Western US Cold Chain Storage Market By Type (Facilities/Services (Refrigerated Warehouse (Private & Semi-Private and Public), Cold Room), Equipment (Blast freezer, Walk-in Cooler and Freezer, Deep Freezer, Others)), By Temperature Range (Chilled (0°C to 15°C), Frozen (-18°C to -25°C), Deep-frozen (Below -25°C)), By Application (Food & Beverages (Fruits & Vegetables, Fruit Pulp & Concentrates, Dairy Products, Fish, Meat, and Seafood, Processed Food, Bakery & Confectionary, Others), Pharmaceuticals (Vaccines, Blood Banking, Others), and Others), and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165307

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

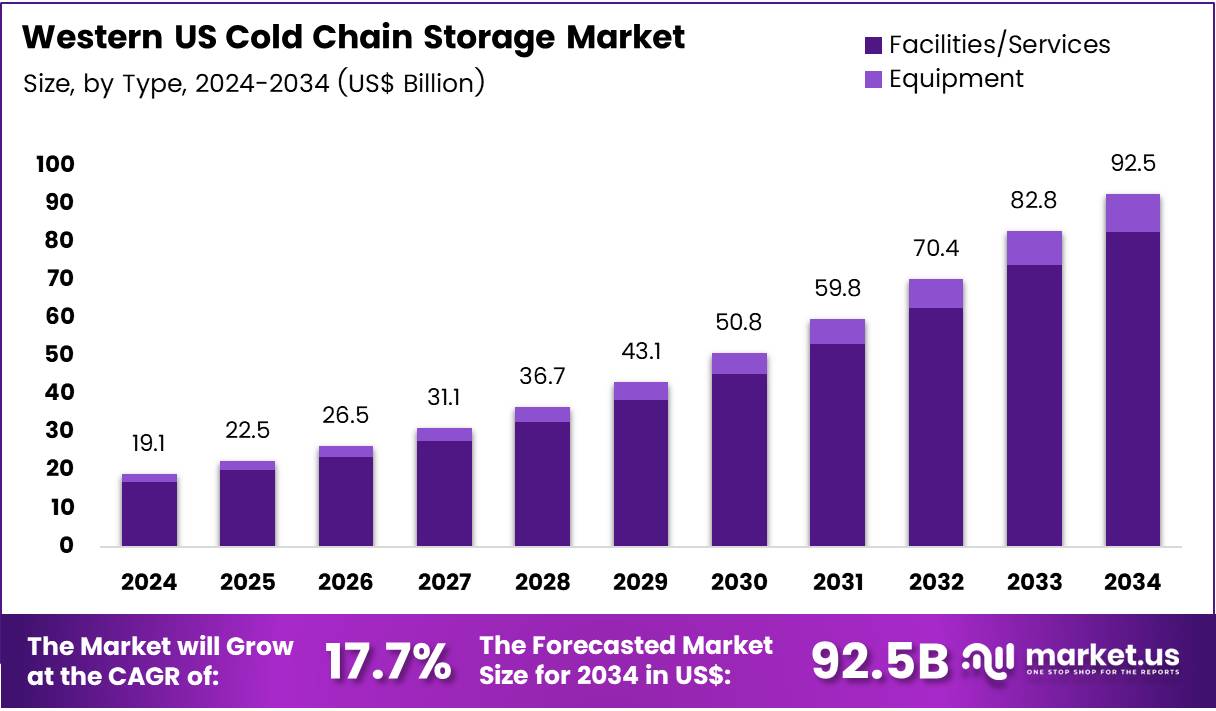

The Western US Cold Chain Storage Market size is expected to be worth around US$ 92.59 billion by 2034 from US$ 19.10 billion in 2024, growing at a CAGR of 17.7% during the forecast period 2025 to 2034.

The cold chain market in the Western United States is a critical segment of the supply chain industry, focused on the storage and transportation of perishable goods that require temperature-controlled environments. This market is significant due to the diverse and expansive geography of the region, which includes major agricultural states like California and Washington. These states are key producers of fruits, vegetables, dairy products, and seafood, all of which require cold chain solutions to maintain freshness and quality from farm to consumer.

