Global Voice Commerce Market Size, Share, Statistics Analysis Report By Device Type (Smart Speakers, Smartphones), By Industry Vertical (Consumer Goods & Retail, Healthcare, Automotive, Travel & Tourism, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140392

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Regional Analysis

- Analysts’ Viewpoint

- Device Type Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

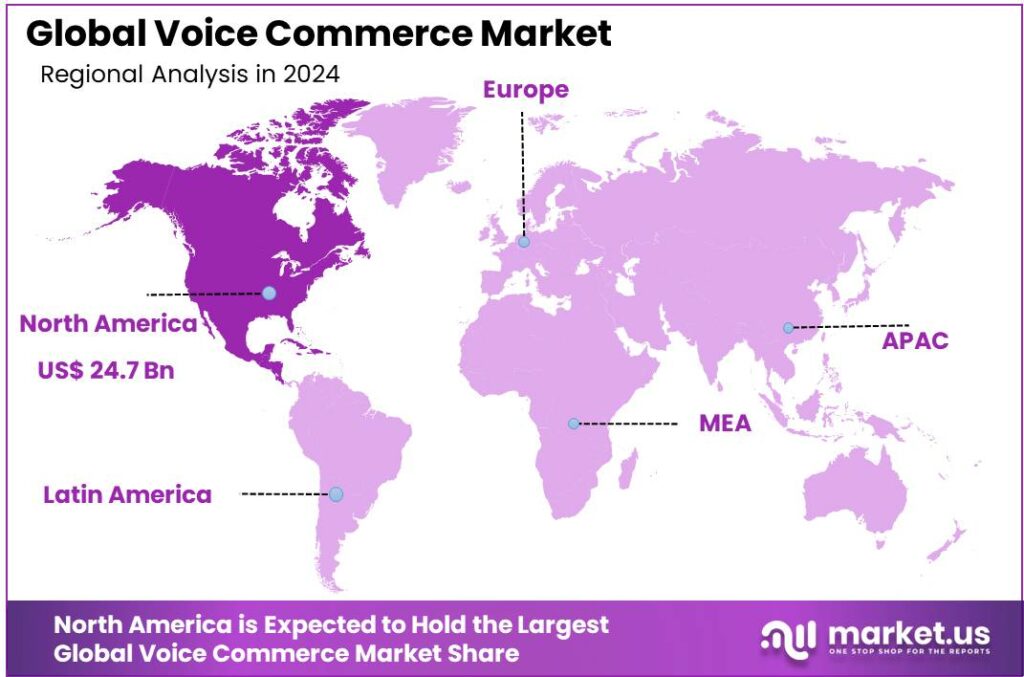

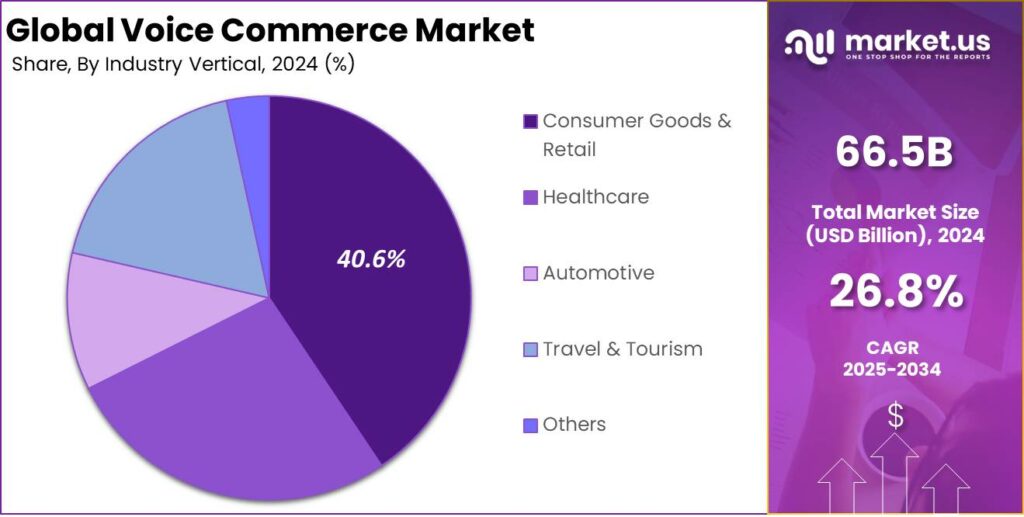

The Global Voice Commerce Market size is expected to be worth around USD 714.5 Billion By 2034, from USD 66.5 Billion in 2024, growing at a CAGR of 26.80% during the forecast period from 2025 to 2034. North America led the market in 2024, holding more than 37.2% of the voice commerce market, with revenues reaching approximately USD 24.7 billion.

