Global Vinyl Chloride Monomer Market Size, Share, And Business Benefits By Production Process (Oxychlorination, Balanced Process, Direct Chlorination), By Application (PVC, Copolymer Resins, Chlorinated Solvents, Others), By End Use (Building and Construction, Healthcare, Agriculture, Electrical and electronics, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151167

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

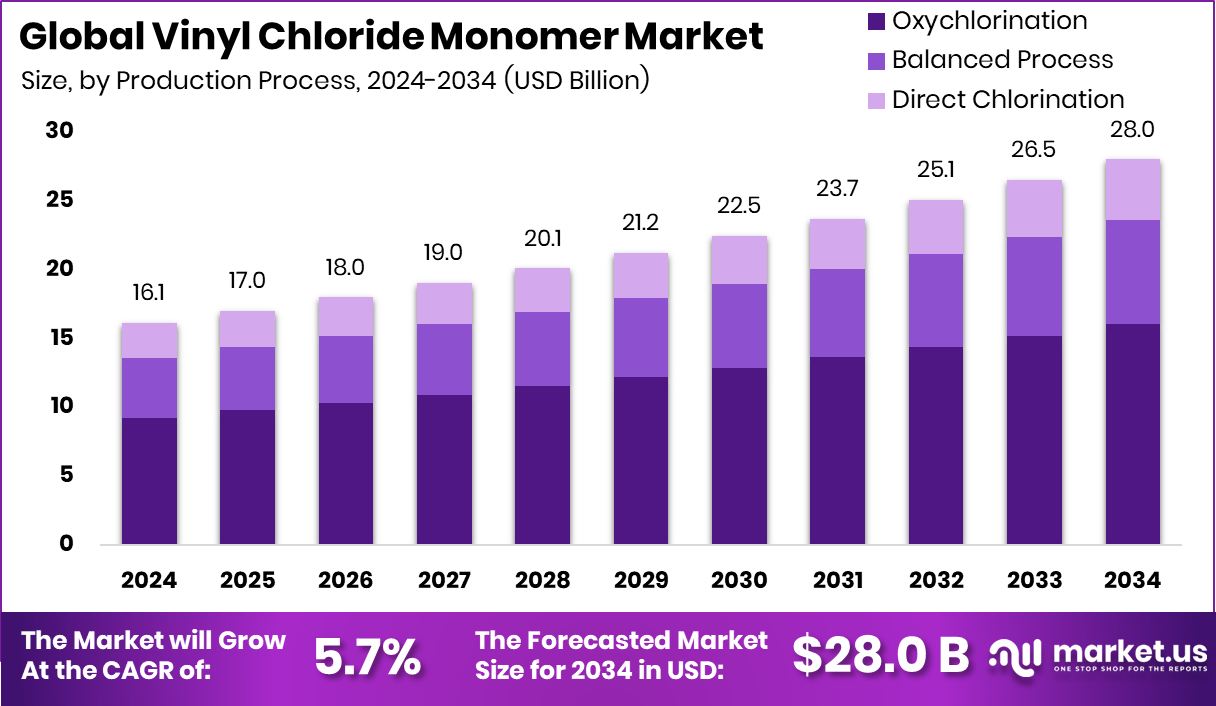

Global Vinyl Chloride Monomer Market is expected to be worth around USD 28.0 billion by 2034, up from USD 16.1 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034. High PVC usage in infrastructure supports North America’s USD 7.7 billion VCM market.

Vinyl Chloride Monomer (VCM) is a colorless, flammable gas used primarily as the key raw material in the production of polyvinyl chloride (PVC). It is synthesized through the chlorination of ethylene and plays a crucial role in a wide range of plastic-based applications. Given its versatility and durability, PVC made from VCM finds usage in construction materials, pipes, electrical cable insulation, medical devices, and packaging.

The Vinyl Chloride Monomer market revolves around the demand and supply of VCM for manufacturing PVC products across various industries. With urbanization and industrial growth on the rise globally, especially in emerging economies, the market for VCM has seen consistent expansion. Demand from the construction and automotive sectors particularly fuels market growth, as both heavily depend on lightweight, durable plastic components derived from PVC.

One of the key growth factors is the rise in infrastructure development projects worldwide. VCM-derived PVC is widely used in plumbing, electrical systems, and structural components due to its corrosion resistance and cost-efficiency. The growing middle-class population and increased housing needs are also contributing to heightened demand.