Western US Cold Chain Storage Market Analysis, 2020-2024 (US$ Million)

Western US 2020 2021 2022 2023 2024 CAGR Revenue 12,441.5 12,886.4 13,788.5 16,229.0 19,101.6 17.7% California, one of the nation’s largest producers of dairy and agricultural goods, depends extensively on advanced refrigerated storage and transportation systems to supply products both across the country and abroad. Likewise, the growing biotechnology industries in areas such as San Francisco and Seattle amplify the demand for highly precise and dependable cold chain facilities capable of managing sensitive biological materials.

According to California Health and Safety Code Section 112355, “cold storage” refers to an artificially refrigerated area maintained at or below 45 degrees Fahrenheit. This definition excludes spaces designated for privately owned food not intended for resale, where items are kept within lockers or compartments of up to 25 cubic feet each, leased exclusively to individual users.

In July 2025, SeaCube Cold Solutions expanded its footprint in the U.S. Southwest through a new partnership with The Wonderful Company. As part of this collaboration, SeaCube will establish a primary refrigerated container depot within The Wonderful Company’s logistics center in Shafter, California.

Serving as the central hub for SeaCube’s cold chain operations in California, the Shafter facility will provide storage, maintenance, and repair services for its refrigerated containers. Strategically located in California’s Central Valley—one of the nation’s leading agricultural regions—the depot ensures close access to major food producers and distributors.

Key Takeaways

- The Western US Cold Chain Storage market was valued at US$ 19.10 billion in 2024 and is anticipated to register substantial growth of US$ 92.59 billion by 2034, with 17.7% CAGR.

- Based on Type, the market is bifurcated into Facilities/Services and Equipment with Facilities/Services taking the lead in 2024 with 89.1%market share.

