Global Water Soluble Packaging Market Size, Share, Growth Analysis By Material (Polymers, Surfactants, Fibers), By Product (Bags, Pouches, Pods & Capsules), By Solubility Type (Hot Water, Cold Water), By End-use (Household Products, Agriculture, Medical, Retail, Chemicals, Water Treatment, Animal Waste, Fishing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144670

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

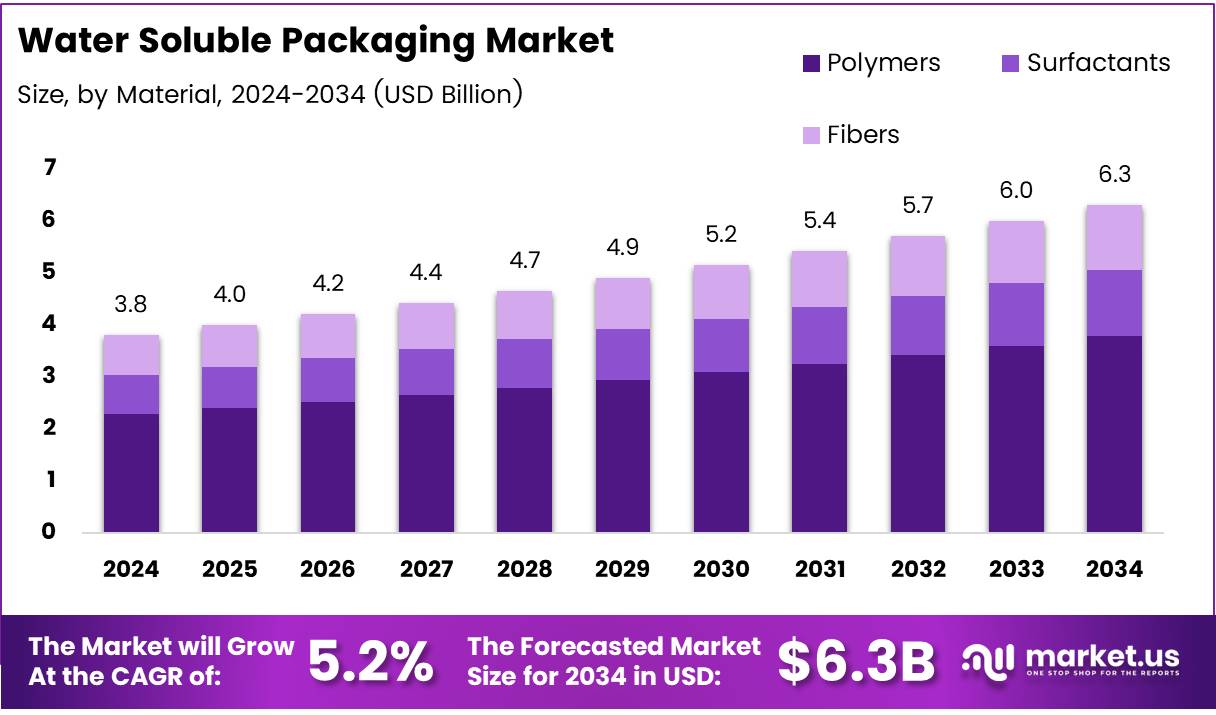

The Global Water Soluble Packaging Market size is expected to be worth around USD 6.3 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

The water soluble packaging market comprises packaging solutions designed to dissolve completely in water, eliminating the need for manual disposal and significantly reducing plastic waste. These materials, commonly made from polyvinyl alcohol (PVOH), are biodegradable and safe for a range of applications including detergents, agrochemicals, food ingredients, and healthcare products.

This market is gaining traction as industries and governments prioritize sustainable, single-use, and waste-reducing packaging alternatives in response to environmental regulations and shifting consumer expectations.

Water soluble packaging is emerging as a highly practical solution to reduce packaging waste while maintaining product safety and convenience. Its growing adoption is supported by measurable benefits in material efficiency.

For example, according to PlanetPristine, water soluble support structures reduce material use and waste by up to 60% compared to traditional plastic supports. The ability to fully dissolve without leaving residue makes this packaging ideal for controlled-dose applications and industries seeking environmentally responsible formats.

The market for water soluble packaging is expanding rapidly due to a combination of technological innovation, regulatory shifts, and evolving consumer preferences. Its role in premium product presentation is also becoming more evident.

