Global Virtual Production Market Size, Share Analysis Report By Component (Hardware (Cameras, Sensors, Servers, Storage systems, Workstations, Displays (LED Walls, Green Screens)), Software (Real-Time Engines (e.g., Unreal Engine, Unity), 3D Modelling & Animation, Virtual Camera Software, Asset Management Tools), Services (Consulting, Support & Maintenance, System Integration, Training & Education)), By Technique (Motion Capture, Virtual Camera Systems, 3D Modelling, Real-Time Rendering, Simulcam (Simulated Camera), Previsualization), By End-User (Movies & TV Series, Commercial Ads, Gaming, Education, Music Videos, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151620

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

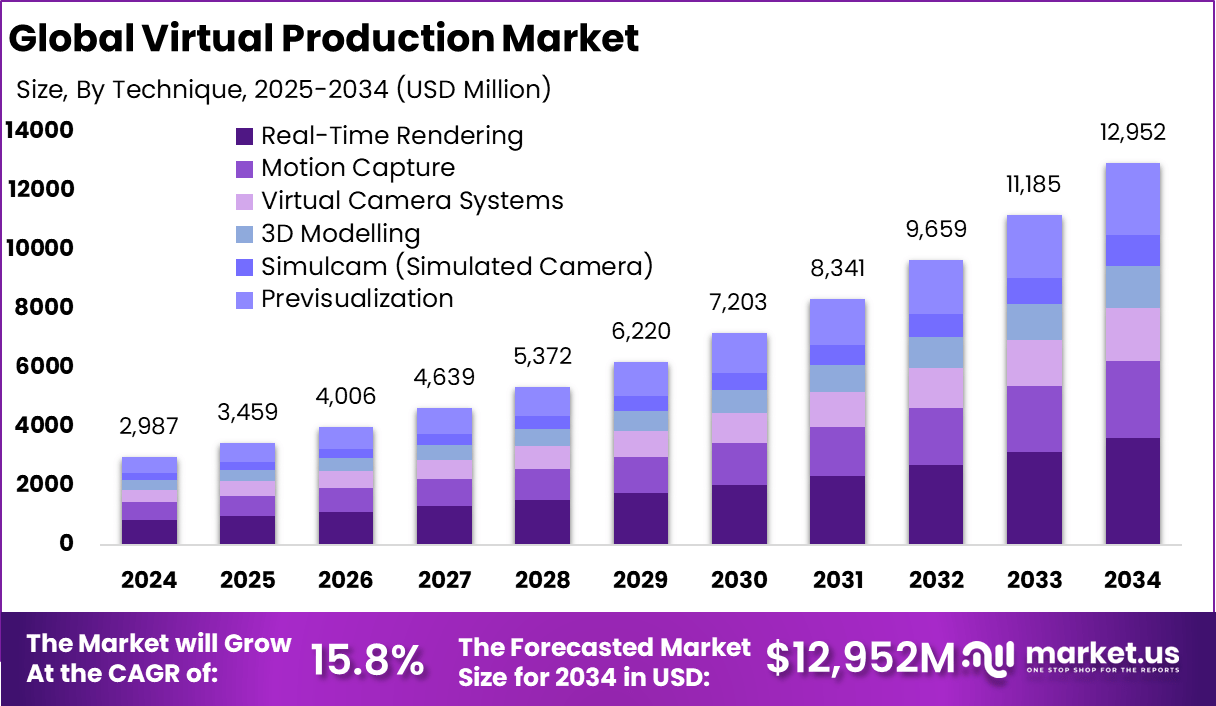

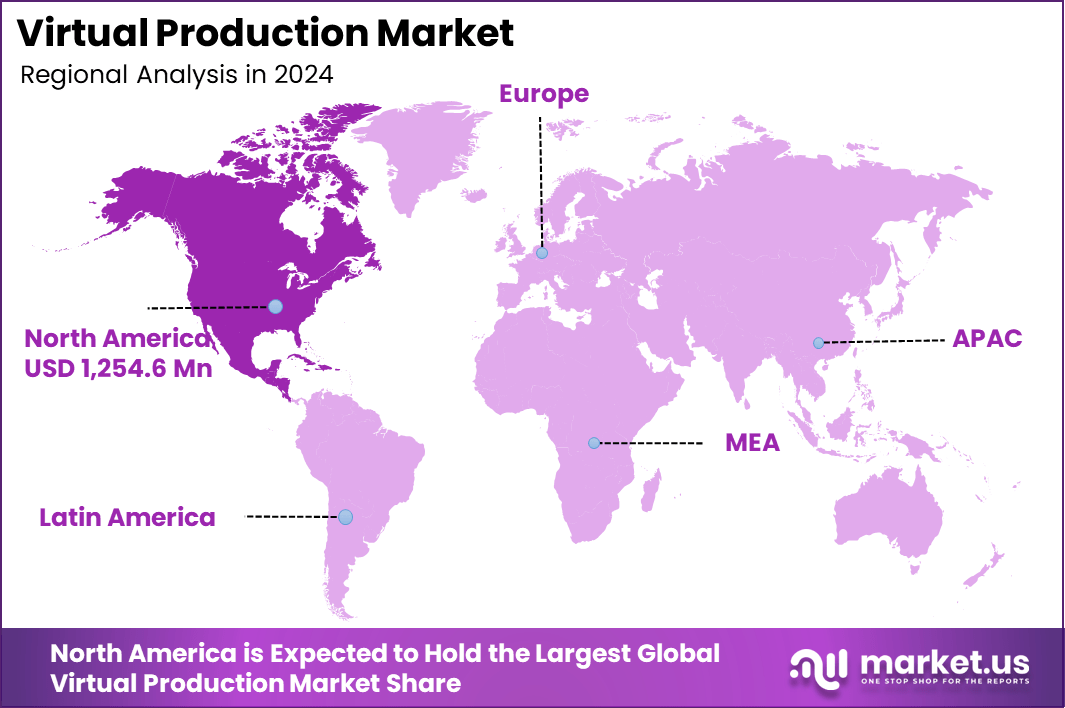

The Global Virtual Production Market size is expected to be worth around USD 12,952 Million By 2034, from USD 2,987 Million in 2024, growing at a CAGR of 15.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42% share, holding USD 1,254.6 Million revenue.

The Virtual Production Market is emerging as a transformative force within the media and entertainment landscape, characterized by the seamless integration of real-time computer-generated imagery (CGI) with live-action filming. This integration – via technologies such as LED volume stages, virtual cameras, real-time rendering engines, motion capture, VR and AR – facilitates dynamic and immersive set environments that are visualized live during production.

