Global Water And Wastewater Treatment Market Size, Share Analysis Report By Type (Chemicals, Equipment, Services), By Process (Primary, Secondary, Tertiary), By Application (Municipal, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152332

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

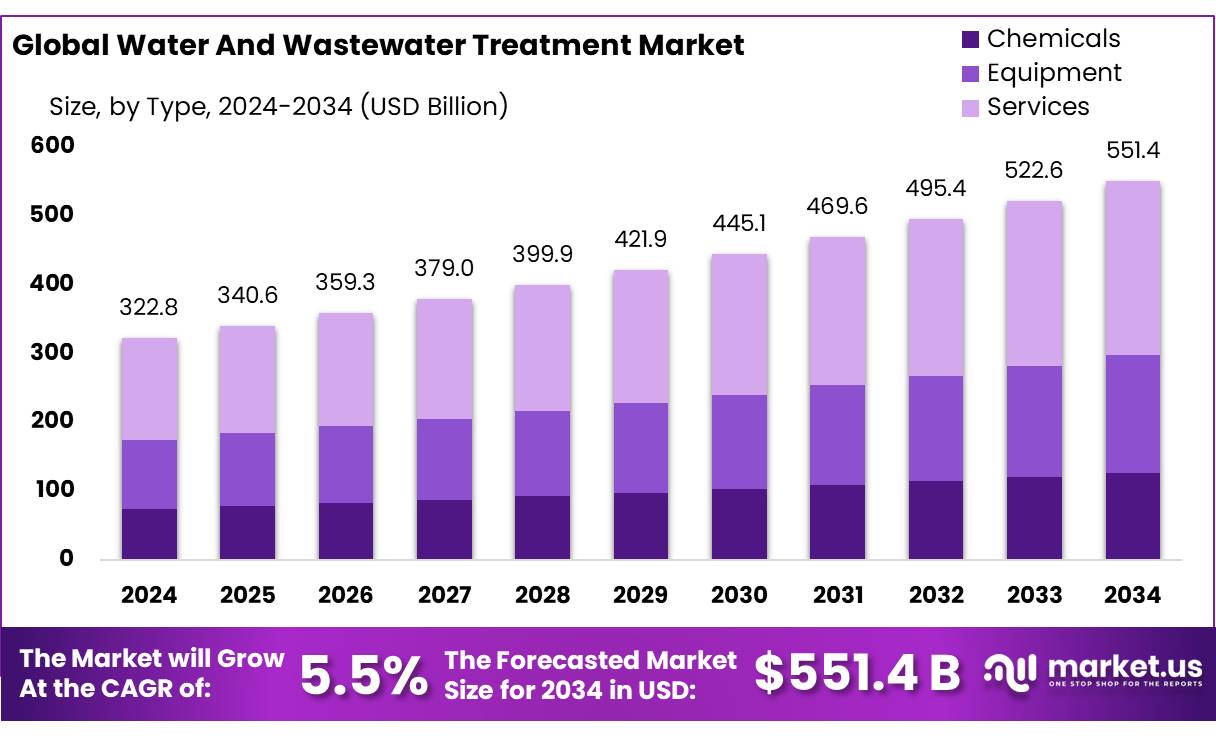

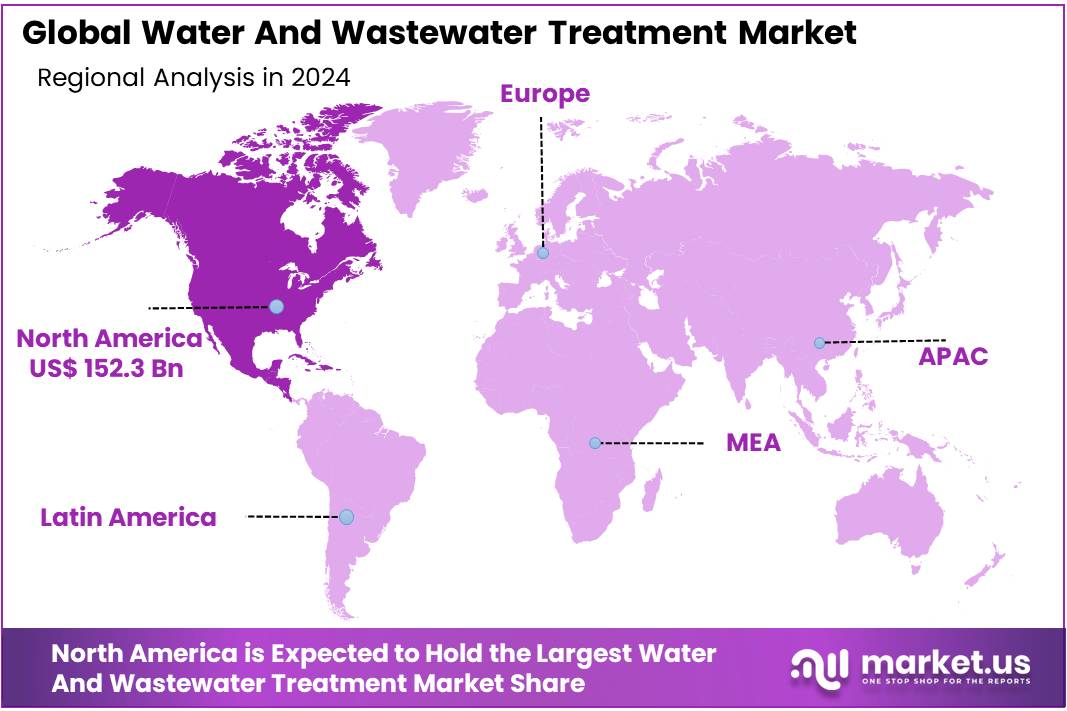

The Global Water And Wastewater Treatment Market size is expected to be worth around USD 551.4 Billion by 2034, from USD 322.8 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 47.2% share, holding USD 152.3 billion revenue.

The water and wastewater treatment concentrates industry encompasses the sectors and chemicals employed to purify, disinfect, and manage liquid effluents at industrial, municipal, and agricultural scales. This includes coagulants (e.g., alum, ferric chloride), disinfectants (chlorine, ozone), pH adjusters, antiscalants, flocculants, sludge conditioners, and advanced specialty concentrates such as PFAS-binding resins. These chemical products are supplied by major chemical providers, often as bespoke formulations tailored to specific treatment systems.

Several driving factors fuel the growth of this sector. Intensifying urbanisation has driven sewage production—India generates approximately 38,354 MLD (million-litres/day) of municipal sewage, whereas its treatment capacity is only 11,786 MLD, indicating a vast infrastructure and treatment gap.

Regulatory measures such as India’s National Water Policy (2012), National Environment Policy (2006), National Sanitation Policy (2008), and National River Conservation Plan have mandated stricter control, reuse, and treatment of wastewater, promoting concentrate management through centralized plants and decentralized systems. Governmental programmes such as the Jal Jeevan Mission, National Mission for Clean Ganga, and Atal Mission for Rejuvenation and Urban Transformation (AMRUT), along with the establishment of the Jal Shakti Ministry in 2019, have additionally funded efforts to upgrade treatment infrastructure.

Chemical concentrates are critical to meeting tightening discharge standards for nutrients, pathogens, heavy metals, and emerging contaminants such as PFAS. A recent US landmark study identified that 95% of sewage sludge sites and associated wastewater plants exhibited elevated levels of PFAS downstream—often exceeding draft EPA guidance of as low as 0.0009 parts per trillion for PFOA—underscoring the urgency to enhance treatment practices through more effective chemical dosing.

Regulatory pressure and government initiatives have been primary drivers. In the United States, the EPA’s Effluent Limitation Guidelines regulate approximately 40,000 direct-discharge industrial facilities and 129,000 point-source dischargers, mandating the use of best available treatment technologies to comply with the Clean Water Act.