According to BRPrinters, 61% of consumers are more likely to repurchase a luxury product if it comes in premium packaging. This highlights a growing opportunity for brands to merge sustainability with customer experience. The market is also witnessing strategic investments in product development to meet the specific needs of sectors like pharmaceuticals, personal care, and industrial chemicals.

The water soluble packaging market is on a strong growth trajectory, fueled by increasing demand for eco-friendly alternatives to single-use plastics. Opportunities are especially prominent in sectors where safe, dissolvable packaging offers operational efficiency—such as agriculture and healthcare.

Governments across regions like North America and Europe are introducing grants and funding programs to support green packaging innovation. Regulations such as the EU’s single-use plastic directive are accelerating the shift toward biodegradable options. As environmental compliance becomes more stringent, businesses are aligning with water soluble packaging to ensure both regulatory adherence and consumer appeal.

Key Takeaways

- Global Water Soluble Packaging Market expected to reach USD 6.3 Billion by 2034, growing at 5.2% CAGR from 2025-2034.

- Polymers led the Material segment in 2024 with a 65.3% share due to high solubility and versatile packaging applications.

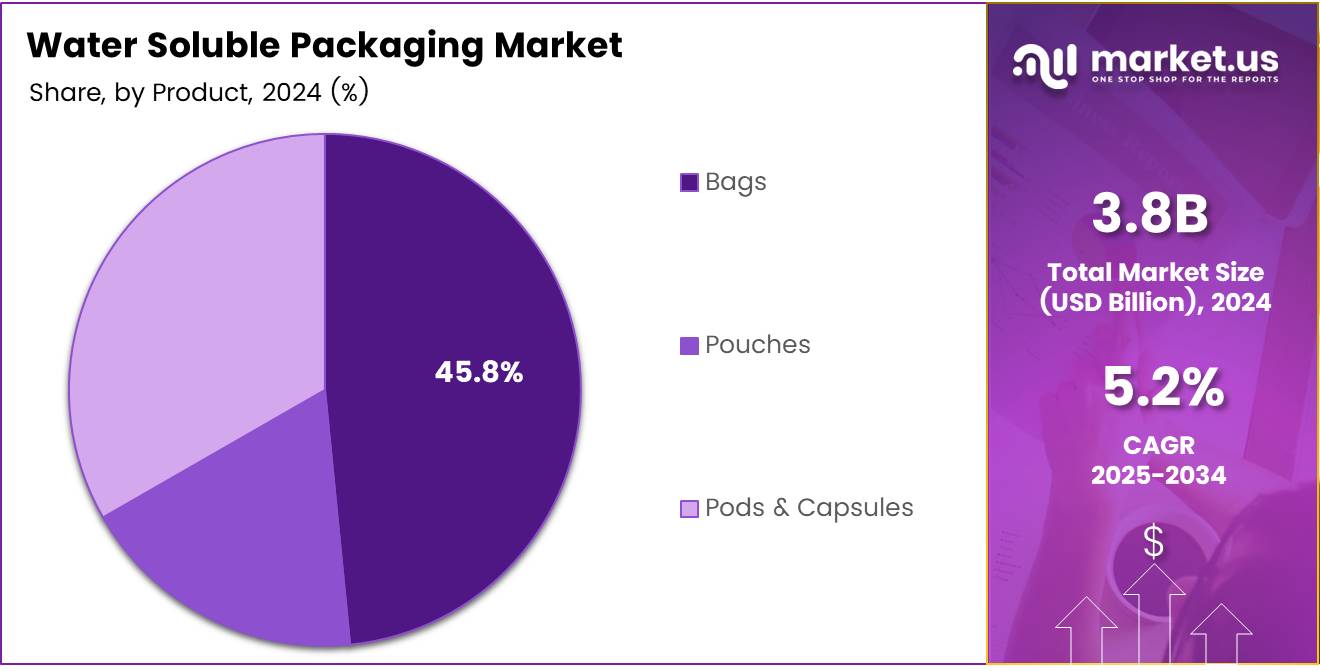

- Bags dominated the Product segment in 2024, capturing 45.8% market share, driven by use in detergents, agrochemicals, and food ingredients.

- Hot Water solubility segment held the largest market share (59%) in 2024, favored in industrial and medical packaging for quick solubility.