On the demand side, VCM consumption is heavily influenced by the need for water management systems, wire and cable coatings, and healthcare applications. As developing regions invest more in sanitation and healthcare infrastructure, the demand for durable, low-maintenance plastic materials continues to rise.

Key Takeaways

- Global Vinyl Chloride Monomer Market is expected to be worth around USD 28.0 billion by 2034, up from USD 16.1 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034.

- The Vinyl Chloride Monomer market sees 57.4% production share through the oxychlorination process today.

- PVC dominates the Vinyl Chloride Monomer market application segment, accounting for a significant 79.7% usage rate.

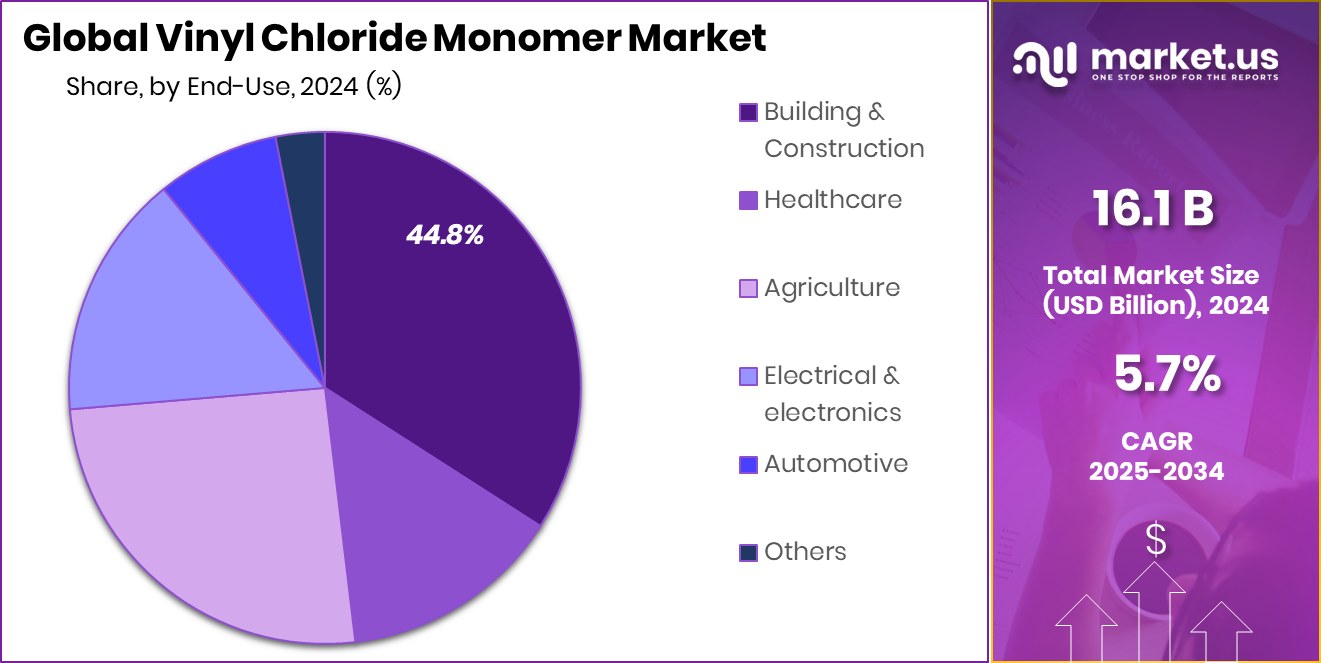

- Building and construction lead the Vinyl Chloride Monomer market end use, contributing 44.8% to the overall demand share

