Global Vitamin D Testing Market By Product (25-Hydroxy Vitamin D Testing, 1,25-Dihydroxy Vitamin D Testing, 24,25-Dihydroxy Vitamin D Testing), By Application (Clinical Testing, Research Testing), By Technique (Radioimmunoassay, ELISA, HPLC, LC-MS, Others), By Indication (Osteoporosis, Rickets, Thyroid Disorders, Malabsorption, Vitamin D Deficiency, Others), By End User (Hospitals, Diagnostic Laboratories, Home Care, Point-of-Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 17732

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

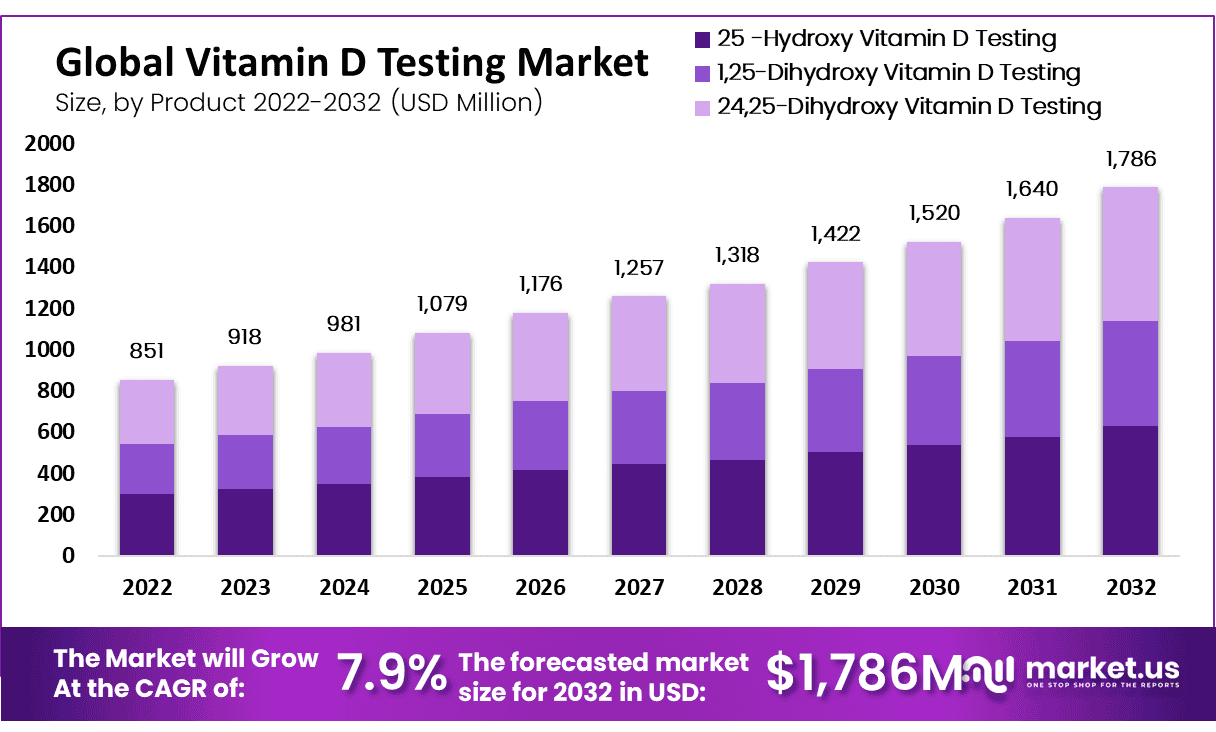

The Global Vitamin D Testing Market size is expected to be worth around USD 1,786.0 Million by 2032 from USD 918 Million in 2023, growing at a CAGR of 7.90% during the forecast period from 2023 to 2032.

Vitamin D is a fat-soluble prohormone steroid used by the body to promote bone growth and maintenance. It also helps increase calcium, magnesium, and phosphate absorption in the body. Around 1 billion people worldwide have vitamin D deficiencies, while 50% of the population has vitamin D deficiency, which can cause widespread weakness, fatigue, muscle pains, muscle twitching, and osteoporosis. All ages are affected by the deficiency, including infants, children, the elderly, pregnant ladies, and others. A vitamin D deficiency can lead to irritability, lethargy, and developmental delay in children.