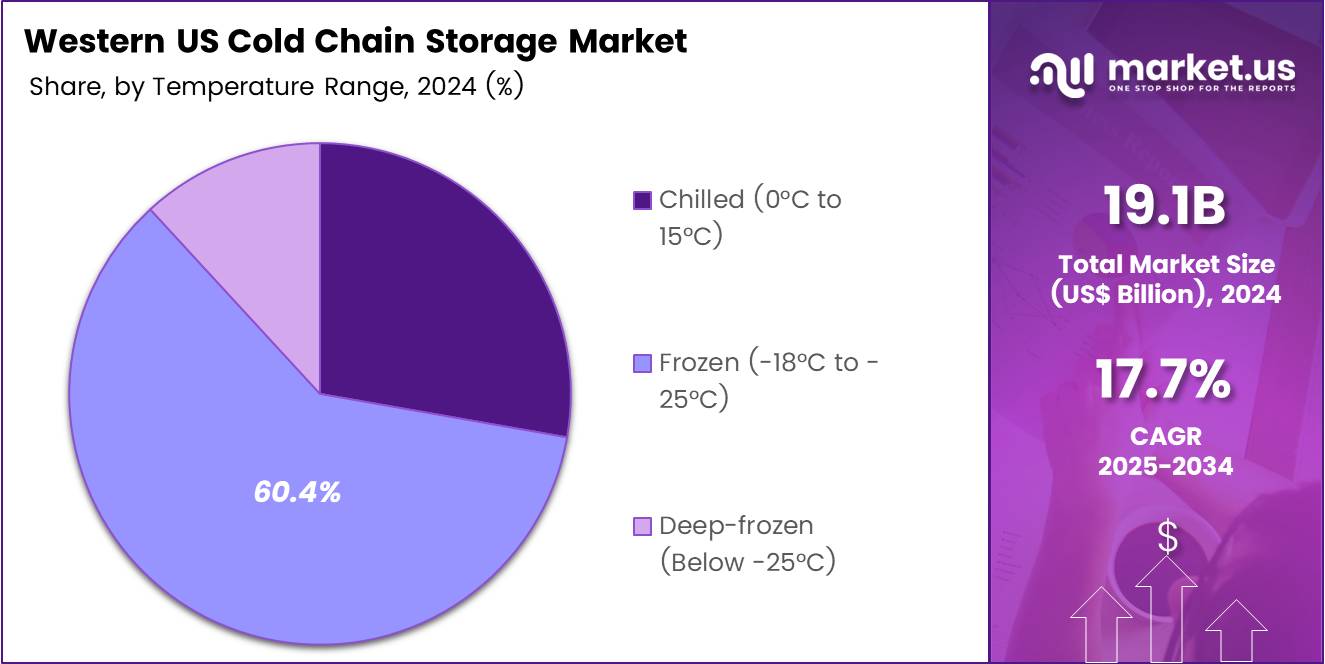

- Based on Temperature Range, the market is bifurcated into Chilled (0°C to 15°C), Frozen (-18°C to -25°C), and Deep-frozen (Below -25°C) with Frozen (-18°C to -25°C) taking the lead in 2024 with 60.4% market share.

- Based on Application, the market is bifurcated into Food & Beverages, Pharmaceuticals and Others with Food & Beverages taking the lead in 2024 with 76.2% market share.

By Type

Facilities/Services segment dominated the market with 89.1% market share which refers to the physical locations and associated services that are essential for cold storage and logistics. Refrigerated Warehouse: These warehouses are industrial-grade facilities designed to store perishable goods in a temperature-controlled environment. Refrigerated warehouses vary in size and capabilities, with some offering sophisticated climate zones for different products.

Private & Semi-Private: A private refrigerated warehouse is exclusively used by a single entity, providing control over storage conditions, which is vital for companies with large volumes of products or specialized needs, such as large food producers or pharmaceutical companies. Public refrigerated warehouses offer storage facilities on a rental basis to various clients. This provides flexibility for companies that do not require or cannot afford to maintain their own private facility.

According to the US Department of Agriculture, as of October 1, 2023, the United States had a total gross refrigerated storage capacity of 3.70 billion cubic feet. California led with 370 million cubic feet, followed by Washington, Wisconsin, Texas, and Florida. There were a total of 900 refrigerated warehouses, with 492 being public and 408 private or semi-private.

Western US Cold Chain Storage Market, Type, 2020-2024 (US$ Million)

Type 2020 2021 2022 2023 2024 CAGR Facilities/Services 11,070.4 11,471.5 12,280.0 14,460.1 17,027.1 17.8% Refrigerated Warehouse 6,765.4 6,983.0 7,445.7 8,733.9 10,242.8 17.3% Private & Semi-Private 1,421.5 1,478.4 1,588.3 1,877.8 2,218.1 18.1% Public 5,343.9 5,504.6 5,857.4 6,856.1 8,024.7 17.0% Cold Room 4,305.0 4,488.5 4,834.3 5,726.2 6,784.4 18.4% Equipment 1,371.1 1,414.9 1,508.5 1,769.0 2,074.4 17.3% Blast Freezer 211.8 220.5 237.1 280.5 331.6 18.2% Walk-in Cooler and Freezer 880.5 905.0 961.0 1,122.5 1,310.9 16.8% Deep Freezer 155.5 164.0 178.6 214.4 256.1 19.5% Others 123.3 125.5 131.9 151.6 175.8 15.4% Total 12,441.5 12,886.4 13,788.5 16,229.0 19,101.6 17.7% By Temperature Range

Frozen (-18°C to -25°C) accounted for 60.4% market share in 2024. Frozen (-18°C to -25°C) segment caters to products that need to be stored at sub-zero temperatures ranging from -18°C to -25°C to prevent microbial growth and preserve quality over extended periods. This range is typical for storing products like ice cream, frozen foods such as vegetables, pizzas, and prepared meals, and some biological samples.

Frozen storage is crucial in industries like food service and retail, where maintaining the texture, taste, and nutritional value of products is essential for consumer satisfaction. For example, a major frozen foods manufacturer would utilize these temperature conditions in their distribution centers to ensure that goods remain frozen until they reach retail outlets or end consumers.

