Global Wearable Technology Market By Product (Wrist-Wear, Eyewear & Headwear, Footwear, Neckwear, Body-wear, and Others), By Application (Consumer Electronics, Healthcare, Enterprise & Industrial Applications, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: April 2024

- Report ID: 16570

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

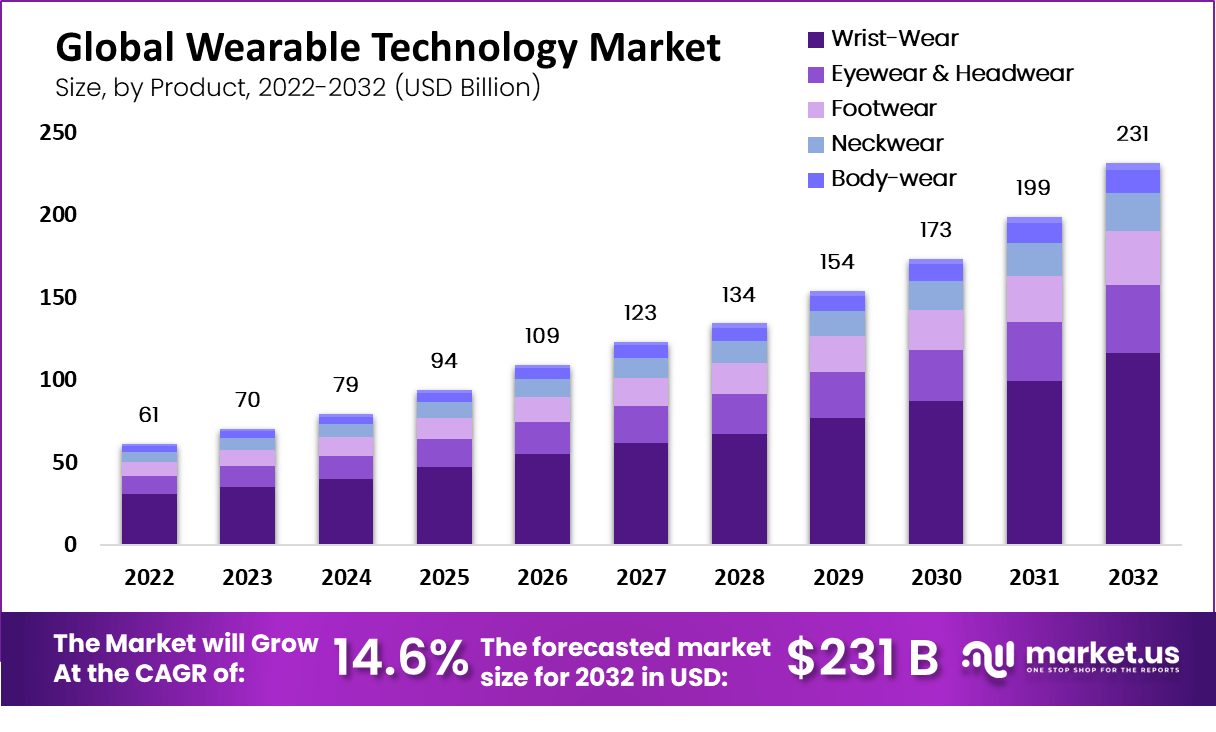

The Global Wearable Technology Market size is expected to be worth around USD 231 Billion by 2032 from USD 70 Billion in 2023, growing at a CAGR of 14.60% during the forecast period from 2023 to 2032.

Wearable technology refers to electronic devices that can be worn on the body, often in the form of accessories like smartwatches, fitness trackers, smart glasses, and even clothing with embedded sensors. These devices are designed to collect and monitor data, provide real-time information, and offer interactive functionalities to enhance the user’s daily activities and overall experience.

The wearable technology market has witnessed remarkable growth in recent years, driven by advancements in miniaturization, sensor technology, connectivity, and the increasing demand for health and fitness monitoring. Wearable devices have become popular among consumers seeking to track their physical activities, monitor sleep patterns, and manage their overall well-being. Fitness trackers, in particular, have gained widespread adoption and have become an integral part of many people’s exercise routines.