The voice commerce market has witnessed significant growth in recent years, driven by the increasing integration of voice-activated devices in consumers’ daily lives. The market expansion can be attributed to the growing adoption of smart speakers, smartphones, and other voice-enabled technologies (Amazon’s Alexa, Google Assistant, and Apple’s Siri), which facilitate a seamless shopping experience.

The major driving factors of the Voice Commerce market include advancements in AI and NLP (Natural Language Processing), increased smartphone penetration, and the growing popularity of smart home devices. Voice assistants are becoming smarter, enabling more accurate and personalized shopping experiences. Consumers are increasingly relying on voice technology for its convenience, particularly for hands-free operations while multitasking.

In recent years, voice-based artificial intelligence (AI) has rapidly changed the way consumers interact with brands, particularly in retail. According to data from Capital One Shopping, 74% of consumers using voice assistants have completed at least part of their buying process through a conversational AI. This highlights a growing trend where voice shopping is becoming a crucial part of the retail experience.

Smartphones continue to dominate as the primary device for voice searches, with 89.2% of voice assistant users engaging mainly through their mobile devices. Interestingly, voice search is not just a convenience but often the preferred method of searching. 71% of consumers would rather use voice search than manually typing out queries, showing a clear shift toward hands-free, faster interactions.

Voice shopping is expected to be a major driver of future e-commerce growth, with projections suggesting it will account for 30% of e-commerce revenue by 2030. Consumers who use voice shopping are also more likely to make a purchase compared to those using social media shopping, being 4.31% more likely to buy through voice-enabled devices. This suggests that voice shopping could offer a more seamless and efficient shopping experience compared to other online platforms.

Impulse buying is another area where voice shopping shows its impact. 11.4% of consumers admit to making impulsive purchases through voice assistants, highlighting how convenient and quick the process can be. When it comes to local and small businesses, voice search is also having a significant effect. 46% of consumers use voice search to look up prices at local businesses, and 41% use it to find grocery stores.

Additionally, 40% of consumers rely on voice search to check product availability at specific businesses, while 32% use it to find clothing stores. The trend suggests that consumers are increasingly turning to voice assistants for everyday shopping needs, including both local and online purchases.

After discovering a local business through voice search, 27% of users visit the business’s website, signaling a shift toward more direct consumer-business interaction. Further, 46% of voice search users, or 26.7% of all consumers, use their voice-enabled devices daily to search for local businesses, and 28% use it weekly.

Key Takeaways

- The Global Voice Commerce Market size is projected to reach USD 714.5 Billion by 2034, growing from USD 66.5 Billion in 2024, reflecting a CAGR of 26.80% during the forecast period from 2025 to 2034.

- In 2024, the Smart Speakers segment dominated the market, accounting for over 45.7% of the total voice commerce market share.

- The Consumer Goods & Retail sector also held a dominant position in 2024, capturing over 40.6% of the overall voice commerce market share.

- North America led the market in 2024, holding more than 37.2% of the voice commerce market, with revenues reaching approximately USD 24.7 billion.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than 37.2% of the voice commerce market, with revenues reaching approximately USD 24.7 billion. The region’s leadership is driven by several key factors, including a high adoption rate of smart speakers and voice assistants, particularly in the United States and Canada.

The widespread use of Amazon Alexa, Google Assistant, and Apple’s Siri has paved the way for seamless voice-enabled shopping experiences, which are increasingly integrated into consumer lifestyles. The region benefits from a highly developed digital infrastructure, robust e-commerce platforms, and a tech-savvy consumer base, all of which contribute to its market.

Additionally, North America’s large-scale investments in AI and machine learning technologies to improve voice recognition and user experience have significantly boosted the growth of voice commerce. Companies are continuously enhancing their voice-based shopping interfaces to make transactions smoother and more personalized, offering users a frictionless and efficient shopping journey.

