Medical Health Screening Services Market By Test Type (Routine Tests, Speciality Tests, Non-routine Tests, Cancer Screening Tests, and Others), By Setting Type (Hospitals/Clinical Laboratories, Workplaces, Multi-Speciality Clinics, Diagnostic Imaging Centers, Ambulatory Care Centers, and Others), By Sample Type (Blood, Saliva, Urine, and Others), By End-user (Hospitals/Clinics Diagnostic Laboratories, Research Institutes, Workplaces, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 138767

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

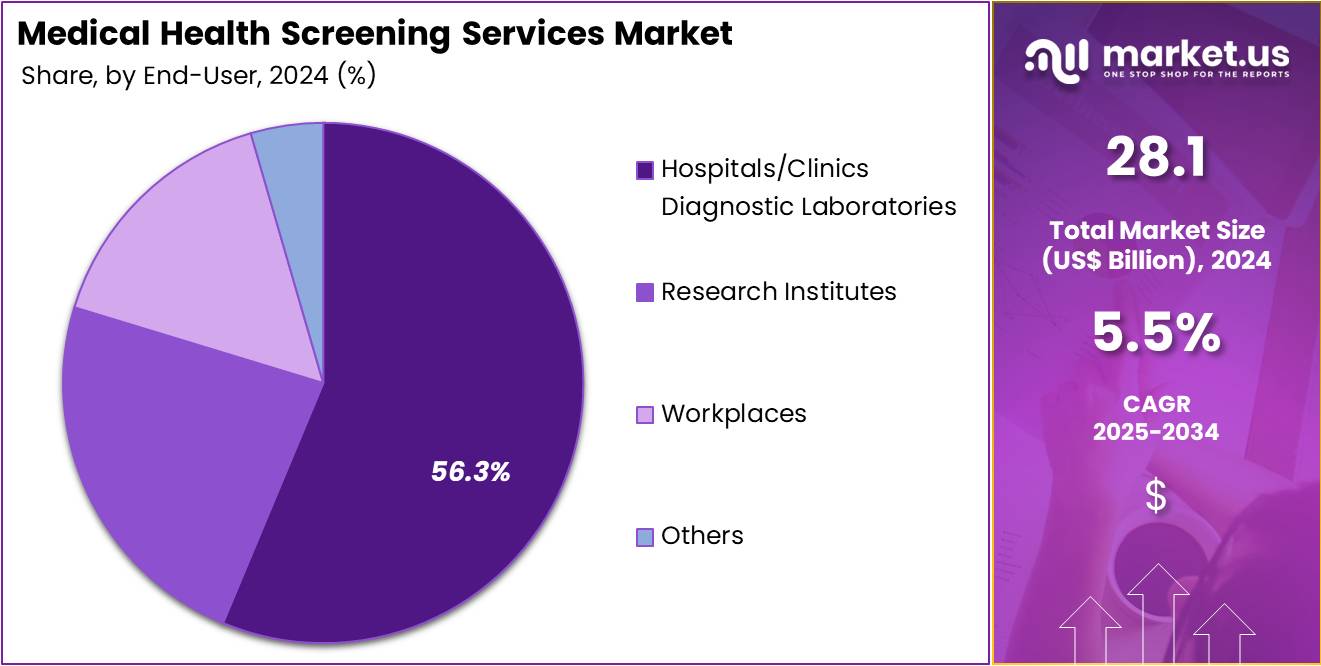

The Global Medical Health Screening Services Market size is expected to be worth around US$ 48 Billion by 2034, from US$ 28.1 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Increasing focus on preventive healthcare and early disease detection is driving the growth of the medical health screening services market. These services, which include routine tests for cardiovascular diseases, cancer, diabetes, and other chronic conditions, help identify health risks before they progress into more severe or life-threatening stages.

Rising awareness about the importance of regular check-ups and the increasing prevalence of lifestyle-related diseases contribute significantly to market expansion. In July 2024, UCI Health Beckman Laser Institute introduced an advanced intraoral camera for detecting oral cancer, improving detection accuracy from 40-60% to 87-93%. This innovation highlights the ongoing trend toward more accurate, specialized diagnostic tools within health screening services.

