Global Well Cementing Market Size, Share Analysis Report By Type (Primary, Remedial, Others), By Well Type (Oil, Gas, Shale Gas), By Application (Onshore, Offshore) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153620

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

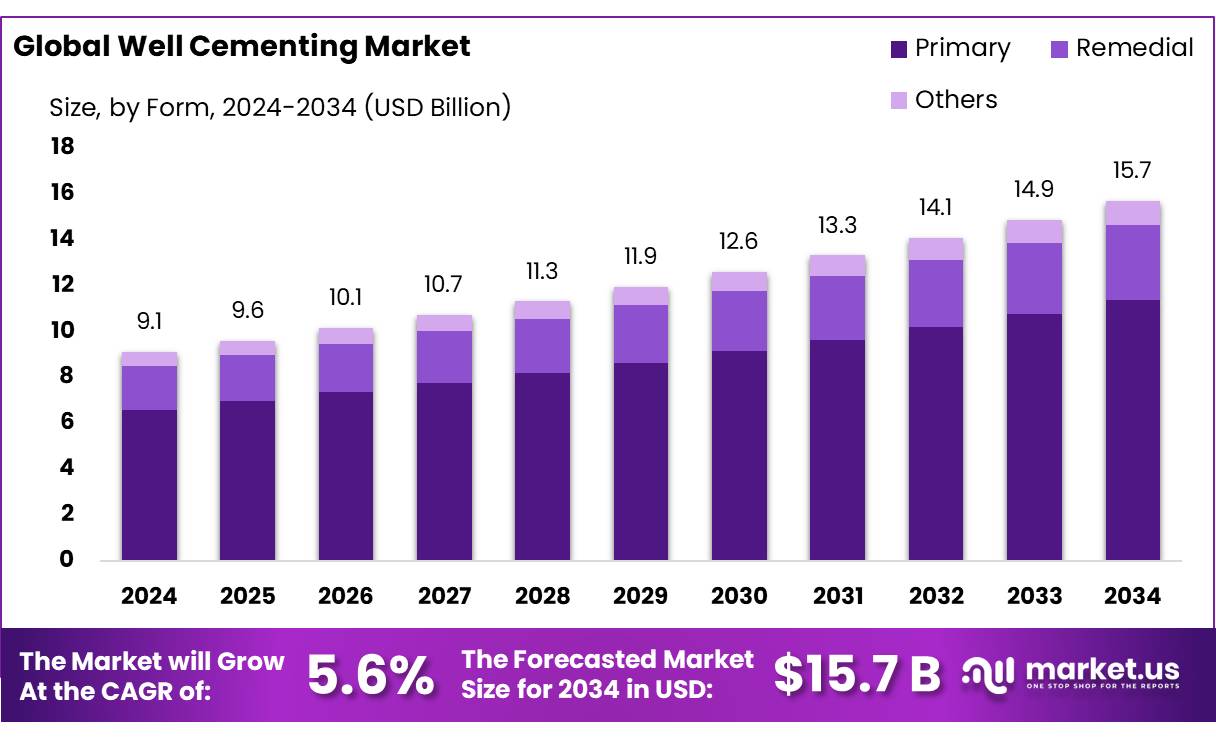

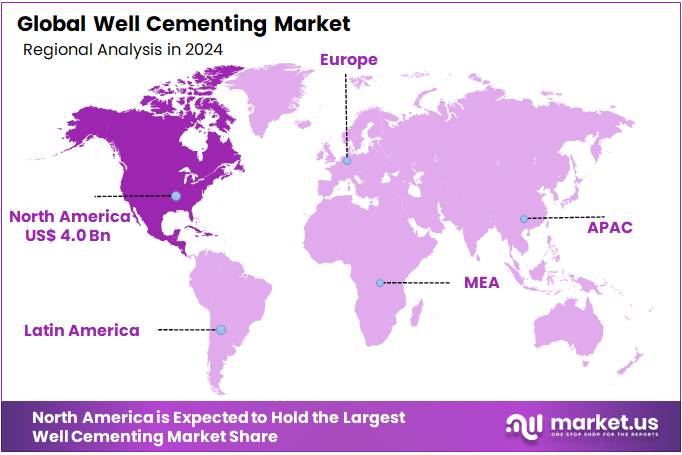

The Global Well Cementing Market size is expected to be worth around USD 15.7 Billion by 2034, from USD 9.1 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 44.7% share, holding USD 4.0 Billion revenue.

