Global Vaginal Inserts Market By Product Type (Vaginal Tablets, Vaginal Suppositories and Vaginal Capsules), By Application (Birth Control, Feminine Hygiene, Fungal Infections and Other Applications), By Distribution Channel (Retail Pharmacy, Online Pharmacy, Hospital Pharmacy and Fertilization Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173153

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

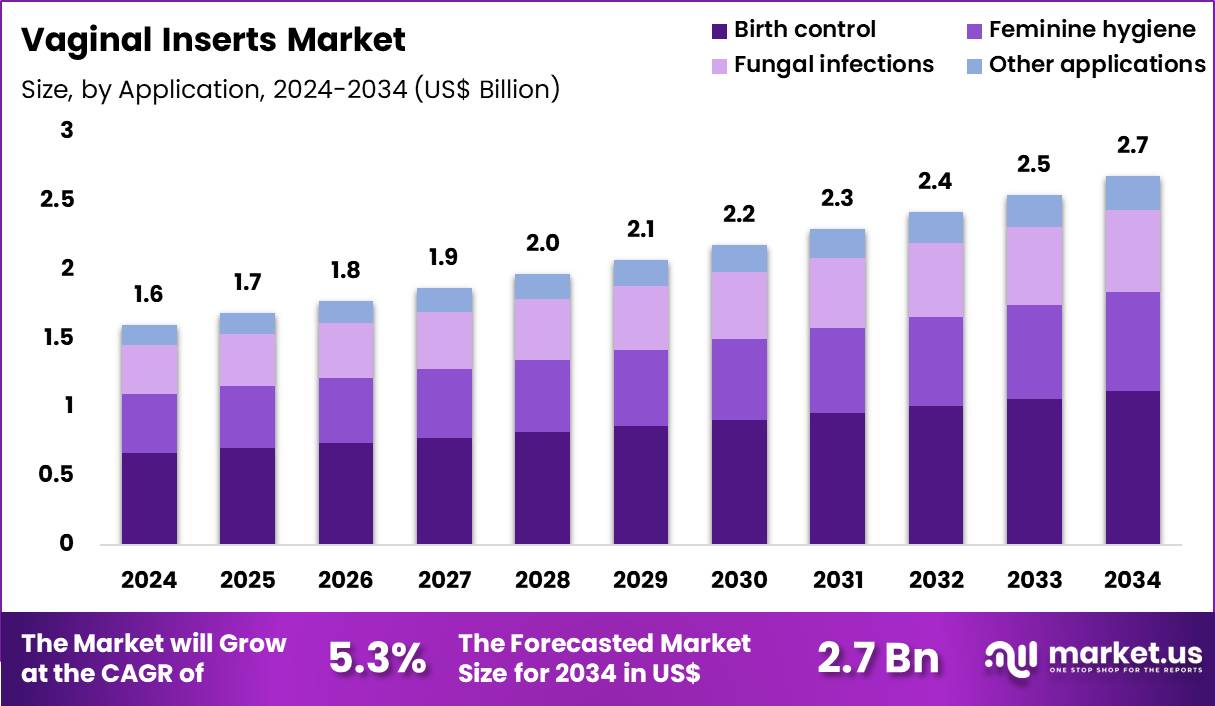

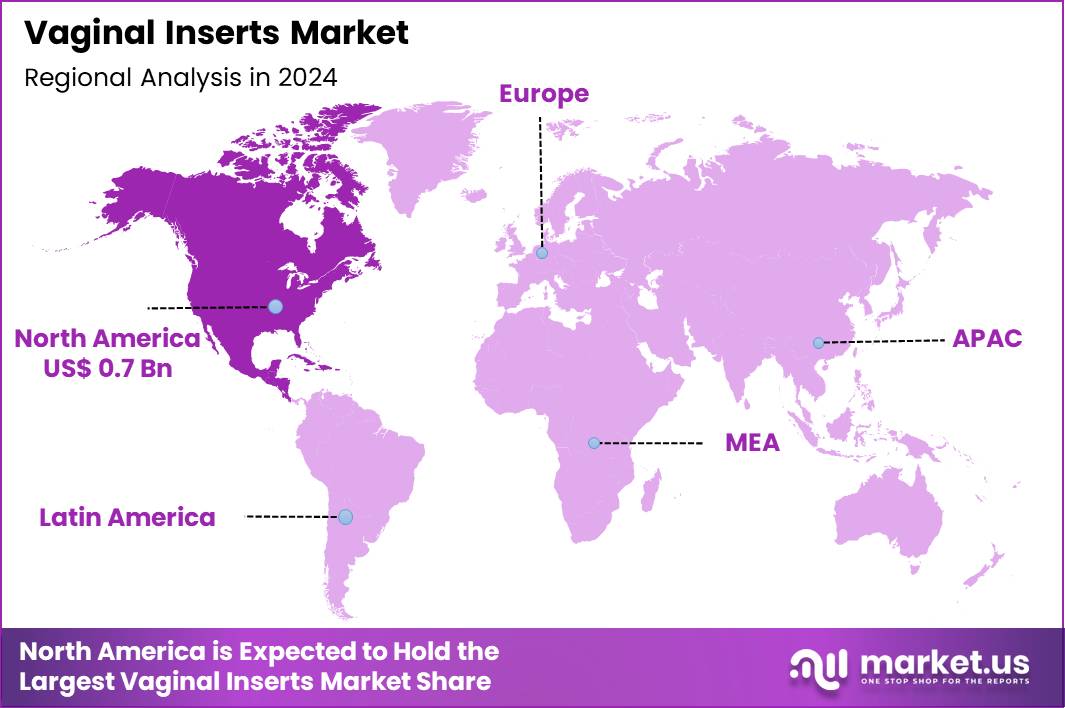

The Global Vaginal Inserts Market size is expected to be worth around US$ 2.7 Billion by 2034 from US$ 1.6 Billion in 2024, growing at a CAGR of 5.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.6% share with a revenue of US$ 0.7 Billion.

Increasing prevalence of gynecological conditions and obstetric emergencies accelerates demand for vaginal inserts that deliver targeted therapeutic effects with minimal systemic impact. Obstetricians increasingly utilize specialized vacuum-induced devices to manage abnormal postpartum uterine bleeding, inducing physiologic uterine contraction for rapid hemorrhage control in delivery settings.

Clinicians apply hormonal inserts to alleviate symptoms of vulvovaginal atrophy in postmenopausal women, restoring tissue integrity and reducing dyspareunia through localized estrogen delivery. These products support infection management by releasing antifungal or antibacterial agents directly at the site, treating recurrent bacterial vaginosis and yeast infections effectively.

Providers employ contraceptive inserts to provide sustained hormone release, offering reliable birth control with convenient administration. In November 2025, Laborie Medical Technologies entered into an agreement to acquire the JADA System from Organon for US$ 465 million. JADA is a specialized vacuum-induced vaginal insert used for the control and treatment of abnormal postpartum uterine bleeding (PPH). This acquisition consolidates Laborie’s position in the acute maternal health market, focusing on non-surgical inserts for obstetric emergencies.

Manufacturers capitalize on opportunities to develop bioadhesive and extended-release formulations that enhance retention time and drug bioavailability, improving outcomes in chronic vaginal dryness and hormone replacement therapy. Developers engineer non-hormonal inserts with natural antimicrobial agents, broadening applications for preventive care in women prone to recurrent infections without disrupting endogenous flora. These innovations facilitate personalized dosing through adjustable insert designs, accommodating individual needs in fertility support and menopausal symptom relief.

Opportunities expand in integrating smart features for real-time monitoring of pH or moisture levels, enabling proactive management in atrophic vaginitis. Companies advance minimally invasive postpartum devices that complement existing protocols, reducing transfusion requirements in high-risk deliveries. Firms invest in sustainable materials that maintain efficacy while addressing environmental considerations in routine gynecological treatments.

Industry specialists refine vacuum-based mechanisms for precise control in obstetric emergencies, minimizing tissue trauma during insertion and removal in postpartum hemorrhage scenarios. Developers introduce patient-friendly applicators with ergonomic designs, streamlining self-administration for long-term therapies like vaginal atrophy management. Market participants prioritize rapid-acting inserts that provide immediate symptom relief in acute infections, enhancing compliance in outpatient settings.

