Global Water-Based Adhesives Market Size, Share Analysis Report By Resin Type (Acrylic Polymer Emulsion, Polyvinyl Acetate Emulsion, Vinyl Acetate Ethylene Emulsion, Styrene Butadiene Latex, Polyurethane Dispersions, Others), By Application (Paper and Packaging, Woodworking, Building and Construction, Automotive and Transportation, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155396

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

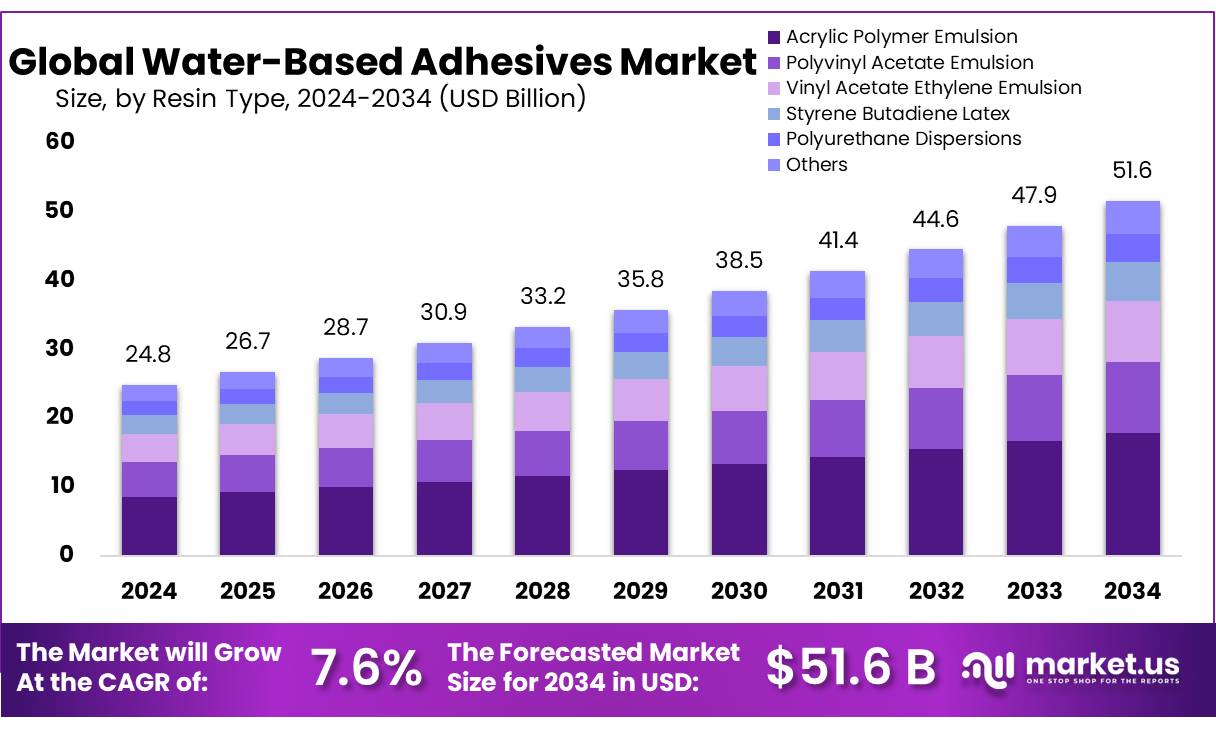

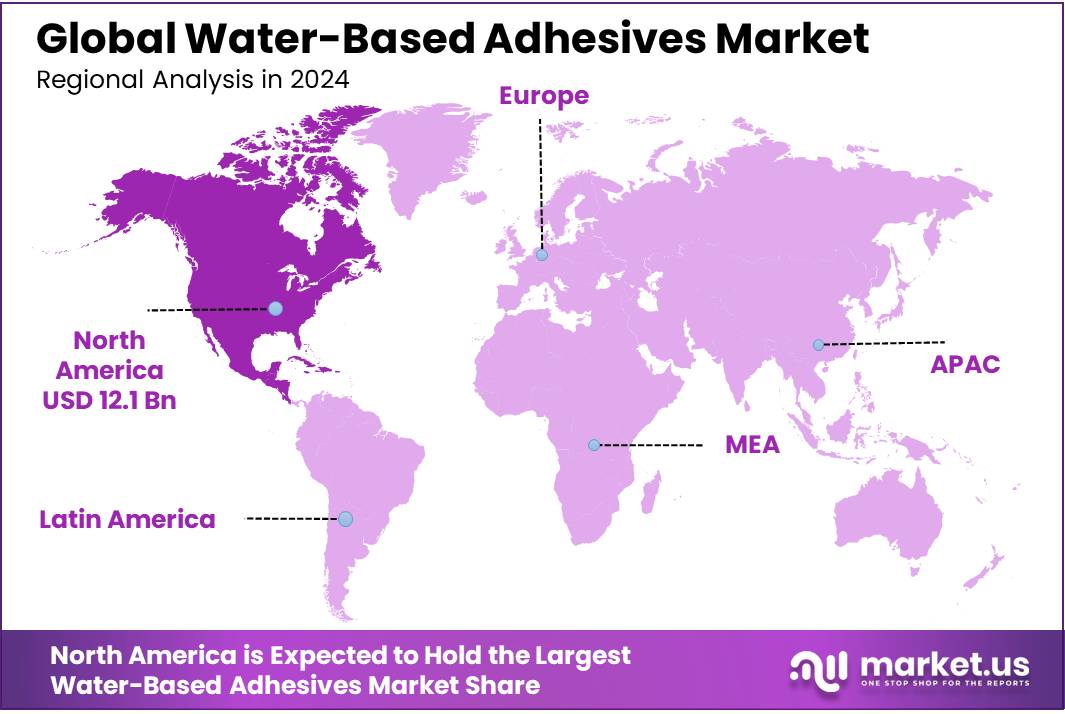

The Global Water-Based Adhesives Market size is expected to be worth around USD 51.6 Billion by 2034, from USD 24.8 Billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 48.90% share, holding USD 12.1 Billion revenue.

Water-based adhesive concentrates—typically polymer dispersions such as acrylic, VAE and PVA—have become the workhorse binders for packaging, paper converting, woodworking, hygiene and select assembly lines because they deliver fast set, clean running, and low residual monomer/VOC versus solvent systems. In Europe, polymer-dispersion/emulsion chemistries account for over 45% of adhesive volume demand, underscoring the central role of water-borne technologies in the industrial mix.

Policy pressure around packaging circularity is a structural demand driver. The EU generated 83.4 million tonnes of packaging waste in 2022 (186.5 kg per capita), and the new Packaging & Packaging Waste Regulation (PPWR) entered into force on 11 February 2025 with application 18 months later, tightening rules on recyclability, recycled content and waste reduction. Brand owners and converters are therefore favoring adhesive systems that facilitate fiber and film recycling—an area where water-based formulations (with low solvents and repulpability-friendly profiles) are advantaged.

Key Takeaways

- Water-Based Adhesives Market size is expected to be worth around USD 51.6 Billion by 2034, from USD 24.8 Billion in 2024, growing at a CAGR of 7.6%.

- Acrylic Polymer Emulsion held a dominant market positiovn, capturing more than a 34.7% share in the water-based adhesives market.