- Household Products segment held a 22.1% share in 2024, fueled by growing consumer demand for sustainable packaging.

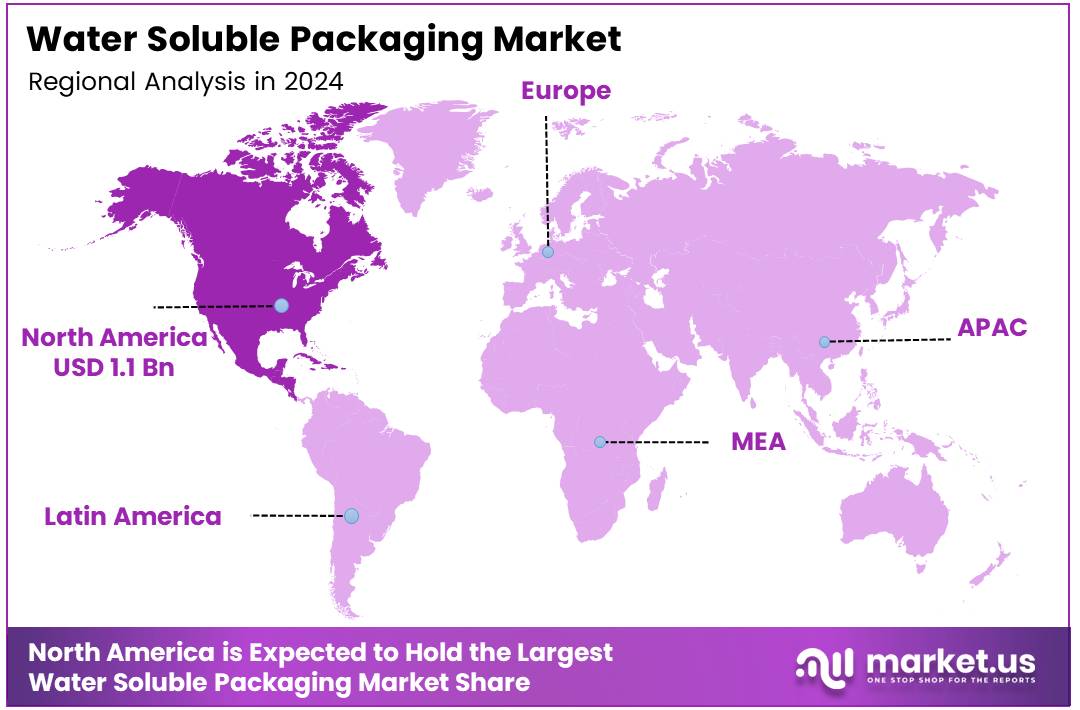

- North America dominated with 31.5% market share (USD 1.17 billion in 2024), driven by stringent regulations and high consumer awareness.

Material Analysis

Polymers lead with 65.3% share, driven by versatility and biodegradability in water-soluble packaging

In 2024, Polymers held a dominant market position in the By Material Analysis segment of the Water Soluble Packaging Market, with a 65.3% share. Their stronghold is largely attributed to their exceptional solubility, film-forming capabilities, and compatibility with a wide range of packaging formats.

Polyvinyl alcohol (PVA), in particular, continues to be a preferred choice due to its biodegradability and low environmental impact, aligning well with increasing sustainability regulations and consumer demand for eco-friendly solutions. Additionally, advancements in polymer chemistry have allowed manufacturers to tailor solubility rates and mechanical strength, widening application in industries like detergents, agrochemicals, and food.

Surfactants enhancing dispersion and solubility in complex formulations has made them indispensable in niche packaging applications, particularly in the cleaning and personal care sectors. Surfactants also contribute to improving product stability, further boosting their market relevance.

Fibers held a comparatively modest share, yet they are gaining traction for their potential in natural and biodegradable alternatives. With growing innovation in fiber-based films and packaging composites, this segment is poised for steady growth, especially as regulatory bodies push for plastic-free materials in packaging solutions.

Product Analysis

Bags lead with 45.8% share in 2024, driven by high demand across industrial and household applications

In 2024, Bags held a dominant market position in the By Product Analysis segment of the Water Soluble Packaging Market, accounting for a 45.8% share. This leadership is primarily attributed to their widespread use across both industrial and household sectors, particularly for packaging detergents, agrochemicals, and food ingredients.