Well cementing concentrates play a crucial role in the oil and gas industry, particularly in the drilling and completion phases of wells. These concentrates, often consisting of cement and additives, are used to seal the annular space between the casing and the borehole, preventing fluid migration and ensuring well integrity. According to the U.S. Department of Energy, cementing is responsible for the long-term safety and performance of wells, with an estimated 50% of all well failures related to issues stemming from improper cementing.

The well cementing concentrates is shaped by technological advancements in the oil and gas extraction process. As global demand for oil and natural gas continues to rise, the need for efficient and durable cementing solutions has become more pressing. According to the U.S. Energy Information Administration (EIA), the global energy demand is expected to grow by 28% between 2015 and 2040, driving the exploration of new oil fields, especially in offshore and deepwater locations. This surge in exploration activities is a primary factor boosting the demand for high-quality well cementing concentrates.

Governments worldwide have recognized the importance of well integrity in safeguarding the environment, prompting regulations to ensure cementing procedures are executed with high standards. In the U.S., the Environmental Protection Agency (EPA) has set specific cementing guidelines under the Safe Drinking Water Act to regulate well integrity, with a focus on preventing contamination of drinking water sources. As of 2022, the U.S. Department of Energy reported a 12% increase in the number of oil and gas wells, further escalating the need for efficient and high-quality cementing techniques.

Driving factors for the growth of well cementing concentrates include the expansion of drilling activities in offshore and unconventional oil fields. The global push towards energy security and the development of shale oil and gas fields, particularly in North America and the Middle East, has boosted demand for cementing services.

- According to the International Energy Agency (IEA), shale gas production in the U.S. is projected to account for 75% of the country’s natural gas output by 2040, which will require substantial cementing solutions to manage the increasing number of wells.

Key Takeaways

- Well Cementing Market size is expected to be worth around USD 15.7 Billion by 2034, from USD 9.1 Billion in 2024, growing at a CAGR of 5.6%.

- Primary held a dominant market position, capturing more than a 72.4% share in the Well Cementing Market.

- Oil held a dominant market position, capturing more than a 67.9% share in the Well Cementing Market.

