Global Water Heating Radiant Ceiling Panels Market Size, Share, And Industry Analysis Report By Type (Hydronic Radiant Ceiling Panels, Electric Radiant Ceiling Panels), By Panel Material (Aluminum Panel, Steel Panels), By Installation Type (New Construction, Retrofit, Renovation), By Application (Commercial Building, Residential Building, Industrial Building), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171235

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

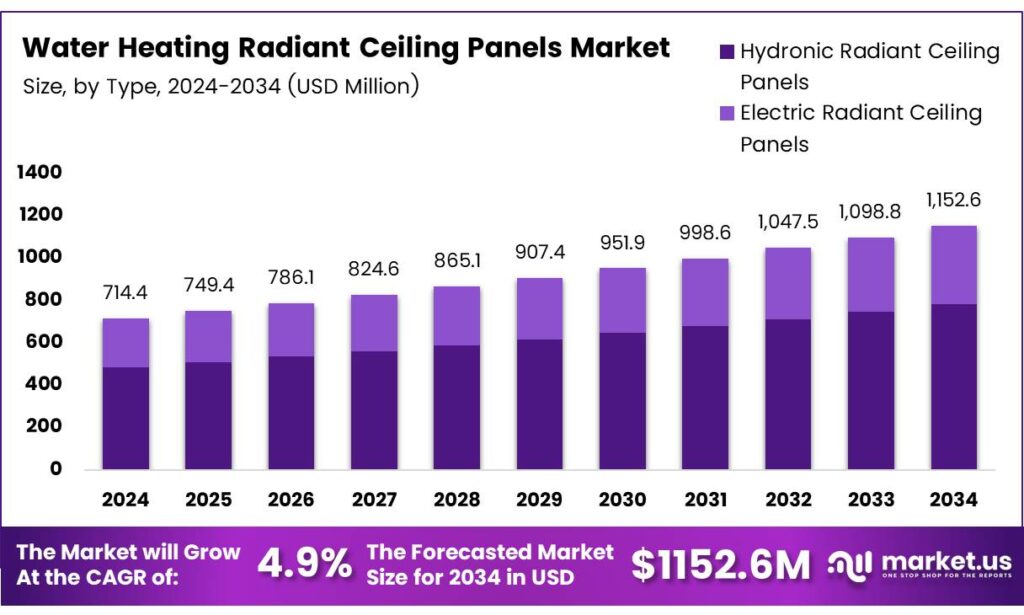

The Global Water Heating Radiant Ceiling Panels Market size is expected to be worth around USD 1152.6 million by 2034, from USD 714.4 million in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Water Heating Radiant Ceiling Panels Market represents a mature and reliable building-energy solution focused on ceiling-mounted panels circulating warm water. These systems deliver heat primarily through radiation instead of air movement. Buildings achieve improved building thermal comfort while reducing overall energy consumption. Water-based radiant ceiling panels align closely with modern efficiency and sustainability objectives.

Radiant ceiling heating integrates smoothly with heat pumps, solar thermal systems, and district heating networks. This flexibility makes the technology attractive for offices, healthcare facilities, schools, and energy-efficient residential buildings. Developers and facility owners increasingly select these systems to secure long-term operating cost stability, quieter operation, and consistent indoor temperatures without drafts or air circulation issues.

- Radiant systems achieved 18%–21% higher instantaneous cooling rates during internal heat gain periods and removed 75%–82% of total heat gains, compared with 61%–63% for air systems. Occupants remain comfortable at 2°F–3°F lower air temperatures, with satisfaction rising from 45% to 63% and dissatisfaction declining by 18%, reinforcing confidence in radiant solutions.

Market growth remains steady as building regulations emphasize energy efficiency and occupant comfort. Governments across Europe and North America promote low-temperature heating solutions under green-building and decarbonization policies. Radiant ceiling panels are particularly suitable for retrofit projects, allowing older buildings to reduce emissions without sacrificing floor space or undergoing major structural modifications.

