Global Smart Water Management Market Size, Share, Statistics Analysis Report By Offering (Water Meter [AMR Meters, AMI Meters], Solutions [Enterprise Assest Management, Security, Analytics & Data Management, Smart Irrigation Management, Advanced Pressure Management, Leak Detection, Others (Mobile Workforce Management, etc.)], Services [Professional Services, Managed Services]), By End-User (Residential, Commercial, Industrial), By Technology (IoT, Artificial Intelligence, Big Data & Analytics, Cloud Computing, Other Technologies), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct. 2025

- Report ID: 142744

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Scope

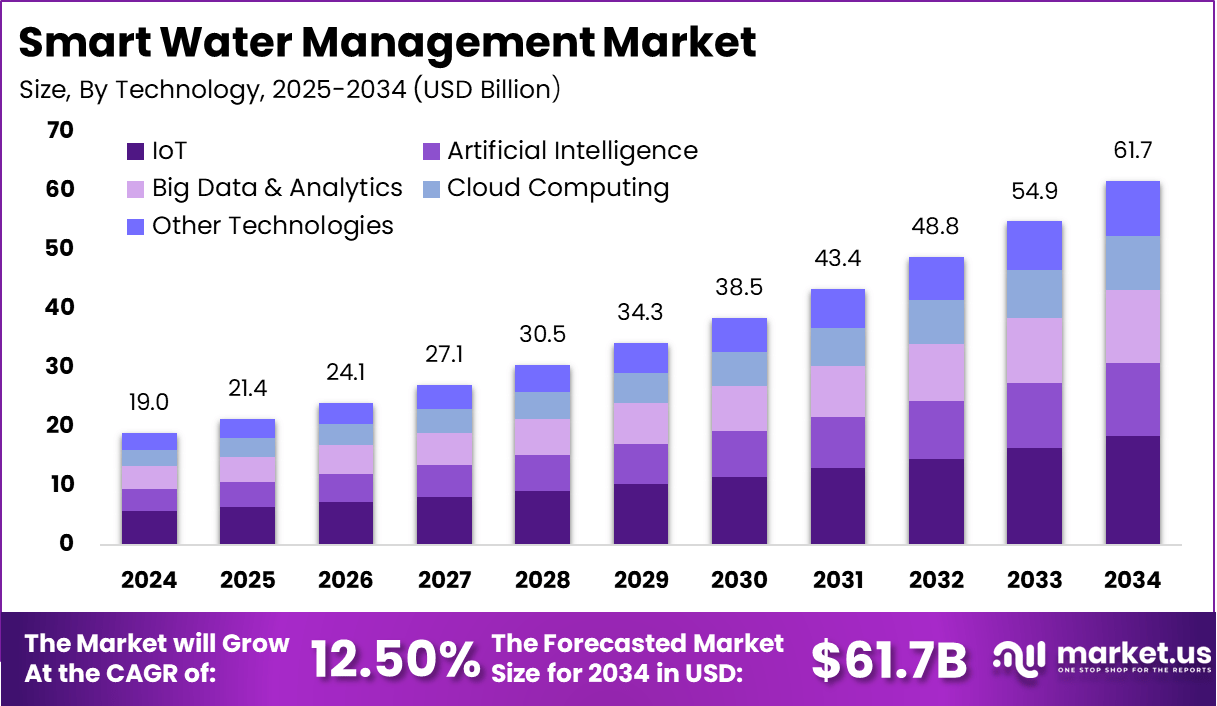

The Global Smart Water Management Market is projected to grow from USD 19.01 billion in 2024 to approximately USD 61.7 billion by 2034, registering a CAGR of 12.5% during the forecast period from 2025 to 2034. The market growth is driven by increasing urbanization, water scarcity concerns, and growing adoption of digital technologies such as IoT, AI, and data analytics in water infrastructure.

The growth of this market is being propelled by increasing water scarcity, aging water infrastructure and rising regulatory pressure for conservation and efficient use of water. Urbanisation and the growth of smart-city programmes are creating heightened demand for digital water solutions. For example, the need to reduce losses in water distribution networks and to optimise water treatment and delivery is shaping investment in smart water technologies.