Key Takeaways

- The wearable technology market is poised for substantial growth, with a projected worth of around USD 231 billion by 2032, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 14.60%.

- In 2022, the largest share of global revenue was held by the wrist-wear segment. It accounted for more than 49.45%.

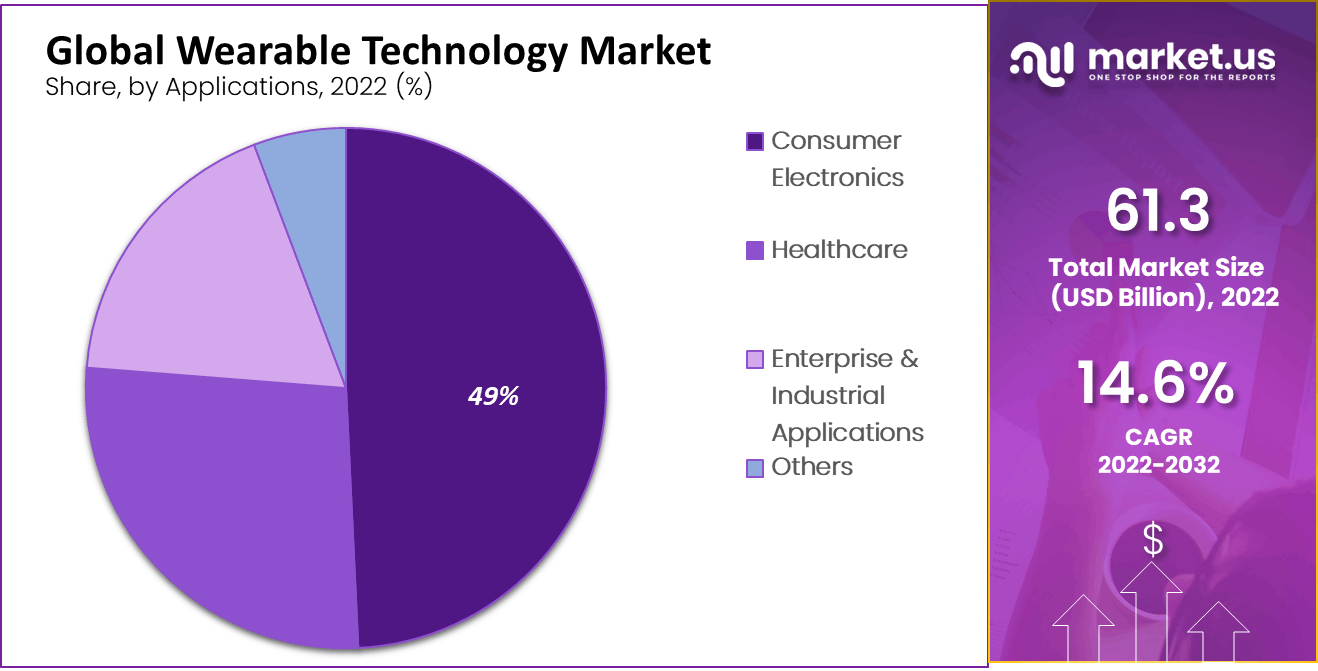

- In 2022, the consumer electronics segment dominated the industry and represented more than 48.95% of total revenue.