Western US Cold Chain Storage Market, Temperature Range, 2020-2024 (US$ Million)

Temperature Range 2020 2021 2022 2023 2024 CAGR Chilled (0°C to 15°C) 3,564.0 3,663.1 3,889.2 4,544.1 5,304.9 16.7% Frozen (-18°C to -25°C) 7,518.4 7,786.0 8,329.6 9,802.3 11,535.4 17.7% Deep-frozen (Below -25°C) 1,359.1 1,437.3 1,569.6 1,882.6 2,261.3 19.8% Total 12,441.5 12,886.4 13,788.5 16,229.0 19,101.6 17.7%

By Application Analysis

Food & Beverages dominated the market with 76.2% market share in 2024. In the western US, the cold chain storage market for food & beverages is being driven by a strong combination of fresh-produce volume, import/export logistics and evolving consumer demand. The west region benefits from large agricultural output in states such as California, where fruits, vegetables, dairy and nuts require temperature-controlled storage to preserve quality and shelf life.

One key driver is the rising demand for fresh and frozen food products delivered via retail and e-commerce channels, which is increasing pressure on storage providers to expand capacity and enhance service levels. Logistics providers in the region are investing in automation, real-time temperature monitoring, advanced warehouse management systems and energy-efficient refrigeration to meet both regulatory requirements (such as food-safety standards) and client expectations.

Strategic proximity to major ports on the Pacific, combined with strong domestic production, gives western storage hubs an advantage for both inbound imports (e.g., frozen seafood) and outbound regional distribution.

Western US Cold Chain Storage Market, Application, 2020-2024 (US$ Million)

Application 2020 2021 2022 2023 2024 CAGR Food & Beverages 9,491.7 9,827.2 10,511.0 12,366.5 14,549.7 17.7% Fruits & Vegetables 1,295.48 1,346.20 1,445.12 1,706.58 2,015.01 18.1% Fruit Pulp & Concentrates 678.39 697.46 740.73 865.66 1,010.96 16.8% Dairy Products 1,816.85 1,894.32 2,040.28 2,417.96 2,863.84 18.4% Fish, Meat, and Seafood 3,395.24 3,496.53 3,719.77 4,353.86 5,094.02 17.0% Processed Food 1,095.83 1,149.25 1,244.91 1,484.76 1,767.48 19.0% Bakery & Confectionary 773.34 795.76 845.88 989.32 1,156.48 16.9% Others 436.52 447.69 474.27 548.39 641.86 16.4% Pharmaceuticals 2,175.8 2,262.6 2,430.6 2,872.5 3,394.1 18.2% Vaccines 1,064.72 1,106.98 1,188.93 1,404.79 1,659.51 18.1% Blood Banking 692.07 722.28 778.70 923.66 1,095.19 18.6% Others 418.98 433.34 462.99 544.09 639.41 17.5% Others 774.1 796.6 846.9 990.0 1,157.8 16.9% Total 12,441.5 12,886.4 13,788.5 16,229.0 19,101.6 17.7% Key Market Segments

By Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

By Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

By Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

Drivers

Increasing Demand for Fresh Food and Pharmaceuticals

The Western United States, with its vast agricultural outputs and burgeoning pharmaceutical industry, serves as a vital center for the cold chain storage market. This region, particularly states like California, Washington, and Oregon, is renowned for its extensive production of fresh produce and dairy products.

These products require meticulous handling and precise temperature control to maintain freshness and nutritional quality from farm to consumer. The demand for these perishable goods is on the rise, fueled by increasing consumer preferences for fresh, organic, and high-quality foods. This trend necessitates robust cold chain logistics to ensure that these sensitive products withstand the journey through diverse climates and reach markets in optimal condition.

Cold chain storage services are crucial in the pharmaceutical industry, particularly as it expands into temperature-sensitive biopharmaceuticals. As per the reports, South San Francisco stands as the epicenter of the largest biotech cluster globally, harboring over 200 companies. This thriving hub attracts a skilled life sciences workforce from nearby academic institutions, further fueling its innovation and growth.