Demand is strongest in utilities and municipalities that operate large water distribution networks and face high non-revenue water losses. Industrial users with heavy water consumption such as chemicals, power generation and food and beverage also represent significant demand. Residential demand is rising as smart metering and consumer water monitoring gain traction.

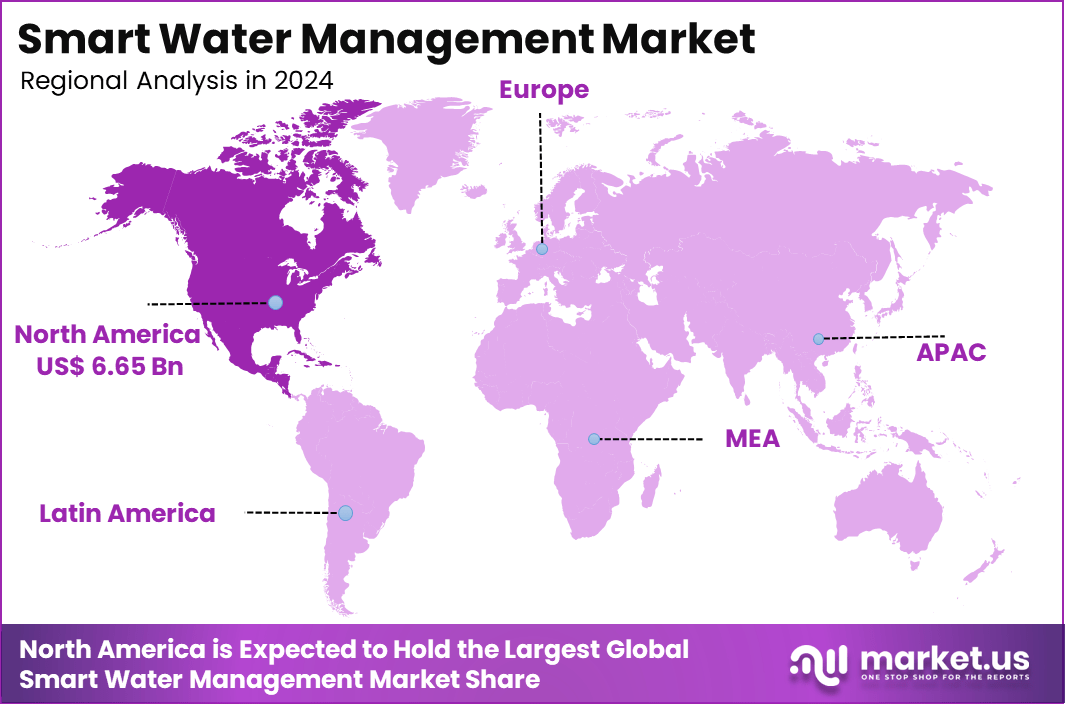

In 2024, North America held a leading position in the market, accounting for over 35% of total revenue and generating about USD 6.65 billion. The dominance of this region is attributed to advanced water infrastructure, high investment in smart utilities, and strong government initiatives promoting sustainable water management.