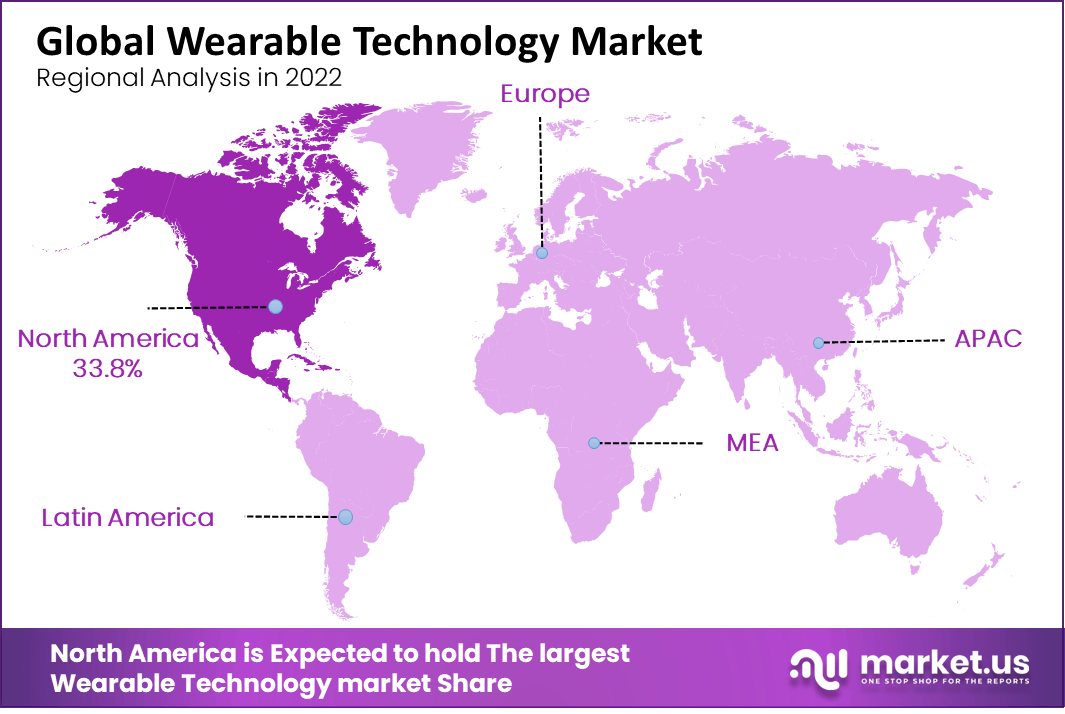

- North America emerges as the dominant market for wearable devices, attributed to early adoption and technological advancements, while the Asia Pacific region exhibits the highest projected CAGR, driven by lifestyle changes and increased demand for wearable medical equipment.

Product Analysis

Wrist-Wear Segment Dominates The Market Globally

The global industry can be further divided into the following product categories: wristwear, eyewear and headwear, footwear (neckwear), body wear (body wear), etc. In 2022, the largest share of global revenue was held by the wrist-wear segment. It accounted for more than 49.45%. To increase sales, many smartwatch manufacturers and fitness trackers targeted athletes, adventurers, and sports fans. These devices track fitness metrics and promote healthy living by providing information about calorie intake, water intervals, and step monitoring.

For the forecasted period, headwear & eyewear will be the second-largest product segment and the second-fastest-growing. This segment is expected to grow due to the increasing use of Virtual Reality headsets and Augmented Reality headsets (VR & AR), in the multimedia and healthcare sectors. Smart hats will also be growing in popularity. Smart caps’ data-driven insights, tracking technology, and increasing popularity are expected to support segment development. Numerous companies such as Spree Wearables, and Life BEAM are now introducing smart caps to the global market.

Application Analysis

In 2022, the consumer electronics segment dominated the industry and represented more than 48.95% of total revenue. This segment has a high percentage of the overall revenue. It is responsible for the rise in wearable technology such as AR/VR headsets and fitness bands. Garmin Ltd., Omron, Apple Inc. and Nemaura are all focused on making gadgets that provide data. This includes both clinical and non-clinical information.

Nemaura’s sugarBEAT Wearable Technology, for example, eliminates the need to calibrate fingernails every day and allows frequent glucose monitoring for diabetic patients. The healthcare sector is expected to experience the second-fastest growth rate. Segment growth will be supported by the expanding application scope of wearable technology in the pharma industry.