From a demand analysis perspective, there is a distinct surge in need for high-quality visual effects, immersive content, and cost-efficient production methods. The expansion of OTT platforms, increased television and gaming production, and a global hunger for digital content are key contributors.

Filmmakers and content creators are migrating from conventional workflows to virtual production systems to enhance creativity, reduce time-to-market, and manage budgets more effectively. The market witnesses increasing adoption of technologies such as LED walls, motion capture, VR/AR tools, real-time rendering engines, and AI-powered systems.

Key reasons for adopting these technologies include the capacity to enhance creative control, reduce travel and location expenses, minimize post-production cycles, and improve collaboration across creative teams. LED volumes also support natural lighting and reflections, empowering actors and cinematographers with more realistic environments and more authentic performances .

Investment opportunities lie in the development of studios with integrated virtual production infrastructure, scalable software platforms, and services offering animation, motion capture, and LED walls. There is also potential in AI-driven real-time rendering solutions and VR/AR-enhanced production tools. Emerging markets in Asia-Pacific, notably India, China, Japan, and South Korea, present fertile ground due to rising content creation activities and government incentives.

Key Takeaways

- The market is set to grow from USD 2,987 million (2024) to USD 12,952 million by 2034, at a CAGR of 15.8%.

- In 2024, North America led with over 42% share, generating USD 1,254.6 million in revenue.

