Global Water and Wastewater Pipe Market By Type(Plastic, Steel, Ductile Iron, Concrete, Clay), By Diameter(Upto 1200 mm, 1200 mm to 3600 mm, Abovee 3600 mm), By Business Type (Original Equipment Manufacturer (OEM), Aftermarket), By Application(Water Supply and Distribution, Wastewater Management, By End-use, Municipal, Industrial, Agriculture), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: April 2024

- Report ID: 49969

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

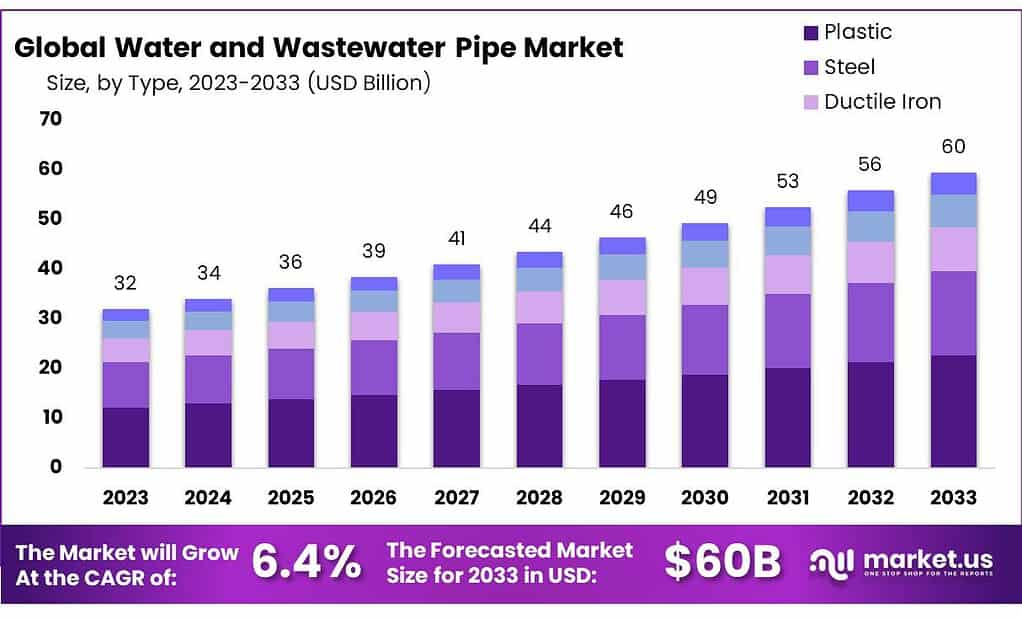

The global Water and Wastewater Pipe Market size is expected to be worth around USD 60 billion by 2033, from USD 32 billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2023 to 2033.

The Water and Wastewater Pipe Market refers to the sector within the broader construction and infrastructure industries that focuses on the manufacturing, distribution, and installation of pipes used for the conveyance of fresh water to residential, commercial, and industrial users, as well as the removal and treatment of wastewater.

This market encompasses a wide range of pipe materials including, but not limited to, metal, plastic, concrete, and clay, each offering distinct advantages in terms of durability, cost, and suitability for different environmental conditions and pressures.

The significance of this market can be attributed to the essential role of water and wastewater management systems in ensuring public health, environmental sustainability, and economic development. As populations grow and urbanization increases, the demand for efficient and reliable water supply and sanitation systems rises, driving the expansion and innovation within this market. Additionally, the aging infrastructure in many regions requires upgrades and replacements, further stimulating market growth.

Market dynamics are influenced by various factors including technological advancements in pipe manufacturing, regulatory policies focused on water conservation and environmental protection, and trends towards the use of more sustainable and durable materials. The market is also impacted by global economic conditions, as investments in infrastructure are closely tied to economic health.

Furthermore, the Water and Wastewater Pipe Market is segmented based on the type of pipe, application, and geography, offering detailed insights into the preferences and needs of different market segments. This market is critical for the development of robust water management systems, reflecting its importance in meeting the water and sanitation needs of societies worldwide.

