Global Water Flosser Market By Product Type (Countertop, Cordless, Shower Flosser, Faucet Flosser, Others), By Category (Standard, Portable), By Tip Type (Classic Jet Tip, Orthodontic Tip, Toothbrush Tip, Plaque Seeker Tip, Others), By Consumer Group (Adults, Kids), By End Use (Residential, Commercial, Hospitals, Dental Clinics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132394

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

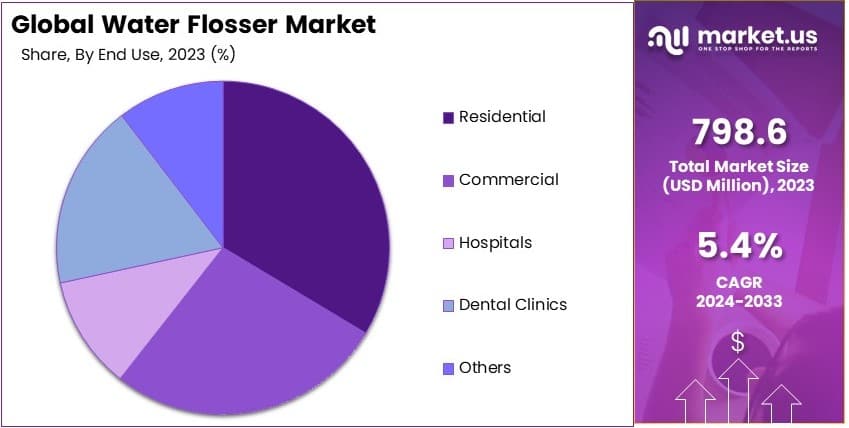

The Global Water Flosser Market size is expected to be worth around USD 1,351.2 Million by 2033, from USD 798.6 Million in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

A water flosser is a dental device that uses a pressurized stream of water to clean between teeth and along the gumline. It is designed to remove plaque and food particles, improving oral hygiene. Water flossers are often recommended for individuals with braces or sensitive gums.

The water flosser market refers to the global industry focused on manufacturing and selling water flossers. It includes various product types, such as countertop and cordless models, and targets both individual consumers and dental professionals. The market is driven by increasing awareness of oral hygiene and technological advancements.

Water flossers are gaining traction as a convenient alternative to traditional flossing. Their ability to enhance gum health and reduce plaque has led to increased adoption. According to Delta Dental Plans Association, 92% of adults believe good oral health boosts confidence, which aligns with the product’s benefits.

The water flosser market is witnessing growth due to rising demand for effective oral care solutions. The market’s competitiveness remains high, with new players entering regularly. As per OECD data, dental health spending per capita is projected to rise from $277 in 2020 to $365 by 2040, supporting industry growth.

Government initiatives and awareness campaigns play a key role. The CDC promotes better oral hygiene, highlighting products that improve plaque removal by up to 20 times. Increasing dental visits, with 83% of insured adults opting for preventive care, also boost water flosser demand.

The market offers significant opportunities in developing regions, where awareness is still low. However, in developed countries, market saturation poses challenges. Competitive pricing and innovation will be critical to maintaining market share.

Globally, rising dental health expenditures indicate broader acceptance of advanced oral care devices. On a local scale, awareness programs are driving demand, particularly in urban areas. Investment in dental equipment infrastructure further supports growth.

Key Takeaways

- The Water Flosser Market was valued at USD 798.6 million in 2023 and is expected to reach USD 1,351.2 million by 2033, with a CAGR of 5.4%.

- In 2023, Cordless water flossers lead the product type with 61.5%, driven by portability and ease of use.

- In 2023, Portable category holds 52.3%, highlighting consumer preference for convenience.

- In 2023, Orthodontic Tip dominates the tip type, supporting specific dental care needs.

- In 2023, Residential end-use leads, driven by at-home dental care demand.