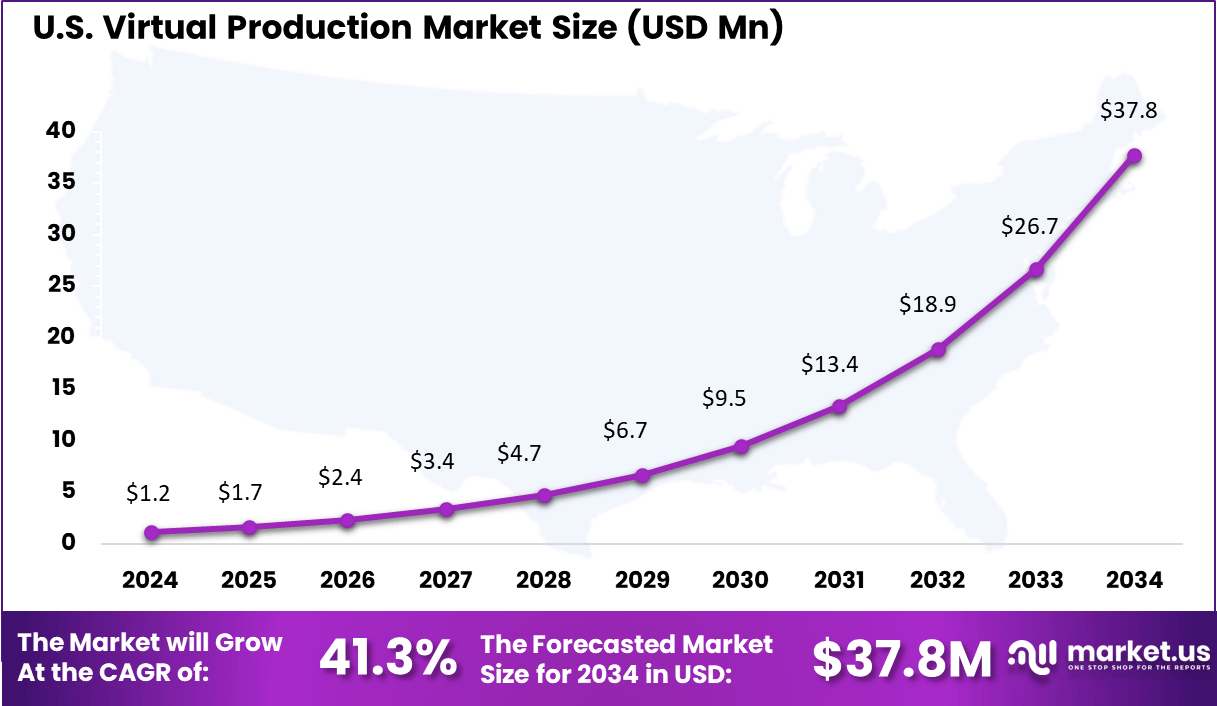

- The U.S. alone accounted for USD 1.19 billion, with a notable CAGR of 41.3%.

- By component, hardware dominated with a 41.3% share, driven by demand for LED walls and motion capture systems.

- Real-time rendering techniques held a 28.1% share, supporting faster and interactive production workflows.