A test tube is used to preserve the blood sample, in which the doctor uses a tiny needle to take a blood sample during a test. This research usually takes about five minutes. Vitamin D deficiency can lead to osteoporosis, bone disease, and other chronic conditions such as osteomalacia. Certain laboratories and healthcare facilities use Vitamin-D assays to determine the amount of vitamin D compounds in the blood.

Vitamin D2 and vitamin D3 are both yeast, and plants make the two main types of vitamin D. Vitamin D2, but only mammals can make it. Vitamin D is required for many body functions, including building bone and muscle and improving the immune system.

Key Takeaways

- Vitamin D deficiency affects 1 billion people globally, with 50% of the population experiencing some level of deficiency.

- More than 200 million women worldwide are affected by osteoporosis.

- The Global Vitamin D Testing Market is growing at a CAGR of 7.90%.

- The market is driven by increasing awareness and the rising incidence of vitamin D deficiency, promoting preventive healthcare.

- The 25-hydroxy vitamin D test is the primary method for assessing vitamin D levels, and it holds the largest market share.

- Clinical testing is the dominant application for vitamin D testing, with diagnostic laboratories being the major end-users.

- Osteoporosis and rickets are significant indications for vitamin D testing due to their links to vitamin D deficiency.

- Liquid Chromatography-Mass Spectrometry (LC-MS) is the dominant technique due to its accuracy in vitamin D metabolite analysis.

- North America leads the market, driven by awareness campaigns and FDA-approved testing kits.

- COVID-19 negatively impacted the market, but the adoption of testing devices increased post-pandemic.

- Key players include F. Hoffmann-La Roche Ltd., DiaSorin S.p.A., and Abbott, with potential for market domination through innovative technology.

- DiaSorin S.p.A. experienced a 25.9% decline in sales of vitamin D testing products in 2022.

- Abbott witnessed a 3.9% decrease in core laboratory revenue in 2022 due to COVID-19-related disruptions.

By Product Analysis

The 25-hydroxy vitamin D segment represented the largest market share in 2022 and is expected to grow the fastest during the forecast period

The global vitamin D testing market is segmented based on products such as 25 -Hydroxy Vitamin D Testing, 1,25-Dihydroxy Vitamin D Testing, and 24,25-Dihydroxy Vitamin D Testing. The 25-hydroxy vitamin D test is the best to determine vitamin D levels. A reliable indicator of vitamin D levels is the blood level of 25-hydroxyvitaminD. To determine if levels of vitamin D are normal, abnormally high, or low, one can check them.

The test is also known as the calcitriol 25-hydroxycholecalciferol test and the 25-OH vitamin D test and is also a key sign of rickets and osteoporosis. Tests are also available that monitor the blood level of vitamin D to determine if there is a nutritional deficiency. Cerascreen GmbH has a cerascreen diagnostic test, which can be used at home for determining blood vitamin D concentration.