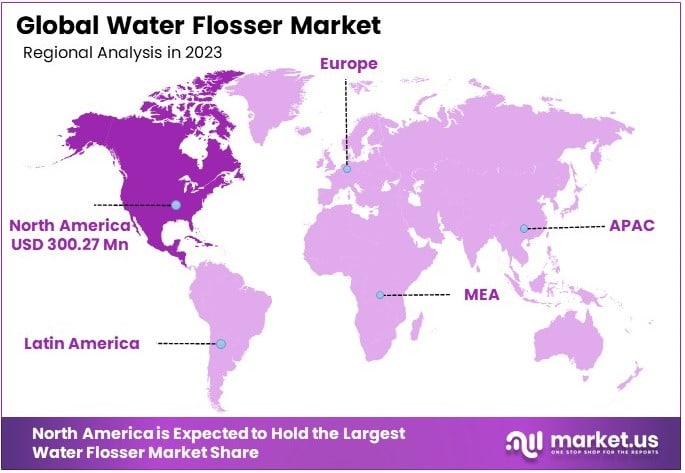

- In 2023, North America leads regionally with 37.6%, reflecting high dental health awareness.

Product Type Analysis

Cordless Water Flossers Dominate with 61.5% Due to Convenience and Portability

In the Water Flosser Market, Cordless water flossers lead the “Product Type” segment, capturing a significant 61.5% of the market. This dominance is due to their portability and convenience, allowing users to easily store and use them at home or on-the-go.

Cordless models appeal especially to consumers who prioritize flexibility and ease of use, as they do not require a permanent setup or a dedicated space. Additionally, cordless water flossers often come with rechargeable batteries, making them more sustainable and travel-friendly.

Countertop water flossers hold a substantial share, particularly among consumers who prefer higher water pressure and larger water reservoirs. These models are ideal for home settings where space and access to a power source are not a concern.

Shower flossers and Faucet flossers, while niche, offer unique setups by attaching to the showerhead or faucet, providing continuous water flow. They cater to consumers looking for innovative, water-saving solutions. Other types, such as specialty models for orthodontic care, serve specific needs within the broader market, adding to its diversity.

Category Analysis

Portable Flossers Lead with 52.3% Due to High Demand for Mobility

Within the “Category” segment, Portable water flossers dominate with 52.3% market share. This demand is largely driven by consumers’ need for mobility, especially among those with busy lifestyles who require easy-to-use devices that are also compact.

Portable flossers are designed for convenience, featuring lightweight builds and rechargeable batteries, which makes them a preferred choice for travelers and individuals who need on-the-go dental care. Consequently, portable flossers meet the evolving consumer preference for products that offer flexibility without compromising on performance.

Standard water flossers remain essential, particularly for users who prioritize stable power and consistent water flow, often provided by countertop models. These standard models, typically larger, are favored in households where space is available, and ease of mobility is less of a priority.

They are reliable for providing high water pressure, serving consumers focused on achieving professional-level oral hygiene at home. Thus, both portable and standard models fulfill the diverse demands within the water flosser market, supporting growth through varied product offerings.

Tip Type Analysis

Orthodontic Tip Leads Due to Specialized Demand from Braces Wearers

In the “Tip Type” segment, Orthodontic Tips dominate due to their specialized design for individuals with braces or orthodontic appliances. These tips are particularly effective at cleaning around brackets and wires, which is challenging with standard tips or traditional flossing.

As orthodontic treatments become more common, the demand for water flossers with orthodontic tips has grown significantly. This sub-segment caters specifically to consumers who require precise cleaning to prevent plaque buildup and maintain oral hygiene, making orthodontic tips essential in the market.

Classic Jet Tips follow closely as a popular choice for general use, suitable for consumers with no specialized needs. They provide a broad cleaning action that appeals to a wide audience, offering a simple solution for daily flossing.

Toothbrush Tips and Plaque Seeker Tips, though niche, serve unique functions by targeting specific areas or providing dual-purpose cleaning. Other specialty tips, designed for sensitive gums or specific conditions, contribute to market diversity by addressing a range of oral hygiene needs and preferences.

Consumer Group Analysis

Kids Dominate Due to Increased Focus on Early Oral Hygiene

In the “Consumer Group” segment, Kids lead the market, reflecting a growing emphasis on early oral hygiene and preventative care. Parents are increasingly aware of the benefits of establishing good dental habits early, and water flossers are seen as effective, kid-friendly tools that simplify flossing.

Kid-focused water flossers are typically designed with gentler pressure settings and are often colorful, making them appealing and easy to use for children. Consequently, this segment is crucial to the growth of the water flosser market, as it aligns with parental priorities on health and wellness for younger age groups.

Adults, while slightly less dominant, make up a substantial part of the market as well. Adult consumers seek water flossers for their effectiveness in maintaining gum health, removing plaque, and offering a thorough clean beyond regular brushing.