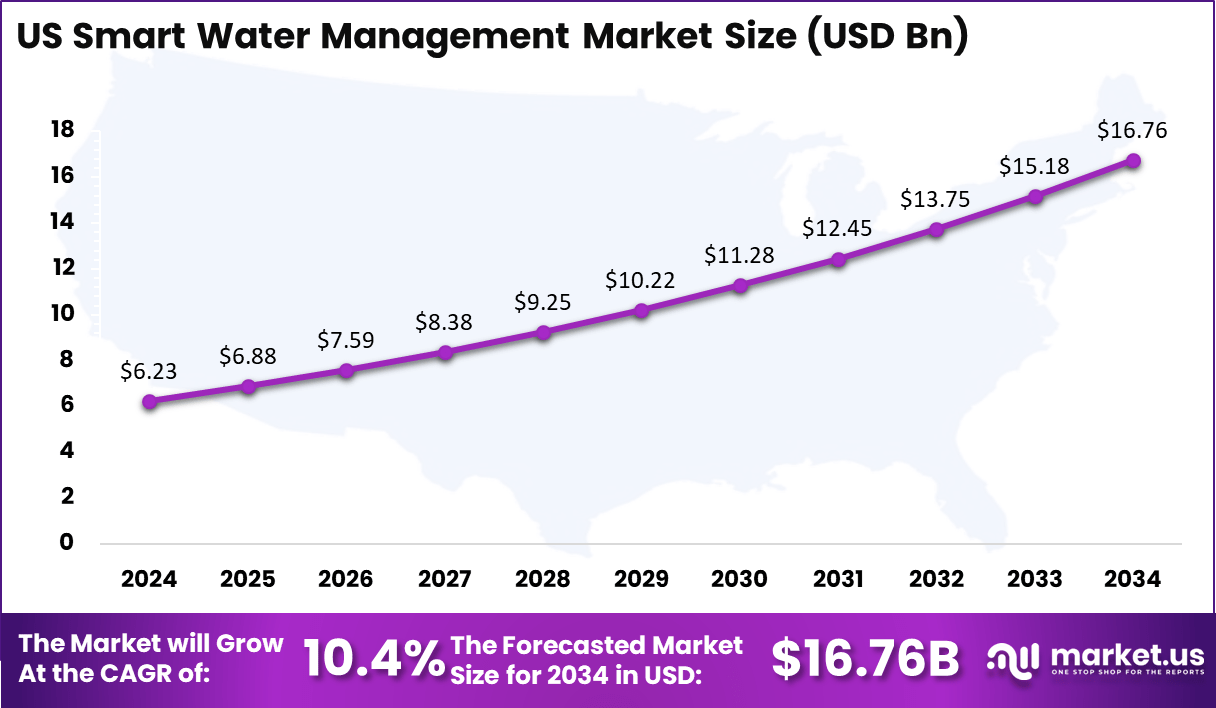

The United States remained the primary contributor within North America, with revenue of USD 6.23 billion in 2024 and an expected CAGR of 10.4%. The country’s leadership reflects the increasing implementation of smart metering systems, leak detection technologies, and real-time water quality monitoring to improve efficiency and reduce resource wastage.

Key Takeaways

- Market Growth: The Smart Water Management market is projected to grow from USD 19.01 billion in 2024 to USD 61.7 billion by 2034, reflecting substantial expansion.

- Strong CAGR: The market is expected to register a CAGR of 12.50% over the forecast period, driven by increasing demand for water conservation and efficiency solutions.

- Solutions Lead the Market: Solutions account for 45% of the market share by offering, indicating high adoption of software and hardware solutions for smart water management.

