024, 0–3 years held a dominant market position, capturing more than a 68.3% share in the Infant Formula DHA Algae Oil market. This age group is the most critical stage of early development, where DHA intake directly supports brain growth, visual acuity, and overall cognitive function. Parents and caregivers across the globe are increasingly aware of the importance of DHA during this window, leading to a stronger demand for formulas enriched with algae oil as a sustainable and safe source of nutrition.

The high share is also linked to the growing trust in algae oil as an alternative to fish-derived DHA, particularly in regions where sustainability and allergen-free ingredients are priorities. By 2025, the 0–3 years category is expected to maintain its leadership as pediatric guidelines consistently emphasize the necessity of DHA in infants and toddlers for healthy neurological and physical development. Infant nutrition companies are actively marketing products within this segment, highlighting clinical benefits and natural sourcing, further reinforcing consumer confidence.

By Application Analysis

Liquid Wheat Gluten Takes the Lead with 53.2% Share in 2024

In 2024, Liquid held a dominant market position, capturing more than a 53.2% share in the wheat gluten market. This strong preference for the liquid form is largely due to its ease of blending in food processing, especially in bakery, beverage, and plant-based meat applications. Liquid wheat gluten offers excellent binding and elasticity properties, making it a favorite among manufacturers aiming for consistent product texture and improved moisture retention.

Its popularity also stems from the fact that liquid wheat gluten reduces processing time and eliminates the need for rehydration, saving both energy and labor costs. As clean-label and high-protein products become more mainstream, food producers are integrating liquid wheat gluten for its functional benefits and nutritional appeal.

By Distribution Channel Analysis

Bakery Segment Dominates with 38.5% Share in 2024 Due to Rising Demand for High-Protein Baked Goods

In 2024, Bakery held a dominant market position, capturing more than a 38.5% share in the global wheat gluten market. This leading position is mainly due to the essential role wheat gluten plays in enhancing the texture, elasticity, and shelf life of baked goods. From breads and pastries to buns and rolls, gluten helps create the soft and chewy texture that consumers love. As demand for artisanal and protein-enriched baked products grows, manufacturers are turning more to wheat gluten to improve product quality and consistency.

Another contributing factor is the steady rise in the popularity of clean-label and high-protein bakery items. Wheat gluten, being a natural plant-based protein, aligns perfectly with this trend, giving it an edge over synthetic additives. The segment’s growth in 2024 also reflects strong performance in both commercial and in-store bakeries, where consistency in dough performance is crucial for high-volume operations.

Key Market Segments

By Form

- Liquid

- Powder

By Application

- Bakery

- Meat Alternatives

- Confectionery

- Nutritional Supplements

- Convenience Foods

- Others

By Distribution Channel

- Retail Stores

- Supermarkets & Hypermarkets

- E-commerce

- Others

Emerging Trends

Growing Demand for Wheat Gluten in Animal Feed Industry Transforms Agricultural Landscape

The wheat gluten industry is witnessing a remarkable shift as animal feed applications emerge as the fastest-growing segment, fundamentally changing how farmers and feed manufacturers approach livestock nutrition. This transformation reflects a broader movement toward sustainable protein sources and efficient feed formulations that support both animal health and agricultural productivity.

Government support for sustainable agriculture practices has helped accelerate this trend. The USDA’s ongoing research and data collection efforts provide farmers with the information they need to make informed decisions about feed formulations. Additionally, various agricultural extension programs have been educating farmers about the benefits of protein-rich feed ingredients, including wheat gluten, as part of comprehensive livestock nutrition programs.

The environmental implications of this trend cannot be overlooked. By maximizing the use of wheat processing byproducts in animal feed, the industry is reducing waste and creating a more circular agricultural economy. This approach aligns with growing consumer and regulatory pressure for more sustainable farming practices.