Adults who have undergone orthodontic treatments or are managing dental issues such as gum sensitivity find water flossers particularly beneficial. Both adult and kid segments support market expansion by meeting diverse age-related dental needs, positioning water flossers as versatile tools in oral hygiene.

End-Use Analysis

Residential Leads Due to High Adoption of Personal Dental Care Devices

The “End-Use” segment is predominantly led by Residential users, reflecting a broad adoption of water flossers in personal dental care routines. As consumers become more proactive about dental health, water flossers are increasingly seen as essential devices for home use.

This trend is driven by the convenience of performing professional-level dental care at home, leading to greater penetration of water flossers in the residential market. Home users appreciate the flexibility, cost savings, and effectiveness of using water flossers regularly without the need for frequent dental visits.

Commercial end-users, including dental clinics and hospitals, use water flossers as part of patient care, primarily in preventive and maintenance procedures. Dental services find water flossers helpful in demonstrating proper oral hygiene practices to patients, especially those with complex dental needs.

Meanwhile, hospitals and other healthcare facilities integrate water flossers to support comprehensive patient care, particularly for long-term patients requiring assisted oral hygiene. This multi-faceted usage across different settings enhances the relevance of water flossers, supporting market growth across residential and commercial applications.

Key Market Segments

By Product Type

- Countertop

- Cordless

- Shower Flosser

- Faucet Flosser

- Others

By Category

- Standard

- Portable

By Tip Type

- Classic Jet Tip

- Orthodontic Tip

- Toothbrush Tip

- Plaque Seeker Tip

- Others

By Consumer Group

- Adults

- Kids

By End Use

- Residential

- Commercial

- Hospitals

- Dental Clinics

- Others

Drivers

Rising Awareness of Oral Health Drives Market Growth

The growing awareness of oral health significantly drives the water flosser market. People are increasingly prioritizing oral hygiene, recognizing its impact on overall health. This awareness has led to a surge in demand for advanced dental care products like water flossers.

The rising demand for portable oral care devices further accelerates market growth. Modern consumers seek convenience, and portable water flossers cater to this need. These compact devices are easy to use, especially for people with busy lifestyles. With travel-friendly designs, portable flossers meet the needs of individuals looking for oral care solutions on the go.

Increasing disposable incomes also fuel market expansion. As consumers have more spending power, they invest in premium health products. Water flossers, often considered a luxury item, become more accessible to a wider audience.

Technological advancements in dental care further boost the water flosser market. Innovations such as smart connectivity, pressure adjustments, and customizable settings enhance the user experience. These advancements make water flossers appealing to tech-savvy consumers who value innovation in personal care products.

Restraints

High Product Cost Restraints Market Growth

The high cost of water flossers presents a significant restraint on market growth. Many consumers view the device as expensive, especially when compared to traditional flossing methods. This cost factor limits its adoption, particularly among budget-conscious consumers.

Limited awareness in developing regions also restrains market growth. In many areas, traditional dental care products are preferred, and awareness of advanced devices like water flossers remains low. Without proper marketing and education, potential consumers in these regions may not consider water flossers a viable option, curbing market expansion.

Additionally, the availability of low-cost alternatives affects the water flosser market. Consumers can choose from a range of more affordable dental products, such as regular floss and interdental brushes. These cheaper alternatives appeal to cost-conscious buyers, challenging the adoption rate of higher-priced water flossers. This factor intensifies market competition and slows the growth of premium water flossers.

Concerns over water waste also impact the market. Some consumers are hesitant to use water flossers due to the perception that they waste water. This environmental consideration reduces the appeal of water flossers among eco-conscious buyers, especially in areas where water conservation is a priority.

Opportunity

Expansion in Emerging Markets Provides Opportunities

Emerging markets offer significant growth opportunities for the water flosser industry. As economies develop in regions like Asia-Pacific and Latin America, disposable incomes rise, allowing more consumers to afford premium dental care products. With increased spending power, consumers in these areas show interest in advanced oral hygiene tools.

Product diversification with added features also creates opportunities. Companies are innovating with water flossers by adding features like pressure control, adjustable tips, and rechargeable batteries. These additions make the product more attractive to different consumer segments, from children to adults with specific dental needs.

The growth of online retail channels further enhances market opportunities. E-commerce platforms provide water flosser manufacturers with direct access to consumers worldwide. Online retail simplifies the purchasing process, making it easier for consumers to explore and buy water flossers. This sales channel offers global reach and supports market expansion, particularly in remote areas where physical retail stores are limited.