Key Takeaways

- The Global Water Heating Radiant Ceiling Panels Market is projected to grow from USD 714.4 million in 2024 to USD 1152.6 million by 2034, registering a 4.9% CAGR.

- Hydronic Radiant ceiling panels dominate the market by type, holding a leading share of 69.3% due to higher energy efficiency.

- Aluminum Panels lead the panel material segment with a market share of 61.2%, driven by thermal conductivity advantages.

- New Construction remains the largest installation segment, accounting for 47.8% of total market demand.

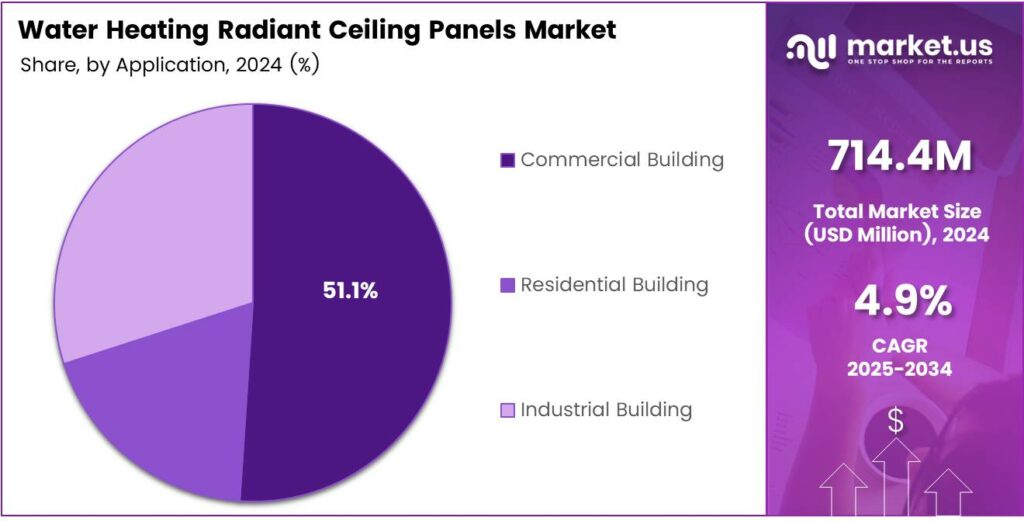

- Commercial Buildings represent the top application segment with a dominant share of 51.1%.