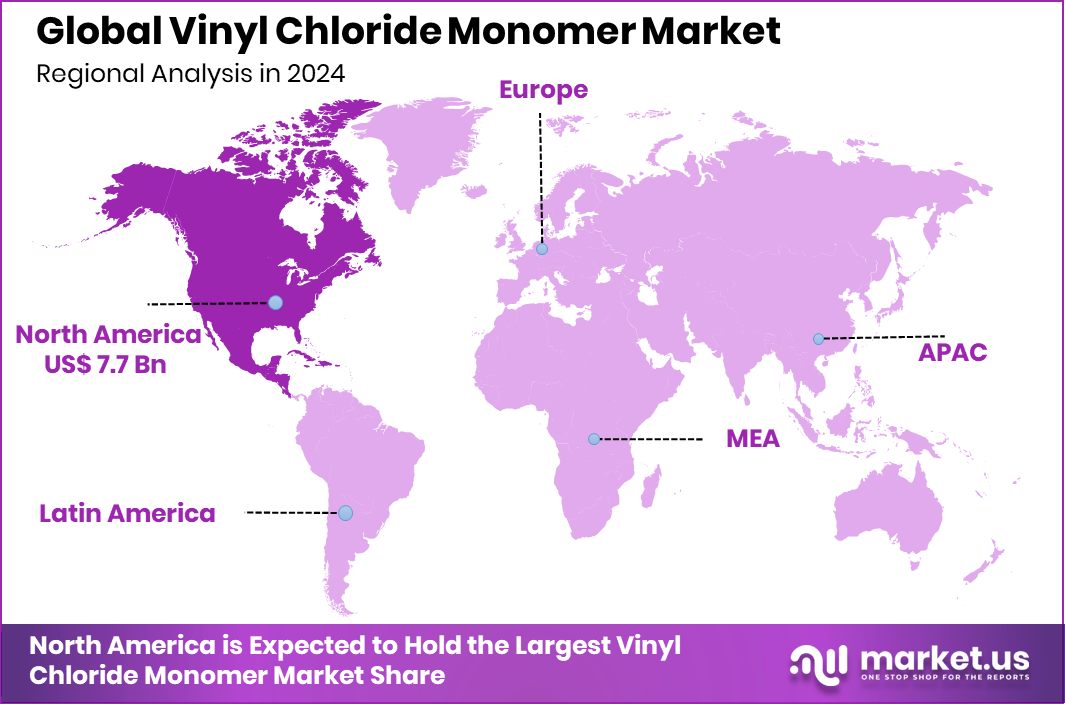

- The North American market value reached USD 7.7 billion, showing strong industrial demand.

By Production Process Analysis

Oxychlorination dominates the Vinyl Chloride Monomer market at 57.4% share.

In 2024, Oxychlorination held a dominant market position in the Product Type segment of the Vinyl Chloride Monomer (VCM) Market, accounting for a significant 57.4% share. This process, known for its efficiency and cost-effectiveness, has gained strong traction in the industry due to its ability to produce VCM with relatively lower energy consumption and operational costs compared to other methods.

Oxychlorination involves the reaction of ethylene, hydrogen chloride, and oxygen to produce ethylene dichloride (EDC), which is then cracked to form VCM. The technological maturity and scalability of this method have positioned it as the preferred choice for large-scale producers aiming to meet growing PVC demand.

The dominance of the Oxychlorination method is also linked to its compatibility with integrated production facilities, where it supports streamlined operations and optimized resource use. With the global increase in infrastructure and construction projects driving up PVC consumption, the reliance on efficient and high-output VCM production methods like Oxychlorination continues to rise.

Its environmental and economic advantages further strengthen its market position, appealing to producers who are balancing cost pressures with evolving regulatory expectations. As such, Oxychlorination is expected to retain its leadership in the product type segment through continued industrial adoption and process optimization.

By Application Analysis

PVC production drives the Vinyl Chloride Monomer market with 79.7% usage.

In 2024, PVC held a dominant market position in the Product Type segment of the Vinyl Chloride Monomer (VCM) Market, with a 79.7% share. This significant share reflects the strong dependence of the VCM industry on PVC production, as VCM serves primarily as the key raw material in manufacturing polyvinyl chloride.

PVC’s widespread application across various end-use sectors such as construction, electrical, healthcare, and packaging continues to drive its high demand, which in turn reinforces the leading position of VCM usage in this segment.

The dominance of PVC in this market segment is supported by its cost-effectiveness, durability, and versatility, making it a material of choice for a broad range of industries. Its favorable properties—such as corrosion resistance, electrical insulation, and ease of processing—ensure sustained consumption, particularly in infrastructure-related developments. With VCM being the foundational component in PVC synthesis, the high production and utilization of PVC naturally anchor its commanding share within the VCM market.

By End Use Analysis

Building and construction sectors consume 44.8% of Vinyl Chloride Monomer output.