Partnerships with dental clinics and professionals offer another avenue for growth. Dentists often recommend oral care products, including water flossers, to patients seeking better dental hygiene. Collaborating with dental professionals builds credibility and drives consumer trust.

Challenges

Intense Competition from Established Brands Challenges Market Growth

The water flosser market faces intense competition from established brands. Major players with well-known reputations dominate the industry, making it challenging for new entrants to gain a foothold. Established brands have loyal customer bases and strong distribution networks, creating a competitive landscape that can be difficult to penetrate.

Complex regulatory standards also challenge the water flosser market. Different countries have varying regulations for medical and dental devices, which water flossers often fall under. Compliance with these standards requires time, resources, and costs, especially for companies seeking global expansion.

Supply chain disruptions pose another challenge. The global supply chain for electronic components, materials, and shipping services has seen significant disruptions recently. Delays in obtaining necessary parts and managing shipping logistics lead to production slowdowns.

The need for consumer education further complicates market growth. Many consumers are unfamiliar with water flossers and their benefits. Educating potential customers about how water flossers work and their advantages over traditional flossing methods is essential. Without adequate consumer knowledge, adoption rates remain low, posing a challenge to expanding the market.

Growth Factors

Increase in Dental Issues Globally Is a Growth Factor

The rise in global dental issues contributes significantly to the water flosser market’s growth. Conditions like gum disease, plaque buildup, and cavities are prevalent, driving demand for effective oral hygiene tools. Water flossers, known for their efficiency in removing plaque and cleaning between teeth, become essential for individuals focused on preventative care.

The aging population is another important growth factor. Older adults often experience more dental issues, and water flossers provide an accessible solution for maintaining oral health. With aging demographics in many regions, the market sees increased interest from this segment.

The rising popularity of preventative care also drives water flosser demand. Consumers recognize the importance of daily oral care in preventing costly dental treatments. Water flossers, as part of a daily routine, offer an efficient way to maintain oral health, appealing to health-conscious individuals.

Government initiatives promoting oral health awareness further support market expansion. Many governments now sponsor programs that educate citizens on dental hygiene practices. These initiatives increase public interest in advanced oral care products, including water flossers.

Emerging Trends

Shift Toward Eco-Friendly Water Flossers Is Latest Trending Factor

The shift toward eco-friendly water flossers is a major trend in the market. As environmental awareness grows, consumers prefer products with sustainable features. Water flosser manufacturers are responding by designing eco-friendly options with energy-efficient motors, recyclable materials, and water-saving technologies.

Smart features in water flossers are also trending. New models offer connectivity with smartphones, allowing users to track their usage and receive personalized tips for improved dental hygiene. These smart features cater to tech-savvy consumers looking for advanced oral care solutions.

Personalized oral care solutions represent another trend. Consumers increasingly seek products tailored to their individual needs, from sensitivity settings to customizable tips. Water flosser manufacturers are responding with designs that allow adjustments in pressure and stream direction, providing a personalized experience.

Lastly, subscription-based models are gaining traction in the water flosser market. Subscription services offer customers regular replacements for tips or cleaning solutions, ensuring consistent performance. This trend promotes brand loyalty and provides a steady revenue stream for companies.

Regional Analysis

North America Dominates with 37.6% Market Share

North America leads the Water Flosser Market, holding a 37.6% share valued at USD 300.27 million. This dominance is supported by high awareness of oral hygiene, strong purchasing power, and widespread adoption of advanced dental care products. Major players in the market benefit from a consumer base that prioritizes dental health and seeks convenient, effective cleaning tools.

Key factors contributing to North America’s lead include consumer interest in preventive healthcare and a well-developed retail network. Products like water flossers are popular due to their effectiveness and accessibility in major retail chains, dental offices, and online platforms, catering to diverse demographics with varied dental needs.

Regional market dynamics in North America are influenced by high dental care standards and an aging population seeking efficient oral care solutions. Additionally, the popularity of advanced dental products is supported by favorable insurance coverage and government health programs, further driving demand for water flossers in households across the region.

Regional Mentions:

- Europe: Europe holds a significant share in the Water Flosser Market, with increasing demand driven by high awareness of oral health. Countries like Germany and the UK lead in adoption, supported by a growing interest in preventive care and advanced dental technologies.

- Asia-Pacific: Asia-Pacific is an emerging market for water flossers, fueled by rising disposable incomes and urbanization. Demand is particularly strong in countries like Japan and South Korea, where consumers show a growing interest in advanced oral hygiene solutions.