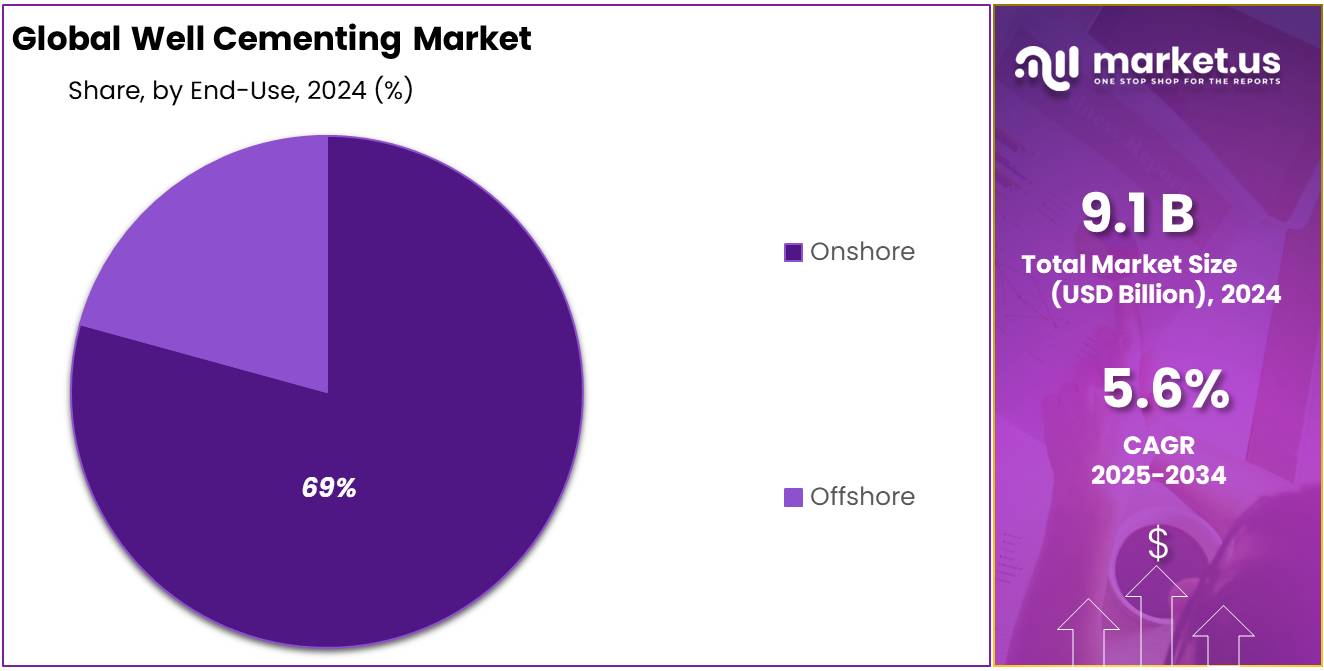

- Onshore held a dominant market position, capturing more than a 69.2% share in the Well Cementing Market.

- North America held a dominant position in the global Well Cementing Market, capturing approximately 44.70% of the total market share. The region accounted for a market value of nearly USD 4.0 billion.

By Type Analysis

Primary Cementing Leads with 72.4% Share in 2024 Due to Its Critical Role in Well Integrity

In 2024, Primary held a dominant market position, capturing more than a 72.4% share in the Well Cementing Market by Type. This leading position can be attributed to its essential role in establishing structural integrity and zonal isolation during the initial stages of well construction. Primary cementing is used to seal the annulus between the well casing and the borehole wall, which is fundamental for protecting freshwater zones and providing long-term support to the casing.

Its widespread application across both onshore and offshore drilling operations—especially in new exploration and development projects—continues to drive demand. The growing number of deepwater and unconventional wells, which require reliable primary cementing to withstand high pressure and temperature conditions, has further reinforced this segment’s prominence. Additionally, regulatory focus on well integrity and environmental protection has led operators to prioritize high-quality primary cementing practices.

By Well Type Analysis

Oil Wells Dominate with 67.9% Share in 2024 as Drilling Activities Rise Globally

In 2024, Oil held a dominant market position, capturing more than a 67.9% share in the Well Cementing Market by Well Type. This significant share reflects the continued global reliance on crude oil and the steady pace of exploration and production projects aimed at meeting energy demand. Cementing operations in oil wells are critical for ensuring wellbore stability, protecting water zones, and securing casing integrity during the drilling and production phases.

The growth in offshore and onshore oil drilling, particularly in regions such as the Middle East, North America, and Asia-Pacific, has strongly contributed to the rising use of well cementing services for oil wells. Oil-producing countries have been increasing drilling budgets to tap into proven and new reserves, reinforcing the need for consistent and high-quality cementing processes.

By Application Analysis

Onshore Cementing Leads with 69.2% in 2024 Backed by Expanding Land-Based Drilling Projects

In 2024, Onshore held a dominant market position, capturing more than a 69.2% share in the Well Cementing Market by Application. This strong foothold is largely driven by the high number of land-based oil and gas wells across major producing regions such as North America, the Middle East, and parts of Asia. Onshore drilling projects are generally more cost-effective and logistically simpler compared to offshore operations, encouraging continuous investments from operators seeking quicker project turnaround and lower development costs.

The increasing focus on redeveloping mature onshore fields, coupled with the expansion of new exploration activities in countries with untapped reserves, has further supported the demand for well cementing services in these regions. Cementing is essential in such environments to secure casing, prevent fluid migration, and ensure long-term well performance.

Key Market Segments

By Type

- Primary

- Remedial

- Others

By Well Type

- Oil

- Gas

- Shale Gas

By Application

- Onshore

- Offshore

Emerging Trends

Adoption of Low-Carbon Cementing Technologies

A significant trend in the well cementing industry is the increasing adoption of low-carbon cementing technologies. This shift is driven by both environmental concerns and regulatory pressures aiming to reduce the carbon footprint of cement production, which is a major contributor to global greenhouse gas emissions.