Innovators incorporate biocompatible polymers for controlled dissolution, optimizing therapeutic duration in hormone delivery applications. Companies emphasize evidence-based protocols that integrate inserts with digital health tools for ongoing monitoring in postpartum recovery. Ongoing advancements focus on hybrid formulations combining anti-inflammatory and regenerative agents, elevating efficacy in comprehensive pelvic health interventions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.6 Billion, with a CAGR of 5.3%, and is expected to reach US$ 2.7 Billion by the year 2034.

- The product type segment is divided into vaginal tablets, vaginal suppositories and vaginal capsules, with vaginal tablets taking the lead in 2024 with a market share of 46.8%.

- Considering application, the market is divided into birth control, feminine hygiene, fungal infections and other applications. Among these, birth control held a significant share of 41.6%.

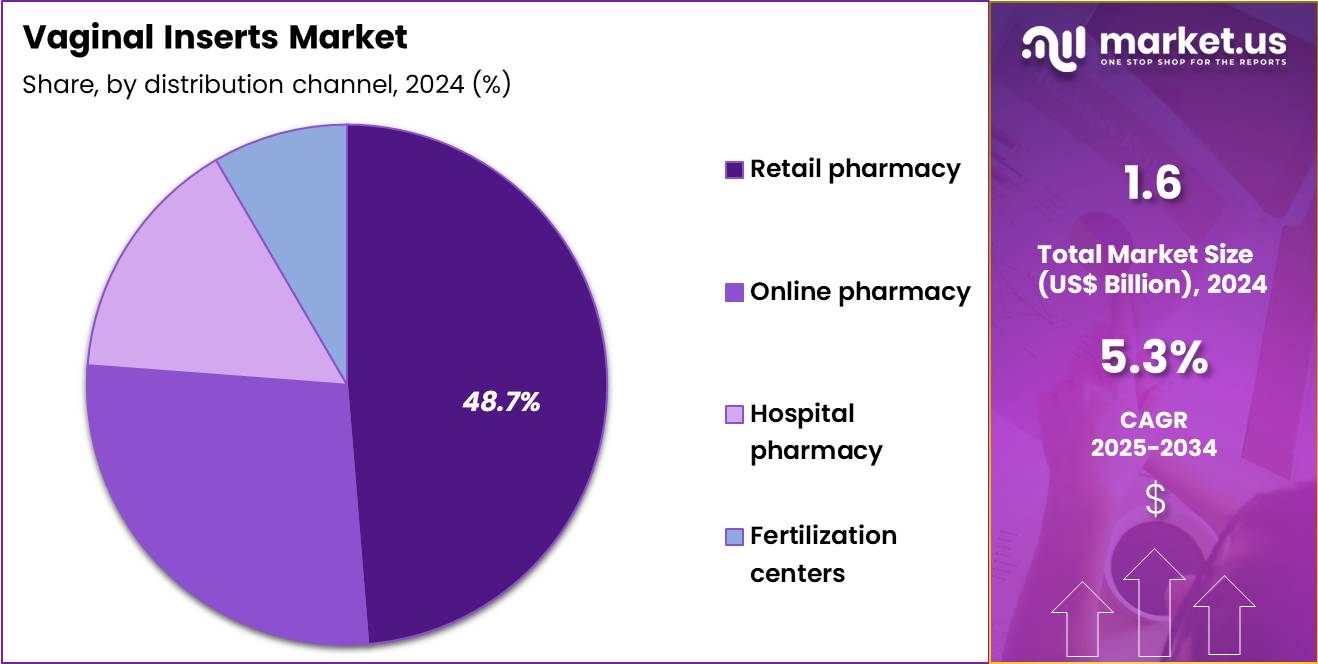

- Furthermore, concerning the distribution channel segment, the market is segregated into retail pharmacy, online pharmacy, hospital pharmacy and fertilization centers. The retail pharmacy sector stands out as the dominant player, holding the largest revenue share of 48.7% in the market.

- North America led the market by securing a market share of 43.6% in 2024.

Product Type Analysis

Vaginal tablets remain the dominant product type in the vaginal inserts market, accounting for a 46.8% growth share. Healthcare providers favor this format because it delivers precise dosing and predictable drug release, supporting consistent clinical outcomes. Manufacturers continue to refine dissolution profiles and formulation stability, which improves therapeutic performance and extends shelf life across hospital and retail settings.