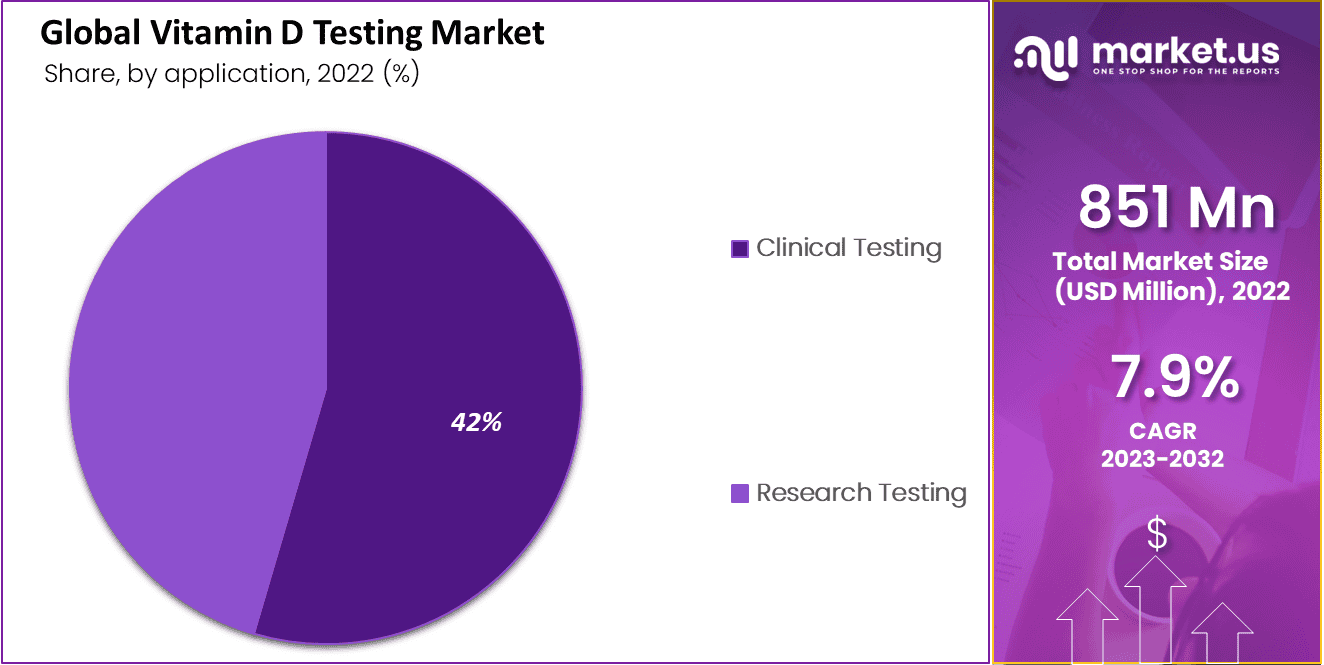

By Application Analysis

A clinical Testing segment is expected to hold the largest market share

The market is segmented based on applications such as Clinical Testing & Research Testing. There is an increasing demand for vitamin D testing procedures due to the rising prevalence of vitamin D deficiencies and increased awareness. The segment’s growth is also driven by the introduction of advanced point-of-care testing kits that can be used to diagnose vitamin D. The market players are expected to increase investment in advanced test kits and the increasing use of vitamin D tests for healthcare research purposes, which will boost the segment’s growth.

By Indication Analysis

The osteoporosis segment held the largest market segment in 2022

This increasing incidence of vitamin D-related osteoporosis increases the market value of the osteoporosis segment. Vitamin D deficiency can also lead to weaker muscles, lower balance, athletic performance, and higher risks of falling and fractures. More than 10 million Americans are affected by osteoporosis. By 2020, it will affect around 14 million people over 50.

Osteoporosis affects approximately 200 million women worldwide. This is driving the rise in testing. The Rickets indication market is forecast to experience significant growth in the future. This segment’s growth is due to increased rickets among the populace, which can be caused by prolonged vitamin D deficiency. For infants, the recommended daily Vitamin D intake should be 400 IU. Supplemental nutrients are necessary because human milk only contains a small amount of vitamin D.

By Technique Analysis

LC-MS segment dominated the market share of 2022

The global vitamin D testing market is segmented by technique type into Radioimmunoassay, ELISA, HPLC, LC-MS, and others. The overall market was dominated by the LC-MS segment, with a market share of 2022. The segment’s dominance can be attributed to the high accuracy of LC-MS/MS tests for Vitamin-D metabolite analyses.

While there are other diagnostic options, the accuracy of measuring Vitamin-D metabolism levels is an important method to determine if a patient is deficient. The radioimmunoassay segment will experience significant growth due to the low accuracy of these tests, which can limit the ability to determine the normal level of vitamin D.

A quick screening 25-hydroxyvitamin-D (25OH-D) assessment that is performed without chromatographic separation and provides greater precision and accuracy than immunoassays, is also highly in demand clinically, and further facilitates the growth of this segment.