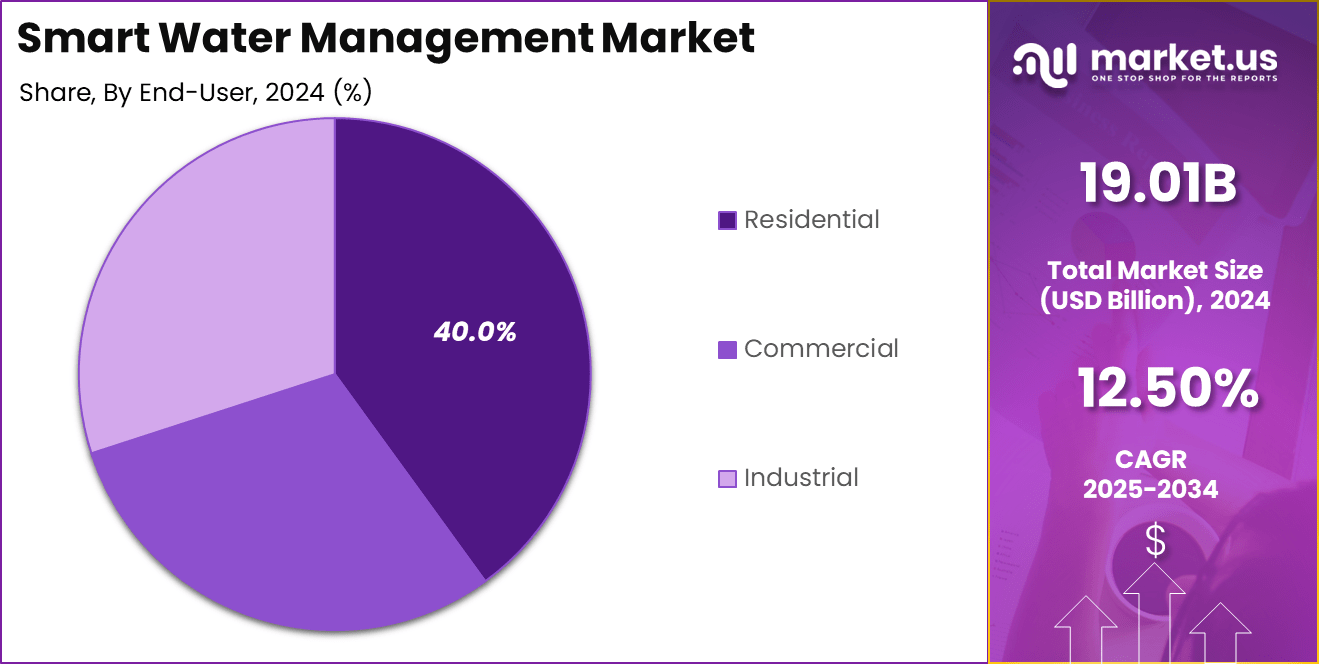

- Residential Demand: The residential sector holds a 40% share in the end-user segment, showcasing significant adoption among households for efficient water usage.

- IoT Integration: IoT technology represents 30% of the market share, highlighting the growing role of connected devices and real-time monitoring in water management.

- Regional Dominance: North America leads with a 35% market share, driven by advanced infrastructure, smart city initiatives, and increasing government investments.

- The US Market: The US alone is valued at USD 6.23 billion and is expected to grow at a CAGR of 10.4%, reinforcing its leadership in smart water management adoption.

Analyst’s Review

The demand for SWM solutions is rising due to the need to address water scarcity and aging infrastructure. Many regions face significant water losses through leaks and inefficient systems, underscoring the necessity for smart technologies that can monitor usage, detect anomalies, and facilitate timely maintenance. This proactive approach conserves water and reduces operational costs for utilities and consumers alike.

Opportunities within the SWM market are abundant, particularly in the context of smart city initiatives. As urban areas strive to become more sustainable and resilient, integrating smart water solutions becomes a priority. This integration opens avenues for companies specializing in IoT, data analytics, and water management to collaborate on innovative projects, thereby driving economic growth and technological advancement in the sector.

Technological advancements are at the core of SWM’s evolution. The deployment of IoT-enabled sensors allows for real-time data collection on water flow, pressure, and quality. Advanced data analytics and machine learning algorithms process this information to predict usage patterns, detect leaks, and optimize distribution networks. Additionally, the advent of smart meters empowers consumers with detailed insights into their water consumption, promoting informed decision-making and fostering conservation efforts.

Key Statistics

Usage and Implementation

- Smart Water Meters: Accounted for 44.1% of the smart water management market in 2023, enabling precise real-time water consumption tracking and billing.

- Water Loss Detection: Studies show potential water losses in urban areas range from 1.56% to 46.73% of total usage due to leaks.

- Urban Applications: Smart water systems are increasingly integrated into smart cities, particularly in Asia-Pacific, where urbanization is expected to reach two-thirds of the population by 2050.

Environmental Impact

- Water Scarcity: By 2025, more than two-thirds of the global population may live in water-scarce areas, with demand expected to rise by 55% by 2050.

- CO2 Emissions Reduction: Smart water management systems have contributed to reducing CO2 emissions by approximately 47,385 tons over 12 years in the specific case study.

Quantitative Performance Indicators

- Non-Revenue Water (NRW): Efforts aim to reduce NRW levels to below 10% by 2025 in some regions through investments in monitoring and control systems.

- Water Consumption Patterns: Metered consumers in England and Wales use an average of 135 liters per person daily compared to 173 liters for non-metered consumers.

Technological Integration

- IoT Sensors: Facilitate real-time monitoring of water quality, flow, and pressure, improving system efficiency and reducing waste.

- AI Algorithms: Analyze data for predictive maintenance, leak detection, and optimization of water distribution networks.