Patients prefer tablets due to minimal leakage, reduced discomfort, and higher compliance. Regulatory familiarity with standardized tablet manufacturing further supports adoption, while cost-efficient production and compact packaging enhance distribution efficiency. Strong utilization in hormonal and antimicrobial therapies, along with expanding access to women’s healthcare in emerging economies, is expected to sustain the segment’s leadership.

Application Analysis

Birth control represents the leading application segment in the vaginal inserts market with a 41.6% growth share. Demand is driven by rising family planning awareness and a growing preference for non-oral contraceptive options that provide localized hormone delivery with fewer systemic effects. Healthcare professionals increasingly recommend vaginal inserts for controlled dosing and reliable contraception.

Government-supported reproductive health programs, wider availability through retail pharmacies, and improving patient education are strengthening adoption. Ongoing pharmaceutical innovation is enhancing efficacy, duration, and dosing flexibility, while shifting social attitudes toward vaginal health products support acceptance. Continued emphasis on reproductive autonomy and convenient contraception is expected to maintain steady growth in this segment.

Distribution Channel Analysis

Retail pharmacies represent the leading distribution channel in the vaginal inserts market, capturing a 48.7% growth share. Their dominance is driven by easy accessibility, privacy, and the availability of professional guidance for women’s health products. Pharmacist recommendations play a critical role in influencing purchasing decisions, particularly for prescription-based vaginal inserts. Large retail chains are expanding dedicated women’s health sections to enhance visibility and consumer engagement.

Urban retail growth continues to improve geographic reach, while efficient prescription fulfillment ensures consistent product availability. In-store promotions and educational materials strengthen brand recognition and awareness. Private label products improve affordability across different income groups, further supporting adoption.

Trust in regulated pharmacy environments reinforces consumer confidence. Integration with digital prescription platforms simplifies repeat purchases, while loyalty programs encourage long-term customer retention. Expanding healthcare infrastructure and strong supplier relationships are expected to sustain the segment’s leadership through reliable access and convenience.

Key Market Segments

By Product Type

- Vaginal Tablets

- Vaginal Suppositories

- Vaginal Capsules

By Application

- Birth Control

- Feminine Hygiene

- Fungal Infections

- Other Applications

By Distribution Channel

- Retail Pharmacy

- Online Pharmacy

- Hospital Pharmacy

- Fertilization Centers

Drivers

Rising prevalence of sexually transmitted infections is driving the market

The vaginal inserts market experiences substantial growth due to the rising prevalence of sexually transmitted infections, which often necessitate targeted treatments such as antifungal or antibacterial inserts for vaginal symptoms. Healthcare providers frequently prescribe these inserts to address conditions like bacterial vaginosis and candidiasis, common manifestations of STIs, thereby enhancing patient recovery.

Regulatory bodies emphasize the importance of accessible therapies to manage infection-related complications in women’s health. Pharmaceutical companies develop specialized inserts to meet the demands of increasing case numbers reported in surveillance data. Clinical guidelines recommend vaginal inserts for localized delivery, minimizing systemic side effects in infected individuals.

Global health organizations track STI trends to inform resource allocation for treatment options including inserts. Academic research supports the efficacy of inserts in reducing recurrence rates among affected women. Patient education campaigns promote early intervention with over-the-counter and prescription inserts for symptom relief.

Economic burdens from untreated infections further justify investment in insert-based solutions. According to the Centers for Disease Control and Prevention’s Sexually Transmitted Infections Surveillance, 2022, around 2.5 million cases of chlamydia, gonorrhea, and syphilis were reported in the United States.

Restraints

Stringent regulatory guidelines for product changes are restraining the market

The vaginal inserts market is constrained by stringent regulatory guidelines for modifications to product components, which require comprehensive risk assessments and reporting for any alterations in formulation or packaging. Manufacturers must navigate detailed submission processes to ensure compliance, often leading to delays in product updates or innovations.

Healthcare facilities face challenges in adopting revised inserts due to potential disruptions in supply chains during regulatory reviews. Pharmaceutical firms allocate significant resources to validation studies, increasing overall development expenses. Clinical practices prioritize established products to avoid uncertainties associated with regulatory scrutiny.