By End-User Analysis

The segment of diagnostic laboratories dominated the market in 2022

Based on End-user analysis, the global vitamin D testing market is segmented into Hospitals, Diagnostic Laboratories, Home Care, Point-of-Care, and others. The diagnostic laboratories segment dominated the market in 2022 and is also anticipated to grow fastest during the forecast period (2023-2032).

Diagnostic laboratories use diagnostic equipment for easier testing at a greater scale. Many hospitals and healthcare providers depend on the accuracy and precision of diagnostic laboratory results. Because of the availability of laboratory-based diagnostic tests and their ease of use, diagnostic laboratories are becoming more popular.

Many diagnostic labs are available to offer test kits and improve the accuracy of the results. The Hospitals segment is expected to grow profitably during the forecast period. Hospitals have specialized testing areas, highly-trained technicians, and staff, making them one of the most important locations for prescribing correct medication. All these factors contribute to the global vitamin D testing market growth.

Key Market Segments

By Product

- 25 -Hydroxy Vitamin D Testing

- 1,25-Dihydroxy Vitamin D Testing

- 24,25-Dihydroxy Vitamin D Testing

By Application

- Clinical Testing

- Research Testing

By Technique

- Radioimmunoassay

- ELISA

- HPLC

- LC-MS

- Others

By Indication

- Osteoporosis

- Rickets Thyroid Disorders

- Malabsorption

- Vitamin D Deficiency

- Others

By End User

- Hospitals

- Diagnostic Laboratories

- Home Care

- Point-of-Care

- Others

Driving Factors

An increasing incidence of Vitamin D deficiency

Vitamin D deficiency is a common and often overlooked condition that affects many people. The symptoms can be vague and vary from one person to another. Many people are affected by vitamin D deficiency due to a lack of knowledge about its importance and role in overall health. Vitamin D testing has become more prevalent in diagnosing and treating this condition. These key factors will drive the global vitamin D testing market growth.

Preventive healthcare is gaining popularity

Preventive healthcare is on the rise, and this has led to an increase in demand for vitamin D testing. There is a growing awareness of the importance of early diagnosis, treatment, and prevention for many health conditions. This has led to increased demand for the global vitamin D testing market.

Restraining Factors

High Demand for 25 Hydroxy Vitamin D Test

This 25 Hydroxy Vitamin D Test segment has grown due to increased global vitamin D testing and the ease of estimating the plasma serum. Its shorter half-life makes it easier to identify and estimate these levels. The segment’s ability to detect bone disorders due to a low vitamin D level is also a major advantage. Due to this, the market value is high for this segment, making the market more conservative and competitive.

Due to the long-term indoor stays required as a precautionary measure during the COVID-19 pandemic, there has been an increase in Vitamin D deficiency. This has resulted in an increase in the prevalence of Vitamin D deficiency during the pandemic, which led to a growth of the market and increased testing after the restrictions and lockdowns were lifted.

Growth Opportunities

Rising Deficiencies

The growing number of vitamin D deficiencies and how they can be treated is another important factor driving the growth of the global vitamin D testing market. It is not a serious illness but can cause other serious issues. Major healthcare authorities and health organizations have launched campaigns and events to encourage vitamin D testing. The market is expected to continue growing in the near future.