Key Takeaways

- Market Growth Projection: The market is to reach USD 60 billion by 2033, with a CAGR of 6.4%.

- Pipe Material Preferences: Plastic pipes lead with 38.3% market share, favored for lightweight and corrosion resistance.

- Segment Analysis: Pipes up to 1200 mm diameter dominate with 39.4% market share, versatile for various applications.

- Application Insights: The water supply & distribution segment holds a 67.4% share, crucial for clean water infrastructure.

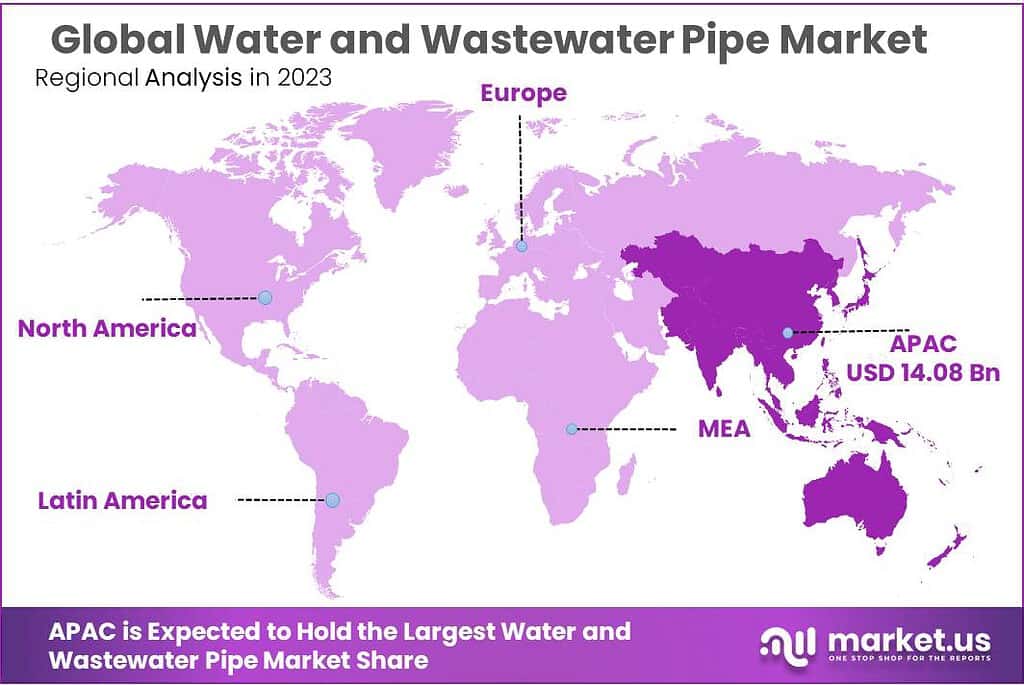

- Regional Analysis: Asia Pacific leads with a 44.5% market share, driven by investments in China and India.

- In 2023, the leakage rate from water distribution systems in England and Wales was estimated to be around 20%

- In the United States, it is estimated that aging water distribution systems account for around 14% to 18% of treated water being lost through leaks and breaks

- In Canada, it is estimated that over $25 billion will be needed to replace and upgrade aging water and wastewater infrastructure in the next 10 years

By Type

In 2024, Plastic pipes held a dominant market position, capturing more than a 38.3% share. Their popularity stems from their lightweight nature, ease of installation, and resistance to corrosion. Plastic pipes, including PVC and HDPE varieties, are widely used in both potable water supply and wastewater systems. Their flexibility and durability under varying environmental conditions make them a preferred choice for a broad range of applications.

Steel pipes, recognized for their strength and longevity, also play a crucial role in the Water and Wastewater Pipe Market. They are particularly valued in high-pressure and industrial applications where their ability to withstand physical stresses and chemical reactions is essential. Although they command a smaller market share compared to plastic, their importance cannot be understated, especially in regions requiring robust infrastructure.