Recent trends also show a growing preference for non-invasive and at-home health screenings, making healthcare more accessible and convenient for individuals. Additionally, the increasing adoption of digital health platforms and wearable technologies presents new opportunities for integrating health screenings into daily routines, offering personalized insights into an individual’s well-being.

The demand for health screenings is also being driven by the aging global population and the need for more efficient management of chronic diseases. As the healthcare landscape continues to evolve, medical health screening services will play a crucial role in improving public health outcomes through early detection and personalized care.

Key Takeaways

- In 2023, the market for Medical Health Screening Services generated a revenue of US$ 28.1 billion, with a CAGR of 5.5%, and is expected to reach US$ 48.0 billion by the year 2033.

- The test type segment is divided into routine tests, speciality tests, non-routine tests, cancer screening tests, and others, with routine tests taking the lead in 2023 with a market share of 41.6%.

- Considering setting type, the market is divided into hospitals/clinical laboratories, workplaces, multi-speciality clinics, diagnostic imaging centers, ambulatory care centers, and others. Among these, hospitals/clinical laboratories held a significant share of 49.5%.

- Furthermore, concerning the sample type segment, the market is segregated into blood, saliva, urine, and others. The blood sector stands out as the dominant player, holding the largest revenue share of 48.2% in the Medical Health Screening Services market.

- The end-user segment is segregated into hospitals/clinics diagnostic laboratories, research institutes, workplaces, and others, with the hospitals/clinics diagnostic laboratories segment leading the market, holding a revenue share of 56.3%.

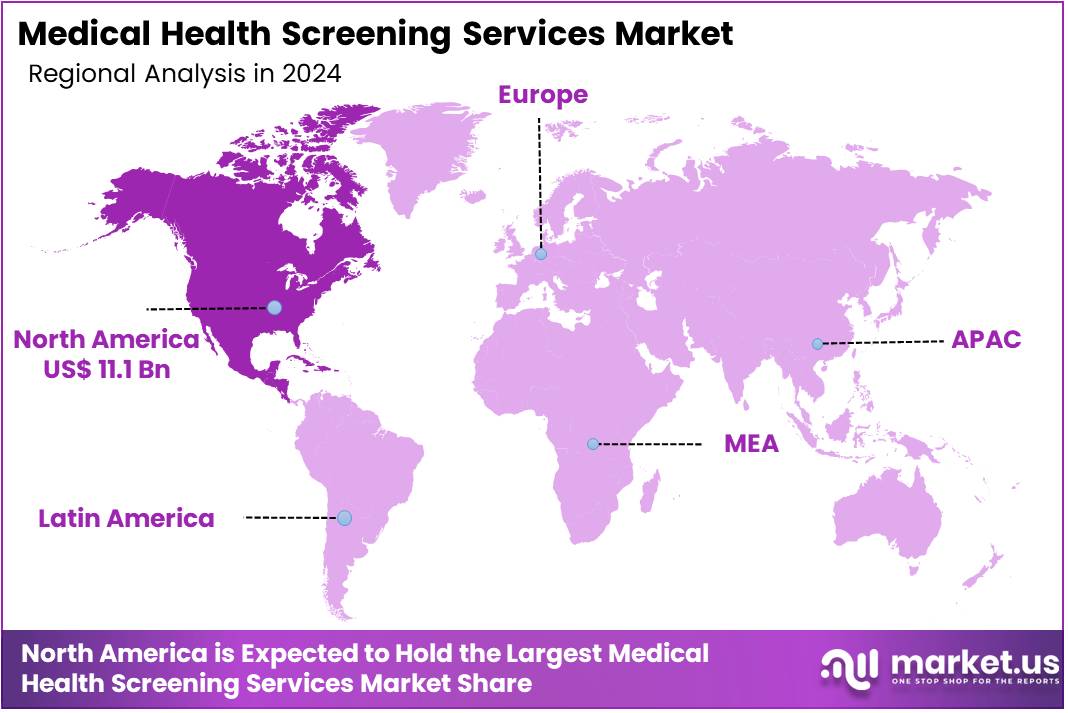

- North America led the market by securing a market share of 39.6% in 2023.