Restraints

Regulatory and Environmental Challenges

The cold chain industry in the Western US operates under stringent environmental regulations, which are primarily focused on reducing greenhouse gas emissions and minimizing the environmental footprint of logistics operations. These regulations are particularly strict in states like California, which leads the nation in implementing progressive environmental policies.

Compliance with these regulations involves adopting newer, more eco-friendly technologies and practices, such as using refrigerants with a lower global warming potential, investing in energy-efficient cooling systems, and optimizing logistics routes to reduce fuel consumption.

For instance, the inclusion of greenhouse gas emissions in California’s AB 32 GHG Inventory, as part of the Priority Climate Action Plan (PCAP), presents regulatory challenges for the Western Cold Chain Market. Compliance with emission reduction targets and reporting requirements mandated by AB 32 regulations may necessitate investments in energy-efficient technologies and sustainable practices, increasing operational costs for cold chain facilities.

Growth Factors

Expansion into Organic and Specialty Foods

The shifting consumer preferences towards organic and specialty foods present a significant opportunity for the cold chain industry, particularly in the Western US, known for its health-conscious and eco-aware population. These types of foods often come with stringent requirements for quality and freshness, demanding robust and precise cold chain solutions.

Organic products, for instance, must be kept free from contamination by non-organic substances throughout their journey, necessitating dedicated storage and transportation facilities that prevent cross-contamination. Similarly, specialty foods, which can include exotic fruits, artisan cheeses, or craft beverages, often require specific temperature and humidity conditions to maintain their unique qualities.

In May 2023, the USDA (US Department of Agriculture) allocated $75 million via OMDG to boost domestic organic agriculture. The Oregon Organic Coalition plans to enhance demand for Oregon and Washington organic products, targeting specialty food and farm-to-school markets.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic headwinds such as elevated energy and labour costs are impacting the western US cold-chain storage market by putting pressure on margins for facility operators and pushing investment toward efficiency-improving technologies.

Rising fuel prices and inflation raise the cost of inland logistics feeding cold storage hubs, which encourages consolidation of warehousing and greater utilisation of existing capacity rather than fast expansion. Additionally, currency and interest-rate fluctuations can affect cost of imported equipment as well as financing cost for new build cold storage facilities.

Geopolitical factors are increasingly relevant for western US cold chain operations because the region is a gateway for imports and exports. Trade restrictions, tariffs, port labour disputes or disruptions at major West Coast ports can interrupt inbound volumes of perishables (especially seafood, produce and frozen goods) and thus reduce demand for storage.

Geopolitical tensions also raise risks of supply-chain instability which influences service providers to diversify sourcing and build buffer storage closer to end markets. In particular operators in regions with heavy export or import orientation must factor in volatility from trade policy shifts and shipping route disruptions.

The combined effect of macro and geopolitical pressures is that cold-chain operators in the western US are shifting toward modular capacity, flexible storage contracts and increased redundancy in temperature-controlled infrastructure to mitigate risk.

Emerging Trends

Development of Green Technologies

In the Western US, where environmental consciousness is particularly high among consumers and businesses alike, there is a notable shift towards sustainable practices across all sectors, including logistics. For cold chain operators, this shift represents both a challenge and an opportunity to innovate and differentiate themselves in the market. Investing in green technologies such as solar-powered cooling systems and eco-friendly refrigerants aligns with the broader trends toward sustainability.

In March 2024, Nancy Skinner, a prominent social justice advocate, clean energy and climate change trailblazer, and accomplished legislator, highlighted that over the past two decades, California has consistently implemented groundbreaking legislation aimed at fostering innovation in clean energy and the advancement of new green technologies.

Solar-powered cooling systems, for example, leverage the abundant sunshine in states like California, Arizona, and Nevada to power refrigeration units, thereby significantly reducing reliance on fossil fuels and lowering greenhouse gas emissions. Similarly, the use of eco-friendly refrigerants that have a lower global warming potential (GWP) than traditional refrigerants addresses growing regulatory and consumer pressure to minimize the environmental footprint of logistical operations.