In 2024, Building and Construction held a dominant market position in the Product Type segment of the Vinyl Chloride Monomer (VCM) Market, with a 44.8% share. This strong share underscores the critical role VCM plays in supporting the infrastructure and real estate sectors through its use in polyvinyl chloride (PVC) production. PVC, derived directly from VCM, is extensively used in construction materials such as pipes, window frames, siding, and flooring, owing to its durability, corrosion resistance, and cost-efficiency.

The construction industry’s steady growth, particularly in urbanizing regions, has sustained high demand for VCM-based products. VCM’s relevance in this sector is driven by the need for long-lasting, low-maintenance building components that can withstand harsh environmental conditions. As residential, commercial, and public infrastructure projects expand, the reliance on VCM-derived materials has remained consistent, reinforcing the segment’s leading market position.

The 44.8% share held by Building and Construction reflects both the volume of VCM consumed and the essential nature of its applications in the sector. This segment’s dominance is further cemented by ongoing investments in infrastructure development, which continue to stimulate demand for construction-grade PVC, thereby sustaining the pivotal role of VCM in the built environment.

Key Market Segments

By Production Process

- Oxychlorination

- Balanced Process

- Direct Chlorination

By Application

- PVC

- Copolymer Resins

- Chlorinated Solvents

- Others

By End Use

- Building and Construction

- Healthcare

- Agriculture

- Electrical and electronics

- Automotive

- Others

Driving Factors

Growing Construction Sector Boosting VCM Demand

One of the top driving factors for the Vinyl Chloride Monomer (VCM) market is the steady growth of the global construction industry. VCM is mainly used to produce polyvinyl chloride (PVC), which is a key material in construction applications like water pipes, window frames, doors, roofing sheets, and flooring.

As more housing, commercial buildings, and infrastructure projects are being developed—especially in rapidly urbanizing countries—the need for PVC materials is rising. This directly increases the demand for VCM. Additionally, PVC is favored in construction due to its strength, low cost, and resistance to weather and corrosion. As governments and private sectors invest more in building and infrastructure, the demand for VCM continues to grow at a steady pace.

Restraining Factors

Health and Safety Risks Limit Market Growth

A major restraining factor for the Vinyl Chloride Monomer (VCM) market is its associated health and safety risks. VCM is a toxic, flammable gas and is classified as a human carcinogen. Prolonged exposure to VCM can lead to serious health issues, including liver damage and cancer. Because of this, strict environmental and workplace safety regulations have been put in place across many countries.

These regulations make the handling, production, and transportation of VCM more complex and costly for manufacturers. Companies must invest in advanced safety systems, emissions control, and worker protection, which increases operational expenses. These health concerns and regulatory pressures can slow down production, limit expansion plans, and reduce overall market growth potential for VCM.

Growth Opportunity

Innovations in Eco-Friendly PVC Production Methods

A key growth opportunity for the Vinyl Chloride Monomer (VCM) market lies in developing and adopting eco-friendly production methods. As the global community increasingly emphasizes sustainability, there is a rising demand for greener manufacturing processes. For VCM producers, this means investing in technologies that reduce greenhouse gas emissions, lower energy consumption, and minimize hazardous byproducts.

Innovative methods—such as catalysts that enable cleaner reactions or electrified processes powered by renewable energy—offer ways to produce VCM more sustainably. These improvements can help manufacturers meet tightening environmental regulations and appeal to customers who prefer products with a smaller carbon footprint.

Latest Trends

Shift Toward Sustainable and Safer Manufacturing Practices

One of the latest trends in the Vinyl Chloride Monomer (VCM) market is the growing shift toward more sustainable and safer manufacturing practices. With increasing awareness about environmental health and worker safety, companies are looking for cleaner production technologies. This includes using advanced control systems to reduce emissions, recycling waste materials during production, and switching to less harmful raw materials where possible.

Some producers are also adopting closed-loop systems to prevent VCM leaks and exposure. These changes are not only about meeting regulations—they’re also about building a safer, more responsible industry. As more consumers and businesses prioritize sustainability, this trend is encouraging innovation and shaping the future direction of the VCM market toward cleaner, safer operations.

Regional Analysis

North America held a 47.9% share in the Vinyl Chloride Monomer market, 2024.

In the global Vinyl Chloride Monomer (VCM) market, regional demand is led by North America, which emerged as the dominant region in 2024, holding a significant 47.9% share and generating a market value of USD 7.7 billion. This strong position is driven by the region’s high demand for PVC across infrastructure, construction, and industrial applications, particularly in the United States.