Regional Analysis

United States Market Size

In North America, the United States dominates the market size by USD 6.23 billion, holding a strong position steadily with a robust CAGR of 10.4%. The growth in the Smart Water Management (SWM) market is driven by several factors, including the increasing demand for efficient water management solutions, especially in urban areas.

With water scarcity and aging infrastructure becoming pressing issues, the U.S. is adopting smart water technologies to reduce waste and improve the sustainability of water systems. The integration of IoT, sensors, and advanced data analytics plays a pivotal role in addressing these challenges, enabling utilities and consumers to monitor water consumption in real time and prevent water loss.

Furthermore, the U.S. government’s focus on sustainability and infrastructure modernization has spurred the growth of smart water management systems. As cities continue to expand and face the complexities of urbanization, the need for innovative water management solutions becomes increasingly crucial. The combination of technological advancements and supportive policies contributes to the rapid adoption of smart water technologies across the country, making the U.S. a key leader in the SWM market in North America.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 35% share, equating to USD 6.65 billion in revenue. The region’s leadership in the Smart Water Management (SWM) market can be attributed to several factors.

Firstly, the advanced technological infrastructure, alongside a strong focus on sustainability and resource conservation, has propelled the demand for smart water solutions. The U.S. alone represents a significant portion of this market, with its rapid adoption of IoT and sensor technologies for real-time water monitoring, helping mitigate issues such as water wastage and scarcity.

The regulatory environment in North America also plays a crucial role in driving market growth. Governments are increasingly prioritizing water efficiency and smart city initiatives, which have led to substantial investments in water infrastructure modernization. The region is home to many key players in the SWM industry, fostering innovation and ensuring that North America remains at the forefront of developing new technologies for water management.

Additionally, high awareness regarding environmental concerns, coupled with substantial public and private investments in water conservation, is fueling the widespread adoption of smart water solutions in both residential and commercial sectors. This holistic approach is why North America is expected to continue leading the market for the foreseeable future.

For Europe, while it also presents significant market opportunities, it is slightly behind North America in terms of overall market share and revenue generation. However, the region is seeing steady growth, primarily driven by stringent water management regulations and increasing focus on sustainability, making it a key market to watch in the coming years.

The Asia-Pacific (APAC) region, on the other hand, is expected to witness the highest growth rate due to rapid urbanization, population growth, and the region’s increasing need for efficient water management solutions. Countries like China and India are actively investing in smart water technologies to address the challenges of water scarcity and aging infrastructure.

In Latin America, the market is gradually gaining momentum, with countries such as Brazil and Mexico making strides toward adopting smart water management systems. While still in the early stages compared to other regions, the growing emphasis on sustainable water use presents opportunities for future market expansion.

The Middle East and Africa are also becoming increasingly important in the global SWM market, especially due to the region’s extreme water scarcity issues. The adoption of smart water management solutions is critical for enhancing water distribution efficiency and reducing wastage, which is essential for long-term sustainability in the region.

By Offering

In 2024, the Solutions segment held a dominant market position, capturing more than a 45% share of the Smart Water Management (SWM) market. The primary reason behind the growth of the Solutions segment is the increasing demand for comprehensive water management systems that offer advanced capabilities.

Solutions such as Enterprise Asset Management, Leak Detection, Smart Irrigation Management, and Analytics & Data Management are crucial for optimizing water usage and minimizing losses. These systems provide utilities with real-time data, predictive analytics, and actionable insights to improve operational efficiency and ensure sustainability.

The widespread adoption of IoT technologies has further bolstered the demand for smart solutions. With solutions like Advanced Pressure Management and Leak Detection, water distribution systems can be monitored for early signs of issues, preventing costly repairs and reducing water wastage.

The integration of Security solutions is also gaining traction, ensuring that water infrastructure is protected from cyber threats. This comprehensive approach to water management is why the Solutions segment continues to lead in the SWM market, offering end-to-end management capabilities that cater to both residential and commercial needs.

By Technology

In 2024, the IoT segment held a dominant market position, capturing more than a 30% share of the Smart Water Management (SWM) market. The reason for IoT’s leadership is its transformative impact on water management systems.

IoT technology allows for real-time monitoring and control of water infrastructure through connected devices and sensors. This connectivity enables utilities to collect data on water usage, flow rates, pressure levels, and quality, leading to improved decision-making and operational efficiency.