Ductile Iron pipes, celebrated for their resilience and reliability, are often used in main water supply networks and critical wastewater handling. Their market segment benefits from the material’s capacity to absorb vibration and resist impact, making ductile iron a go-to for urban and industrial settings. Despite facing competition from newer materials, ductile iron pipes maintain a significant market presence due to their long service life and proven performance.

Concrete pipes, favored for large-diameter applications, are a key component in stormwater drainage systems and large-scale wastewater management. Their market segment benefits from the material’s strength, durability, and cost-effectiveness for large projects. The ability of concrete pipes to handle high volumes of water and their resistance to environmental degradation make them indispensable in specific infrastructure projects.

Lastly, Clay pipes, with a history dating back thousands of years, continue to be valued for their natural resistance to corrosion and their sustainability. Primarily used in sewer systems, their market segment appeals to those looking for environmentally friendly and durable solutions. While they hold a smaller share of the market, the demand for clay pipes persists in niche applications where their unique properties are most advantageous.

By Diameter

In 2024, the segment of pipes with a diameter of up to 1200 mm emerged as the market leader, securing over 39.4% of the market share. These smaller diameter pipes are widely used in various applications such as residential, commercial, and industrial sectors due to their versatility and ease of installation.

The diameter range of 1200 mm to 3600 mm accounted for a significant portion of the market, showing steady growth and holding a substantial market share. These medium-sized pipes are often employed in municipal water supply and wastewater management projects, as well as in industrial applications requiring higher flow rates.

Meanwhile, the segment comprising pipes with a diameter above 3600 mm demonstrated promising growth potential in 2024. Although representing a smaller portion of the overall market, these large diameter pipes are essential for major infrastructure projects such as water distribution networks, sewage systems, and drainage solutions in urban areas.

Overall, the water and wastewater pipe market exhibited a diversified landscape in 2024, with different diameter segments catering to distinct application needs and contributing to the overall growth of the industry.

By Business Type

In 2024, the Aftermarket segment claimed the top spot in the market, seizing over 72.3% of the share. This segment comprises businesses involved in the sale of replacement parts, maintenance, and repair services for water and wastewater pipes after the initial installation.

Conversely, the Original Equipment Manufacturer (OEM) segment accounted for a smaller portion of the market, showing steady growth and holding a notable market share. Companies in this segment specialize in the production and sale of new water and wastewater pipes, fittings, and related equipment.

Overall, the Aftermarket segment’s dominance in 2024 reflects the ongoing demand for maintenance and repair services in the water and wastewater pipe industry, driven by the need to ensure the efficient operation and longevity of existing infrastructure. However, the OEM segment remains crucial for supplying new equipment and supporting infrastructure development projects worldwide.

By Application

In 2024, the Water Supply & Distribution segment dominated the market, securing over 67.4% of the share. This segment includes pipes used to transport clean water from treatment plants to homes, businesses, and other facilities, as well as within distribution networks.

On the other hand, the Wastewater Management segment accounted for a significant portion of the market, exhibiting steady growth and holding a substantial market share. Pipes in this segment are crucial for collecting and transporting wastewater from residential, commercial, and industrial sources to treatment facilities for processing and disposal.

Overall, the Water Supply & Distribution segment emerged as the primary driver of market growth in 2024, reflecting the importance of clean water infrastructure in supporting communities and industries. However, the Wastewater Management segment also played a critical role in addressing environmental concerns and ensuring public health and safety through effective wastewater treatment and disposal systems.