Moreover, North America’s e-commerce giants like Amazon, Walmart, and Target have aggressively embraced voice commerce as a way to enhance their market reach and customer engagement. As these companies expand their voice-activated shopping features, the demand for voice-enabled devices and services continues to grow.

Analysts’ Viewpoint

The demand for voice commerce is primarily driven by consumer preferences for convenience and speed in their purchasing decisions. With consumers often seeking faster and easier ways to complete online transactions, voice commerce offers a compelling solution. Personalization plays a crucial role, as virtual assistants can recommend products based on consumer preferences and past buying behavior.

Investors are increasingly turning their attention to the voice commerce sector, recognizing it as a lucrative avenue for growth. Opportunities for investment exist in developing voice-activated shopping platforms, voice-recognition technology, and expanding the retail ecosystem through voice-powered integrations.

Companies that specialize in artificial intelligence (AI), machine learning, and cloud computing are well-positioned to capitalize on the demand for voice commerce solutions. However, the market is not without risks. Security concerns related to voice data, potential privacy violations, and data breaches could create obstacles to widespread adoption.

Moreover, the evolving nature of voice commerce technology and the lack of standardized regulations could present uncertainties for investors. The regulatory environment surrounding voice commerce remains fluid, with governments around the world beginning to focus on consumer protection, privacy, and data security. In particular, regulations surrounding voice data collection, consumer consent, and data storage are expected to evolve as the technology becomes more integrated into daily life.

Device Type Analysis

In 2024, the Smart Speakers segment held a dominant market position, capturing more than a 45.7% share of the voice commerce market. This significant share can be attributed to the increasing adoption of smart speakers in households worldwide.

Devices like Amazon Echo, Google Nest, and Apple HomePod have become central to smart homes, enabling seamless voice command integration into daily routines. With voice assistants like Alexa, Google Assistant, and Siri, these devices have become key entry points for voice-based shopping, making them the go-to choice for consumers in voice commerce.

Smart speakers are highly convenient due to their hands-free, always-on functionality. As they become more affordable and feature-rich, they’re increasingly appealing to both consumers and businesses. With an intuitive interface for purchasing, checking order status, and reordering items, they create an ecosystem that encourages frequent use.

The growing use of smart speakers for voice-enabled shopping is shaping consumer behavior. These devices offer a hands-free, engaging experience with voice-activated promotions, personalized recommendations, and easy transactions. The convenience of ordering via simple voice commands is appealing to busy consumers seeking shopping options.

Industry Vertical Analysis

In 2024, the Consumer Goods & Retail segment held a dominant market position, capturing more than 40.6% of the overall voice commerce market share. This is primarily attributed to the rapid digital transformation of retail, where convenience and personalization are key drivers for consumer engagement.

The increasing reliance on voice assistants like Amazon Alexa and Google Assistant has further boosted the segment’s growth, as these platforms are integrated into everyday consumer habits. Retailers are leveraging voice-enabled devices not only for transactional purposes but also to offer personalized product recommendations, which significantly improve customer loyalty and retention.

Moreover, advancements in voice recognition technology have enabled retailers to offer a more intuitive and engaging shopping experience. Consumers can now interact with virtual assistants to search for specific products, compare prices, and even track orders all without needing to physically engage with their devices.

The Consumer Goods & Retail segment remains the largest and most influential in voice commerce, with retailers heavily investing in the technology to enhance the shopping experience. While other industries are exploring voice commerce, none have matched retail’s scale and integration, ensuring its continued dominance.

Key Market Segments

By Device Type

- Smart Speakers

- Smartphones

By Industry Vertical

- Consumer Goods & Retail

- Healthcare

- Automotive

- Travel & Tourism

- Others

Driver

Increased Adoption of Smart Speakers and Voice Assistants

The rise in adoption of smart speakers and voice assistants is a key driver propelling the growth of voice commerce. As these technologies improve, the frictionless experience they offer whether it’s reordering frequently purchased products or exploring new ones appeals to the modern consumer’s preference for convenience and speed.

With smart speakers, consumers can place orders while cooking, exercising, or even driving. The ease and seamlessness of placing orders via voice eliminate the need for complicated navigation or manual input, which has been a key barrier in traditional e-commerce. Voice-activated shopping also appeals to a wide range of demographics, particularly the elderly or those with disabilities, who might find traditional online shopping interfaces more cumbersome.