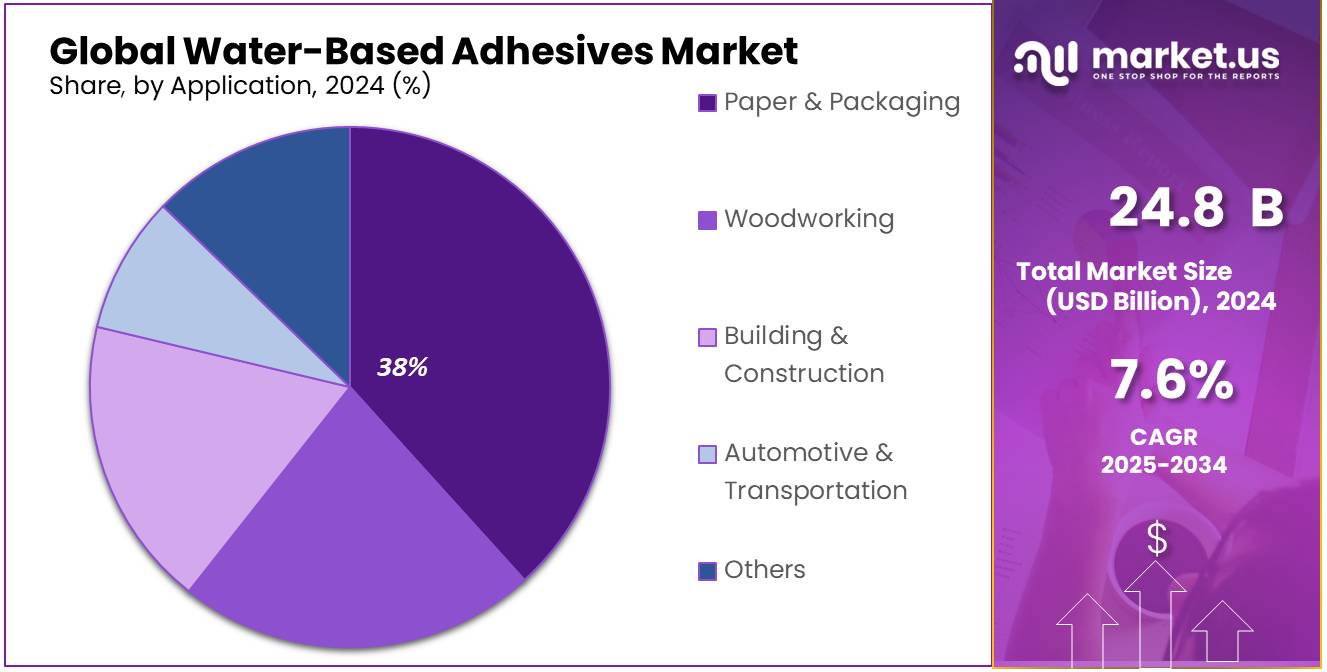

- Paper & Packaging held a dominant market position, capturing more than a 36.9% share in the water-based adhesives market.

- North America held the leading position in water-based adhesives, capturing 48.90% of global demand, valued at USD 12.1 Bn.

By Resin Type Analysis

Acrylic Polymer Emulsion leads with 34.7% share in 2024 due to its versatility and eco-friendly profile

In 2024, Acrylic Polymer Emulsion held a dominant market positiovn, capturing more than a 34.7% share in the water-based adhesives market. This resin type has gained preference in industries such as packaging, woodworking, textiles, and construction, largely due to its strong bonding properties, resistance to yellowing, and ability to perform well on a wide range of substrates. Its low volatile organic compound (VOC) content also aligns with strict environmental regulations, including the U.S. EPA’s guidelines on adhesive emissions and the EU’s REACH framework, making it a suitable choice for manufacturers aiming for compliance without compromising performance. The increasing adoption of water-based adhesives in paper and board packaging—driven by e-commerce growth and single-use plastic reduction policies—has further strengthened demand for acrylic emulsions.

By Application Analysis

Paper & Packaging dominates with 36.9% share in 2024 driven by sustainable packaging demand

In 2024, Paper & Packaging held a dominant market position, capturing more than a 36.9% share in the water-based adhesives market. This segment’s leadership comes from the rising global shift toward eco-friendly packaging solutions and the rapid growth of e-commerce, which demands reliable, high-strength bonding for cartons, corrugated boxes, and paper-based wraps. Water-based adhesives, particularly those formulated with acrylic or starch-based binders, offer low VOC emissions and easy recyclability, aligning with government-led waste reduction and circular economy initiatives in the EU, North America, and parts of Asia. For example, the European Green Deal’s packaging waste targets and U.S. state-level bans on certain single-use plastics are pushing industries to adopt paper-based alternatives sealed with compliant adhesives.

Key Market Segments

By Resin Type

- Acrylic Polymer Emulsion

- Polyvinyl Acetate Emulsion

- Vinyl Acetate Ethylene Emulsion

- Styrene Butadiene Latex

- Polyurethane Dispersions

- Others

By Application

- Paper & Packaging

- Woodworking

- Building & Construction

- Automotive & Transportation

- Others

Emerging Trends

Government Policies Driving the Shift to Water-Based Adhesives in Food Packaging

Governments worldwide are increasingly implementing policies to promote sustainable practices in the food packaging industry. These regulations are significantly influencing the adoption of water-based adhesives, which are considered more environmentally friendly compared to traditional solvent-based alternatives.