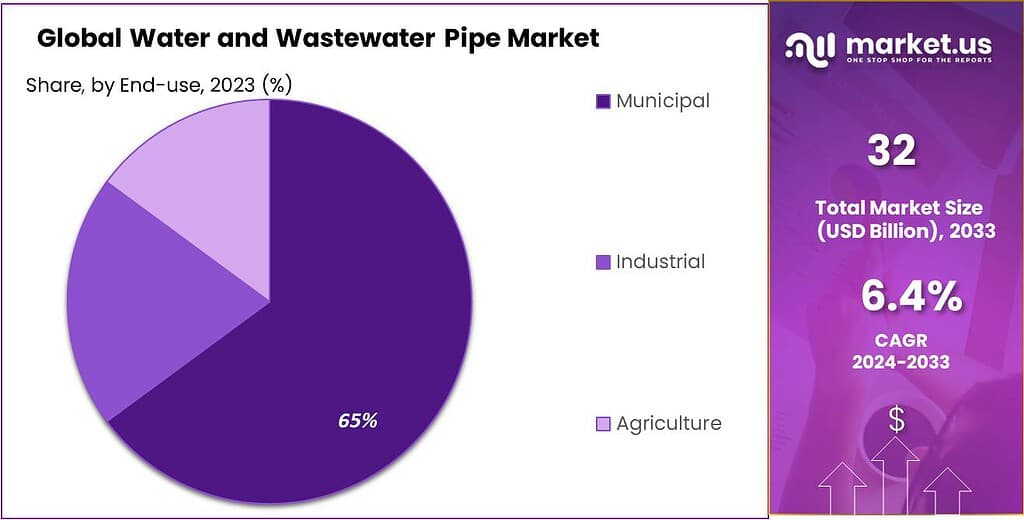

By End-use

In 2024, the Municipal segment led the market, capturing over 64.6% of the share. This segment includes pipes used in water supply and wastewater management systems for cities, towns, and other urban areas.

Conversely, the Industrial segment accounted for a significant portion of the market, showing steady growth and holding a substantial market share. Pipes in this segment are employed in various industrial applications such as manufacturing, processing, and power generation.

Additionally, the Agriculture segment represented a smaller portion of the market, but it exhibited promising growth potential in 2024. Pipes in this segment are utilized for irrigation systems, drainage, and water distribution on farms and agricultural lands.

Overall, the Municipal segment’s dominance underscores the importance of water infrastructure in supporting urban development and public health. However, the Industrial and Agriculture segments also play vital roles in meeting the diverse water needs of industries and agricultural activities, contributing to the overall growth of the water and wastewater pipe market.

Key Market Segments

By Type

- Plastic

- Steel

- Ductile Iron

- Concrete

- Clay

By Diameter

- Upto 1200 mm

- 1200 mm to 3600 mm

- Abovee 3600 mm

By Business Type

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Application

- Water Supply & Distribution

- Wastewater Management

By End-use

- Municipal

- Industrial

- Agriculture

Drivers

Infrastructure Development

Infrastructure development stands as a paramount driver propelling the water and wastewater pipe industry forward. Across the globe, burgeoning populations and urbanization trends amplify the demand for robust water and wastewater management systems. As governments and municipalities embark on extensive infrastructure projects to meet the escalating needs of growing communities, the requirement for reliable water and wastewater pipes intensifies.

In both developed and emerging economies, aging water and wastewater infrastructure presents a pressing concern. Deteriorating pipes are prone to leaks, corrosion, and inefficiencies, jeopardizing water quality, public health, and environmental sustainability. Consequently, there’s a palpable urgency to replace outdated infrastructure with modern, durable piping systems capable of withstanding the rigors of long-term service.

Moreover, expanding urbanization exerts substantial stress on existing water and wastewater networks. Rapid urban growth necessitates the extension and augmentation of these systems to accommodate burgeoning populations. Urban planners and policymakers recognize the imperative of investing in resilient infrastructure to ensure the reliable delivery of clean water and effective wastewater treatment to urban residents.

Furthermore, the imperative to mitigate the impacts of climate change amplifies the significance of robust water and wastewater infrastructure. Extreme weather events, such as floods, droughts, and storms, underscore the vulnerability of existing systems. To enhance resilience and adaptability, governments allocate substantial resources toward upgrading infrastructure, and incorporating advanced materials and technologies to enhance durability and performance.

The proliferation of innovative technologies also fuels the demand for water and wastewater pipes. Advancements in materials science, such as the development of high-density polyethylene (HDPE), polyvinyl chloride (PVC), and ductile iron pipes, offer superior strength, corrosion resistance, and longevity compared to traditional materials. Additionally, smart pipe technologies, including sensors and monitoring systems, enable real-time data collection and remote management, enhancing operational efficiency and reducing maintenance costs.