Doctors can now connect via digital health tech with their patients through telehealth and phone apps. This allows doctors to remotely monitor patients. The health sector is catching on to the VR and AR advances. The medical practice uses VR technology to aid in surgical training and procedures.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Based on Product

- Wrist-Wear

- Eyewear & Headwear

- Footwear

- Neckwear

- Body-wear

- Others

Based on Application

- Consumer Electronics

- Healthcare

- Enterprise & Industrial Applications

- Others

Driving Factors

Portability And Compactness Of The Product To Drive The Market Growth Of The Market

The global wearable technology market is forecast to grow due to its portability and compactness. Wearable devices have become smaller and more portable over the years. This is due to technological advances in the wearable technology sector. Computing devices used to be bulky, but their size decreased gradually. Now, products that use computing technology are slimmer and more stylish. These advanced technological devices, such as smart glasses, smartwatches, and military heads-up displays, are small and multi-functional.

The global wearable tech market is expected to grow over the forecast period due to the increasing use of wearable technologies in different sectors. Many sectors are using wearable technology, including medical, industrial, and military. Head-up displays are expected to be used in a variety of sectors, including construction, industry, military, and the health and fitness sector.

Restraining Factors

High Cost Of The Wearable Technology To Restraint The Growth Of The Market.

The high cost of wearable technology is expected to limit growth in the global market for wearable technology during the forecast period. Wearable devices can be more expensive than other electronic devices. The product’s price is high because the technology is still in its infancy and there are fewer players in the market.

The product is unaffordable for middle-class consumers due to its high price. The global wearable technology market is likely to slow down due to slower consumer acceptance. Consumer acceptance of this technology remains the greatest obstacle. Wearable technology products are not easy to accept. Wearable technology products in a cyborg-like form, for example, will be difficult to accept if the person is not used to them.

Growth Opportunities

Higher Quality And Innovation In The New Product Design Has The Most Growth Opportunity.

Innovations in product design can lead to lucrative growth opportunities. Wearable technology products will be more accepted if they are of higher quality. Only a handful of players currently dominate this market. While multifunctional products like Nike+Fuelband and Google Glass are currently available, they are expensive and not affordable for middle-class customers. This market is very niche and new entrants will likely increase product quality and lower prices. Business opportunities can be created by new product launches.

To expand the product portfolio, major players in the market focus on research and development. For miCoach Mobile, Adidas introduced heart rate-based coaching, in September 2011. Runners who use the miCoach app can now benefit from the new mobile heart rate-based coaching system to help them reach their training goals. Adidas also launched the miCoach powered adizero F50 – The boot with a brain – In November 2011, Adidas released the intelligent football boot, adizero F50. It is known as the “football boot with a brain”, and it is expected that it will bring smart technology to the game.

Trending Factors

Wearable Devices With The Functions Of Wellness And Fitness Awareness Is The Key Trend Of This Market.

There are currently a number of products on the market, including smart glasses, smartwatches and sleep sensors, smart clothes, activity monitors as well as wearable patches, drug delivery systems, continuous glucose monitors, hand-worn terminals, and other smart devices. As major players in the sector continue to innovate and research in this area, additional wearable technology products will likely be introduced. New entrants will likely enter the market.

However, Microsoft, for example, is creating its own augmented reality headset that will compete directly with Google Glass. Smart sports glasses with advanced features will be a big hit in the fitness and wellness industry. With the rising incidence of old age diseases, and growing awareness about health and fitness among both young and old, activity monitors and sleep sensors will see a lot of growth. The fitness and wellness market will see a significant increase in sales of wearable technology products due to an aging population.

Regional Analysis

North America Dominate The Market Globally In Terms Of Region.

North America is the dominant market for wearable devices. This is due to its early adoption and global technological hub. The growth factor has increased due to increasing awareness about the use of products and health concerns. The Asia Pacific market for wearable devices is expected to grow at the highest CAGR.

It is expected that the market will be the largest in the future. This is due to lifestyle changes, increased demand for wearable medical equipment, and the fact that the region is known for its fitness and sports. China and India will enjoy the highest growth rates from the rest of Asia Pacific, due to their high populations.