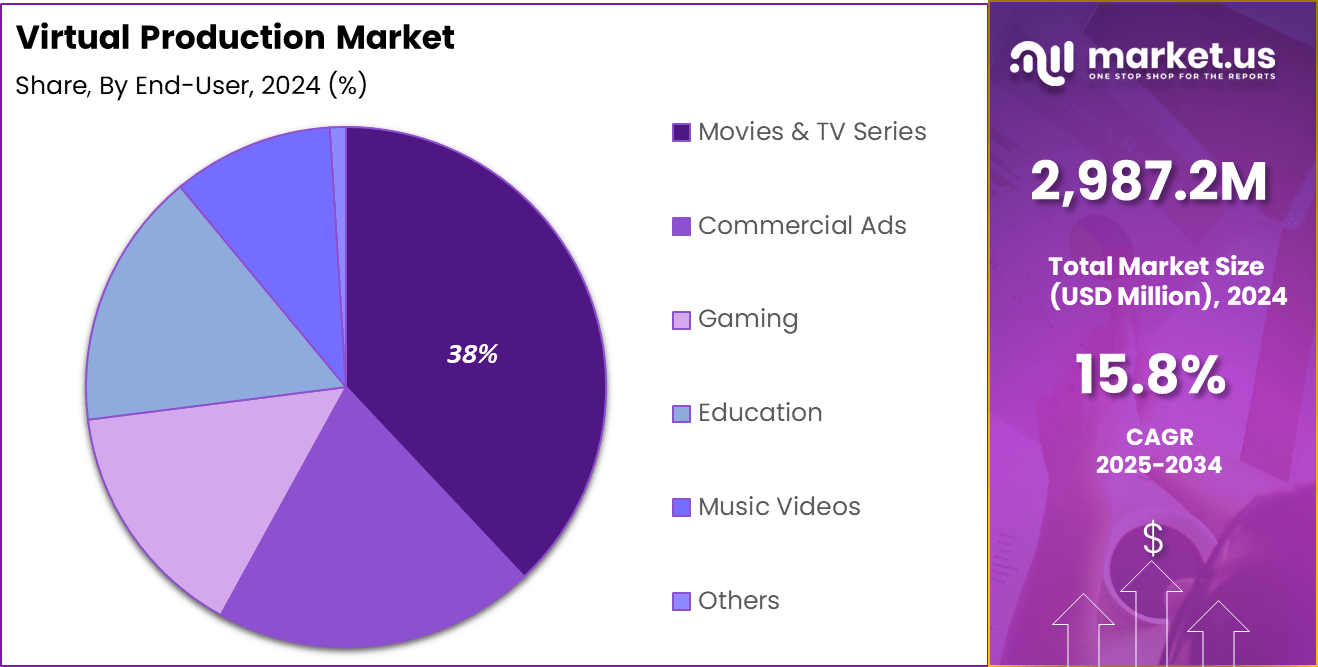

- The Movies & TV series segment led end-user demand with a 38% share, reflecting high adoption in cinematic content creation.

Impact of Agentic AI

Agentic AI is reshaping virtual production by transforming isolated tasks into an integrated, autonomous workflow, which can significantly enhance both creative agility and operational efficiency. At the 2025 NAB Show, industry leaders highlighted Agentic AI’s role in post‑production indexing, real‑time localization, and adaptive content delivery as a strategic asset rather than a simple tool.

According to Market.us, The Global Agentic AI Market is projected to surge from USD 5.2 billion in 2024 to approximately USD 196.6 billion by 2034, registering a remarkable CAGR of 43.8% during the forecast period. In 2024, North America led the market, capturing over 38% share and generating USD 1.97 billion in revenue, with the United States alone contributing USD 1.58 billion and reflecting a strong CAGR of 43.6%.

The integration of agentic AI in scene breakdowns, shot selection, and real-time adaptation within virtual environments enhances both speed and quality, allowing creative teams to focus on storytelling rather than repetitive procedural work. Moreover, wider enterprise use of agentic AI suggests a productivity gain of approximately 30% per user when routine tasks are offloaded and AI is allowed to operate with oversight.

Applying this uplift to virtual production suggests that overall project timelines can be shortened by a similar margin – even as human oversight ensures artistic control and emotional resonance remain intact. This dual benefit of efficiency and empathetic realism underscores how agentic AI in virtual production is not simply a technical enhancement; it supports a more humane and artistically driven process, enabling teams to deliver richer, more resonant experiences without compromising creative integrity.

US Market Expansion

The U.S. Virtual Production Market was valued at approximately USD 1.2 million in 2024 and is expected to grow significantly, reaching around USD 37.8 million by 2034. This growth reflects a steady CAGR of 41.3% from 2025 to 2034, driven by the increasing adoption of real-time rendering, LED wall technology, and immersive virtual environments in film, television, and advertising.

In 2024, North America held a dominant market position, capturing more than a 42% share, holding USD 1,254.6 million revenue, driven by early technological adoption and robust investment in digital content creation infrastructure. The region’s leadership is primarily anchored in its established ecosystem of film studios, visual effects (VFX) firms, and cloud service providers that actively integrate virtual production tools across both cinematic and television workflows.

The demand for real-time rendering engines, AI-powered motion capture, and LED wall technologies is growing, especially in the U.S., where major productions increasingly rely on digital-first workflows to reduce location dependency and streamline post-production.

Another factor contributing to North America’s lead is the strong presence of training institutes, research collaborations, and media-tech startups that push continuous innovation in virtual environments. Government grants and tax credits for film and creative industries further enhance the scalability of virtual production systems in the region.

By Component Analysis

In 2024, the Hardware component segment held a dominant market position in the virtual production industry, capturing more than a 41.3% share. This leadership can be attributed to several strategic and technological factors. First, hardware investments are essential to enable the full potential of virtual production.

Cutting-edge cameras, sensors, LED walls, motion-tracking systems, servers, storage arrays, workstations, and displays form the foundational infrastructure that drives real-time rendering, immersive depth, and in-camera graphics. Hardware’s foundational role ensures that content producers prioritize it when establishing and upgrading virtual sets.

Moreover, hardware infrastructure commands significant capital expenditure due to its tangible, high-cost nature. Unlike software – where licensing can scale with usage – hardware requires upfront investment and maintenance. This results in a larger share of spending concentrated in physical infrastructure, reinforcing hardware’s market prominence.