Additionally, federal funding mechanisms such as the US Congress-sponsored infrastructure programs under the Clean Water State Revolving Fund have allocated billions for upgrading plants and chemical systems. In Brazil, PRODES reimburses up to 50 % of capital for new wastewater plants if performance standards are met

Key Takeaways

- Water And Wastewater Treatment Market size is expected to be worth around USD 551.4 Billion by 2034, from USD 322.8 Billion in 2024, growing at a CAGR of 5.5%.

- Services held a dominant market position, capturing more than a 44.9% share of the overall Water and Wastewater Treatment Market.

- Primary held a dominant market position, capturing more than a 48.2% share in the Water and Wastewater Treatment Market.

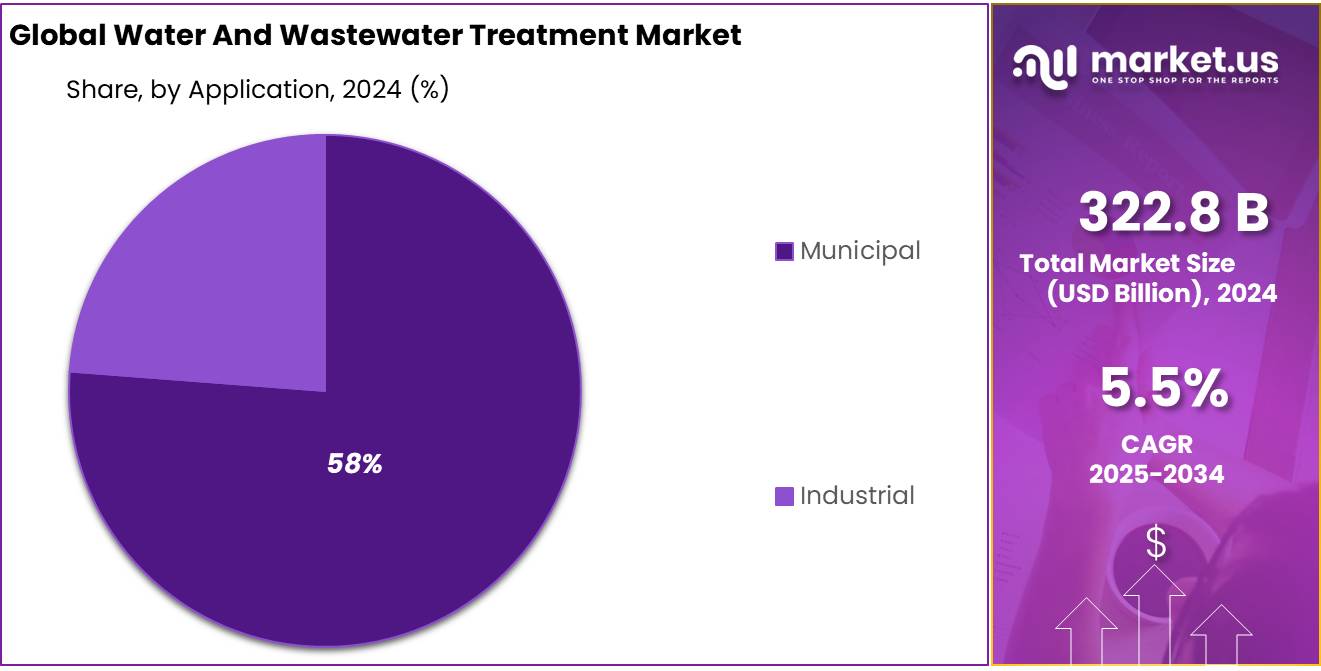

- Municipal held a dominant market position, capturing more than a 58.3% share in the Water and Wastewater Treatment Market.

- North America stands as a dominant force in the global water and wastewater treatment market, commanding a substantial 47.2% share, equating to approximately USD 152.3 billion.

By Type Analysis

Services dominate with 44.9% share in 2024 due to growing demand for operational efficiency and regulatory compliance.