Global harmonization of guidelines remains incomplete, creating inconsistencies across markets and complicating international distribution. Academic evaluations highlight the impact of these requirements on market agility. Patient access to improved inserts is limited by prolonged approval timelines for changes. Ethical considerations in regulatory frameworks emphasize safety, further extending evaluation periods. These factors collectively impede rapid market adaptation and limit competitive differentiation.

Opportunities

Increasing FDA approvals for generic vaginal inserts is creating growth opportunities

The vaginal inserts market benefits from increasing FDA approvals for generic versions, which enhance affordability and accessibility for treatments addressing menopausal symptoms and vaginal atrophy. Developers can expand product lines with cost-effective generics, targeting underserved populations in women’s health. Regulatory pathways for generics facilitate faster market entry, encouraging investment in bioequivalent formulations.

Healthcare providers gain options for prescribing economical inserts without compromising efficacy. Pharmaceutical partnerships focus on scaling production to meet demand for approved generics in gynecology. Clinical applications broaden with generics supporting hormone replacement therapy in postmenopausal women.

Global adoption in emerging markets aligns with approvals promoting equitable access to care. Patient adherence improves with lower-cost alternatives enabling sustained use. Economic analyses project savings for healthcare systems through generic integration. The U.S. Food and Drug Administration approved the first generic estradiol vaginal insert for treatment of dyspareunia in 2024.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic growth is supporting expansion in the vaginal inserts market, as higher healthcare spending and increasing awareness of women’s health encourage manufacturers to scale production of hormone-based and antimicrobial inserts used for menopause management and infection control. Companies are introducing more patient-friendly designs to address the needs of aging populations, particularly in higher-income regions where demand remains steady.

At the same time, inflation has increased input, packaging, and transportation costs, pushing manufacturers to streamline operations and causing some healthcare providers to delay large-volume purchases. Supply chains remain vulnerable to geopolitical tensions, including trade disputes between major economies and regional conflicts that disrupt manufacturing hubs in Asia, resulting in shipment delays and operational risk.

In the United States, import tariffs implemented through 2025 have raised costs for foreign-sourced medical devices, tightening margins for distributors and limiting price flexibility. Retaliatory trade measures have also constrained exports and complicated cross-border research collaboration.

In response, companies are increasing investment in domestic production and shifting sourcing toward politically stable regions. These adjustments are improving supply security, supporting localized innovation, and helping the market adapt toward more resilient and sustainable long-term growth.

Latest Trends

Introduction of innovative extended-release formulations is a recent trend

In 2024, the vaginal inserts market has demonstrated a prominent trend toward the introduction of innovative extended-release formulations, which provide prolonged therapeutic effects for conditions such as vaginal dryness and infections. Manufacturers prioritize these designs to improve patient compliance by reducing the frequency of administration. Healthcare experts endorse extended-release inserts for their ability to maintain consistent drug levels in the vaginal environment.

Regulatory reviews accommodate these innovations with evidence of enhanced stability and bioavailability. Clinical feedback informs refinements in formulation to address user preferences for discreet and effective options. Academic studies evaluate the impact of extended-release technology on treatment outcomes in women’s health.

Global distribution expands access to these advanced inserts through retail and prescription channels. Patient satisfaction increases with formulations that minimize side effects over extended periods. Ethical protocols ensure inclusive testing for diverse demographic needs. This trend reflects ongoing commitment to advancing drug delivery systems in gynecological care.

Regional Analysis

North America is leading the Vaginal Inserts Market

In 2024, North America captured a 43.6% share of the global vaginal inserts market, propelled by heightened emphasis on women’s reproductive and menopausal health management amid advancing telehealth integrations and consumer-driven demand for discreet, effective treatments. Gynecologists and patients alike favored hormone-releasing inserts for alleviating vaginal atrophy and dryness associated with menopause, supported by expanded insurance coverage that facilitated broader access in outpatient clinics.

Innovations in biodegradable and extended-release formulations addressed concerns over long-term estrogen exposure, aligning with guidelines from professional bodies that prioritize minimally invasive options for urinary incontinence and pelvic floor disorders. Rising fertility awareness among millennials boosted utilization of contraceptive inserts, offering reliable alternatives to daily pills in busy lifestyles.