By Technique Analysis

In 2024, Real‑Time Rendering segment held a dominant market position in the virtual production industry, capturing more than a 28.1% share. This leading position is underpinned by its foundational role in enabling immersive cinematic workflows.

Real‑Time Rendering integrates game‑engine technology directly into live on‑set production, allowing filmmakers to visualize and manipulate digital environments and lighting as scenes are being shot. This capability sharply reduces post‑production effort and accelerates the creative iteration process, making it indispensable for efficient content creation.

Furthermore, Real‑Time Rendering empowers cross‑departmental collaboration by delivering immediate visual feedback. Directors, cinematographers, and visual effects teams can interact dynamically with virtual environments, adjusting camera angles, lighting, and asset placement in real time.

The capability to lock lighting, reflections, and backgrounds in-camera fosters greater creative precision while compressing production timelines – a compelling value proposition that drives studios to allocate a significant portion of technique‑level investment toward this segment.

By End-User Analysis

In 2024, Movies & TV Series segment held a dominant market position in the virtual production industry, capturing more than a 38% share. This leadership is rooted in the segment’s early adoption of virtual production workflows, driven by high-budget feature films and premium streaming series that benefit most from in-camera visual effects and immersive virtual set environments.

Major productions have leveraged LED volumes and real-time engines to reduce location shoot complexities, improve creative control, and accelerate production timelines – making this segment the largest investor in virtual production technologies. Moreover, the Movies & TV Series segment leads due to its capacity to distribute fixed hardware and software costs across large-scale projects.

Cinematic productions naturally carry higher budgets, which align with the extensive capital requirements of LED stages, motion tracking, and real-time compositing systems. Studios producing multi-episode series or big-screen films derive substantial value from these investments, reinforcing their dominant share. The critical success of early virtual productions has encouraged continued investment, creating a virtuous cycle of adoption and innovation.

Key Market Segments

By Component

- Hardware

- Cameras

- Sensors

- Servers

- Storage systems

- Workstations

- Displays (LED Walls, Green Screens)

- Software

- Real-Time Engines (e.g., Unreal Engine, Unity)

- 3D Modelling & Animation

- Virtual Camera Software

- Asset Management Tools

- Services

- Consulting

- Support & Maintenance

- System Integration

- Training & Education

By Technique

- Motion Capture

- Virtual Camera Systems

- 3D Modelling

- Real-Time Rendering

- Simulcam (Simulated Camera)

- Previsualization

By End-User

- Movies & TV Series

- Commercial Ads

- Gaming

- Education

- Music Videos

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Integration of AI and Real‑Time Rendering

The incorporation of artificial intelligence (AI) and machine learning (ML) into virtual production workflows is gaining traction. This fusion enables automated scene management, real‑time graphics enhancement, and camera control, transforming traditional pipelines. In tandem, real‑time rendering engines – famously exemplified by Unreal Engine – allow creators to visualize final scenes live on set, minimizing post‑production effort.

LED Volumes and Immersive Environments

Virtual production is increasingly anchored by LED volume stages – large, high‑resolution screen arrays that replace green screens. These setups support immersive in‑camera effects, enabling actors to interact directly with their environment and substantially reducing the need for traditional location shoots.

Driver

Demand for Cost‑Effective, High‑Quality Content

Pressure to deliver premium digital content – across film, television, live events, and gaming – has pushed creators toward virtual production. The ability to produce realistic environments without expensive location shoots or extensive VFX pipelines has made this paradigm increasingly attractive.

Remote Collaboration and Cloud Workflows

Virtual production benefits from cloud‑based tools that facilitate remote collaboration. As distributed production teams become the norm, scalable cloud platforms enable real‑time sharing and iteration, supporting geographically dispersed asset creation and deployment.

Restraint

High Capital Expenditure

The upfront investment required – LED walls, motion‑capture rigs, real‑time rendering infrastructure – remains a significant barrier, especially for smaller studios. Such capital intensity slows the pace of adoption despite technological advancements.

Technical Complexity and Talent Shortage

Operating a virtual production stage requires highly specialized skills spanning real‑time graphics, camera tracking, virtual cinematography, and software integration. The shortage of trained professionals hinders scaling and adoption across the industry.