In 2024, Services held a dominant market position, capturing more than a 44.9% share of the overall Water and Wastewater Treatment Market. This segment includes essential offerings such as plant operations, maintenance, water quality monitoring, consultancy, and regulatory compliance services. The growing need for efficient water management systems, especially in industrial and municipal sectors, has driven the demand for specialized service providers.

Many governments and private operators are increasingly outsourcing operations to third-party service companies to ensure adherence to strict environmental norms and improve treatment efficiency. The shift toward Public-Private Partnerships (PPP) for managing large-scale water infrastructure projects has further contributed to the expansion of the services segment.

By Process Analysis

Primary process leads with 48.2% share in 2024 driven by its essential role in initial pollutant removal.

In 2024, Primary held a dominant market position, capturing more than a 48.2% share in the Water and Wastewater Treatment Market by process. This stage plays a critical role in removing large solids, grit, oils, and floating materials from raw wastewater before it moves to more advanced treatment levels. Its importance lies in preparing the water for secondary and tertiary processes by reducing the pollutant load at an early stage. The widespread use of sedimentation tanks and screening methods in municipal and industrial treatment facilities has solidified the primary segment’s stronghold. Additionally, the relatively low operational cost and simpler infrastructure needs have made it a preferred choice, particularly in regions developing new wastewater systems.

By Application Analysis

Municipal sector dominates with 58.3% share in 2024 as cities focus on clean water and sanitation.

In 2024, Municipal held a dominant market position, capturing more than a 58.3% share in the Water and Wastewater Treatment Market by application. This strong presence is mainly due to the growing need for clean water supply and effective sewage management across urban and semi-urban areas. Municipalities are under increasing pressure to improve water quality, reduce pollution, and ensure access to safe drinking water for rapidly expanding populations. As a result, governments are investing heavily in centralized treatment plants, sewage networks, and water reuse systems. Programs such as city-level sanitation upgrades and rural water missions have significantly boosted the adoption of treatment technologies at the municipal level.

Key Market Segments

By Type

- Chemicals

- pH Conditioners

- Coagulants & Flocculants

- Disinfectants & Biocidal Products

- Scale & Corrosion Inhibitors

- Antifoam Chemicals

- Others

- Equipment

- Biological

- Filtration

- Sludge Treatment

- Disinfection

- Demineralization

- Others

- Services

- Designing & Installation

- Operations

- Maintenance

- Others

By Process

- Primary

- Secondary

- Tertiary

By Application

- Municipal

- Industrial

- Food & Beverage

- Power Generation

- Pharmaceuticals

- Pulp and Paper

- Oil & Gas

- Petrochemical

- Others

Emerging Trends

Adoption of Advanced Water Reuse Technologies

A significant trend in the water and wastewater treatment market is the increasing adoption of advanced water reuse technologies. This shift is driven by the need to address water scarcity and improve water sustainability.

For instance, in 2024, the U.S. Environmental Protection Agency (EPA) launched the National Water Reuse Action Plan, aiming to enhance water reuse across the country. The plan outlines 37 actions across 11 strategic themes to promote the adoption of water reuse as part of integrated water resources planning.

Additionally, the EPA awarded $6.4 million in research grants to Iowa State University and the Water Research Foundation to support national efforts in reducing technological and institutional barriers for expanded water reuse. These initiatives are part of a broader effort to unlock the nationwide potential of water reuse and ensure a sustainable water future .

Globally, countries are implementing similar strategies. For example, China has mandated raising the proportion of sewage that must be treated to reuse standards to 25% by 2025, as part of its 14th Five-Year Plan . These developments indicate a global shift towards recognizing water reuse as a critical component of sustainable water management.

Drivers

Government Regulations and Initiatives Driving the Water and Wastewater Treatment Market

The global demand for water and wastewater treatment technologies has surged, fueled significantly by stricter government regulations on water quality and wastewater management. According to the U.S. Environmental Protection Agency (EPA), nearly 80% of wastewater generated in the country undergoes some form of treatment, showcasing the critical role of regulations in ensuring public health and environmental sustainability. These regulations require municipalities and industries to invest in advanced treatment processes to meet the standards for water quality.