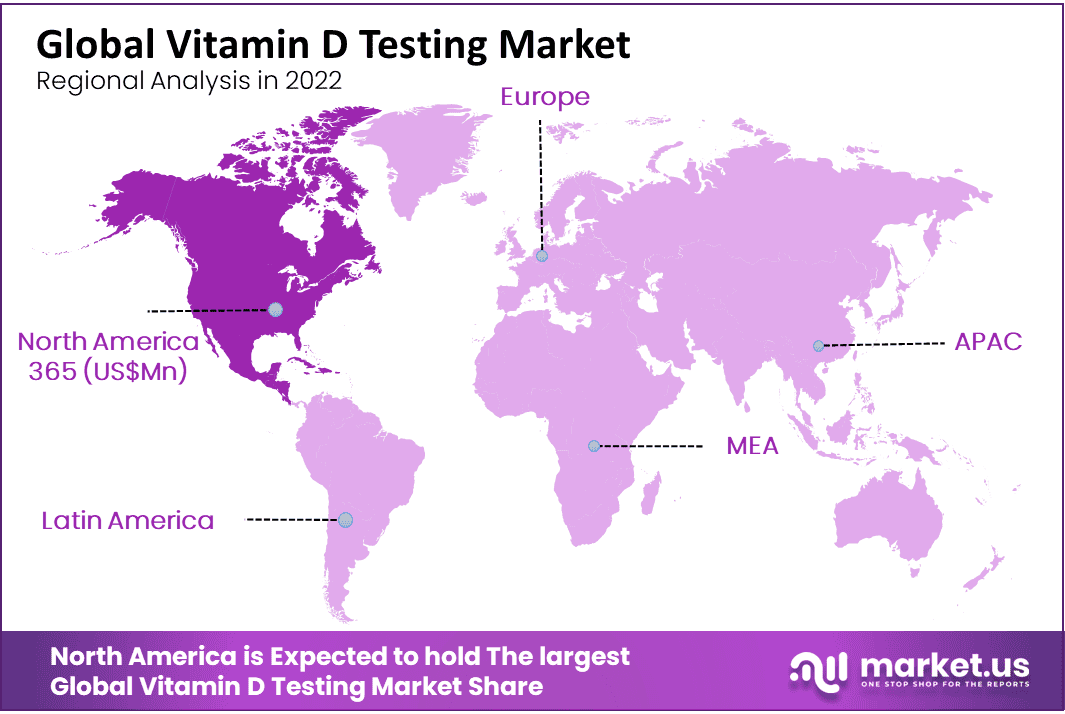

Regional Analysis

North America Dominates the Global Vitamin D Testing Market During the Forecast Period

North America is expected to be the dominant market due to several factors. These include the increasing prevalence of vitamin D deficiencies and the increased number of products approved by the U.S. FDA for vitamin D testing kits. This increases the demand for and adoption of diagnostic tools in the region and fuels regional growth over the study period.

Several organizations in the United States are also organizing awareness campaigns to raise awareness about vitamin D’s nutritional value. This has resulted in a rise in vitamin D testing adoption and increased demand. The availability of favorable reimbursement policies and increased awareness among the general public about vitamin D testing is expected to encourage large-scale adoption.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Only a few players are in the global vitamin D testing market, so there is no consolidation. F. Hoffmann-La Roche Ltd., DiaSorin S.p.A., and Abbott make up the majority of the share in the market. These players can dominate the market by introducing cutting-edge technology that provides precise results for patients. F. Hoffmann-La Roche Ltd. launched Cobas Infinity Edge in January 2022. This cloud-based platform allows for the integration and management of point-of-care data and can be used in clinical settings around the world.

Market Key Players

Below are some of the most prominent global vitamin D testing key industry players.

- Abbott

- Beckman Coulter, Inc.

- Hoffmann-La Roche Ltd

- Danaher

- Siemens Healthcare GmbH

- BIOMÉRIEUX

- DiaSorin S.p.A.

- Quest Diagnostics Incorporated.

- Thermo Fisher Scientific Inc.

- Tosoh Bioscience, Inc.

- Other Key Players.

Recent Developments

- Abbott (March 2024): Abbott introduced the ARCHITECT 25-OH Vitamin D assay, enhancing its diagnostic capabilities in vitamin D testing. This assay offers improved accuracy and efficiency for laboratories, aiding in the assessment of vitamin D levels for better patient care and management.

- Beckman Coulter, Inc. (January 2024): Beckman Coulter unveiled the DxC 500 AU Chemistry Analyzer at Medlab Middle East. This automated analyzer, featuring advanced Six Sigma performance, expands Beckman Coulter’s clinical chemistry portfolio, supporting the diagnostic needs of both central and satellite laboratories.

- Hoffmann-La Roche Ltd (April 2024): Roche acquired the diagnostic startup VitaScan, known for its innovative point-of-care vitamin D testing technology. This acquisition aims to integrate VitaScan’s rapid testing solutions with Roche’s extensive diagnostic platform, enhancing accessibility to vitamin D testing in diverse clinical settings.