Restraint

Privacy and Data Security Concerns

Despite its growing popularity, voice commerce faces significant challenges in terms of privacy and data security. The continuous rise in voice assistant usage also increases the potential for unauthorized data access, as these devices are always listening.Data breaches and fears around surveillance could discourage consumers from fully embracing voice-activated shopping, especially in sensitive areas like financial transactions.

The data collected by voice assistants often includes search history, preferences, and even conversations. While companies claim to encrypt and anonymize this data, past incidents have raised doubts about how securely user data is handled. A significant amount of personal information is often tied to the accounts linked to these devices, such as payment details, making it a potential target for hackers. Consumers may feel uneasy knowing that their data could be accessed by unauthorized third parties, potentially exposing them to identity theft or fraud.

Opportunity

Integration of Voice Commerce with E-Commerce Platforms

One major opportunity in voice commerce lies in its integration with existing e-commerce platforms. Leading online retailers, like Amazon and Walmart, are already beginning to integrate voice-activated shopping features into their websites and apps, allowing consumers to place orders via smart speakers or mobile devices.

By tracking voice-based orders, companies can gather data on the types of products that are frequently purchased, the average order value, and the timing of purchases. This information can be used to improve marketing strategies, refine product recommendations, and optimize inventory management.

Voice commerce also opens up opportunities for dynamic pricing strategies. E-commerce platforms can tailor prices based on user preferences, regional data, and purchasing history. This allows businesses to offer personalized deals, increasing customer satisfaction and retention.

Challenge

Voice Recognition Accuracy in Diverse Accents and Languages

While voice commerce offers immense convenience, a major challenge it faces is the accuracy of voice recognition, particularly when it comes to diverse accents and languages. Voice assistants, although significantly improved over the years, still struggle with understanding various regional accents, dialects, and speech patterns.

The challenge lies not only in accurately understanding words but also in interpreting context and intent. For instance, a consumer may request a product, but voice assistants may misinterpret the request based on ambiguous phrasing or lack of context, resulting in an incorrect order or frustration during the transaction.

Moreover, voice assistants are often limited by the languages they support. While major languages like English, Spanish, and Mandarin are well-covered, the tech has yet to accommodate regional languages and dialects, limiting the inclusivity of voice commerce.

Emerging Trends

One of the key emerging trends in this space is the growing integration of voice assistants with shopping platforms. Amazon’s Alexa and Google Assistant, for example, are enhancing their e-commerce capabilities, enabling users to make purchases directly through voice commands. Consumers can order everything from groceries to gadgets, simply by speaking to their devices.

Another noteworthy trend is the rise of voice-activated search. As voice search becomes more accurate, more people are using it to find products online. Retailers are adapting by optimizing their websites for voice search, ensuring that their products are easily discoverable through voice-enabled devices.

Personalization is also becoming a key focus within voice commerce. Devices like Amazon Echo or Google Home now offer customized recommendations based on users’ previous purchases and preferences, making the shopping experience more tailored and efficient.

Additionally, there is a growing trend of integrating voice technology into customer service. Businesses are using voice assistants to handle queries, resolve issues, and offer post-purchase support, reducing the need for human interaction in simple cases.

Business Benefits

One of the most significant advantages is convenience. By offering a hands-free shopping experience, businesses can cater to consumers looking for speed and ease. This ease of use can lead to higher conversion rates, as customers can place orders without even needing to look at their devices.

Voice commerce also offers an opportunity for businesses to capture data on consumer preferences and behavior. By analyzing the voice queries and orders made, businesses can gain insights into customer needs and trends, enabling them to make more informed decisions and refine their marketing strategies.

Additionally, voice commerce enables businesses to tap into the rapidly growing smart device market. With more consumers adopting devices like Amazon Echo, Google Home, and Apple’s Siri, businesses have a wider audience to cater to. By integrating with these devices, companies can open up new sales channels and increase visibility in a way that aligns with modern consumer habits.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

As Voice Commerce Market expands, key players are continually shaping the industry with innovative technologies, offering solutions that blend voice recognition, AI, and e-commerce platforms.