Test Type Analysis

The routine tests segment led in 2023, claiming a market share of 41.6% owing to the increasing demand for preventive healthcare and early disease detection. Routine tests, such as cholesterol and blood sugar levels, play a key role in assessing general health and identifying risk factors for chronic conditions.

With the rising prevalence of lifestyle diseases, such as diabetes and heart disease, healthcare providers and patients are placing more emphasis on regular health screenings. Additionally, the growth of wellness programs and health check-up packages that include routine tests is anticipated to drive the demand. These tests are likely to remain essential due to their affordability, simplicity, and effectiveness in detecting health issues before they become severe.

Setting Type Analysis

The hospitals/clinical laboratories held a significant share of 49.5% due to the increasing volume of health screenings being conducted in these settings. Hospitals and clinical laboratories are central to offering a range of diagnostic services, including medical health screenings for early detection of diseases and preventive care.

The rise of outpatient care services and a growing demand for specialized health check-ups are expected to propel the growth of this segment. Furthermore, technological advancements in diagnostic equipment and a rising focus on personalized healthcare are anticipated to make hospitals and clinical laboratories key players in the expansion of the medical health screening services market.

Sample Type Analysis

The blood segment had a tremendous growth rate, with a revenue share of 48.2% as blood tests are one of the most commonly used diagnostic methods for assessing overall health and detecting diseases. Blood samples provide valuable insights into various health parameters, including cholesterol levels, glucose, and liver and kidney functions.

The increase in health-conscious consumers, along with growing demand for routine check-ups and early detection of conditions like diabetes and cardiovascular diseases, is expected to contribute to the expansion of the blood sample segment. Blood tests are likely to continue being the primary choice for most medical health screenings due to their accuracy, affordability, and non-invasive nature.

End-User Analysis

The hospitals/clinics diagnostic laboratories segment grew at a substantial rate, generating a revenue portion of 56.3% due to the increasing focus on preventive care and the demand for regular health screenings. Hospitals and clinics with diagnostic laboratories are crucial in providing health screening services, including testing for chronic diseases, cancer, and other conditions.

The demand for personalized healthcare and the need for accurate, timely results are projected to drive the growth of this segment. Additionally, technological advancements in laboratory testing, such as automated and high-throughput testing systems, are anticipated to increase efficiency and further fuel the adoption of health screening services in hospitals and clinics.

Key Market Segments

By Test Type

- Routine Tests

- Speciality Tests

- Non-routine Tests

- Cancer Screening Tests

- Others

By Setting Type

- Hospitals/Clinical Laboratories

- Workplaces

- Multi-Speciality Clinics

- Diagnostic Imaging Centers

- Ambulatory Care Centers

- Others

By Sample Type

- Blood

- Saliva

- Urine

- Others

By End-user

- Hospitals/Clinics Diagnostic Laboratories

- Research Institutes

- Workplaces

- Others

Drivers

Rise in Global Geriatric Population Driving the Medical Health Screening Services Market

Rising global geriatric population is anticipated to drive the medical health screening services market significantly. The World Health Organization projected that the elderly population worldwide will nearly double by 2050, posing substantial challenges to healthcare systems. Older adults face a higher risk of chronic diseases such as diabetes, cardiovascular disorders, and cancer, necessitating regular health screenings for early detection and management.

Medical health screening services provide essential diagnostic tools to monitor and address these age-related conditions effectively. Increasing life expectancy and the aging population’s focus on quality healthcare further fuel the demand for these services. Technological advancements improve the accuracy and efficiency of diagnostic tests, ensuring timely interventions. Governments and private healthcare providers prioritize screening initiatives to reduce the burden of late-stage disease management.