Drivers

Government Support and Policy Initiatives Driving Wheat Gluten Demand

One significant factor driving the demand for wheat gluten is the increasing global consumption of wheat, which is projected to continue rising. According to the Food and Agriculture Organization (FAO), world wheat production in 2022 was estimated at 693.8 million tonnes, with global wheat trade reaching 173.1 million tonnes. This surge in wheat production and trade is largely attributed to the growing demand for wheat-based products, including wheat gluten, which is a vital ingredient in various food applications such as bread, pasta, and processed foods.

To meet this escalating demand, governments worldwide are implementing policies that support wheat production and processing. For instance, in 2007, the FAO-OECD report highlighted that about 93 million tons of wheat and coarse grains were utilized for ethanol production, doubling the amount used in 2005 . This surge is attributed to government incentives promoting biofuel production, which in turn increases the demand for wheat and its derivatives, including wheat gluten.

These government initiatives not only support wheat farmers but also contribute to the growth of the wheat gluten market by ensuring a steady and increasing supply of wheat. As wheat production continues to rise globally, the demand for wheat gluten is expected to follow suit, driven by its essential role in the food industry and the supportive policies fostering its availability.

Restraints

Consumer Health Concerns and Dietary Restrictions

A significant challenge facing the wheat gluten market is the increasing prevalence of gluten-related health issues, particularly celiac disease and gluten sensitivity. The Food and Drug Administration (FDA) has established that foods labeled as “gluten-free” must contain less than 20 parts per million (ppm) of gluten, a threshold that is considered safe for most individuals with celiac disease . However, the rising awareness and diagnosis of gluten-related disorders have led to a growing demand for gluten-free products, thereby limiting the market for wheat gluten.

Celiac disease is a serious autoimmune condition where the ingestion of gluten leads to damage in the small intestine. According to the National Institute of Diabetes and Digestive and Kidney Diseases, an estimated 1 in 100 people worldwide have celiac disease, though many remain undiagnosed . Additionally, non-celiac gluten sensitivity is a condition where individuals experience symptoms similar to those of celiac disease after consuming gluten, without the autoimmune response. This condition further contributes to the demand for gluten-free products.

The increasing prevalence of these conditions has led to a shift in consumer preferences towards gluten-free diets, even among individuals without diagnosed gluten-related disorders. This trend is supported by various health organizations and has been reflected in food labeling regulations. For instance, the FDA’s gluten-free labeling rule ensures that consumers can trust products labeled as such, knowing they meet the established gluten content standards.

Opportunity

Expanding Role in Plant-Based Meat Alternatives: A Protein Revolution

The most promising growth opportunity for wheat gluten lies in its expanding role as a key ingredient in plant-based meat alternatives, where it serves as a crucial protein source and texture enhancer. This opportunity represents a significant shift in how food manufacturers approach meat substitutes, with wheat gluten playing an increasingly important role alongside traditional proteins like soy and pea.

The ingredient composition of plant-based meat products reveals wheat gluten’s strategic importance. Materials and ingredients make up 20% of the total cost of plant-based meat products, with alternative protein ingredients like pea protein, soy protein, and wheat gluten being key drivers of demand. This cost structure indicates that wheat gluten suppliers have significant influence over product development and pricing in this growing sector.

The broader plant-based movement is creating favorable conditions for wheat gluten expansion. Research shows that plant-based meat substitutes have on average 50% lower environmental impact compared to traditional meat products. This environmental advantage appeals to increasingly conscious consumers who are willing to pay premium prices for sustainable alternatives.

Government initiatives are supporting this growth trajectory through regulatory clarity and support for alternative proteins. The FDA issued regulations defining “gluten-free” for food labeling, providing consumers with consistent and reliable claims across the food industry. While this might seem counterintuitive for wheat gluten growth, it actually helps by clearly distinguishing products that contain wheat gluten from those that don’t, allowing manufacturers to target specific consumer segments more effectively.