Key Western US Cold Chain Storage Company Insights

Key players in the Bearings market include Lineage Logistics, Americold Logistics, United States Cold Storage, Vertical Cold Storage, Arcadia Cold Storage & Logistics, RealCold, Progressive Logistics, FreezPak Logistics, RLS Logistics, Smart Warehousing, Coastal Pacific Food Distribution, D L Cole & Company, and Other key players.

Lineage Logistics is the world’s largest temperature-controlled warehousing operator, operating a global network of 480 + facilities in 19 countries, and focuses on innovations in data science and sustainability within cold chain logistics. Americold Logistics is a major provider of temperature-controlled infrastructure and supply-chain services, owning/operating over 230 warehouses (~1.5 billion cubic feet of capacity) across multiple continents and offering value-added logistics solutions.

United States Cold Storage is a long-established U.S. refrigerated warehousing and logistics firm headquartered in New Jersey, with a nationwide facility network serving food-industry clients and offering public refrigerated warehouse services.

Top Key Players in the Market

- Lineage Logistics

- Americold Logistics

- United States Cold Storage

- Vertical Cold Storage

- Arcadia Cold Storage & Logistics

- RealCold

- Progressive Logistics

- FreezPak Logistics

- RLS Logistics

- Smart Warehousing

- Coastal Pacific Food Distribution

- D L Cole & Company

- Other key players

Recent Developments

- In October 2025, Americold, a leader in temperature-controlled logistics, real estate, and value-added services, announced that its Dublin facility received certification from Ireland’s Department of Agriculture, Food and the Marine (DAFM) to export products to the United States. This recognition establishes Americold as the sole dedicated third-party cold storage provider in Ireland with such authorization, enabling Irish meat producers to access a compliant and reliable logistics route to one of the world’s most highly regulated food markets.

- In April 2025, Lineage, Inc., the world’s largest temperature-controlled warehouse REIT, announced plans to strengthen its U.S. cold-storage network through strategic acquisitions, new greenfield projects, and the integration of advanced automation technologies.

- In January 2025, RealCold, a prominent cold chain logistics provider, announced the deployment of Blue Yonder Warehouse Management to digitally modernize its warehouse operations, enhancing efficiency and responsiveness to evolving customer and industry demands. The implementation will be carried out in collaboration with Netlogistik, an official Blue Yonder partner.

Report Scope

Report Features Description Market Value (2024) USD 19.1 Billion Forecast Revenue (2034) USD 92.5 Billion CAGR (2025-2034) 17.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Facilities/Services (Refrigerated Warehouse (Private & Semi-Private and Public), Cold Room), Equipment (Blast freezer, Walk-in Cooler and Freezer, Deep Freezer, Others)), By Temperature Range (Chilled (0°C to 15°C), Frozen (-18°C to -25°C), Deep-frozen (Below -25°C)), By Application (Food & Beverages (Fruits & Vegetables, Fruit Pulp & Concentrates, Dairy Products, Fish, Meat, and Seafood, Processed Food, Bakery & Confectionary, Others), Pharmaceuticals (Vaccines, Blood Banking, Others), and Others) Competitive Landscape Lineage Logistics, Americold Logistics, United States Cold Storage, Vertical Cold Storage, Arcadia Cold Storage & Logistics, RealCold, Progressive Logistics, FreezPak Logistics, RLS Logistics, Smart Warehousing, Coastal Pacific Food Distribution, D L Cole & Company, Other key players Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Western US Cold Chain Storage MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Western US Cold Chain Storage MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lineage Logistics

- Americold Logistics

- United States Cold Storage

- Vertical Cold Storage

- Arcadia Cold Storage & Logistics

- RealCold

- Progressive Logistics

- FreezPak Logistics

- RLS Logistics

- Smart Warehousing

- Coastal Pacific Food Distribution

- D L Cole & Company

- Other key players