Government-driven initiatives are also a major contributor. In 2023, the European Commission introduced the EU Water Framework Directive, emphasizing the need to treat wastewater effectively to protect water bodies and ecosystems. This directive, along with other similar regulations, pushes industries to adopt innovative treatment methods, including membrane filtration, advanced oxidation processes, and chemical treatment solutions.

The growing global population and industrial activities further complicate water scarcity, creating an urgent need for better treatment processes. The International Water Association (IWA) reports that nearly 1.7 billion people globally are experiencing water scarcity. As a result, governments have ramped up their efforts to promote wastewater recycling and reuse to address water shortages.

As governments invest in sustainable infrastructure and green technologies, the market for water and wastewater treatment systems is projected to grow significantly. In 2024, the U.S. government allocated over US$6 billion for clean water initiatives under the American Rescue Plan, marking one of the largest investments in wastewater treatment systems in decades.

Restraints

High Capital and Operational Costs Limiting Market Growth

A major restraining factor for the water and wastewater treatment market is the high capital and operational costs associated with setting up and maintaining treatment facilities. These expenses can be a significant barrier for both developing nations and smaller municipalities that struggle to secure adequate funding.

According to the U.S. Environmental Protection Agency (EPA), the estimated cost of upgrading and maintaining water and wastewater infrastructure in the U.S. alone is about US$271 billion over the next 20 years. These high upfront costs for installation, along with ongoing expenses for energy, labor, and maintenance, present a challenge for many regions, especially those facing economic pressures.

Additionally, energy consumption is a significant cost driver in the treatment process. The water treatment industry is energy-intensive, and with energy costs rising globally, the cost of operating wastewater treatment plants has also increased. The U.S. Department of Energy (DOE) reports that water and wastewater treatment accounts for around 3% of the total energy use in the U.S. This is a considerable share of national energy consumption, which further adds to the operational costs of these facilities.

While governments in developed countries are investing in infrastructure improvements and technology, the financial burden remains a challenge in many parts of the world. The United Nations (UN) has estimated that by 2030, over 50% of the global population will live in water-stressed regions. This highlights the urgent need for affordable, cost-effective treatment solutions, yet the high costs of conventional methods remain a major limiting factor for market expansion.

Opportunity

Increase in Water Recycling and Reuse Initiatives Driving Market Growth

A significant growth opportunity in the water and wastewater treatment market lies in the increasing adoption of water recycling and reuse technologies. As water scarcity becomes a more pressing global issue, governments, industries, and municipalities are looking for sustainable solutions to reduce water consumption.

According to the World Health Organization (WHO), nearly 2.2 billion people around the world lack access to safely managed drinking water services, and the demand for water is expected to grow by 40% by 2030. This situation is pushing industries to adopt water recycling technologies that allow treated wastewater to be reused for non-potable applications like irrigation, industrial processes, and even potable use after advanced treatment.

In response to this, many countries have introduced initiatives and policies to encourage water reuse. For example, the U.S. Environmental Protection Agency (EPA) has launched the “Water Reuse Action Plan,” which includes strategies to increase the use of reclaimed water for various purposes. The plan outlines a vision to significantly reduce pressure on freshwater resources, with a goal of recycling and reusing more than 10 billion gallons of water per day by 2030.

Additionally, the European Union’s Circular Economy Action Plan emphasizes water reuse as a vital part of its sustainable growth strategy. The EU has already started implementing policies for water recycling in several member states, with a particular focus on agricultural and industrial sectors. In 2022, the EU adopted new guidelines to standardize and promote water reuse for agricultural irrigation, which is expected to enhance water availability and reduce the strain on natural freshwater resources.

Regional Insights

North America takes the lead with 47.2% share and a market value of US 152.3 billion in 2024.