In 2024, the U.S. Department of Energy announced plans to establish a Cement and Concrete Center of Excellence, with up to $9 million in funding allocated to national laboratories. The center aims to accelerate the development and adoption of novel low-carbon cement and concrete technologies, supporting the U.S. goal of achieving net-zero carbon emissions by 2050.

Similarly, the Indian government approved the establishment of five carbon capture and utilization (CCU) testbeds in the cement sector. These testbeds are intended to showcase effective pathways to achieve ‘net-zero’ emissions through the deployment of CCU technologies, marking a significant step toward decarbonizing heavy industries in India.

Drivers

Increased Demand for Oil and Gas Production

One of the key driving factors behind the growth of the well cementing concentrates market is the increasing demand for oil and gas production worldwide. As energy needs rise globally, there is a corresponding surge in exploration and drilling activities, particularly in regions like North America, the Middle East, and Asia Pacific. This growing demand is boosting the need for well cementing services to ensure the structural integrity of oil and gas wells.

The International Energy Agency (IEA) reported in 2023 that global oil demand is projected to increase by 1.2 million barrels per day (mb/d) in 2024, reflecting continued growth in both transportation and industrial sectors. As a result, the need for efficient and reliable well cementing practices has never been greater. Cementing is a critical part of the drilling process, ensuring that the wellbore remains stable, preventing the migration of fluids, and protecting the environment from contamination.

Government initiatives also play a role in driving the demand for well cementing. For example, in the U.S., the Department of Energy (DOE) has been pushing for advancements in energy extraction technologies and improving safety standards in the oil and gas industry. The DOE’s support for innovative drilling technologies, which includes more efficient cementing methods, is helping improve both the safety and productivity of drilling operations.

Additionally, environmental regulations are influencing well cementing practices. Countries like Canada and Norway are implementing stricter regulations on oil and gas extraction, focusing on environmental protection and reducing greenhouse gas emissions. These regulations encourage companies to adopt best practices in cementing to meet compliance requirements and reduce environmental impact.

Restraints

Environmental and Regulatory Challenges

One of the major restraining factors for the well cementing industry is the growing environmental concerns and the tightening of regulations. As oil and gas companies continue their operations, they face increasing scrutiny over their environmental impact, especially regarding the cementing process, which is critical for wellbore stability and preventing leaks. Cementing operations often involve the use of chemicals and materials that can potentially harm the environment if not managed properly.

In recent years, various environmental agencies have imposed stricter regulations on the oil and gas sector to minimize the risk of contamination. In the United States, the Environmental Protection Agency (EPA) has introduced regulations that limit the use of certain chemicals in cementing operations. These regulations aim to reduce the risk of groundwater contamination, which can be caused by the improper disposal of cementing fluids and additives. Similarly, in the European Union, stricter rules around the use of hazardous chemicals in drilling and cementing are pushing companies to adapt and find more environmentally friendly alternatives.

Additionally, as global focus intensifies on climate change, government initiatives are becoming more aggressive in requiring energy companies to reduce their carbon footprint. The EU Green Deal and the U.S. Clean Energy Standard are examples of initiatives that promote cleaner energy production and discourage practices that harm the environment. These regulations are putting pressure on oil and gas companies to adopt cleaner, more sustainable technologies in well cementing, which can result in higher operational costs.

Despite efforts to adapt to these challenges, companies are finding it difficult to balance the need for cost-effective cementing solutions with the growing environmental compliance requirements. This often leads to increased costs associated with sourcing eco-friendly materials and technology.

Opportunity

Government Initiatives and Technological Advancements

A significant growth opportunity for the well cementing industry lies in the increasing adoption of low-carbon technologies and government-backed initiatives aimed at reducing industrial emissions. These efforts are not only addressing environmental concerns but also creating avenues for innovation and market expansion.

In the United States, the Department of Energy (DOE) has announced plans to establish a Cement and Concrete Center of Excellence, with up to $9 million in funding allocated to national laboratories. The center aims to accelerate the development and adoption of novel low-carbon cement and concrete technologies, thereby enhancing the industry’s economic competitiveness and contributing to the nation’s goal of achieving net-zero carbon emissions by 2050.