Bags are favored for their ease of use, biodegradability, and compatibility with water-soluble polymers like PVA, aligning well with rising sustainability preferences among consumers and regulatory mandates pushing for eco-friendly alternatives.

Pouches followed as the second-largest segment. Their flexible nature, efficient material utilization, and suitability for unit-dose packaging make them a preferred choice in healthcare and personal care industries. Moreover, advancements in film-forming technology and increasing demand for convenient, single-use formats continue to support growth in this category.

Pods & Capsules gaining traction due to their precision dosing and tamper-proof features. These formats are increasingly popular in home care products and pharmaceuticals, where controlled release and user safety are critical. While still a niche compared to bags and pouches, this segment is projected to grow steadily with innovations in encapsulation technology and expanding applications.

Solubility Type Analysis

Hot Water Soluble Packaging Leads with 59% Share Owing to Faster Dissolution and Industrial Preference

In 2024, Hot Water held a dominant market position in the By Solubility Type Analysis segment of the Water Soluble Packaging Market, accounting for a substantial 59% share. This dominance is primarily driven by its rapid solubility in high-temperature environments, making it ideal for industrial applications such as detergent packaging, agrochemical doses, and medical-grade products.

Industries prefer hot water-soluble films due to their efficiency in reducing residue, minimizing environmental impact, and enhancing operational convenience. Furthermore, their compatibility with automated packaging systems and stronger film integrity until dissolution point has made them a go-to choice in sectors with stringent quality and hygiene standards.

On the other hand, Cold Water soluble packaging, while trailing behind, is gradually gaining traction in the consumer goods segment. It offers the benefit of usability in low-temperature settings, aligning well with personal care, home care, and food packaging applications.

However, due to slower solubility rates and limited industrial adaptability, its market share remains moderate in comparison. Nonetheless, with growing consumer demand for sustainable and convenient solutions, the Cold Water segment is poised for steady growth, especially in eco-conscious retail applications.

End-use Analysis

Household Products lead with 22.1% share in 2024, driven by rising eco-conscious consumer demand.

In 2024, Household Products held a dominant market position in the By End-use Analysis segment of the Water Soluble Packaging Market, with a 22.1% share. This growth is primarily fueled by the rising consumer shift toward sustainable and biodegradable packaging for laundry pods, dishwasher tablets, and cleaning products. Growing awareness regarding plastic pollution, coupled with the convenience offered by unit-dose packaging, has positioned household applications as a key driver of demand.

Agriculture followed closely, gaining momentum due to increased use of water-soluble films in fertilizer and pesticide packaging, aiding precise and waste-free application. The segment accounted for a considerable share, reflecting the sector’s gradual transition toward sustainable practices.

Medical applications are emerging as a high-potential segment, as pharmaceutical companies explore biodegradable packaging alternatives for unit-dose drugs and hygiene-sensitive products. Retail and Chemicals sectors also showed steady growth, with businesses leveraging eco-packaging to meet sustainability mandates.

The Water Treatment, Animal Waste, and Fishing segments represented niche but growing opportunities, driven by environmental regulations and demand for dissolvable bags in specific operations. Others, including industrial use-cases, contributed modestly, but present future potential as awareness and regulatory support for green packaging continue to rise.

Key Market Segments

By Material

- Polymers

- Surfactants

- Fibers

By Product

- Bags

- Pouches

- Pods & Capsules

By Solubility Type

- Hot Water

- Cold Water

By End-use

- Household Products

- Agriculture

- Medical

- Retail

- Chemicals

- Water Treatment

- Animal Waste

- Fishing

- Others

Drivers

Rising Environmental Awareness Drives Shift Toward Sustainable Packaging

The water soluble packaging market is gaining momentum as industries respond to growing environmental concerns and stricter regulations on plastic waste. With increasing awareness among consumers and governments about the harmful impact of plastic pollution, there is a strong push toward eco-friendly alternatives—making water-soluble films a popular choice. This trend is especially noticeable in the detergent industry, where unit-dose packaging provides both convenience and safety, reducing direct contact with chemicals.

Additionally, the boom in e-commerce and retail is fueling the demand for innovative, sustainable packaging that is easy to use, transport, and dispose of responsibly. Companies are exploring water-soluble options not only to align with green initiatives but also to improve product differentiation in a competitive market. Overall, these factors are creating a solid foundation for the growth of the water soluble packaging industry in the coming years.