The well-established construction industry, along with ongoing renovation and maintenance projects, continues to fuel VCM consumption. Europe follows with moderate demand, supported by consistent use of PVC in automotive and construction sectors, though regulatory pressures on chemical processing slightly temper growth. The Asia Pacific region shows strong potential, owing to rapid urbanization and industrial development, especially in emerging economies, though specific data is not provided.

Meanwhile, the Middle East & Africa and Latin America maintain a steady but smaller presence in the VCM market. These regions benefit from gradual expansion in construction and infrastructure, but currently contribute less to the overall market share. North America’s clear lead, marked by both high volume and value, highlights its continued dominance in the Vinyl Chloride Monomer landscape, supported by mature manufacturing capacity, regulatory compliance, and sustained end-use demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as AGC Chemicals, BASF, and Evonik Industries maintained a strategic presence in the global Vinyl Chloride Monomer (VCM) market, focusing on reliability, technological integration, and chemical innovation.

AGC Chemicals demonstrated a strong operational focus on high-efficiency chemical manufacturing. With its experience in chlor-alkali production, AGC supports VCM manufacturing through advanced material science and well-established processing capabilities, contributing to supply chain consistency in VCM production.

BASF, known for its large-scale operations and diverse chemical portfolio, leveraged its vertically integrated structure to manage VCM-related processes efficiently. In 2024, BASF continued to emphasize sustainable practices and resource optimization, supporting stable output levels while aligning with environmental safety standards. Its strong global infrastructure helped support consistent availability in key industrial regions.

Evonik Industries, though not a primary VCM producer, plays a critical role by supplying specialty chemicals and additives that enhance polymer performance, including those used in PVC manufacturing. In 2024, Evonik’s innovations in additive technologies contributed indirectly to improved VCM downstream product quality, especially in applications requiring higher durability and performance.

Top Key Players in the Market

- Agc Chemicals

- BASF

- Evonik Industries

- Formosa Plastics Group

- INEOS Group

- Jubail Chevron Phillips

- LG Chem

- Lyondellbasell Industries

- Mitsubishi Chemical Holdings Corporation

- Nissan Chemical Industries, Ltd.

- Nova Chemical

- Occidental Chemical Corporation

- Qatar Vinyl Company

- ShinEtsu Chemical Co., Ltd.

- Wacker Chemie AG

- Westlake Corporation

Recent Developments

- In March 2025, BASF secured its first issuance of newly developed CO₂ inset credits. These credits are part of a novel carbon farming method aimed at reducing emissions within BASF’s value chain, including processes tied to VCM. This marks a major step toward lowering the carbon footprint of VCM-related manufacturing.

- In July 2024, Formosa announced an expansion project at its Baton Rouge plastics complex in Louisiana. While focused on PVC output, this upgrade includes enhancements to its internal VCM supply chain infrastructure to support increased resin production.

Report Scope

Report Features Description Market Value (2024) USD 16.1 Billion Forecast Revenue (2034) USD 28.0 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Production Process (Oxychlorination, Balanced Process, Direct Chlorination), By Application (PVC, Copolymer Resins, Chlorinated Solvents, Others), By End Use (Building and Construction, Healthcare, Agriculture, Electrical and Electronics, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agc Chemicals, BASF, Evonik Industries, Formosa Plastics Group, INEOS Group, Jubail Chevron Phillips, LG Chem, Lyondellbasell Industries, Mitsubishi Chemical Holdings Corporation, Nissan Chemical Industries, Ltd., Nova Chemical, Occidental Chemical Corporation, Qatar Vinyl Company, ShinEtsu Chemical Co. Ltd., Wacker Chemie AG, Westlake Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vinyl Chloride Monomer MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Vinyl Chloride Monomer MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agc Chemicals

- BASF

- Evonik Industries

- Formosa Plastics Group

- INEOS Group

- Jubail Chevron Phillips

- LG Chem

- Lyondellbasell Industries

- Mitsubishi Chemical Holdings Corporation

- Nissan Chemical Industries, Ltd.

- Nova Chemical

- Occidental Chemical Corporation

- Qatar Vinyl Company

- ShinEtsu Chemical Co., Ltd.

- Wacker Chemie AG

- Westlake Corporation