In the United States, the Environmental Protection Agency (EPA) has been actively encouraging the reduction of volatile organic compounds (VOCs) in industrial processes. Water-based adhesives, which contain lower levels of VOCs, align with these environmental goals. This regulatory push is leading food packaging companies to transition towards using water-based adhesives to comply with environmental standards and reduce their carbon footprint.

Similarly, in the European Union, the implementation of the Directive on Single-Use Plastics (SUPD) has led to stricter regulations on packaging materials. This directive encourages the use of sustainable materials and processes in packaging, thereby fostering the adoption of water-based adhesives in food packaging applications.

These government initiatives are not only promoting environmental sustainability but also driving innovation in the food packaging industry. Companies are investing in research and development to create more efficient and eco-friendly water-based adhesives, thereby enhancing the overall sustainability of food packaging solutions.

Drivers

Government Initiatives Promoting Water-Based Adhesives in Food Packaging

One of the primary driving factors for the adoption of water-based adhesives in food packaging is the increasing emphasis on sustainability and environmental safety. Governments worldwide, including in India, are implementing policies that encourage the use of eco-friendly materials in various industries, including packaging. Water-based adhesives, known for their low volatile organic compound (VOC) emissions and non-toxic properties, align well with these regulatory frameworks.

In India, the government’s initiatives such as the “Swachh Bharat Abhiyan” (Clean India Mission) have played a significant role in promoting hygiene and environmental awareness. This national movement has led to increased demand for disposable sanitary products, which often utilize water-based adhesives in their manufacturing. The shift towards sustainable and bio-based adhesives is also evident in the hygiene sector, where manufacturers are focusing on developing products that are both effective and environmentally friendly.

Furthermore, the Indian government’s “Housing for All” and “Smart Cities” initiatives are contributing to the growth of the adhesives market, including water-based adhesives. These programs aim to enhance infrastructure and urban development, leading to increased demand for construction materials and adhesives that comply with environmental standards.

The global trend towards sustainable packaging is also influencing the food packaging industry. Consumers are becoming more conscious of the environmental impact of packaging materials, prompting companies to adopt water-based adhesives that offer a safer alternative to solvent-based options. This shift is not only driven by regulatory requirements but also by consumer preference for products that are perceived as more environmentally responsible.

Restraints

Performance Limitations in Extreme Conditions

One of the significant challenges facing water-based adhesives in food packaging is their performance under extreme environmental conditions. While these adhesives are favored for their eco-friendly properties and safety, they can struggle with durability when exposed to high temperatures, humidity, or cold storage environments.

Water-based adhesives often require heat to evaporate the water content, a process that can be energy-intensive and may not be suitable for all packaging materials. In colder climates, these adhesives can become brittle, leading to potential failures in the packaging seal. Additionally, exposure to moisture can weaken the adhesive bond, compromising the integrity of the packaging and potentially affecting food safety.

These performance limitations necessitate careful consideration during the selection and application of adhesives in food packaging. Manufacturers must ensure that the chosen adhesive can withstand the specific environmental conditions the packaging will encounter, including transportation and storage temperatures. This may involve additional testing and possibly the use of specialized formulations to enhance the adhesive’s resilience.

Opportunity

Government Support for Sustainable Food Packaging

The global shift towards sustainable practices has significantly influenced the food packaging industry, with governments worldwide implementing policies to encourage the use of eco-friendly materials. This trend has notably impacted the adoption of water-based adhesives in food packaging, offering both environmental and economic benefits.

Water-based adhesives, which utilize water as a solvent instead of harmful chemicals, are gaining traction due to their reduced environmental impact. These adhesives are particularly suitable for food packaging applications, as they are non-toxic and comply with stringent food safety regulations. For instance, the U.S. Environmental Protection Agency (EPA) has reported a steady increase in the recycling rate of generated packaging and containers, reaching 53.9% in 2018, indicating a growing trend towards sustainable packaging solutions.

In Europe, the European Union has set ambitious recycling targets, aiming for a recycling rate of 80% for glass packaging. This regulatory push has led to an increased demand for adhesives that facilitate recycling processes, with water-based adhesives being a preferred choice due to their compatibility with recyclable materials.