Furthermore, regulatory frameworks and environmental mandates exert a significant influence on the water and wastewater pipe industry. Stringent regulations governing water quality, pollution control, and environmental conservation drive the adoption of advanced pipe materials and treatment technologies. Compliance with regulatory standards necessitates ongoing investments in infrastructure upgrades and improvements to ensure regulatory compliance and safeguard public health and environmental integrity.

Restraints

Financial Constraints

Financial constraints emerge as a significant restraint hampering the growth and development of the water and wastewater pipe industry. Despite the pressing need for infrastructure upgrades and expansions, limited financial resources pose formidable barriers to investment in new piping systems and rehabilitation of existing infrastructure.

One of the primary challenges stems from the sheer scale and scope of infrastructure projects required to address aging water and wastewater networks. Upgrading and replacing pipelines, treatment facilities, and distribution systems entail substantial capital outlays, often exceeding the budgetary capacities of municipal governments and utilities. As a result, many infrastructure projects face delays or downsizing, compromising the effectiveness and reliability of water and wastewater systems.

Moreover, competing funding priorities exacerbate financial constraints within the water sector. Municipal budgets must allocate resources across various essential services, including transportation, education, healthcare, and public safety, leaving limited funding available for water and wastewater infrastructure. In times of economic downturn or fiscal austerity, governments may prioritize immediate needs over long-term infrastructure investments, further constraining funding for pipe replacement and rehabilitation projects.

Additionally, the decentralized nature of water and wastewater infrastructure ownership and management complicates funding arrangements. In many regions, water systems are fragmented, comprising numerous small-scale utilities and local authorities with limited financial capacities. Coordinating funding efforts and implementing large-scale infrastructure projects across multiple stakeholders pose logistical and financial challenges, impeding progress in upgrading and expanding water and wastewater networks.

Furthermore, reliance on traditional funding mechanisms, such as government grants, bonds, and user fees, may prove insufficient to meet the escalating demands for infrastructure investment. Inadequate revenue streams and revenue volatility jeopardize the financial sustainability of water utilities, hindering their ability to finance capital-intensive projects. Additionally, concerns over affordability and ratepayer burdens may constrain utilities’ ability to raise revenues through tariff adjustments, limiting their capacity to finance infrastructure improvements.

The complexity of regulatory compliance also contributes to financial constraints within the water and wastewater pipe industry. Stringent environmental regulations and quality standards necessitate investments in advanced treatment technologies and infrastructure upgrades to ensure regulatory compliance. However, the associated costs of compliance may strain the financial resources of utilities, particularly smaller entities with limited economies of scale.

Opportunities

Adoption of Sustainable Solutions

The adoption of sustainable solutions presents a significant opportunity for the water and wastewater pipe industry, driving innovation, efficiency, and environmental stewardship. As societies increasingly prioritize sustainability and environmental responsibility, there is growing demand for infrastructure solutions that minimize resource consumption, reduce emissions, and enhance resilience to climate change.

One of the key opportunities lies in the promotion of water conservation and efficiency measures through advanced pipe technologies. Sustainable pipe materials, such as high-density polyethylene (HDPE) and PVC, offer superior durability, corrosion resistance, and leak-proof performance, minimizing water loss and maximizing system efficiency. By deploying leak detection systems, pressure management technologies, and smart metering solutions, utilities can identify and address leaks promptly, conserving precious water resources and reducing operational costs.

Furthermore, the transition towards decentralized and distributed water management systems presents fertile ground for innovation and investment in the water and wastewater pipe industry. Decentralized wastewater treatment technologies, such as membrane bioreactors (MBRs) and constructed wetlands, offer scalable, cost-effective solutions for treating wastewater closer to the point of generation. Flexible pipe materials and modular designs facilitate the installation and integration of decentralized systems, enabling utilities to adapt to changing demographics and land-use patterns.