China and India offer wearable devices at a low price, which could help increase consumer electronics adoption. The market is expected to see steady and substantial growth in South America and Europe over the forecasted period. This is due to factors like increased awareness and growing tech-savvy populations.

The Middle East and Africa will also see significant growth over the forecasted time due to the increased adoption of technology by the hospitality industry. They provide wristbands to guests that they can use to pay for meals and open doors. The market is also witnessing a huge shift from smartwatches to fitness bands.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market for wearable technology is competitive and includes many individual players. Companies such as Xiaomi, Apple, and Samsung hold a significant market share. Many startups are also entering the wearable technology market, which in turn intensifies market competition. Companies invest continuously in new products, expanding operations, and entering into strategic mergers or acquisitions to keep their market at a competitive edge.

Top Market Leaders

- Alphabet Inc.

- Samsung Electronics Co., Ltd.

- Sony Corp.

- Huawei Technologies Group Co., Ltd.

- Apple Inc.

- Xiaomi Corp.

- Adidas AG

- Nike, Inc.

- Fitbit, Inc.

- Garmin Ltd.

- Other Key Players

Recent Developments

- In February 2024, Samsung introduced the Galaxy Fit 3 to the Indian market. This entry-level health and fitness tracker features a 1.6-inch AMOLED display, which is 45% wider than its predecessor. The device, encased in an aluminum frame, is available in grey, silver, and pink gold colors.

- In a related development, Noise, another key player in the wearable technology sector, announced the launch of the NoiseFit Vortex Plus in January 2024. This new smartwatch is equipped with Bluetooth calling capabilities, enhancing its utility for users.

Report Scope

Report Features Description Market Value (2023) US$ 70 Bn Forecast Revenue (2032) US$ 231.5 Bn CAGR (2023-2032) 14.6% Base Year for Estimation 2023 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product: Wrist-Wear, Eyewear & Headwear, Footwear, Neckwear, Body-wear, and Others; By Application: Consumer Electronics, Healthcare, Enterprise & Industrial Applications, and Others. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Alphabet Inc., Samsung Electronics Co., Ltd., Sony Corp., Huawei Technologies Group Co., Ltd., Apple Inc., Xiaomi Corp., Adidas AG, Nike, Inc., Fitbit, Inc., Garmin Ltd., Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is wearable technology?Wearable technology refers to electronic devices worn as accessories or integrated into clothing that provide functionality such as tracking health and fitness data, monitoring vital signs, providing connectivity and convenience services, or offering connectivity and convenience solutions.

How big is the wearable technology market?The Global Wearable Technology Market size is expected to be worth around USD 231 Billion by 2032 from USD 61.3 Billion in 2022, growing at a CAGR of 14.60% during the forecast period from 2023 to 2032.

What are the 5 wearable technologies today?Wearable technology covers an expansive spectrum of functionality. This range extends from smartwatches and fitness trackers like the Fitbit Charge to VR headsets, smart jewelry pieces, web-enabled glasses and Bluetooth headsets.

Who is the market leader in wearable technology?Market Leaders: Alphabet Inc., Samsung Electronics Co., Ltd., Sony Corp., Huawei Technologies Group Co., Ltd., Apple Inc., Xiaomi Corp., Adidas AG, Nike, Inc., Fitbit, Inc., Garmin Ltd., Other Key Players.

Which is the first largest wearable brand?Apple is the undisputed market leader when it comes to wearable devices. Their Apple Watch remains the best-selling wearable device on the market and their customer loyalty has become legendary. Other major wearable brands include Samsung, Fitbit, Garmin and Xiaomi.

Wearable Technology MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Wearable Technology MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Alphabet Inc.

- Samsung Electronics Co., Ltd.

- Sony Corp.

- Huawei Technologies Group Co., Ltd.

- Apple Inc.

- Xiaomi Corp.

- Adidas AG

- Nike, Inc.

- Fitbit, Inc.

- Garmin Ltd.

- Other Key Players