Restraints

Weak Strength and Easy Damage from Moisture Slow Down Market Growth

One of the main restraints holding back the water-soluble packaging market is its limited mechanical strength and high sensitivity to moisture. These films are designed to dissolve in water, which makes them less suitable for packaging heavy or sharp items, or products that need to be stored for a long time.

If exposed to humidity during transport or storage, the packaging can weaken or start breaking down prematurely, creating challenges for manufacturers and users. This limits the range of industries that can adopt water-soluble packaging, especially those needing durable and long-lasting solutions.

Another challenge is the lack of awareness among consumers, particularly in developing countries. Many end-users are unfamiliar with how to use these products correctly or are unaware of their environmental benefits. This lack of education means that even where water-soluble packaging is available, it may not be used properly or to its full potential.

As a result, companies in this space often need to invest extra time and resources in educating customers and building trust in these newer, more sustainable options. These combined factors—technical limitations and low awareness—are slowing down the wider adoption of water-soluble packaging despite its strong potential in reducing plastic waste.

Growth Factors

Innovation in Film Materials Like Polyvinyl Alcohol Blends Opens New Doors for the Market

The water soluble packaging market is poised for growth, thanks to ongoing innovations in film materials like polyvinyl alcohol (PVA) blends. These new materials make the packaging stronger, more affordable, and better suited for different industries. One big opportunity is in the food and beverage industry, where these films can be used for single-serve drink powders, sauces, or seasoning packs, reducing waste and improving convenience for consumers.

Another major growth area is the pharmaceutical sector, where water soluble packaging offers a safe and hygienic way to handle single doses of medicines, especially for elderly or visually impaired users. With increasing focus on sustainability and reducing plastic waste, many companies are exploring water soluble options to meet eco-friendly packaging goals.

As regulations tighten and consumer demand for greener products rises, businesses that invest in these advanced materials and adapt to industry-specific needs could see significant returns. Overall, the combination of material innovation, health and safety benefits, and environmental appeal is opening up new revenue streams across multiple sectors, making water soluble packaging a smart area for strategic growth.

Emerging Trends

Shift Toward Zero-Waste Goals Fuels Demand for Water-Soluble Packaging

One of the major trends pushing the growth of the water-soluble packaging market is the global shift toward zero-waste and eco-friendly packaging solutions. As governments, businesses, and consumers become more environmentally conscious, there’s a growing preference for packaging that leaves no trace—literally.

Water-soluble packaging, which dissolves completely in water without releasing toxins or microplastics, aligns perfectly with these sustainability goals. This makes it especially attractive for industries looking to reduce their environmental footprint. Additionally, premium and niche brands are turning to water-soluble packaging not just for its functionality, but also as a way to enhance their eco-conscious branding. It’s being seen as a smart way to stand out in a crowded market while signaling responsibility and innovation.

Another factor driving this trend is the rising use of such packaging in the cannabis and CBD sectors. With increasing legalization, these industries are prioritizing single-dose, clean, and discreet packaging options—something water-soluble formats provide with ease. These packs ensure accurate dosing and convenience while eliminating the hassle of waste disposal.

Altogether, the combination of sustainability regulations, branding needs, and functional demand across emerging sectors is creating a favorable environment for the water-soluble packaging market. As more industries move toward circular economy models and cleaner consumption, the adoption of this type of packaging is expected to accelerate.

Regional Analysis

North America leads the water-soluble packaging market with 31.5% share worth USD 1.17 billion

The global water-soluble packaging market exhibits a dynamic regional distribution, with significant developments across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Among these, North America dominates the market, accounting for approximately 31.5% of the global share, valued at USD 1.17 billion in 2024. This regional dominance can be attributed to strong environmental regulations, growing adoption of sustainable packaging solutions by major FMCG and detergent brands, and increasing consumer awareness regarding eco-friendly alternatives.

Regional Mentions:

Europe represents another key regional market, driven by stringent EU environmental regulations and strong policy support under initiatives like the European Green Deal. Countries such as Germany, France, and the UK are at the forefront of adopting compostable and water-soluble materials in industrial and consumer packaging. The demand in Europe is further propelled by a high level of environmental consciousness among consumers and progressive corporate sustainability goals.