Moreover, the rise of circular economy principles offers opportunities for resource recovery and value creation within the water sector. Advanced pipe materials, such as thermoplastic composites and reinforced concrete, enable the construction of pipelines capable of transporting not only water but also reclaimed water, recycled materials, and renewable energy sources. By integrating resource recovery technologies, such as anaerobic digestion and nutrient capture, into wastewater treatment processes, utilities can extract value from waste streams and reduce environmental impact.

Additionally, the convergence of digitalization and data analytics unlocks new opportunities for optimizing water and wastewater infrastructure performance. Smart pipe technologies, embedded with sensors and communication devices, enable real-time monitoring of flow rates, pressure levels, and water quality parameters, empowering utilities to make informed decisions and preemptively address potential issues. By leveraging big data analytics and predictive modeling, utilities can optimize asset management, prioritize maintenance activities, and enhance system resilience in the face of evolving environmental challenges.

Furthermore, the increasing emphasis on climate resilience and adaptation creates demand for innovative pipe solutions capable of withstanding extreme weather events and environmental hazards. Resilient pipe materials, such as fiber-reinforced polymers (FRP) and concrete-lined steel, offer enhanced durability and resistance to corrosion, erosion, and seismic activity, ensuring the long-term reliability of water and wastewater infrastructure in vulnerable regions.

Trends

Integration of Advanced Materials and Technologies

The water and wastewater pipe market is witnessing a transformative trend characterized by the integration of advanced materials and technologies, revolutionizing the design, construction, and operation of water infrastructure systems. As the industry seeks to address pressing challenges related to aging infrastructure, water scarcity, and environmental sustainability, stakeholders are increasingly turning to innovative solutions that enhance durability, efficiency, and resilience.

One prominent trend driving this paradigm shift is the adoption of advanced pipe materials offering superior performance and longevity. Traditional materials such as cast iron and concrete are being supplanted by high-performance polymers, composites, and alloys engineered to withstand harsh operating conditions and minimize lifecycle costs. High-density polyethylene (HDPE), polyvinyl chloride (PVC), and fiberglass-reinforced plastics (FRP) are gaining prominence due to their lightweight, corrosion-resistant properties, and ease of installation, facilitating faster, more cost-effective pipeline construction.

Furthermore, the integration of digital technologies and smart infrastructure solutions is reshaping the water and wastewater pipe market landscape. The proliferation of sensors, actuators, and communication devices embedded within pipelines enables real-time monitoring of flow rates, pressure levels, and water quality parameters, facilitating proactive maintenance and asset management. Advanced data analytics platforms leverage big data and machine learning algorithms to optimize system performance, detect anomalies, and predict potential failures, enhancing operational efficiency and reliability.

Moreover, the trend towards modular and prefabricated pipe systems is gaining traction, offering greater flexibility, scalability, and cost-effectiveness in infrastructure deployment. Modular pipe components, such as precast concrete segments and prefabricated plastic modules, streamline construction processes, minimize onsite disruption, and accelerate project timelines. Prefabrication also enables customization and standardization of pipe components, ensuring consistency in quality and performance across diverse applications and geographic regions.

Additionally, the emergence of circular economy principles is driving innovation in the water and wastewater pipe market, promoting resource recovery, and sustainable materials management. Closed-loop systems, incorporating recycled and reclaimed materials, reduce environmental impact and conserve natural resources while enhancing the resilience and durability of water infrastructure. Advanced treatment technologies, such as membrane filtration and reverse osmosis, enable the purification and reuse of wastewater, mitigating water scarcity and reducing reliance on freshwater sources.

Furthermore, the trend towards decentralized and distributed water management systems is reshaping the traditional centralized model, empowering communities to manage water resources locally and adapt to changing environmental conditions. Decentralized treatment technologies, such as modular bioreactors and green infrastructure, offer scalable, cost-effective solutions for wastewater treatment and stormwater management, reducing the burden on centralized treatment facilities and improving system resilience.

Regional Analysis

The Asia Pacific region is forecasted to lead the global water and wastewater pipe market, capturing a dominant share of 44.5%. This growth is primarily fueled by rising demand for efficient water management solutions across key industries such as manufacturing, construction, and environmental conservation efforts.