North America stands as a dominant force in the global water and wastewater treatment market, commanding a substantial 47.2% share, equating to approximately USD 152.3 billion in 2024. This leadership is underpinned by stringent environmental regulations, advanced infrastructure, and significant investments in sustainable water management practices.

Canada also plays a pivotal role, with major cities like Ottawa and Toronto operating advanced water treatment facilities. For instance, Ottawa’s Britannia Water Treatment Plant treats approximately 200 megalitres of water daily . Such infrastructure supports the nation’s commitment to maintaining high water quality standards and addressing challenges related to water scarcity and pollution.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Suez reported consolidated revenue of €9.2 billion in 2024, with around 40,000 employees across its global operations focused on water and wastewater services. The company’s activities in tertiary water treatment technologies are expanding to meet stricter discharge standards in both municipal and industrial sectors. As a subsidiary of the Suez utility group, it leverages proven expertise in ozone, UV, and advanced oxidation processes to add capacity in emerging markets and retrofit ageing facilities—an area poised for further investment through 2025.

Xylem generated approximately USD 8.6 billion in revenue in 2024 and operates in over 150 countries with 23,000 employees. It serves markets encompassing clean water, wastewater transport and treatment, analytical instrumentation, and dewatering. The 2023 acquisition of Evoqua for USD 7.5 billion has broadened Xylem’s capabilities across treatment and service offerings.

DuPont offers a spectrum of high-performance materials and filtration membranes for water and wastewater applications. Its solutions support ultrafiltration, reverse osmosis, and ion-exchange across municipal and industrial sectors. As a recognized major equipment provider, DuPont’s technologies are frequently used in tertiary and advanced treatment systems. Integration of new polymer chemistries and modular membrane systems is expected to enhance project delivery and cost efficiency through 2025.

Top Key Players Outlook

- Suez Environnement S.A.

- Veolia Environnement SA.

- Xylem, Inc.

- DuPont de Nemours, Inc.

- 3M Company, Inc

- Pentair plc

- United Utilities Group PLC

- Kingspan Group Plc

- The Dow Chemical Company

- BASF SE

- Kurita Water Industries Ltd.

- Bio-Microbics, Inc.

- Calgon Carbon Corporation

- Trojan Technologies Inc.

- Kemira Oyj

- Thermax Limited

Recent Industry Developments

In 2024, 3M Company, Inc. reported overall revenues of USD 24.6 billion, with adjusted sales at USD 23.6 billion—reflecting a modest 1.2% organic growth year-on-year.

In 2024, DuPont de Nemours, Inc. posted full-year net sales of USD 12.39 billion, up 3% from the prior year, with organic sales increasing by 1% and the Water & Protection segment—covering water treatment technologies—growing 6% to USD 1.36 billion in Q4 alone.

Report Scope

Report Features Description Market Value (2024) USD 322.8 Bn Forecast Revenue (2034) USD 551.4 Bn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Chemicals, Equipment, Services), By Process (Primary, Secondary, Tertiary), By Application (Municipal, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Suez Environnement S.A., Veolia Environnement SA., Xylem, Inc., DuPont de Nemours, Inc., 3M Company, Inc, Pentair plc, United Utilities Group PLC, Kingspan Group Plc, The Dow Chemical Company, BASF SE, Kurita Water Industries Ltd., Bio-Microbics, Inc., Calgon Carbon Corporation, Trojan Technologies Inc., Kemira Oyj, Thermax Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Water And Wastewater Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Water And Wastewater Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Suez Environnement S.A.

- Veolia Environnement SA.

- Xylem, Inc.

- DuPont de Nemours, Inc.

- 3M Company, Inc

- Pentair plc

- United Utilities Group PLC

- Kingspan Group Plc

- The Dow Chemical Company

- BASF SE

- Kurita Water Industries Ltd.

- Bio-Microbics, Inc.

- Calgon Carbon Corporation

- Trojan Technologies Inc.

- Kemira Oyj

- Thermax Limited