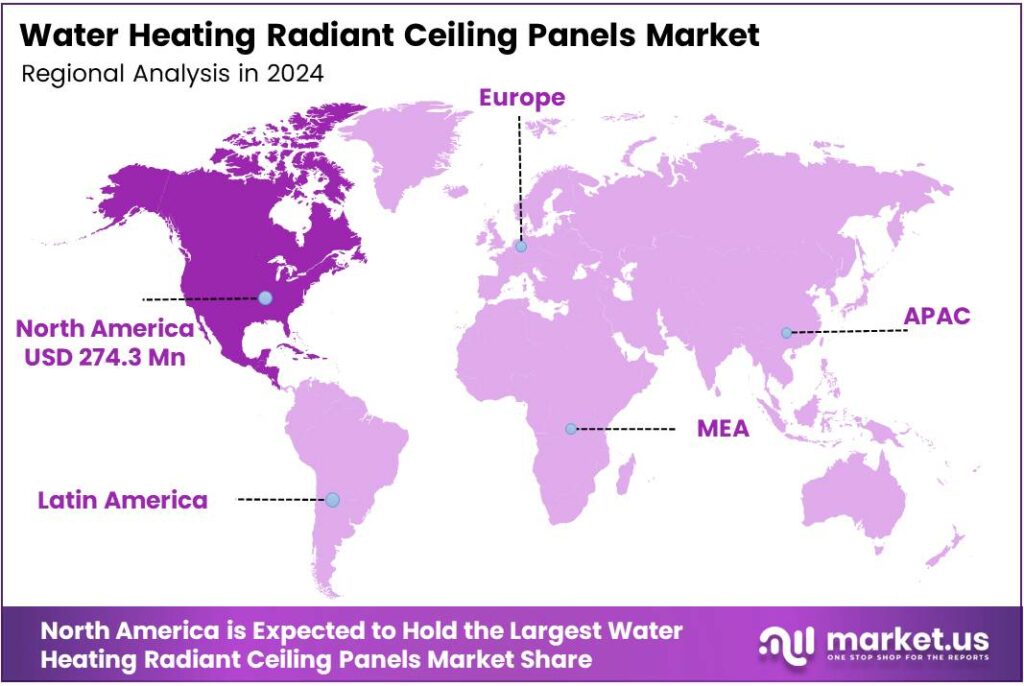

- North America is the leading region, capturing 38.4% of the global market, valued at USD 274.3 million.

By Type Analysis

Hydronic Radiant Ceiling Panels dominate with 69.3% due to superior energy efficiency and compatibility with centralized hot water systems.

In 2024, Hydronic Radiant Ceiling Panels held a dominant market position in the By Type Analysis segment of the Water Heating Radiant Ceiling Panels Market, with a 69.3% share. This dominance is supported by lower operating costs, stable heat distribution, and strong adoption in large commercial and institutional buildings.

Hydronic systems use circulating warm water to heat ceiling surfaces evenly. As a result, they reduce air movement and energy losses. Moreover, they integrate well with boilers, heat pumps, and renewable heat sources, making them attractive for long-term energy planning.

Electric Radiant Ceiling Panels serve niche and small-scale applications where installation simplicity is critical. These systems are easier to deploy in limited spaces. However, higher electricity costs and load constraints reduce their preference for large-area heating projects.

By Panel Material Analysis

Aluminum Panel leads with a 61.2% share due to high thermal conductivity and lightweight installation benefits.

In 2024, Aluminum Panel held a dominant market position in the By Panel Material Analysis segment of the Water Heating Radiant Ceiling Panels Market, with a 61.2% share. Aluminum panels heat quickly and distribute warmth evenly, improving overall system responsiveness and occupant comfort.

The lightweight nature of aluminum simplifies ceiling integration and reduces structural load requirements. In addition, corrosion resistance improves durability in humid commercial spaces such as hospitals, offices, and educational facilities. Steel Panels are preferred where mechanical strength and cost stability are prioritized.

Although heavier, steel panels offer long service life and consistent performance in industrial and utility-driven environments. Other materials, including composite and specialty alloys, address custom design needs. However, limited availability and higher costs restrict their use to specific architectural or performance-driven projects.

By Installation Type Analysis

New Construction dominates with 47.8% driven by early-stage HVAC integration and energy-efficient building designs.

In 2024, New Construction held a dominant market position in the By Installation Type Analysis segment of the Water Heating Radiant Ceiling Panels Market, with a 47.8% share. Early planning enables seamless integration with ceilings, piping networks, and insulation systems.

New buildings increasingly adopt radiant heating to meet energy codes and sustainability goals. Developers prefer ceiling panels for improved thermal comfort and reduced operational energy demand. Retrofit installations focus on upgrading aging HVAC systems in offices and public buildings.

Space limitations and structural adjustments slightly slow adoption, yet energy savings continue to drive gradual uptake. Renovation projects adopt radiant ceiling panels selectively, especially during major interior redesigns. Although timelines are shorter, careful planning allows these systems to enhance comfort without major layout changes.

By Application Analysis

Commercial Building application leads with 51.1% supported by high occupancy efficiency and operational cost savings.

In 2024, Commercial Building held a dominant market position in the By Application Analysis segment of the Water Heating Radiant Ceiling Panels Market, with a 51.1% share. Offices, hospitals, and schools value consistent indoor temperatures and reduced noise.

Radiant ceiling panels improve comfort without drafts, benefiting productivity-focused environments. Additionally, centralized hydronic systems align well with large commercial energy management strategies. Residential Building adoption grows steadily as homeowners seek quiet, space-saving heating solutions.

However, higher upfront costs slow penetration compared to traditional heating systems. Industrial Building applications remain limited but stable. These panels are used in controlled environments where precise temperature regulation is required, rather than in high-heat industrial production zones.