Significant investments in water and wastewater pipe projects in countries like China, India, and various Southeast Asian nations including Korea, Thailand, Malaysia, and Vietnam are expected to drive market expansion in the region. This surge is supported by increasing industrial activities and a growing emphasis on sustainable water management practices to meet escalating demand and achieve environmental goals.

In North America, economic progress and the expansion of sectors requiring reliable and sustainable water infrastructure, such as manufacturing and large-scale construction projects, are projected to boost demand for water and wastewater pipes. The region’s commitment to achieving renewable energy targets and reducing environmental impacts further strengthens this demand, positioning North America as a significant market for water and wastewater pipe solutions.

Similarly, Europe is set to witness substantial growth in the water and wastewater pipe market. This growth is driven by the transition towards sustainable water management practices by consumers and industries, coupled with robust demand from manufacturing sectors, infrastructure development initiatives, and sustainable resource management projects. Europe’s focus on energy independence, sustainability, and environmental responsibility highlights the increasing adoption of water and wastewater pipe solutions in the region.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The water and wastewater pipe market is characterized by a diverse landscape of manufacturers, suppliers, and distributors competing to capture market share across various regions and segments. A comprehensive market share analysis provides insights into the competitive dynamics, key players, and market trends shaping the industry.

Key Market Players

- Compagnie de Saint-Gobain S.A

- China Lesso Group Holdings Limited

- Aliaxis S.A.

- Mexichem

- S.A.B. de C.V.

- Sekisui Chemical Co.Ltd.

- Tenaris S.A.

- Welspun Corp Limited

- Nan Ya Plastics Corporation

- Advanced Drainage Systems Inc.

- Tata Steel Limited

- Wienerberger AG

- ISCO Industries LLC

Recent Developments

In 2024, Compagnie de Saint-Gobain S.A. expanded its market presence by acquiring several key players in the water and wastewater pipe sector, strategically positioning itself as a leading supplier of comprehensive solutions for water infrastructure projects

Report Scope

Report Features Description Market Value (2023) USD 32 Bn Forecast Revenue (2033) USD 60 Bn CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Plastic, Steel, Ductile Iron, Concrete, Clay), By Diameter(Upto 1200 mm, 1200 mm to 3600 mm, Abovee 3600 mm), By Business Type (Original Equipment Manufacturer (OEM), Aftermarket), By Application(Water Supply and Distribution, Wastewater Management, By End-use, Municipal, Industrial, Agriculture) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Compagnie de Saint-Gobain S.A, China Lesso Group Holdings Limited, Aliaxis S.A., Mexichem, S.A.B. de C.V., Sekisui Chemical Co.Ltd., Tenaris S.A., Welspun Corp Limited, Nan Ya Plastics Corporation, Advanced Drainage Systems Inc., Tata Steel Limited, Wienerberger AG, ISCO Industries LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Water and Wastewater Pipe Market?Water and Wastewater Pipe Market size is expected to be worth around USD 60 billion by 2033, from USD 32 billion in 2023

What CAGR is projected for the Water and Wastewater Pipe Market?The Water and Wastewater Pipe Market is expected to grow at 6.4% CAGR (2024-2033).Name the major industry players in the Water and Wastewater Pipe Market?Compagnie de Saint-Gobain S.A, China Lesso Group Holdings Limited, Aliaxis S.A., Mexichem, S.A.B. de C.V., Sekisui Chemical Co.Ltd., Tenaris S.A., Welspun Corp Limited, Nan Ya Plastics Corporation, Advanced Drainage Systems Inc., Tata Steel Limited, Wienerberger AG, ISCO Industries LLC

Water and Wastewater Pipe MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Water and Wastewater Pipe MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Compagnie de Saint-Gobain S.A

- China Lesso Group Holdings Limited

- Aliaxis S.A.

- Mexichem

- S.A.B. de C.V.

- Sekisui Chemical Co.Ltd.

- Tenaris S.A.

- Welspun Corp Limited

- Nan Ya Plastics Corporation

- Advanced Drainage Systems Inc.

- Tata Steel Limited

- Wienerberger AG

- ISCO Industries LLC