With IoT, utilities can detect leaks, optimize water distribution, and reduce wastage, all while ensuring that the infrastructure is well-maintained. Furthermore, IoT-powered systems enable predictive maintenance, which can help prevent costly breakdowns and service interruptions. The ability to monitor and manage water networks remotely is another key factor driving the adoption of IoT technology in the sector.

As water scarcity and sustainability concerns grow, IoT continues to be the foundation for creating more efficient, reliable, and cost-effective water management solutions. This is why the IoT segment remains the dominant technology in the smart water management market.

By End-User

In 2024, the Residential segment held a dominant market position, capturing more than a 40% share of the Smart Water Management (SWM) market. The leading position of the Residential segment is primarily driven by the growing awareness among homeowners about the need for water conservation and efficiency. As water scarcity becomes a more pressing issue globally, consumers are increasingly adopting smart water management systems to monitor and reduce their water consumption.

Smart water meters, leak detection systems, and automated irrigation solutions have become popular among residential users, helping them to lower water bills while contributing to sustainability efforts. Additionally, the integration of smart technologies allows homeowners to receive real-time data on water usage and detect inefficiencies, such as leaks or wastage, before they escalate.

The growing trend of smart homes, which increasingly rely on IoT devices, further supports the demand for smart water solutions in residential settings. This combination of cost savings, environmental consciousness, and technological advancements is why the Residential segment continues to lead the smart water management market.

Key Market Segments

By Offering

- Water Meter

- AMR Meters

- AMI Meters

- Solutions

- Enterprise Asset Management

- Security

- Analytics & Data Management

- Smart Irrigation Management

- Advanced Pressure Management

- Leak Detection

- Others (Mobile Workforce Management, etc.)

- Services

- Professional Services

- Managed Services

By Technology

- IoT

- Artificial Intelligence

- Big Data & Analytics

- Cloud Computing

- Other Technologies

By End-User

- Residential

- Commercial

- Industrial

Driving Factor

Integration of Advanced Technologies

The integration of advanced technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), Big Data analytics, and Cloud Computing has significantly propelled the growth of the Smart Water Management (SWM) market. These technologies collectively enhance the efficiency, reliability, and sustainability of water management systems.

IoT Integration

The deployment of IoT devices enables real-time monitoring of water usage, leak detection, and infrastructure health assessments. This connectivity facilitates proactive maintenance and optimized water distribution, leading to reduced wastage and improved service delivery. For instance, IoT sensors can detect anomalies in water flow, allowing for immediate corrective actions.

Artificial Intelligence and Big Data Analytics

AI and Big Data analytics process vast amounts of data collected from various sources to predict water demand patterns, detect leaks, and optimize resource allocation. By analyzing historical and real-time data, AI algorithms can forecast future water usage trends, aiding in better planning and decision-making. This predictive capability is crucial for managing water resources efficiently, especially in urban areas facing rapid population growth.

Cloud Computing

Cloud Computing offers scalable storage and computing power, enabling centralized data management and accessibility. Water utilities can leverage cloud platforms to store and analyze data without significant investments in on-premises infrastructure. This flexibility supports the deployment of advanced analytics and machine learning models, enhancing the overall effectiveness of SWM systems.

The convergence of these technologies addresses critical challenges such as water scarcity, aging infrastructure, and the need for sustainable resource management. By embracing these innovations, utilities and municipalities can enhance operational efficiency, reduce costs, and provide better services to consumers. This technological integration is a key driver in the evolution of smart water management solutions.

Restraining Factor

Data Privacy and Security Concerns

As the adoption of smart water management systems increases, so do concerns regarding data privacy and security. The collection, transmission, and storage of vast amounts of data make these systems susceptible to cyber threats and unauthorized access, posing significant risks to both utilities and consumers.

Cybersecurity Risks

Smart water systems rely on interconnected devices and sensors that communicate over networks, creating potential entry points for cyberattacks. Threats such as hacking, malware, and ransomware can lead to operational disruptions, data breaches, and financial losses. For example, unauthorized access to a water treatment facility’s control system could result in the manipulation of water quality parameters, endangering public health.