Key Market Segments

By Type

- Hydronic Radiant Ceiling Panels

- Electric Radiant Ceiling Panels

By Panel Material

- Aluminum Panel

- Steel Panels

- Others

By Installation Type

- New Construction

- Retrofit

- Renovation

By Application

- Commercial Building

- Residential Building

- Industrial Building

Emerging Trends

Growing Preference for Silent and Comfortable Heating Systems Shapes Trends

A key trend in the water heating radiant ceiling panels market is the rising preference for silent heating solutions. Unlike air systems, radiant panels operate without fans, creating quiet indoor environments. This is especially valued in hospitals, libraries, and offices.

- The US Department of Energy notes radiant systems beat traditional heating by avoiding duct losses, often saving 20-30% on energy. In 2024, global solar thermal yield hit 443 TWh, avoiding 153.5 million tons of CO2, showing how water-based panels pair well with renewables.

Design flexibility is another trending factor. Modern radiant ceiling panels blend seamlessly with interior designs. Architects prefer these systems as they free up wall and floor space. The shift toward low-temperature heating is also shaping market trends. Radiant panels perform efficiently at lower water temperatures, supporting energy-saving goals.

Drivers

Rising Focus on Energy-Efficient Building Heating Drives Market Growth

The water heating radiant ceiling panels market is mainly driven by the growing focus on energy-efficient building solutions. These systems heat spaces evenly using warm water, reducing heat loss compared to forced-air systems. As energy costs rise, building owners look for solutions that lower long-term heating expenses.

- Modern renewable heat consumption driven heavily by heat pumps and solar thermal is expected to accelerate by 42% globally between 2025 and 2030. This is huge because radiant panels are uniquely designed to work with lower water temperatures (often around 35°C to 45°C), making them the ideal partner for these eco-friendly heat pumps.

The increasing adoption of green building standards. Radiant ceiling panels support low-temperature heating, making them compatible with heat pumps and solar thermal systems. This alignment with sustainable construction goals encourages adoption in commercial and residential buildings.

Urbanization and new construction projects also support market growth. Offices, hospitals, schools, and hotels prefer radiant systems for silent operation and improved indoor comfort. These benefits help developers meet occupant comfort expectations without increasing energy use.

Restraints

High Initial Installation Costs Limit Market Expansion

One major restraint in the water heating radiant ceiling panels market is the high upfront installation cost. These systems require specialized panels, piping, and professional installation. For small residential users, this cost can delay adoption despite long-term savings.

- Many consumers are more familiar with conventional radiators or air-based systems. Solar water heating ties perfectly with ceiling panels for a steady hot water supply. In 2024, solar thermal systems saved 47.6 million tons of oil worldwide, proving their power. Lack of technical understanding about radiant heating benefits slows decision-making, especially in price-sensitive markets.

Retrofitting challenges further act as restraints. Installing radiant ceiling panels in existing buildings may require ceiling modifications. This can disrupt occupants and increase renovation time, making alternatives more attractive. Although systems are durable, any leakage or control failure requires skilled technicians.

Growth Factors

Integration with Renewable Heating Systems Creates New Opportunities

The integration of water heating radiant ceiling panels with renewable energy systems presents strong growth opportunities. These panels work efficiently with heat pumps and solar thermal units, supporting low-carbon heating strategies. This makes them attractive for future-ready buildings.

- The rising demand for smart buildings also opens new opportunities. Radiant systems can be paired with smart thermostats and building management systems. The European Heat Pump Association (EHPA) reported that in the first half of 2025 alone, heat pump sales in 13 European countries grew by an average of 9% compared to the same period in 2024, reaching approximately 980,000 units.

Older buildings seeking energy upgrades increasingly consider radiant ceiling solutions. This trend is strong in offices, healthcare facilities, and educational institutions. Emerging economies offer untapped potential. As construction standards improve and energy awareness grows, radiant ceiling panels can gain wider acceptance in new urban developments.