Asia Pacific is poised for the fastest growth during the forecast period, fueled by rapid industrialization, expanding middle-class population, and increasing demand for single-use and unit-dose packaging formats, particularly in China, India, and Japan. Rising government emphasis on reducing plastic pollution and the presence of a large packaging manufacturing base support the market’s expansion in this region.

Latin America and the Middle East & Africa are emerging markets with growing awareness around sustainability and increasing adoption of innovative packaging formats. While these regions currently hold smaller market shares, government initiatives to curb plastic use and the growth of sectors like agriculture and personal care packaging are expected to support long-term development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global water soluble packaging market in 2024 is witnessing strong momentum, driven by increasing environmental concerns, stringent regulations on single-use plastics, and growing demand for sustainable packaging alternatives. Key players in this space are leveraging innovation, strategic partnerships, and global expansion to gain a competitive edge.

Kuraray and Mitsubishi Chemical Corporation remain industry frontrunners, with their robust R&D capabilities and diverse product portfolios in polyvinyl alcohol (PVOH) films. SEKISUI CHEMICAL CO., LTD. also plays a vital role in advancing biodegradable solutions, particularly for industrial and medical applications. These Japanese firms continue to dominate the high-tech segment of the market.

Mondi Group, with its global footprint and commitment to sustainable packaging, is accelerating its presence by integrating water soluble formats into broader flexible packaging solutions. Meanwhile, Aquapak Polymers Ltd. and INVISIBLE COMPANY are gaining attention for developing innovative, marine-safe materials, catering to the growing demand for zero-waste packaging in the FMCG and e-commerce sectors.

Niche players such as Soltec Development, Soluble Technology Limited, and Acedag Ltd are carving out market share by offering customized solutions for specific applications like laundry pods, agrochemical packaging, and industrial cleaners.

Latin American entities like Rovi Packaging, S.A. and Medanos Claros HK Limited are expanding regional supply capabilities, meeting local sustainability mandates. Additionally, Cortec Corporation and AICELLO CORPORATION contribute to market diversification with their specialty in anti-corrosion and high-barrier water soluble films.

Top Key Players in the Market

- Kuraray

- Lithey Inc.

- Mondi Group

- SEKISUI CHEMICAL CO., LTD.

- Mitsubishi Chemical Corporation

- Soltec Development

- Soluble Technology Limited

- Aquapak Polymers Ltd.

- Rovi Packaging, S.A.

- INVISIBLE COMPANY

- AICELLO CORPORATION

- Medanos Claros HK Limited

- Cortec Corporation

- Acedag Ltd

Recent Developments

- In February 2025, Pulpex secured £62 million in funding to build its first large-scale fibre-based packaging factory. The investment aims to accelerate sustainable packaging solutions and reduce reliance on plastic.

- In October 2024, Solubag raised $4.5 million to further develop its innovative water-soluble materials. The startup is focused on replacing single-use plastics with eco-friendly alternatives that dissolve in water.

- In May 2024, Kelpi secured £4.3 million in funding to commercialize its seaweed-based packaging technology. The company plans to use the investment to scale operations and bring its biodegradable packaging to market.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Billion Forecast Revenue (2034) USD 6.3 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polymers, Surfactants, Fibers), By Product (Bags, Pouches, Pods & Capsules), By Solubility Type (Hot Water, Cold Water), By End-use (Household Products, Agriculture, Medical, Retail, Chemicals, Water Treatment, Animal Waste, Fishing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kuraray, Lithey Inc., Mondi Group, SEKISUI CHEMICAL CO., LTD., Mitsubishi Chemical Corporation, Soltec Development, Soluble Technology Limited, Aquapak Polymers Ltd., Rovi Packaging, S.A., INVISIBLE COMPANY, AICELLO CORPORATION, Medanos Claros HK Limited, Cortec Corporation, Acedag Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Water Soluble Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Water Soluble Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kuraray

- Lithey Inc.

- Mondi Group

- SEKISUI CHEMICAL CO., LTD.

- Mitsubishi Chemical Corporation

- Soltec Development

- Soluble Technology Limited

- Aquapak Polymers Ltd.

- Rovi Packaging, S.A.

- INVISIBLE COMPANY

- AICELLO CORPORATION

- Medanos Claros HK Limited

- Cortec Corporation

- Acedag Ltd