Asia-Pacific, particularly countries like China and India, are also witnessing a surge in the adoption of sustainable packaging materials. This is driven by rapid industrialization, urbanization, and a growing consumer preference for eco-friendly products. The region’s strong growth in e-commerce further boosts the demand for flexible packaging, where water-based adhesives are extensively used.

Regional Insights

North America leads with 48.90% and USD 12.1 Bn in 2024, powered by packaging and policy tailwinds

In 2024, North America held the leading position in water-based adhesives, capturing 48.90% of global demand, valued at USD 12.1 Bn. The region’s scale is underpinned by a broad adhesives ecosystem—the Adhesive & Sealant Council pegs the North American adhesives and sealants industry at about USD 22 Bn and 28,000+ jobs, reflecting deep downstream demand in packaging, woodworking, construction, and transportation.

The United States is the primary contributor to this dominance, driven by stringent environmental regulations and a strong push towards sustainable manufacturing practices. The U.S. Environmental Protection Agency (EPA) has been instrumental in enforcing policies that limit the use of volatile organic compounds (VOCs), thereby encouraging industries to adopt water-based adhesives. These adhesives are favored for their low toxicity and compliance with environmental standards, making them suitable for various applications, including packaging, construction, and automotive industries.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Henkel is a global leader in adhesives, sealants, and functional coatings, with a strong footprint in water-based adhesive technologies for packaging, woodworking, and construction. Its products meet strict VOC and sustainability standards, supporting industries shifting from solvent-based systems. In 2024, Henkel expanded low-emission adhesive lines to align with EU Green Deal and U.S. regulatory goals. The company leverages its global R&D network to deliver high-performance acrylic and PUD dispersions, maintaining strong presence in North America, Europe, and Asia.

H.B. Fuller specializes in adhesives and sealants, offering a broad portfolio of water-based solutions for paper converting, hygiene products, and flexible packaging. In 2024, the company strengthened its eco-friendly adhesive range to comply with California’s Rule 1168 and European VOC directives. With operations in over 35 countries, H.B. Fuller focuses on high-bond strength, repulpable, and food-safe adhesive systems, supporting the circular economy. Its innovations target e-commerce packaging and recyclable label adhesives, ensuring compliance and performance in demanding applications.

Dow is a major supplier of water-based acrylic and polyurethane dispersions used in packaging, textiles, and building materials. Its adhesives are designed for high performance, low environmental impact, and compliance with VOC regulations in the U.S., EU, and Asia. In 2024, Dow advanced its waterborne adhesive technologies to improve recyclability in paper and plastic packaging. The company’s innovation focus includes food-safe, repulpable systems that align with extended producer responsibility (EPR) policies, strengthening its competitive position in sustainable adhesives.

Top Key Players Outlook

- Henkel AG & Co. KgaA

- H.B. Fuller

- Arkema

- Dow

- Ashland

- Bayer AG

- PPG Industries

- Sika AG

- Akzo Nobel N.V.

- 3M

- DuPont

Recent Industry Developments

In 2024, Henkel AG & Co. KGaA generated approximately €21.6 billion in total sales, with its Adhesive Technologies division delivering around €10.97 billion, up 1.7% year‑on‑year.

In 2024, Dow Inc. posted total net sales of USD 42,964 million, with the Packaging & Specialty Plastics segment—home to its water‑based and other adhesive businesses—bringing in USD 21,776 million, albeit down from USD 23,149 million in 2023

Report Scope

Report Features Description Market Value (2024) USD 24.8 Bn Forecast Revenue (2034) USD 51.6 Bn CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Resin Type (Acrylic Polymer Emulsion, Polyvinyl Acetate Emulsion, Vinyl Acetate Ethylene Emulsion, Styrene Butadiene Latex, Polyurethane Dispersions, Others), By Application (Paper and Packaging, Woodworking, Building and Construction, Automotive and Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Henkel AG & Co. KgaA, H.B. Fuller, Arkema, Dow, Ashland, Bayer AG, PPG Industries, Sika AG, Akzo Nobel N.V., 3M, DuPont Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Water-Based Adhesives MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Water-Based Adhesives MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Henkel AG & Co. KgaA

- H.B. Fuller

- Arkema

- Dow

- Ashland

- Bayer AG

- PPG Industries

- Sika AG

- Akzo Nobel N.V.

- 3M

- DuPont