- Middle East & Africa: The Middle East and Africa are gradually adopting water flossers, with demand driven by increasing awareness of dental hygiene. While market growth is slower, urban areas and affluent consumers are beginning to show interest in these advanced dental care products.

- Latin America: Latin America sees rising interest in water flossers, especially in countries like Brazil and Mexico. Growing dental care awareness and economic improvement contribute to increased demand, with an expanding middle class supporting market growth.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Water Flosser Market is led by a few prominent brands that excel in innovation, performance, and customer trust. Top players—Waterpik, Panasonic Corporation, Philips Sonicare, and Oral-B—are known for their advanced designs, reliability, and commitment to enhancing oral hygiene through high-quality water flossers.

Waterpik is a pioneer in the water flosser market and holds a dominant position with its strong reputation for effectiveness and quality. Known for its clinically tested products, Waterpik’s devices offer multiple pressure settings and specialized nozzles that cater to diverse consumer needs. Its well-established brand and focus on dental health make it the market leader, particularly in North America.

Panasonic Corporation stands out with its compact, portable water flossers that emphasize convenience without sacrificing performance. Panasonic targets consumers looking for efficient and user-friendly options, especially those seeking travel-friendly devices. Its range of innovative features, such as powerful water jets and cordless designs, appeals to a broad demographic focused on ease of use.

Philips Sonicare has made a significant impact in the water flosser market, known for integrating advanced technology and design into its products. With a strong focus on ergonomic and efficient models, Philips Sonicare water flossers are highly regarded for their quality and effectiveness. Philips’ global brand strength and commitment to oral health innovation support its significant market share.

These top players drive the Water Flosser Market by addressing consumers’ needs for quality, convenience, and effective oral care. Their commitment to innovation and performance ensures they meet consumer expectations, reinforcing the market’s growth and establishing standards in a competitive landscape.

Top Key Players in the Market

- Waterpik

- Panasonic Corporation

- Philips Sonicare

- Oral-B

- H2ofloss

- AQUAJET

- FlyCat

- ProFloss

- ToiletTree Products

- Jetpik

- Nicefeel

- Hydro Floss

- Hangsun

- B.Well Swiss

- Fairywill

Recent Developments

- Waterpik: In September 2024, Waterpik introduced the Sensonic™ Complete Care system, combining their top-rated water flosser with the award-winning Sensonic Toothbrush into a single, compact device. This integration aims to provide users with a comprehensive oral care solution, enhancing both convenience and effectiveness. The product underscores Waterpik’s commitment to innovative dental hygiene tools tailored to personalized oral health needs.

- SLATE: In August 2024, SLATE, a female-founded and dentist-recommended company, launched the world’s first 3-in-1 rechargeable electric flosser. The device integrates flossing, gum cleaning, and tongue scraping, leveraging supersonic technology with up to 14,000 vibrations per minute. Designed for sustainability, it includes 450 strands of woven floss and provides up to two months of use per charge.

- Waterpik: In May 2023, Waterpik expanded its handheld water flosser lineup with the Cordless Slide model. This flosser features a collapsible design for easy storage and travel, alongside a rechargeable lithium-ion battery that lasts up to four weeks per charge. It also includes three precision flossing tips, three pressure settings, and is waterproof for shower use.

Report Scope

Report Features Description Market Value (2023) USD 798.6 Million Forecast Revenue (2033) USD 1,351.2 Million CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Countertop, Cordless, Shower Flosser, Faucet Flosser, Others), By Category (Standard, Portable), By Tip Type (Classic Jet Tip, Orthodontic Tip, Toothbrush Tip, Plaque Seeker Tip, Others), By Consumer Group (Adults, Kids), By End Use (Residential, Commercial, Hospitals, Dental Clinics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Waterpik, Panasonic Corporation, Philips Sonicare, Oral-B, H2ofloss, AQUAJET, FlyCat, ProFloss, ToiletTree Products, Jetpik, Nicefeel, Hydro Floss, Hangsun, B.Well Swiss, Fairywill Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Waterpik

- Panasonic Corporation

- Philips Sonicare

- Oral-B

- H2ofloss

- AQUAJET

- FlyCat

- ProFloss

- ToiletTree Products

- Jetpik

- Nicefeel

- Hydro Floss

- Hangsun

- B.Well Swiss

- Fairywill