Regional Insights

North America Dominates the Wheat Gluten Market with 42.80% Share in 2024

In 2024, North America held a dominant position in the wheat gluten market, capturing more than a 42.80% share, valued at approximately USD 4.7 billion. This strong market presence is largely driven by the increasing demand for wheat gluten in the food and beverage industry, particularly in bakery products, plant-based meat alternatives, and packaged snacks. North America has seen a marked rise in consumer preference for high-protein and functional foods, making wheat gluten an essential ingredient for many manufacturers.

The region’s dominance can also be attributed to the advanced food processing infrastructure and significant investments in the research and development of wheat gluten-based products. As plant-based diets gain popularity, particularly in the United States and Canada, the demand for wheat gluten as a primary protein source in vegan and vegetarian foods has skyrocketed. This trend is expected to continue, with North America leading innovation in plant-based protein development, further driving wheat gluten consumption.

Furthermore, regulatory support and the growing awareness of the nutritional benefits of wheat gluten have contributed to the market’s growth in North America. As the demand for clean-label, high-protein foods rises, food producers are increasingly turning to wheat gluten as a natural and functional ingredient to meet consumer expectations.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Crespel & Deiters GmbH is a prominent global player in the wheat gluten market, specializing in high-quality wheat-based products. The company is known for its innovative solutions in food, feed, and industrial applications. With a strong emphasis on sustainability and product development, Crespel & Deiters has a significant presence in Europe and beyond. They provide specialized wheat gluten products used in bakery, pasta, and plant-based protein sectors.

Pioneer Industries Limited is a leading manufacturer and supplier of wheat gluten, focusing on high-performance food-grade products. With a strong market presence, especially in the Asian market, Pioneer Industries offers wheat gluten used in a variety of food applications, including bakery products and meat substitutes. The company is committed to enhancing the quality of its offerings by investing in technology and sustainable practices to meet the evolving demands of the global market.

Anhui Ante Food is a key player in the wheat gluten industry, known for producing high-quality wheat gluten products primarily for the food processing sector. The company offers a range of products used in bakery, noodles, and meat alternatives. Anhui Ante Food is well-regarded for its strong production capabilities and commitment to food safety and quality. With a growing footprint in both domestic and international markets, the company continues to expand its reach and product innovation.

Top Key Players Outlook

- Crespel & Deiters GmbH

- Pioneer Industries Limited

- Anhui Ante Food

- Ardent Mills LLC

- MGP Ingredients

- Z & F Sungold Corporation

- Royal Ingredients Group

- Tereos

- Bryan W. Nash & Sons Limited

- Kroener Staerke

Recent Industry Developments

MGP Ingredients, through its Ingredient Solutions division, plays an important role supplying wheat‑based proteins, including wheat gluten, to food manufacturers. In 2024, this segment posted sales of USD 130.6 million, showing a slight decline of 1 % compared to the previous year.

Ardent Mills LLC weaves resilience into its wheat gluten role—in fiscal 2024, the company recorded net sales of USD 4.6 billion, a 12 % dip from fiscal 2023, and net earnings of USD 361.5 million, down 21 % from the prior year.

Report Scope

Report Features Description Market Value (2024) USD 11.0 Bn Forecast Revenue (2034) USD 26.8 Bn CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder), By Application (Bakery, Meat Alternatives, Confectionery, Nutritional Supplements, Convenience Foods, Others), By Distribution Channel (Retail Stores, Supermarkets and Hypermarkets, E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Crespel & Deiters GmbH, Pioneer Industries Limited, Anhui Ante Food, Ardent Mills LLC, MGP Ingredients, Z & F Sungold Corporation, Royal Ingredients Group, Tereos, Bryan W. Nash & Sons Limited, Kroener Staerke Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Crespel & Deiters GmbH

- Pioneer Industries Limited

- Anhui Ante Food

- Ardent Mills LLC

- MGP Ingredients

- Z & F Sungold Corporation

- Royal Ingredients Group

- Tereos

- Bryan W. Nash & Sons Limited

- Kroener Staerke