Similarly, in Australia, the federal government has committed over $52 million to Cement Australia’s Railton plant as part of the $330 million Powering the Regions Fund. This investment supports the plant’s transition to alternative fuel methods, such as using wood-based fiber and shredded tires, to reduce coal usage and cut emissions by 107,000 tonnes annually.

These initiatives are encouraging the well cementing industry to explore and implement sustainable practices. By aligning with government objectives and investing in innovative technologies, companies can not only comply with regulatory standards but also position themselves as leaders in the transition to a low-carbon economy.

Regional Insights

North America Leads Global Well Cementing Market with 44.70% Share in 2024, Valued at USD 4.0 Billion

In 2024, North America held a dominant position in the global Well Cementing Market, capturing approximately 44.70% of the total market share. The region accounted for a market value of nearly USD 4.0 billion, supported by consistent upstream activities across key oil and gas-producing areas, particularly in the United States and Canada.

The United States continues to lead North American cementing operations, backed by a well-established oilfield service infrastructure and favorable regulatory environment that encourages domestic energy development. As per the U.S. Energy Information Administration (EIA), U.S. crude oil production averaged 12.9 million barrels per day in 2024, reflecting a steady increase in drilling activity and thereby supporting cementing requirements for new wells and maintenance operations.

In Canada, the development of oil sands and unconventional resources further contributes to regional demand, especially for primary cementing in onshore wells. Moreover, companies across North America are adopting advanced cementing additives to ensure zonal isolation, reduce environmental risks, and comply with well integrity standards.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Halliburton is one of the leading players in the well cementing market, providing a range of services and solutions aimed at ensuring well integrity. The company’s expertise in cementing services, including advanced formulations and equipment, makes it a key player in the global market. With a strong global presence, Halliburton caters to both onshore and offshore operations, leveraging its innovative technologies to meet the growing demand for well cementing services. Halliburton’s focus on sustainability and safety enhances its market position.

COSL is a major player in the well cementing market, particularly in the Asia Pacific region, where it provides a broad range of oilfield services. Known for its advanced cementing technologies and commitment to high-quality services, COSL supports both conventional and unconventional oil and gas exploration projects. The company’s expertise in cementing services, backed by strong regional knowledge, enables it to effectively meet the needs of clients while adhering to industry standards. COSL continues to expand its market share through continuous innovation.

Baker Hughes is a key player in the well cementing market, offering innovative solutions and technology-driven services. The company provides advanced cementing equipment and high-performance cementing systems tailored to specific well conditions. Baker Hughes focuses on improving wellbore integrity and minimizing environmental impact through sustainable cementing solutions. With a global presence and a commitment to customer satisfaction, Baker Hughes remains a major player in the market, continuously adapting its services to meet the evolving needs of the energy sector.

Top Key Players Outlook

- Halliburton

- Schlumberger

- COSL-China Oilfield Services Limited

- Baker Hughes

- C&J Energy Services

- Trican Well Service Ltd.

- Superior Energy Services

- Weatherford

- Calfrac Well Services Ltd.

- Sanjel Energy Services

- Gulf Energy SAOC

Recent Industry Developments

In the second quarter of 2025 Halliburton, revenue increased to $5.5 billion, with net income of $472 million, indicating a recovery from earlier declines.

Baker Hughes, a prominent player in the well cementing market, reported a revenue of $27.8 billion in 2024, marking a 9% increase from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 9.1 Bn Forecast Revenue (2034) USD 15.7 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Primary, Remedial, Others), By Well Type (Oil, Gas, Shale Gas), By Application (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Halliburton, Schlumberger, COSL-China Oilfield Services Limited, Baker Hughes, C&J Energy Services, Trican Well Service Ltd., Superior Energy Services, Weatherford, Calfrac Well Services Ltd., Sanjel Energy Services, Gulf Energy SAOC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Halliburton

- Schlumberger

- COSL-China Oilfield Services Limited

- Baker Hughes

- C&J Energy Services

- Trican Well Service Ltd.

- Superior Energy Services

- Weatherford

- Calfrac Well Services Ltd.

- Sanjel Energy Services

- Gulf Energy SAOC