Privacy Issues

The extensive data collection inherent in smart water systems includes detailed information on water usage patterns, which can be sensitive. Without robust data protection measures, there is a risk of exposing personal consumption habits, leading to privacy violations. Consumers may be hesitant to adopt smart meters and related technologies if they fear their data could be misused or inadequately protected.

Regulatory Challenges

Navigating the complex landscape of data protection regulations adds another layer of complexity for utilities implementing smart water solutions. Compliance with laws such as the General Data Protection Regulation (GDPR) in Europe requires significant resources and expertise. Non-compliance can result in legal penalties and damage to an organization’s reputation.

Addressing these concerns necessitates a comprehensive approach that includes implementing robust cybersecurity protocols, ensuring data anonymization and encryption, and fostering transparency with consumers regarding data usage practices. By proactively managing data privacy and security, stakeholders can build trust and facilitate the broader adoption of smart water management technologies.

Growth Opportunity

Expansion of Smart Cities Initiatives

The global trend towards urbanization has led to the development of smart cities, presenting significant growth opportunities for the smart water management market. Integrating smart water solutions into urban planning enhances sustainability, efficiency, and quality of life for residents.

Urbanization and Population Growth

As urban populations swell, the demand for efficient water management intensifies. Smart water systems equipped with IoT sensors and data analytics can monitor consumption patterns, detect leaks, and optimize distribution, ensuring equitable and reliable water access. This is particularly crucial in rapidly growing cities where infrastructure may struggle to keep pace with demand.

Government Initiatives and Investments

Governments worldwide are investing in smart city projects to improve urban infrastructure and services. These initiatives often include the deployment of smart water management systems to enhance operational efficiency and sustainability. For instance, the development of alternative water grids utilizing recycled and treated stormwater is being explored to address water scarcity and support regional growth.

Technological Advancements

Advancements in technology facilitate the integration of smart water solutions into urban environments. The adoption of AI, big data analytics, and cloud computing enhances the capabilities of smart water systems, enabling real-time monitoring, predictive maintenance, and data-driven decision-making. These technologies contribute to the development of resilient and adaptive water management infrastructures in smart cities.

Enhanced Quality of Life

Implementing smart water solutions in urban areas leads to improved water quality, reduced waste, and better resource management. Residents benefit from reliable water services, timely leak repairs, and transparent billing, enhancing overall satisfaction and trust in public utilities.

The convergence of urbanization, governmental support, technological innovation, and a focus on quality of life creates a fertile environment for the growth of smart water management solutions within smart cities. This synergy presents a compelling opportunity for stakeholders to invest in and develop technologies that address the evolving challenges of urban water management.

Challenging Factor

Infrastructure Investment Deficits

A significant challenge hindering the widespread adoption of smart water management systems is the insufficient capital investment in water infrastructure. Many utilities face financial constraints that limit their ability to upgrade aging systems and implement advanced technologies.

Financial Constraints

Allocating funds for infrastructure improvements competes with other pressing public needs, often resulting in water projects being deferred or underfunded. This financial reluctance stems from budgetary limitations, competing priorities, and a lack of immediate visible returns on investment. Consequently, utilities may struggle to modernize infrastructure to support smart water solutions.

Growth Factors

Increasing Water Scarcity and Demand

Global water consumption has surged by 600% over the past century, with demand expected to rise by 55% by 2050 due to industrial and domestic needs. This escalating demand, coupled with water scarcity, drives the adoption of smart water solutions to optimize resource use.

Urbanization and Infrastructure Challenges

Rapid urbanization intensifies the strain on existing water infrastructure. Smart water management systems help address these challenges by improving efficiency and sustainability in urban water distribution.

Technological Advancements

Innovations in IoT, AI, and big data analytics enhance real-time monitoring and management of water resources, leading to reduced wastage and improved service delivery.

Emerging Trends

Several trends are shaping the future of SWM, reflecting a shift towards more intelligent and sustainable water management practices.

Integration with Smart Cities

The development of smart cities incorporates advanced water management solutions to enhance urban living.

Adoption of Advanced Metering Infrastructure

Utilities are increasingly implementing smart meters and advanced metering infrastructure to monitor water usage accurately, reduce non-revenue water, and improve billing processes.