Pharmaceutical firms collaborated on antifungal inserts for recurrent infections, responding to antibiotic resistance trends through targeted delivery systems. Retail expansions in pharmacies and online platforms enhanced availability, empowering self-care initiatives for postpartum recovery. Regulatory approvals accelerated launches of pH-balancing products, catering to diverse demographic needs in multicultural populations. The National Institutes of Health notes that more than 1 million women reach menopause every year in the United States.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Healthcare professionals project substantial expansion in vaginal insert solutions across Asia Pacific during the forecast period, as improving economic conditions and educational campaigns empower women to seek proactive reproductive care. Clinicians prescribe medicated devices for managing bacterial vaginosis and yeast infections, optimizing adherence in humid climates prone to microbial imbalances.

Authorities implement subsidies for contraceptive variants, enabling family planning programs to reach underserved rural communities facing high fertility rates. Biotech developers customize progesterone-releasing options, supporting assisted reproduction cycles in infertility clinics amid urbanization stresses. Regional networks advocate for hormone therapy inserts, addressing postmenopausal symptoms in aging female workforces.

Pharmaceutical entities adapt antimicrobial formulations, tailoring them to local dietary influences that exacerbate vaginal dysbiosis. Community health workers distribute educational materials on insertion techniques, fostering confidence in self-administered therapies for cervical ripening. The United Nations 2024 Sustainable Development Goals Report estimates that only 56% of women aged 15–49 can decide on their sexual and reproductive health and rights.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Vaginal Inserts market drive growth by advancing formulation science that delivers controlled release, improved comfort, and consistent therapeutic outcomes for gynecological and reproductive indications. Companies expand adoption through clinician education and evidence generation that positions inserts as convenient, localized alternatives to oral or injectable therapies.

Commercial strategies emphasize portfolio diversification across hormones, anti-infectives, and fertility-related applications to stabilize demand across cycles. Innovation priorities include bioadhesive materials, patient-friendly applicators, and stability improvements that extend shelf life and simplify storage.

Market expansion targets regions with rising women’s health awareness and improved access to OTC and prescription gynecologic care. Bayer stands out as a key participant with a strong women’s health franchise, global regulatory expertise, and scalable manufacturing that supports reliable supply of vaginal therapeutic products worldwide.

Top Key Players

- TherapeuticsMD, Inc.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Novo Nordisk A/S

- Mylan N.V.

- Endo Pharmaceuticals Inc.

- Bayer AG

- Amgen Inc.

- Allergan plc

- AbbVie Inc.

Recent Developments

- In June 2025, Organon partnered with Evvy to expand access to XACIATO (clindamycin phosphate) vaginal gel 2%. This single-dose vaginal insert/gel is designed to treat bacterial vaginosis (BV). The collaboration integrates Evvy’s at-home vaginal microbiome testing with a telehealth platform, allowing patients to receive prescription-grade vaginal inserts for same-day pharmacy pickup.

- The Population Council announced a major subsidy in December 2025 to reduce the cost of the Dapivirine Vaginal Ring (DapiRing) to US$ 5.90 per unit. Primarily used for HIV prevention, this flexible silicone insert is currently under review by the European Medicines Agency (EMA) for a new 3-month version, which would significantly reduce the burden of monthly replacements for users in high-risk regions.

Report Scope

Report Features Description Market Value (2024) US$ 1.6 Billion Forecast Revenue (2034) US$ 2.7 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Vaginal Tablets, Vaginal Suppositories and Vaginal Capsules), By Application (Birth Control, Feminine Hygiene, Fungal Infections and Other Applications), By Distribution Channel (Retail Pharmacy, Online Pharmacy, Hospital Pharmacy and Fertilization Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape TherapeuticsMD, Inc., Teva Pharmaceutical Industries Ltd., Pfizer Inc., Novo Nordisk A/S, Mylan N.V., Endo Pharmaceuticals Inc., Bayer AG, Amgen Inc., Allergan plc, AbbVie Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- TherapeuticsMD, Inc.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Novo Nordisk A/S

- Mylan N.V.

- Endo Pharmaceuticals Inc.

- Bayer AG

- Amgen Inc.

- Allergan plc

- AbbVie Inc.