Regional Analysis

North America Dominates the Water Heating Radiant Ceiling Panels Market with a Market Share of 38.4%, Valued at USD 274.3 Million

North America leads the Water Heating Radiant Ceiling Panels Market, driven by strong adoption of energy-efficient building technologies. In the region, the market accounted for a dominant 38.4% share, reaching a value of USD 274.3 million. Growth is supported by strict energy efficiency standards, rising green building certifications, and increasing renovation of commercial and residential properties.

Europe represents a mature and steadily growing market, supported by aggressive climate targets and building energy performance regulations. The region benefits from widespread adoption of radiant heating in offices, healthcare facilities, and public buildings. Increasing retrofitting activities in older structures and a strong focus on reducing heating-related emissions continue to support demand for radiant ceiling panel systems.

Asia Pacific is emerging as a high-growth region due to rapid urbanization and expanding construction activity. Rising investments in commercial infrastructure, smart buildings, and energy-efficient housing projects are key growth drivers. Countries across East Asia and South Asia are increasingly adopting modern heating technologies to improve indoor comfort and reduce long-term energy costs.

The Middle East and Africa market is gradually gaining traction, particularly in premium commercial buildings and institutional projects. Demand is supported by growing investments in sustainable construction, hospitality infrastructure, and public facilities. Radiant ceiling panels are increasingly preferred for their space-saving design and ability to deliver uniform thermal comfort in large indoor environments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Zehnder Group remains one of the most recognized names in indoor climate solutions, and its radiant ceiling panel strength comes from pairing thermal comfort with clean architectural integration. From an analyst lens, Zehnder’s edge is in system consistency—reliable components, controlled installation quality, and a portfolio that fits both new-build and premium retrofit projects where aesthetics matter.

MESSANA continues to be viewed as a specialist player in hydronic radiant ceiling systems, leaning into engineered solutions for commercial buildings that want quiet operation and even heat distribution. The company’s positioning benefits from rising demand for low-noise HVAC upgrades, especially in offices, education, and healthcare projects where comfort complaints directly affect occupant satisfaction.

SPC competes through practical, project-driven execution, supplying radiant panel configurations that contractors can deploy without overcomplicating controls and integration. Analysts typically see SPC performing well when buyers prioritize straightforward procurement, installability, and predictable performance over highly customized, design-first solutions.

Frenger is often associated with dependable, radiant, and chilled ceiling capabilities that align with energy-conscious building targets. Its market relevance in 2024 is tied to retrofit-friendly approaches and engineered ceiling solutions that support modern efficiency goals, especially as building owners look for stable comfort delivery with reduced airflow dependence.

Top Key Players in the Market

- Zehnder Group

- MESSANA

- SPC

- Frenger

- Marley Engineered Products

- Uponor

- Indeeco

- Rehau

- Rossato Group

Recent Developments

- In 2024, Zehnder launched a new high-capacity chilled beam and radiant ceiling panel hybrid product. It combines radiant cooling with ventilation, designed for offices and schools, emphasizing energy efficiency and low noise. This represents an advancement in integrated radiant ceiling technology.

- In 2024, MESSANA focuses on high-end residential and boutique commercial projects globally. Their developments are centered on the Radiant Climate Control (RCC) system, which integrates radiant ceilings (both heating and cooling) with dedicated outdoor air systems (DOAS) for precise humidity and temperature control.

Report Scope

Report Features Description Market Value (2024) USD 714.4 Million Forecast Revenue (2034) USD 1152.6 Million CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hydronic Radiant Ceiling Panels, Electric Radiant Ceiling Panels), By Panel Material (Aluminum Panel, Steel Panels, Others), By Installation Type (New Construction, Retrofit, Renovation), By Application (Commercial Building, Residential Building, Industrial Building) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Zehnder Group, MESSANA, SPC, Frenger, Marley Engineered Products, Uponor, Indeeco, Rehau, Rossato Group Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Water Heating Radiant Ceiling Panels MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Water Heating Radiant Ceiling Panels MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zehnder Group

- MESSANA

- SPC

- Frenger

- Marley Engineered Products

- Uponor

- Indeeco

- Rehau

- Rossato Group