- Danaher (February 2024): Danaher launched the Vitamin D Total II assay, designed for use on its latest immunoassay analyzer. This product enhances the accuracy and throughput of vitamin D testing, addressing the growing demand for reliable diagnostic tools in clinical laboratories.

- Siemens Healthcare GmbH (May 2024): Siemens Healthcare merged with Biotech Solutions, combining their expertise to advance diagnostic testing technologies. This merger is expected to enhance Siemens’ capabilities in vitamin D testing, providing comprehensive solutions to meet the evolving needs of healthcare providers.

- BIOMÉRIEUX (June 2024): BIOMÉRIEUX acquired NutriDx, a company specializing in nutritional diagnostics, including vitamin D testing. This acquisition aims to broaden BIOMÉRIEUX’s portfolio, offering innovative solutions for nutritional assessment and management in clinical practice.

Report Scope:

Report Features Description Market Value (2023) USD 918 Mn Forecast Revenue (2032) USD 1,786 Mn CAGR (2023-2032) 7.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (25 -Hydroxy Vitamin D Testing, 1,25-Dihydroxy Vitamin D Testing, 24,25-Dihydroxy Vitamin D Testing), By Application (Clinical Testing, Research Testing), By Technique (Radioimmunoassay, ELISA, HPLC, LC-MS, Others), By Indication (Osteoporosis, Rickets, Thyroid Disorders, Malabsorption, Vitamin D Deficiency, Others), By End User (Hospitals, Diagnostic Laboratories, Home Care, Point-of-Care, Others). Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Abbott, Beckman Coulter, Inc. (BD), F. Hoffmann-La Roche Ltd, Danaher, Siemens Healthcare GmbH, BIOMÉRIEUX, DiaSorin S.p.A., Quest Diagnostics Incorporated., Thermo Fisher Scientific Inc., Tosoh Bioscience, Inc., Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Vitamin D testing?Vitamin D testing involves measuring the level of Vitamin D in a person's blood to assess bone health and the potential risk of disorders related to bone metabolism. This test typically measures levels of 25-hydroxyvitamin D, considered the best indicator of Vitamin D status.

How big is the Vitamin D Testing Market?The global Vitamin D Testing Market size was estimated at USD 918 Million in 2023 and is expected to reach USD 1,786.0 Million in 2032.

What is the Vitamin D Testing Market growth?The global Vitamin D Testing Market is expected to grow at a compound annual growth rate of 7.90%. From 2024 To 2032

Who are the key companies/players in the Vitamin D Testing Market?Some of the key players in the Vitamin D Testing Markets are Abbott, Beckman Coulter, Inc. (BD), F. Hoffmann-La Roche Ltd, Danaher, Siemens Healthcare GmbH, BIOMÉRIEUX, DiaSorin S.p.A., Quest Diagnostics Incorporated., Thermo Fisher Scientific Inc., Tosoh Bioscience, Inc., Other Key Players.

Who should get tested for Vitamin D levels?ting is recommended for individuals at risk of deficiency, including older adults, people with limited sun exposure, those with certain medical conditions such as osteoporosis or kidney disease, and individuals undergoing certain medical treatments that affect Vitamin D metabolism.

What are the key drivers of the Vitamin D Testing Market?drivers include an increasing awareness of Vitamin D deficiency, growing prevalence of bone-related disorders, and advancements in diagnostic technologies. Additionally, the aging global population and an increase in preventive healthcare measures contribute to the market growth.

What challenges does the Vitamin D Testing Market face?llenges include variability in test results across different methods and devices, lack of standardization in testing procedures, and in some regions, insufficient insurance coverage for the tests.

What trends are influencing the Vitamin D Testing Market?Current trends include the development of point-of-care testing devices for immediate results, increasing use of automation in diagnostic laboratories, and the integration of artificial intelligence to improve test accuracy.

-

-

- Abbott

- Beckman Coulter, Inc.

- Hoffmann-La Roche Ltd

- Danaher

- Siemens Healthcare GmbH

- BIOMÉRIEUX

- DiaSorin S.p.A.

- Quest Diagnostics Incorporated.

- Thermo Fisher Scientific Inc.

- Tosoh Bioscience, Inc.

- Other Key Players.