Opportunity

Expansion into Live Broadcast, Sports, and Education

Virtual production is no longer limited to film and television. Emerging applications in live news studios, sports analysis, and virtual classrooms are creating new fronts for immersive, interactive content delivery – driven by increasing broadcaster interest and educational institutions seeking interactive solutions.

Democratization via AI‑Driven Tools

As AI‑powered tools become more ubiquitous and affordable, independent filmmakers and smaller studios are gaining access to virtual production technologies. This democratization broadens creative participation and encourages innovation outside high‑budget studio contexts.

Challenge

Data Privacy, IP, and Standardization Risks

The use of cloud platforms and shared virtual assets raises concerns about copyright, intellectual property rights, and data security. Fragmented technology standards further complicate these issues, potentially leading to licensing challenges and limiting interoperability.

Environmental Impact from Energy‑Intensive Hardware

LED volumes and real‑time computing systems require substantial energy, generating concerns about sustainability and operating costs. Addressing these environmental and efficiency issues will be necessary to align with broader industry commitments to sustainability .

Key Player Analysis

The global virtual production market continues to experience dynamic evolution, marked by increasing competition and strategic realignments among leading technology and creative firms. Companies such as Adobe, Autodesk Inc., Epic Games, HTC Corporation (VivePort), Mo-Sys Engineering Ltd., NVIDIA Corporation, Pixar under The Walt Disney Company, and Technicolor are playing influential roles in shaping the industry’s direction.

The competitive landscape remains highly fragmented, with numerous players bringing in diverse strengths across hardware, software, visual effects, and real-time rendering technologies. Over the past few years, the sector has witnessed a surge in mergers, acquisitions, and partnerships, as firms seek to consolidate capabilities and deliver integrated production pipelines.

These alliances are primarily driven by the need to improve workflow interoperability, enhance visual fidelity, and accelerate time-to-market for immersive content. Strategic moves have also centered on expanding virtual production capabilities for film, television, and immersive media – enabling faster, more cost-efficient content creation amid rising global demand for high-quality digital storytelling.

Top Key Players Covered

- Epic Games, Inc.

- NVIDIA Corporation

- Autodesk Inc.

- Adobe Inc.

- Arri AG

- Sony Group Corporation

- Mo-Sys Engineering Ltd.

- Walt Disney Company

- Disguise Systems Ltd.

- Blackmagic Design

- Zero Density

- Brompton Technology

- Vicon Motion Systems Ltd.

- Others

Recent Developments

- In February 2024, Planar launched upgraded versions of its LED video wall solutions, including the Venue Pro VX, VenuePro, and Luminate Pro Series, designed for indoor, outdoor, and on-camera virtual production. These enhancements offer improved durability, flexible deployment, and superior visual quality.

- In January 2024, Sony introduced a new spatial content creation system featuring a 4K OLED XR headset with video see-through and intuitive 3D interaction, aiming to collaborate with developers in entertainment and industrial design to advance mixed reality production workflows.

Report Scope

Report Features Description Market Value (2024) USD 2,987 Mn Forecast Revenue (2034) USD 12,952 Mn CAGR (2025-2034) 15.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware (Cameras, Sensors, Servers, Storage systems, Workstations, Displays (LED Walls, Green Screens)), Software (Real-Time Engines (e.g., Unreal Engine, Unity), 3D Modelling & Animation, Virtual Camera Software, Asset Management Tools), Services (Consulting, Support & Maintenance, System Integration, Training & Education)), By Technique (Motion Capture, Virtual Camera Systems, 3D Modelling, Real-Time Rendering, Simulcam (Simulated Camera), Previsualization), By End-User (Movies & TV Series, Commercial Ads, Gaming, Education, Music Videos, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Epic Games, Inc., NVIDIA Corporation, Autodesk Inc., Adobe Inc., Arri AG, Sony Group Corporation, Mo-Sys Engineering Ltd., Walt Disney Company, Disguise Systems Ltd., Blackmagic Design, Zero Density, Brompton Technology, Vicon Motion Systems Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Epic Games, Inc.

- NVIDIA Corporation

- Autodesk Inc.

- Adobe Inc.

- Arri AG

- Sony Group Corporation

- Mo-Sys Engineering Ltd.

- Walt Disney Company

- Disguise Systems Ltd.

- Blackmagic Design

- Zero Density

- Brompton Technology

- Vicon Motion Systems Ltd.

- Others