Business Benefits

Implementing SWM solutions offers numerous advantages to businesses, contributing to operational efficiency and sustainability.

Operational Efficiency and Cost Savings

Smart water systems enable businesses to monitor consumption patterns, detect leaks, and optimize usage, leading to significant cost reductions. For instance, implementing smart leak detection systems has resulted in a 30% reduction in non-revenue water for utilities.

Regulatory Compliance and Sustainability

With increasing regulatory pressures for water conservation, businesses adopting smart water solutions can ensure compliance and demonstrate commitment to sustainability, enhancing their corporate reputation.

Enhanced Customer Satisfaction

By providing reliable and efficient water services, businesses can improve customer satisfaction, leading to increased loyalty and a positive brand image.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In early 2024, ABB Ltd., a global leader in automation and electrification technologies, expanded its smart water management portfolio by acquiring Real Tech, a Canadian company renowned for its innovative optical sensor technology. This acquisition enhances ABB’s capabilities in real-time water quality monitoring, addressing global sustainability challenges by integrating advanced optical sensors and AI-driven data analytics into its offerings.

In January 2025, Badger Meter Corporation, a prominent provider of smart water solutions, acquired SmartCover Systems from XPV Water Partners for $185 million. This strategic move adds real-time monitoring of sewer lines and lift stations to Badger Meter’s BlueEdge suite, enhancing its network monitoring applications and solidifying its position in the smart water management market.

While specific recent acquisitions or product launches by Honeywell International Inc. in the smart water management sector were not identified in the provided sources, the company has a history of integrating advanced technologies into water management solutions. Honeywell’s commitment to innovation positions it as a key player in the ongoing evolution of smart water management technologies.

Top Key Players in the Market

- ABB Ltd.

- Badger Meter Corporation

- Honeywell International Inc.

- Hydropoint Data Systems Inc.

- IBM Corporation

- Itron Inc.

- Landis+Gyr Corporation

- Neptune Technology Group

- Oracle Corporation

- Schneider Electric SE

- Siemens AG

- Suez Water Technologies & Solutions

- TaKaDu

- Trimble Inc.

- Xenius Corporation

- Ayyeka Services

- KETOS

- Elster Group SE

- Global Water Management LLC

- i2O Water Ltd

- Other Key Players

Recent Developments

- In 2024, The Smart Water Management market witnessed significant growth, driven by increasing adoption of IoT and smart metering solutions across urban areas.

- In 2024, Several municipalities worldwide adopted advanced leak detection technologies, enhancing real-time monitoring and improving overall water conservation efforts.

Report Scope

Report Features Description Market Value (2024) USD 19.01 Billion Forecast Revenue (2034) USD 61.7 Billion CAGR (2025-2034) 12.50% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Water Meter [AMR Meters, AMI Meters], Solutions [Enterprise Assest Management, Security, Analytics & Data Management, Smart Irrigation Management, Advanced Pressure Management, Leak Detection, Others (Mobile Workforce Management, etc.)], Services [Professional Services, Managed Services]), By End-User (Residential, Commercial, Industrial), By Technology (IoT, Artificial Intelligence, Big Data & Analytics, Cloud Computing, Other Technologies) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape ABB Ltd., Badger Meter Corporation, Honeywell International Inc., Hydropoint Data Systems Inc., IBM Corporation, Itron Inc., Landis+Gyr Corporation, Neptune Technology Group, Oracle Corporation, Schneider Electric SE, Siemens AG, Suez Water Technologies & Solutions, TaKaDu, Trimble Inc., Xenius Corporation, Ayyeka Services, KETOS, Elster Group SE, Global Water Management LLC, i2O Water Ltd, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Smart Water Management MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Water Management MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Badger Meter Corporation

- Honeywell International Inc.

- Hydropoint Data Systems Inc.

- IBM Corporation

- Itron Inc.

- Landis+Gyr Corporation

- Neptune Technology Group

- Oracle Corporation

- Schneider Electric SE

- Siemens AG

- Suez Water Technologies & Solutions

- TaKaDu

- Trimble Inc.

- Xenius Corporation

- Ayyeka Services

- KETOS

- Elster Group SE

- Global Water Management LLC

- i2O Water Ltd

- Other Key Players