Expanding healthcare infrastructure in developing regions supports the adoption of preventive care services for aging populations. Collaborations between healthcare organizations and technology providers foster innovation in screening methodologies. These trends underscore the critical role of medical health screening services in addressing the healthcare needs of an aging world.

Restraints

High Costs Are Restraining the Medical Health Screening Services Market

High costs associated with medical health screening services are restraining the market. Advanced diagnostic tests, such as imaging and genetic screenings, require significant investment in equipment and technology. Healthcare providers in low-income regions struggle to implement these high-cost services. Patients often face out-of-pocket expenses for preventive screenings, as limited insurance coverage discourages regular utilization.

Smaller clinics and community healthcare centers lack the financial resources to offer comprehensive screening programs. Regular maintenance and calibration of diagnostic tools further increase operational expenses. Economic disparities create accessibility gaps, particularly in rural and underserved areas, limiting the reach of screening services. Addressing these challenges requires cost-effective innovations and expanded insurance coverage to ensure broader access to preventive healthcare.

Opportunities

Increasing Awareness for Health Screenings as an Opportunity for the Medical Health Screening Services Market

Increasing awareness for health screenings is projected to create significant opportunities for the medical health screening services market. In March 2024, Lebanon’s Ministry of Public Health and Ministry of Education collaborated with UNICEF to launch a nationwide school health screening program. This initiative targeted 400,000 children across 1,000 public schools, emphasizing the importance of early medical checkups. Public health campaigns and educational programs highlight the benefits of preventive screenings for early disease detection.

Healthcare providers increasingly incorporate awareness initiatives into their outreach strategies to attract more individuals to avail of screening services. Technological advancements enable mobile and remote screening units, improving access in rural and underserved regions. Government policies and subsidies further promote affordable screenings, encouraging broader participation.

Collaborations with non-governmental organizations enhance the scope and efficiency of awareness campaigns. These efforts emphasize the transformative potential of awareness initiatives in driving the adoption of medical health screening services globally.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a crucial role in shaping the medical health screening services market. On the positive side, rising healthcare expenditures, particularly in emerging markets, drive demand for preventive health services and early diagnosis. The growing focus on preventive healthcare, along with increasing awareness of lifestyle-related diseases, fuels the adoption of medical screenings across various age groups. However, economic downturns or healthcare budget cuts may restrict access to these services, especially in developing regions where resources are limited.

Geopolitical factors such as trade barriers, political instability, and regulatory discrepancies can disrupt the supply chains for medical equipment, delaying service delivery and increasing costs. Additionally, changing healthcare policies and reimbursement structures can affect the affordability and accessibility of health screenings. Despite these challenges, the global emphasis on improving healthcare outcomes through early detection and prevention remains a driving force, ensuring continued growth in the market.

Trends

Integration of AI Driving the Medical Health Screening Services Market

Rising integration of artificial intelligence (AI) is significantly driving the medical health screening services market. High demand for more efficient, accurate, and accessible diagnostic solutions is expected to increase the adoption of AI-driven technologies in healthcare. AI enables faster analysis, reduces human error, and enhances decision-making capabilities in medical diagnostics, improving overall healthcare outcomes.

The growing trend of utilizing AI in various healthcare settings, including screening and diagnostics, is likely to further accelerate the market’s growth. In March 2024, a Japanese startup, AI Medical Services, introduced an AI-powered tool designed to analyze endoscopy results for the stomach and colon, helping to assess future cancer risks. As AI continues to advance, the medical health screening services market is expected to expand, offering more precise, cost-effective solutions that enhance the efficiency of healthcare systems worldwide.

Regional Analysis

North America is leading the Medical Health Screening Services Market

North America dominated the market with the highest revenue share of 39.6% owing to advancements in accessibility and regulatory support for preventive care. The FDA’s authorization in May 2024 for self-collection of HPV samples in healthcare settings marked a pivotal step in expanding cervical cancer screening. This decision empowered individuals to actively participate in their health management, reducing barriers associated with traditional screening methods.

Rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, further increased the demand for comprehensive health screenings. Employers emphasized wellness programs, incorporating routine health checks to foster employee well-being. Technological advancements in diagnostics, including portable and AI-driven devices, improved the accuracy and speed of screening processes, attracting healthcare providers and patients alike.

Government funding for community health initiatives and partnerships between public health organizations and private companies enhanced service reach, particularly in underserved areas. Expanding healthcare insurance coverage for preventive services and increasing awareness about the importance of early detection also contributed to market growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising awareness about preventive care and growing healthcare investments. A report by the Australian Institute of Health and Welfare in 2022 highlighted that 38% of Australians, approximately 9.7 million people, were managing two or more chronic conditions, underscoring the need for early detection services.

Expanding healthcare access in countries like India and China is expected to increase the adoption of screening programs, especially in rural areas. Government initiatives aimed at reducing the burden of chronic diseases are anticipated to encourage widespread adoption of diagnostic services. Rising disposable incomes and an aging population are likely to drive demand for preventive care across the region. Technological advancements introduced by local and global players are projected to make screening services more efficient and affordable.

The growing trend of medical tourism, supported by cost-effective yet advanced healthcare infrastructure, is expected to further boost demand. Collaborations between governments, private healthcare providers, and insurance companies are likely to enhance market penetration and improve awareness about the benefits of routine health screenings.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the medical health screening services market focus on expanding service portfolios to include comprehensive preventive screenings for conditions like cardiovascular diseases, diabetes, and cancer. Companies invest in advanced diagnostic technologies and digital platforms to streamline appointment scheduling and report delivery. Partnerships with corporate organizations and community health programs help increase accessibility and awareness of preventive care.

Geographic expansion into underserved areas with rising healthcare needs supports broader market reach. Many players prioritize affordability and patient-centric solutions to enhance service adoption and long-term engagement. Life Line Screening is a leading company in this market, providing a wide range of preventive health screenings for at-risk populations.

The company emphasizes convenience by offering mobile units and easy access to diagnostic tests, ensuring timely detection of potential health issues. Life Line Screening’s focus on early intervention and community outreach solidifies its position as a trusted provider of health screening services.

Recent Developments

- In April 2024, DDRC Agilus opened a 24/7 wellness center in Kottayam, offering a comprehensive range of 3,600 diagnostic tests and services to cater to regional healthcare needs.

- In July 2024, Truvian Health raised US$ 74 million in funding to further develop its automated blood-testing platform. The company is also collaborating with Drug Mart in Canada to achieve FDA approval for its technology.

- In 2024, DELFI Diagnostics received funding from Merck Global Health Innovation Fund to accelerate the development of its AI-driven cancer screening technology, aimed at improving early detection and diagnostic precision.

Top Key Players in the Medical Health Screening Services Market

- Unilabs

- Truvian Health

- SYNLAB International

- Sonic Healthcare

- LifeLabs

- LabCorp

- Healthscope

- DELFI Diagnostics

- DDRC Agilus

Report Scope

Report Features Description Market Value (2024) US$ 28.1 billion Forecast Revenue (2034) US$ 48.0 billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (Routine Tests, Speciality Tests, Non-routine Tests, Cancer Screening Tests, and Others), By Setting Type (Hospitals/Clinical Laboratories, Workplaces, Multi-Speciality Clinics, Diagnostic Imaging Centers, Ambulatory Care Centers, and Others), By Sample Type (Blood, Saliva, Urine, and Others), By End-user (Hospitals/Clinics Diagnostic Laboratories, Research Institutes, Workplaces, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Unilabs, Truvian Health, SYNLAB International, Sonic Healthcare, LifeLabs, LabCorp, Healthscope, DELFI Diagnostics, and DDRC Agilus. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Health Screening Services MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Medical Health Screening Services MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Unilabs

- Truvian Health

- SYNLAB International

- Sonic Healthcare

- LifeLabs

- LabCorp

- Healthscope

- DELFI Diagnostics

- DDRC Agilus