Adobe Inc. has cemented its position as a key player in voice commerce with its cutting-edge digital marketing and analytics tools. Adobe’s Experience Cloud leverages artificial intelligence to help businesses personalize the shopping experience through voice-powered interactions. Adobe integrates voice recognition into marketing, helping brands engage customers, streamline transactions, and improve overall engagement.

Algolia Inc. stands out for its robust search and discovery solutions, which are crucial for voice commerce applications. Algolia’s AI-driven search engine enhances voice search accuracy and relevance, enabling businesses to deliver fast, personalized voice commerce experiences that meet consumer expectations. Its focus on speed and scalability ensures optimal performance.

Alibaba Group Holding Ltd. has been a pioneer in integrating voice commerce with its vast e-commerce platform. The company’s smart speakers and AI-driven virtual assistant, AliGenie, enable users to browse, order, and pay for products via voice commands. Alibaba’s ecosystem blends its digital payment services with advanced voice technologies, creating a seamless shopping journey for consumers.

Top Key Players in the Market

- Adobe Inc.

- Algolia Inc.

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- Apple Inc.

- Baidu Inc.

- BigCommerce Pty. Ltd.

- Google LLC

- Salesforce Inc.

- Samsung Electronics Co.

- Sonos Inc.

- Twilio Inc.

- Other Key Players

Top Opportunities Awaiting for Players

- Enhanced Consumer Shopping Experience: Voice commerce provides a seamless and hands-free shopping experience, making it a highly attractive option for busy consumers. The opportunity here lies in enhancing the customer experience further by integrating personalized features. Companies that focus on improving voice search algorithms, personalization, and easy voice-based transactions will see significant returns as they cater to the evolving consumer behavior.

- Expanding into New Market Segments: There’s a large untapped market of senior citizens and less tech-oriented consumers who are seeking more accessible shopping solutions. Businesses that create user-friendly voice interfaces and target this demographic with easy navigation and clear instructions could unlock a new, profitable customer base.

- Integration with Smart Homes and IoT: Consumers are increasingly looking for convenience, and integrating voice shopping into smart home systems like ordering groceries, controlling appliances, or reordering products opens up numerous touchpoints for engagement. Companies can collaborate with IoT manufacturers to embed voice commerce features directly into their devices, making it easier for customers to shop without having to leave their homes or switch devices.

- Expansion of Subscription-Based Models: Subscription-based services, such as automatic reordering of essentials, are gaining traction in voice commerce. Market players can capitalize on this by offering subscription services that are voice-activated, creating an easy and hassle-free method for customers to manage regular purchases, increasing repeat orders, and customer retention.

- Voice Search and SEO Optimization: Companies that optimize their websites for voice search will ensure that they show up in results when consumers are making voice-activated queries.The businesses that optimize their content, keywords, and user experience for voice search will have an advantage over competitors who haven’t yet adapted. Creating content that’s easy to understand, concise, and conversational can help businesses rank higher in voice search results.

Recent Developments

- In June 2024, Announced Adobe Commerce Integration and Became an Adobe Technology Partner at the Gold Level.

- In August 2024, SoundHound AI acquired Amelia, an enterprise AI software company specializing in voice interfaces and natural language conversational capabilities for customer service applications.

- Salesforce reached an agreement to acquire Tenyx in September 2024. This acquisition, set to close in 2025, integrates Tenyx’s Voice AI technology into Salesforce’s offerings, enhancing autonomous agent capabilities and AI-driven solutions for customer service.

Report Scope

Report Features Description Market Value (2024) USD 66.5 Bn Forecast Revenue (2034) USD 714.5 Bn CAGR (2025-2034) 26.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device Type (Smart Speakers, Smartphones), By Industry Vertical (Consumer Goods & Retail, Healthcare, Automotive, Travel & Tourism, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe Inc., Algolia Inc., Alibaba Group Holding Ltd., Amazon.com Inc., Apple Inc., Baidu Inc., BigCommerce Pty. Ltd., Google LLC, Salesforce Inc., Samsung Electronics Co., Sonos Inc., Twilio Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adobe Inc.

- Algolia Inc.

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- Apple Inc.

- Baidu Inc.

- BigCommerce Pty. Ltd.

- Google LLC

- Salesforce Inc.

- Samsung Electronics Co.

- Sonos Inc.

- Twilio Inc.

- Other Key Players